What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

We cannot deny that all the ideas Ethereum brings to users are innovative and new, while other blockchain projects rely on ideas on Ethereum to develop.

However, the biggest drawback of Ethereum is the high transaction and gas fees, sometimes network congestion leading to transactions taking a long time to be completed successfully. And this has become a barrier to entry for retail investors.

In fact, Ethereum's high transaction and gas fees are one of the main reasons that make 2021 the year of tremendous growth for Layer 1 blockchain platforms like Solana, BNB Chain , etc. Ethereum blockchain.

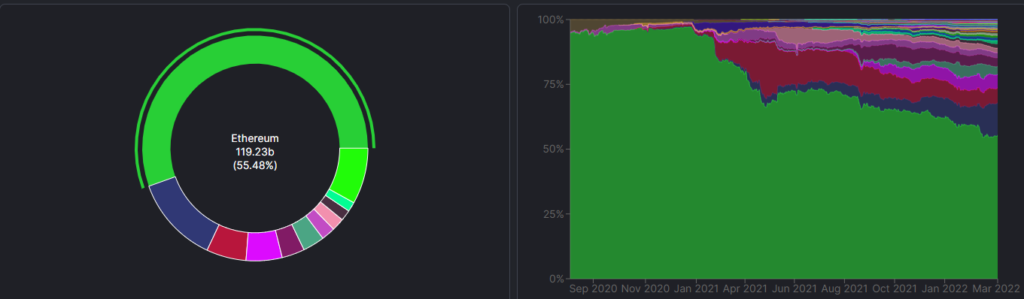

Although, Ethereum accounts for 97% of the total value of locked assets of DeFi (data recorded as of January 1, 2021). But with the emergence of many Layer 1 blockchains today, the total value of assets locked on Ethereum has dropped below 60%.

However, there is still no ecosystem that has grown so much that it can surpass Ethereum's dominance in the DeFi space. At the same time, Ethereum is still the leading Layer 1 blockchain platform, but with its downside has been unable to meet the demand for a blockchain platform with cheaper fees.

And Layer 1 blockchains like Solana, BNB Chain, Avalanche , Fantom… meet that need, but each has its own disadvantages when it comes to security, liquidity, and decentralization.

Therefore, Ethereum's Layer 2 scaling solutions were born, it has the same security as Ethereum, but the gas fee is much cheaper. Arbitrum is one of the pioneering platforms that make it possible for users to interact with Ethereum without paying exorbitant fees.

Arbitrum is a Layer 2 scaling solution for Ethereum that uses Optimistic Rollup technology. Essentially, a Layer 2 scaling solution as a blockchain is built on top of another blockchain. In this case, Arbitrum is built on top of Ethereum.

Although built on the Ethereum blockchain, Arbitrum offers a platform with cheaper transaction fees and faster transaction processing speeds, while also benefiting from the security of Ethereum. This is a huge advantage over other Layer 1 sidechains or blockchains.

A good example of this is the recent Wormhole bridge hack on Solana. When users connect Ethereum-based assets for cross-chain transactions to another Layer 1 blockchain, there is a risk of being exploited or hacked, so the user's assets are not really safe.

However, when users connect Ethereum-based assets to Arbitrum, no similar risk exists on the platform. And especially this has been confirmed by Vitalik Buterin.

As mentioned, Arbitrum is a Layer 2 scaling solution of Ethereum that makes transactions go smoothly with low gas fees. To do this, Arbitrum's Optimistic Rollup technology will take the information, transaction data that occurs on Layer 1 and then roll it all together and process it off-chain. The data is then compressed and sent back to the Layer 1 main chain.

Basically, the Optimistic Rollup technology does not perform the calculations in processing transactions like Ethereum's Proof of Work algorithm. To be able to ensure transactions are legit and free of bad behavior, this technology relies on Fraud Proof. This makes it easy for Arbitrum to detect fraudulent issues in transaction processing to quickly undo it for users.

