FTX is a centralized cryptocurrency exchange that offers various applications and services like derivatives, options, volatility products, and leveraged tokens. Let's learn about FTX features and how to use them!

What is FTX?

FTX is a centralized cryptocurrency exchange that offers various applications and services like derivatives, options, volatility products, and leveraged tokens. In July 2021, FTX raised $900 million at an $18 billion valuation from over 60 investors. This is the biggest fundraising event to be ever recorded in the history of crypto.

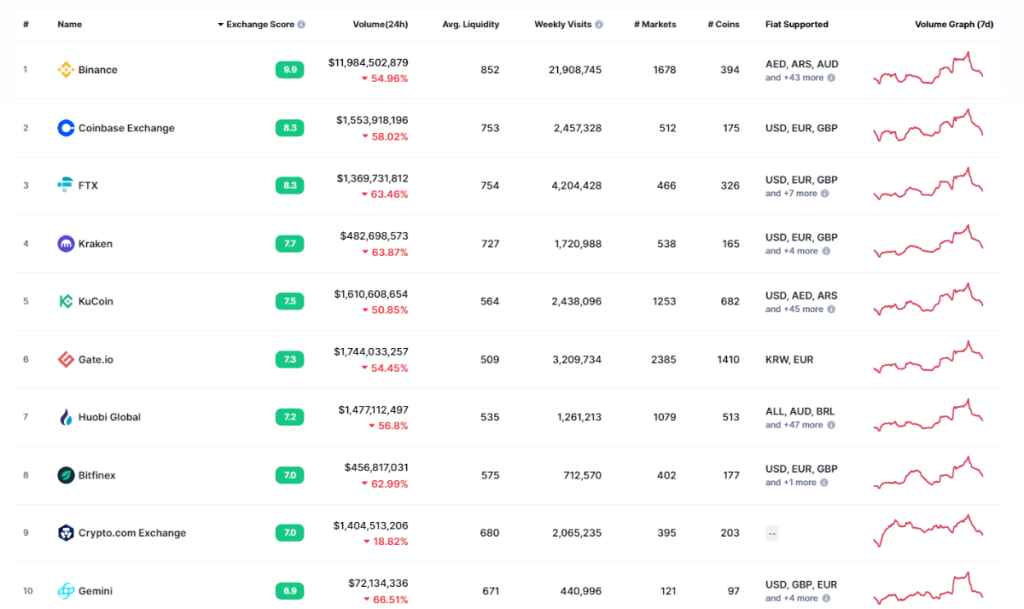

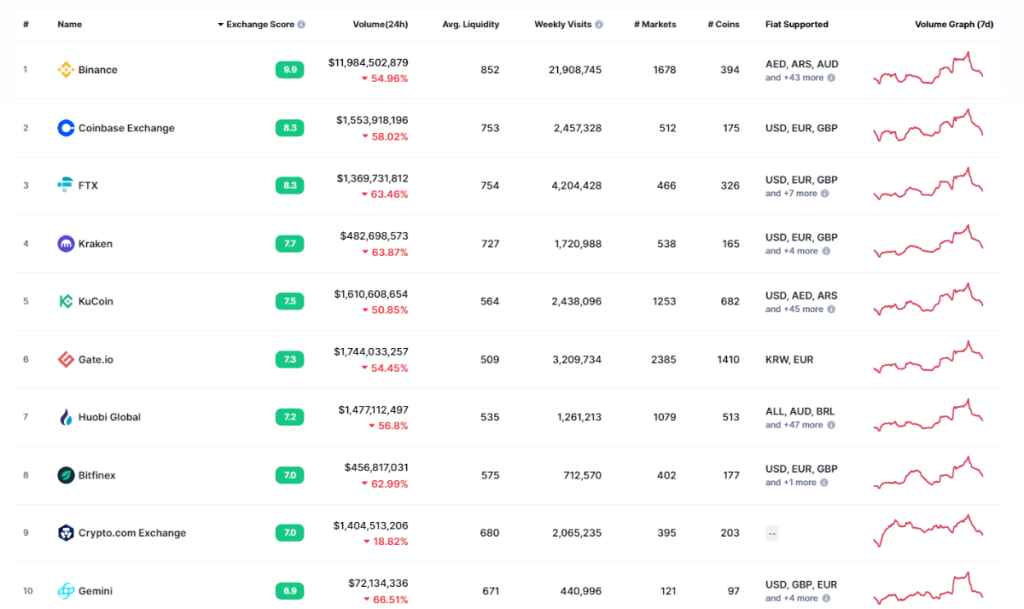

At the moment, FTX is in the top 3 centralized cryptocurrency exchanges, ranked by CoinMarketCap (Source: here).

Who created FTX?

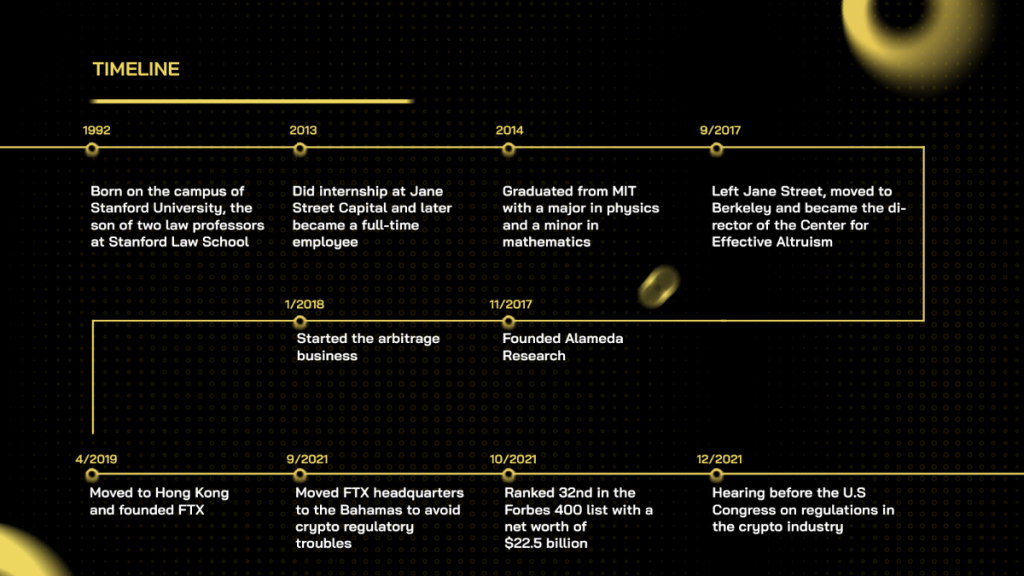

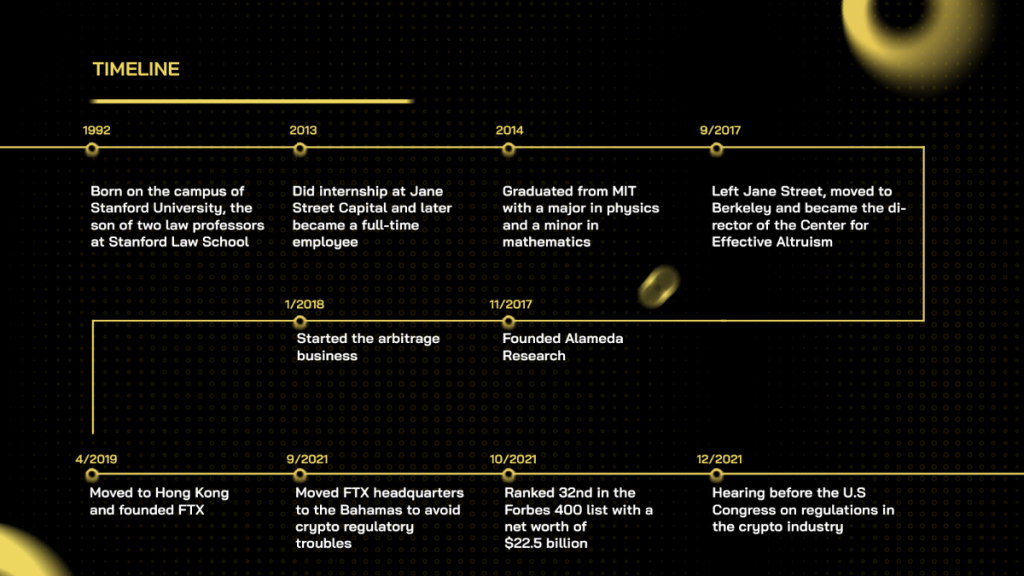

Sam Bankman-Fried (SBF) and Gary Wang - two MIT graduates, founded FTX in May 2019. Before that, Sam Bankman-Fried used to be an international trader at Jane Street Capital and owned a quantitative trading firm called Alameda Research.

The timeline ò Sam Bankman-Fried

What is FTX used for? Why use FTX?

As mentioned above, FTX is a cryptocurrency exchange. This means that people can use FTX to buy and sell crypto assets at ease, along with numerous other add-ons.

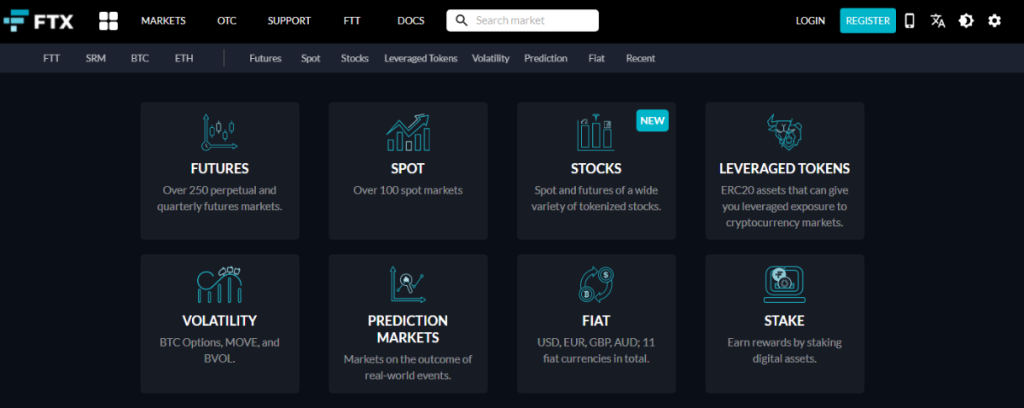

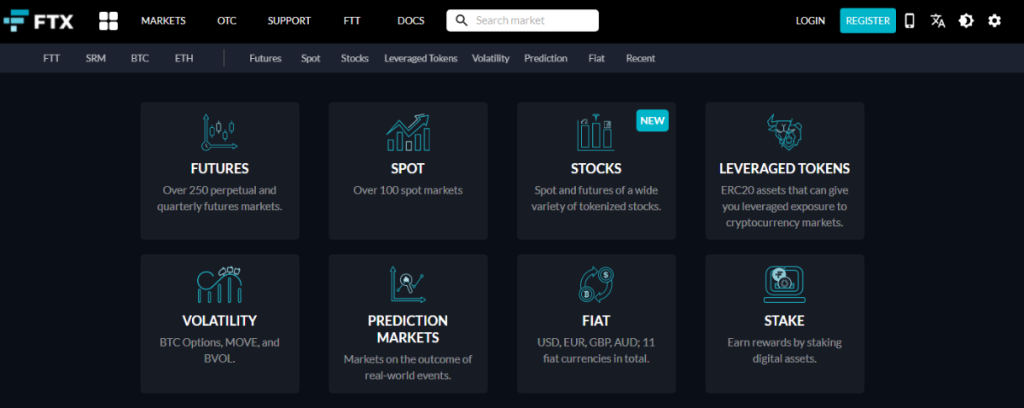

There are various features that you should use FTX for besides its traditional spot trading, such as:

- FTX Margin Trading, Futures, Leverage Tokens, and Options.

- FTX NFT Marketplace.

- Support both US and non-US citizens.

- FTX (Debit) Card.

FTX features

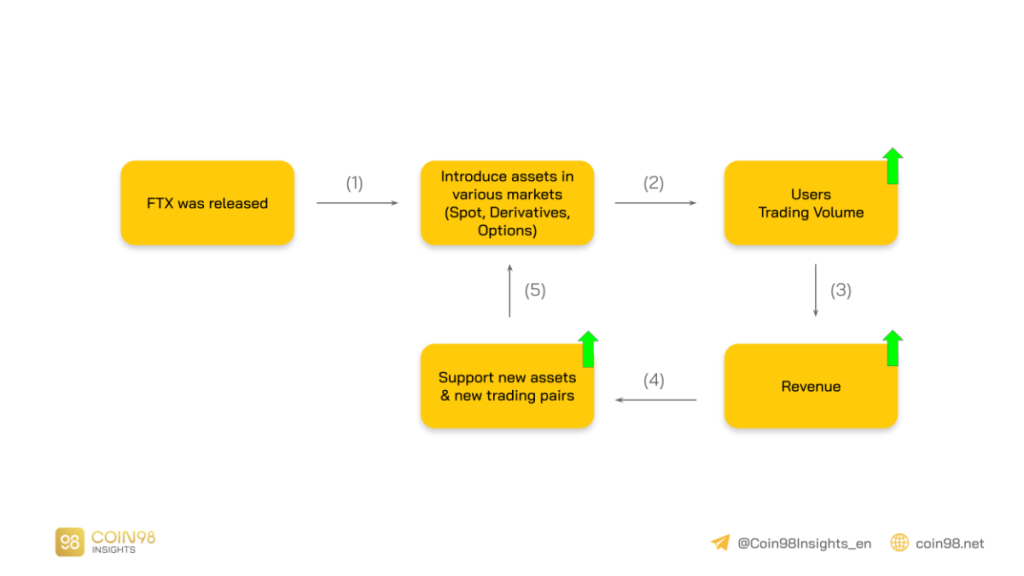

How does FTX work?

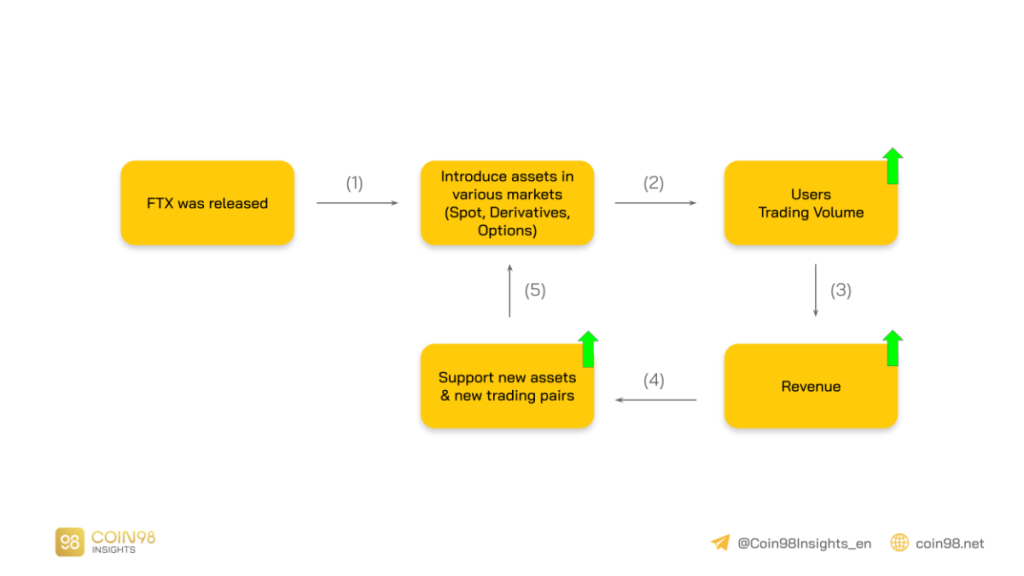

As a cryptocurrency exchange, FTX works in a similar way to any other CEX. The flywheel of FTX can be seen as:

Step 1: FTX was released with some initial markets and assets.

Step 2: FTX incentivized users to trade on their platforms. This can be done in multiple ways (Advertisement, Marketing, Incentive Program,...).

Step 3: FTX gains more users and trading volume.

Step 4: As a result, FTX receives more revenue.

Step 5: FTX grows in value, and continues to attract more users and trading volume by introducing more markets and assets.

FTX Exchange Review (2022)

Even though FTX is and has been one of the best CEXs in the crypto market at the moment, it still has pros and cons. Here are some unbiased valuations of FTX:

Advantages of FTX

- Support over 300 cryptocurrencies.

- Low trading fees with discount programs.

- 0 deposit and withdrawal fees for a variety of tokens (USD stablecoins + SPL tokens).

- Favor FTT (FTX’s native token) holders by offering numerous benefits.

- Versatile market types, including leverage of up to 100x.

- Have an NFT Marketplace.

- Develop applications on both desktop and mobile.

Disadvantages of FTX

- Maybe unfriendly for new crypto users as they have a professional interface with lots of complicated features.

- No live chat support.

FTX vs. FTX US: What is the difference?

FTX has numerous versions like FTX US (United States) or FTX TR (Turkey). This is due to the complication of regulation that makes FTX unable to operate in a few countries. This case is extremely popular in countries like the U.S.

To tackle this problem, CEXs specifically usually have various versions for different countries to suit their rules and laws. For example, Binance also has Binance.US and Binance TR, similar to FTX.

Key Products of FTX Exchange

In this part, I will go through some of the most outstanding features of FTX, and explain to you how it works.

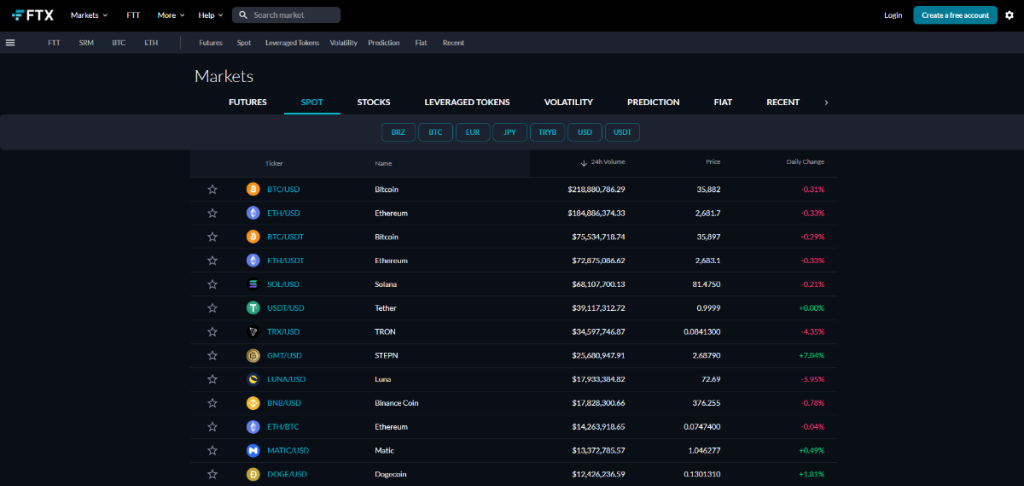

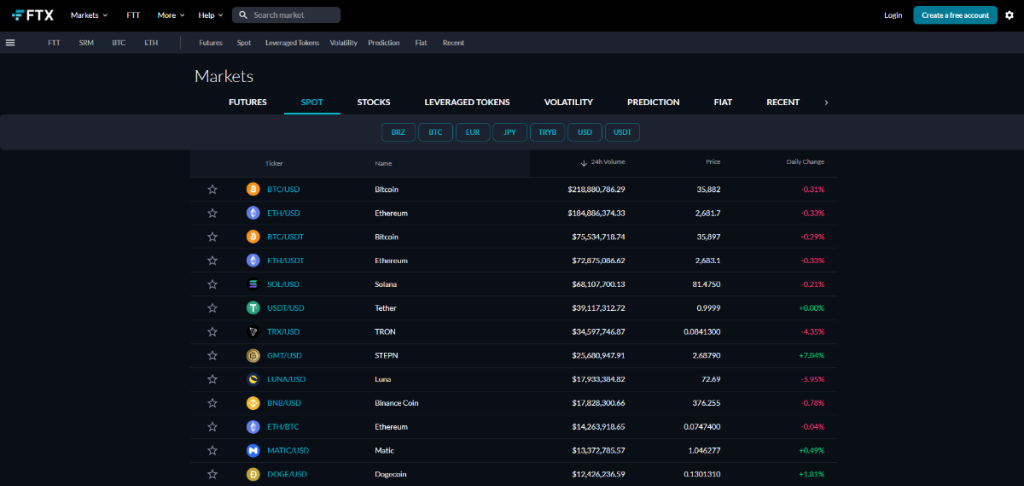

Spot Trading

Spot Trading is the most basic function that every exchange must-have. It is simply the direct buying and selling of different currencies, like BTC or ETH.

Margin Trading

Margin Trading is closely similar to Spot Trading. The only difference is that Margin Trading allows you to borrow more capital to leverage your position while Spot Trading does not.

As you borrow funds in Margin Trading, be aware that you will be exposed to liquidation risks. All of your funds (including the original funds) will be lost if the borrowed asset goes down in price past a certain threshold.

When you close your Margin Trading order, you have to repay a percentage of the amount you borrow as interest. This rate depends on the platform and the asset. The longer you borrow, the more you will have to repay.

Margin Trading shares the same market as Spot Trading (Spot Market). This means that an asset in Margin Trading will always have the same price as that asset in Spot Trading.

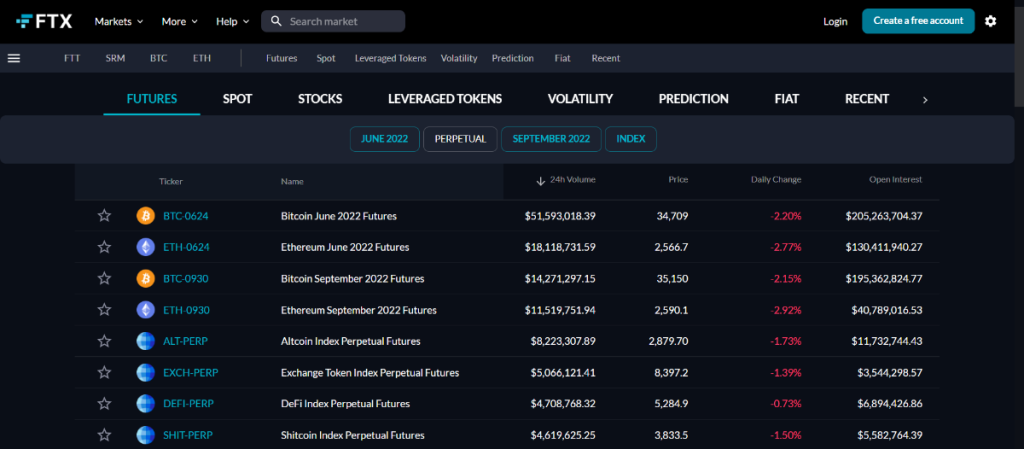

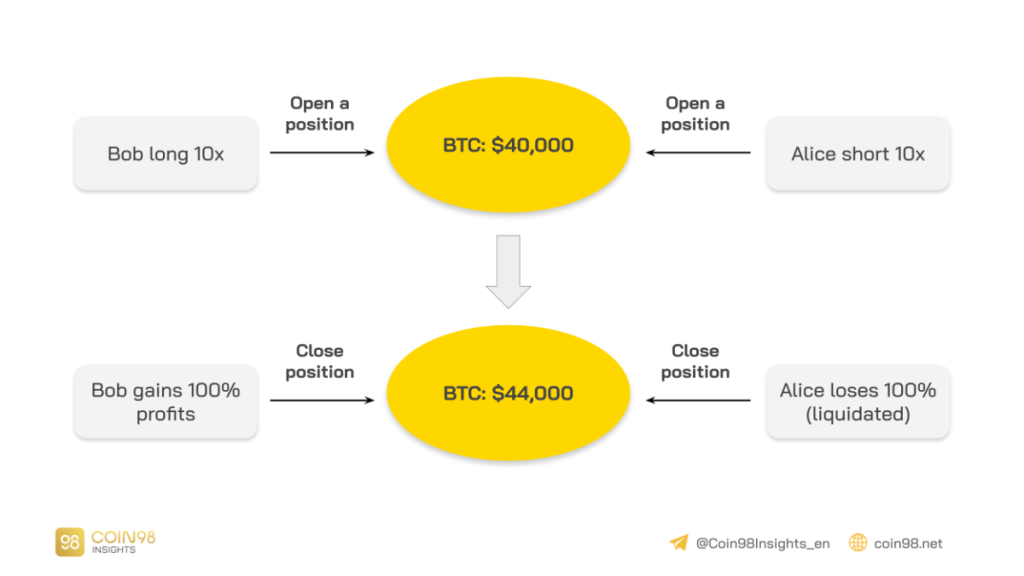

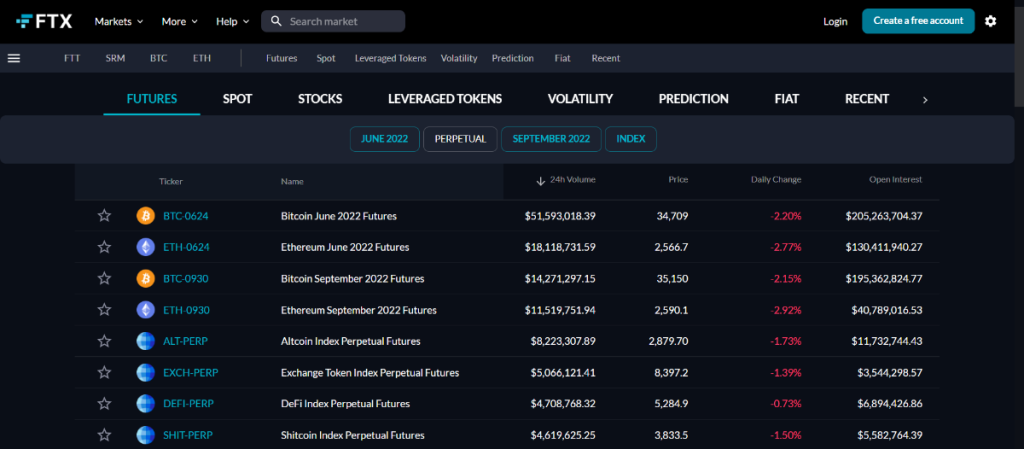

Futures Trading

Futures are a type of derivative trading product. Futures Trading does not involve tokens or cryptocurrencies, but rather contracts that hold the value of the underlying asset. As such, users trade contracts in Futures Trading, not directly the tokens themselves.

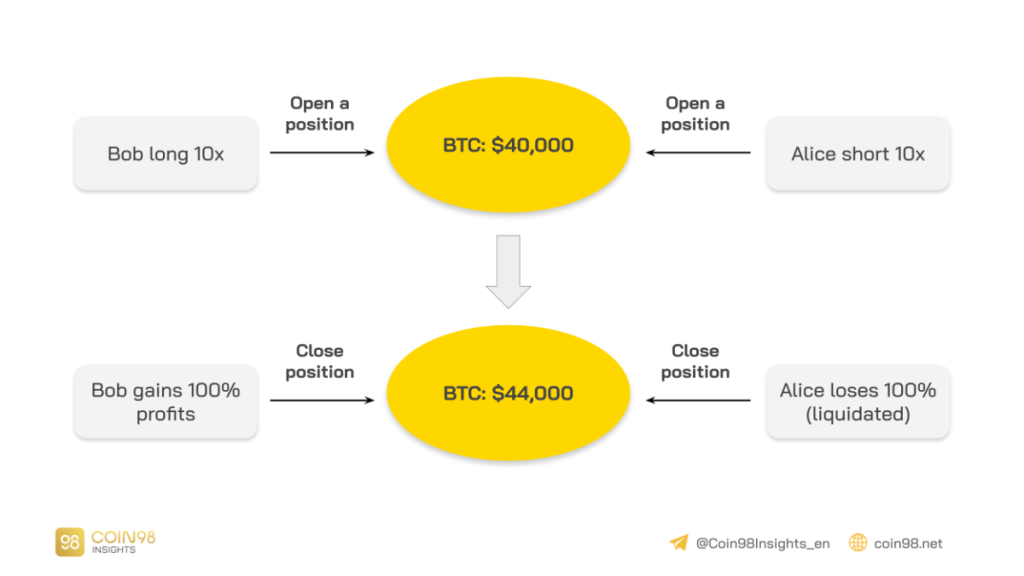

These contracts involve an agreement between two parties to purchase (Long) or sell (Short) an underlying asset at a fixed price on a certain date. Investors open a long position if they expect the price of the underlying asset to go up, and a short position if they expect its price to go down. Futures Trading usually goes along with leverage.

For example: The price of BTC is $40,000. Bob opens a long position on BTC while Alice opens a short position, both at 10x leverage. Now the price of BTC becomes $44,000 (+10%). If both of them decide to exit their positions at this moment, Bob will profit 100% (10*10%) while Alice will be liquidated as her position is down 100%.

An example of how Futures Trading works

Futures contracts usually have an expiration date that is set when the contract is opened. However, there is a type of Futures contract called Perpetual that allows you to keep the contract for as long as you wish. For this kind of contract, you have to pay a specific Interest Rate (similar to borrowing in Margin Trading).

FTX supports a large number of Perpetual Futures contracts. As they are contracts and not assets, the underlying value can be very versatile. For example, FTX even enables Indexes like ALT (Altcoin Index) or DEFI (DeFi Index) as the underlying value of these contracts.

