What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

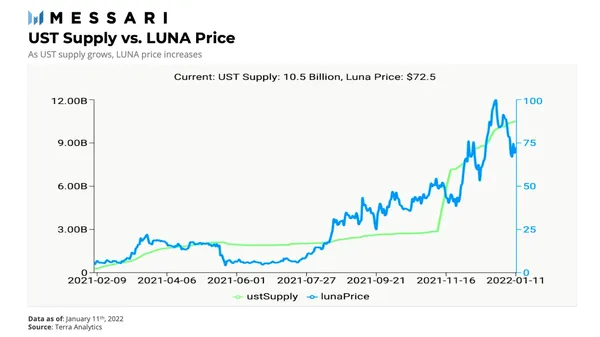

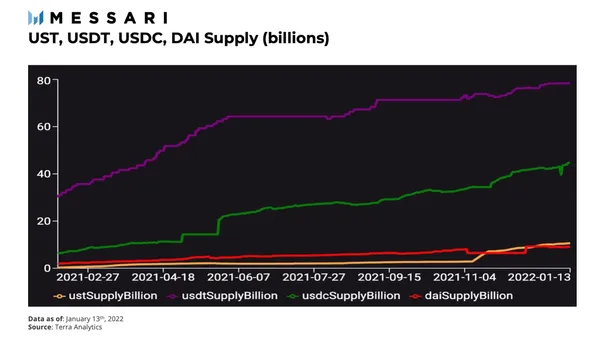

Blockchain Terra and its native token LUNA have recently experienced unparalleled growth thanks to the rapid growth of UST. In 2021 alone, LUNA has surpassed 14,000% in market capitalization, and the supply of UST has surpassed $10 billion.

Terra's Columbus-5 upgrade, made early last fall, is largely responsible for UST's recent supply growth. Columbus-5 was initiated with the primary goal of simplifying Terra's economic design and improving LUNA holders' value capture based on UST's growth.

The upgrade helped achieve much of the above goal by reducing LUNA's liquid supply through increased burning, staking, and increasing UST supply by expanding its cross-chain popularity. . The enhancement of cross-chain UST distribution has also improved the security of assets by eliminating the risk of reliance on a small number of protocols. Before diving into the specifics of Columbus-5, let's take a quick look at Terra's foundational setup.

Terra is a Proof of Stake (PoS) protocol that creates decentralized, algorithmic stablecoins. While Terra can create stablecoins to track any Fiat currency, UST is its primary use case. Terra maintains the UST USD rate through an elastic monetary policy enabled by the dual UST-LUNA token model.

When the value of one UST unit is higher than the USD rate, users are encouraged to burn LUNA and mint UST. When the value of one UST unit is lower than the USD rate, users are encouraged to burn UST and mint LUNA. During UST contraction, LUNA valuation decreases, and during expansion, it increases. LUNA is a mutable agent for the UST. By adjusting the supply, LUNA's valuation increases as the demand for UST increases.

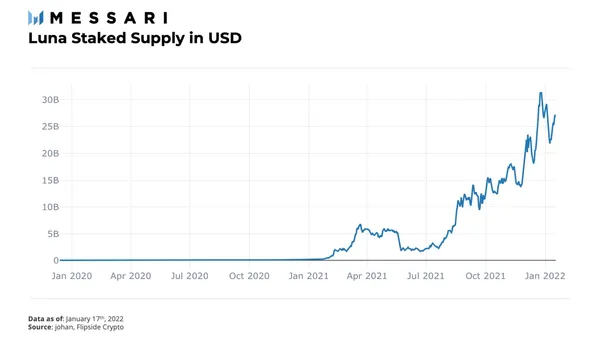

LUNA holders secure the network by linking their LUNA to a network validator. LUNA staking rewards come from three sources: gas fees, market stability fees, and swap fees. Users can stake their LUNA to a network validator via Anchor Protocol in exchange for bLUNA – an encrypted representation of LUNA that can be freely traded or used as collateral across protocols other in the Terra network. Unlinking LUNA can take up to 21 days, during which time rewards are not accrued.

Seignorage occurs when the LUNA is changed to a new UST. Prior to TIP43 and Columbus-5, whenever UST was minted, Terra Protocol would burn a portion of the LUNA earned and the rest would go to funding various community projects. Due to the rapid generation rate, Terra's community pool and oracle reward pool have become overloaded. In an effort to remedy this and maximize the cumulative value for LUNA holders, Columbus-5 has burned all community funds and transferred 100% of all future cash flows to be burn.

About 89 million LUNA were burned from the community. The amount of burned LUNA converted to UST was used to start Ozone – an algorithm-based insurance protocol, as requested by Terra. Ozone will then be taken over by Risk Harbor – an automated risk management protocol for DeFi.

