What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

What is sushi?

According to the development team, Sushi is a community-based organization that was established to solve the liquidity problem in the decentralized financial market. Sushi combines multiple markets and tools into a single product system. So far, Sushi has launched a wide range of products ranging from a decentralized exchange (SushiSwap), a decentralized lending market (Kashi Lending) to passive income generators such as: Yield Farming (Sushi Yield Farms) and Staking (SushiBar Staking). Similar to other DeFi projects, the products are managed by investors who own SUSHI tokens.

Some information about SushiSwap

SushiSwap is a decentralized, permissionless exchange under the AMM model and is the first product of Sushi. SushiSwap allows users to trade peer-to-peer with liquidity provided by other users. Initially SushiSwap was fork from Uniswap V2, so the operating model of SushiSwap is similar to Uniswap , but there are some differences.

Read more: Uniswap (UNI) on-chain analysis launches Uniswap V3 what data reveal?

Difference between SushiSwap and Uniswap

Same: both projects are AMM and use classic curve algorithm with formula x*y = k; Liquidity Pool model with 2 tokens with the same ratio 1:1; transaction fee is 0.3%.

Different:

SushiSwap's operating model – Multichain AMM

The similarity of SushiSwap and Uniswap lies in the liquidity pool model and the classic curve algorithm x*y = k. Both of these things I have detailed in the article "Analyzing the operating model of Uniswap V2" so you should read this article first, to understand how a typical AMM model works. Within the scope of this article, I will only explain in detail the differences of SushiSwap

Components participating in the model include:

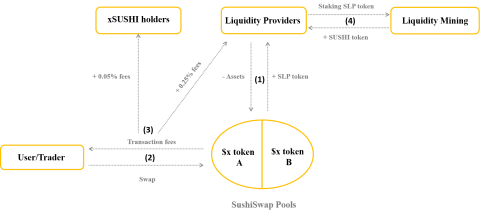

The operation process of the SushiSwap model is described in 4 main steps:

Step 1: The liquidity provider (LP) will provide 2 types of assets (A and B) to the respective liquidity pool (A/B) on SushiSwap with the ratio 1:1. Then receive the SLP token (Sushiswap Liquidity Provider), this token represents ownership of a part of the assets in that pool.

Step 2: Users (User/Trader) who want to swap (swap) token A to token B must put token A into the corresponding pool and receive token B.

Step 3: For each swap, users have to pay 0.3% transaction fee, 0.25% of this fee will go to the liquidity provider (LP) and 0.05% to xSUSHI holders.

Step 4: To encourage Liquidity, in addition to receiving 0.25% transaction fee, you can also bring SLP tokens to Staking and receive more SUSHI tokens, this program is called Liquidity Mining to encourage the provision of liquidity. account more.

The details are illustrated in the following figure:

SushiSwap's operating model – Multichain AMM

So how is the SushiSwap model better than Uniswap V2?

Improvement of SushiSwap aims to solve problems of profit optimization, more incentives and especially can overcome high Slippage when there is not enough liquidity.

