What is Aura Finance?

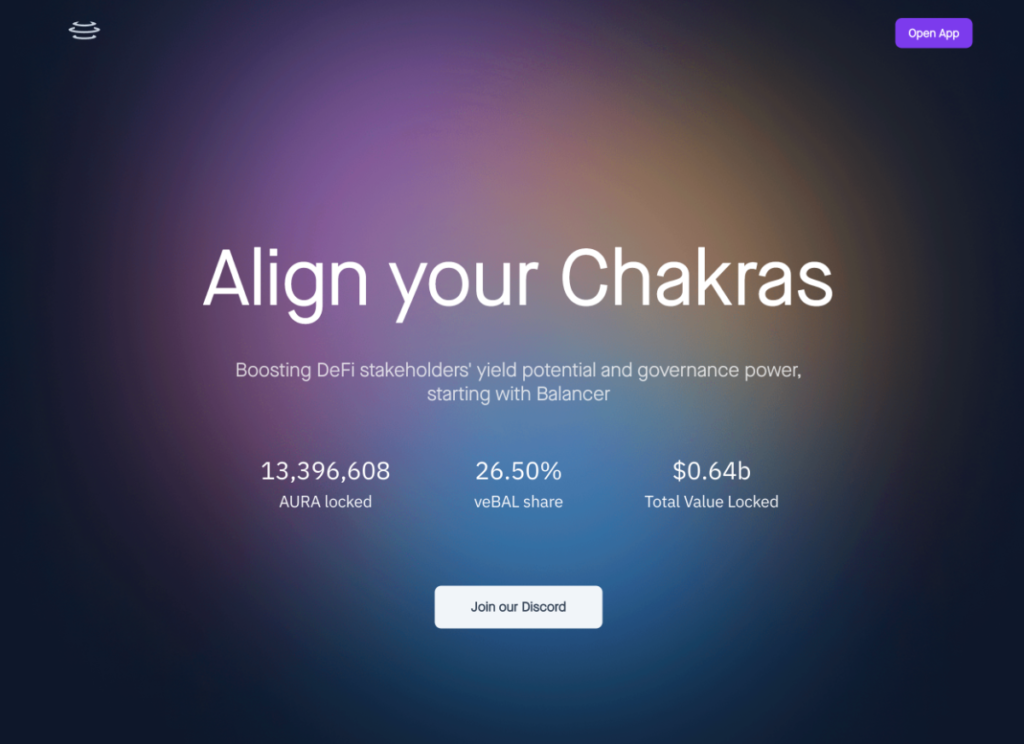

Aura Finance is a protocol built on top of the Balancer system to provide maximum incentives to Balancer liquidity providers and BAL staking people. This was made possible through the aggregation of BAL deposits and Aura tokens.

A seamless referral process to veBAL is provided by Aura to BAL staking participants through the creation of a wrapped token called auraBAL. This token represents 80/20 BPT locked for maximum time at VotingEscrow. You can staking this amount to get existing rewards (BAL and bbaUSD) from Balancer. This minting cannot be undone, however users can convert their auraBAL holdings into BAL through the liquidity pool providing incentives.

Aura makes the process of depositing into Balancer's metering system much simpler for liquidity providers by providing a streamlined integration process for any and all metering deposits. by Balancer. Aura allows depositors to achieve high gains through protocol-owned veBAL while also accumulating additional AURA rewards for their participation.