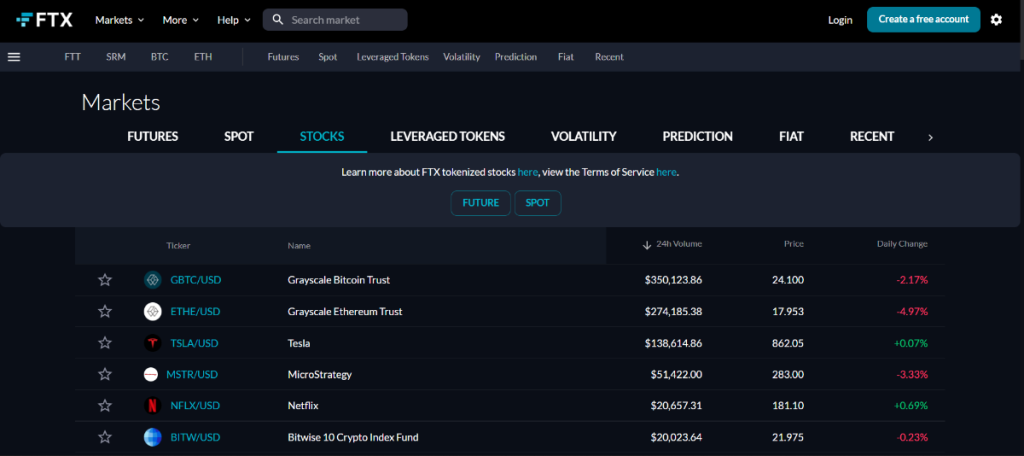

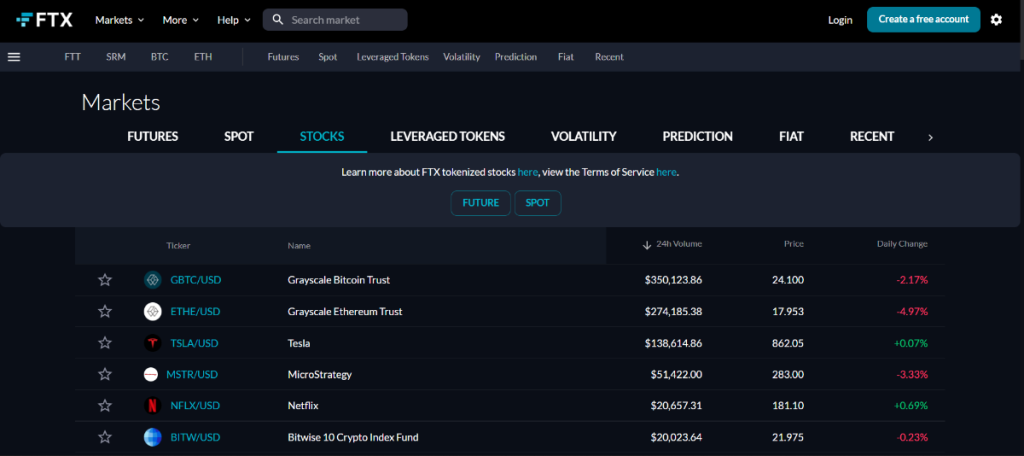

Tokenized Stocks

FTX also issues Tokenized Stocks as derivatives assets. Different stocks like TSLA (Tesla), AMZN (Amazon), or TWTR (Twitter) are also available for purchase on FTX. Their prices will be identical to those in the original Stock Market.

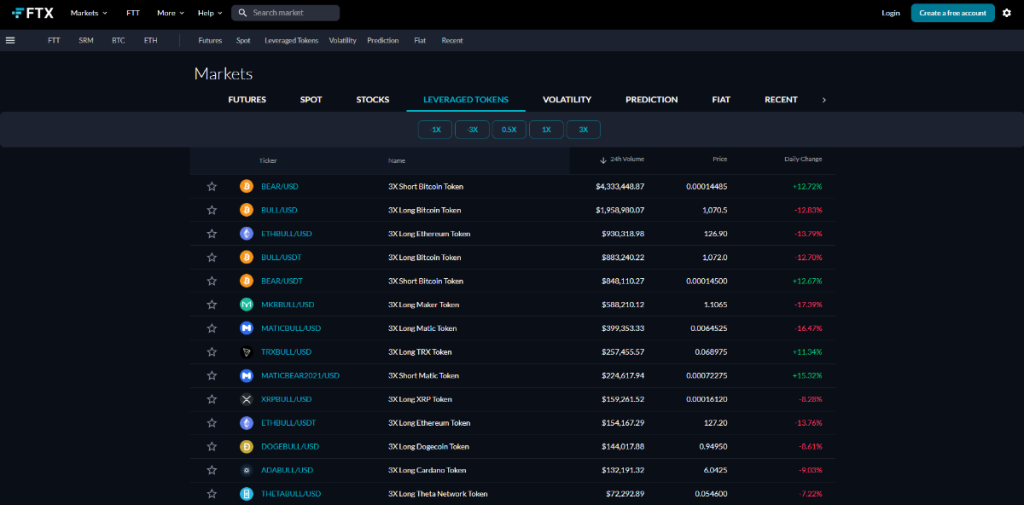

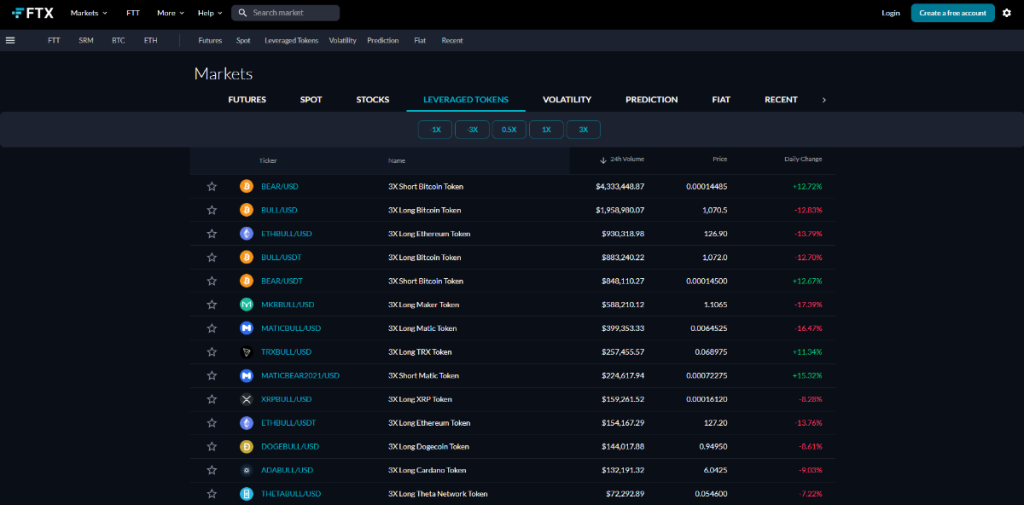

Leveraged Tokens

Leveraged Tokens are ERC-20 assets that bear the intrinsic leveraged value of the original assets. Leverage Tokens work similarly to Perpetual Futures contracts, with the only difference being they do not impose liquidation risks on users.

Each Leveraged Token gets its price action by trading FTX Perpetual Futures. For instance, say that you want to create $10,000 of ETHBULL. To do so, you send in $10,000, and the ETHBULL account on FTX buys $30,000 worth of ETH Perpetual Futures. Thus, ETHBULL is now 3x long ETH.

There are 5 types of Leveraged Tokens on FTX:

- BULL (+3x): If the underlying asset increases 1% in value, its BULL token will increase 3% in value.

- BEAR (-3x): If the underlying asset increases 1% in value, its BEAR token will decrease 3% in value.

- HEDGE (-1x): If the underlying asset increases 1% in value, its HEDGE token will decrease 1% in value.

- HALF (+1/2x): If the underlying asset increases 1% in value, its HALF token will increase 0.5% in value.

When the price goes down, a portion of BULL tokens possessed by users will be sold to maintain the 3x leverage. In this way, BULL token holders will always be exposed to a 3x long position without getting liquidated. The same situation applies to other Leveraged Token types.

Leveraged Tokens are extremely helpful for:

- Managing risks: Different from Perpetual Futures contracts, Leveraged Tokens do not impose liquidation risks.

- Managing strategies: Leveraged Tokens are automatically rebalanced, whether the price of the original asset goes up or down. HEDGE tokens, for example, automatically increase their position if the asset’s price decreases. This is beneficial for long-term investments as they constantly enlarge the position size.

- Convenience: Leveraged Tokens are actually ERC-20 assets, meaning they can be transferred between different wallets while still maintaining their functionality.

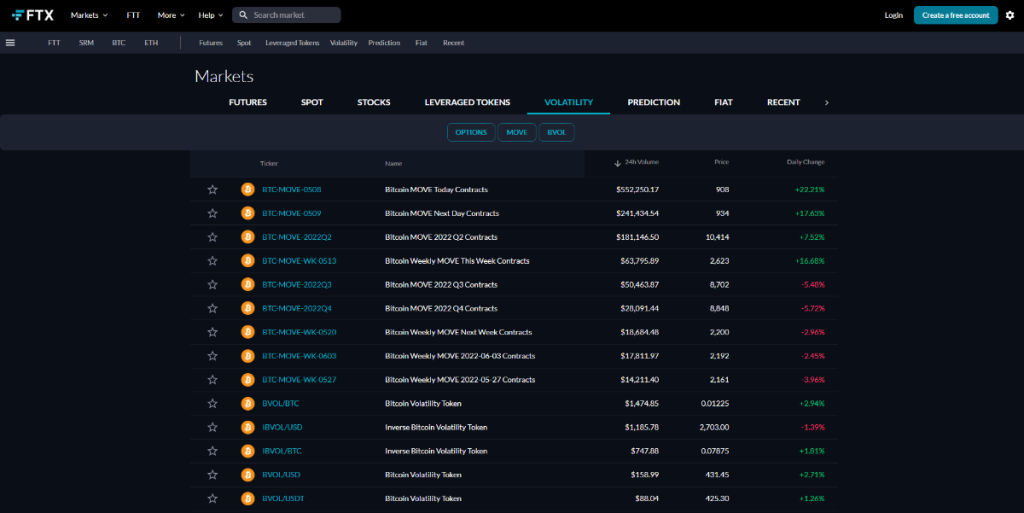

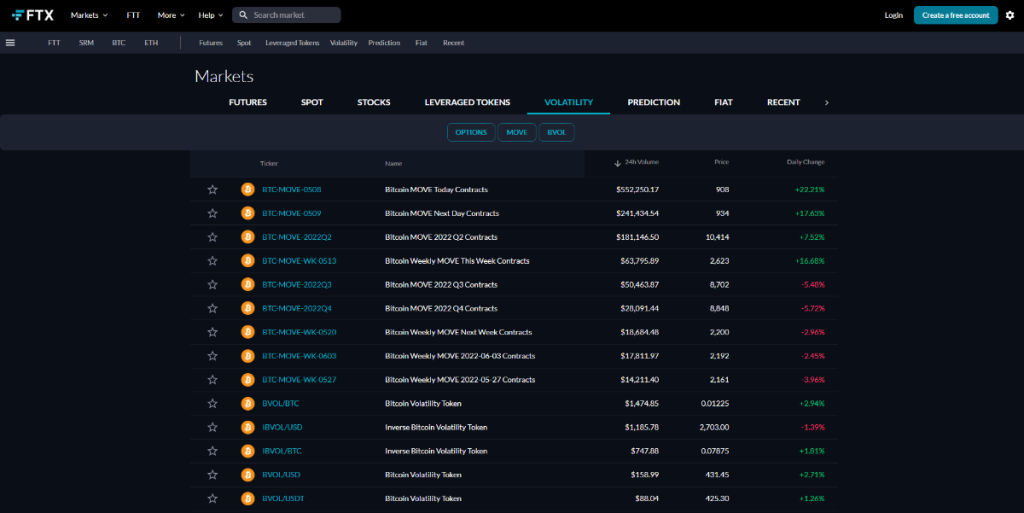

Volatility

The volatility feature on FTX consists of 2 main elements: Bitcoin MOVE contracts and (Inverse) Bitcoin Volatility tokens.

Bitcoin MOVE contracts represent the absolute value of Bitcoin’s price change over a certain period of time. For instance, Bitcoin MOVE Today Contracts record the price of Bitcoin at the beginning and the end of the day. Whether Bitcoin’s price goes up or down that specific day, the absolute value of change will be recorded to those contracts.

The duration of Bitcoin MOVE contracts can be daily, weekly, or quarterly. In a simple way, Bitcoin MOVE contracts work pretty similarly to Futures contracts as they can both be applied with leverage.

The only difference is that MOVE contracts take the absolute value of price change into consideration, rather than its direction of up or down. Longing MOVE contracts means you want to speculate that the price of the asset will fluctuate a lot while shorting means you believe that its price will be relatively stable.

Bitcoin Volatility (BVOL) and Inverse Bitcoin Volatility (iBVOL) tokens track the implied volatility of Bitcoin by using FTX MOVE contracts and BTC-PERP contracts. BVOL attempts to track the daily returns of being 1x long the implied volatility of BTC; iBVOL attempts to track the daily returns of being 1x short the implied volatility of BTC.

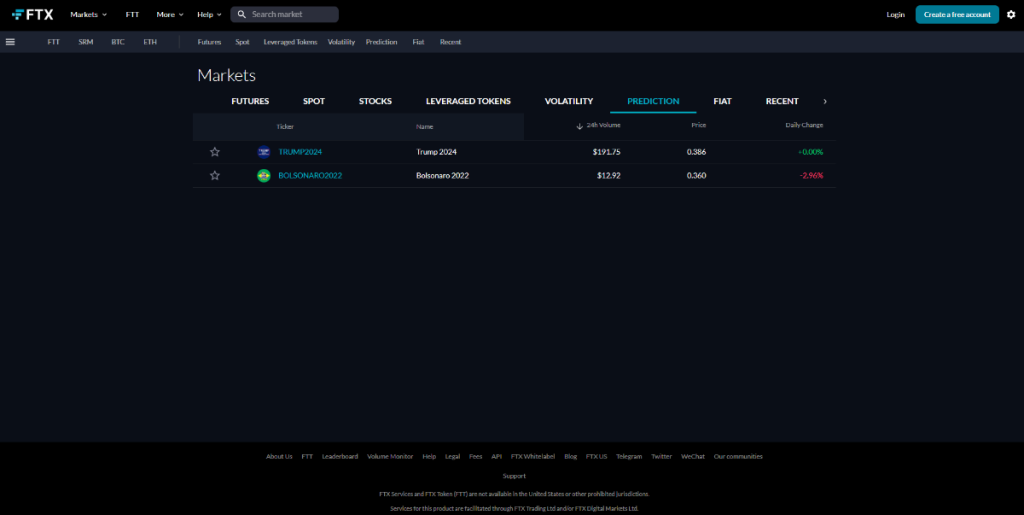

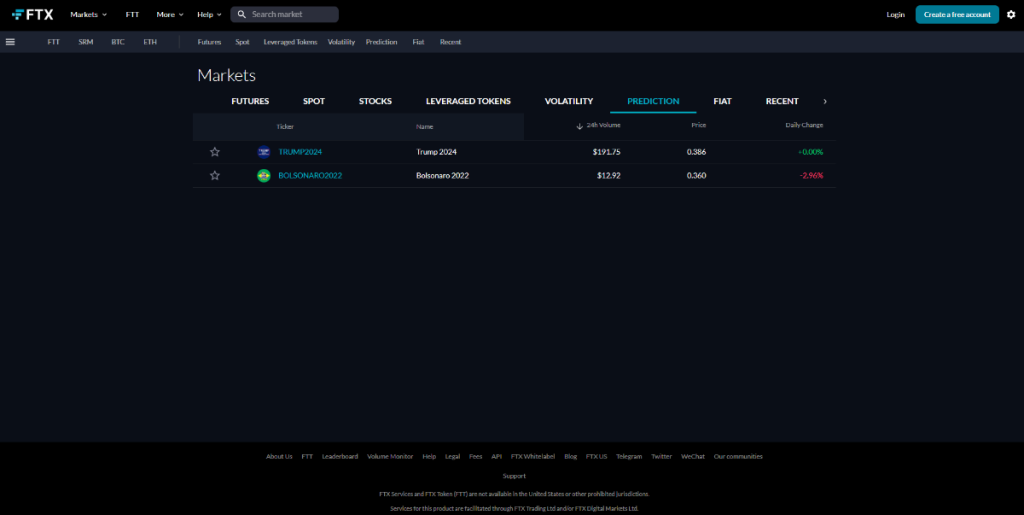

Prediction Market

FTX also supports the Prediction feature, which is called Prediction Market. The Prediction Market produces Futures contracts that will offer 2 choices: one condition will get them to $0, while the other makes them $1. Longing these Prediction contracts will benefit you if your choice is correct and the contract goes to $1 while shorting will benefit you if the contract goes to $0.

For example, TRUMP-2024 (TRUMP2024) is a futures contract on FTX that expires to $1 if Donald Trump wins the 2024 US presidential general election, and $0 otherwise.

- Longing means you believe that Donald Trump will win, and the value of the contract will become $1.

- Shorting means you believe that Donald Trump will lose (not win), and the value of the contract will become $0.

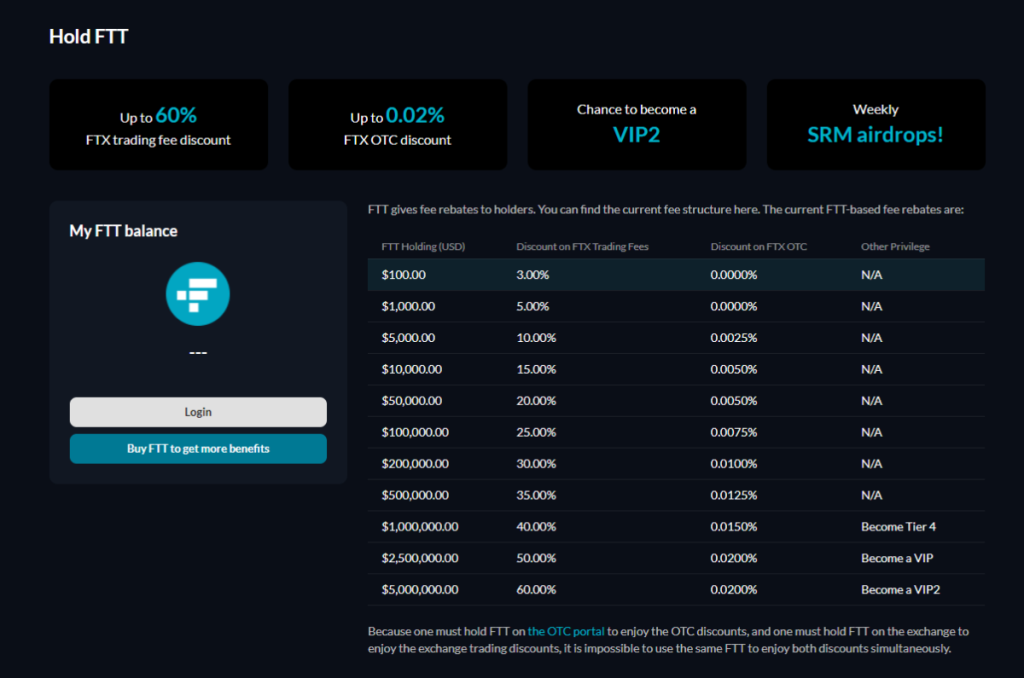

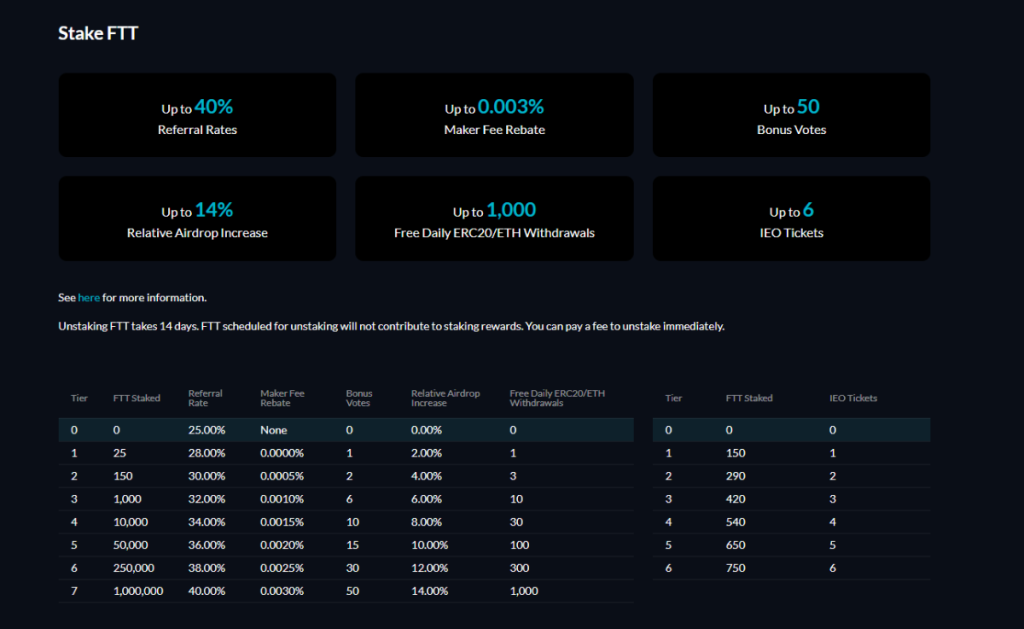

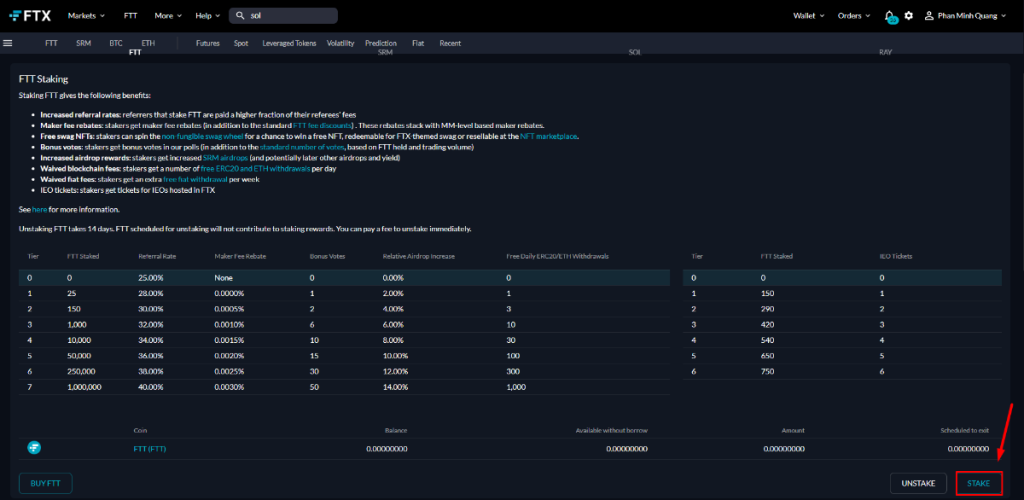

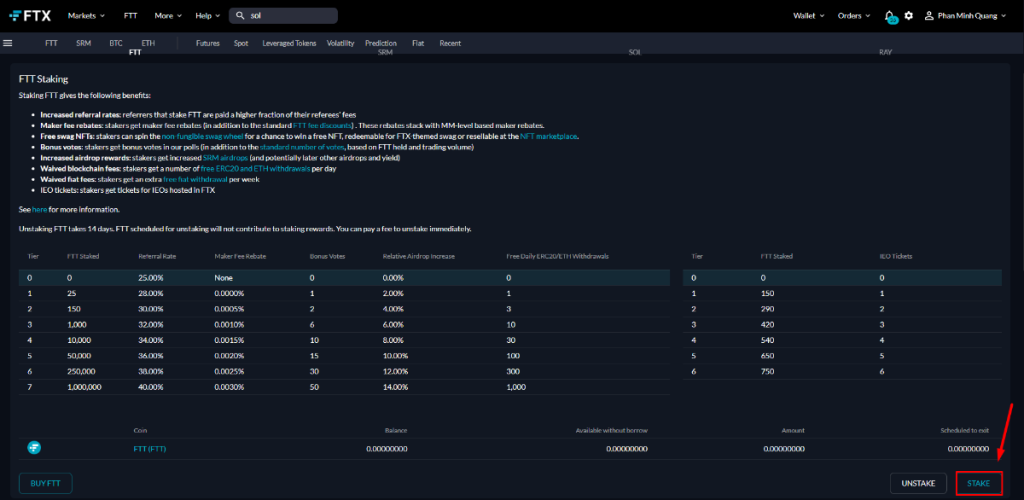

FTT Staking

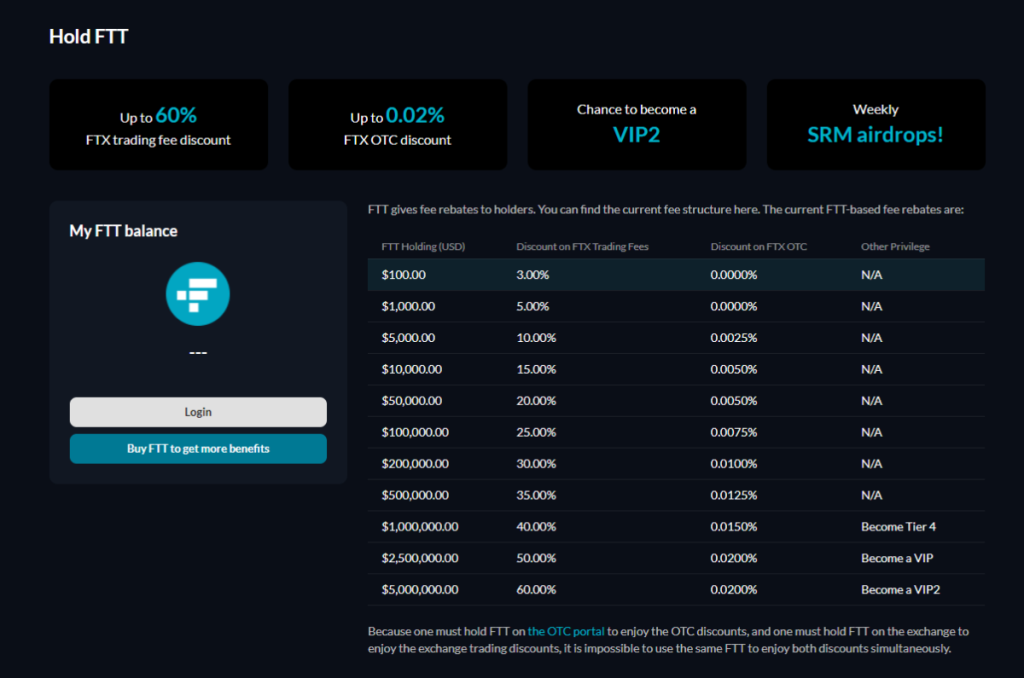

As mentioned above, FTT is the native token of FTX. You will receive multiple benefits for possessing FTT, such as:

Holding:

- Up to 60% FTX trading fee discount.

- Up to 0.02% FTX OTC discount.

- Chance to become a VIP2.

- Weekly SRM airdrops.

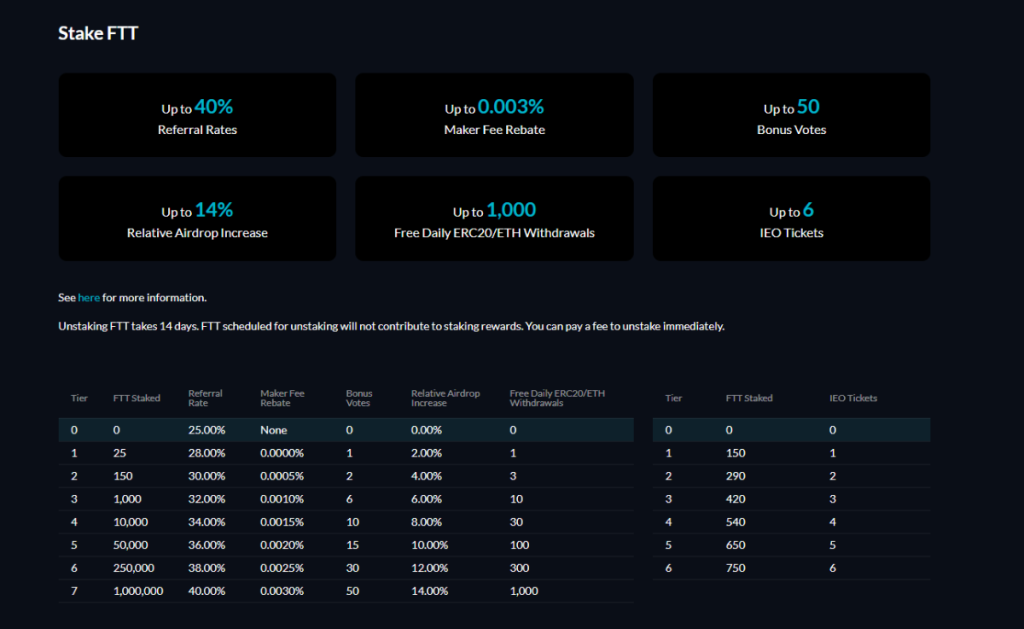

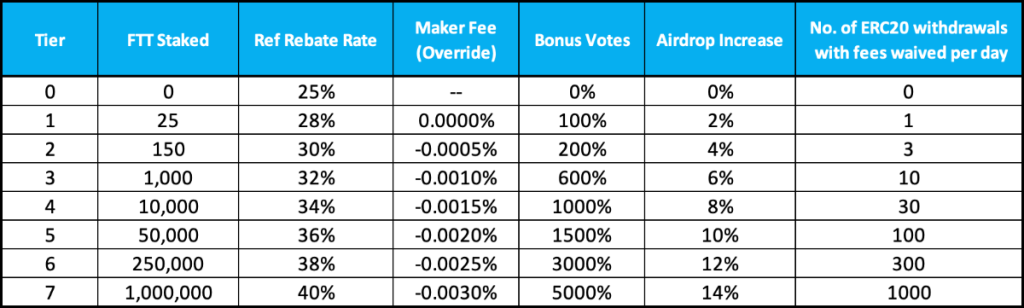

Staking:

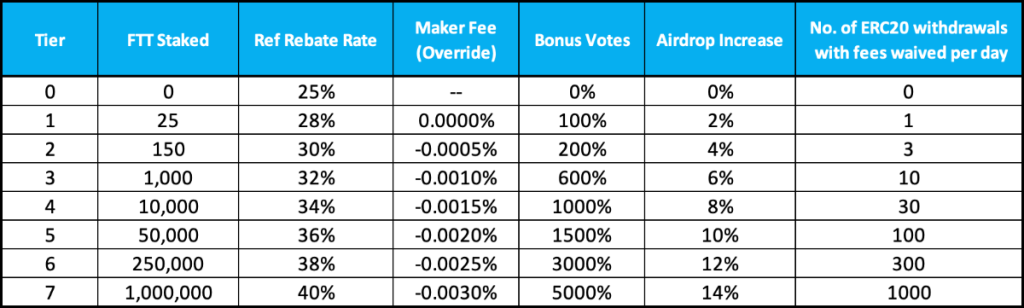

- Up to 40% Referral Rates.