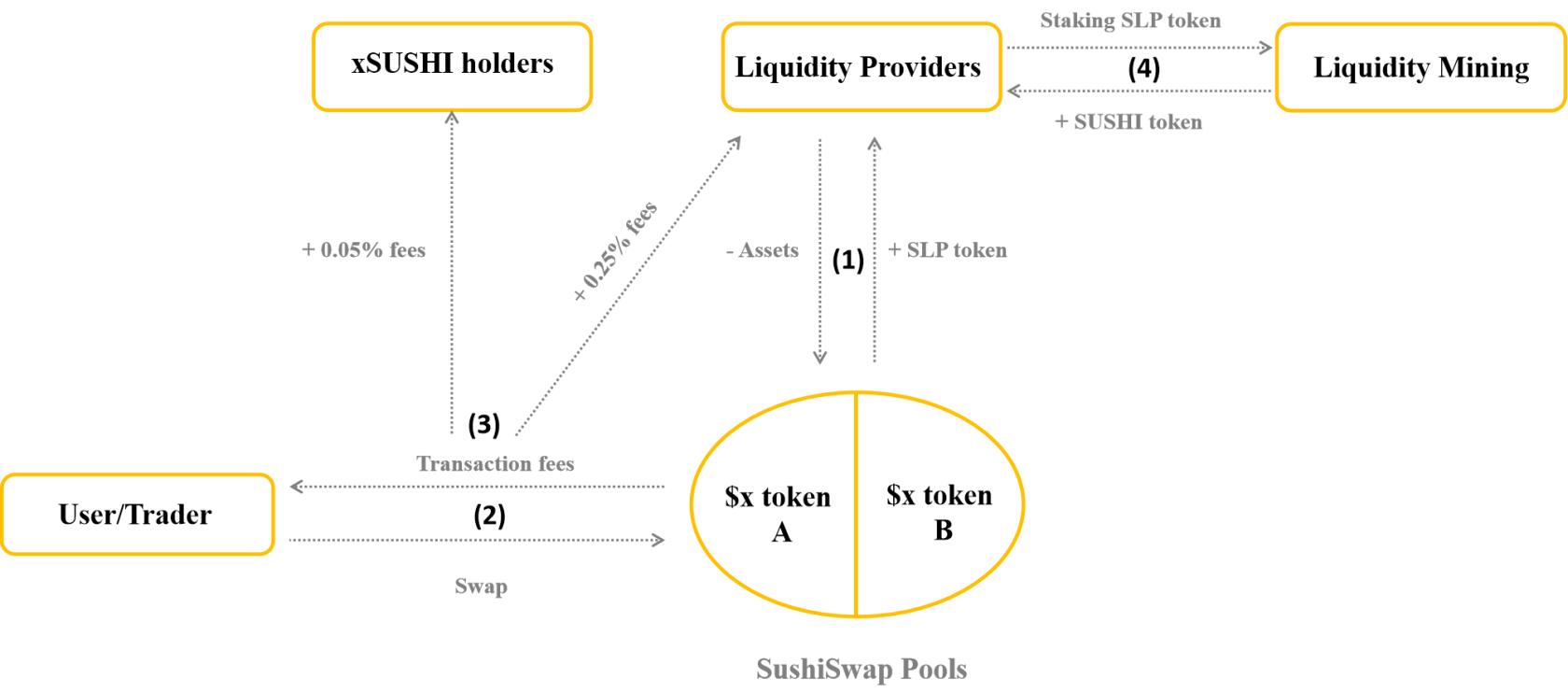

In short, the innovation of SushiSwap is to optimize costs and rewards for all participants. The incentive program to use SushiSwap is quite good and has also attracted a lot of liquidity providers, helping the liquidity source to become rich. The proof is that TVL has reached $2.7B USD, making SushiSwap the 3rd correct decentralized exchange (DEX) in the top DEXs with the highest amount of TVL.

Keyed Value (TVL)

Operation model of other products of Sushi

SushiBar's operating model

