Things you may not know about the Camelot project – DEX platform on Arbitrum

This article will share with you information about the Camelot project, a prominent DEX platform on Arbitrum.

Camelot V2 is a new upgraded version of Camelot exchange, launched on April 8 with three phases:

Camelot's original goal was to build a DEX that supports developers with sustainable infrastructure, not just a Yield Farming. The fact that Camelot built V2, using a model based on stableswap AMM, is the first step towards the platform becoming a truly ecosystem-focused DEX.

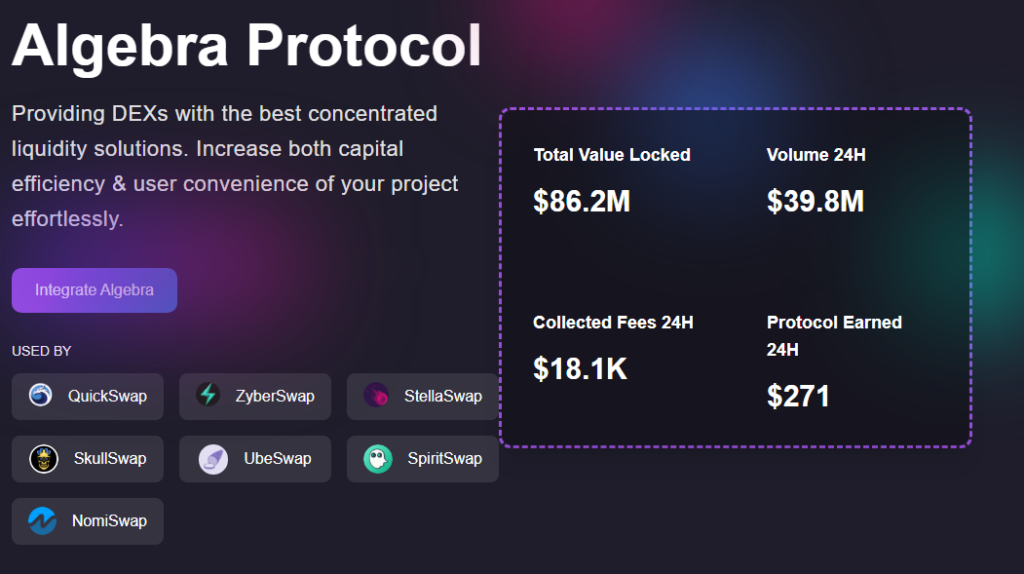

The implementation of concentrated liquidity helps Camelot build the best possible product that root users, traders and builders want to use. By integrating with Algebra V2 protocol (based on concentrated liquidity AMM of Uniswap V3) that has been used by many other DEXs such as Quickswap, Zyberswap, Spiritswap...

In addition to the standard codebase of Uniswap V3, a number of notable improvements have been implemented on Camelot V2. Dynamic Directional Fee for each pool automatically adjusts to fundamental fluctuations, greatly increasing efficiency. Therefore, the fee per pool will be very specific to each market type, thereby driving fees and transaction volume.

AMM will also support rebasing tokens (tokens with elastic supply) like stETH. This unique feature will provide the ability to share between active liquidity providers (LPs) with unaccounted excess balances from rebases as fees.

Camelot will provide users with limit orders. This makes the protocol more efficient and increases transaction volume and fees.

Although concentrated AMMs currently offer more efficient trading, they are generally used only by active or experienced traders. The Camelot team simplifies complexity by building a more user-centric product that integrates concentrated farms with the current spNFT and Nitro pool designs.

Algebra V2 also provides the ability to customize each pool with options for us to choose from. Thus giving Camelot flexibility for every trading pair through tailored parameters, allowing pools to capture more volume and fees.

By combining this new AMM with the existing Incentive program, Camelot is able to promote the effect of concentrated liquidity for the entire Arbitrum ecosystem. Regular users and passive LPs will soon achieve the same experience as active and experienced traders.

Camelot will also distribute Airdrops to participants who purchase the GRAIL token public sale.

How will Camelot DEX provide real profit to GRAIL/xGRAIL holders and stakers?