- Up to 0.003% Maker Fee Rebate.

- Up to 50 Bonus Votes.

- Up to 14% Relative Airdrop Increase.

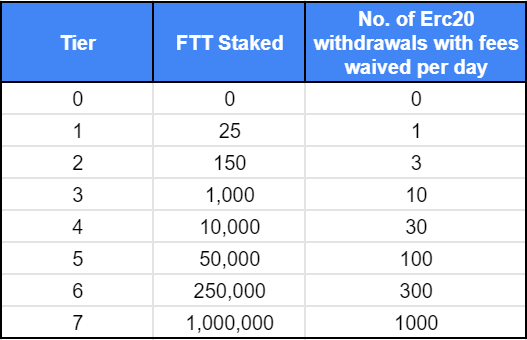

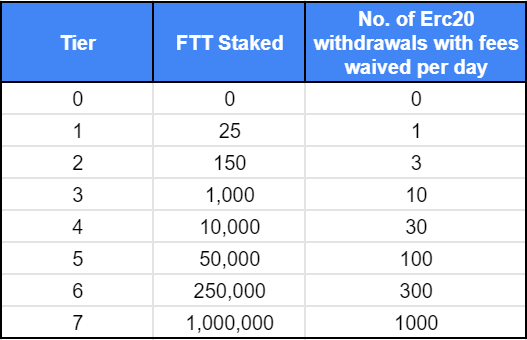

- Up to 1,000 Free Daily ERC20/ETH Withdrawals.

- Up to 6 IEO Tickets.

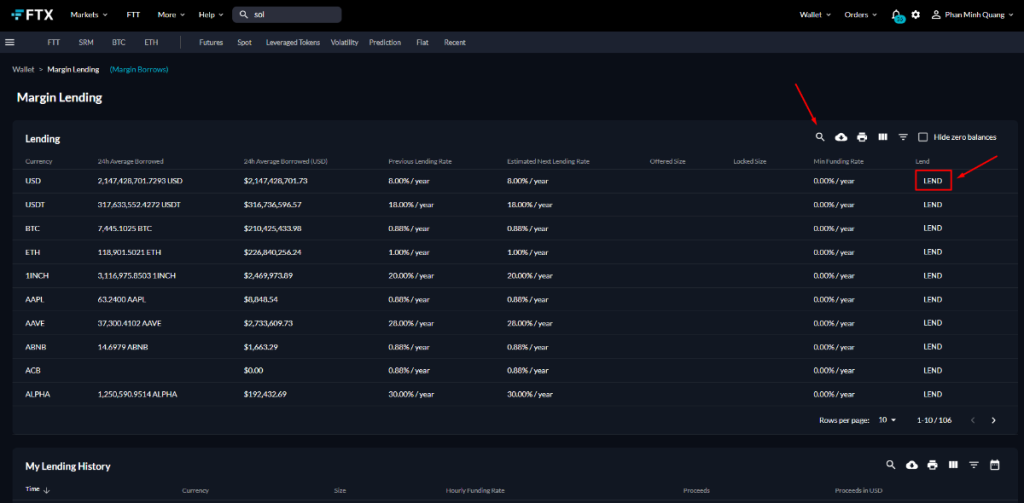

FTX Lending

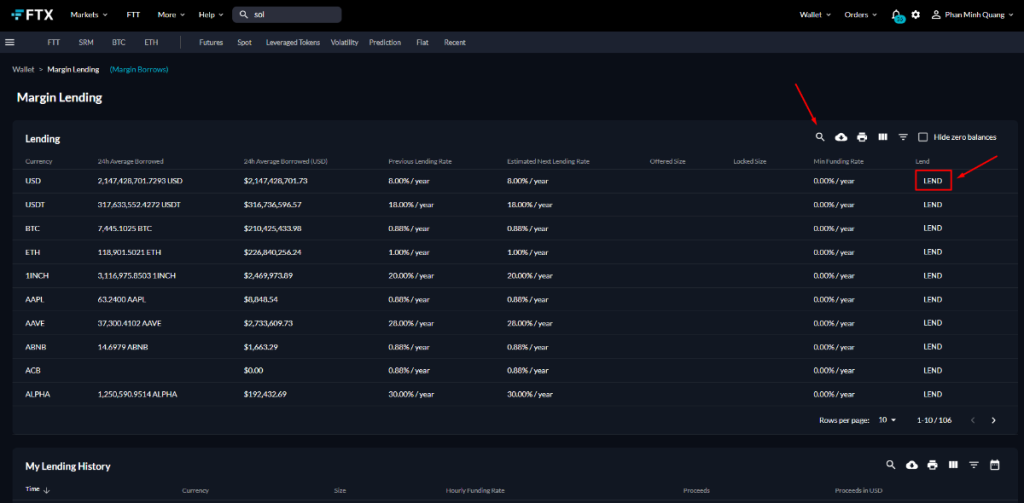

You can lend various assets on FTX to earn passive income, similar to traditional savings. At the moment, FTX supports the supplying of 106 assets. Among them, the lowest yield for lending assets on FTX is 0.88%/year for BTC, while the highest is 90%/year for AXS.

Further instructions on how to use FTX lending will be introduced later in this article.

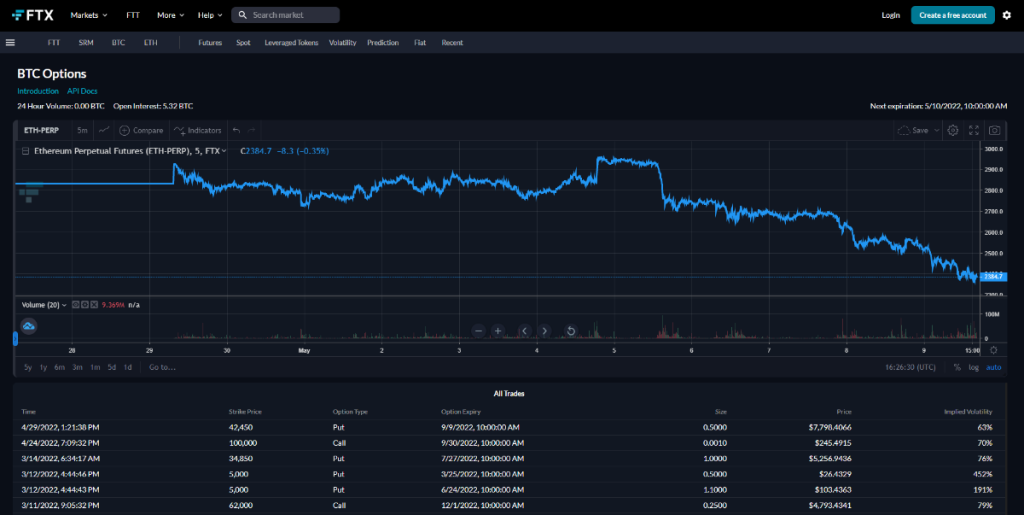

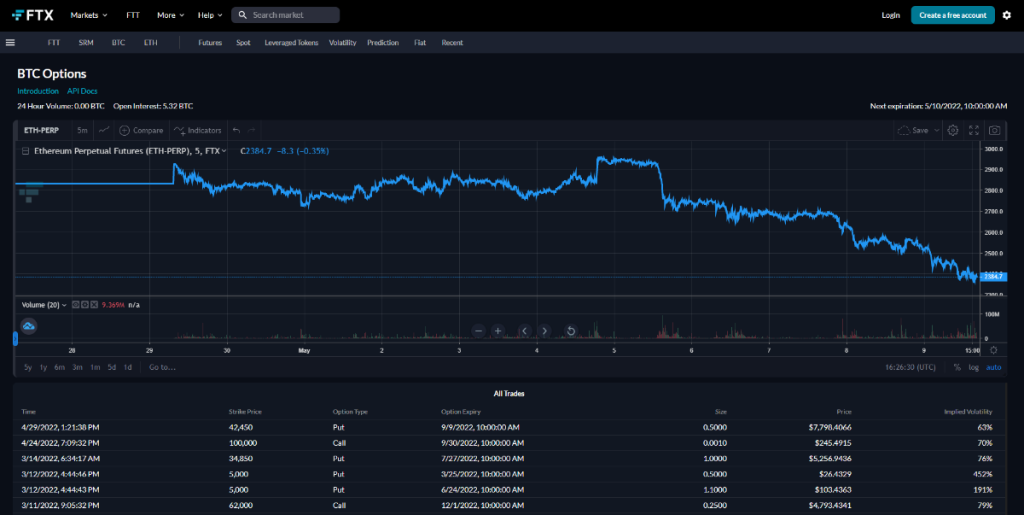

FTX Options

FTX also supports Options contracts. For those who don’t know, the Options feature is extremely identical to Futures, with the Call Option being similar to long and the Put Option being similar to short. The key difference between the two lies in their ultimate goal.

For Options contracts, you can choose whether or not to use them at their expiration date. However, once Futures contracts hit their expiration date, their conditions have to be fulfilled. That being said, Futures contracts must be executed at some point in the future. On the opposite, Options contracts can be left intact with no problem.

As a result, investors often use Options contracts as a hedging method, whereas they optimize Futures contracts for speculative purposes.

At the moment, FTX only supports BTC as the underlying asset for Options contracts.

FTX Pay

FTX Pay is a widget that you can integrate into your product to start accepting crypto payments, with FTX being the third-party service provider.

FTX Pay used to be available on the original FTX. However, recently it has been moved to FTX US, so feel free to use FTX US for this particular feature.

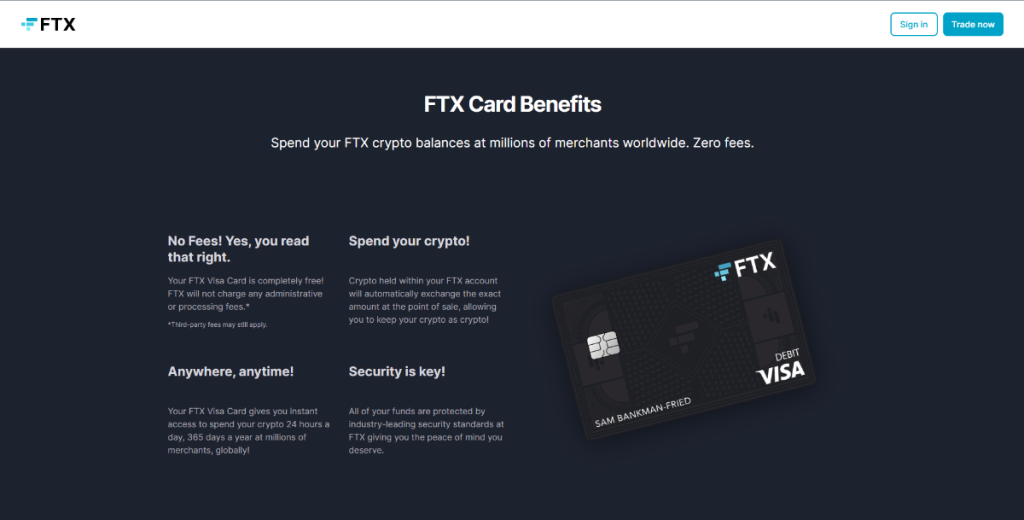

FTX Debit Card

FTX Debit Card is a special Visa Card made exclusively by FTX. The great thing about this Debit Card is that FTX charges 0 fees. This is a huge improvement compared to the Debit Card you normally get at the bank.

With FTX Debit Card, you can spend your crypto assets more easily and efficiently. You do not have to swap from crypto to fiat before paying anymore, as FTX will automatically do that work for you at the precise payout time.

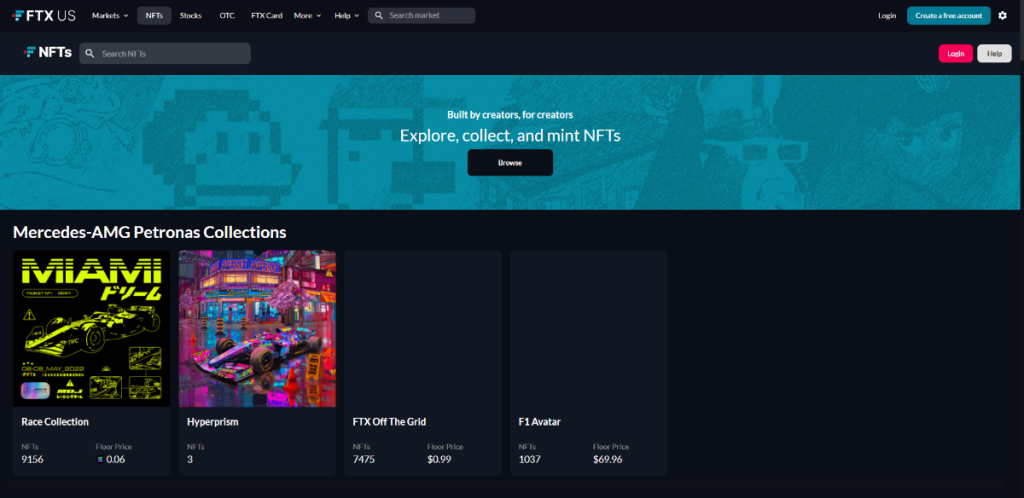

FTX NFTs

Recently, FTX has deployed an NFT Marketplace. It will be Solana-based with only a $3 minting cost. FTX will also charge a 2% exchange fee to the seller.

What are FTX Fees?

In this part, I will introduce to you all kinds of fees on FTX as well as on FTX US. At the same time, I will put up those data in parallel so that you can compare the fees on FTX vs FTX US.

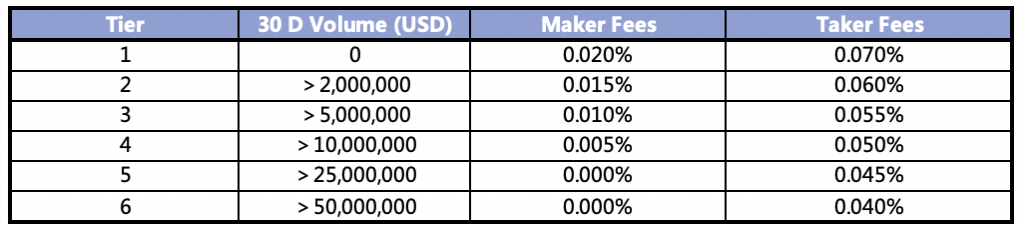

Trading fees

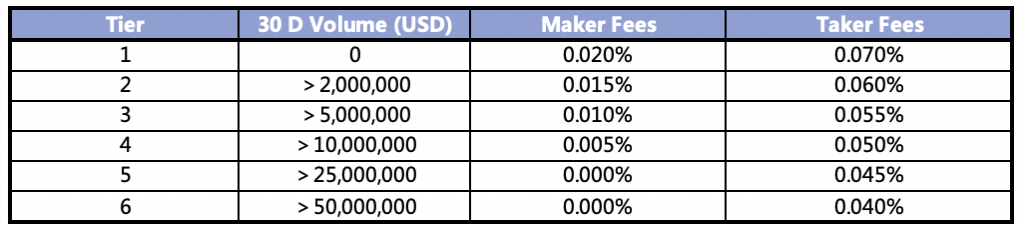

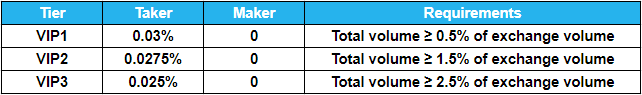

First, let’s take a look at the trading fees on FTX. Maker fees are fees for “creating orders”, whereas Taker fees are fees for “filling orders”. FTX has 6 tiers for Makers and Takers based on trading volume per 30 days.

At the same time, these fees can be reduced by being an FTT holder or staker. Specifically, by staking only 25 FTT (~$850 at the moment of writing - May 10th, 2022), you won’t have to pay for Maker fees anymore. Staking more FTT allows you to even earn by being a Maker as its fees become negative. Further details are given in this table:

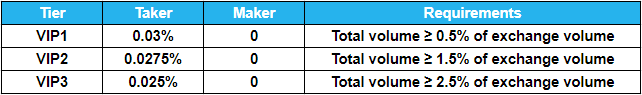

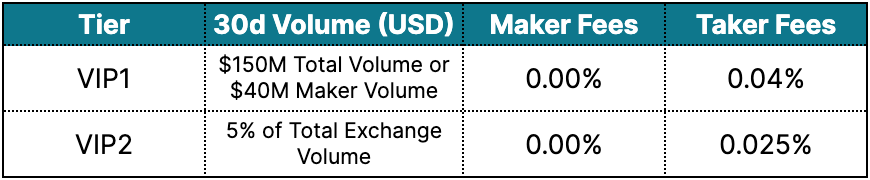

At the same time, FTX also benefits VIP users, which are defined based on the cumulative trading volume.

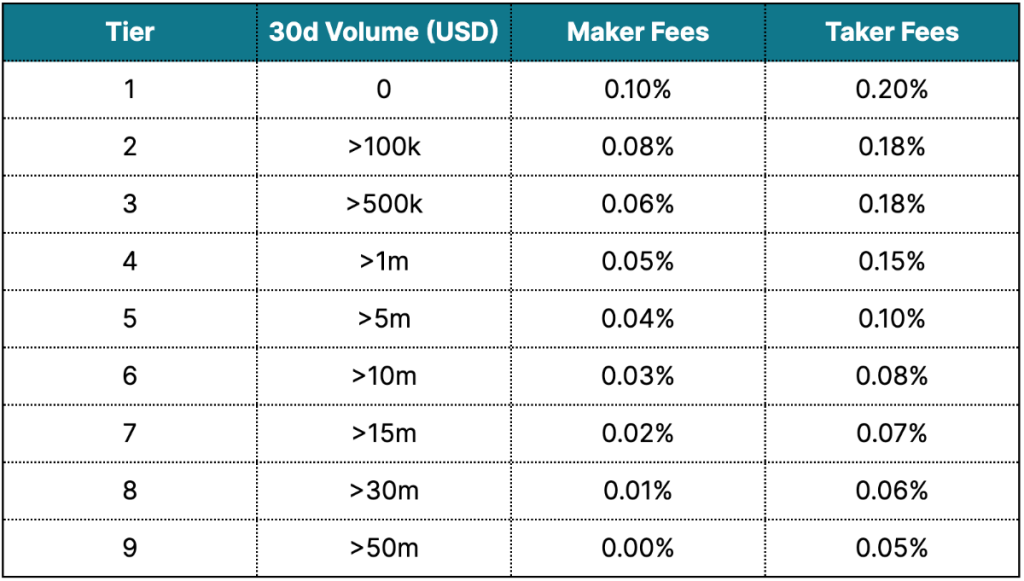

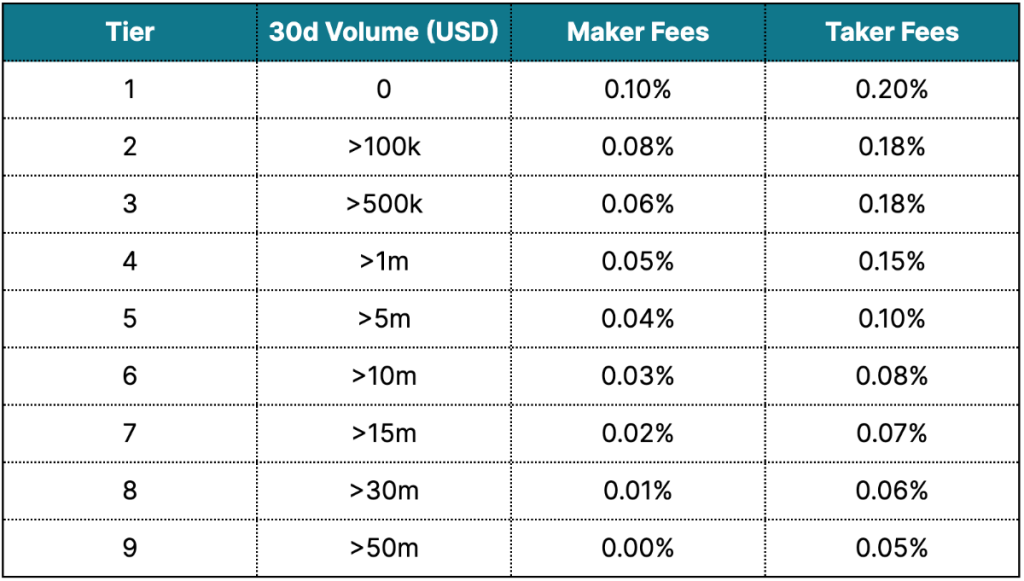

Now let’s look at FTX US. FTX US has 9 tiers for Maker and Taker fees, also on the basis of the 30-day trading volume.

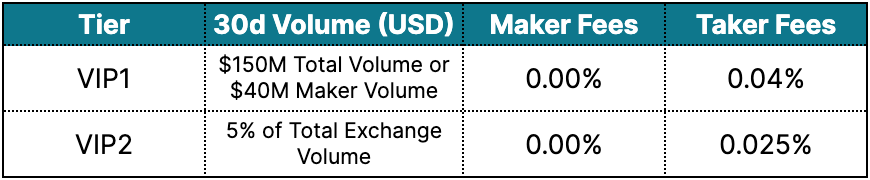

Unfortunately, FTT is currently not available for US residents. As such, there are no FTT holding or staking benefits for FTX US. Nevertheless, VIP privileges are still applied as follows:

Deposit and withdrawal fees

There are no fees on deposits and withdrawals, except for ETH, ERC-20 tokens, or small BTC withdrawals (< 0.01="" btc).="" however,="" you="" will="" have="" 1="" free="" btc="" withdrawal="" per="" day.="" ftx="" users="" will="" pay="" the="" blockchain="" fees="" for="" all="" eth="" and="" erc20="" tokens="" unless="" they="" have="" ftt="">

In the case of a user whose fiat/stablecoin deposit/withdrawal volume surpasses their trading volume, FTX may charge an extra fee of up to 0.1%.

FTX US works in a similar way as it pays crypto withdrawal blockchain fees for all tokens except for ERC20/ETH and small BTC token withdrawals. Again, there are no benefits for staking FTT as FTT is not available on FTX US.

Other fees

There are also other fees that you have to consider before using FTX and FTX US. For FTX:

- Futures contracts: 0 fees.

- Leveraged tokens: Creation and redemption fees of 0.10%, and daily management fees of 0.03%.

- Borrow/Margin trading: Fees vary for each asset.

- MOVE contracts: Fees depend on the price of the underlying index.

- OTC trading: 0 fees.

- Convert: 0 fees.

For FTX US:

- Borrow/Margin trading: Fees vary for each asset.

- Wire Withdrawal: You can withdraw below $5000 USD once per rolling week period. Additional withdrawals below $5000 will incur a $25 withdrawal fee. Withdrawals above $5000 USD are free.

- Wire Deposit: 0 fees.

- ACH: $0.50 per ACH is the standard fee. You will not be charged a fee if this is your first ACH deposit, the deposit is over $100, or the deposit is over $10, and you have deposited via ACH within the previous week.

- NFT: 2% fees charged to the NFT seller, and $3 for minting/listing NFT.

How to use FTX Exchange basically

In this part, I will guide you through FTX and how to use this exchange.

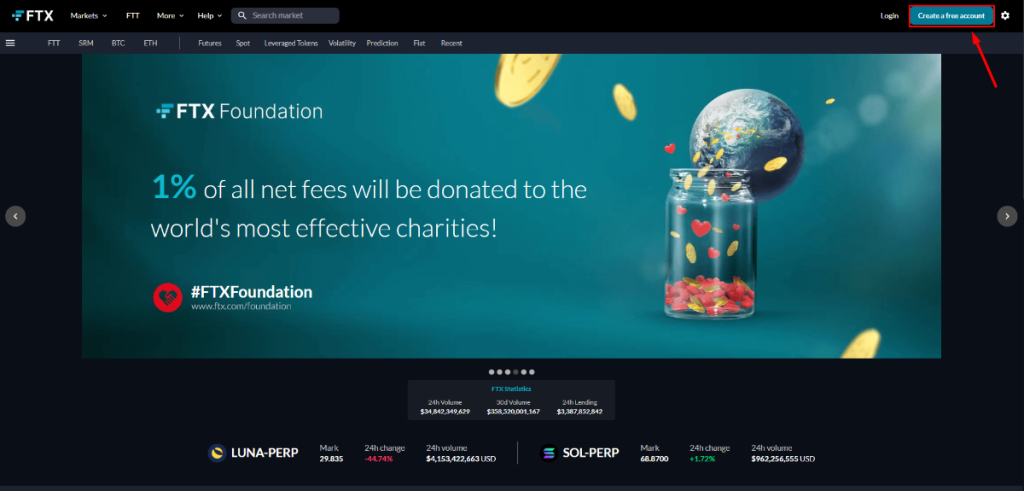

How to create an account on FTX Exchange

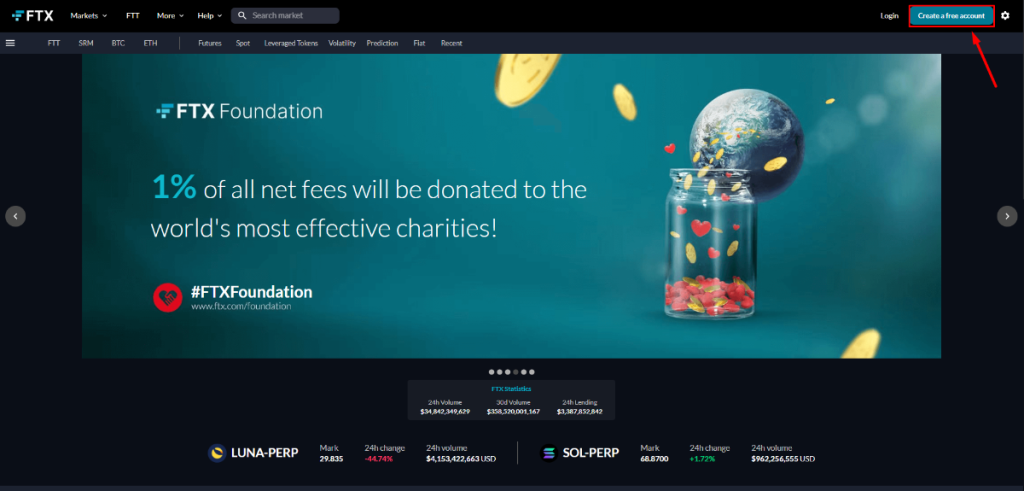

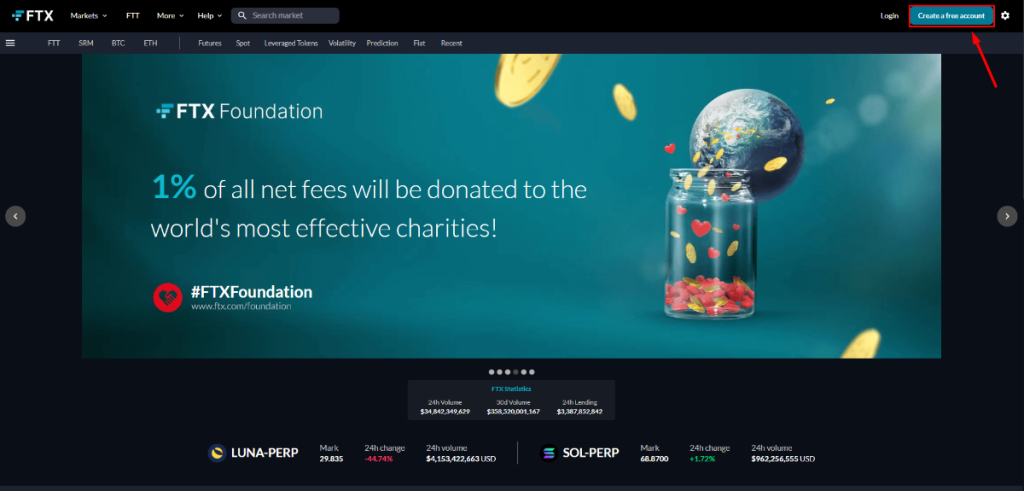

To create an account on FTX, click on: coin98.xyz/ftx

Or you can go to FTX’s website here. Then, on the top right corner, click on “Create a free account”.

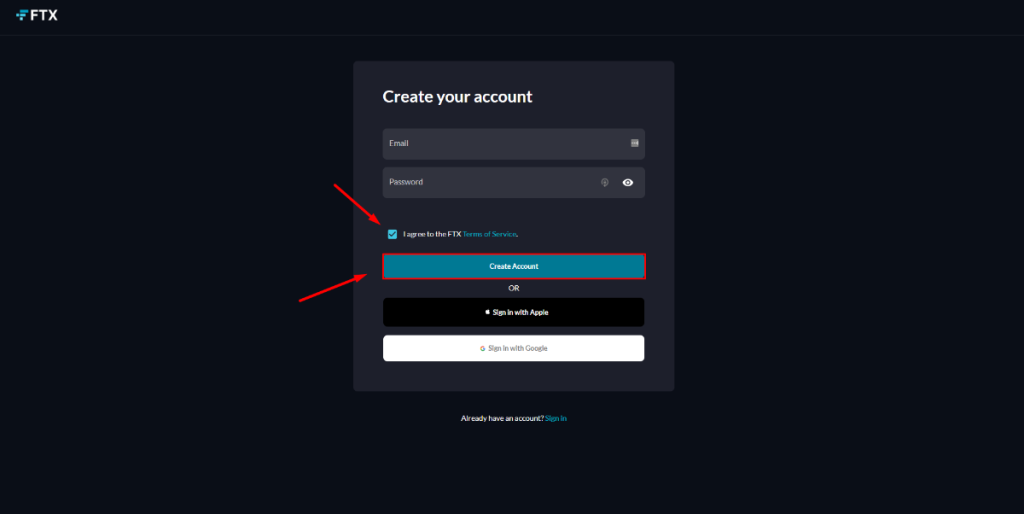

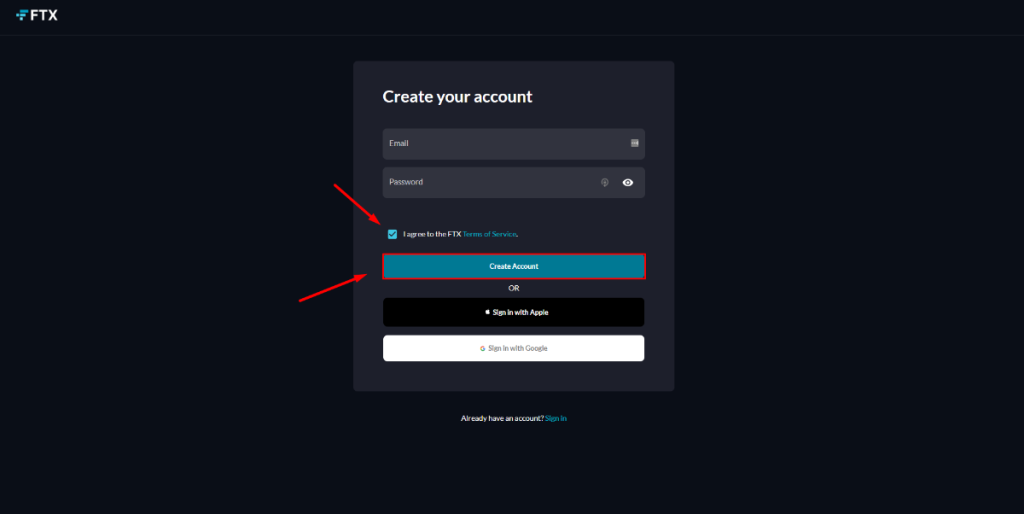

Here you have 3 options: You can sign in using your Apple or Google account, or you can create a completely new FTX account. Here I will create an FTX account as an example.

