What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

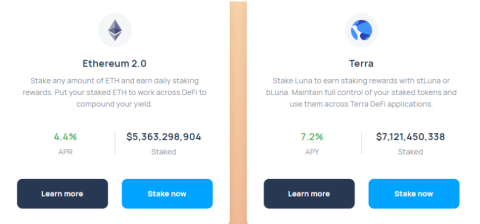

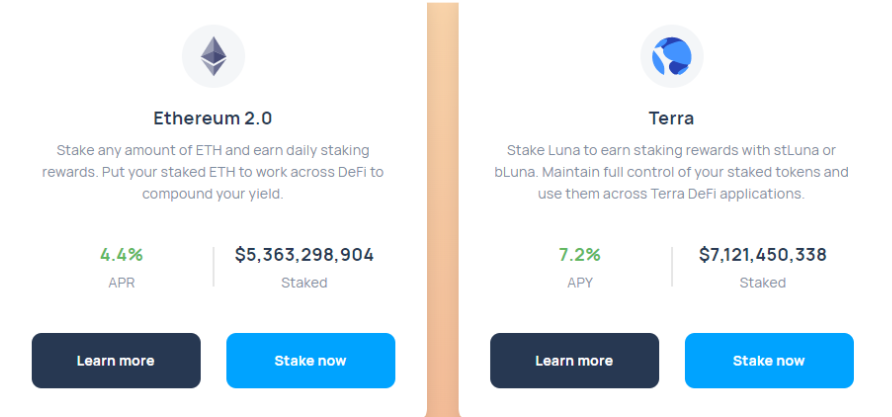

Lido Finance is a platform that allows staking users to provide liquidity for Ethereum and other Proof of Stake blockchain projects. Built on Ethereum 2.0's Beacon Chain, Lido Finance allows their users to earn staking rewards on the Beacon Chain without the need for an ETH lock.

Lido Finance users will receive daily rewards in the form of staking valuable derivative tokens pegged to the underlying assets in a 1:1 ratio. That is, when users stake ETH, they will receive stETH. The smart contract will then stake tokens with node operators selected by the Lido Finance DAO.

User staking funds will be pooled into DAO's escrow account. This will ensure that node operators do not have direct access to user assets.

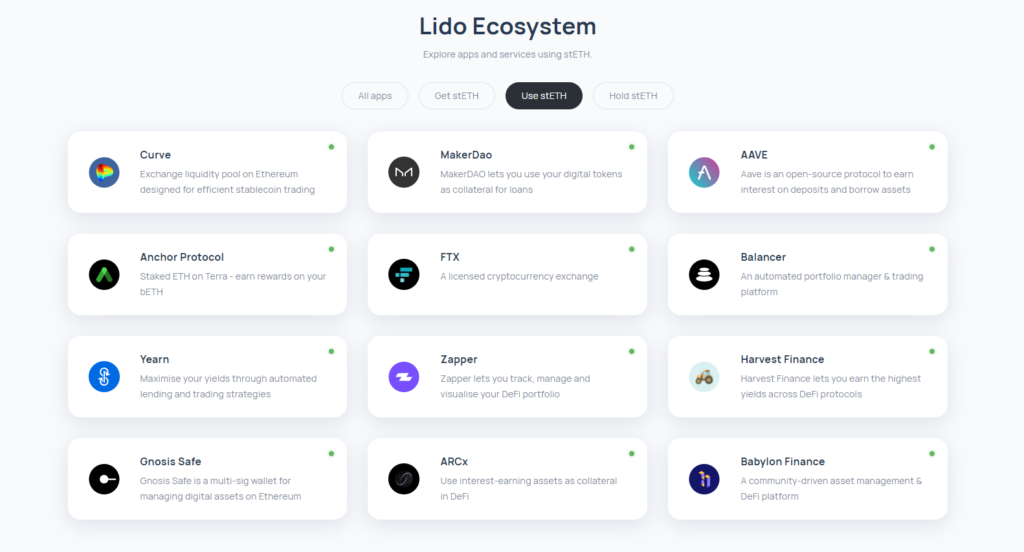

Additionally, stETHs can be reinvested on stETH-enabled DApps. Some DApps that support stETH rollover are: Curve, MakerDAO, Aave, Anchor Protocol, Balancer, Zapper…