Aura's products

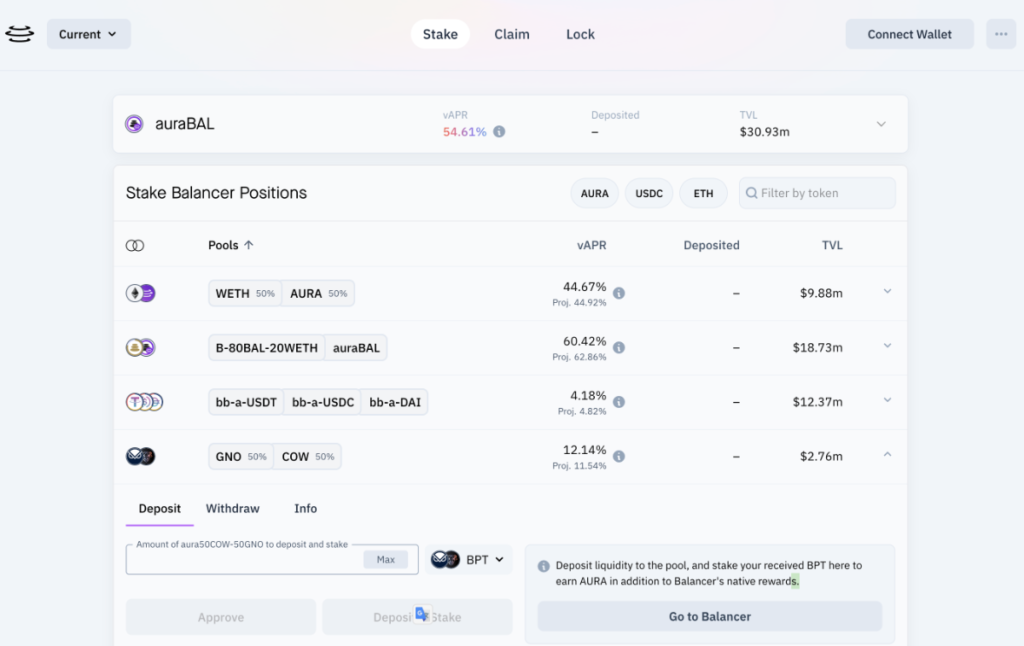

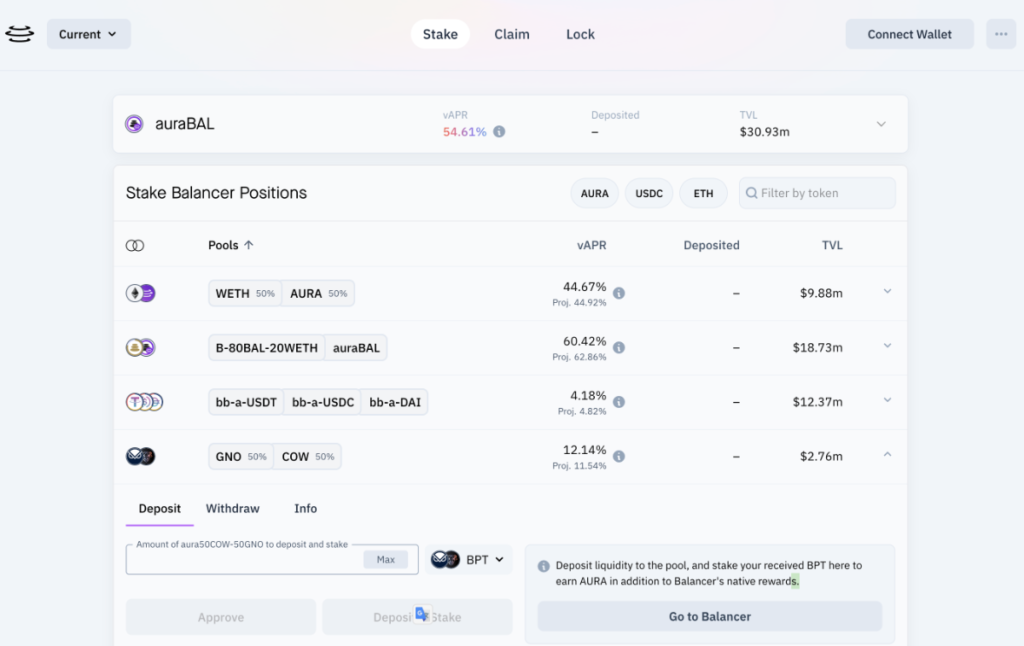

Stake

This is where users stake token pairs and receive transaction fees from the platform. The APY rate of each pool will correspond to the amount of BPT (Balancer Pool token) tokens that users receive. In addition, the collected BPT can be converted to AURA.

Locking AURA

Aura Finance provides AURA Locking program for voting. Users can lock AURA and get self-voting (or delegate to a third party), as well as receive auraBAL. Users can then stake auraBAL tokens to get back BAL, bbaUSD rewards from Balancer and BAL or AURA.

Highlights of Aura Finance

Aura Finance is developed based on Balancer – a leading AMM in the cryptocurrency market. The project tends to be more open in governance when shareholders in Aura have the right to vote with Pool BAL/ETH LP tokens veBAL or auraBAL. In addition, auraBAL users can stake on Balancer to generate BAL rewards, along with Aura transaction fees.

Users staking on Aura Finance will have a higher APR rate of return than investing directly on other platforms because users can staking on both Aura Finance and Balancer instead of just doing them individually, this will save time and maximize more profits for the participants.

Aura Finance is one of the LSD protocols that ensures liquidity in the ecosystem. Specifically, Aura has approached more than 10 LSD protocols to find liquidity sources for users with extremely attractive APY levels.