Fill in your email address along with the password, then click on the checkbox to agree to the FTX Terms of Service. If your account is legitimate, you can proceed by clicking on “Create Account”.

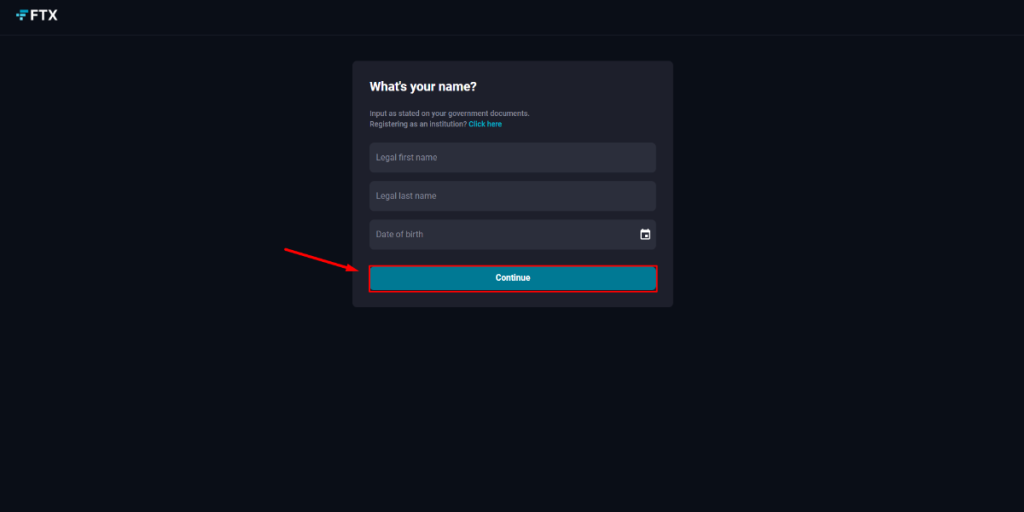

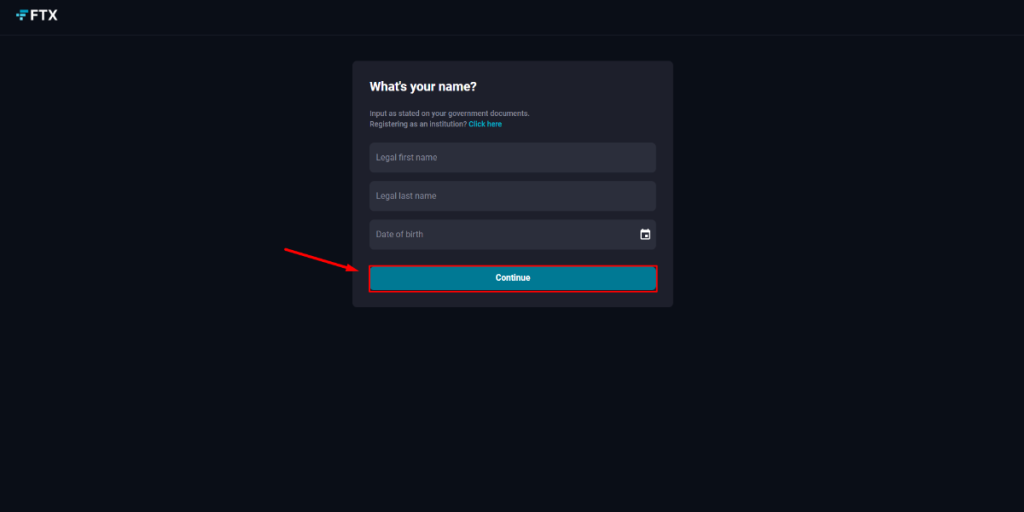

Your account has been created. To use your account, fill in your personal information, including first name, last name, and date of birth. Continue by clicking on “Continue”.

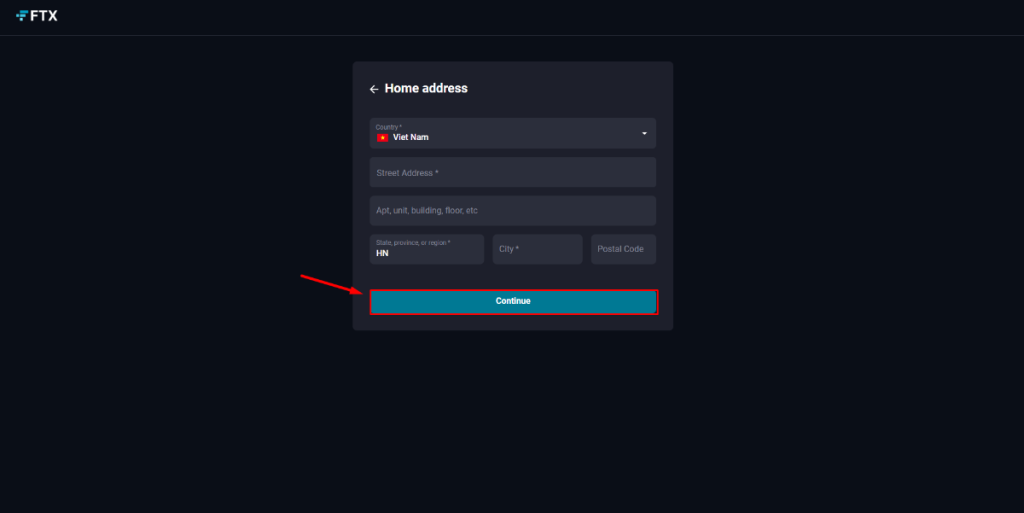

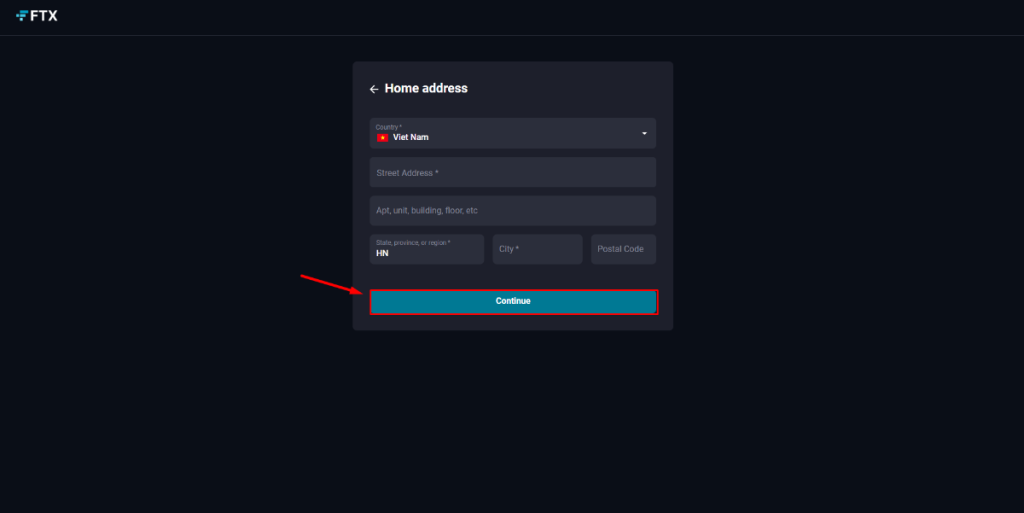

FTX will ask you to enter your home address. Finish filling in all the information and go forward with “Continue”.

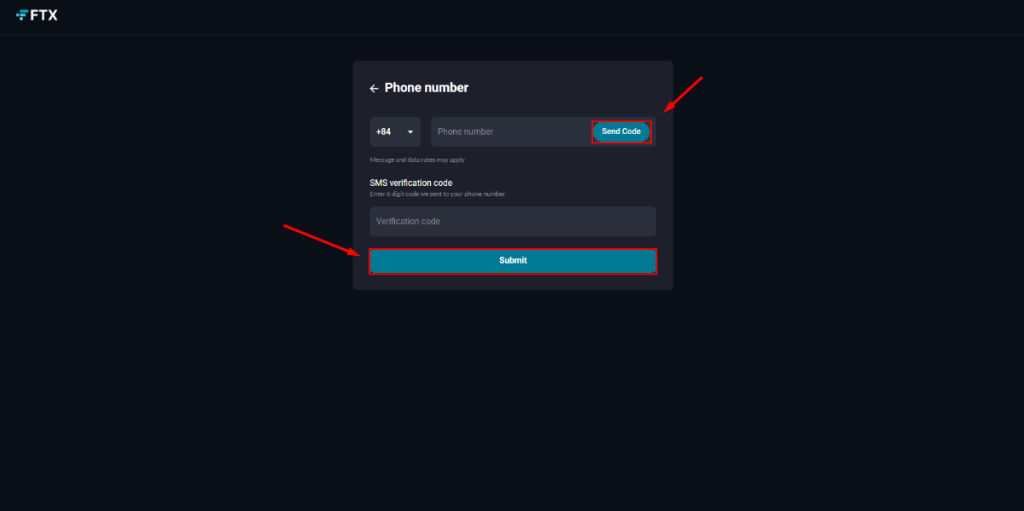

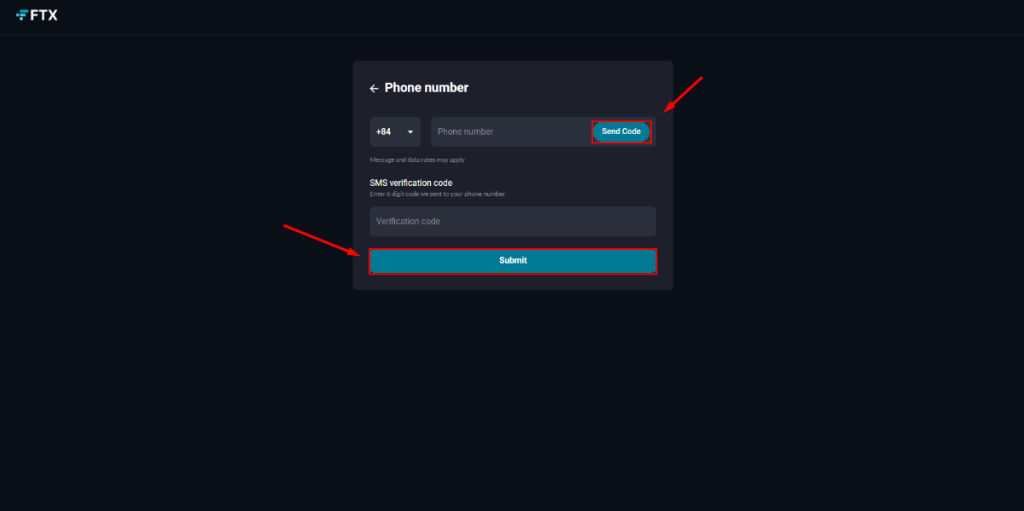

Enter your phone number and click on “Send Code” to receive the 6-digit code FTX sends to your mobile phone. Enter the verification code and click on “Submit”.

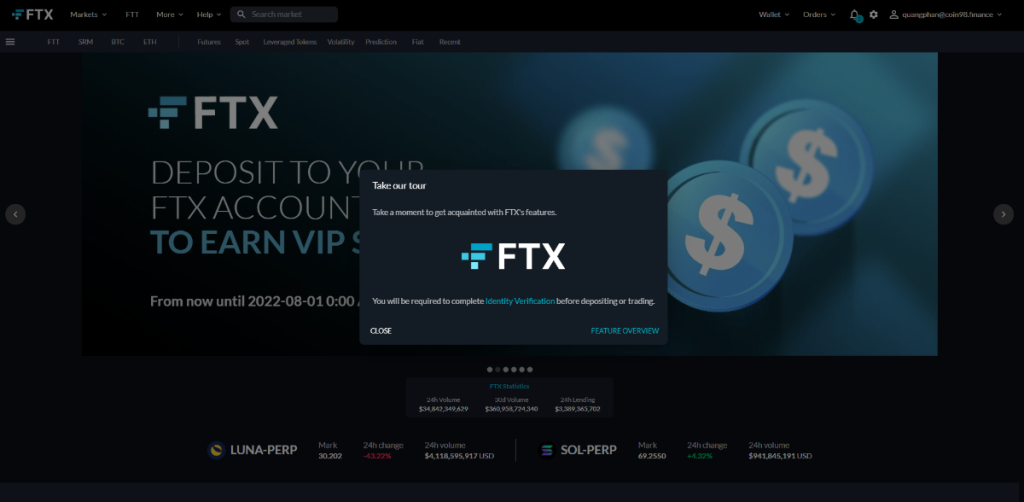

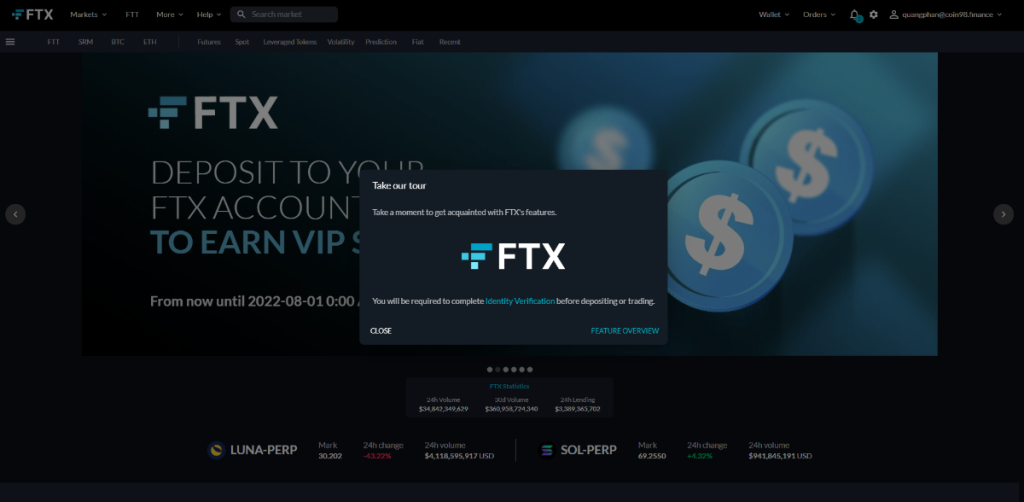

Congratulations! You have successfully created an FTX account.

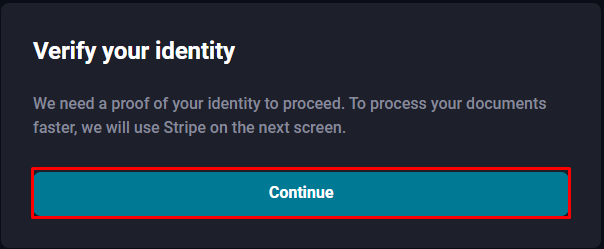

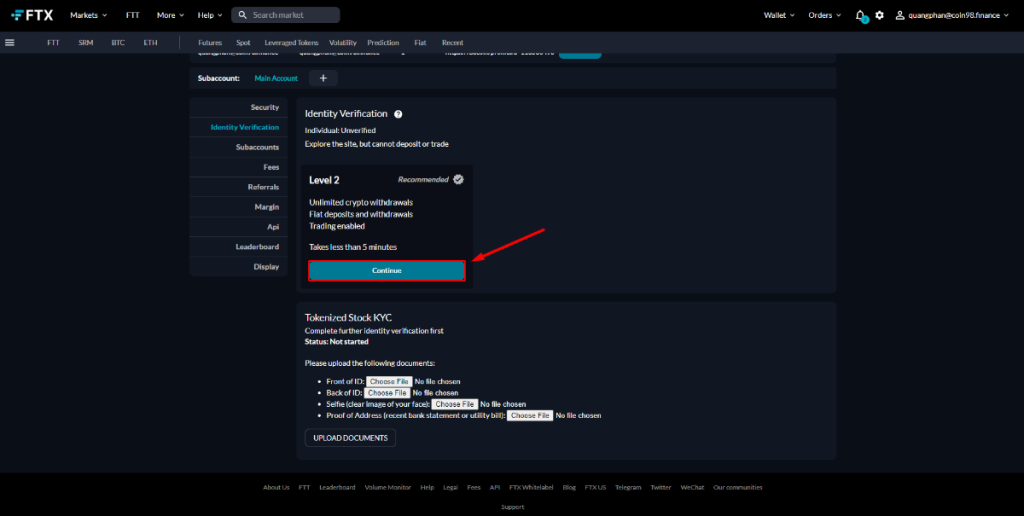

How to complete Identity Verification Level 2 on FTX

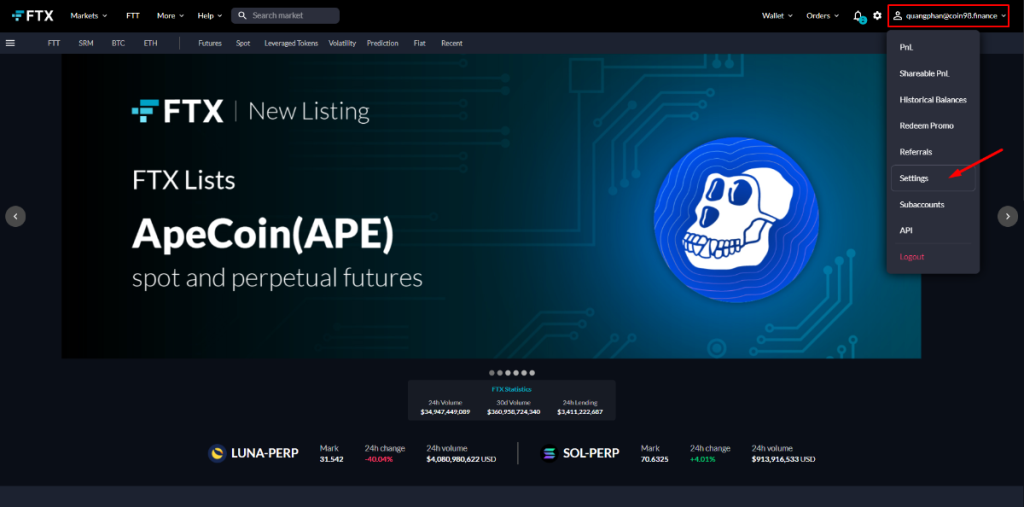

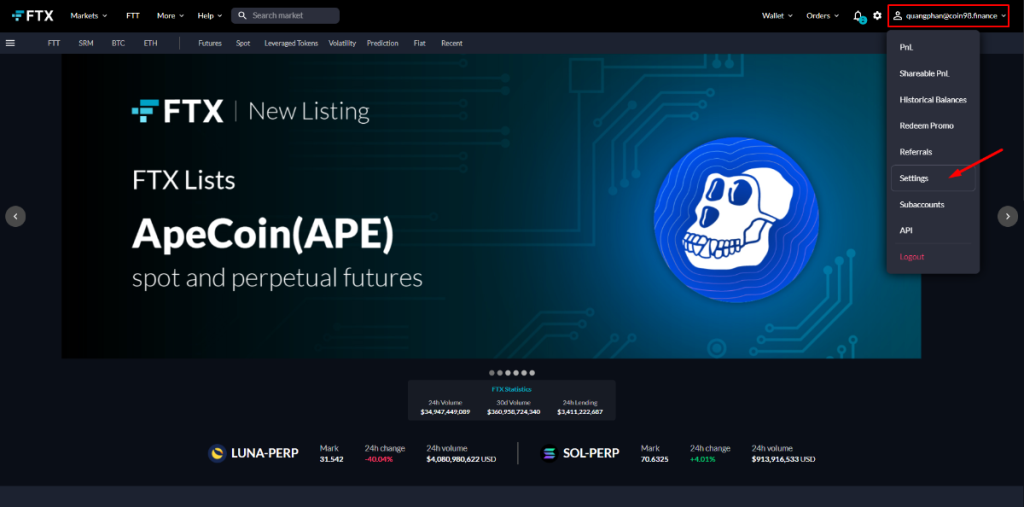

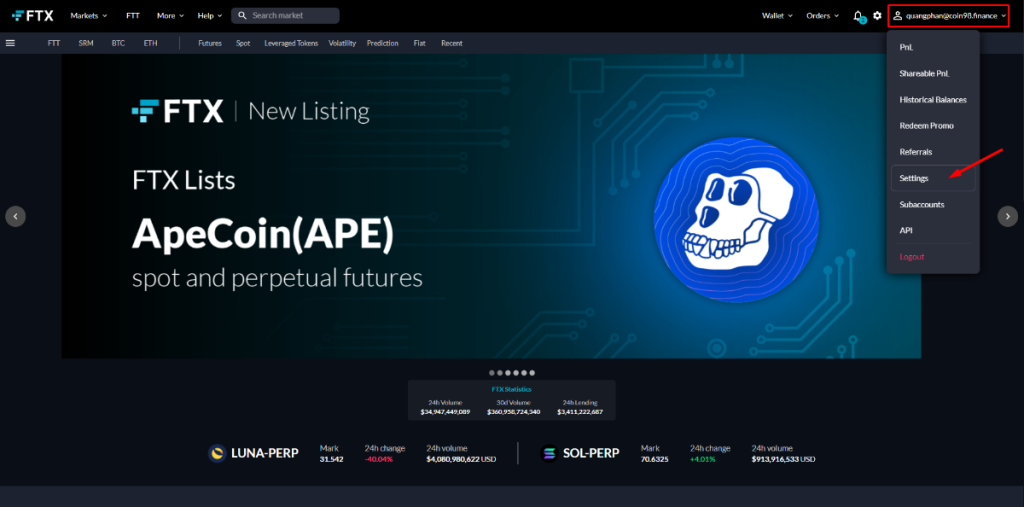

Identity Verification Level 2 First, point to your account name on the top right corner. A list will appear. Select “Settings”.

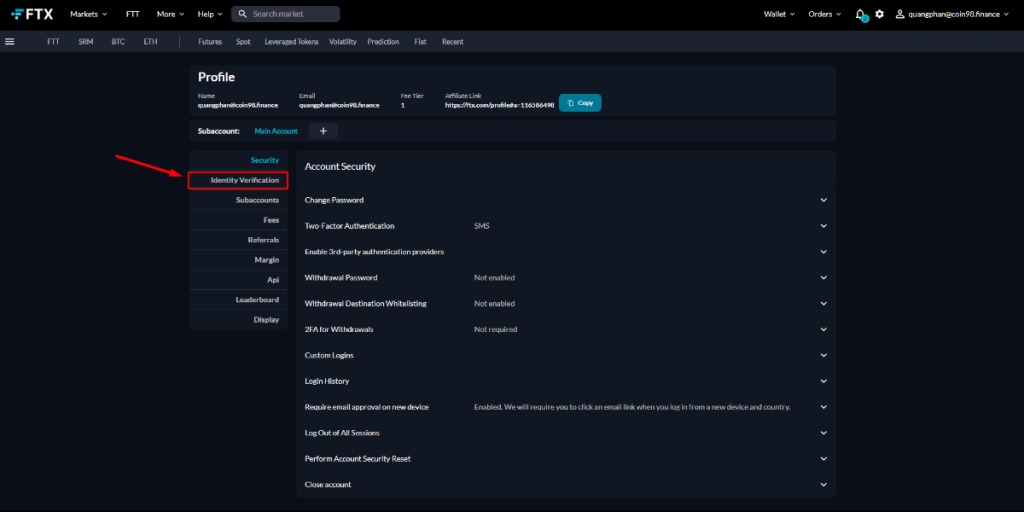

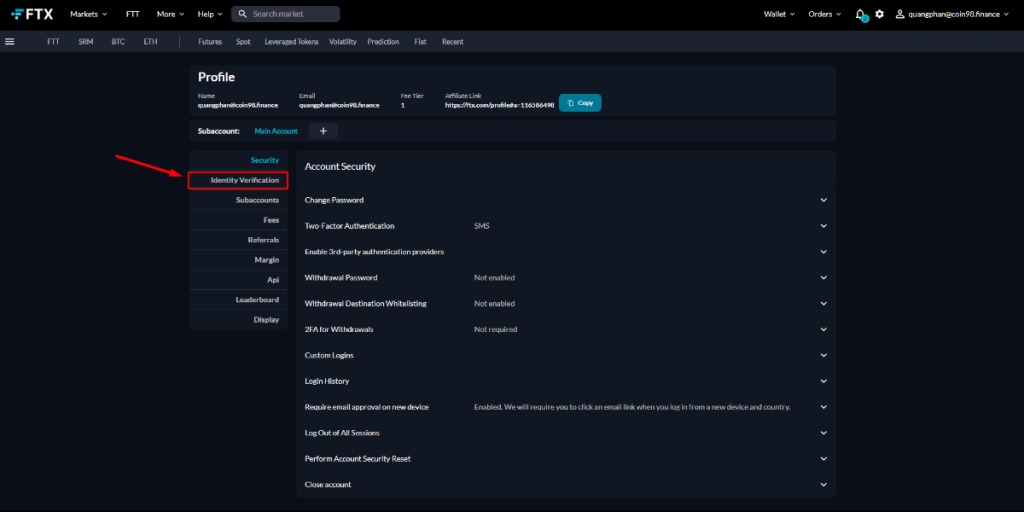

Change to the “Identity Verification” tab.

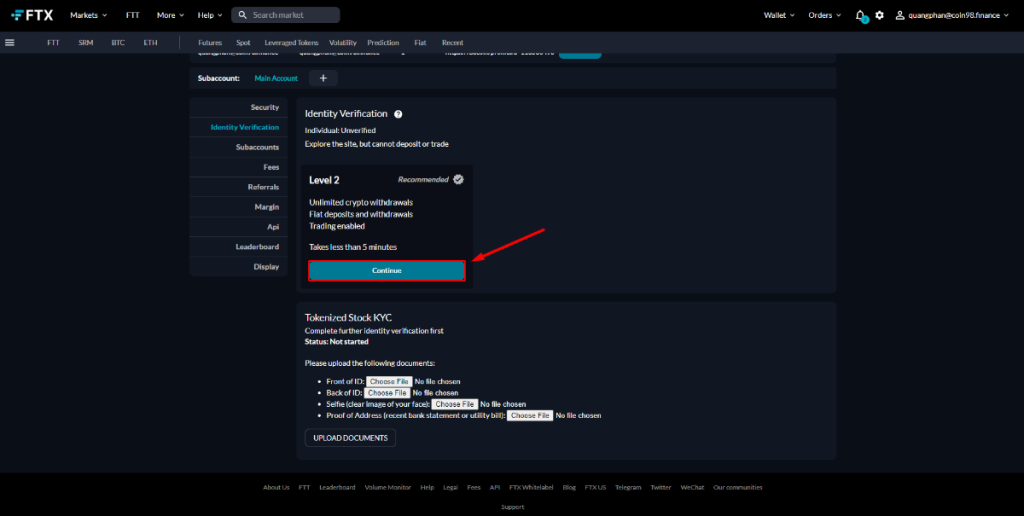

Click on “Continue” to proceed.

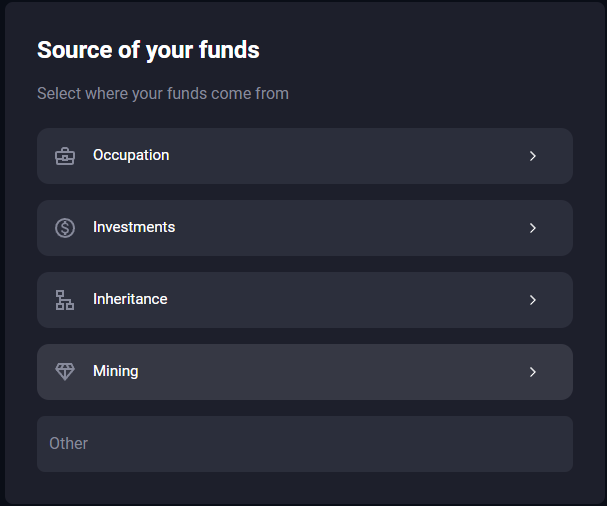

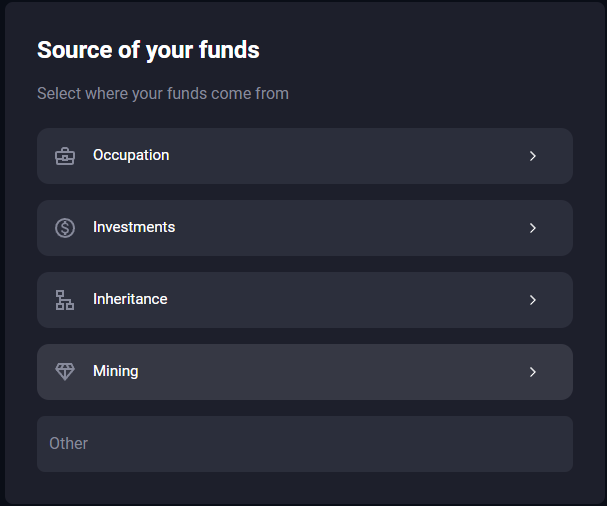

You will be asked about your source of funds. Any choice is fine.

