API3s position in the Oracle space

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Chainlink is one of the most important projects in the cryptocurrency industry, providing a platform service called Oracle for the Web 3.0 economy . Its services make it possible for hundreds of blockchain projects to access various information and price data in real time.

In addition to price feed services, it has other products including Proof of Reserve, VRF, Keepers, and CCIP.

In this article, we will take a look at the main services of Chainlink, and evaluate whether the LINK token is a “gem” in the bear market.

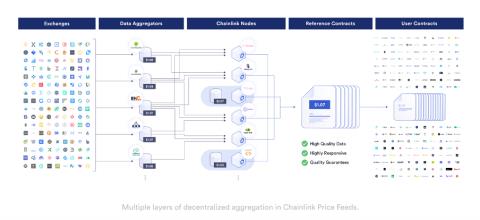

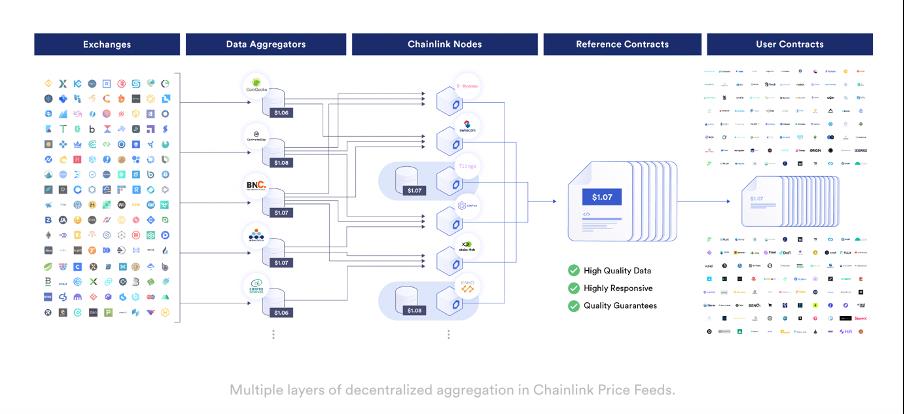

This is Chainlink's most important service, it provides off-chain price data for on-chain smart contracts. Price data includes data from centralized exchanges or price feeds from one blockchain to another.

Chainlink uses a multi-layered data aggregation process to ensure the reliability and decentralization of the price feed data.

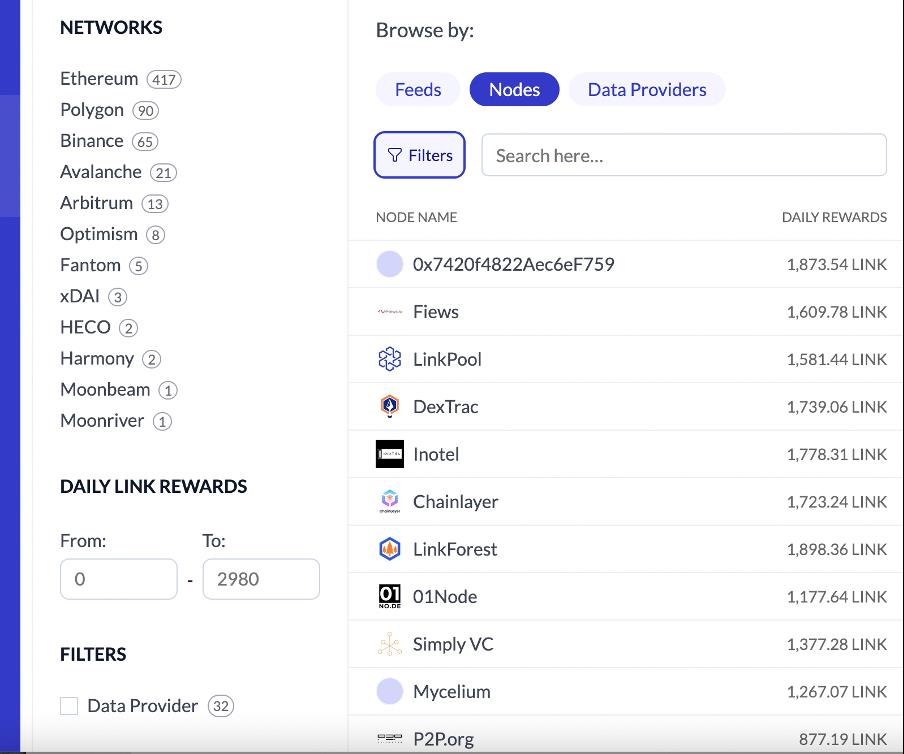

Node Operators are the core of the data aggregation process for Chainlink, there are 4 types as follows:

Chainlink's Node Operator can be seen as an income generating job for investors. Below you can find the daily LINK revenue a node can earn.