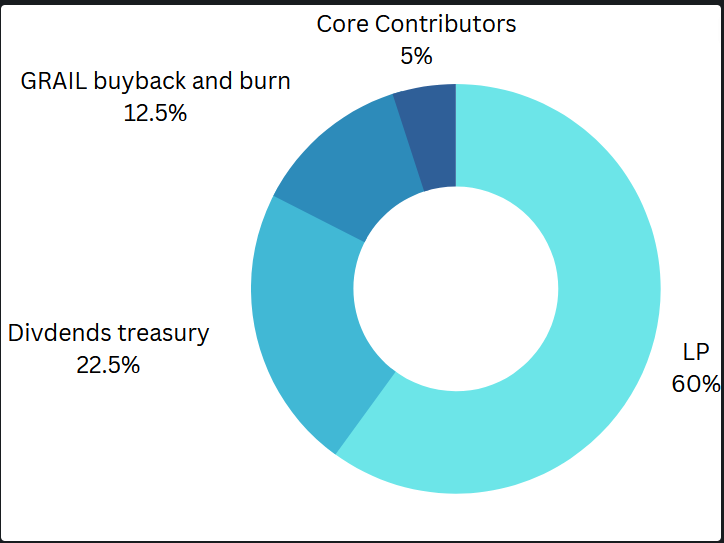

To answer that, let's find out where the fees go and to whom.

The distribution ratio is as follows:

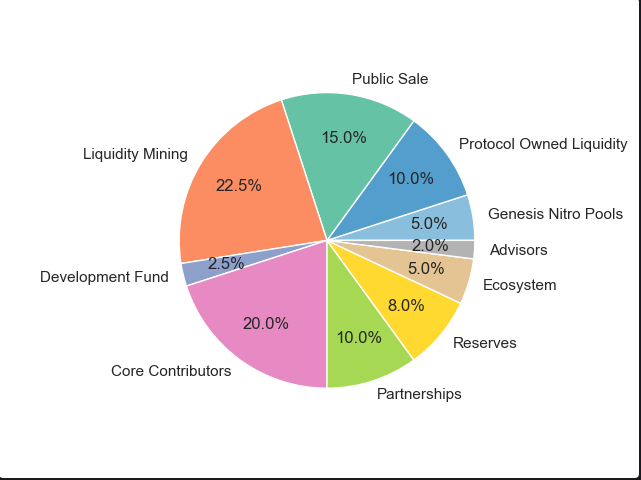

Almost 25% of the total supply is reserved for partners (10%), reserves (8%), ecosystem (5%) and development funds (2.5%). This means that they are strongly incentivizing existing partners to use Camelot as their primary DEX while setting aside reserves for future partnerships. This is a pretty good strategy of Camelot combined with many big projects on Arbitrum.

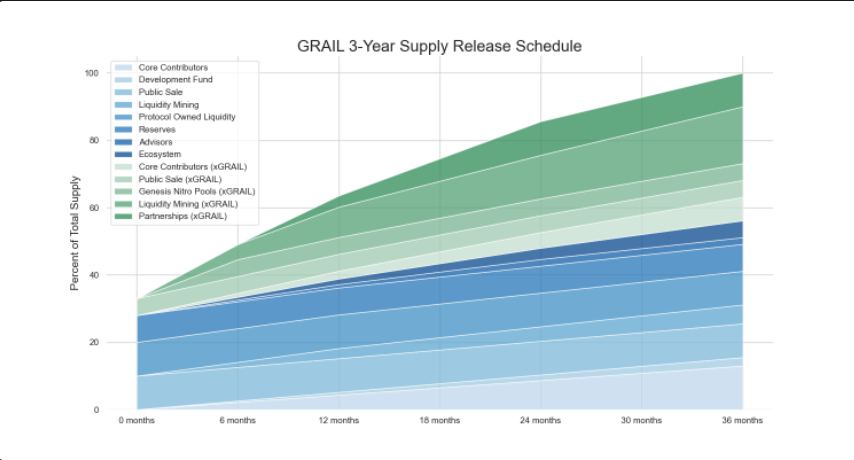

The token distribution schedule highlights most of the dilution that came from xGRAIL in the first year, while GRAIL (in blue) only increased by about 50%.

Conversions xGRAIL (inflation to GRAIL) or burn (deflation) cannot be taken into account. Because to redeem 100% xGRAIL to GRAIL takes 6 months.

However, with the above-mentioned buyback and burn mechanism GRAIL is similar to the model of ETH where the transaction volume increases over time causing GRAIL to become increasingly deflationary.

Camelot's predecessor was the Excalibur Exchange. This is the DEX that was established in early 2022 and operates on Fantom. However, later the Excalibur team decided to move to Arbitrum for product development and changed the name to Camelot. The operating model and the main concept of Camelot remain the same according to Excalibur.

The current partners with Camelot are all popular projects on Arbitrum such as: GMX, Jones DAO, Plutus, JustBet, Sperax, Dopex...

With TVL and top trading volume among DEXs on Arbitrum , Camelot has attracted a lot of liquidity and community attention to become the top 1 Native DEX of Arbitrum ecosystem. However, Camelot is more focused on collaborating with projects and Launchpad. To be able to develop sustainably in the long term, Camelot's team should perfect and focus on the needs of product users more.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.

Highstreet is a game that combines Metaverse, commerce and the Play to Earn trend. Thanks to the unique idea Highstreet has raised 5 million USD.