Increased burning has made LUNA a radical deflationary asset and has improved its ability to capture value based on UST growth. While community projects may no longer receive funding from seigniorage, other community-led programs have emerged to fund new projects.

Validator votes are crucial in maintaining UST issuance at the correct price. Prior to Columbus-5, oracle votes were likely to be pushed out of the mempool during times of high network demand. Exactly this situation occurred during the market crash of May 2021 when a series of other transactions boxed oracle votes out of the block. After Columbus-5, oracle votes will be prioritized in the mempool so that they are never forced out of the block during network traffic spikes.

Before 100% seigniorage was burned, a portion of it was allocated to validators to incentivize voting. To compensate validators for the loss of seigniorage rewards, Columbus-5 pays them a swap fee dividend. This change has resulted in higher productivity when staking LUNA and the number of LUNA staking has increased significantly.

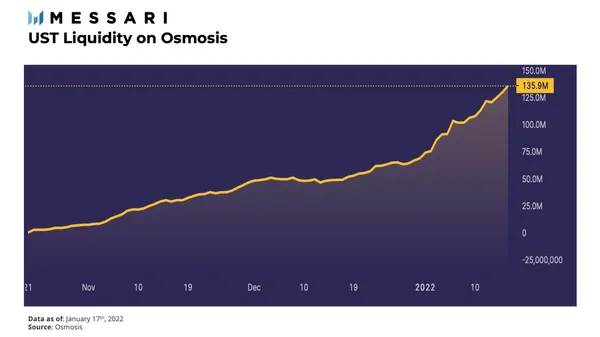

Terra is a blockchain Cosmos SDK that uses Tendermint consensus. All blockchains built on top of the Cosmos SDK come with IBC, a standardized communication protocol for IBC-compatible blockchains. Columbus-5 enabled IBC functionality on Terra, allowing seamless transfer of assets and data between Terra and other IBC-enabled chains such as Cosmos Hub, Secret Network, Akash, Thorchain, etc. Prior to Terra IBC integration , IBC lacks a highly liquid stablecoin. The IBC activation allowed UST liquidity to spill over into other IBC-enabled chains, and hypothetically, UST has since become the dominant stablecoin pair on the DEX, Cosmos' most liquid Osmosis. As the Cosmos ecosystem continues to grow, the growth of UST will be of great benefit.

The increased demand for UST on other connected blockchains will further develop UST's network effect and improve UST's liquidity distribution. While cross-chain UST's popularity is improving, the prominent UST supply is still heavily concentrated on a small number of protocols, such as Anchor.

While IBC connects Terra to application-specific blockchains on Cosmos, Wormhole connects Terra to various shared blockchains such as Solana and Ethereum. While many cross-chain bridges currently sacrifice a degree of decentralization for convenience, Wormhole claims to retain the benefits of both. Wormhole acts as a decentralized oracle network that relays messages between chains, relying on consensus of connected chains to accept state changes between them. At the time of writing, $755 million in UST has been moved by bridge to other Wormhole-integrated blockchains.

More recently, Wormhole suffered the largest DeFi exploit on record, in which over $326 million was stolen from the bridge. Jump Capital compensated all stolen funds to Wormhole users. Despite this setback, Wormhole remains one of the largest cross-chain bridges with over $2 billion locked up.

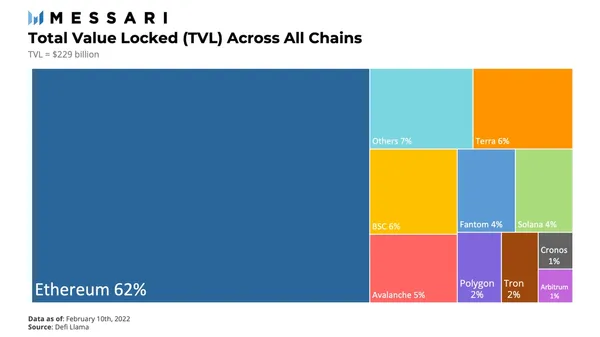

Many new projects have launched on Terra after Columbus-5, bringing new use cases and utility to blockchain. Recently launched projects such as Astroport have rapidly increased liquidity and have made Terra the second largest blockchain after Ethereum with $14 billion in TVL, almost 7% TVL across all chains. In addition to new projects, strengthening risk management through Ozone will also likely grow the TVL of existing projects on Terra. Ozone recently launched protection specifically for Anchor and will soon integrate with Mirror and Orion.