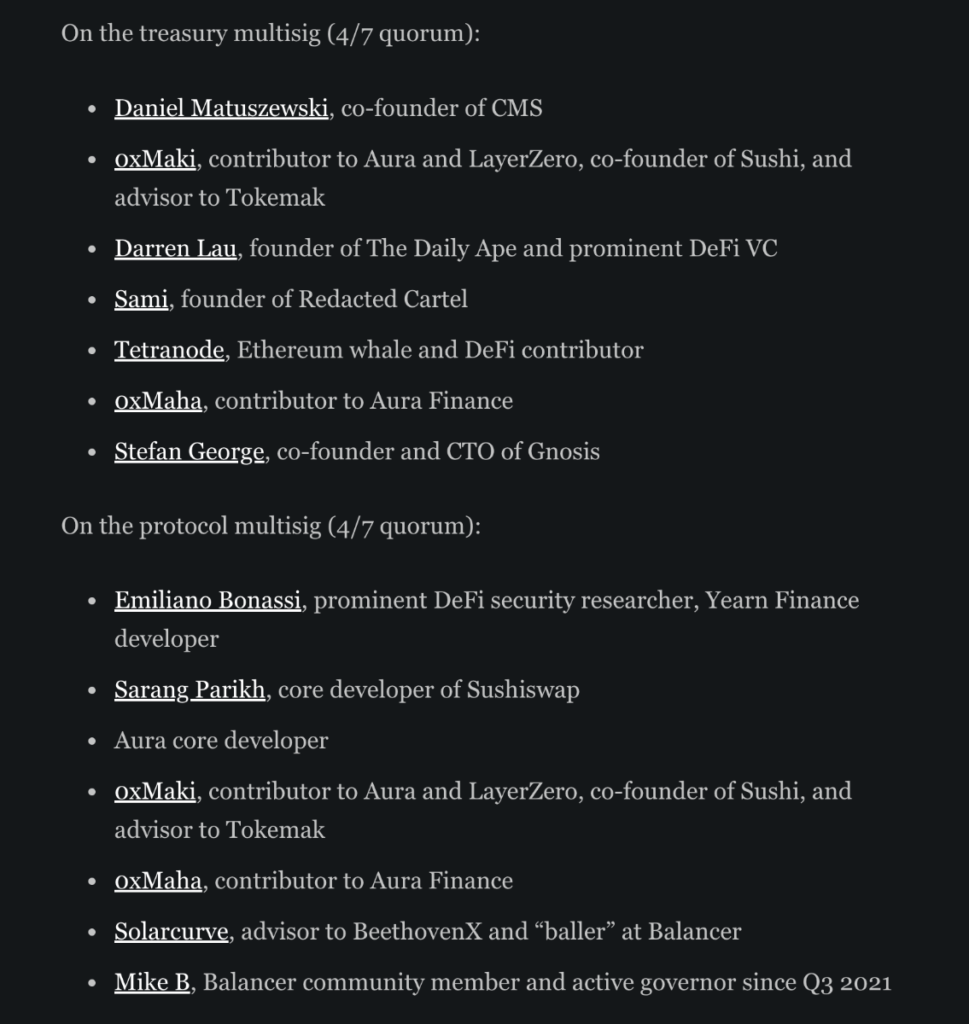

Investors and partners

Investors

The Aura protocol does not organize fundraising rounds or seed investors like other projects in the market. Instead, 100% of the AURA tokens will be allocated to the fairlaunch.