SushiBar is a place for SUSHI holders to bring SUSHI tokens to Staking to receive xSUSHI tokens, and at the same time receive benefits from other Sushi products such as transaction fees on SushiSwap, service fees on BentoBox, voting rights and other benefits.

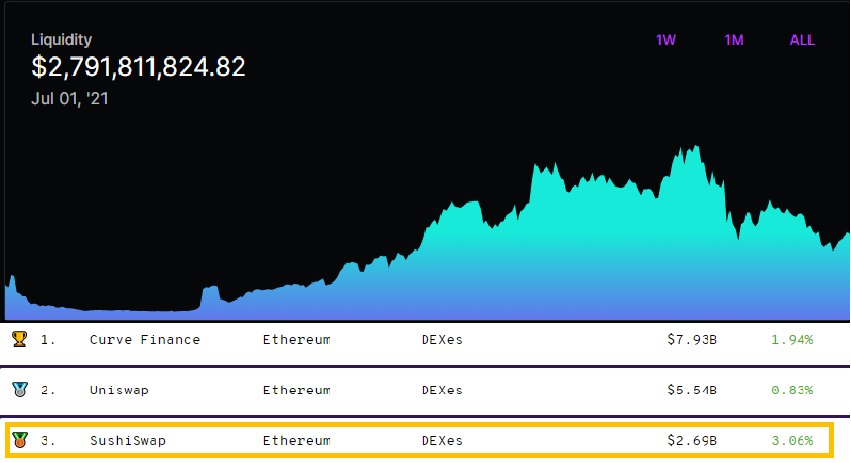

Working model of BentoBox – a wallet containing tokens

BentoBox is a Vault containing all the tokens that generate profits for liquidity providers. When users deposit crypto assets into BentoBox and will receive annual return (APY). BentoxBox serves as the infrastructure for future DeFi protocols coming soon on SushiSwap and the first protocol is Kashi, the operating model of BentoBox is as follows:

Step 1 : Liquidity provider deposits crypto assets into BentoBox and gets benefits in return such as: annual profit, cost reduction when using other services or products of Sushi, low gas fee when trading tokens inside the Vault,…

Step 2 : When users use BentoxBox's service, they will pay a part of the fee depending on the type of service, this fee will be divided among xSUSHI holders (those who bring SUSHI tokens to Staking).

The details are illustrated in the following figure:

Working model of BentoBox – a wallet containing tokens

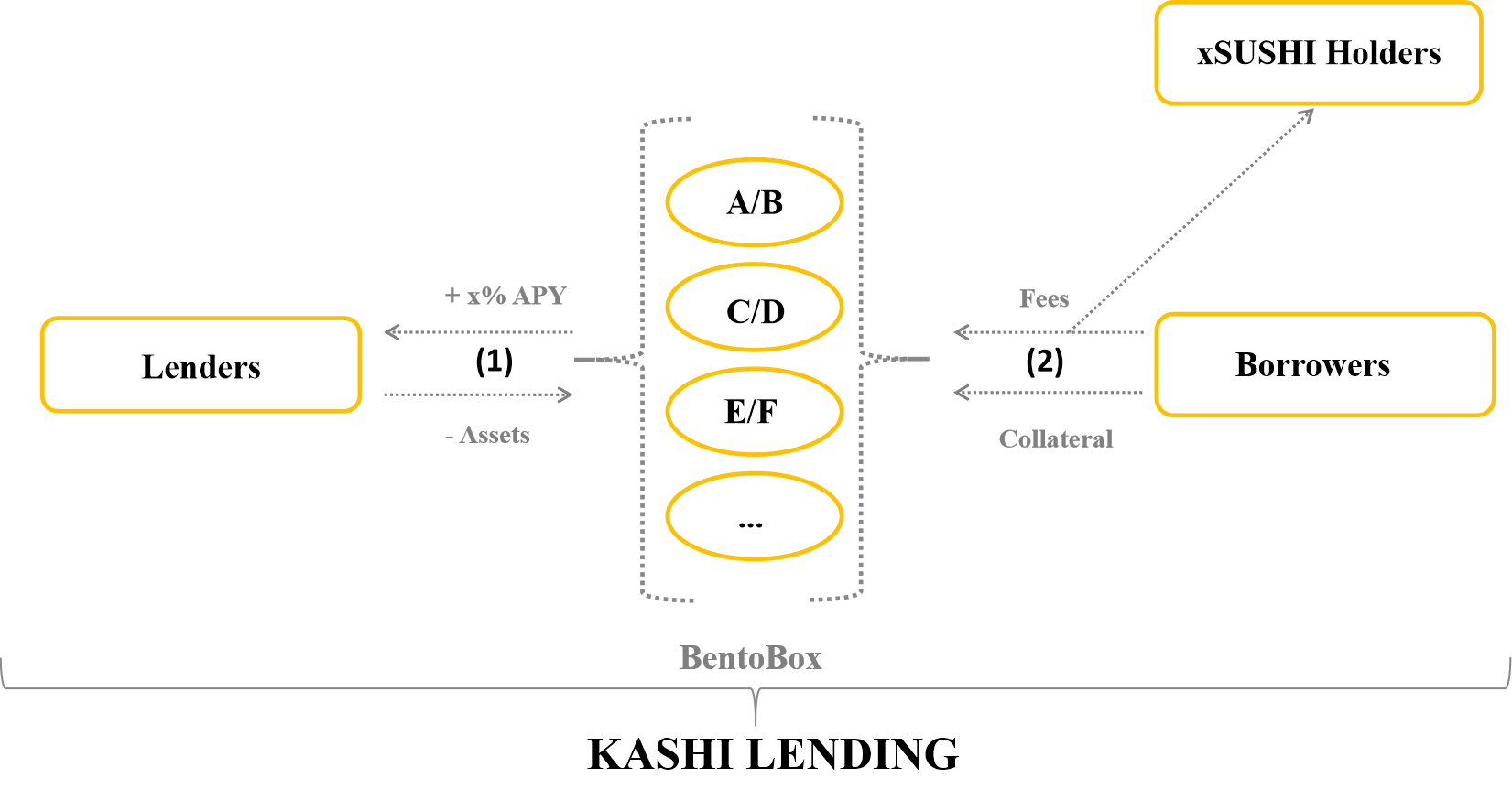

Operation model of Kashi Lending

Kashi is the first product suite of BentoBox, the model is similar to the lending and borrowing platforms, but the unique feature of Kashi is that it allows to borrow and lend in pairs (Isolated Lending Pair). There are: lenders (Lenders), borrowers (Borrowers) and borrowers (BentoBox – Vault contains the lender's tokens), Kashi's operating model is as follows:

For Lenders:

Step 1 : Lenders will deposit crypto assets into BentoBox, similar to a liquidity provider, so they will receive the same benefits as I mentioned above.

Step 2 : Select the Pool corresponding to your assets to lend and earn interest.

For Borrowers:

Step 1 : Borrowers provide collateral to BentoBox.

Step 2 : Select the Pool corresponding to the token you want to borrow to borrow the token and pay the loan interest.

The details are illustrated in the following figure:

Operation model of Kashi Lending

Unique features of the Kashi Lending model:

Low gas fees: supported by BentoBox, helping Kashi reduce unnecessary transactions.

Allows users to create their own Lending pairs with simple operations: just choose a type of token as a lending asset, a type of token as collateral, and users can create a Lending pair on Kashi.

Separate Pools: the benefit of separate Pools is to ensure the safety of the system, if there is a hacked token, it will only affect the Pool containing that token, not affect the remaining Pools and create the market. Diversify more tokens to borrow and lend.