After the Ethereum 2.0 Beacon Chain went live, there were a few challenges with staking on the Ethereum blockchain. Specifically, users can only stake multiples of 32 ETH and require more technical expertise in staking. Besides, once a user has staked ETH, it means that the user's assets are completely locked and cannot be reinvested in other protocols.

Lido Finance solves these problems by providing an unattended staking service. When users stake ETH, they will receive stETH – the encrypted version of the staked ETH. Users can use stETH to invest on other protocols that support stETH.

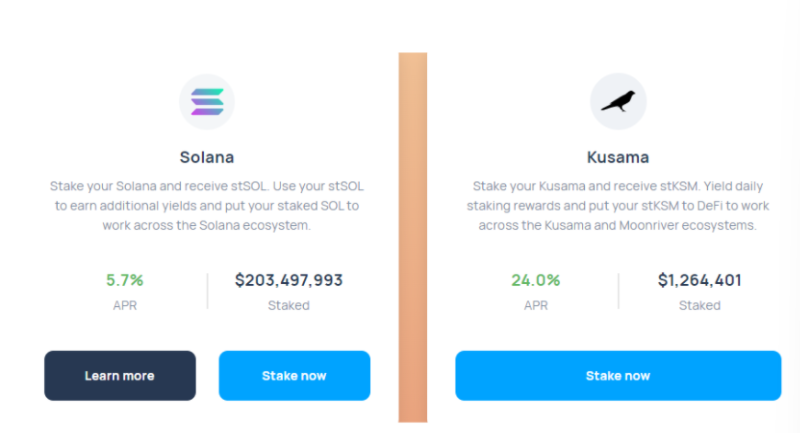

Initially, Lido Finance only focused on Ethereum, but now the project has been expanding to other blockchains. In the past 2021, Lido officially supported staking on Terra and Solana. Similar to Ethereum, those who stake Terra's LUNA asset or Solana's SOL asset will receive a derivative token (bLUNA or stSOL). Most recently, Lido Finance has supported staking on the Kusama network .

Lido builds a modern staking liquidity protocol to develop a staking model that supports DeFi. Specifically, the project allows users to stake their assets for daily rewards. At the same time, users will receive additional derivative tokens whose value is pegged to the underlying assets in a 1:1 ratio during the staking process. These tokens can be used to invest on decentralized financial applications to increase profits for investors, as well as contribute to the development of DeFi.

Lido DAO is a decentralized autonomous organization responsible for managing the Lido Finance platform. Lido Finance's governance token holders have the right to propose and vote in the Lido DAO to make a decision to change key parameters such as: Platform usage fees, node operators...

In addition, the DAO will accumulate service fees for premium payment, as well as financial support for protocol development and upgrades. In addition, the Lido DAO controls the withdrawal credentials through the WithdrawalsManagerStub contract.

