Whats remarkable about the Hidden Gem PlutusDAO project on Arbitrum?

In this article, we will learn about a project that is considered Hidden Gem on the Arbitrum ecosystem, which is PlutusDAO.

The Sperax team decided to launch SperaxUSD on Arbitrum, the platform that is considered the future of DeFi.

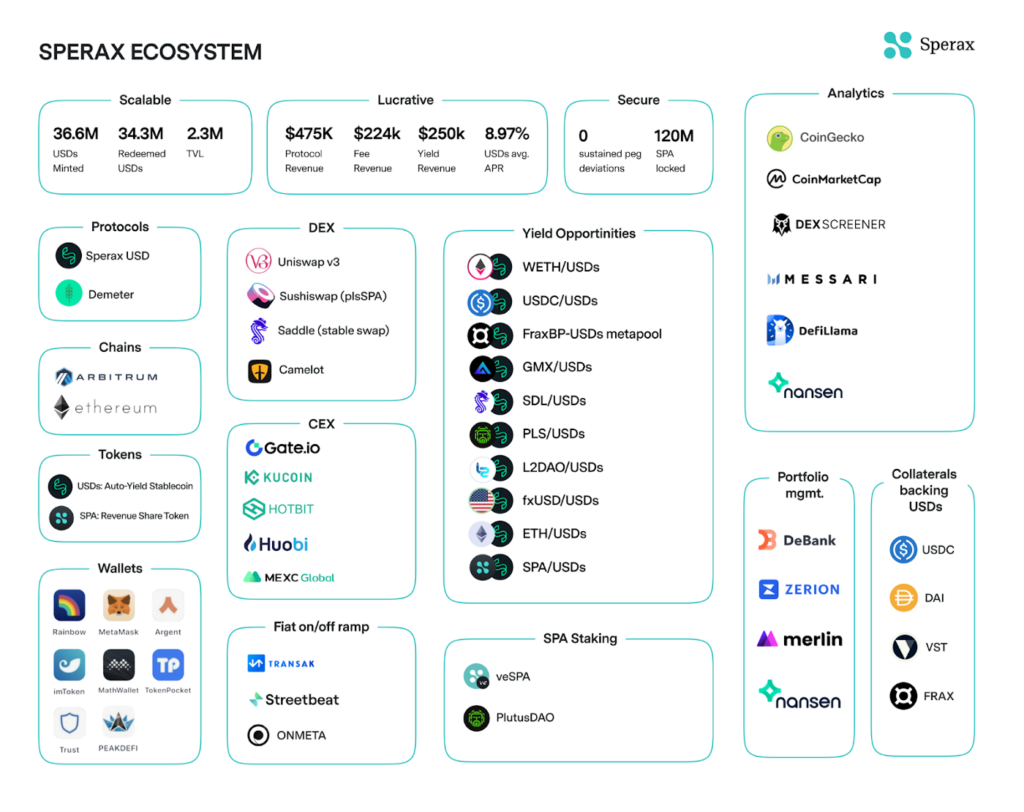

During the first 11 months of 2022, Sperax DAO shipped two protocols: SperaxUSD stablecoin and Demeter liquidity management. These protocols have attracted a community of users, investors, and builders committed to driving the development of the project. Sperax is building a trusted and publicly accessible financial infrastructure.

Arbitrum 's transaction volume, total locked value, and user base have grown enormously throughout 2022, surpassing other Layer 1 platforms. The Sperax community is committed to building an ecosystem on Arbitrum. The figure below depicts the Sperax Ecosystem.

Sperax in the list of projects with the most number of weekly active users on Arbitrum:

For the Sperax ecosystem to be successful, emphasis must be placed on the main performance indicator of that protocol, the circulating supply of USDs.

As the circulating supply of USDs increases, so does the collateral (TVL) supporting USDs. This collateral is controlled by SperaxUSD and generates revenue for the protocol. 50% of the revenue is used to fund automatic profit USDs. The remaining 50% is given to SPA stakers as part of the revenue. As the TVL of USDs increases, so does the value sent to SPA stakingers, which creates a positive relationship between the growth of the circulating supply of USDs and the SPA price.

In 2023, the activity will focus on increasing USDs trading pairs and driving demand for USDs to increase circulating supply and subsequently the revenue of the protocol.

After finishing the Demeter Genesis program, Sperax will start a gauge. Sperax gauge holds SPA incentives allocated to different pools including USDs. The purpose of the gauge is to reward DAOs that use USDs in their DEX trading pairs (GMX-USDs instead of GMX-USDC). More pairs provide a better experience for Arbitrum traders.

When using Demeter to launch a farm, the DAO can pair with USDs, which results in automatic approval and listing on Sperax Gauge. Once listed, a pool is eligible for two release types:

Future iterations will include completely permissionless issuance, allowing any DAO to earn SPA based on TVL USDs pooled by users without any bribery or voting.

Similar to Demeter Genesis campaign, many DEXs will be introduced as partners of Sperax Gauge Genesis. Any pools launched on these DEXs that feature USDs, are automatically approved to the gauge.

DAOs participating in Genesis benefit from an allocation of SPA for governance plus a SPA bounty to incentivize TVL USDs on a partner DEX.

