What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Decentralized applications (Dapps) need accurate real-world data such as financial metrics, forecasts, etc. When deploying Dapps, Web3 developers use on-chain APIs – known as oracle – as a data feed for smart contracts. Most of the oracle solutions act as a middleman between the data provider and the user.

The API3 protocol allows data providers to run oracle nodes themselves, thus eliminating middlemen. Due to the absence of a middleman, data providers can no longer remain anonymous, instead they are held accountable and may face consequences if incorrect feeds are delivered to user.

API3 differs from existing oracle solutions in two ways. First, API3 provides complete transparency about the feed provided to consumers. Second, this project provides on-chain service coverage in the event of an API glitch. How does the technology behind API3 work?

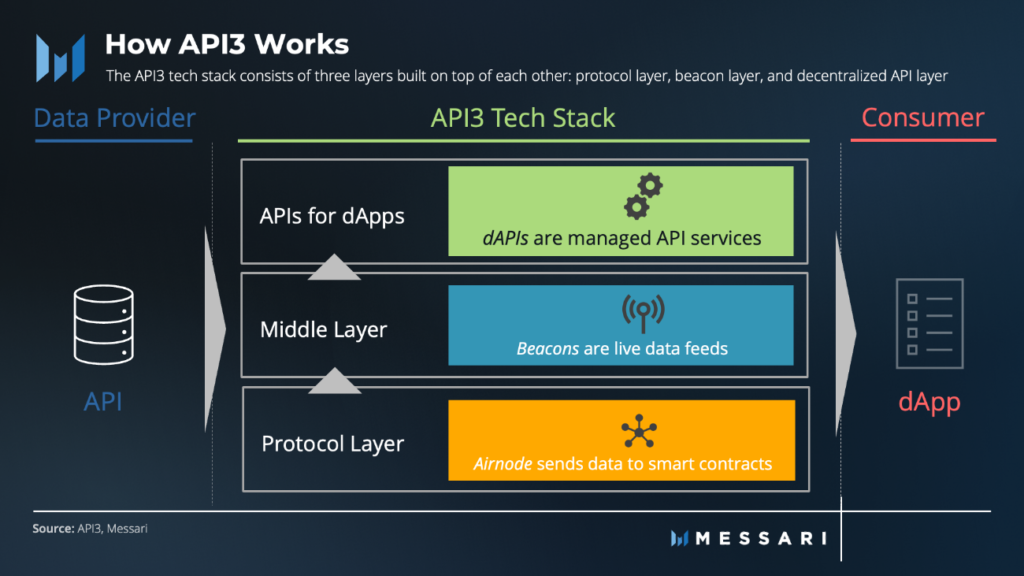

API3 allows data providers to directly expose their data to smart contracts. To meet the needs of developers, API3 has a modular design with three layers built on top of each other: the protocol layer, the middle layer, and the top layer.

Depending on development needs, a Dapp can consume API3 services in one of three layers.

The lowest layer is the API3 protocol layer, where data providers subscribe to the feeds they serve. Dapps are authorized to take data a technology called Airnode. In a word, Airnode retrieves data when requested by Dapps. That is to say, Airnodes are used by data providers to send data to smart contracts. It requires no skills to operate and no daily button maintenance. As of September 13, 2022, Airnode has been deployed on 13 chains and is EVM-chain compatible.

The middle layer consists of API3 beacoins built on top of Airnode. Each beacon is a live feed, where data from API providers is always fed into the chain according to certain parameters (e.g. every 1% price change). Good examples of beacons are forex, stock, or commodity data.

A beacon is maintained so that protocols can simply read the data or actively request it. Beacon allows API providers to respond to dApp requests. As a result, Beacon allows developers to get API3 data without dealing with the technical complexity of a particular Airnode protocol.

At the top layer are the APIs for Dapp (dAPI). Essentially, a dAPI is a mapping where a name such as “BTC-USD price” is mapped to the ID of a Beacon. API3 can point that mapping to another Beacon, which makes dAPI an actively managed service. dAPI is a top-level solution for developers, hence the default choice for Dapp deployments.