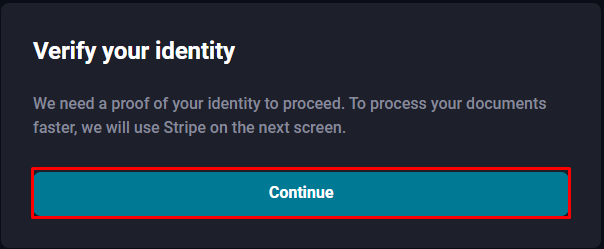

Click on “Continue” and follow the instructions to finish setting up your Identity Verification Level 2 on FTX.

How to complete Institutional Account KYC on FTX

To set up an Institutional Account on FTX, you have to create a specialized account. First, go to FTX’s website here. Then, on the top right corner, click on “Create a free account”.

Fill in your email address along with the password, then click on the checkbox to agree to the FTX Terms of Service. If your account is legitimate, you can proceed by clicking on “Create Account”.

Here, instead of entering your personal information to create a normal account, you have a choice to register as an institution. Choose “Click here”.

You will then be required to fill in the information of your institution. Follow the instructions on FTX to complete your institutional account KYC.

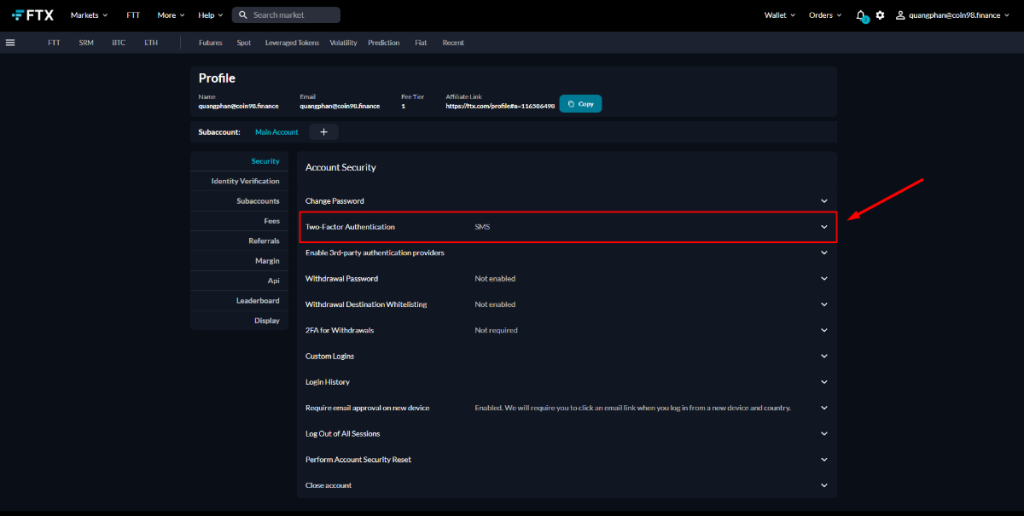

How to enable 2FA on FTX

2FA (Two Factor Authentication) is a way to increase the security of your FTX account by adding an additional layer of authentication. It is highly recommended to enable this feature on any CEX.

To turn on 2FA on FTX, first, point to your account name on the top right corner. A list will appear. Select “Settings”.

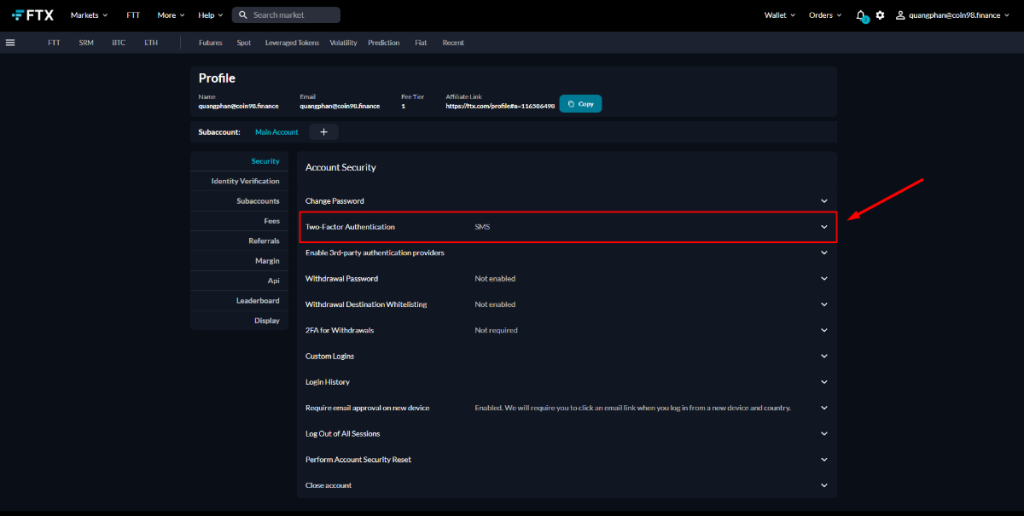

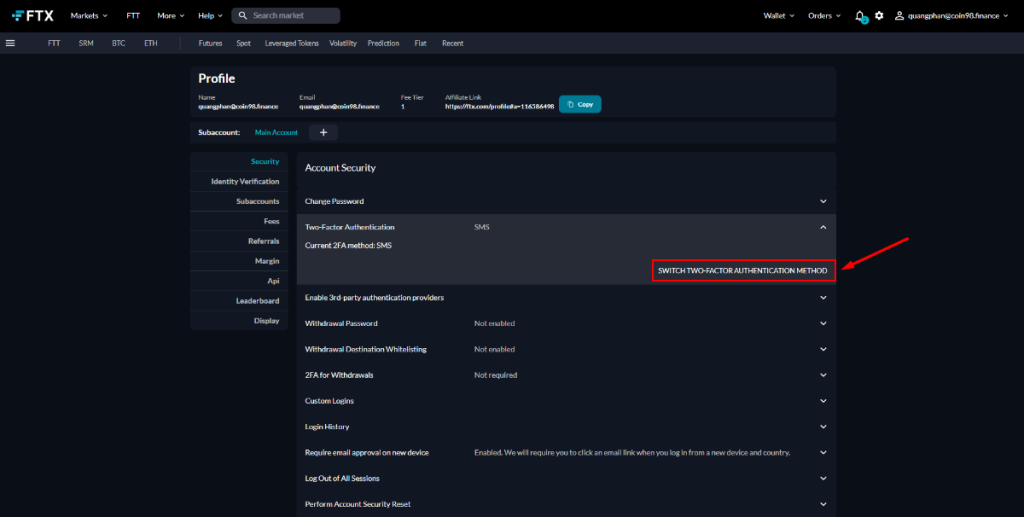

You can see that SMS has been automatically selected as your 2FA authentication. If you wish to change it, click on the line “Two-Factor Authentication”.

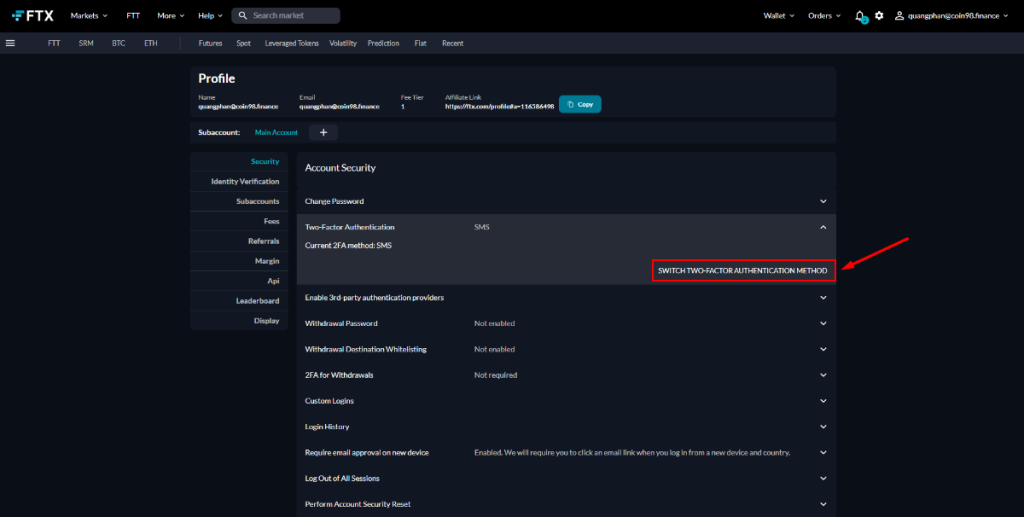

Click on “Switch Two-Factor Authentication Method”.

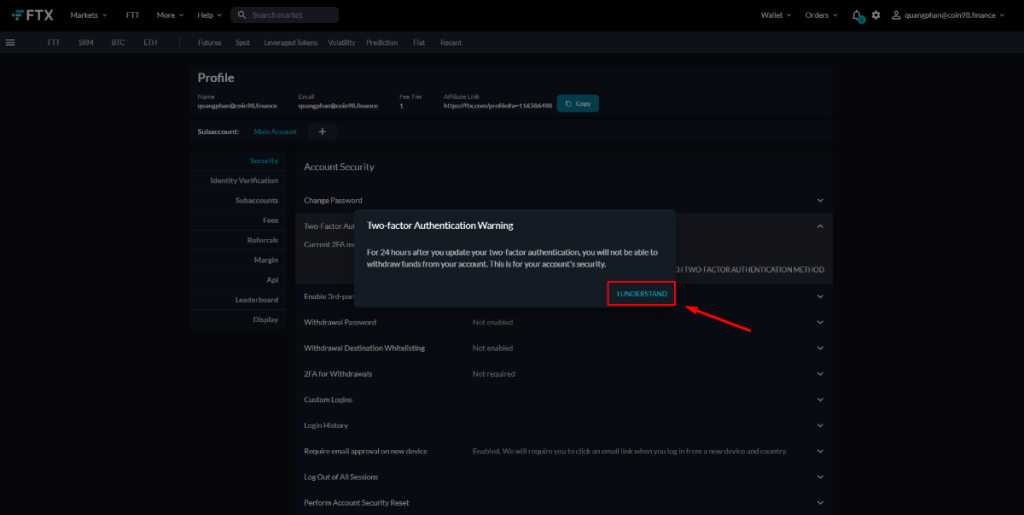

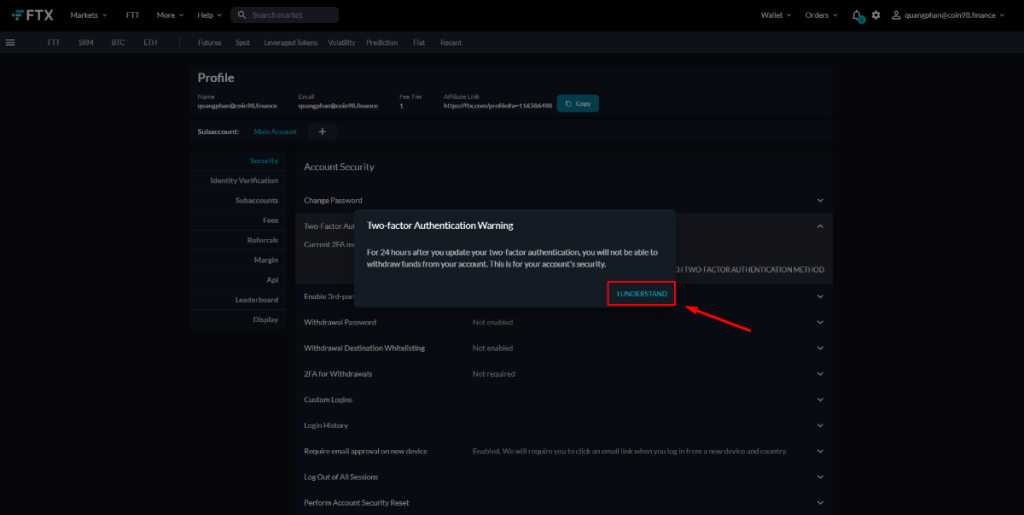

A screen will pop up to remind you that once you change your 2FA on FTX, you will be suspended from withdrawing for 24 hours as a security measure. Click on “I understand” to continue.

Here you will be given 3 options: Switch to Authy/Google Authenticator, Switch to Security Key (Fido, U2F, Yubikey), and Switch Device. I highly recommend you to select “Switch to Authy/Google Authenticator” as it is, in my opinion, the easiest and most secure way to set up your 2FA.

Coin98 has had a detailed article on how to use Authy and Google Authenticator. Click on “Switch to Authy/Google Authenticator” and refer to these articles in order to finish setting up your 2FA on FTX.

How to deposit into FTX

To deposit assets into FTX, make sure that you have passed the Level 2 KYC. Refer to the heading “How to complete Identity Verification Level 2 on FTX” if you have not gone through this process.

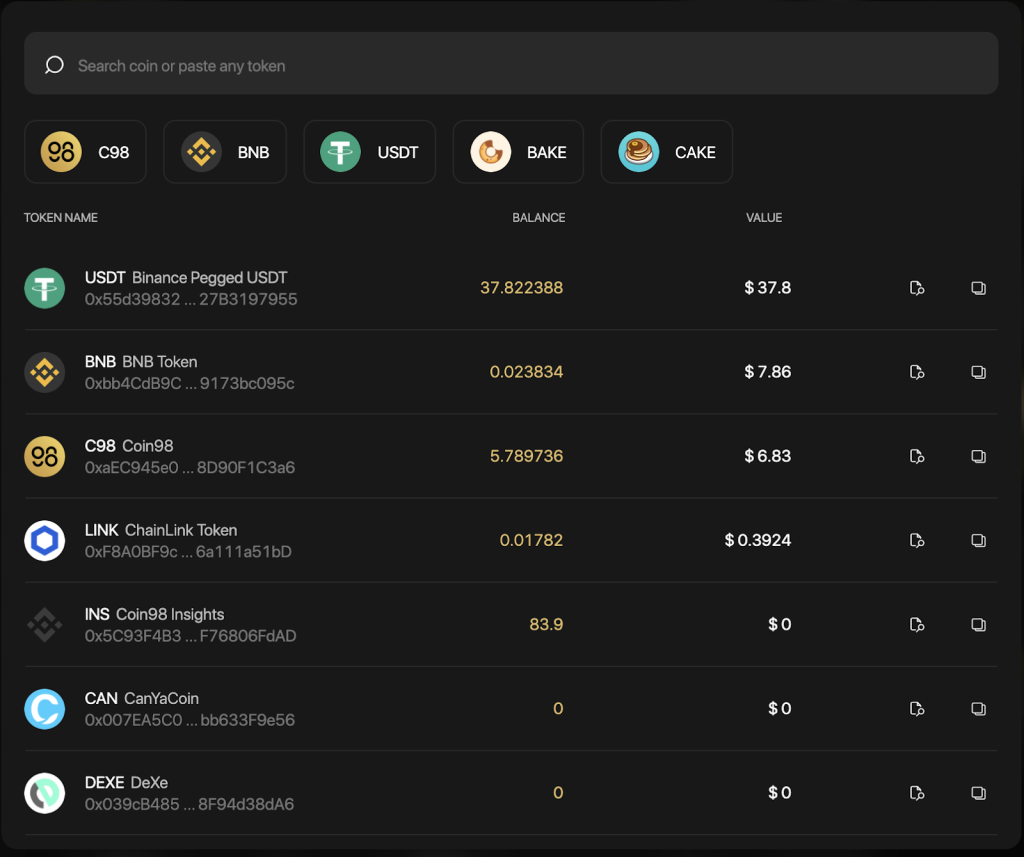

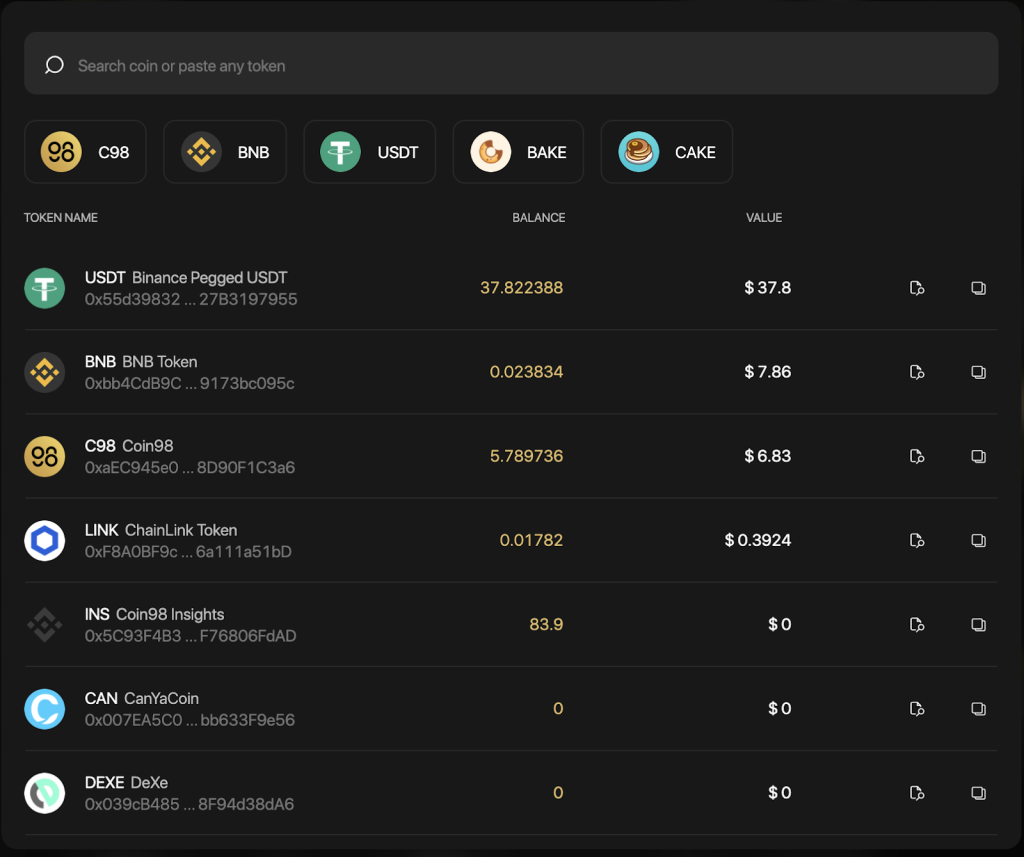

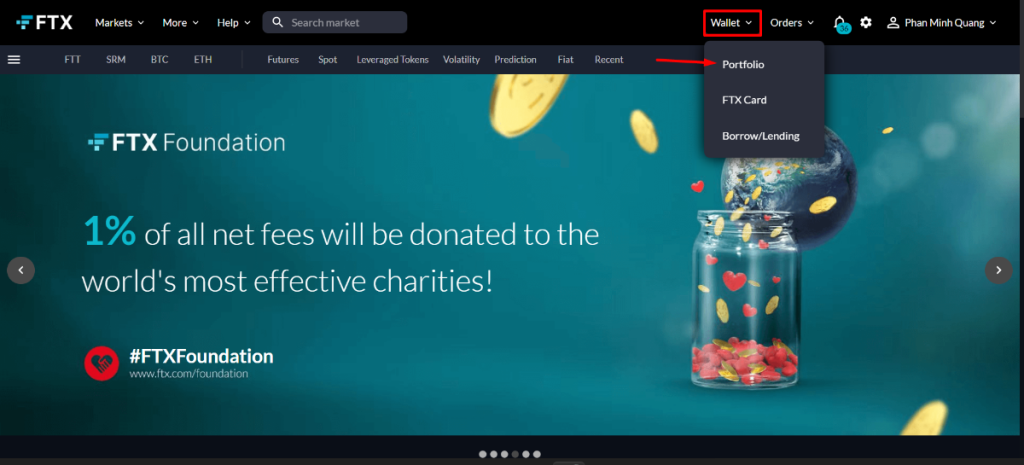

Now let’s get into the details of the deposit process. First, on the main page, point to “Wallet”. A few options will appear. Select “Portfolio”.

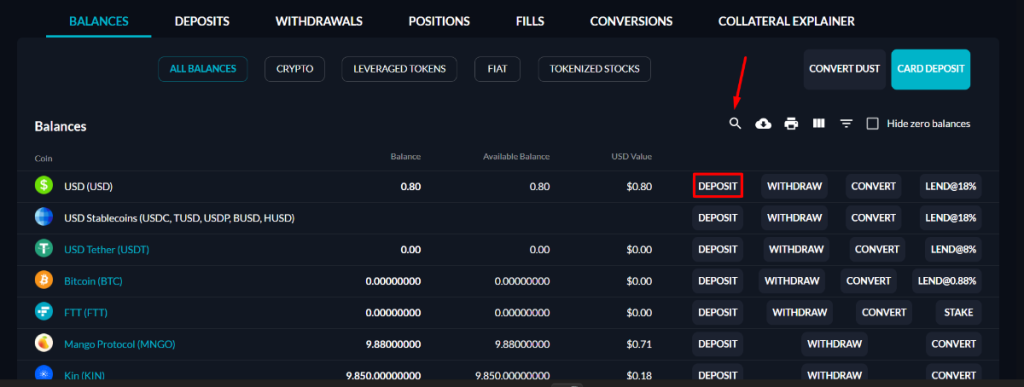

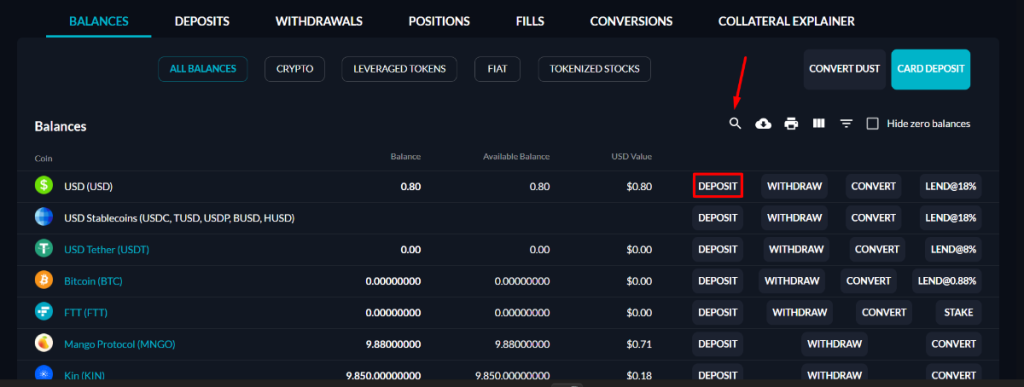

On this page, choose the asset that you want to deposit, and click on “Deposit”. You can search for your wanted token by clicking on the search icon. Depositing “USD” is highly recommended as FTX has made it one of the easiest ways to deposit into the platform. Therefore, I will deposit into this category as an example.

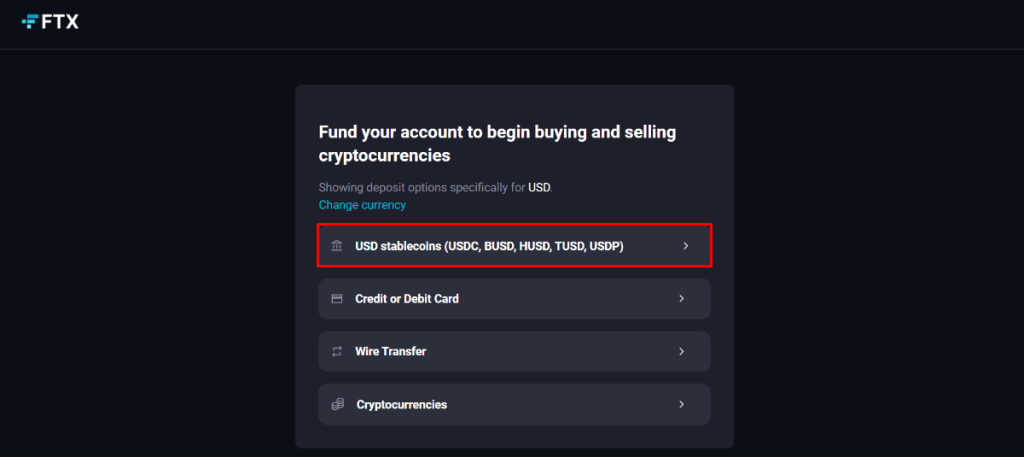

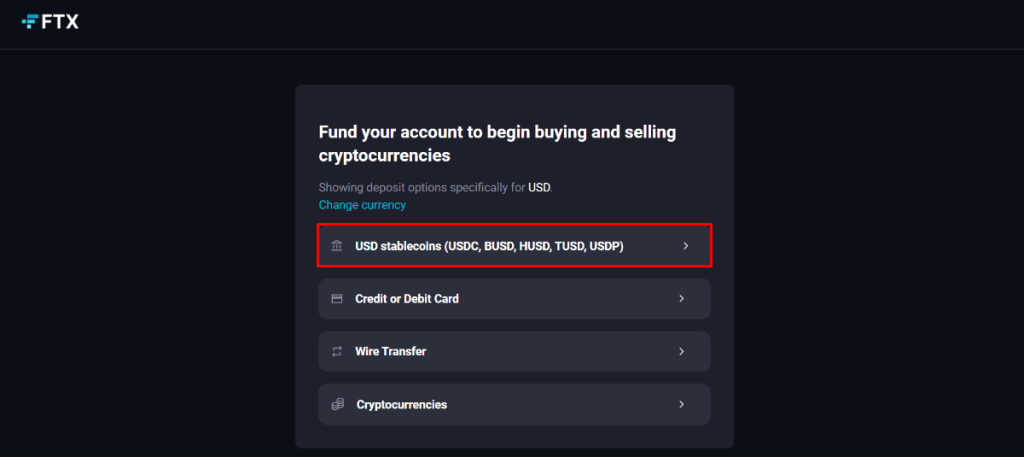

There are now 4 options for you to choose from:

- USD Stablecoins (USDC, BUSD, HUSD, TUSD, USDP).

- Credit or Debit Card.

- Wire Transfer.

- Cryptocurrencies.

I will use USD Stablecoins in this example.

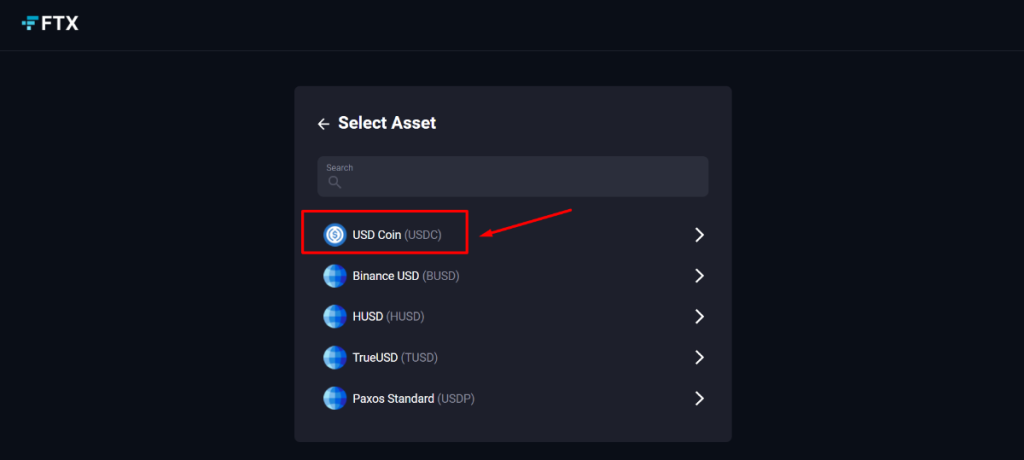

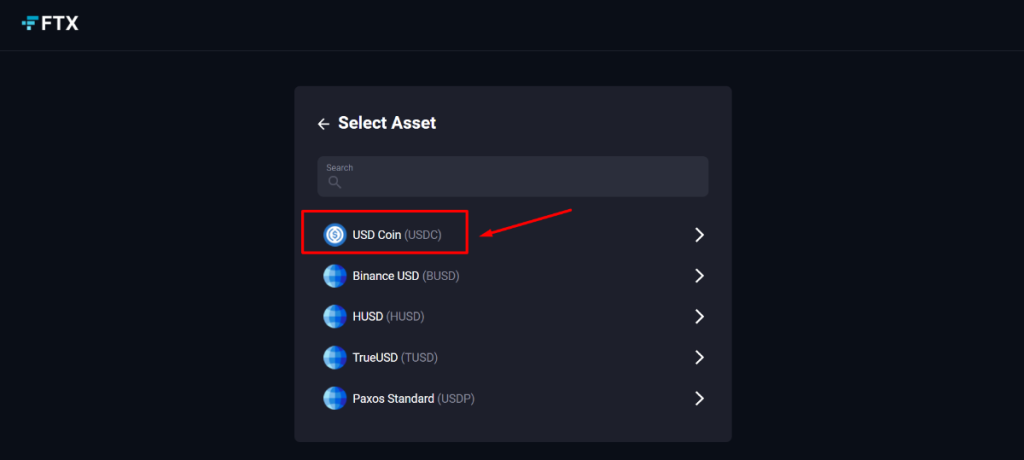

You can choose which type of stablecoin you would want to deposit. FTX currently supports 5 stablecoins: USDC, BUSD, HUSD, TUSD, and USDP. I will use USDC as an example.

