What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Passive investing in the form of Yield Farming is not far away from crypto investors. Surely investors are familiar with large-scale projects such as: Yearn.Finance, Curve Finance, Synthetix, Maker DAO, etc. So have you ever wondered how Yield Farming's operating model is? To better understand this model, today TraderH4 will analyze the operating model of Inverse Finance – one of the protocols for creating Yields on stablecoins, and then continue to invest those Yields in certain assets. .

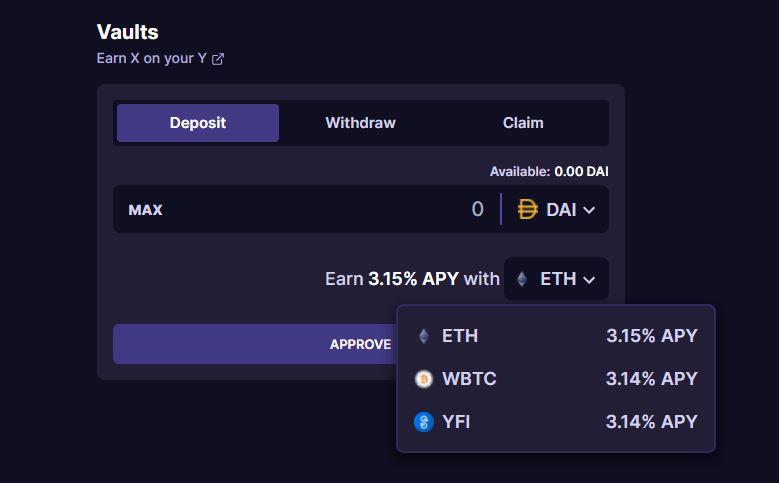

Inverse.finance is a permissionless decentralized financial toolkit managed by the Inverse DAO – a decentralized autonomous organization built on the Ethereum platform . To make it easier to understand, Inverse.finance is a protocol that provides a passive investment solution by creating Yields on Stablecoins, that is, according to the “Earn X on your Y” model, similar to sending DAI to receive interest. is the ETH coin.

Read more: What is Yield Farming? Yield Farming's Role in the DeFi Revolution.

Inverse.finance's main products are Anchor , DOLA and DCA Vaults:

Anchor is a currency marketplace, aggregated asset protocol that allows borrowing and lending.

DOLA is a stablecoin, created using other assets on Anchor as collateral and can also use DOLA as collateral to borrow other assets on Anchor similar to MakerDAO's DAI coin .

DCA Vaults allows averaging the price of tokens, ie instead of buying a large amount of tokens at one price and holding regardless of the fluctuations in the token price, Inverse.finance's DCA mechanism allows buying In installments, if the price drops, more will be purchased. This will increase your token holdings without all-in pressure at one price.

Read more: Stablecoin growth could pose a threat to credit markets.

Inverse.finance's operating model will revolve around 2 main components, including Inverse DAO and Inverse.finance products (Anchor, DOLA, DCA Vault)

Function of Inverse Knife

Inverse DAO as a decentralized autonomous organization, this organization will manage Inserve.finance and Anchor, DOLA, DCA Vault products through On-chain Voting on the Ethereum platform where INV holders are the voters or proponents. Proposals.

