What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

EthereumPoW (ETHW), a Proof-of-Work (PoW) fork of Ethereum, is a community-based project of sovereign developers and miners led by crypto industry veteran Chandler Guo. Guo presented the ETHW idea on Twitter on July 27, 2022. Since then, the topic has attracted a lot of attention, especially from miners against The Merge. Even Tron founder and Poloniex investor, Justin Sun, lobbied for the project to support PoW mechanism on Ethereum and offered to donate some of the forked ETHW to build the ecosystem.

However, after The Merge , Poloniex ended supporting another fork called EthereumFair (ETHF).

ETHW core contributors posted a thread on Twitter with the mainnet activation roadmap of ETHW mechanisms. As planned, the main network will be up and running a few hours after The Merge (the transition from PoW to PoS). Besides, the mainnet will be activated on the 2049th block era after the change. This is why the ETHW block height will forever be the height of The Merge +2048. Initially, it will have an average mining difficulty of about 220 transactions, while the hash rate will be more than 15 transactions per second (TPS).

Before finding out why the EthereumPoW hard fork took place, let's find out what the hard fork means. A hard fork is a blockchain software upgrade that requires all network validators to comply with the latest version of the network software. Although Ethereum has experienced many hard forks before, the most significant hard fork occurred in 2016 when Ethereum split into Ethereum (ETH) and Ethereum Classic (ETC).

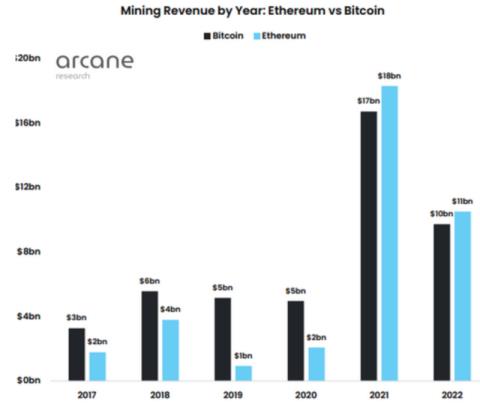

EthereumPoW hard fork happens because some miners don't want to give up PoW mechanism which can be more profitable than PoS mechanism. According to the latest report from Arcane Research, Ethereum mining earnings reach $18 billion in 2021, slightly higher than Bitcoin's $17 billion profit. Even in the better times of 2022, Ethereum miners have topped the earnings charts. Below is a chart comparing the mining rewards of the two most important cryptocurrencies by market capitalization over the past two years.

As shown, Bitcoin mining revenue is higher than Ethereum until 2021. With revenue reaching billions, Ethereum miners have invested heavily in high-end mining equipment to increase their income. However, these earnings immediately plummeted when Ethereum switched from PoW to PoS (Proof-of-Stake). This is why some miners have vowed to continue with PoW on the Ethereum network.

In a PoW network, miners are responsible for validating transactions and competing with each other to solve mathematical puzzles. On the other hand, the PoS network removes miners from the equation. Instead, investors stake their tokens to secure the network and don't need mining equipment. An algorithm randomly selects staking people to determine the next block, and those with a larger number of staked tokens have a higher chance of being selected. The main benefit of a PoS network is that it saves energy compared to the PoW blockchain.

A blockchain fork entails duplicating all existing features, wallet balances, assets, and smart contracts. This implies that all assets running on Ethereum will now run on the EthereumPoW mainnet. However, this does not make sense without the support of the community. When a grid is split, the user identifies the "real" string by looking up the value. For EthereumPoW to succeed, it requires broad support from users, developers, and cryptocurrency companies – not just miners. Without these three objects, ETHW would be useless, like a discounted copy of the Mona Lisa.

However, this is unlikely to happen, mainly due to Ethereum's vast ecosystem. Ethereum's ecosystem includes thousands of independent assets, DeFi markets, NFTs, and stablecoins.

Adding stablecoins to ETHW is more complicated because stablecoins are backed by real-world assets, such as USD in a bank account. This means that it is virtually impossible to divide such assets without depositing the collateral in a financial institution unless you are the Federal Reserve of the United States.

For example, the largest stablecoin by market capitalization, Tether (USDT), has considered the above issues. Its CTO Paulo Ardoino said the company will only back Ethereum post-merger. USDT accounts for billions of dollars on Ethereum. EthereumPoW would face some challenges without Tether support. Ardoino claims that DeFi complications guided their decision.

It's on Paolo's radar https://t.co/JCnYnRtHPl

— Larry Cermak (@lawmaster) July 31, 2022

Aave , the largest DeFi lending protocol on Ethereum, has also had its say, with Head of Integration Marc Zeller emphasizing Ardoino's views.