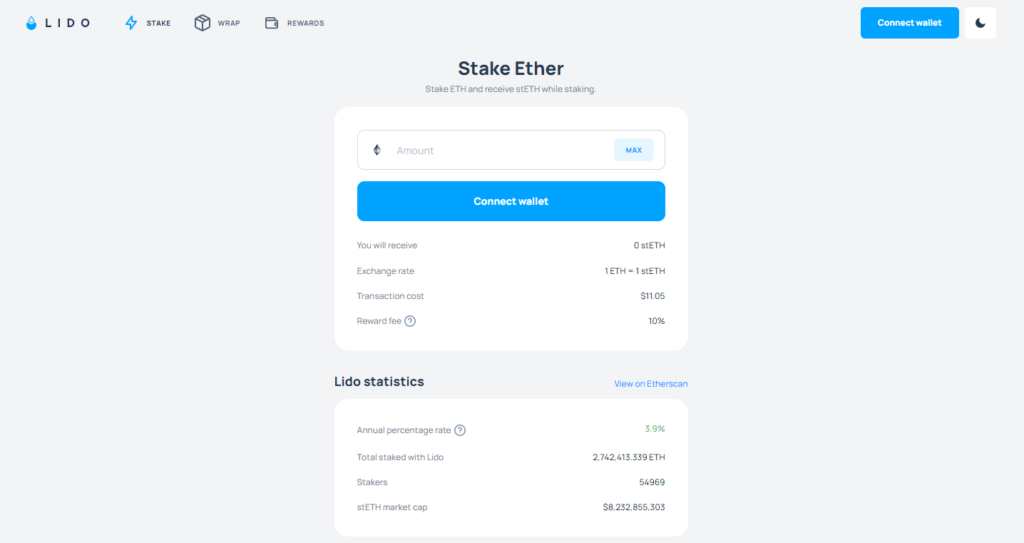

Ethereum Staking App

When staking with Lido, users will receive stETH tokens representing the staked ETH. This token can be used to earn profits and rewards on decentralized financial applications that support stETH.

As such, Lido Finance has solved a number of issues related to staking ETH 2.0, allowing staked ETH to become liquid and investable on decentralized financial applications.

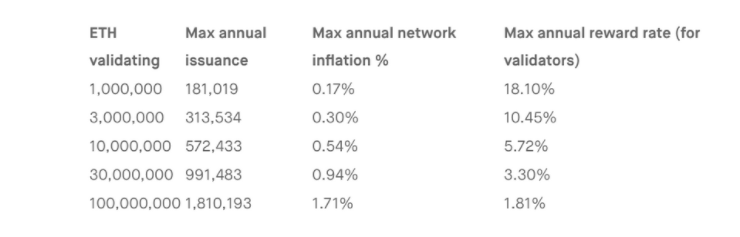

The percentage of rewards received by the user may vary based on the total amount of ETH staked. If the total amount of ETH staked is low, then the percentage of rewards the user receives will be higher. Investors can refer to the table below to understand the annual reward ratio.

In addition, Lido Finance will apply a 10% fee on staking rewards to be distributed among node operators, DAOs, and insurance funds. This fee can be changed by the administrative members in the Lido DAO through voting.