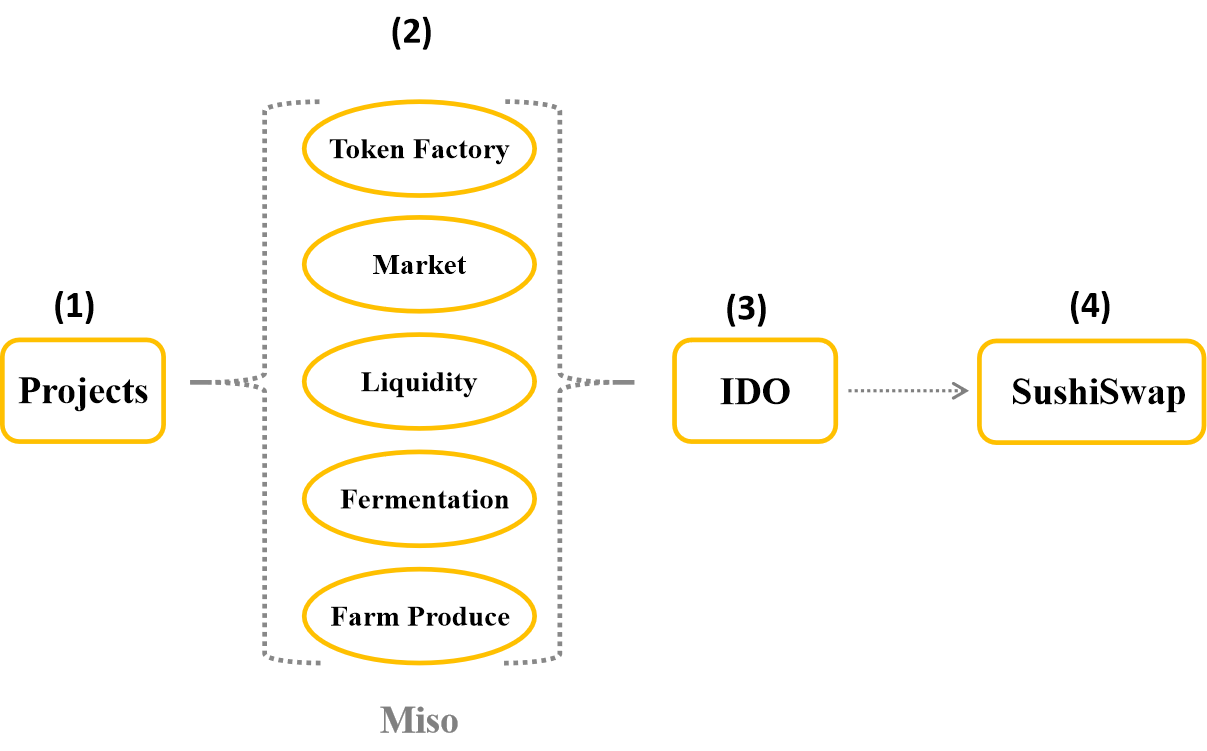

Miso – IDO (Initial Dex Offering) platform

MISO is an open source set of smart contracts created to simplify the process of launching a new project on SushiSwap. Similar to other IDO platforms, Miso was created to be a launch pad for researchers and project developers to easily access the crypto investor community to launch projects, as well as promote projects. push capital through trading tokens on SushiSwap.

Miso ingredients include:

Token Factory: where to create tokens for projects.

Market: where IDO is conducted, Miso supports the auction form Crowdsale and Dutch & Batch.

Liquidity: a part of capital raised from IDO will create liquidity for SushiSwap.

Fermentation: storage/escrow options to lock tokens over time.

Farm Produce: new IDO tokens will be farmed in SushiSwap's Liquidity Mining program.

To give new projects the best chance of launching on SushiSwap, the ingredients in Miso will be combined in different ways depending on the project. Therefore, I will limit my in-depth analysis of Miso's model, but readers can imagine the most basic way through the image below:

Miso – IDO (Initial Dex Offering) platform

Note: In (2) the project will be the one to decide how the components of Miso are combined.

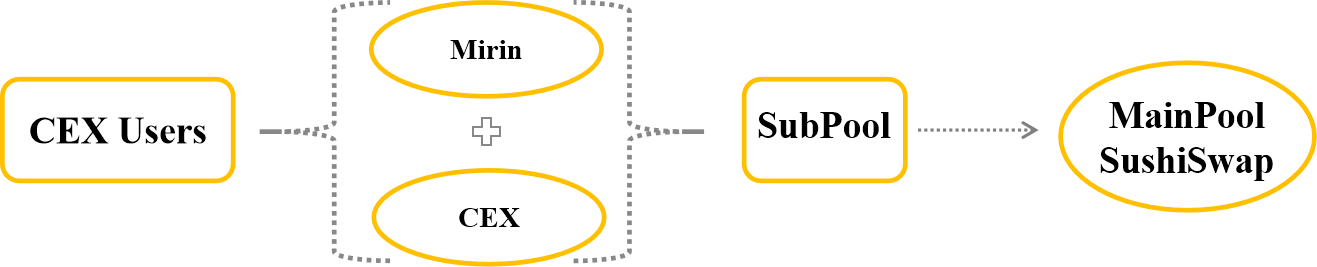

Mirin working model – a feature coming soon

Currently this feature has not been released, in the future Mirin will be released with SushiSwap V3. Simply put, Mirin will help Sushi combine with a centralized exchange ( CEX ) or a certain 3rd party, allowing users to provide liquidity to SushiSwap through the exchange, this liquidity will be contained in The subpool is linked to the main liquidity pool of SushiSwap, you can imagine through the illustration below:

Mirin working model – a feature coming soon

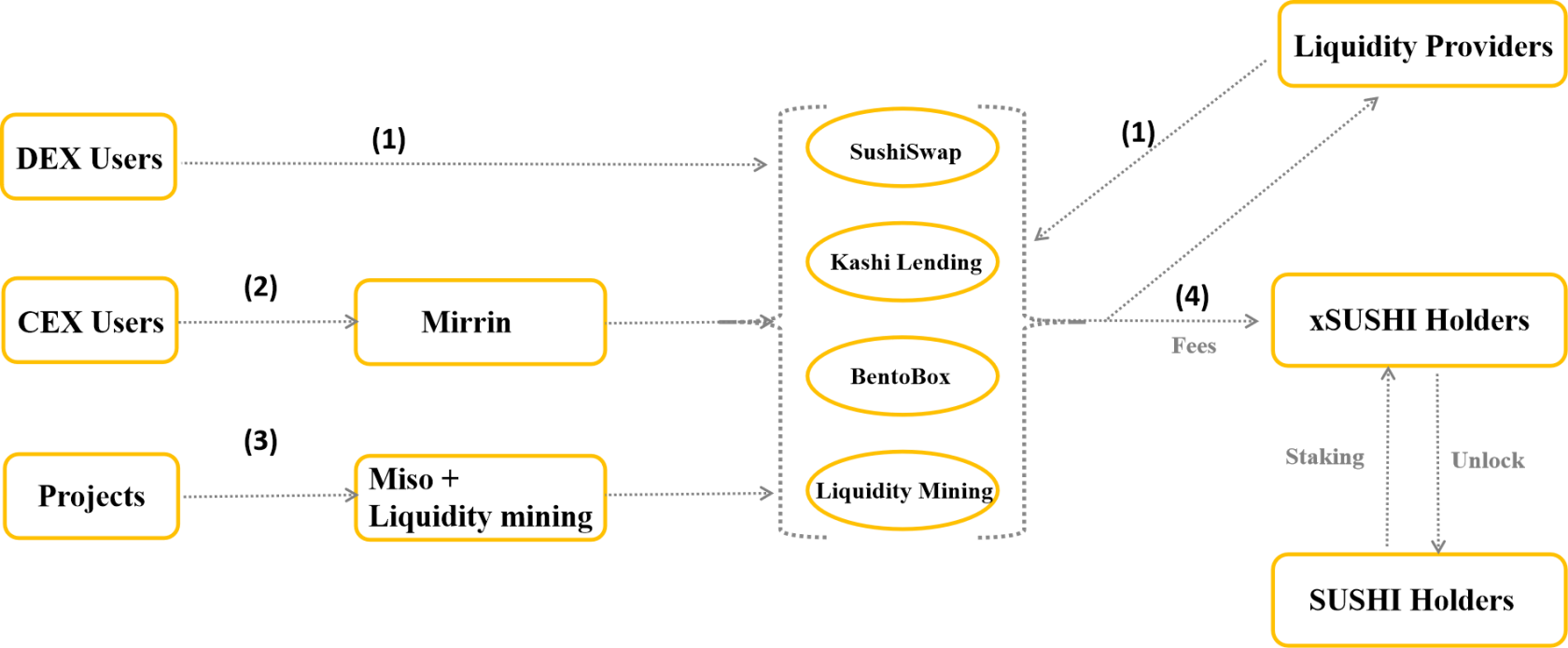

Overview of how the whole system works in the SushiSwap . model

Thus, here you can have a basic understanding of the operating models of SuShi's products. Now I will summarize the overall operation of the whole SushiSwap model as follows:

The details are illustrated in the following figure:

Overview of how the whole system works in the SushiSwap . model

SushiSwap is no longer just an AMM forked from Uniswap V2 but has become a system operating under a diversified product model serving many audiences. The solution that SushiSwap brings is to optimize the efficiency of capital use, while partially limiting the risk of slippage when trading. The products are all aimed at creating a rich source of liquidity. In my personal opinion, this is a very good model for SUSHI holders and other users when integrating many utilities and products into the same system. However, if you look at the opposite side, it is difficult to control many products and it is difficult to ensure that all products are working effectively. So I finished analyzing the operating model of SushiSwap,DeFi or not?

Above is information about the operating model of SushiSwap from many sources that TraderH4 synthesizes and researches for readers. Hope to help you better understand the project and operating model of a typical multi-product integration model like SushiSwap.

Does the solution that SushiSwap brings to the crypto market really work? Discuss with us at Telegram Group TraderH4. And don't forget to visit TraderH4's website to quickly update the upcoming events of the project. See you again in the next issue of "Active Model Analysis" of TraderH4.

Note: All information in this article is intended to provide readers with the latest information in the market and should not be considered investment advice. We hope you read the above information carefully before making an investment decision.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.