This is why transferring money from Ethereum to Arbitrum only takes about 10 minutes, but transferring money from Arbitrum to Ethereum can take almost 1 week. On the other hand, at the moment users cannot directly invest in Arbitrum, as there is still no token associated with it and all gas fees must be paid in ETH.

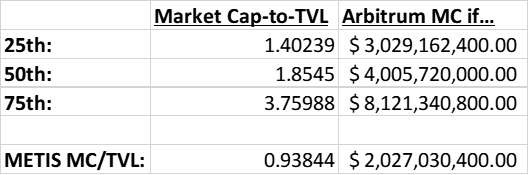

While there is no token, that doesn't mean there's no way of valuing Arbitrum. According to DefiLlama, Arbitrum currently has a TVL of US$2.17 billion (recorded on March 22, 2022). Currently, there are 13 smart contract platforms with TVLs reaching over 1 billion USD. By taking the average TVL limit value, the 25th and 75th percentiles of those 13 smart contract platforms gave the following results:

Also, when comparing it to Metis – another Layer 2 platform of Ethereum. If Arbitrum does launch a token, then its most likely market capitalization will be in the $2-8 billion range.

Based on these numbers, we can see that Arbitrum has established itself as a valuable smart contract platform. Out of all the smart contract platforms (both Layer 1 and Layer 2), Arbitrum has repeatedly been in the top 10 highest TVL statistics by DefiLlama. This is just the beginning for Arbitrum as Layer 2 blockchains will continue to grow, becoming more popular in 2022 and beyond.

The issues surrounding this token are purely hypothetical and do not exist yet. As such, the only way to invest in Arbitrum is through its growing ecosystem.

Now, let's explore the vast ecosystem of Arbitrum with the TraderH4 team in the section below.

The most important factor contributing to the success of Arbitrum is that the platform is compatible with the EVM system. Developers familiar with EVM can easily build and deploy code on Arbitrum just as they would on Ethereum. This means that DeFi protocols built on Ethereum can be launched on Arbitrum easily and quickly.

These Ethereum-based protocols made up the bulk of the TVL for Arbitrum in its early stages. SushiSwap is a typical project that contributes to the success of Arbitrum. It is also the largest protocol and accounts for 22.48% of Arbitrum's total TVLs.

The most interesting point is that SushiSwap deployed on Arbitrum has advantageously attracted many users and generated a larger amount of TVL when it deployed on the Ethereum main chain. The presence of SushiSwap in the Arbitrum ecosystem has helped the ecosystem to have an abundant source of liquidity. This allows users to trade their favorite asset pairs no longer facing the risk of slippage.

Although SushiSwap is considered the most successful Ethereum-based protocol implemented on Arbitrum, there are still many other successful protocols. Both Curve Finance and Abracadabra Money have launched on the platform with TVLs of US$235 million and US$222 million respectively.

After a year of launch, the Arbitrum ecosystem has featured many Ethereum-based Dapps and protocols. In addition to the typical names mentioned above, Uniswap, Balancer, Ren, Multichain and Synapse have all been successfully deployed.

Although, Ethereum-based protocols and Dapps deployed on Arbitrum receive more attention and account for the majority of the TVL of this Layer 2 platform. But Arbitrum has also made a splash thanks to its protocols and Dapps deployed directly on its platform. Dopex, GMX and Treasure DAO are typical representatives in the group of projects deployed directly on Arbitrum.

Dopex

Dopex is the first protocol launched on Arbitrum, built by TzTok-Chad and funded by famous DeFi whales such as Tetranode and DeFiGod1.

Dopex provides users with an abundant source of liquidity and a decentralized options trading platform with as little risk as possible. Currently, the main product of the project is Single Staking Option Vaults (SSOVS). This product allows users to deposit assets such as ETH, DPX, rDPX CRV, BTC, BNB… into Vaults and receive premiums, as well as associated rewards.

Dopex uses a two-token model to best capture the value of the protocol. DPX is Dopex's governance token, used to vote on any project's governance proposal. In addition, all fees generated by the Dopex platform will be distributed to DPX holders in a system called “veTokenomics”, which is yet to be released.