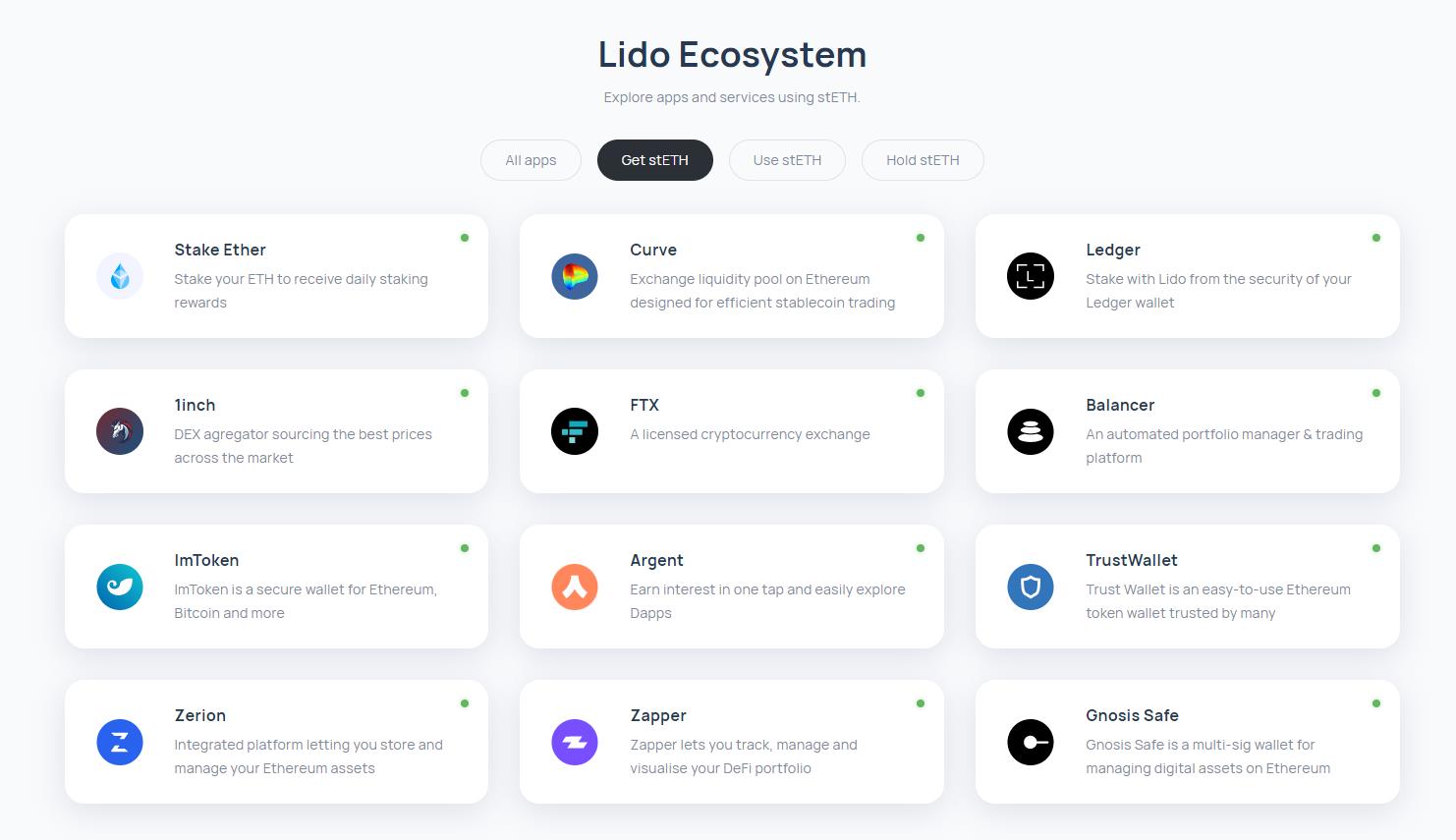

The Lido Finance ecosystem will be divided into 3 categories based on features as follows:

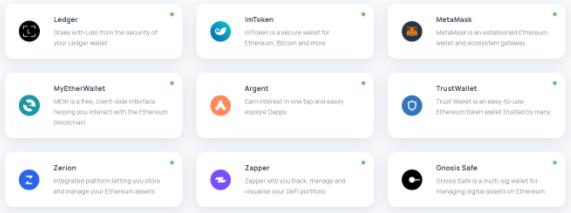

DApps that support users to receive stETH

When users stake ETH across protocols, the platform will receive stETH in return for the amount of ETH they staked. In addition, they receive additional fees from the protocol or platform they stake.

