What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Equilibrium is a project designed in the form of a decentralized money market platform. Equilibrium allows users to cross-chain liquidity, with a system of products that support lending, crypto-lending, mining and trading of synthetic assets.

Currently, Equilibrium is built on two main blockchain platforms, EOS and Polkadot's Substrate . However, the project development team also has plans and plans to expand Equilibrium on many other blockchains.

Equilibrium's cross-chain protocol enables the consolidation of these platforms into one decentralized aggregated trading, lending, borrowing and staking platform. With Equilibrium, the three main challenges of DeFi including space fragmentation, limited cross-chain aggregation, and liquidity issues are resolved. At the same time, in the future, the Equilibrium founding team intends to make the platform fully compatible with other blockchains through a “unified interface” for DeFi users.

Rated as one of the platforms that can solve DeFi's outstanding problems in the most comprehensive way today. Equilibrium has a lot of outstanding features, making the system more stable and giving its product a distinct identity.

Has strong interoperability

To date, Equilibrium is the only DeFi platform with true cross-chain compatibility. The value of blocked blockchains can move back and forth through the system.

Because of this powerful interoperability, financial freedom in the crypto world is also enhanced and more efficient. To achieve this, the Equilibrium creative team required a lot of complex engineering. However, this will certainly become the norm in the future.

Enhance system stability

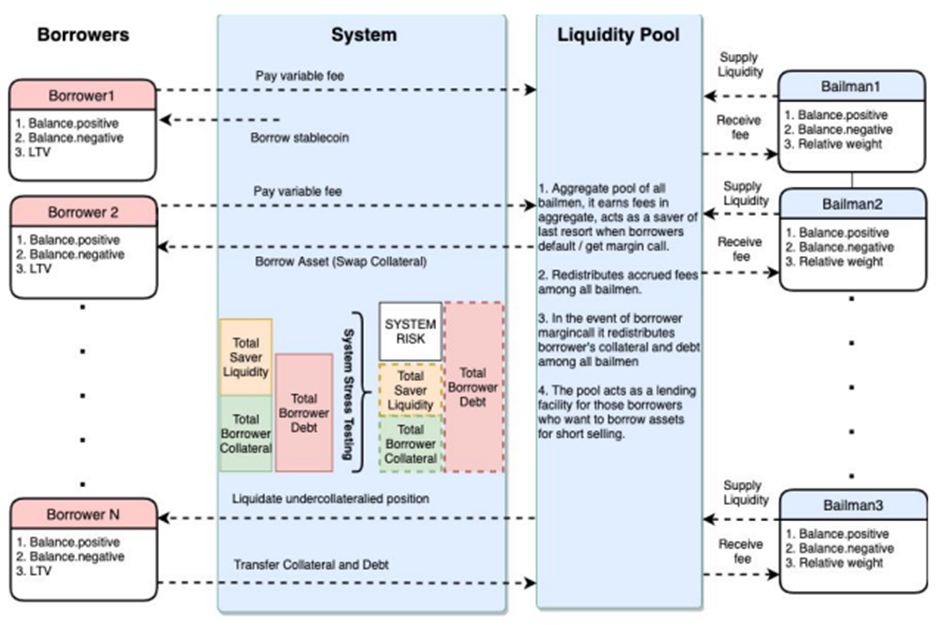

Within a platform, reliability, stability, and safety are highly dependent on the architecture and financial backing model of that platform. For Equilibrium, a relief mechanism that allows users to assume the role of “rescuer” has been designed. In addition, Equilibrium also provides the system with more liquidity when needed, and earns interest from the money users put into the baliout pool. For escrow cases, the collateral, the debt will be transferred to the advanced liquidity pool and spread over it.

Claim a mortgage with a real amount of collateral

Unlike other platforms, the collateral requirement that Equilibrium requires users is much lower, only 105% (while Synthetix's collateral requirement is 600%, MakerDAO is 150%, Compound is 133%). Equilibrium collateral is reasonable for a crypto loan or creating decentralized stablecoins in DeFi.

On the other hand, the system is also designed to support borrowers who can request to reduce their mortgage to 100%. At first glance, this is a relatively risky mortgage when there is a risk of insolvency. However, Equilibrium has an edge in being able to maintain liquidity even when the mortgage is only at 100% thanks to enhanced liquidity in the bailout pool.