Demeter will soon come up with new ways to incentivize and structure liquidity campaigns. The project has begun testing new systems with Bond Protocol, Revest Finance and other partners.Sperax will build any incentive program that the Arbitrum community deems necessary.

Liquidity moat: Since USDs are already traded against GMX, PLS, gDAI and other tier 1 Arbitrum tokens. When transaction fees are cheap thanks to this, USDs become the de facto stablecoin of Arbitrum.

Chainlink Price Feed: Once there are enough TVLs on these pools, Chainlink has committed to roll out a USDs price feed. Once the price feed is live, USD can be listed as an asset to lend or borrow on dapps like Aave and Compound or as collateral in GMX's GLP product.

Auto Profit: All USDs backed 1:1. All of this collateral backing is making a profit, but not all USDs are getting a profit.

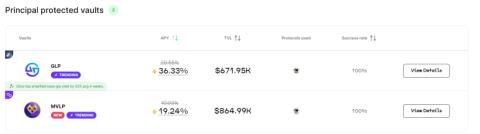

To boost demand for USDs, the project will launch fixed-key USDs vaults. Users deposit their USDs into the vault where USDs are locked. The longer the lock, the bigger the bonus. This return is naturally generated by reducing the return of liquid USDs or transaction fees from specific pools of stablecoins.

Sperax has begun expanding USDs as a DAO treasury asset. By holding USDs in their coffers, DAOs benefit from automatic yield payments of up to 11% APR. This is especially beneficial for several reasons:

This strategy will be replicated across Arbitrum DAOs. Future versions of this will have buyback leverage. When the buy back leverage is pulled by the DAO treasury, the yield automatically funds the desired buyback of ERC20 tokens on the DEX of their choice.

Perpetual protocols rely on a basket of collateral for traders to trade. Without this pool of collateral, traders would not be able to open large positions. The value of the collateral is directly tied to the size that traders can put in. As more collateral is deposited, larger transactions can occur, bringing more rewards to the collateral pool.

This means that when USDs are listed as collateral on perp exchanges, this will be a fixed collateral because trading demand has historically remained constant. GMX and VELA are in talks to integrate USDs on their platforms.

In 2023, Sperax will make the SperaxUSD open source available. This will be done after all processes are decentralized including restarts, reward harvesting, and reward distribution. This means that functions can be called by the community. If they are not called by a certain time, Gelato contracts are executed on behalf of the community.

In Bear Market, many traders leave and builders stay. Launching a bear market contribution crowdfunding program offers a unique opportunity for the Sperax DAO and its contributors.

For SperaxDAO, the project is funding contributors who have proven resilient and continue to build during the bear market. These users are less affected by price and more in line with the long-term vision of the protocol.

As for contributors, you have the opportunity to purchase more SPA units due to the significantly reduced price. For the same $10,000 contribution, in January 2022, this contributor will only receive 100,000 SPA tokens.

At current valuation, this contributor will earn 2,000,000 SPA. If this contributor holds the SPA, and hypothetically if the SPA returns to its valuation by January 2022, then this user will hold $200,000 worth of SPA.

The above is a summary of the achievements in 2022 and the plan of the Sperax project in 2023. To be safe, a decentralized financial system must be reliable and unstoppable. In 2023, Sperax will continue to build a sustainable ecosystem on Arbitrum to avoid being affected by centralized impact.

In this article, we will learn about a project that is considered Hidden Gem on the Arbitrum ecosystem, which is PlutusDAO.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

The TreasureDAO ecosystem has also received attention from the market and its activity volume has also increased in a short period of time.

GMD Protocol is a profitable platform built on Arbitrum. Let's learn about this project together with TraderH4 team.

Arbitrove is a project within the Nitro Cartel ecosystem that aims to help Passport holders make profits on Arbitrum. The project is currently being sold by Public Sales on the Camelot platform - the leading AMM on the Arbitrum ecosystem.

This article will share with you information about the Camelot project, a prominent DEX platform on Arbitrum.

Perpy is a follow-up project to a public token sale on Camelot - a prominent launchpad on Arbitrum. Let's learn about Perpy project with TraderH4 in the article below.

This article will introduce us to a new DEX called ApeX Pro. A unique platform that subtly combines the advantages of both CEX and DEX trading modes.

The following article will provide readers with the most detailed information about a prominent project on the Arbitrum ecosystem that is Umami Finance.

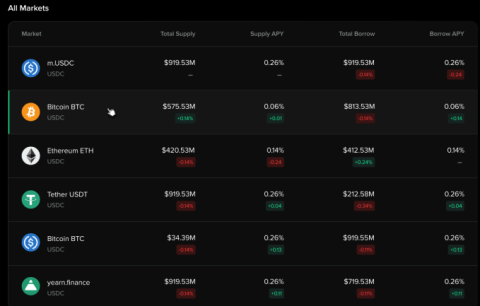

At the present time, Arbitrum is still the hottest ecosystem ever when receiving the attention of investors. Tender Finance is one of the Lending projects on this ecosystem.

In this article, let's learn about Olive Finance in detail - a multi-chain project just launched on the Ethereum network.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.