Partner

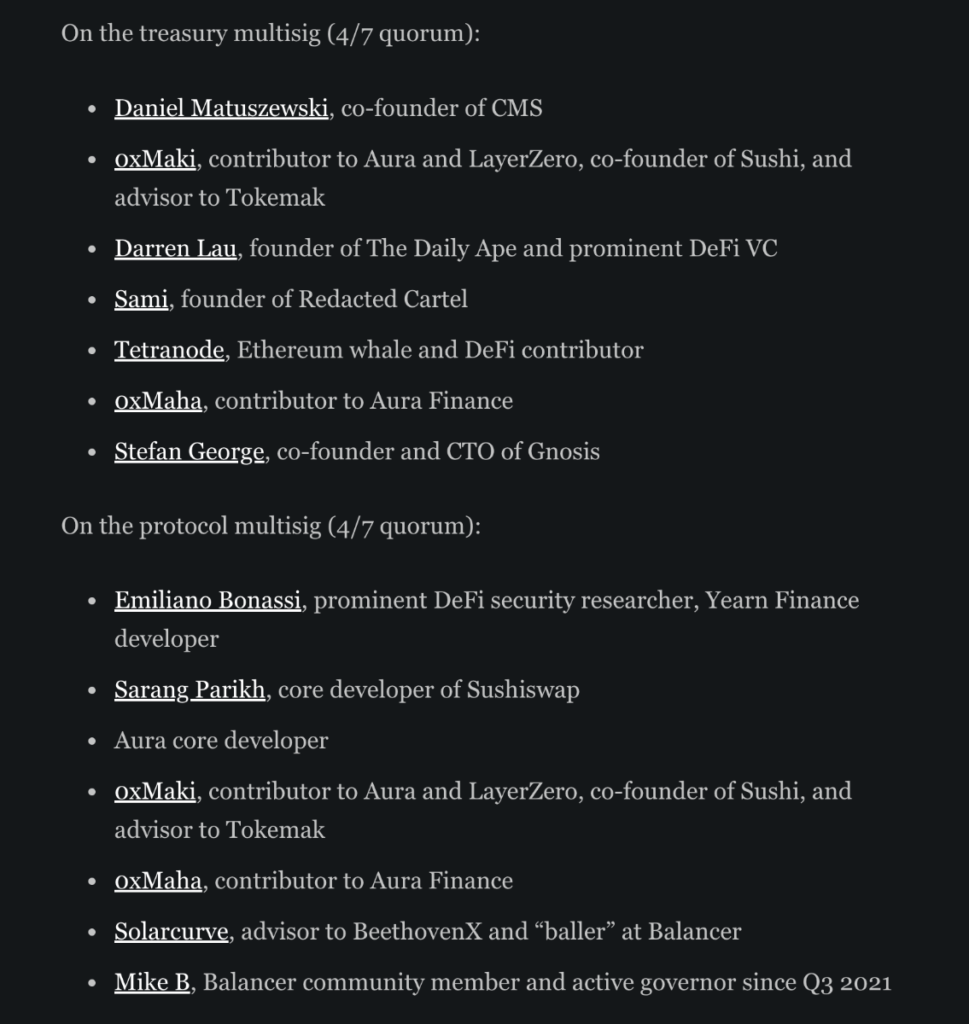

Information about Aura Finance's partners has not been disclosed. Aura Finance has shared some information about the people joining the Aura treasury including Daniel Matuszewski – Co-Founder CMS, oxMaki – collaborator of Aura and LayerZero, Co-Founder Sushi, Darren Lau – Founder of The Daily Ape, Sami – Founder of Redacted Cartel, Stefan George – Co-Founder of Gnosis…

Tokenomics

Basic information about the AURA . token

- Token Name: Aura Finance

- Ticker: AURA

- Blockchain: Ethereum

- Token Contract: 0xc0c2…903dbf

- Token Type: Utility

- Total Supply: 100,000,000 AURA

- Circulating Supply: 22,508,127 AURA

AURA Token Utility

In the ecosystem, the AURA token serves as a governance tool and incentivizes user participation. Locked AURA tokens will be able to vote on both internal proposals and use voting rights owned by the protocol itself when it comes to veBAL voting. These tokens will also have administrative rights in the system.

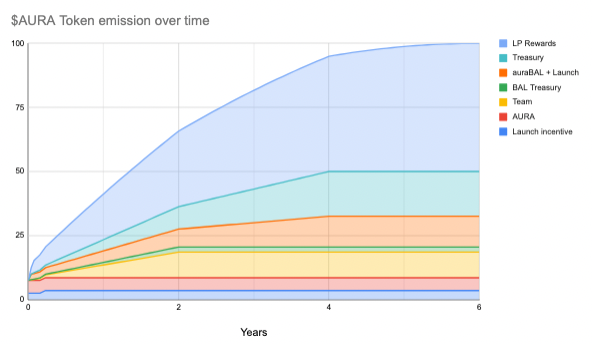

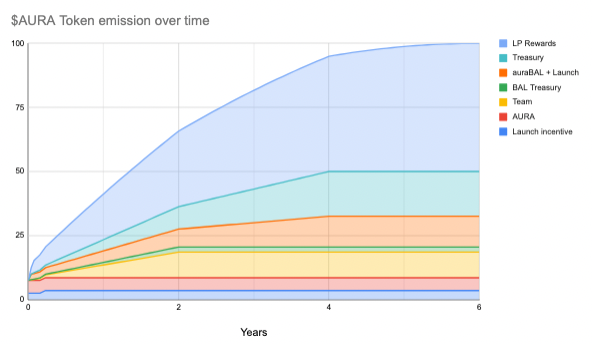

Allocation rate and token distribution schedule

- Balancer LP rewards: 50%

- Treasury: 17.5%

- StableSwap auraBAL/BPT: 10%

- Aura contributors: 10%

- Initial liquidity: 3%

- Bootstrapping token holder: 2.5%

- Bootstrap liquidity: 2%

- BAL treasury: 2%

- veBAL Bootstrapping Incentives: 2%

- Future Incentives: 1%

AURA is distributed according to the figure below:

summary

Above is the information you need to know about the Aura Finance project and the AURA token. This project is receiving FOMO from investors thanks to Ethereum's Shanghai upgrade event. If you are interested in this project, you can follow the following social networking sites:

Website | Discord | Twitter