What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Whether a developer belongs to a startup or an enterprise, integrating blockchain technology into a developer's current or future products can help increase efficiency, reduce costs, and enhance security, while creating new avenues for revenue growth. Therefore, choosing the right blockchain to build a developer's next projects can play an essential part in the success of that project.

Elrond is a high-throughput smart contract execution platform, with strong security capabilities derived from technological breakthroughs such as:

The platform is currently up and running with 16,200 transactions per second (expanding to hundreds of thousands), 6 seconds latency and 0.001 USD transaction cost are the numbers that attract users to the platform. However, Elrond's appeal to businesses and startups comes from innovations in smart contracts, smart accounts, and tokens, which allow for the creation of a wide variety of products on-chain, with tools that help reduce development time and costs.

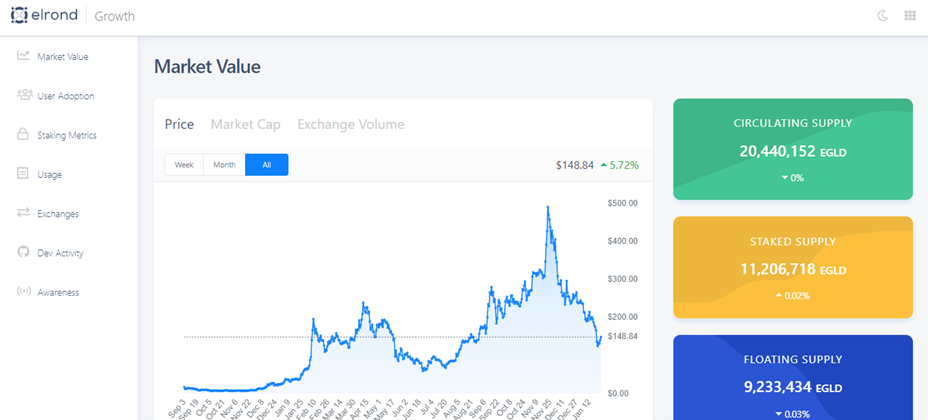

Elrond describes itself as a blockchain platform for the new Internet economy, decentralized applications and enterprise platform. The highlight of the project is its high scalability as it is the first blockchain network where state sharding, network and transaction are all implemented. According to Elrond's economic article, the project seeks to build its ecosystem and establish EGLD as a store of value asset.

To this end, the network runs on 2,169 validator nodes which are divided into four shards: 03 execution shards, capable of performing 5,400 transactions per second, and a coordinating shard known as the “metachain”. Elrond's adaptive state segmentation architecture completely shards state, transactions, and the network. It can scale by adding an additional shard when throughput needs are not being met. It was tested to run 263,000 TPS in a public environment with 1,500 nodes from 29 countries grouped into 50 shards.

To increase adoption, the project also supports developers building on the platform, allowing them to earn 30% of smart contract fees in the form of royalties.

The company maintained a supply of EGLD tokens to stake on the network for the first year, with validators receiving an annual percentage rate of 36%.

By solving some of the toughest consensus and distribution problems in the blockchain space, Elrond is able to provide a very high level of performance on a network made up of underlying computers, resulting in costs for very low per transaction. In addition to performance and cost, Elrond stands out for the quality of its developer experience and, as a result, increased usability on the end-user side.

Elrond is a high-throughput public blockchain that aims to provide security, efficiency, scalability, and interoperability. The two most important features that set Elrond apart are Adaptive State Sharding and Secure Proof of Stake consensus.

Elrond is a complete redesign of the blockchain architecture, with the aim of achieving global scalability and near-instant transaction speeds. Elrond's architecture is based on the following key innovations:

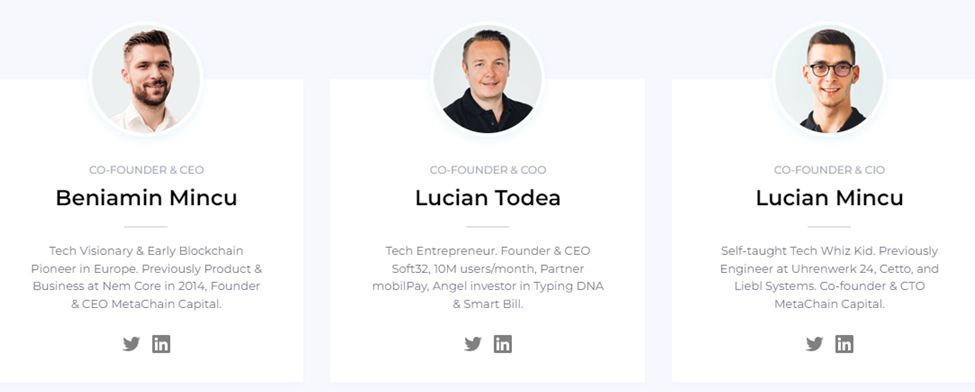

Elrond was co-founded in late 2017 by brothers Beniamin and Lucian Mincu, along with Lucian Todea. The project is a solution to the blockchain scalability problem, which the team considers the most pressing problem facing the industry.

