What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

What is Tether (USDT)?

Tether (USDT) is the world's first stablecoin . In 2014, USDT was first issued under the name Realcoin by Tether Limited. Tether supports four major stablecoins, the US dollar (USDT), the Chinese yuan (CNHT) and the Euro (EURT), as well as a 1-ounce gold-backed stablecoin (XAUT).

Each unit of USDT is backed by one US dollar at the Tether Limited reserve and can be redeemed via the Tether platform. The total value of all USDT is said to be equal to the amount of reserve and management assets held by Tether Limited.

Initially, USDT was issued on the Bitcoin protocol through a layer called the Omni Layer. But then, this coin has expanded and developed to many other blockchain platforms such as Ethereum , TRON, EOS, Algorand, Solana, etc.

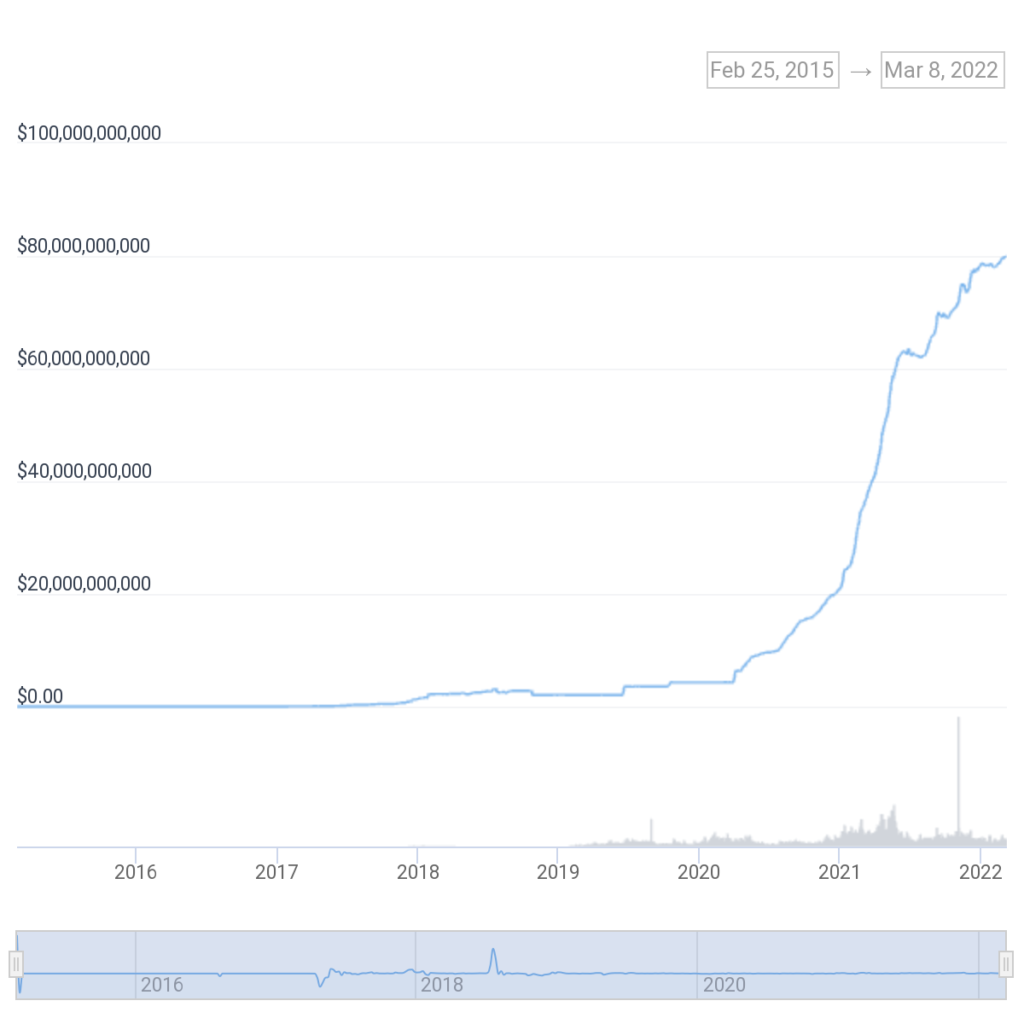

As of 2022, USDT remains the largest and most widely used stablecoin in the crypto market.

Tether created USDT and other stablecoins in the hope of overcoming the disadvantages and limitations of today's currencies, including cryptocurrencies and fiat. This makes it easier for people to access and use cryptocurrencies.