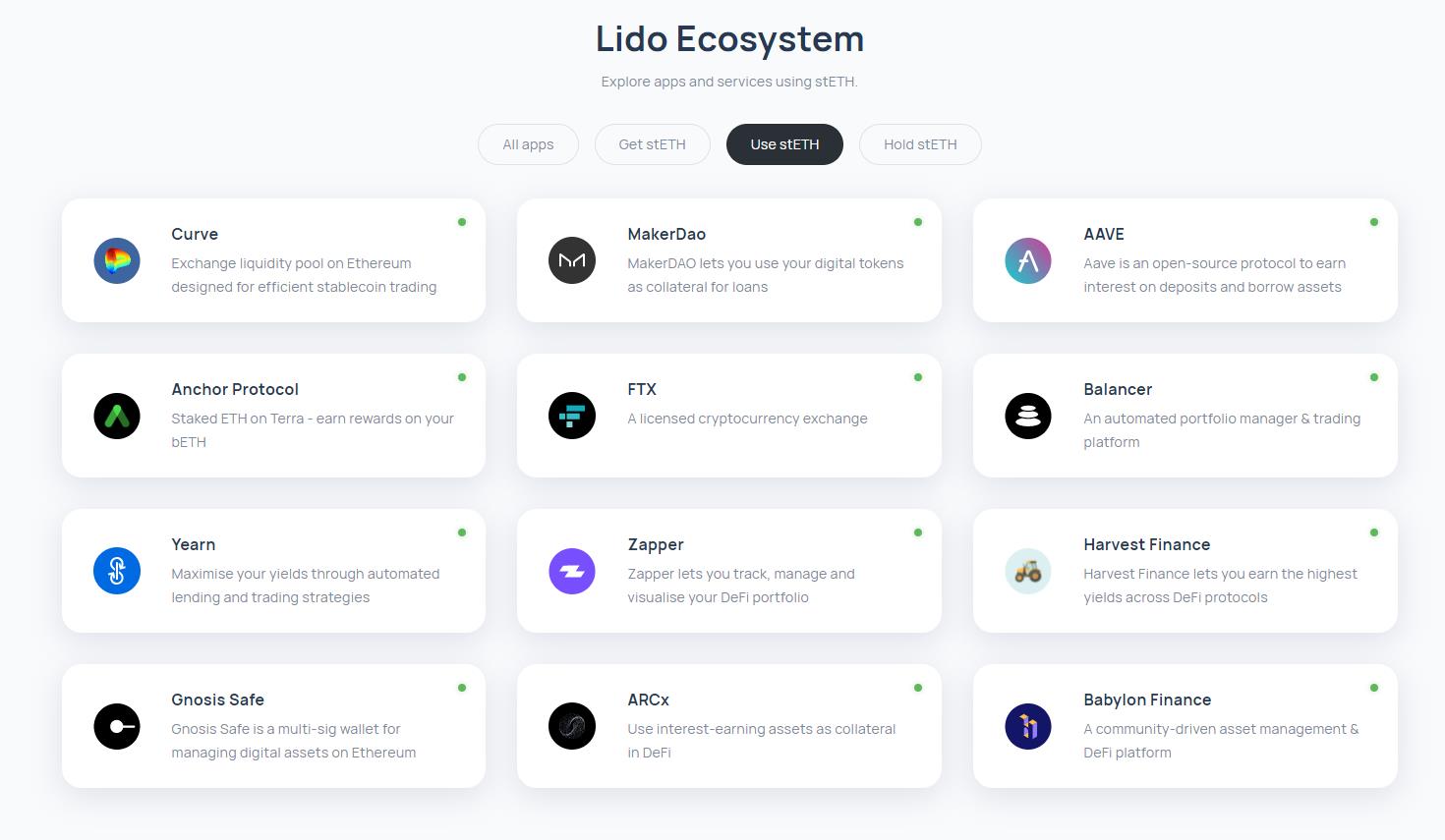

DApps that support the use of stETH

Users can use stETH as a regular crypto asset to invest on these DApps. Example: Investors can use stETH as collateral on lending protocols like Aave to borrow other assets.

DApps that support stETH . storage

Users can store stETH like a regular crypto asset on these DApps. Additionally, they can transfer stETH back and forth between different wallets, protocols, or platforms.

LEGO – Lido Ecosystem Grants Organization

The Lido Ecosystem Sponsor Organization (LEGO) will provide valuable resources (including incentives, bonuses, infrastructure, etc.) to those who contribute to the development of Lido Finance and the system. its ecology.