Prior to Elrond, Beniamin and Lucian Mincu co-founded MetaChain Capital – a digital asset investment fund, with Beniamin Mincu as managing director and Lucian Mincu as chief technology officer. The two also co-founded ICO Market Data, a company that aggregates information about initial coin offerings.

In addition, the project has built a professional team of entrepreneurs, engineers and researchers to develop the project.

Elrond was invested with an amount of $1.9 million in a seed round led by Binance Labs, with the participation of institutional investors such as Maven 11 Capital, Electric Capital, MapleBlock Capital, Authorito Capital, Woodstock Fund, NGC and AU21.

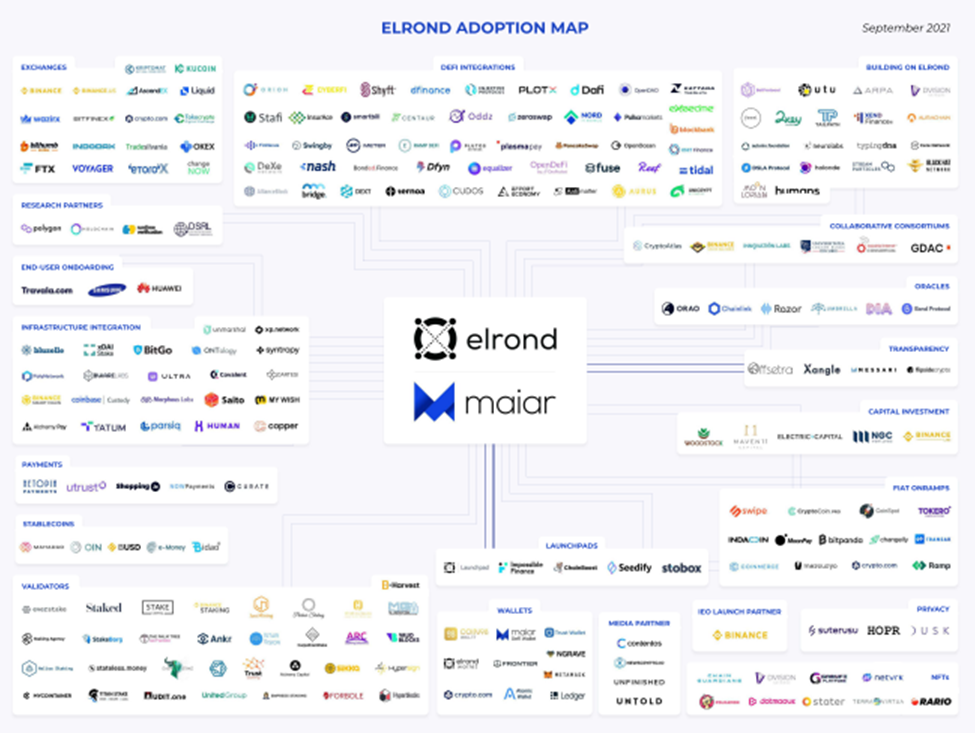

Although in the picture, Elrond's ecosystem looks many and crowded, but most of the applications are only partners with Elrond, and have not yet deployed applications on this ecosystem.

One of the most prominent DEX projects on the Elrond ecosystem is Maiar Exchange.

This is the largest DEX and the only native exchange of the Elrond ecosystem that is strongly supported by Elrond. The reason is because the team building the project is the Elrond construction team. The exchange has just launched the official mainnet not long ago, with the amount of TVL reaching ATH at $ 2.5 billion after only 2 weeks of launch.

The reason they achieved this impressive number is because the liquidity stimulus package worth $ 1.29 billion MEX token - the exchange's token - was opened and was extremely successful in the media, earning liquidity. extremely abundant. Currently, Maiar Exchange's TVL volume has decreased to 1.25 billion USD, partly because of the influence of the general market.

Because this is the main DEX puzzle piece in the Elrond ecosystem, it is possible that many more uses of this DEX will be integrated in the near future such as launchpad (when the team behind has a strong relationship with the builders in the system. , it is extremely easy for them to develop launchpad). This is a puzzle piece that needs attention on the Elrond ecosystem. The AMM DEX array is the first piece that needs to be completed in any ecosystem to be ready for the future boom of other segments.

Lending projects on the Elrond ecosystem currently do not have any applications that have been put into operation. They only announced cooperation with lending partners on other platforms, but no applications have actually launched products on Elrond yet:

In general, the lending array on the ecosystem is still very rudimentary and has no original puzzle pieces, so it is not possible to further analyze this array on Elrond. Because there are no lending applications, the capital utilization on the ecosystem is still relatively low, because it is not possible to create investment leverage for a more continuous and stronger cash flow.