With fiat money, your assets as well as all your information will be stored and managed by the bank. Moreover, when you want to make international payments, you will have to pay a lot of money and time for many surcharges and complicated procedures while the transaction processing time is relatively slow. Cryptocurrency thanks to blockchain technology, all users' assets and information are managed by themselves. Users can also make transactions with unlimited amounts, at any time, to anywhere in the world with fast speed and extremely low costs, but still ensure security.

However, most cryptocurrencies are not stable as their value always fluctuates according to the trend of the market and Bitcoin. This makes the cryptocurrency less popular among the general public because the risks outweigh the benefits.

When USDT and stablecoins are launched with their stability, investors can hold them similar to fiat money but easier to use and trade in the crypto market. As of 2021, more than 75% of Bitcoin and crypto transactions are conducted in USDT with the primary purpose of being used for liquidity and as a safe haven during volatile markets.

As a general rule of a stable coin, the number of coins in circulation should always correspond to the amount of US dollars in the issuer's storage account, in the case of USDT Tether Limited. These US dollars are used so that users can directly resell USDT on Tether's platform.

The USDT coin works simply as follows:

To prove that the amount of USD in the bank account is always equal to or more than the amount of USDT in circulation, Tether Limited has published the account balance in the bank on its official website. In Tether's proof and data system, the amount of USDT in circulation can be easily checked on the blockchain through the tools provided at Omni Explorer .

As analyzed above, USDT is a Stablecoin, so its value is guaranteed and maintains a fixed rate of 1:1 with the US dollar. Therefore, with its stability, USDT helps investors to minimize losses and protect their accounts whenever the market has strong fluctuations.

Currently, USDT is the largest stablecoin by market capitalization, so this cryptocurrency is supported for trading on most cryptocurrency exchanges. Therefore, USDT is very liquid, easy to buy, sell, exchange or convert to cash. In addition, because the capitalization of USDT is very large, over 83 billion USDT, investors can be assured when trading this Stablecoin.

The profitability of USDT is not an attractive factor for investors because when holding this Stablecoin, investors will not receive any other profits. However, USDT will significantly assist in minimizing transaction costs. Because if you use the services of financial companies or banks, you will have to pay a significant cost, especially for large transactions. However, with USDT, the transaction cost between crypto wallets is now zero.

USDT is developed based on blockchain technology, so investors can fully check the transaction information and ensure that every transaction in the network is done correctly and publicly.

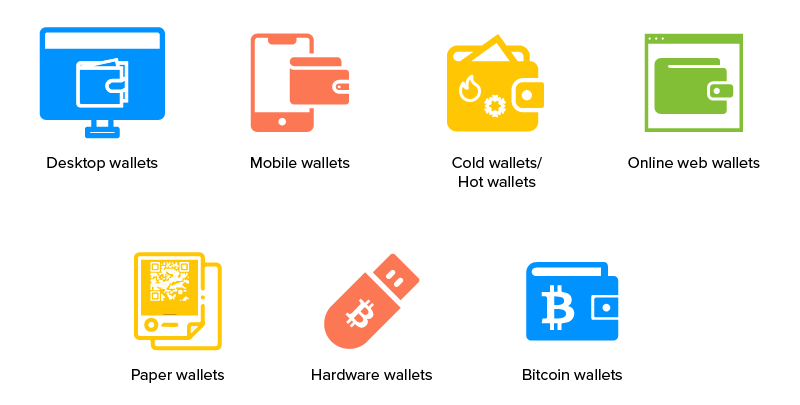

As the most popular stablecoin in the crypto market, USDT is supported on most crypto wallets today:

USDT is used to buy BTC, ETH or other cryptocurrencies. In addition, investors can also easily convert USDT into cash. Regarding transaction fees, all USDT transactions made through Tether.to crypto wallets are completely free. As for the linked blockchain wallets, Tether.to will bear all transaction costs.

In addition, you also need to note that if you use a bank account to buy or withdraw USDT, you will have to incur costs, ranging from about 10 - 20 USD.

You can buy USDT at most cryptocurrency exchanges. In fact, the average daily trading volume on USDT exchanges is often equal to, or even higher than Bitcoin's, making it possible to trade USDT anywhere without worrying about liquidity. Some of the exchanges with the largest 24 hour USDT trading volume include Binance, Crypto.com, HitBTC, Huobi…

In Vietnam, you can buy USDT on any cryptocurrency exchange that supports P2P trading. As long as the exchange does not block users from Vietnam. Some exchanges support buying and selling USDT directly in VND through Vietnamese banks, you can experience such as Remitano , Bitmoon ...