In addition, Equilibrium also expands the functionality of blockchain-based mortgage lending by allowing borrowers to collateralize an amount of cryptocurrency (instead of opening a wallet with only one token). While this is new in the DeFi space in general, it is essential for fund management in traditional finance.

Increase the level of network security assurance

When designing Equilibrium, blockchain security experts at Quantstamp have been examining the code base to improve the security and privacy of the platform and minimize the risk of security breaches. .

The Equilibrium platform is a trading place for 4 groups of users with 4 different roles, including:

To meet these activities of all 4 user groups, the founding team of Equilibrium designed this platform with a diverse product system.

Staking

All users can profit from their assets participating in providing liquidity on the PoS/DPoS blockchain. Equilibrium provides users with a relatively safe, risk-free staking mechanism that allows locking smart contracts or tokens as a bridge to other blockchains. At the same time, through staked tokens, these smart contracts can generate additional rewards based on inflation in the PoS system. The Equilibrium system through which it distributes rewards to its users.

Lending

With this feature, users can allow those in need to borrow part of their property. The biggest difficulty for Equilibrium when implementing the lending feature is the depletion of the lender's assets. On the other hand, the lender must wait for a sufficient number of borrowers to be able to return to the pool, or the lender must add more collateral to be able to return to the lending pool.

Besides, Equilibrium's lending function will allow users to choose to become a guarantor. Lenders can set the corresponding flag when providing cross-chain liquidity to be able to perform this function.

Borrowing

When making a loan, the borrower will have to pay a floating interest fee. This fee is calculated based on the mortgage rate, the specific portfolio and the associated volatility risk. For crypto assets, volatility risks cannot be ignored, so in the event that a borrower uses crypto as collateral, additional collateral comes with a fee.

If the borrower offers more than 1 crypto asset, that is, using different crypto assets as collateral through cross-chain wrapping. Therefore, to determine asset value, Equilibrium will look at their portfolio of collateral rather than dealing with each token individually. If with other major DeFi platforms like MakerDAO and Compound, this is a shortcoming, with Equilibrium, this problem has been solved.

Synthetic assets and decentralized stablecoins

A synthetic asset is a collection of different cryptocurrencies that can maintain the same value as another asset. Decentralized stablecoins are price-stable cryptocurrencies. Stablecoins will be circulated when users need a collateral for their digital assets. In the Equilibrium platform, users can use both types of assets.

Relief packages

Relief packages are considered as an opportunity to earn extra income for liquidity providers when learning to participate in Equilibrium. This is the difference of Equilibrium because in other platforms, users can only earn money through lending assets.

Trading

As the DEX is built on Polkadot with the support of the Equilibrium engine, there will be a number of advantages and differences compared to other DEXs in the Ethereum ecosystem:

Liquidity farming

With 10% of the total supply (equivalent to 12 million EQ tokens) to serve the purpose of incentivizing users to bring assets into the DeFi market, the Liquidity farming pool will distribute EQ tokens to borrowers and guarantors equally. . The main goal is to be able to evenly distribute all 12 million EQ tokens over a period of 3 years.

Updating

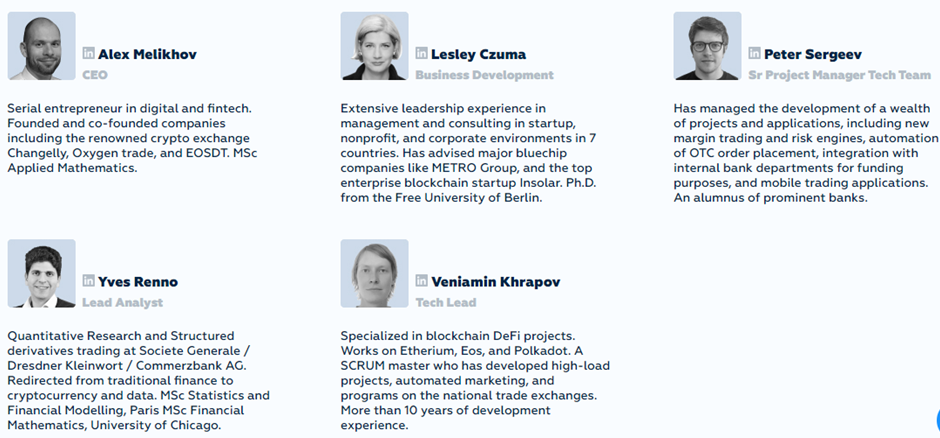

Equilibrium's development team is a team of more than 25 international experts who research and work on decentralized finance, banking, classical finance as well as blockchain and digital transformation distributed across worldwide scale. However, the core team currently has 5 members:

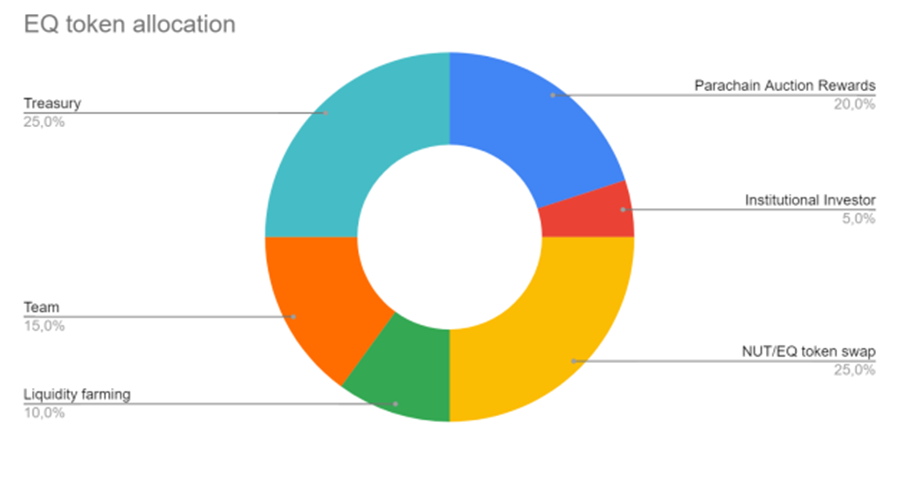

Since the fundraising round took place on October 1, 2020, the Equilibrium project has raised $ 5.5 million. Through “token swaps,” EOS users can swap their NUT tokens for EQ tokens on the Polkadot network. There have been many institutional investors involved in this token swap such as BKEX Capital, PNYX Ventures and Taureon.

Regarding partners, the Equilibrium project currently has many different partners such as Moonbeam, REN, Curve Finance, Band Protocol, Bluezelle, Chainlink, Kylin, Reef Finance and Polkadot DeFi Alliance.

In the Equilibrium market, the core token as well as the trading center is the EQ token. This token is now widely used throughout the Equilibrium system and across the applications that operate within it.

Detailed information about the EQ token:

With a total supply of 12,000,000,000 EQ tokens, Equilibrium plans to allocate tokens to stakeholders as follows:

The EQ token traded on Equilibrium has the following basic functions:

At the moment, the EQ token has not been released to the public. For investors wishing to own EQ tokens, they can contribute DOT and receive EQ tokens through participating in crowndloan.

Currently, Equilibrium has distributed one of the most complex and useful Dapps on the blockchain platform, EOS. However, there is still a lot of potential of this project that has not been fully exploited because it has not yet built enough supporting financial products such as decentralized leverage, stable liquidity units or money market protocols. and aggregate assets.

In the future, Equilibrium is predicted to become the first DeFi center to provide special services to users of major electronic assets such as BTC, ETH, XRP, EOS, etc. With Polkadot technology and the framework of the platform. Substrate platform, Equilibrium can create a different decentralized system, distinguishing its technology from other current blockchain 3.0 projects such as Kava, Cardano, Algorand...

As can be seen, Equilibrium now inherits the features of the previous DeFi. Typical examples include developing Stablecoins on the DeFi market, building a synthetic asset system for users, or optimizing investment portfolios when sending assets to the platform. In the future, Equilibrium promises to bring optimal solutions to the Web 3.0 ecosystem, providing the opportunity to perform multi-chain cross-chain transactions and unlimited liquidity.

Readers who want to learn more information about the Equilibrium project can watch at the following channels:

Website | Twitter | Telegram | Medium | GitHub | Blog | Whitepaper

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.