The native token, called API3, is used for two main purposes:

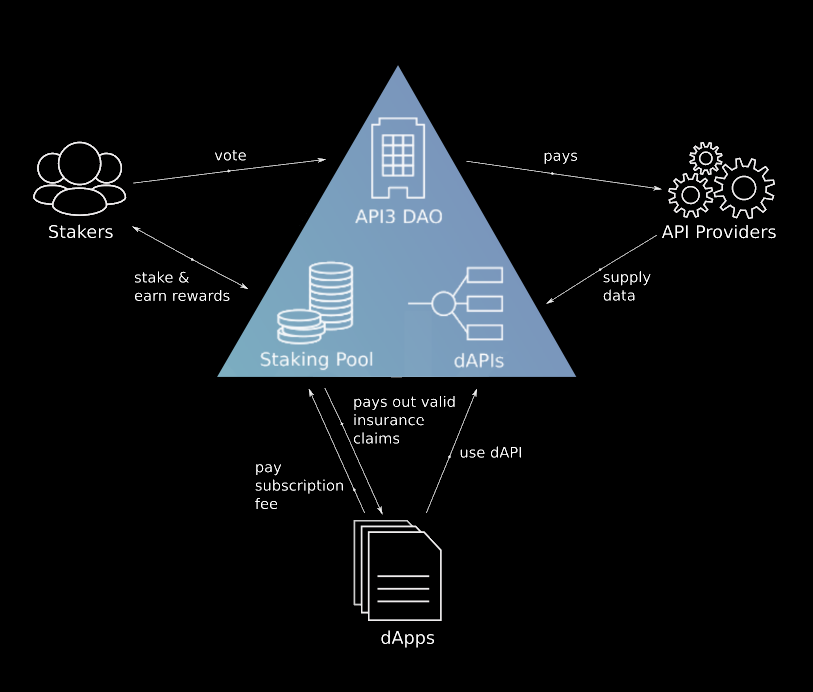

Governance: The API3 token arranges to align incentives between different stakeholders in the API3 protocol and facilitate smooth operations.

Staking: API3 can be staking in return for community rewards and voting rights.

The holders of their API3 related tokens receive a reward proportional to the protocol staking reward. These rewards are paid in exchange for the risk of being hacked if dAPI malfunctions. Also, data providers operating API3 oracles nodes are not required to hold API3 tokens.

To decentralize the management of dAPIs and the entire project, API3 is run by a non-profit DAO. The API3 DAO oversees the entire network and is responsible for directing and implementing the API3 project. Public management – all stakeholders can participate directly when staking API3 tokens.

The DAO votes on dAPI governance, staking incentives, collateral for the onchain service insurance fund, and disbursement of funds held in the DAO governance contract (USDC and API3 tokens).

In addition, the DAO awards are for the API3 ecosystem. Detailed tasks are performed through a hierarchical sub-DAO group structure for scalable governance. Any DAO individual or subgroup running the day-to-day operations of the protocol can apply for a DAO grant. DAO proposals, including proposals for such grants, are disallowed as long as the person has, or has been authorized, sufficient voting rights.

API3 uses two monetization mechanisms. First, when using beacons and dAPI, the Dapp will pay in USDC. API3 will then pay API data providers in USDC or fiat based on their preferences. Once payment is completed, Dapps will receive a whitelist allowing them to read their feed. At the same time, Dapps receive a service insurance policy that allows them to make claims in the event of a dAPI failure.

Second, at the Airnode level, Dapps can directly subscribe to an Airnode and make protocol-level requests to it. While this is not a requirement in the case of free API3 services, smart contracts can be used to collect token payments in return for protocol-level access.

API3 provides service coverage against dAPI crashes to mitigate potential security, governance, and reliability issues. For example, API3 can compensate Dapps when the API is down or the feed is incorrect. When a Dapp registers with a dAPI, a specific scope of service is issued based on potential crash risks and the quality and quantity of data transferred.

API3 service coverage begins with the DAO choosing which data to serve, managing trusted data providers, and deciding to include them. Since the staking pool pays the requests, it incentivizes the DAO to manage to be more secure. DAO members are directly incentivized to optimize decision-making, such as not recommending unreliable API vendors. In this sense, the dAPI governance manages the budget and incentivizes the DAO to maintain data integrity.

When a failure occurs, an on-chain service insurance claim will be issued. Claims come to API3 as a first instance. The potential outcomes are approval, objection, or rejection. Straight statements are generally approved by the DAO and paid for directly using API3 tokens. For more complex cases that require reporting, API3 uses an on-chain court system called Kleros to arbitrate claims payments. Simply put, Kleros can cut API3 on the basis of the facts presented to them. In this way, Kleros adds another layer of decentralization to the scope of services and allows fair treatment of dApps that use API3 feeds.