“You can’t have a fiat-backed stablecoin that doubles its supply overnight and holds $1 in value.”

He further explained that stablecoins can limit any successful fork and that it is best to issue new stablecoins – which again demonstrates the nature of the fork in the first place.

For a quick overview of the different Ethereum forks and blockchains, you can check out the Eth Wars page on Gecko Terminal, which aggregates the prices of different coins, 24-hour price changes, dominance and how it compares to the ETH market cap.

On September 16, EthereumPoW was hit by an attack that resulted in 200 ETH being stolen by hackers. Blockchain security firm BlockSec revealed the incident two days later, saying that the attack occurred via the Omni bridge on the Gnosis chain.

The short analysis of the attack https://t.co/87OVRqaYb2 https://t.co/vhRJyZVc72

— BlockSec (@BlockSecTeam) September 18, 2022

This is a cyberattack in which a hacker postpones or dishonestly replays a transaction message on another network in order to execute a transaction twice or more. The attackers first transferred 200 wrapped ETH (wETH) through the Gnosis Omni Bridge chain and then replayed the transaction on the EthereumPoW blockchain for an additional 200 wETH. The attack depletes the balance of the contract running on the network.

While acknowledging the attack, the ETHW team released raw data illustrating two completely different transactions, thus refusing to replay the transaction on the network. Instead, it clarified that the attack was a replay of mobile data due to vulnerabilities in the Omni Bridge contract.

ETHW is the native token of the EthereumPoW network, while ETH is Ethereum's native currency. Here's how to compare these two tokens

After the transition to PoS mechanism, the Ethereum network randomly selects an ETH validator and assigns them the responsibility of determining the next block. To become a personal validator, you must stake a minimum of 32 ETH. If you have less than 32 ETH and want to participate in staking ETH, you can join the staking group. To protect the network from scams and scams, validators caught verifying fraudulent transactions are penalized – a process known as guillotine.

Besides sustainability, PoS consensus makes Ethereum more decentralized than EthereumPoW. Besides, validators don't have to buy expensive mining equipment anymore. Even if they don't hold 32 ETH to participate as individual validators, ETH holders can staking their tokens through a mining pool to secure the network and more participation leads to to more hierarchy.

Another important upcoming update that differentiates ETH from EthereumPoW is sharding. Sharding is a programming process in which data is distributed to multiple computers to speed up processing. Ethereum will leverage sharding by introducing 64 shards. Each shard is like a new chain linked to the previous Ethereum network to integrate with previously recorded transactions. Ethereum and EthereumPoW work similarly, only ETH distributes the workload into several databases.

Sharding will directly solve Ethereum's scalability problems. Unlike EthereumPoW, which only handles 15 TPS, ETH will become more efficient, processing close to 100,000 TPS. You can think of EthereumPoW as a busy street with a single lane and ETH as a busy road with multiple lanes. The expansion makes traffic flow continuously and increases the speed of vehicles.

However, Sharding is estimated to only ship in 2023-2024.

The issue of how Ethereum introduced 64 shards and how validators were chosen to verify blocks were discussed. However, something will connect the shards and identify validators. This brings us to the last significant difference between ETHW and ETH. 64 shards are integrated into a single blockchain to control them and facilitate transactions. As such, the blockchain acts as the brain of the entire ecosystem and is known as the Beacon Chain.

Beacon Chain was launched in 2020 to ensure the PoS mechanism works efficiently and sustainably before the official implementation. Therefore, it works together with the original PoW chain. But after The Merge, it started to act as a main chain for ETH.

Another role of the Beacon Chain is to randomly select validators and monitor their activity. The chain is also responsible for penalizing validators who attempt to validate illegal transactions. Randomness in the selection of validators is necessary to ensure the network does not depend on a few participants.

Despite sharing the same chain (Ethereum Mainnet), the value of ETHW and ETC has a significant difference. Since ETC split from ETH in 2016, it has missed out on decentralized finance (DeFi) and NFT developments. In comparison, ETHW is a recent fork of ETH. Given the growth in DeFi applications developed over the past four years, ETHW could be more valuable than ETC if the whole community fully supports it.

The latest Ethereum fork, EthereumPoW, is set to benefit from The Merge. Through airdrop incentives and traction, the EthereumPoW team convinced nearly 20 former Ethereum mining pools to continue to secure the network. While the post-Consolidation market may be suitable for a smart contract chain using PoW consensus, some feel ETHW is more like a larger sum. If EthereumPoW gets more community support, it will definitely be more successful than Ethereum Classic.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.