LEGO acts as a catalyst for the growth and retention of Lido Finance. It also makes Lido Finance the leading and most useful liquidity staking protocol in the entire DeFi space.

Development team

The project is led by members of the P2P Validator team, including CTO Vasiliy Shapovalov and CEO Jordan Fish.

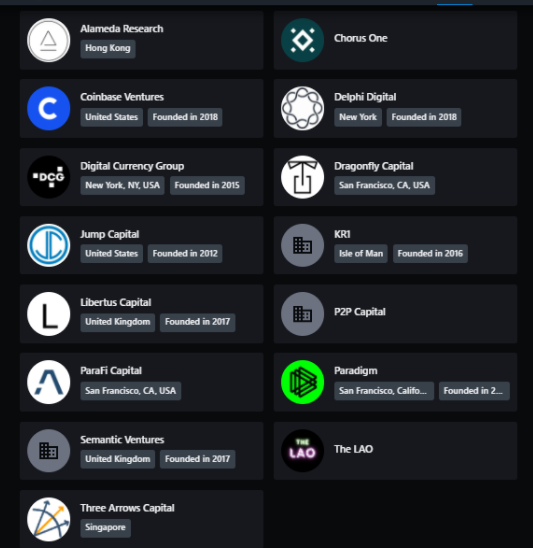

Other members participating in Lido DAO include Semantic VC, ParaFi Capital, Libertus Capital, Terra, Bitscale Capital, StakeFish, StakingFacilities, Chorus, KR1.

Other key angel investors include Aave's Stani Kulechov, Deversifi's Will Harbourne, Stake Capital's Julien Bouteloup and Synthetix's Kain Warwick.

Investors

Lido has raised US$142 million after 3 rounds of fundraising, with the participation of many large investment funds such as a16z, Alameda Research, Jump Trading, Digital Currency Group, Paradigm, Three Arrows Capital, Coinbase Ventures...

Partner

The project is currently integrating with many partners and expanding to many different blockchain platforms such as Terra, Solana, Kusama and soon Polygon.

Current partners such as Curve, Aave, MakerDAO, Ledger...

Currently, Lido has not announced the development roadmap of the project. TraderH4 team will update as soon as there is information from Lido.

LDO is the original token of the Lido project, some information that investors need to know about this token is as follows:

LDO has several functions as follows:

Currently, LDO tokens are listed on exchanges such as SushiSwap, Uniswap (V2), Bybit, Gate.io, MEXC...

Lido is a staking solution built to solve the liquidity problems at the early stages of Ethereum 2.0 development. Besides, Lido is also supported by some of the leading staking providers in the industry.

When using Lido to stake ETH on the Ethereum 2.0 Beacon Chain, users will receive stETH 1:1 to their staked ETH – the asset that represents their ETH on the Beacon Chain. It effectively acts as a bridge bringing ETH 2.0 staking rewards to ETH 1.0. This makes the staked ETH liquid and can be used to participate in investment forms on Lido-enabled DApps, such as lending. This provides users with the opportunity to double profit from providing liquidity on Lido and use stETH to generate profits on other DeFi protocols. At the same time, it also helps create a more secure Ethereum network.

If investors are interested in the Lido project, they can find more information about the project through the official social media channels below:

Website | Twitter | Telegram | Discord | Github

Thus, the TraderH4 team has just brought to readers all information about the Lido Finance project and the LDO token. In general, the idea of the project is quite good when it helps to solve the problem of generating profits from staked assets, helping investors earn double profits.

On the other hand, Lido is a project that has just been launched for more than 1 year, but Lido has proven its attraction to investors through impressive numbers such as: Total value of staked assets reached more than 14.7 billion US dollars, the total number of stakers has reached more than 84 thousand people.

With the above information, hopefully readers have had an overview of the Lido project and can make the right investment decision for themselves.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.