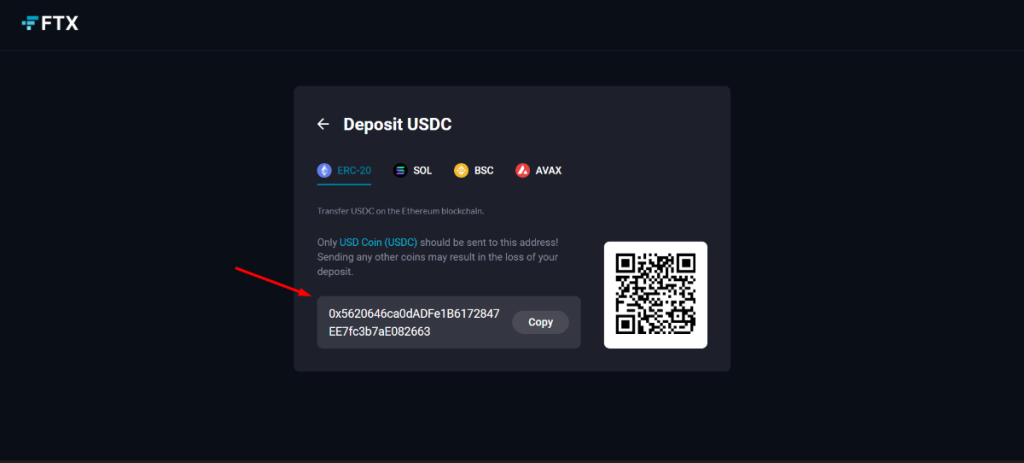

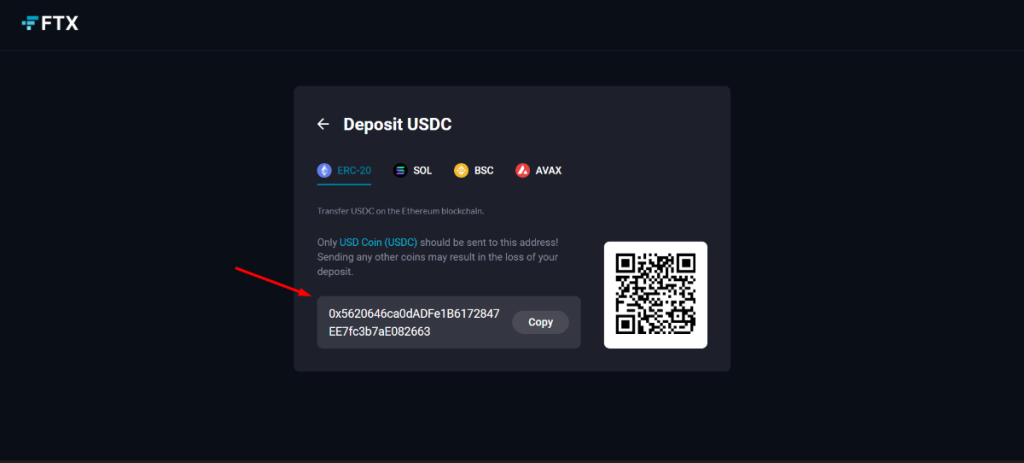

Supported networks along with a corresponding wallet address will be shown. Carefully select the network you are using, and transfer your USDC to the wallet address FTX provides. If you either select the wrong network or transfer tokens to the wrong address, FTX will not be able to receive your deposit.

Once you send your assets to the right wallet address on the correct network, it will take a few minutes for the blockchain to handle the transaction. Afterwards, your assets will be automatically received and shown on FTX.

How to withdraw from FTX

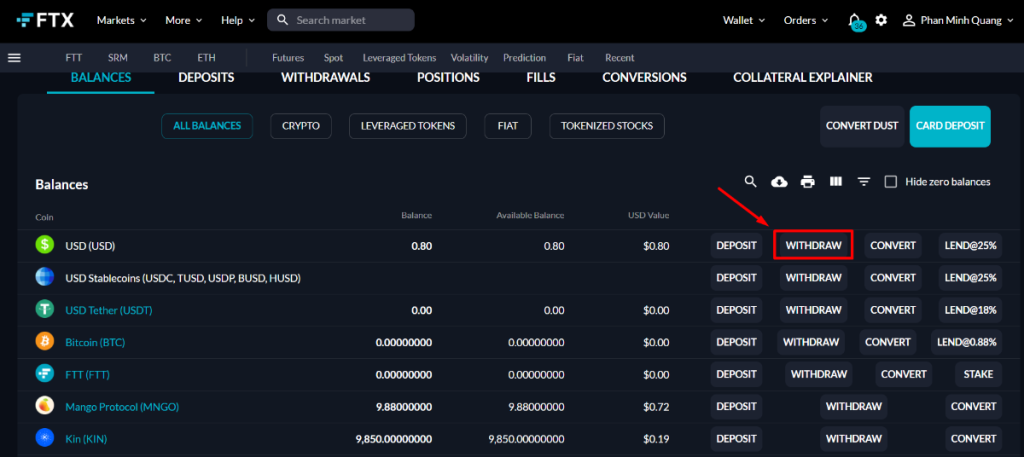

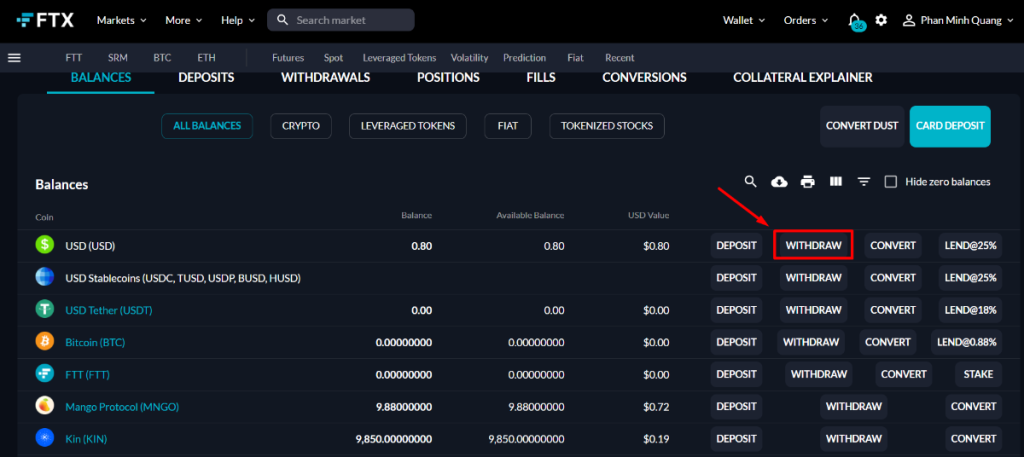

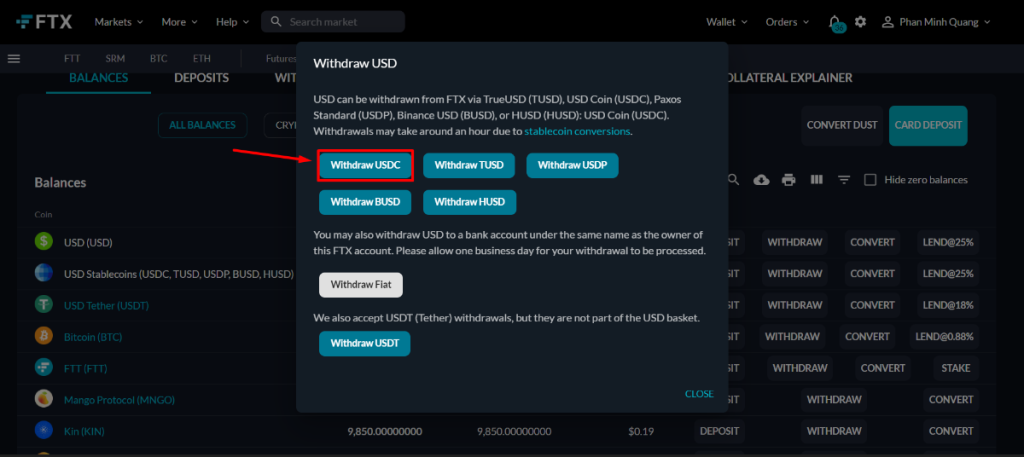

The process of withdrawing on FTX is similar to depositing. On the Portfolio page, select the asset that you want to withdraw and click on “Withdraw”. I will use USD as an example.

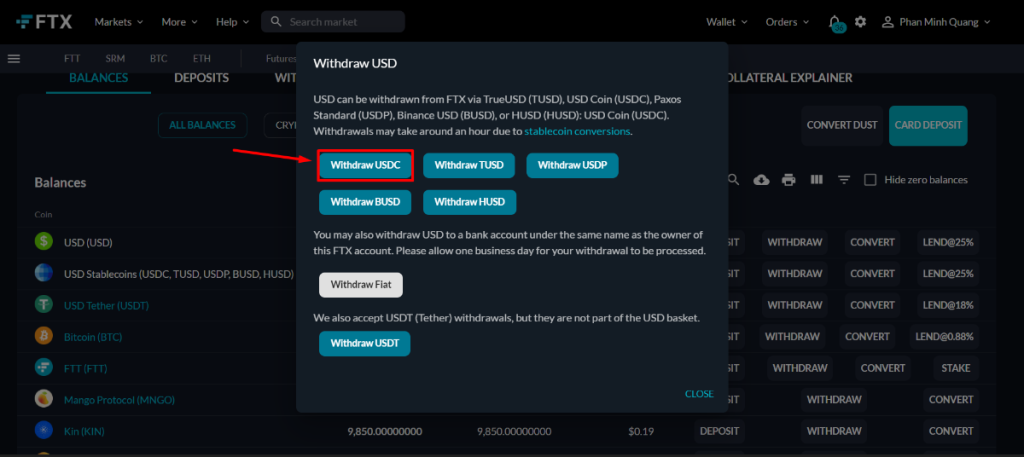

You can withdraw USD to various stablecoins or Fiat. At the moment, FTX supports 6 stablecoins, including USDC, BUSD, TUSD, HUSD, USDP, and USDT. You can also withdraw USD from FTX to directly Fiat in your bank account.

I will use USDC in this example. Choose “Withdraw USDC”.

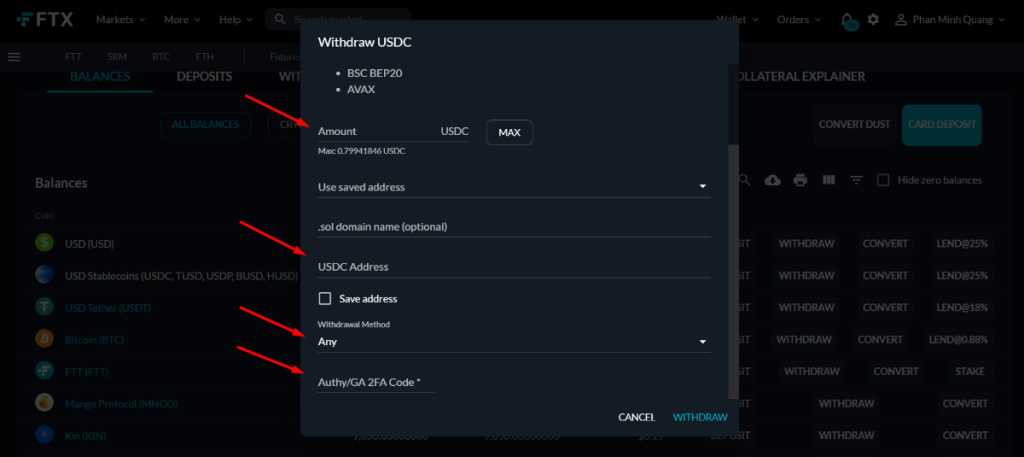

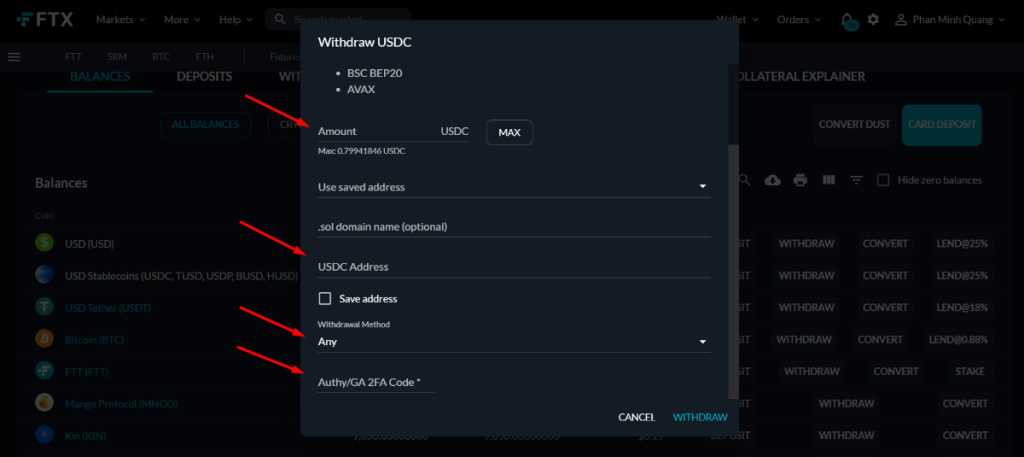

At this step, you have to fill in the information about your withdrawal. This includes:

- Amount: The amount you want to withdraw.

- USDC Address: Enter the wallet address that you want to withdraw to.

- Withdrawal Method: The blockchain platform that you are using for this specific address/asset. For USDC, FTX currently supports 4 networks: Ethereum (ERC-20), BSC (BEP-20), Solana (SPL), and AVAX.

- Authy/GA 2FA Code: The authentication code taken from Authy/Google Authenticator.

After entering all of the information, click on “Withdraw”.

How to buy/sell tokens on FTX

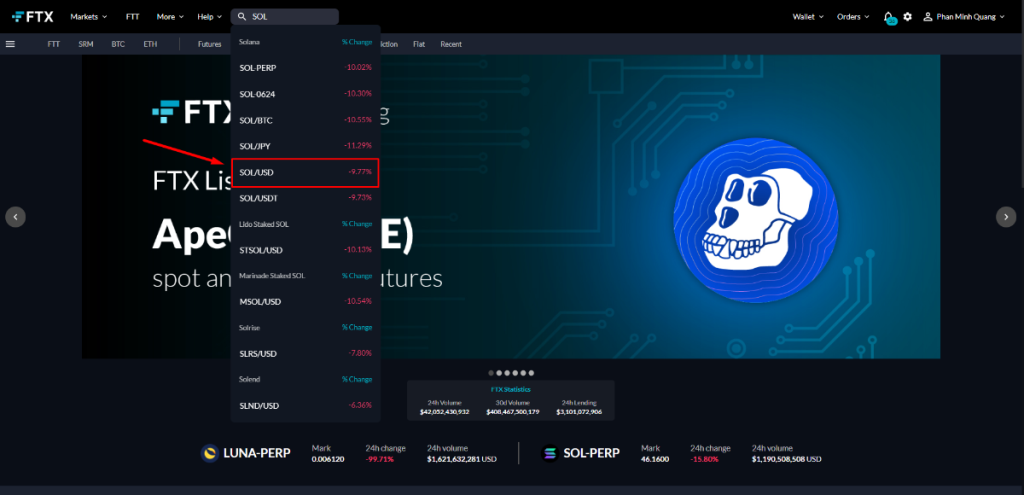

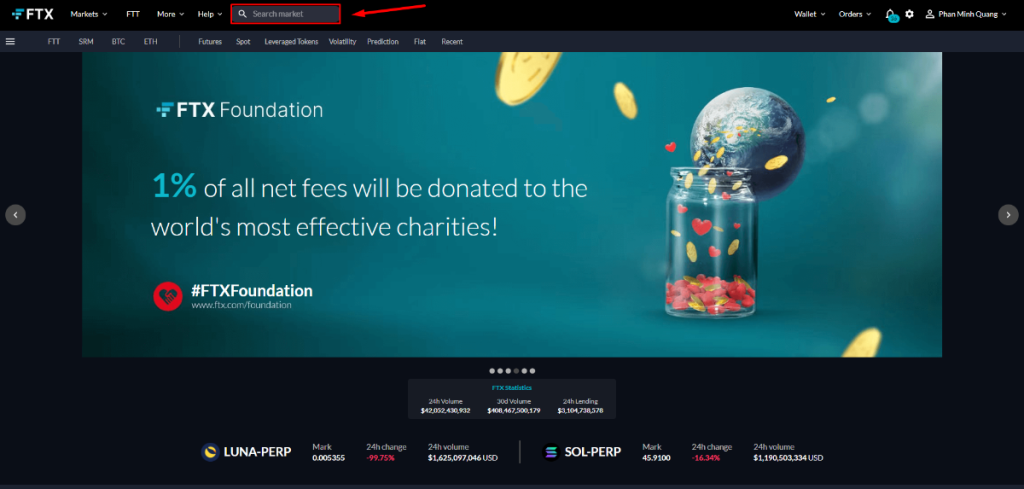

On the front page, click on the “Search market” bar and find the token that you want to buy or sell.

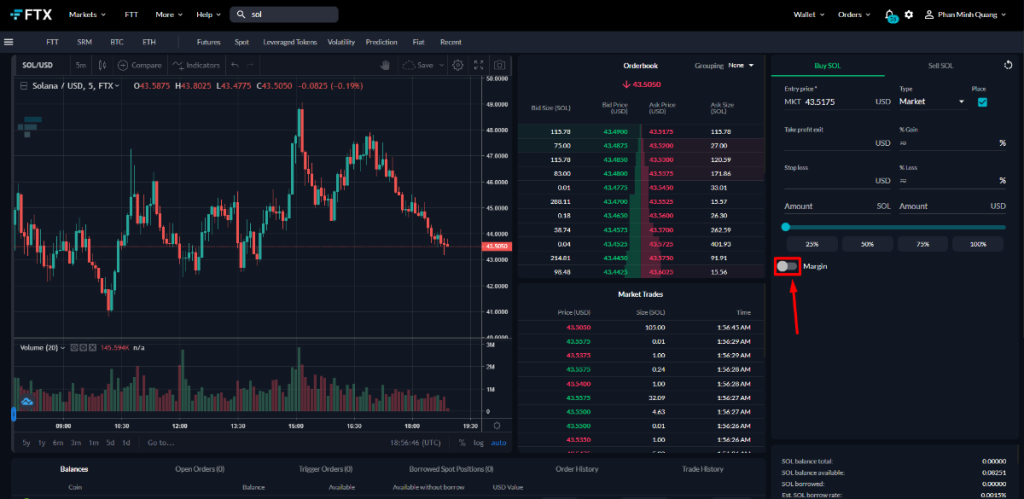

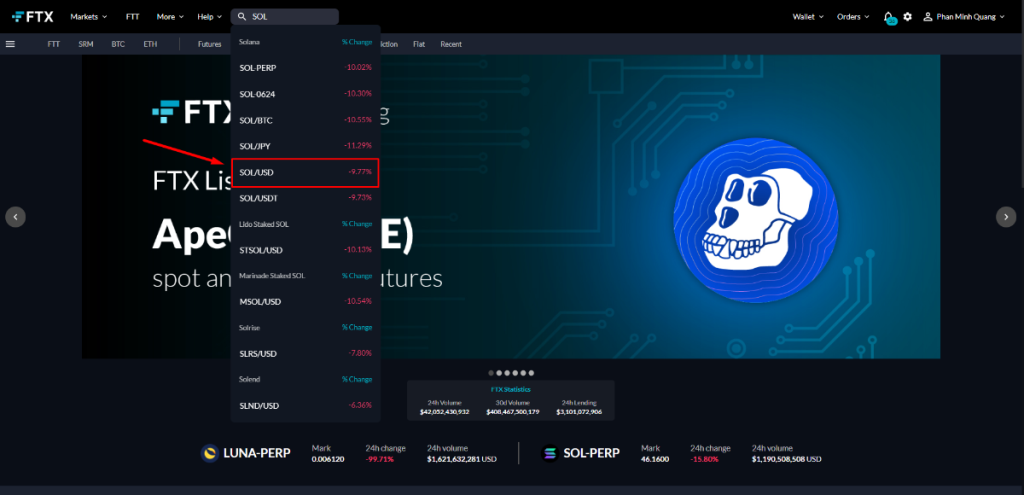

I will use SOL as an example. When I search for SOL, there will appear numerous pairs and types (Spot, Perpetual, Futures,...). You should choose the one that suits your demand. I will select SOL/USD as an example.

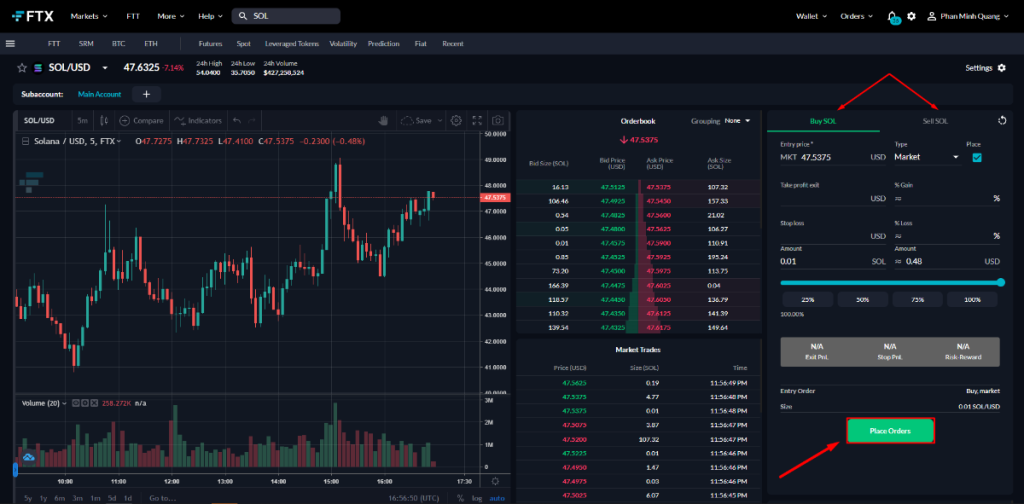

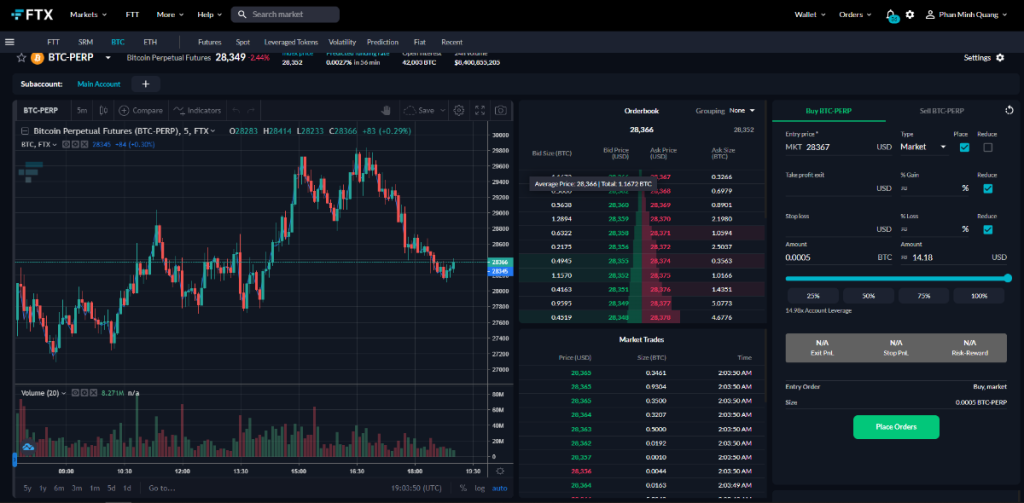

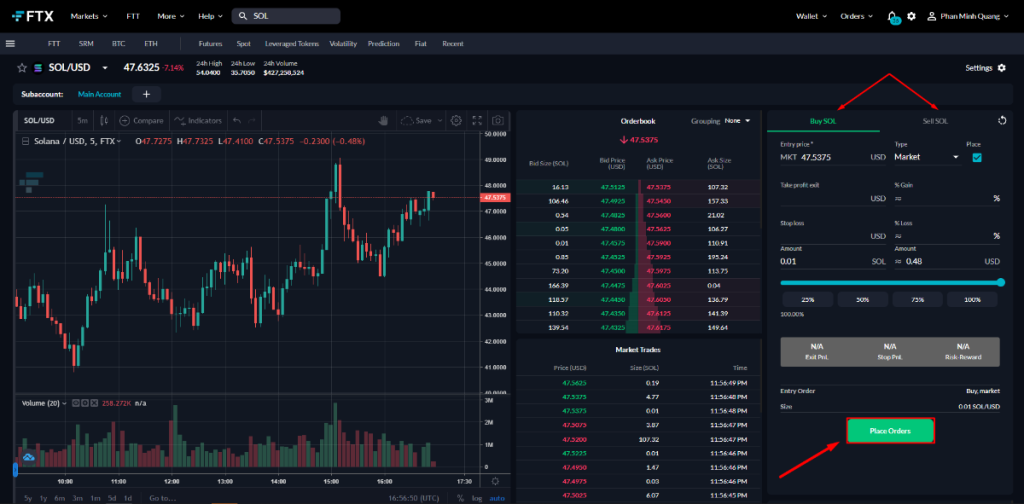

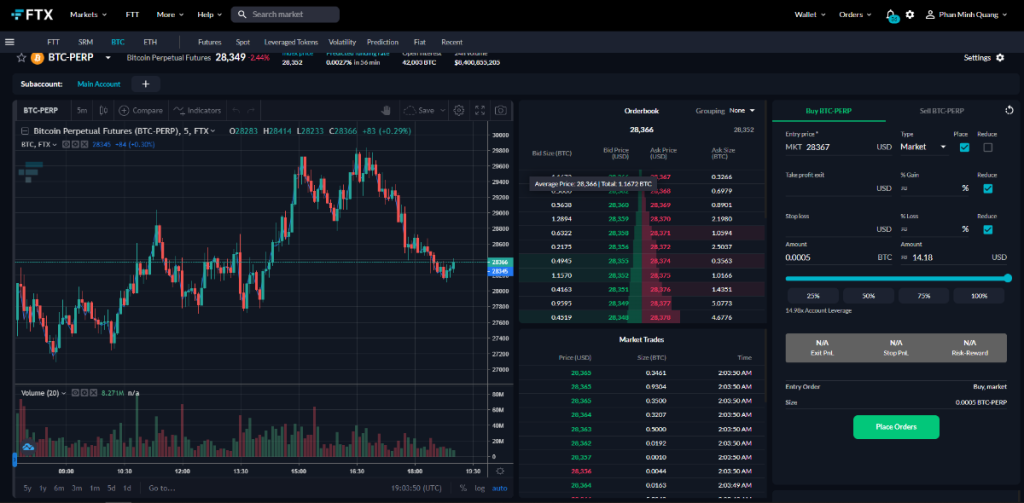

FTX Market orderbook will be shown. Here you can see the price chart, orderbook orders, as well as market trades. The option to either buy or sell is on the top right of the screen, as shown in the picture below

There will be multiple options available when you choose to buy/sell:

- Entry price: The price that you want to buy/sell the token.

- Type: Select the type of order - limit order or market order. Further explanations about these two will be discussed below.

- Take profit exit/% gain: Customize at what price/% gain you want to sell your token.

- Stop loss/% loss: Customize at what price/% loss you want to sell your token.

- Amount: Choose the amount you want to buy/sell.

Once you have filled out all the details, click on “Place Orders” to execute the buy/sell order.

Types of Orders you must know when trading on FTX

There are various types of trading orders. On FTX, there are 4 kinds of orders that you have to know before trading.

- Limit Order: Allows users to buy or sell tokens at a predetermined price. If the market price does not reach the user’s set price, the order will not be executed.

- Market Order: Is a more basic type of trade. Market Order allows users to immediately execute the order at the current market price. It is guaranteed that you can buy/sell your tokens instantly.

- Stop Market Order (Stop Loss Order): Allows users to place a Market Order right when a specified price hits. This is made to prevent serious losses when the market crashes.

- Stop Limit Order: Works pretty similarly to Stop Market Order as they are both order types that will be executed when the price reaches a predefined number. The difference is that, while Stop Loss Order immediately sells your asset at market price when it is triggered, Stop Limit Order splits it into 2 different functions.

For Stop Limit Order, there will be a stop price that converts the order to a sell order and a limit price that determines the selling price. This is made to prevent flash crash events that are followed by a quick market recovery, which may cause you to sell at a lower price than predicted.

How to trade on FTX Exchange

How to leverage trade on FTX

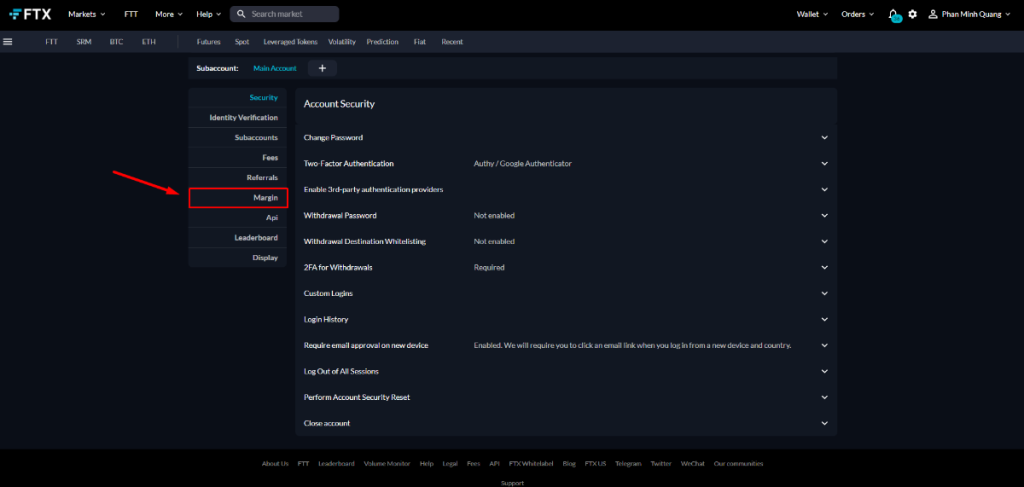

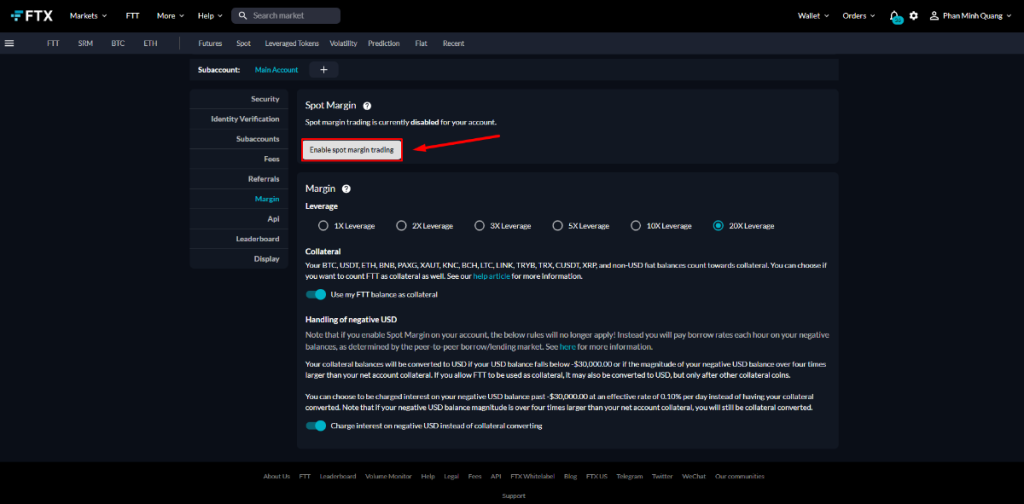

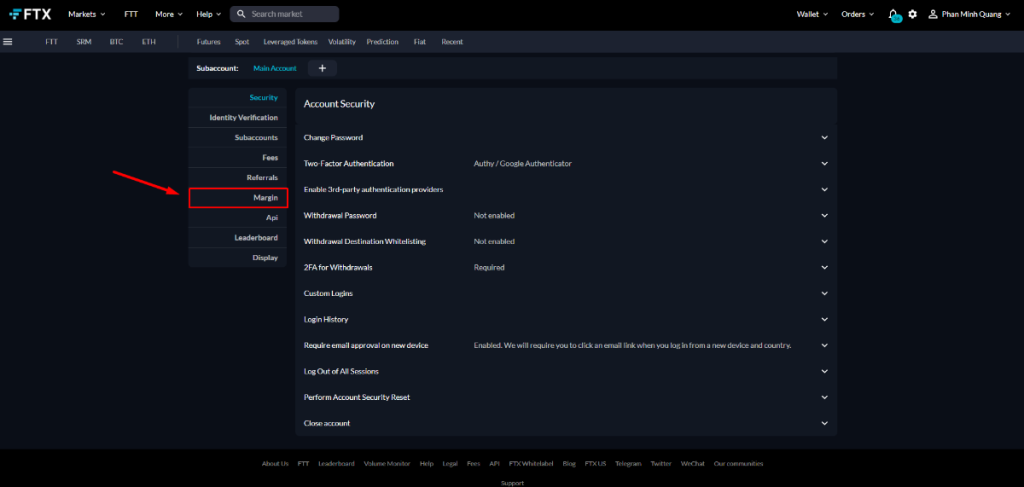

Margin Trading is initially disabled on your FTX account. To open this feature, first, point to your account name on the right. A few options will show up, select “Settings”.