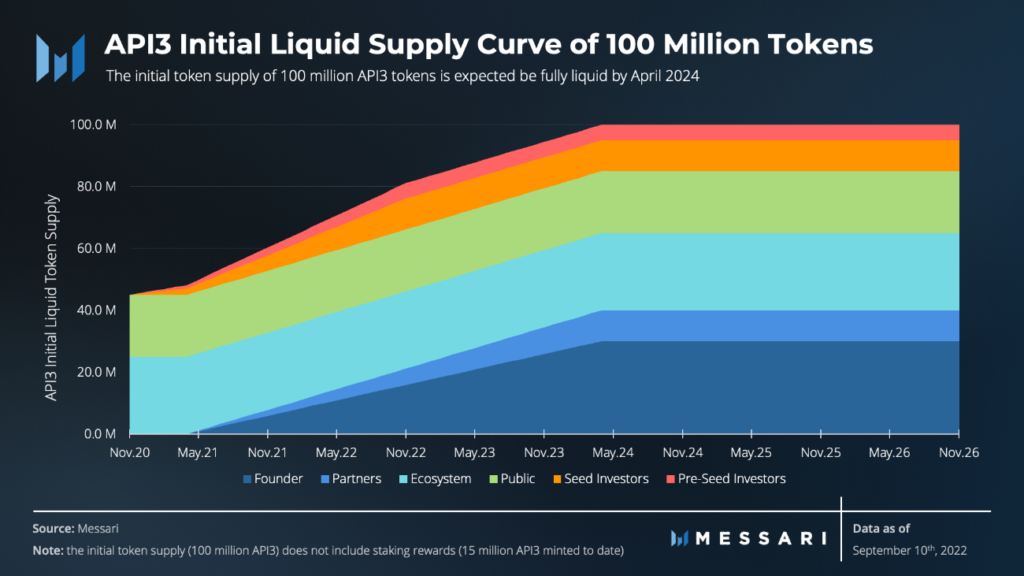

So far, the total supply of API3 tokens is 115 million. Of this total supply, 100 million API3s were initially allocated in November 2020, and the remaining 15 million API3s have been minted as staking rewards so far.

API3 Initial Token Distribution Launching November 2020 on Mesa DEX, a decentralized exchange using a mass auction mechanism. Anyone can participate in the auction, in which 20 million tokens have been sold. A full breakdown of the initial API3 supply and scheduled distribution of API3 tokens is as follows:

30 million tokens (30%) to API3 founders and team awarded over three years with a six-month period.

25 million tokens (25%) for API3 DAO to build community and ecosystem of the project awarded for three years with a period of six months. These tokens are used to fund builders, to direct the direction of the project, and to drive growth.

20 million tokens (20%) for public investors unlocked after the initial Mesa DEX offering.

10 million tokens (10%) to API3 partners (e.g. data providers) awarded over three years with a term of six months.

10 million tokens (10%) to seed investors issued over two years.

5 million tokens (5%) for investors who pre-order the seed for two years.

To secure the network through staking, API3 maintains an inflationary release of staking rewards. Stake tokens are primarily used as collateral in an on-chain service insurance fund. If the API3 DAO nonprofit has excess revenue after deducting all expenses, it will use this excess revenue to purchase API3 tokens to burn. Similarly, any USDC left over from operations will be used to buy API3 from the open market and burn it.