To further apply UST on other blockchains, LUNA holders adopted a governance decision in November 2021. From there, deploying 3 million USD community LUNA pool for UST liquidity mining incentive programs, through strategic applications and protocols on main Layer 1. Recently, LUNA holders voted to launch an additional liquidity mining program to deploy $2 million worth of LUNA to various protocols on Solana, Oasis, and NEAR.

Despite the recent growth of decentralized stablecoins, centralized stablecoins still dominate the overall liquidity of stablecoins. As such, Terra aligns their interests with the decentralized stablecoins MIM and FRAX to increase the share of decentralized stablecoins in the stablecoin market.

As the majority of stablecoin liquidity on Ethereum resides on Curve, LUNA holders recently voted to deploy a large amount of capital to incentivize deep UST liquidity on Curve. These incentives include the deployment of $12 million in LUNA for Convex incentives, $250 million in UST for farming CVX/CRV through Curve's USTw-3CRV pool, and $2 million in LUNA for Tokemak incentives.

While DAI is technically a decentralized stablecoin, it is primarily collateralized by USDC, making it more centralized than the UST. Before UST overtook it on November 18, 2021, DAI was the largest decentralized stablecoin by market capitalization. The supply of UST is now 17% larger than that of DAI as it continues to grow at a faster rate than its peers.

When looking at UST's recent period of rapid growth, incentive programs show the potential to significantly boost UST adoption. Even so, it will take a long time for UST to eclipse USDC or USDT. However, the recent regulatory concerns surrounding centralized stablecoins combined with the UST, MIM, and FRAX partnership to increase the liquidity of decentralized stablecoins on Curve have the potential to shorten the timeframe. above and change the situation.

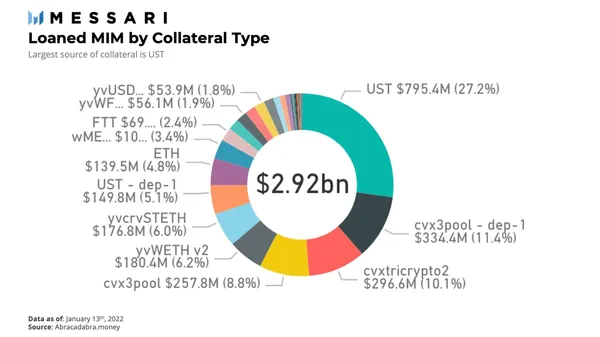

Currently MIM is more of a companion than a competitor, however, it is still the second largest decentralized stablecoin, behind only UST. While many asset classes offer MIM collateral returns, UST primarily collateralizes it through its Degenbox strategy. It contributes to a significant amount of deposits on Terra's Anchor protocol. Like Terra, Abracadabra has also spent significant capital to incentivize UST and MIM growth on Curve by pledging millions of SPELL emissions to Votium UST-MIM incentives.

MIM and Abracadabra are also part of a larger ecosystem of projects led by developer Daniele Sestagalli, called “Frog Nation” (SPELL, TIME, ICE and SUSHI). In addition to Abracadabra, Wonderland also recently contributed to UST adoption by implementing a $48 million yield farming UST strategy . While decentralized stablecoins like MIM could become a long-term competitor to UST if their supply starts to overtake centralized stablecoins like USDC and USDT, for now their growth is symbiotic. .

As of January 14, 2022, Terra will reduce the tax rate to zero. LUNA producers currently earn rewards through a combination of on-chain swap fees and network tax income. Tax rates are currently a barrier for capital-constrained developers looking to deploy contracts on-chain. Terra seeks to inspire more new developers to build on blockchain and further drive innovation by reducing tax rates.

Other proposals recently adopted relate to UST's continued efforts to bring liquidity outside of the Terra ecosystem, further solidifying it as a cross-chain stablecoin. This requires allocating:

While most of Terra's recent governance proposals are aimed at improving UST's cross-chain dominance, Terra's latest proposal is marketing-focused. After approving $40 million in community pool funds to be used for a sports partnership, Do Kwon announced that Terra will partner with the Washington Nationals. As part of the agreement, UST will become the accepted method of payment at Nationals Park.

Terra's Columbus-5 upgrade has made UST the largest decentralized stablecoin and has created tremendous value for LUNA holders. The upgrade laid the groundwork for UST approval to continue to grow on other IBC-enabled blockchains and major Layer 1s. The supply of LUNA will also shrink more in the future following the improved burning and zoning mechanism of Columbus-5.

Recently, Terra participants have launched active initiatives in an effort to further boost UST's supply growth by increasing cross-chain popularity and real-world use cases. If these initiatives prove to be successful, LUNA holders will accumulate tremendous value as a direct result of the changes made in Columbus-5.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.