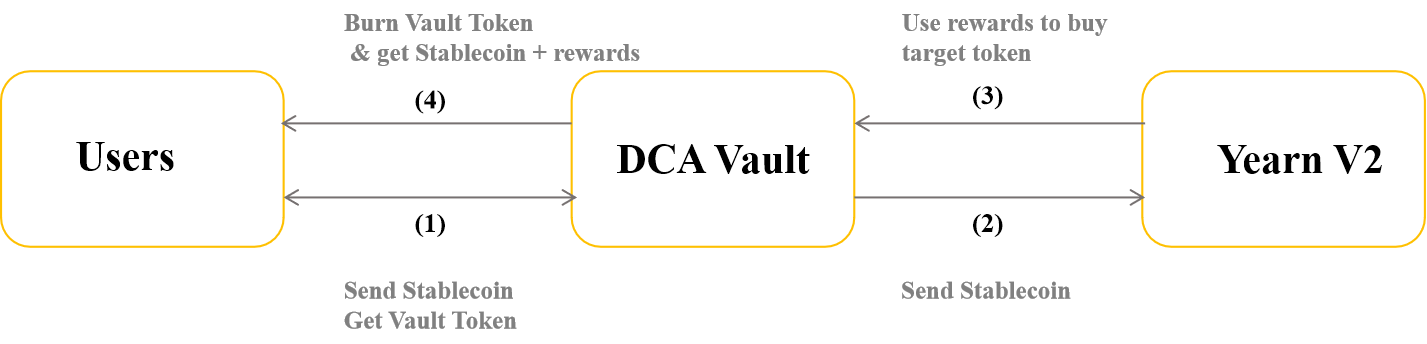

Activity takes place in DCA Vault

The idea of DCA Vault originates from the “Earn X on your Y” model, which means that users will invest their Stablecoins in profit strategies and apply the DCA (Dollar cost averaging) strategy model for profits. earned to buy other crypto assets (currently the project allows the purchase of 3 tokens, ETH, WBTC, YFI and depositable stablecoins DAI and USDC). Inverse.finance (INV) is implementing 4 strategies as shown in the image below.

Earn X on your Y strategies on Inverse.finance. Source: Inverse.finance.

Read more: Ampleforth On-chain Data Analysis (AMPL) – What is the demand for Algorithmic Stablecoins?

The DCA Vault model works in 4 steps as follows:

Step 1: Investors deposit Stablecoins (DAI, USDC) into DCA Vault and receive Vault Tokens back with the ratio 1:1.

Step 2: Investor's Stablecoins will be sent to Yearn V2 corresponding to the Vault previously deposited and start earning profit rewards.

Step 3: The profit rewards just earned from step 2 will automatically buy target tokens on AMMs ( once a day), namely crypto-assets such as: ETH, WBTC, YFI.

Step 4: When the investor withdraws his Stablecoin, the Vault tokens received in step 1 will be burned (Burn) and the investor will receive back the entire previously deposited stablecoin along with the profit earned in the form of target tokens (ETH, WBTC or YFI).

The details are illustrated in the following figure:

The DCA Vault model works in 4 steps

Activities taking place in Anchor banking

Anchor is a money market, as well as a synthetic asset protocol similar to Compound, that allows users to borrow and lend on the platform.

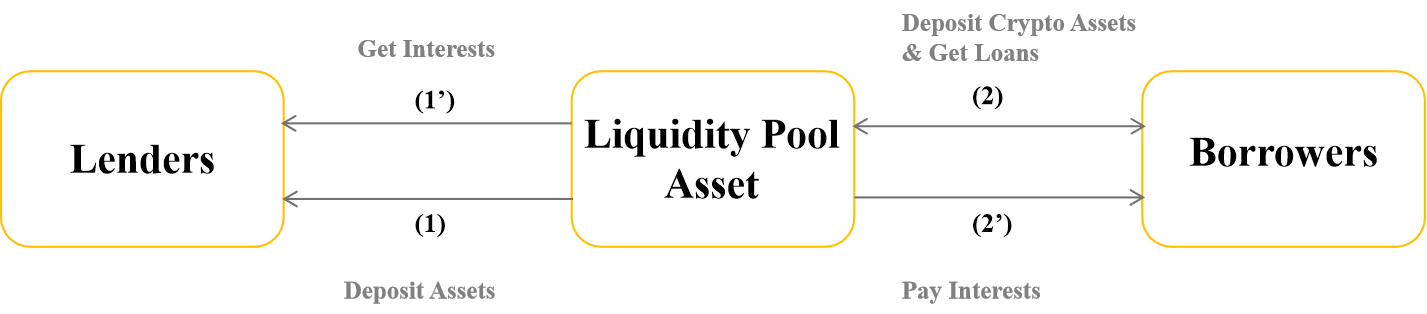

Participants in Anchor include: Liquidity Pool Assets (LPs) (simply understood as Liquidity Pool), lenders (Lender) and borrowers (Borrowers).

The mechanism of action I will summarize in the following 2 steps:

Step 1: The Lender will transfer Inserve.finance-backed crypto assets into the liquidity pool and will receive interest in return.

Step 2: Borrowers will deposit their crypto assets into the Liquidity Pool as collateral, when borrowing the tokens they need from the Pool, they will pay an interest. Interest is calculated automatically depending on the supply-demand of each asset class in the Pool.

In Anchor, there is a new cryptocurrency, DOLA, DOLA will be the first stablecoin issued by Anchor. Investors can use DOLA as collateral to borrow other crypto assets and vice versa. The price of DOLA is pegged to DAI (stable at $1), investors can deposit DAI and use DAI as collateral to generate DOLA.