In addition, when you want to buy or withdraw a large amount of USDT, you can also use the OTC service. However, this is the most likely form of fraud because there is no third party to act as an intermediary as well as when the user trusts the service provider too much without conducting a thorough verification and inspection.

Is USDT a scam?

Since its inception, Tether has issued more than 80 billion USDT to serve the trading needs in the cryptocurrency market. This also means that the company holds $80 billion worth of cash and assets, assets that would make Tether one of the 50 largest banks in the US.

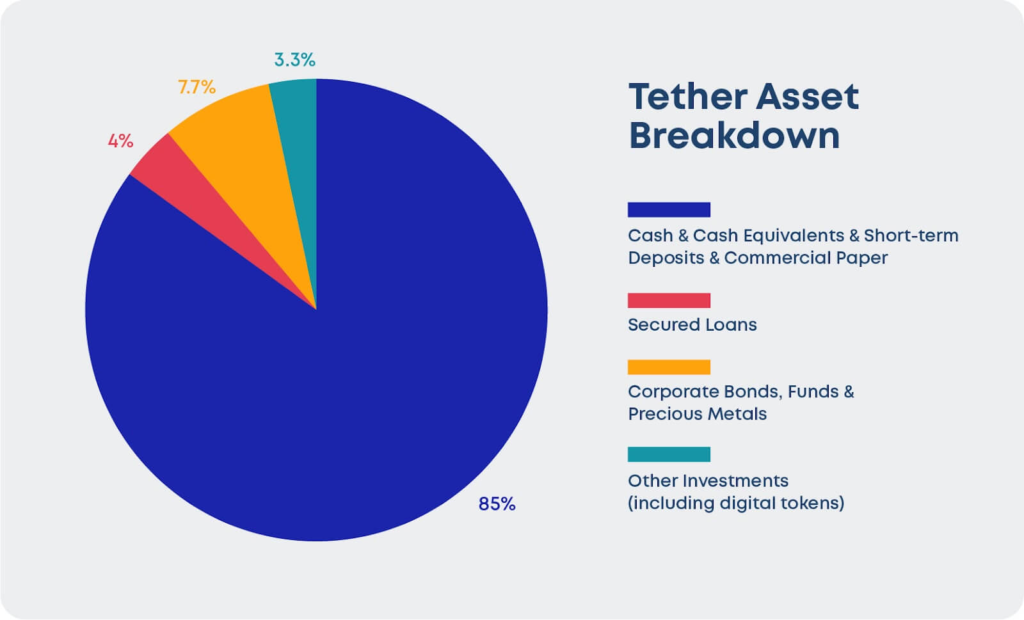

According to the latest Reserve Breakdown report of Tether released by auditing firm MHA Cayman, the assets this company holds include:

However, Tether has been accused of not having enough assets to maintain a 1:1 exchange rate between USDT and USD as well as being related to US inflation. Bloomberg also reports that Tether's billions of dollars of debt are mainly coming from Chinese investors.

The famous financial newspaper Business Insider said that Tether is a scam company, USDT is a multi-level currency, operating without a license and if Tether collapses it will destroy the entire cryptocurrency market.

Tether responded to the above information as false and stated that USDT is backed with a transparent and complete amount of assets.

Information about Tether's staff and assets is quite meager, making investors not know exactly who they are? Is the stored asset real?… To assess whether Tether is a scam or not, we will need to wait for official information from the authorities. To date, there is no concrete evidence of this, so investors can still feel secure when holding USDT.

Should I Invest in Tether (USDT)?

The value of USDT always fluctuates around 1 USD. USDT is used by many investors to store the value of other coins as well as a shelter when the market is volatile.

However, investing in USDT is not without profit. If you have a large capital, have a good reputation in the crypto community, then you can become an OTC trader and profit from the price difference of USDT. To put it more simply, when the market corrects sharply, USDT will often spike in price within a certain period of time. You can take advantage of this moment to sell fiat then wait for USDT to drop and buy it back or use your USDT to bottom out other coins/tokens.

Above is the basic information about Tether (USDT) that TraderH4 has synthesized. The advent of stablecoins and USDT has brought a lot of benefits to crypto investors. Despite the controversy and accusations about the transparency of Tether Limited, USDT is still the most trusted stablecoin by many investors to trade and shelter when the market fluctuates.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.