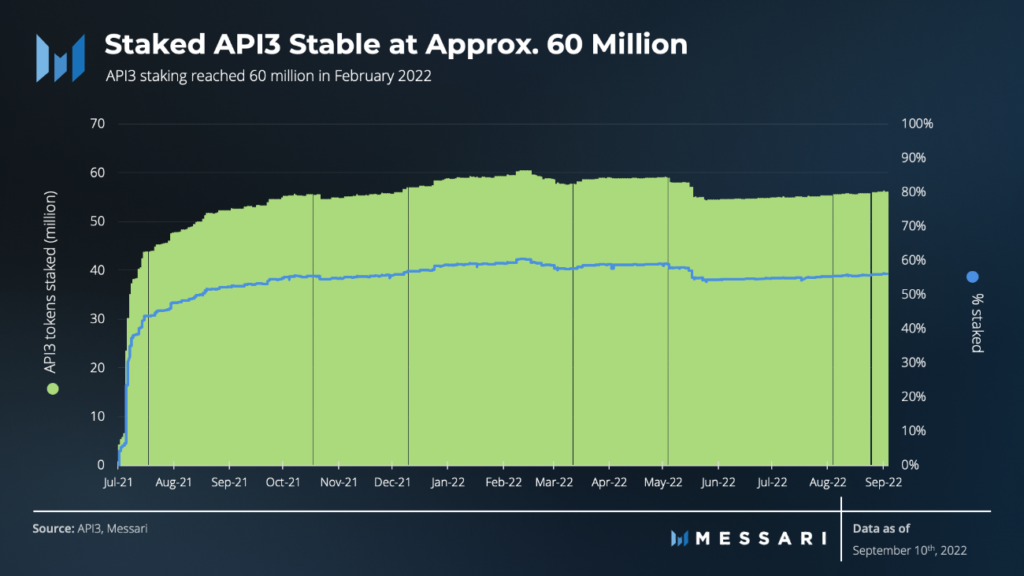

Up to now, there are 5,362 wallets actively staking. About 60% of the total API3 supply has been staking as of Q3 2021. This ratio has been kept relatively stable despite the general market showing signs of recession. The downturn also corresponded to a drop in APR to less than 6% in May 2022, down from a peak of 45% APR in August 2021.

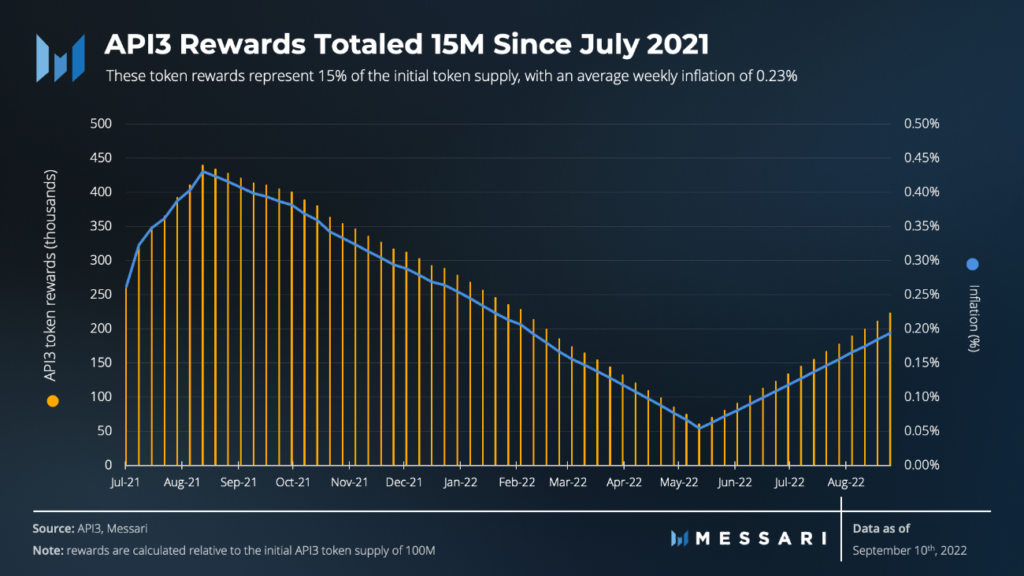

After that, API3 rewards dropped in May 2022, followed by a recent recovery. In total, over 15 million API3 tokens have been awarded for staking since July 2021. These rewards come from an average weekly inflation rate of 0.23% since July 2021. Inflation rate This release is calculated using the staking pool size as a percentage of the total supply set by the API3 DAO. If the target is reached, the APR decreases by 1% per week. If the target is not met, the APR increases by 1% per week. Staking rewards are paid weekly and locked for one year after they are paid.