The details are illustrated in the following figure:

Operation mechanism of Anchor Banking

Some Inverse.finance crypto assets for lenders such as: INV, WBTC, Dola, ETH, YFI, Sushi, etc.

Inverse.finance crypto assets for lenders. Source: Inverse.finance

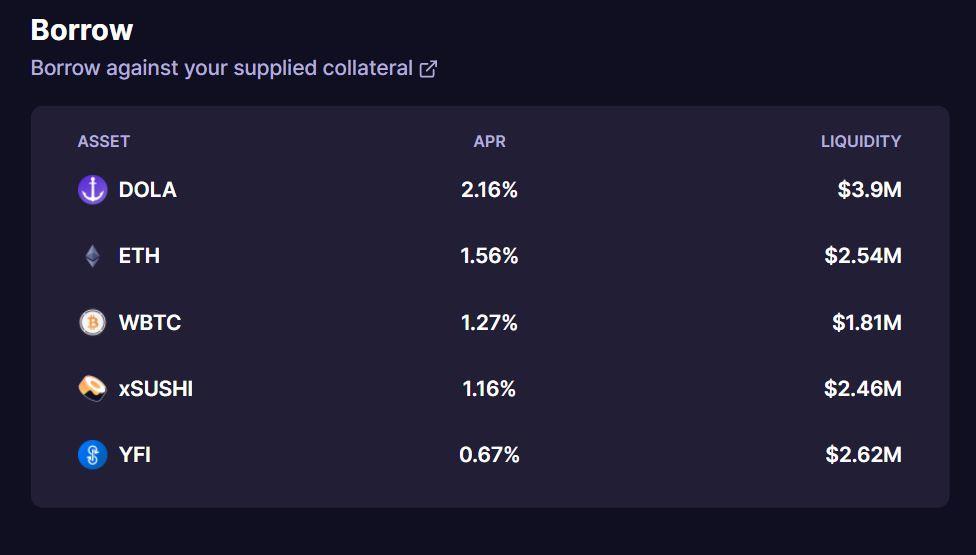

Some Inverse.finance crypto assets are available to borrowers (Borrowers) for collateral such as: INV, Dola, ETH, YFI, Sushi, etc.

Inverse.finance crypto assets for borrowers. Source: Inverse.finance.

It can be said that Yearn.finance opened a great field of Yield Farming for the cryptocurrency market, Yearn.finance itself also created quite a surprise for investors when the price of YFI surpassed BTC and was dubbed the BTC of the DeFi Market . With Yearn.finance's proposal for Inverse.finance to integrate Yearn V2 Vaults into Inverse Finance Vaults, it has created available capital and empowered Inverse.finance since its inception.

On the other hand, most projects like Compound, MakerDAO, Synthetix, etc. provide collateral for crypto assets to borrow, in other words will borrow on collateral, the risk is if the price of assets If the investor's collateral token falls deeply, that asset will be liquidated. To solve this problem, MakerDAO created the stablecoin DAI to insure borrowers' assets from this risk. That is, when the borrower deposits collateral into MakerDAO's Vault, he will receive back an amount of DAI corresponding to the collateral, when he pays off the borrowed DAI for the system, he will receive the entire asset back. your assets regardless of how assets have changed. However, DAI will not be able to borrow assets from MakerDAO.

Therefore, Inverse.finance has come up with a solution that combines cryptographic credit with an available capital source, which will increase capital efficiency. Specifically integrated into the same Pool on Anchor, investors can use cryptographic assets supported by Inverse.finance to make profits in many ways: make a profit from bringing assets deposited into the Vault for lending, or used to borrow DOLA, but use this DOLA number to serve any purpose, anywhere that investors want to even use as collateral to borrow another property. As can be seen, the solution that Inverse.finance brings to investors can both create passive income and optimize their own capital. So according to readers, does Inverse.finance really have potential?

Above is information about Inverse.finance's operating model from many sources that TraderH4 synthesizes and researches for readers. Hope to help you better understand the project and operation model of a typical Yield Farming like Inverse.finance.

Is the solution that Inverse.finance brings to the cryptocurrency financial market really potential? Discuss with us at Telegram Group TraderH4. And don't forget to visit TraderH4's website to quickly update the upcoming events of the project. See you again in the next issue of "Active Model Analysis" of TraderH4.

Note: All information in this article is intended to provide readers with the latest information in the market and should not be considered investment advice. We hope you read the above information carefully before making an investment decision.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.