The traditional definition of a proof of reserve is that it refers to a business holding a cryptocurrency that creates public attestations of reserves to prove their solvency.

The most obvious example are centralized stablecoin issuers such as USDT, BUSD, and USDC, which all issue periodic attestation reports regarding their US dollar reserves.

PoR provides smart contracts with the data needed to calculate the collateral of any on-chain asset backed by off-chain or cross-chain reserves.

Example : Chainlink PoR obtains TUSD reserve data from Armanion, an independent accounting firm that reviews TUSD escrow bank accounts to ensure a backed reserve. Armanio executes data calls from TUSD escrowd bank accounts separately.

Through this approach, the transparency of Fiat-backed stablecoins can be significantly improved compared to the current periodic validations, which are usually conducted on a monthly basis, or for USDT which is conducted only quarterly.

Chainlink VRF is a random number generator for blockchain. This is a very important function with many use cases, such as NFT projects that need to assign random properties to the NFT and blockchain game applications to generate random maps.

Keepers are Chainlink nodes responsible for running off-chain computations to verify conditions have been met before activating on-chain functionality.

Example: Chainlink holders monitor the off-chain financial viability of AAVE borrowers by consistently calculating mortgages and checking if mortgage rates fall below a predefined liquidation threshold . If found to be uncollateralized, Chainlink Keepers will call the AAVE liquidation function.

CCIP refers to the cross-chain interaction protocol. This is a cross-chain bridge for messages. Initially, a cross-chain bridge could only connect assets from one chain to another, such as the ETH bridge on Ethereum with Solona. Recently, with the popularity of Stargate developed by Layerzero, messages are cross-chainable, meaning that a smart contract on one chain can directly invoke a smart contract on another chain. .

The cross-chain messaging protocol market is becoming very competitive, besides Layerzero, other cross-chain bridges are also implementing their cross-chain messaging protocols, such as Wormhole. The advantage of CCIP is that it is not only a cross-chain protocol, but can also act as a bridge for off-chain information into different blockchains.

Chainlink provides one of the most fundamental services for the entire Crypto/Web 3.0 industry. Whether this importance can create value for Chainlink's token or not. In fact, the price of LINK is close to following the market and has experienced a significant drop in the past few months.

The total supply of Chainlink native tokens is 1 billion LINK and the distribution is as follows:

LINK is a payment token, it is used to pay Chainlink node operators to provide Oracle services. Service fees are variable and set by different node operators and are paid by the feed requester, such as DeFi protocols.

Staking

Chainlink is building LINK staking functionality. It recently updated its roadmap for implementing staking functionality. Two staking functions are expected to go live this year: Staking for Reputation and Staking for Alert.

Staking for Reputation

Node operators can stake LINK as collateral (secured) to signal a commitment to accurate, honest, and timely performance when providing data feeds for smart contracts. Mechanisms will be developed for those nodes that do not meet service standards.

Staking for Alert

LINK holders can staking tokens and have the ability to issue alerts if they believe an Oracle has failed to meet performance standards and earn rewards for valid and timely alerts.

LINK is a payment token, without the staking function there would be no incentive to hold the token in the long run. The introduction of a staking mechanism will likely remove a percentage of LINK from circulation to participate in staking contracts, creating supportive factors for future token prices.

When looking at the current total capitalization of LINK, it can be seen that Chainlink has a certain position in the cryptocurrency market. In the future, it is likely that Chainlink will quickly develop on many different fields. A lot of large projects using LINK coins reward nodes. Besides, Chainlink also developed a staking feature to help reduce the supply circulating outside the market. Both of these lead to the price of LINK coin going up in the near term.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.