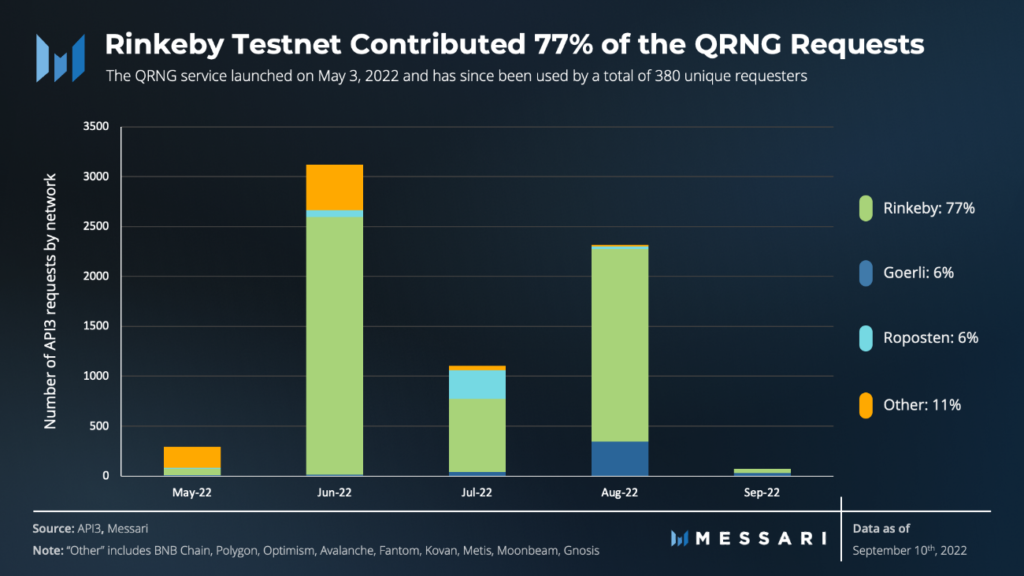

The latest Airnode version (V0.7) was released in September 2022. API3 also released the QRNG API for its platform in May 2022. API3 QRNG is based on the ANU Quantum Numbers (AQN) API and is capable of supply is truly random. number for smart contract. From a security point of view, to optimally address the threat of Sybil attacks, it is important to be able to generate truly random keys – API3 QRNG is enabling that, becoming the gold standard for random number generation .

QRNG itself is free, although users need to pay gas fees to call the API. API3 QRNG is currently available on 13 blockchain platforms. As of May 2022, the Rinkeby testnet contributed 77% of all QRNG requests coming from a total of 380 unique claimants.

The launch of the single-source dAPI feed on Polygon, BNB Chain, Avalanche and RSK was announced in July 2022. The multi-source feed is expected to be released in the near future.

API3 introduced a total of 179 data providers. Notably, 169 of them were introduced in Q2 to Q3 of 2021 as the API3 team prioritized growing their API provider base. So far, the API3 team has focused on managing feeds by relying on existing API providers instead of introducing new API providers. Apparently API3 is prioritizing quality over quantity.

According to the API3 roadmap, the main goal is basically to provide a data-chain service in a fully automated manner. To achieve this, API3 Marketplace will provide consumers with a means to visualize all available APIs and pay for services with a Web3 wallet. After payment, users are automatically whitelisted for their data access using their respective chains. Additionally, their service insurance policy will be generated on the Ethereum Mainnet and used to initiate claims in the event of a potential dAPI failure and resulting damage.

In addition, API3 also plans for additional platform features such as consolidated feeds, automatic Web3 billing, automatic whitelisting, automatic insurance policy setting, making dAPIs multi-source available on as many EVM chains as possible, including Solana and Near. Additionally, cross-chain subscriptions can open up market opportunities through further chain compatibility.

In terms of competition, Chainlink is the most dominant oracle solution today with over 1025 oracle networks and over 1400 projects in its ecosystem. That can be explained by Chainlink essentially becoming the backbone for the DeFi sector with leading projects like Aave , Compound, and Synthetix all relying on Chainlink for off-chain data. Chainlink seems to be the only oracle platform with steady user growth over time.

Competing with established oracle solutions like Chainlink is an uphill endeavor for API3. However, API3's growth momentum can be attributed to the fact that API3 is the only first-party solution on the market to serve the increasing demands of users for data transparency and reliability.

As for risk, API3 uses complex technologies by its nature as an integrated solution and can be prone to downtime when relying on centralized infrastructure providers. API3 proactively resolves potential issues by building redundancy in RPC service providers like Infura, Alchemy.

Based on their goals, API providers may still prefer third-party solutions where they can keep their anonymity. If API providers run their nodes on third-party solutions like Chainlink, they will need to maintain the node and cover the operational costs, rather than just using Airnode. These complex situations can reveal the trade-offs of trying to eliminate the middleman.

Another risk associated with service insurance claims is token sales. Since claims are paid in API3 tokens, API3 claimants can sell those tokens to cover the damage, resulting in further price fluctuations. Since dAPIs have so many glitches that can further compromise the token, even more is needed to maintain dAPI integrity through careful DAO governance.

API3 is an emerging technology in Web3's advanced infrastructure. It differentiates from existing oracle solutions by allowing API providers to run oracle nodes themselves and by providing complete transparency about the feed provided to consumers. To date, no other oracle platform provides this level of data transparency beyond the scope of on-chain services.

As the project leader in transparency and scope of services, API3 plays an important role in the technical advancement of decentralized oracle solutions. API3 is still in its early days as a project. We can fully expect the development of API3 as more and more users request accurate feeds.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.