Choose “Margin”.

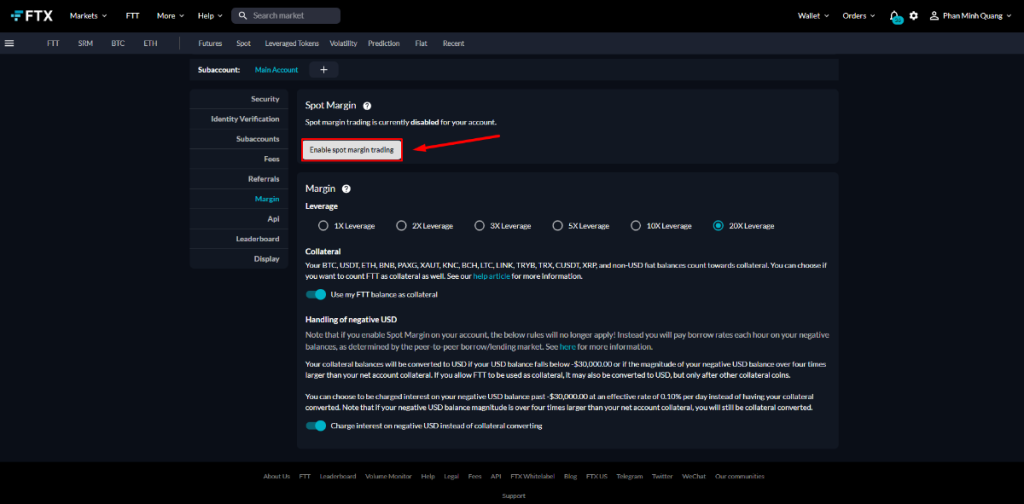

Click on “Enable Spot Margin Trading”. In this section, you can also change your margin leverage.

Spot Margin Trading is now available on your account. Click on “View Borrows” to check the borrow rates of all supported assets on FTX.

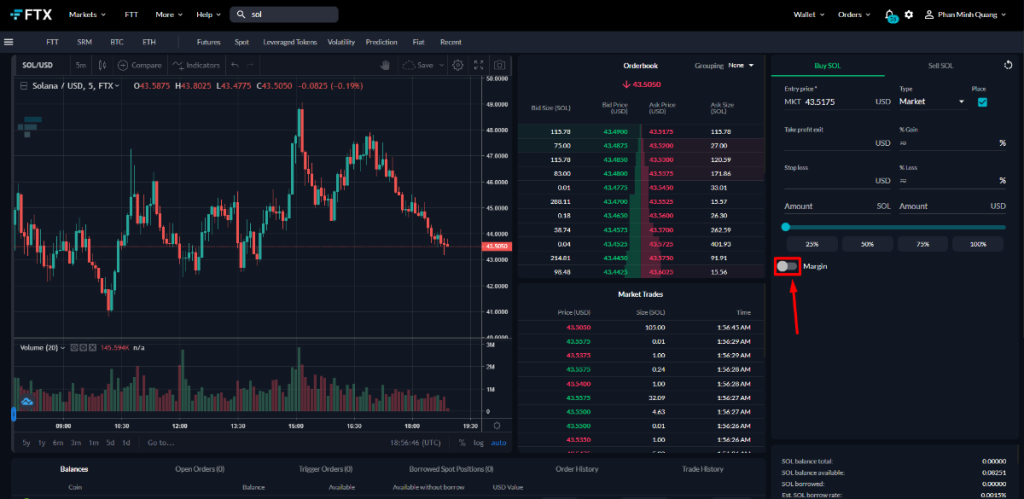

You can now leverage your trade easily. Simply go to the spot market of an asset (Refer to the above heading: “How to buy/sell tokens on FTX” for a detailed guide) and turn on “Margin”.

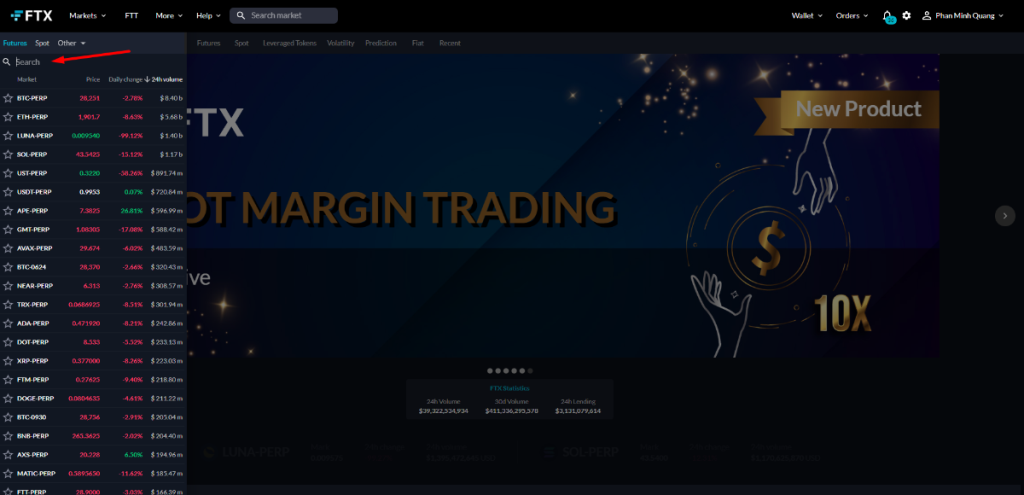

How to trade futures on FTX

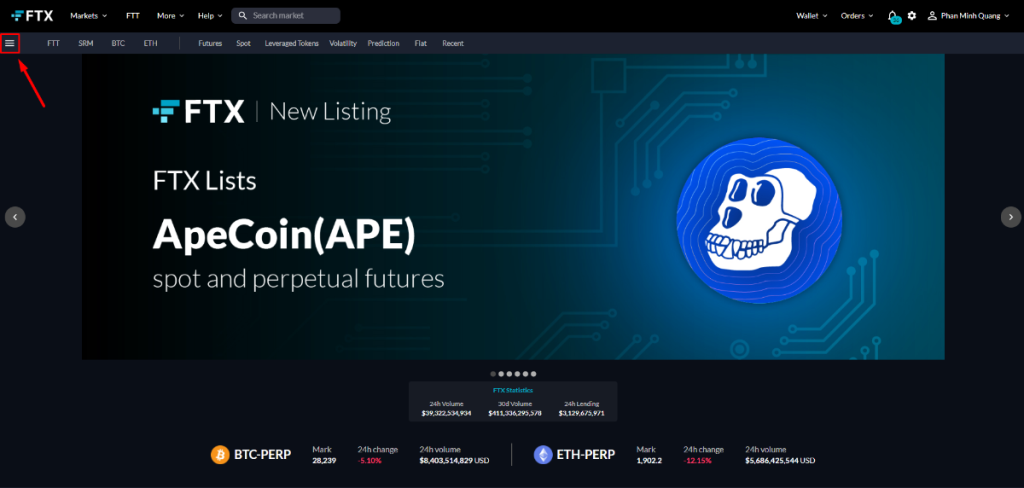

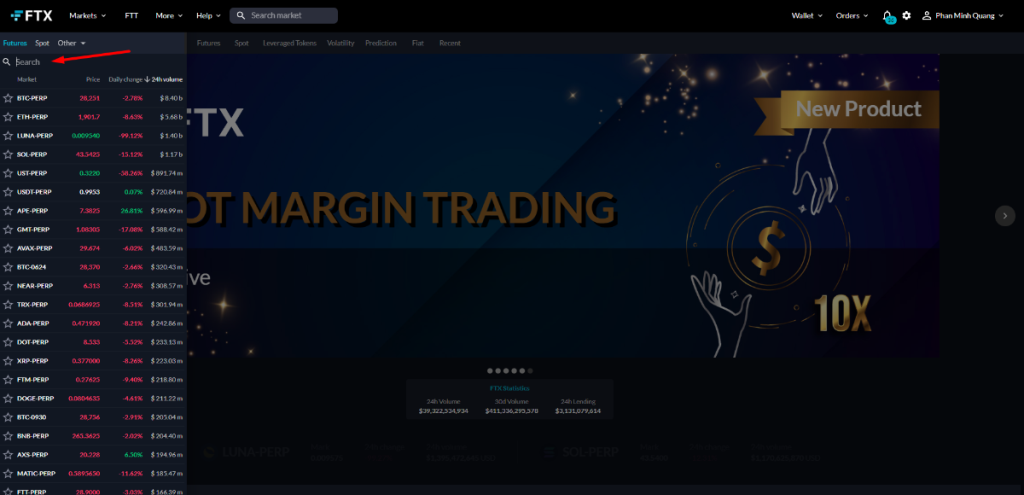

On the main page, click on the “Menu icon” on the top left of the screen.

All Futures contracts on FTX are shown here. Search for the contract that you want to trade. I will use BTC-PERP as an example.

Trading Futures is similar to trading spot, as both have the same interface. Your leverage will automatically be applied to your order size. Click on “Place Orders” to execute your order.

How to use earn on FTX Exchange

You can earn on FTX Exchange using various tools and features. In this part, I will introduce you to each of them as well as how to use them for profit.

How to lend on FTX

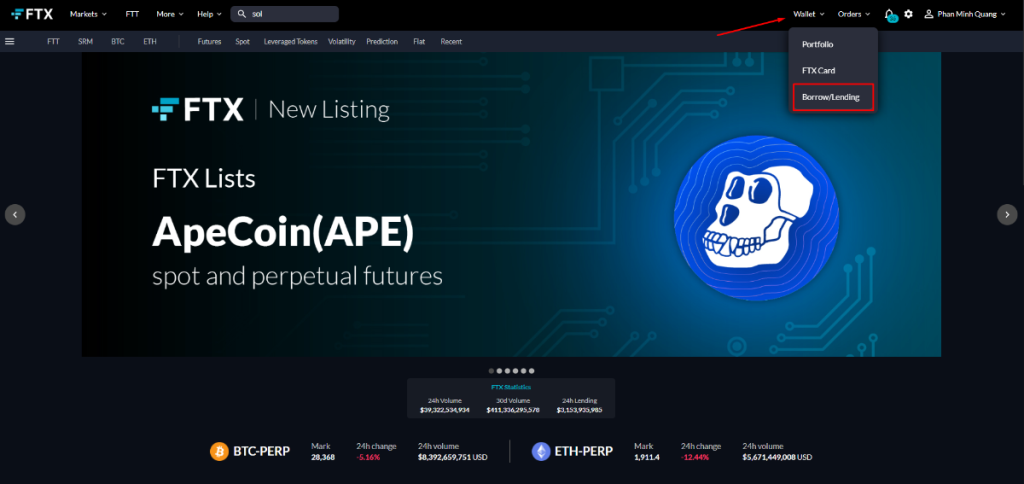

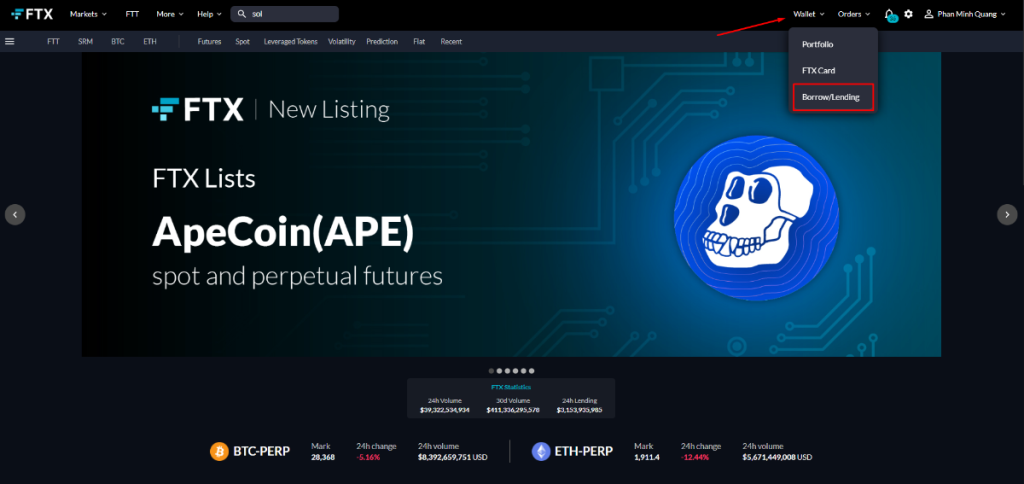

On the main page, point to “Wallet” and choose “Portfolio”.

All supported assets for lending will be available on this page, as well as their lending rate. Choose the token that you want to lend, or click on the “Search icon” to find a specific one. Afterwards, click on “Lend”. I will use USD as an example.

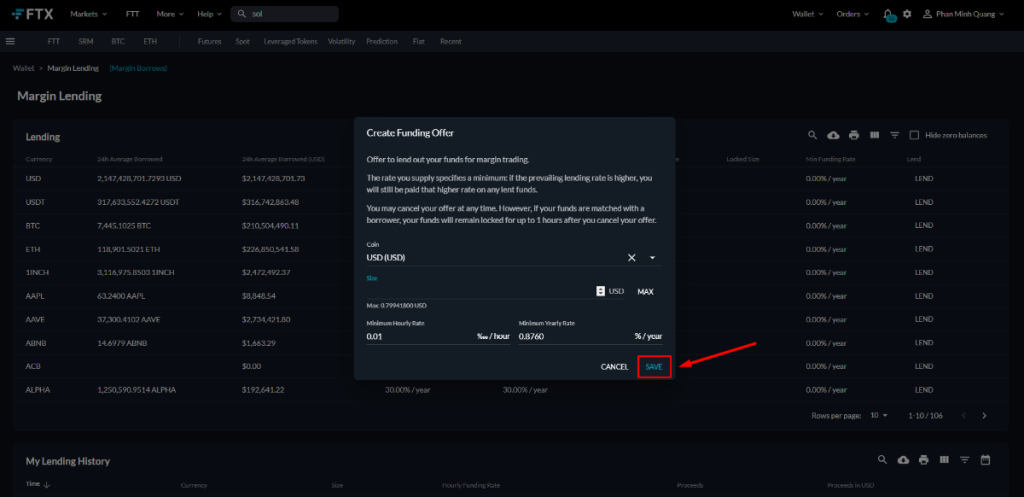

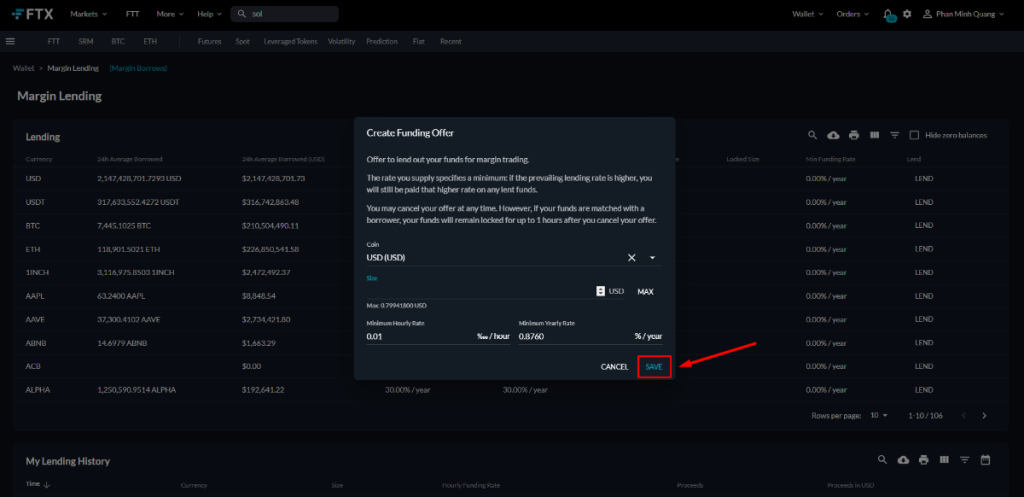

Enter the amount that you want to lend. Look over the information carefully before lending. Do bear in mind that if your funds are matched with a borrower, your funds will remain locked for up to 1 hour after you cancel your offer. When you finish, click “Save”.

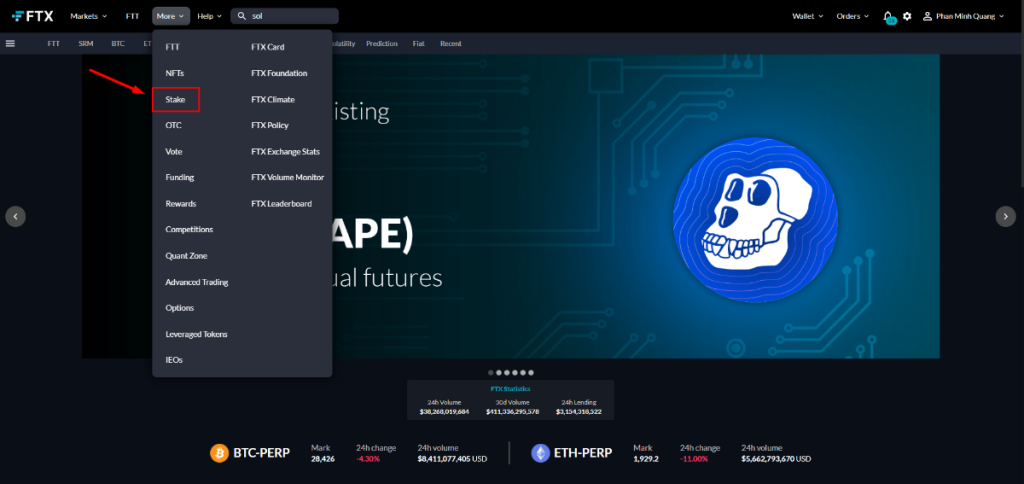

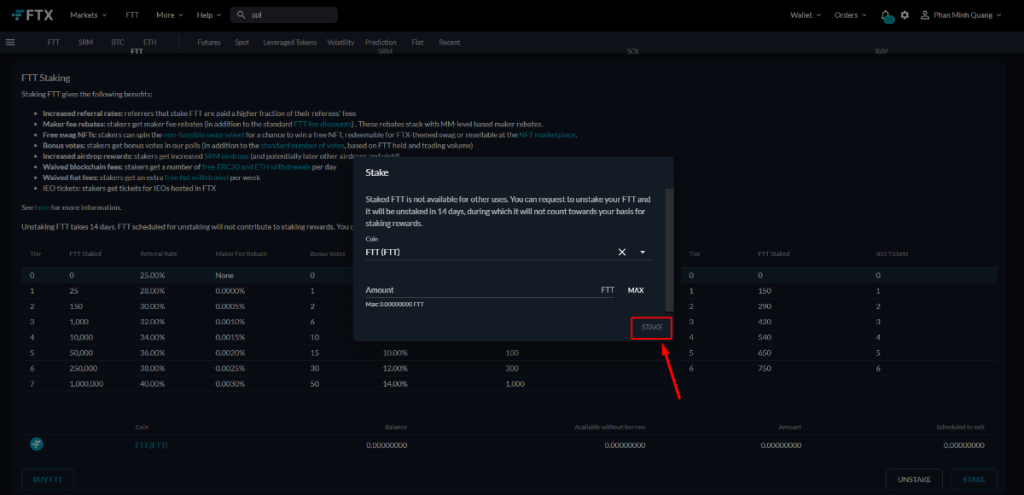

How to stake on FTX

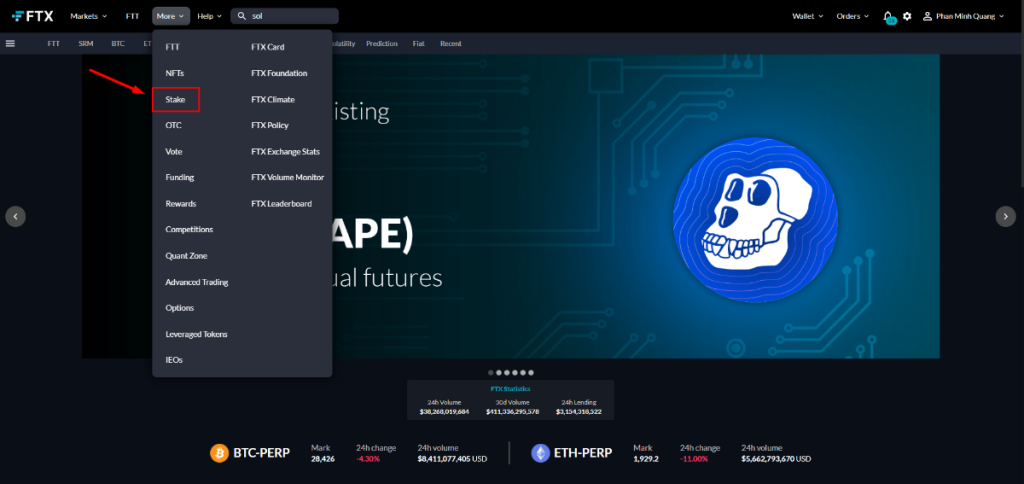

Staking is one of the easiest and safest ways to earn passive income. On the main page of FTX, click on “More” and select “Stake”.

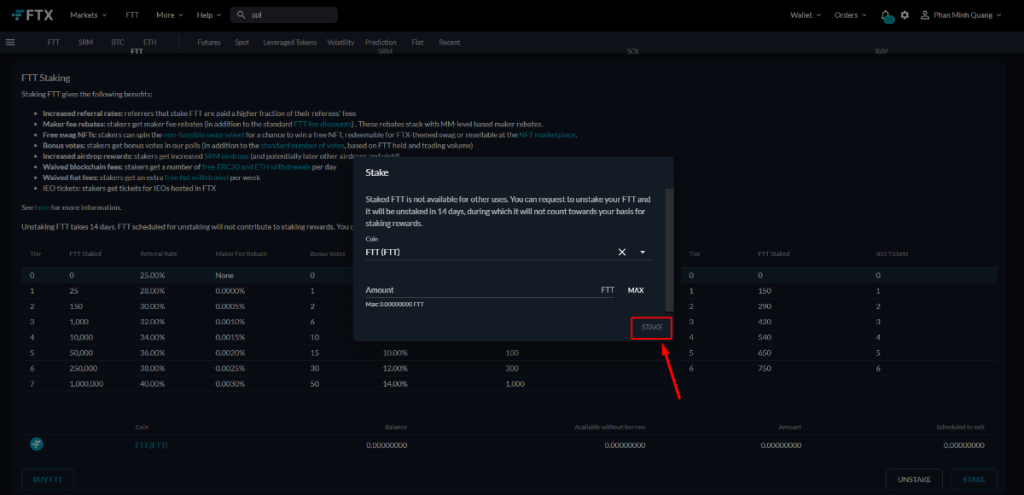

For the time being, FTX only supports staking FTT. Click on “Stake” at the bottom right of the screen.

Enter the amount of FTT to stake, then click on “Stake”. You have successfully staked FTT on FTX.

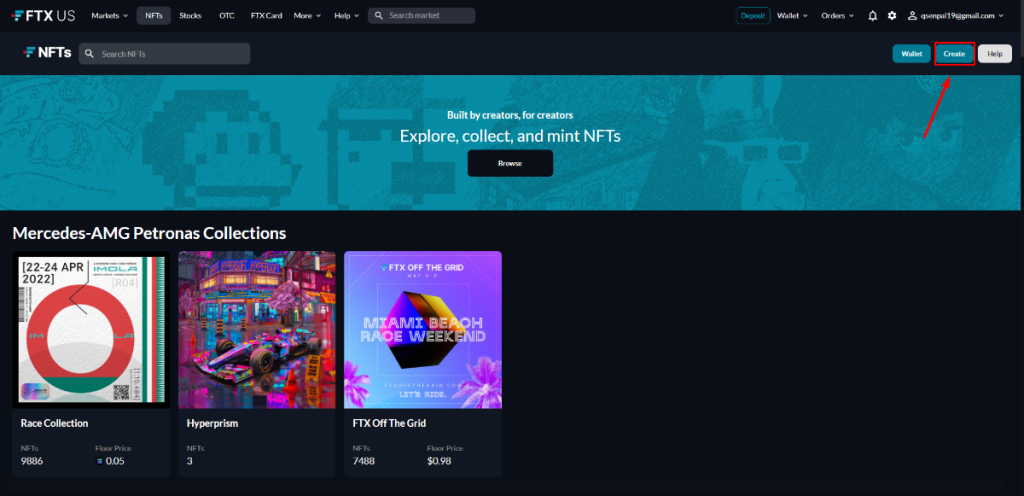

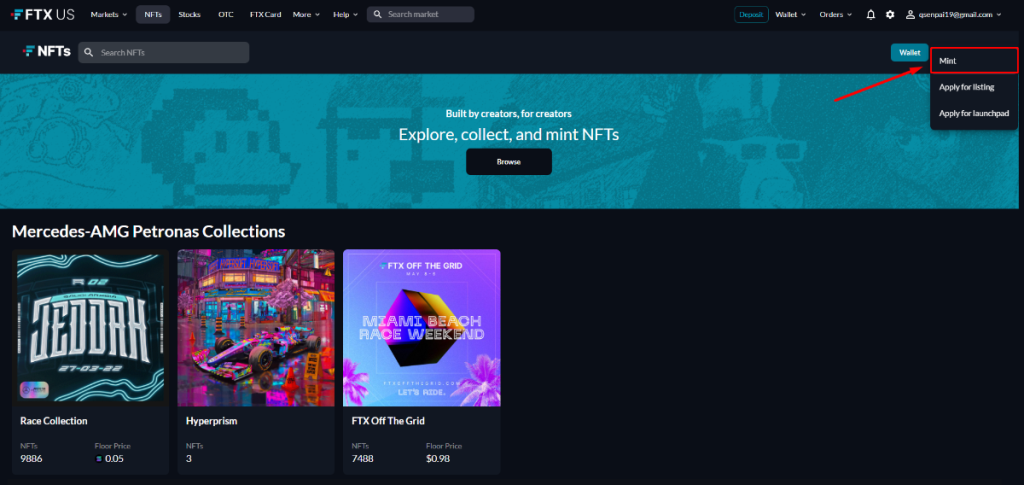

How to list NFT on FTX

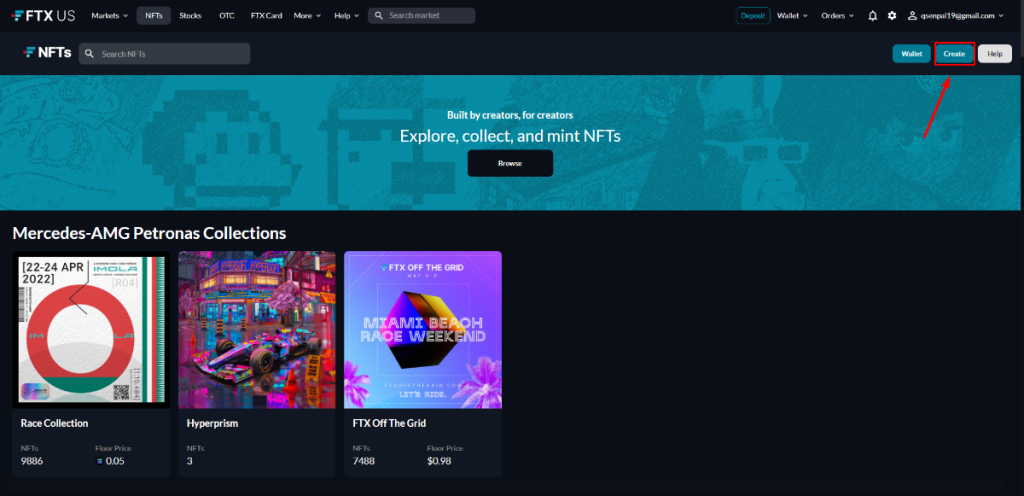

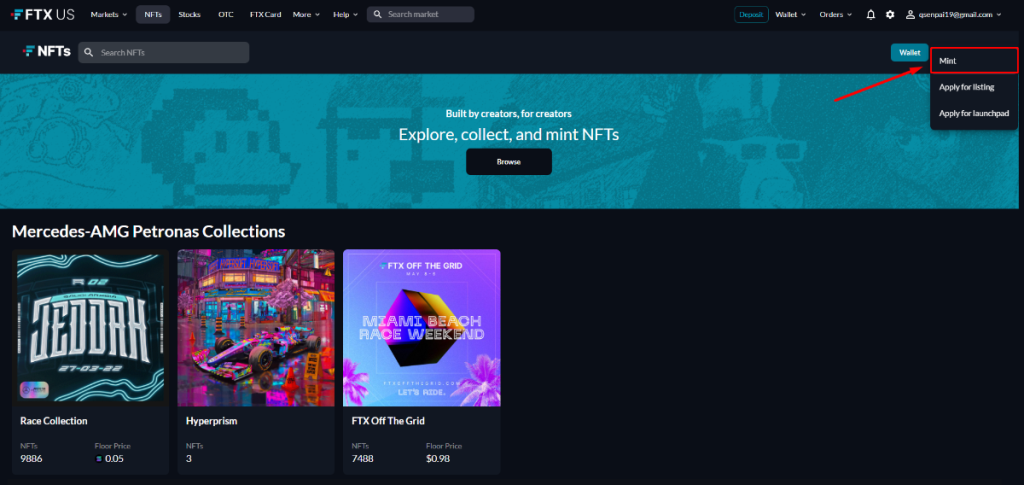

Minting or listing NFT is currently only available on FTX US. To list an NFT, first, go to the FTX US website here. Log into your account and click on “Create”.