GMX

GMX is a decentralized perpetual futures exchange launched on both Arbitrum and Avalanche. GMX allows you to trade Long/Short assets like ETH, BTC, LINK and UNI with up to 30x leverage on a decentralized platform. Up to now, the total volume of transactions made on GMX has reached more than 16 billion USD and the transaction fees collected by the platform is more than 22 million USD.

Similar to Dopex, GMX has also implemented a two-token model. GMX is the primary governance token that allows users to vote on project governance proposals. In addition, users can use this token for staking and receive 30% of the platform's fees. The second token of the GMX platform is GLP. When providing liquidity to GMX, investors will receive GLP back and when using this token for staking, they will receive 70% of the platform's fees.

In December 2021, an NFT collection called GMX Blueberry Club was launched. Different from regular NFT collections, instead of just using NFTs as avatars on social networking sites, GMX Blueberry Club is attached with a number of financial benefits.

It is known that the GMX team will use more than 650,000 USD in the project's coffers to distribute to members of GMX Blueberry Club. This is a great way to encourage people who have contributed to the development project, and always follow and support them.

Treasure Knife

Metaverse has been one of the hottest topics of the past few months. Therefore, it will not be too strange when the Arbitrum ecosystem has the presence of a Metaverse project, called Treasure DAO.

Treasure DAO will build a miniature Metaverse ecosystem called “Bridgeworld”. Bridgeworld aims to be a “bridge” between all the different Metaverse and NFT projects. In addition, the token of TreasureDAO – MAGIC will be the common currency for all linked projects in Bridgeworld.

Treasure DAO and Bridgeworld are still in their infancy, but the fact that the MAGIC token has a market capitalization of more than 100 million USD has partly confirmed the potential of this project.

While Dopex, GMX, and Treasure DAO may be the most successful of the Arbitrum native projects, there are plenty of others with potential. Arbitrum has provided many projects and development teams with the perfect place to launch their projects.

Tracer Knife

Tracer DAO is a brand new decentralized perpetual futures trading platform. The key innovation of the Tracer DAO is the use of the Perpetual Pool, which is responsible for encoding traders' Long/Short positions. This makes it possible for users to conveniently trade assets on the secondary market and without the risk of liquidation.

TCR is the governance token of the Tracer DAO, used to vote on proposals related to the implementation and modification of the code, as well as to control treasury funds.

Jones DAO

Jones DAO is a brand new protocol on Arbitrum that just completed a public token sale. Its goal was to raise 5,000 ETH, but in reality the project raised more than 23,000 ETH.

Jones DAO has a close relationship with the Dopex project as its goal is to be an options strategy delivery platform.

Basically, if a user doesn't want to manage their own trading positions, they can deposit assets into the Jones DAO. The project will use Dopex's SSOV product to manage their positions on behalf of users.

JONES is a token of Jones DAO, used to vote on project governance proposals, pay transaction fees, and as a liquidity mining reward. In addition, Jones DAO will also deploy a second token, veJONES to improve the efficiency of the protocol, which is expected to launch in Q2 2022.

Vesta Finance

Vesta Finance is a multi-collateralized lending protocol on Arbitrum. Vesta Finance works under the same mechanism as MakerDAO or Abracadabra Money. Essentially, users can deposit collateral such as ETH, renBTC and gOHM into Vesta Finance and in return they will receive VST – a stablecoin pegged to USD. In the future, Vesta Finance will add more assets for further collateral.

VSTA is the token of the Vesta Finance project, it is used to vote on the project's governance proposals and as rewards in liquidity mining incentive programs.

Above is the basic information about Ethereum's Layer 2 scaling solution and a few projects in the Arbitrum ecosystem. The Arbitrum ecosystem is really growing strongly, but compared to the Layer 1 blockchain platforms that replace Ethereum (such as Solana, BNB Chain …), Arbitrum still lacks some important pieces in DeFi.

To learn more about the highlights of Arbitrum and its development through on-chain data, readers can refer to the article " Arbitrum overview and on-chain data analysis of the project." judgment ”.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.