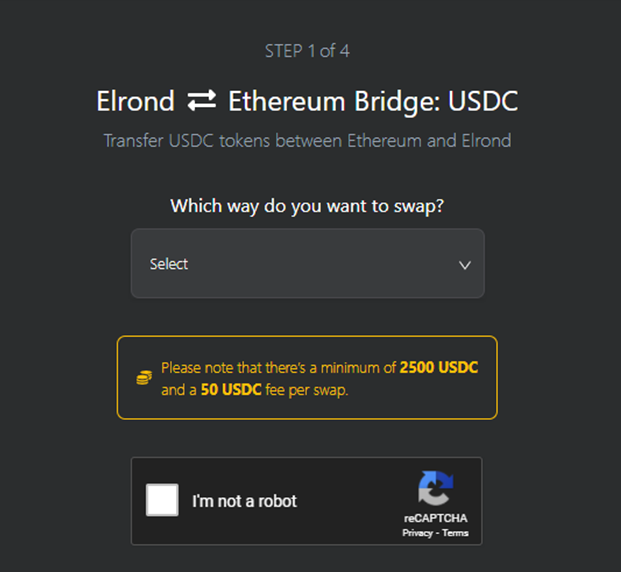

USDC is the most used stablecoin on the Elrond system, as the only liquidity incentives or bridges on the system are using this stablecoin to develop applications and attract users. Currently, there is 560 million USDC on Elrond.

In addition, Elrond has implemented a stablecoin for projects that want to create their own token, the Elrond Standard Digital Token (ESDT).

The ESDT token model allows for true ownership of assets, advanced programmability, and low transfer fees, making it an essential foundation for building more powerful and efficient DeFi products.

Inexpensive token transfers are made possible thanks to the functionality built into the protocol, which allows the token to be transferred from one account to another without going through a smart contract and paying the associated fees. As a result, stablecoins and other tokens are transferable at a much lower cost than other blockchains, helping Elrond play an important role in the development of DeFi.

Stablecoins are an important part of each ecosystem, reflecting the level of development of that system. When money flows into the ecosystem, stablecoins will be the first place where the money flows. Elrond's $560 million level is not large, reflecting that the amount of money poured into the ecosystem is not at a high level, and there are not many applications to attract money flow from other systems. As the yield increases in the system, stablecoins will continue to pour into the Elrond ecosystem.

Infrastructure projects on the Elrond ecosystem include:

The existing infrastructure pieces on Elrond are still incomplete and there is a lack of bridges to effectively move money in and out of the system. A single bridge from Ethereum to Elrond is certainly not enough to stimulate the development of the system. In the future, it is necessary to flow money from systems such as Binance Smart Chain, Polygon, Avalanche, Fantom ... to Elrond.

The essential elements that the Elrond ecosystem should add in the near future are:

In addition, a number of factors have been well done by Elrond to stimulate the development of the system, such as launching a liquidity stimulus package on Maiar DEX worth 1.29 billion USD to attract users, thereby earning volume. huge users and TVL.

In general, the basic elements of the ecosystem have begun to appear, take shape but are not complete, it is necessary to wait for other important pieces to appear before they can grow strongly in the near future. . However, that does not mean that this ecosystem has no opportunities, even the farming opportunities on the ecosystem are huge, with liquidity mining on Maiar DEX being implemented strongly.

The EGLD token is the native token of the Elrond Network ecosystem.

EGLD token details:

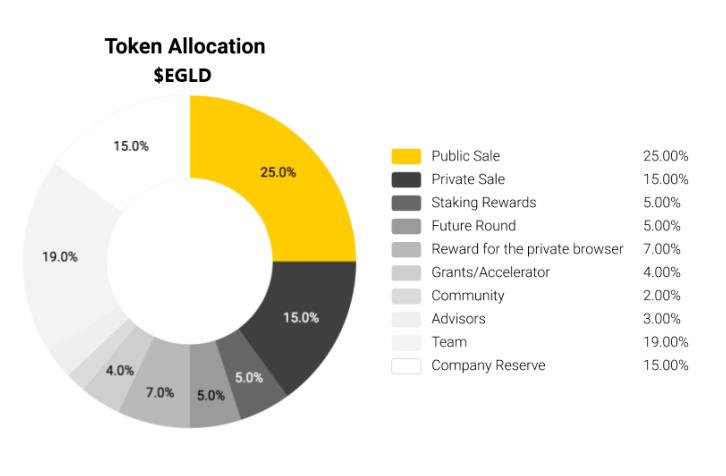

Token Allocation:

Currently, the EGLD token is available on most of the major exchanges.

In the next 3-5 years, we will see the most rapid financial transformation. Specifically, it is from a slow, 40-year-old traditional financial technology, to modern blockchain technology that enables transactions at the speed and scale of the Internet.

The Elrond project was born with the overarching goal of creating a backbone for high bandwidth, a transparent financial system, and extending universal access to anyone, anywhere.

This will be a multi-trillion-dollar market and will ultimately aim to have a significant impact on the GDP multiplier on the world economy. Increasing the speed and bandwidth of the global economy enables 1.7 billion users to connect and provides real new value creation tools. That could really allow the entire economy to grow by a factor of 10 or even 100.

Elrond has all the prerequisites for future success: An experienced team, resources, strong partner network, and a well-developed token with low inflation.

Above is an article about Elrond – a blockchain platform. Hopefully through this article, everyone has had a better overview of the EGLD token. For more details about the project, investors can follow at the media channels:

Website | Twitter | Telegram | YouTube | Medium | Docs | Whitepaper

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.