A few options will be given out. Click on “Mint”.

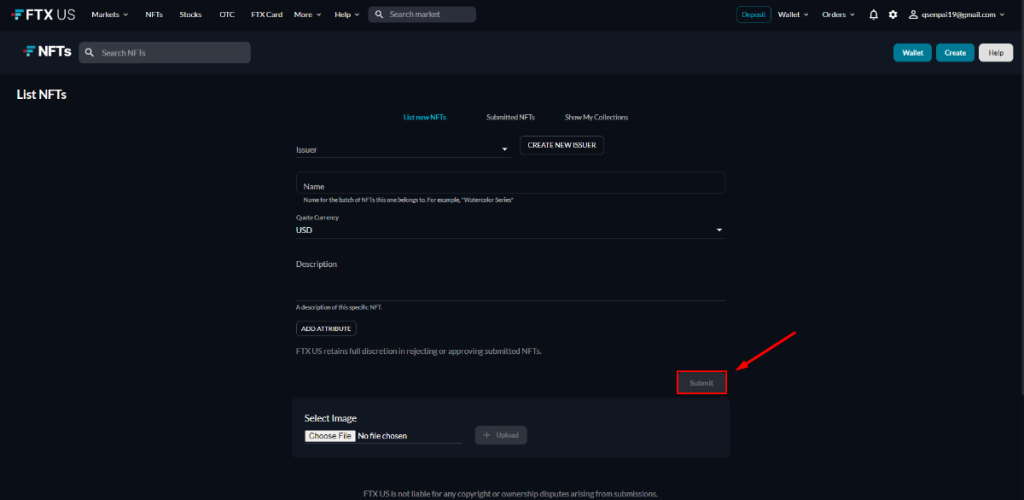

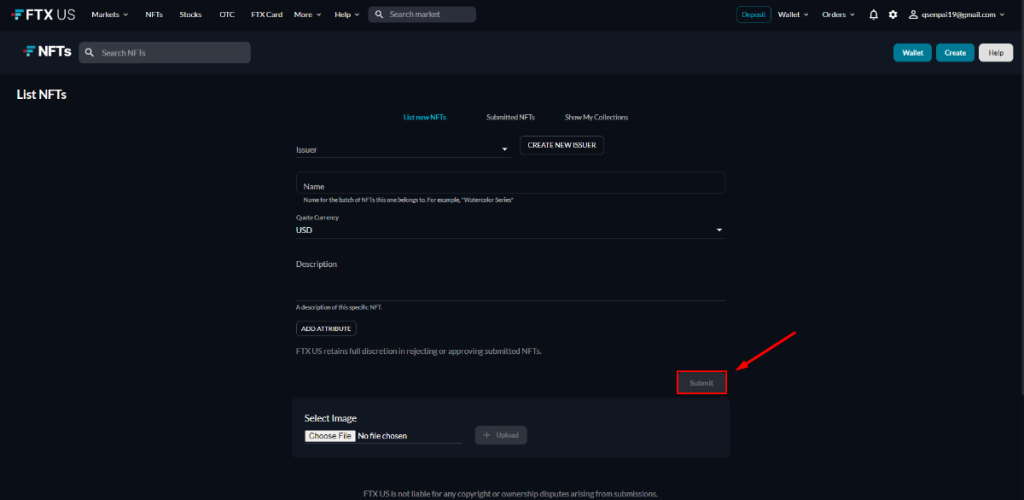

In order to list your NFT, you have to submit a form to FTX US. Some information must be included:

- Issuer: Public name for the creator of the NFT.

- Name: Name for the batch of NFTs this one belongs to, in case you want to list multiple NFTs into 1 collection.

- Quote Currency: The currency that will be used to trade the NFT. FTX US currently supports USD, ETH, and SOL.

- Description: A brief overview of the NFT.

- Attribute (Optional): Some special attributes for this specific NFT. This can help differentiate an NFT from others within its collection.

- Select Image: The picture of the NFT.

After you have filled in all the requirements above, click on “Submit” to list your NFT.

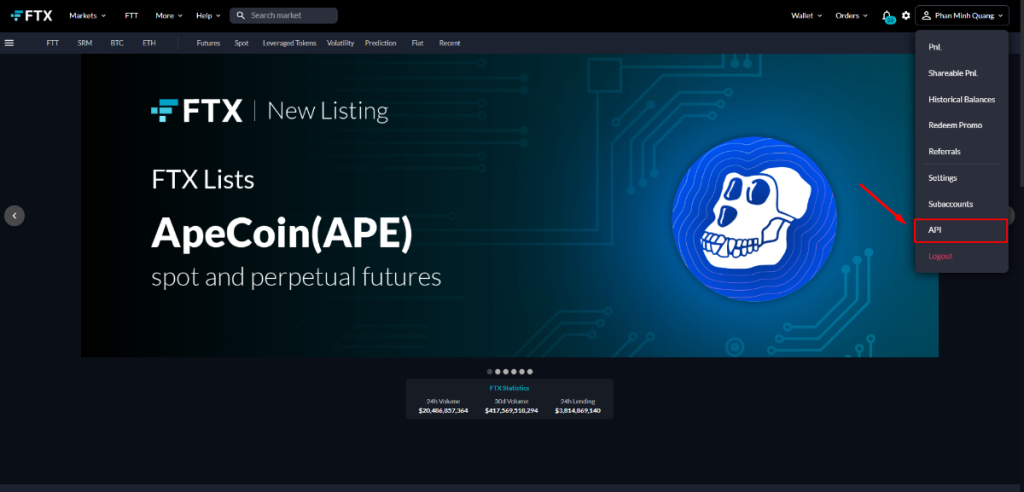

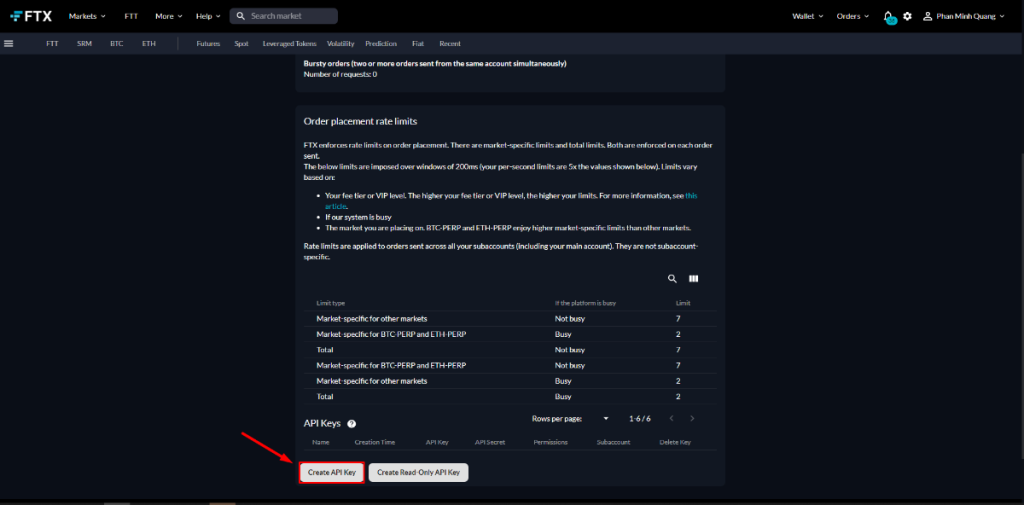

How to get FTX API

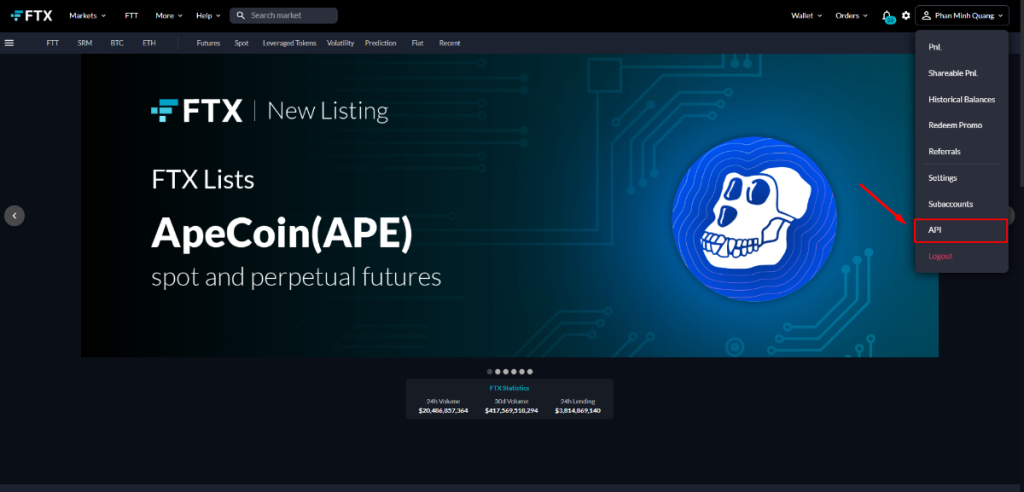

On the main page, point to your name on the top right corner and select “API”.

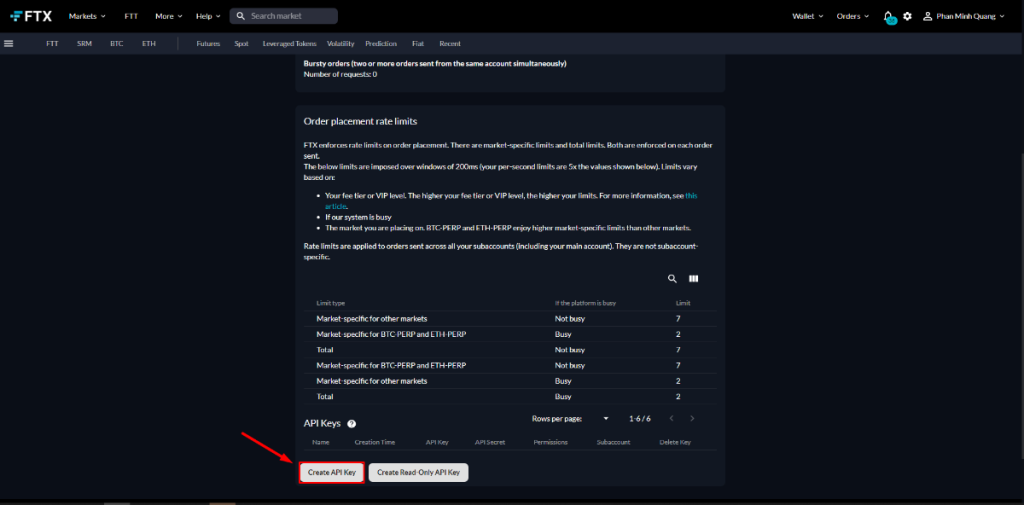

Scroll down, and you will see an option to “Create API Key”. Click on it to get FTX API.

FTX will show you your API Key and API Secret. Remember to write down these lines when you see them, as they will not be shown after you close this dialog. At the same time, do not share these codes with anyone since they can get access to your FTX account.

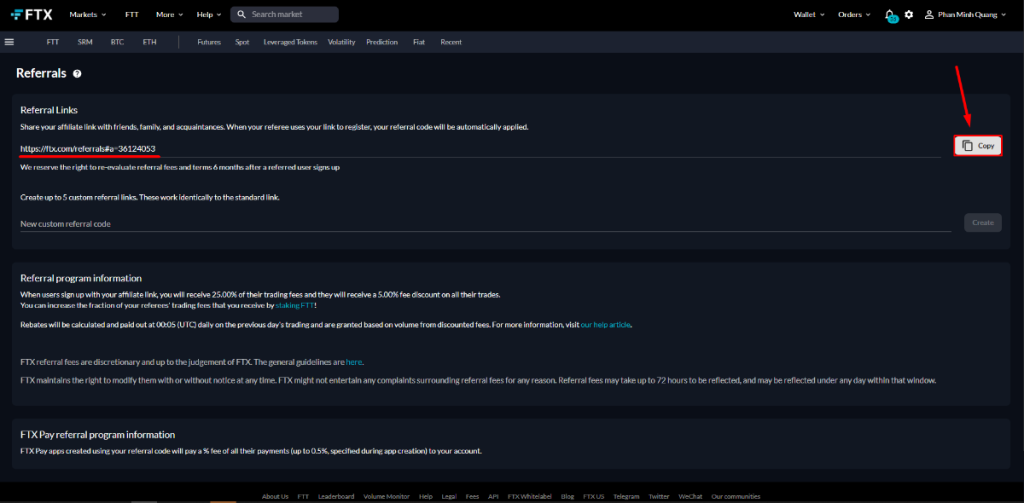

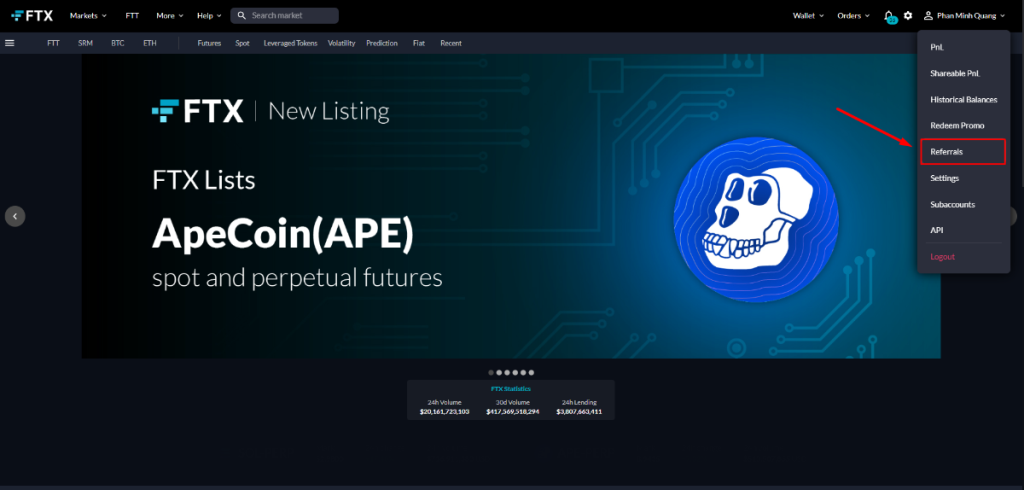

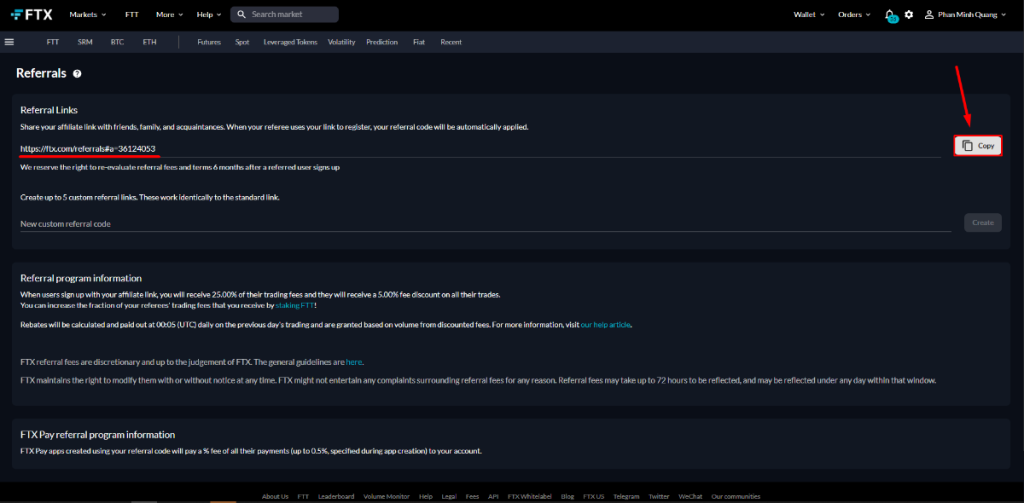

How to get FTX Referral Code

On the main page, point to your name and click on “Referrals”.

Your referral code will be shown here. You can also create up to 5 custom referral links for your own preference. Click on “Copy” to copy your FTX Referral Code.

How FTX compares to other exchanges

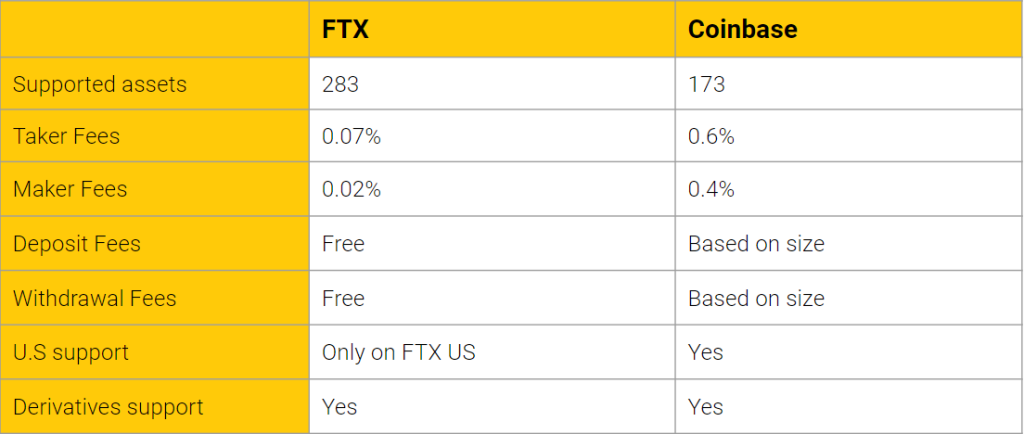

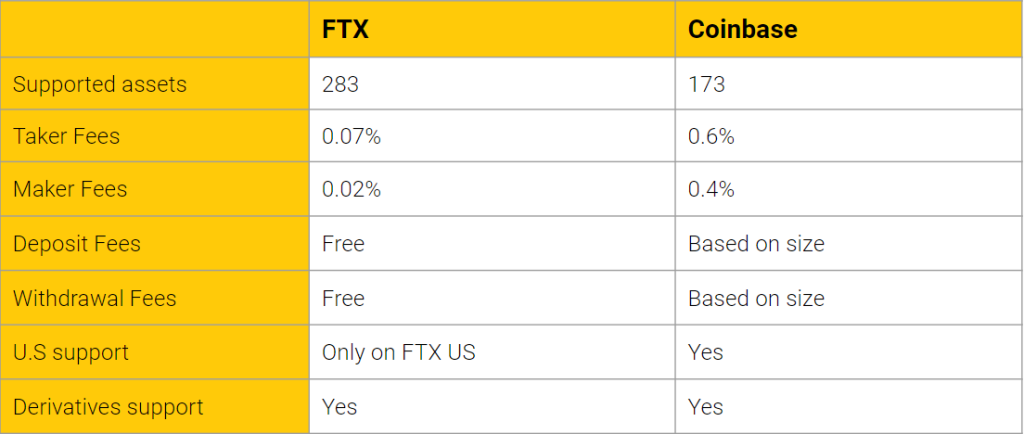

FTX vs. Coinbase

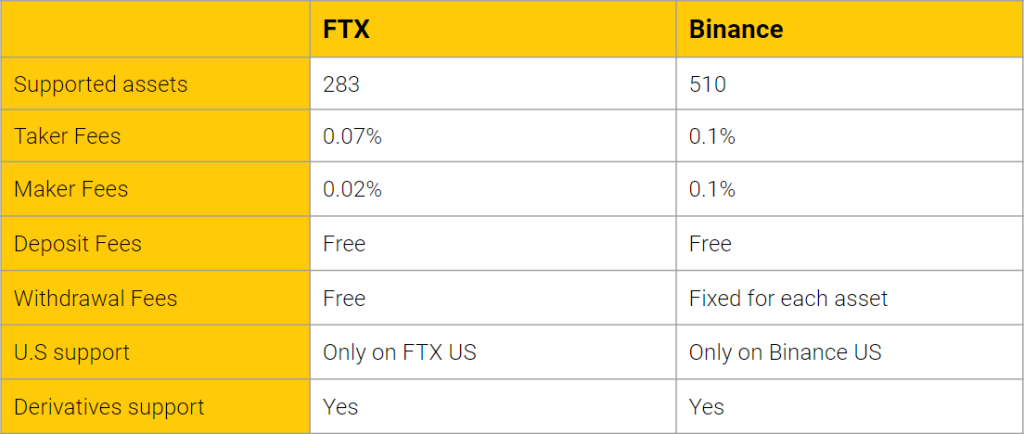

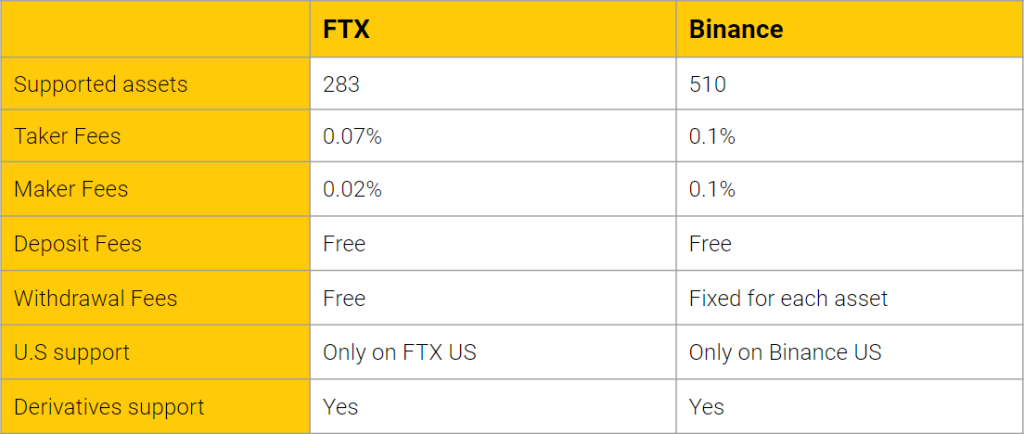

FTX vs. Binance

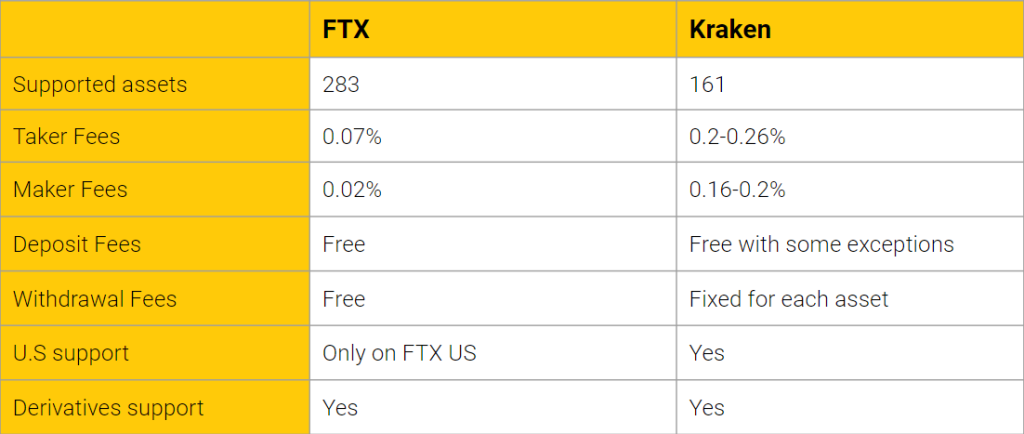

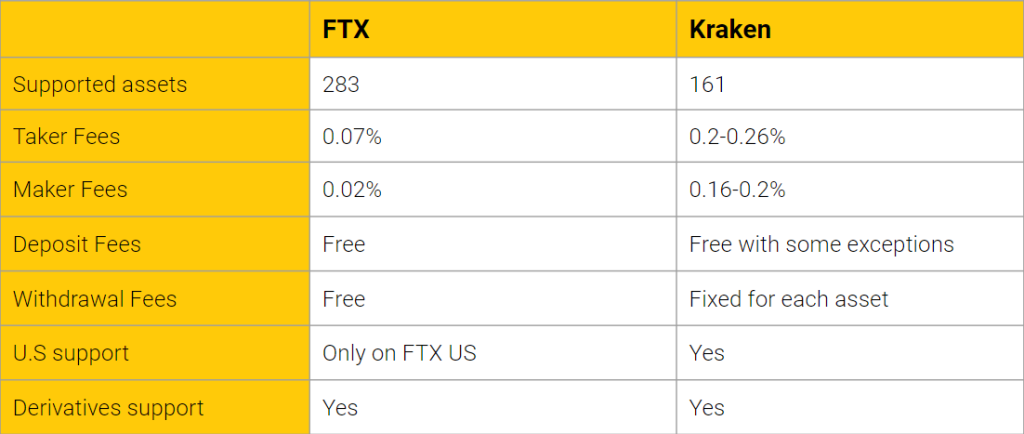

FTX vs. Kraken

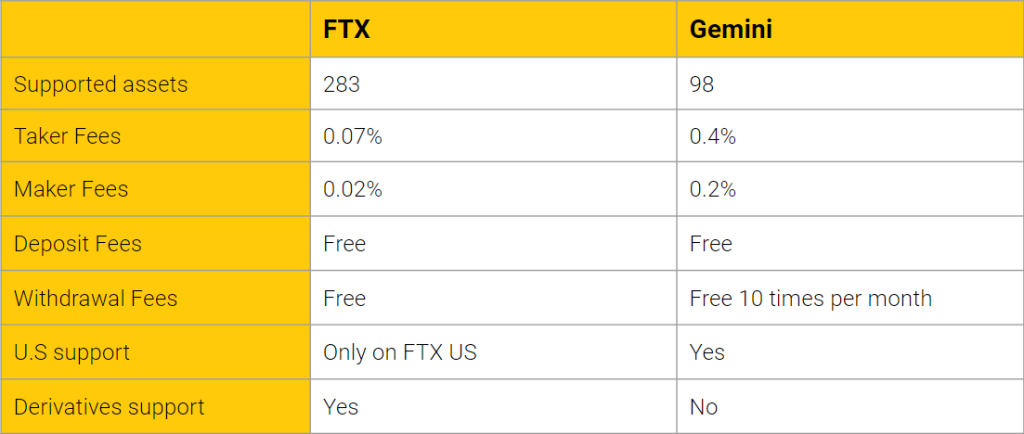

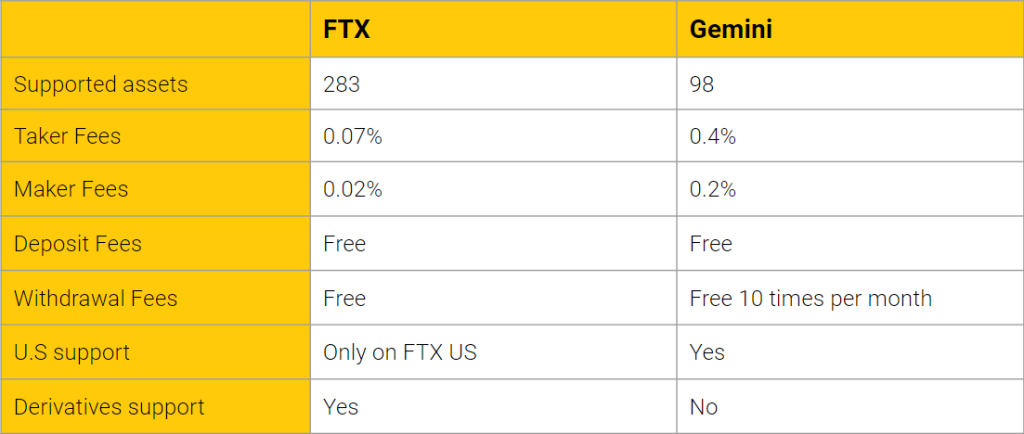

FTX vs. Gemini

Some questions when using FTX Exchange

What is FTX's token?

FTX’s token is FTT, as mentioned above. You can check out the details of FTT on Coingecko or CoinMarketCap.FTX’s token is FTT, as mentioned above. You can check out the details of FTT on Coingecko or CoinMarketCap.

Learn more: What is CoinMarketCap?

Is FTX safe and legit?

FTX is a reputable centralized exchange that has operated since 2019, and there have not been any hacks or exploits to the exchange. FTX has also been carefully regulated by various parties, which is addressed here.

Is FTX insured?

All users can be insured while using FTX as they have implemented an extremely strict level of security. Your funds are guaranteed to stay safe on FTX.

Is FTX available in the US?

At the moment, due to regulations in the United States, FTX cannot operate in the US. Therefore, US residents do not have access to FTX as well as its native token - FTT.

Nevertheless, FTX has developed a completely new product called FTX US, which is an identical exchange to FTX but can operate in the US. If you are a US citizen, feel free to enjoy FTX features on FTX US.

Does FTX report to IRS?

No, FTX does not report to IRS or provide a tax report.

Conclusion

And that is everything you need to know about FTX. If you have any questions about FTX and how to use this exchange, don't hesitate to leave a comment below. The Coin98 team will answer your questions as soon as possible!