What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Stablecoins are an extremely important and indispensable piece in the digital currency market. Besides, the development of DeFi entails the need to use Stablecoins to invest more and more. In addition to Fiat-backed and Crypto-backed Stablecoins, there is another type of Stablecoin called Algorithmic Stablecoin (algorithmic Stablecoin) that works based on the mechanism of supply and demand elasticity. Basis Cash is the most typical project of its kind and uses the Seignorage 3 Token mechanism. So what's so special about Basis Cash's operating model?

Overview of Basis Cash

What is Basic Cash?

Basis Cash (BAC) is an open source, fully decentralized stablecoin, the value of BAC is designed to follow the value of DAI - a stablecoin of Maker DAO, equivalent to 1 USD. Basis Cash is built on the Ethereum platform with the aim of inheriting the vision of Basis Protocol – the project has been discontinued before.

Read more: What is Ethereum 2.0 and why is Ethereum 2.0 important?

The idea of the project is to use the operating model of a Central Bank operated by an algorithm to balance supply and demand changes to ensure that the value of tokens is stable in the digital currency market. .

Read more: Stablecoin growth could pose a threat to credit markets.

Basis Cash 3 Token Seignorage Mechanism

Basis Cash (BAC): this is the core token of the system, the value is tied to USD and follows the value of DAI and is considered as a means of transaction.

Basis Share (BAS): This token represents the value of the protocol, BAS holders can take away Stake in Boardroom to receive BAC coins in new issuances. When the price of 1 BAC is greater than 1 DAI, the protocol will issue an additional amount of BAC tokens to add to the supply. When supply and demand are in balance, the price of BAC is adjusted to be close to the value of DAI (ratio 1:1). The BAC coins in this issue will be distributed to BAS stakers in Boardroom. This is called an Expansion mechanism - one of the operating mechanisms to ensure that the price of 1 BAC fluctuates around 1 DAI.

Read more: What is Staking and what to keep in mind when investing in Staking.

Basis Bond (BAB) : this is also a token of the protocol, BAB token serves the purpose of buying or redeeming BAC at the ratio 1:1. That is, when the price of 1 BAC is less than 1 DAI, users can use BAC to buy cheap BAB (currently the price of BAB is equal to the price of BAC ^2). The obtained BACs will be burned to reduce the supply, along with the stimulation of demand from buying BAB in exchange for BAC will push the price of BAC to nearly 1 DAI. This is called a supply contraction mechanism (Contraction).

Read more: Ampleforth On-chain Data Analysis (AMPL) – What is the demand for Algorithmic Stablecoins?

Basis Cash 3 Token Seignorage Mechanism

Basis Cash has 4 main activities:

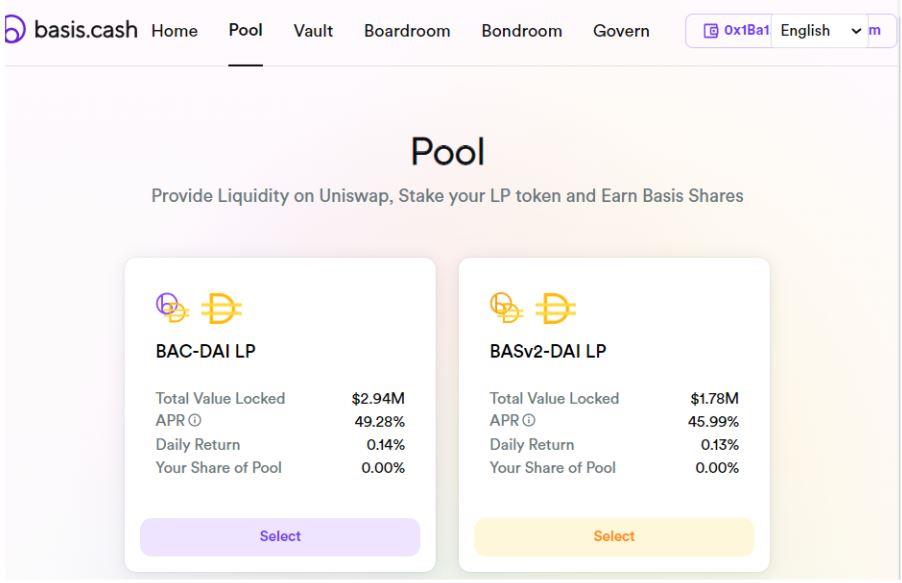

Pool Basis Cash: provide liquidity on Uniswap to get back BASv2 Token .

Users will provide liquidity on Uniswap to receive LP tokens and bring LP tokens to stake to receive BAS Tokens – rewards for users who provide liquidity for the protocol.

I will describe it in 4 simple steps:

Step 1: Add liquidity to the pool on Uniswap. Currently support 2 pairs ( BAC-DAI and BASv2-DAI ).

Step 2: After completing step one, you will receive the LP Token corresponding to the pool that you provide liquidity.

Step 3: Then you go to the Pool of Basis Cash to Staking the corresponding LP Token.

Step 4: You will receive BASv2 Token.

Pool Basis Cash

Read more: Uniswap (UNI) on-chain analysis launches Uniswap V3 what data reveal?

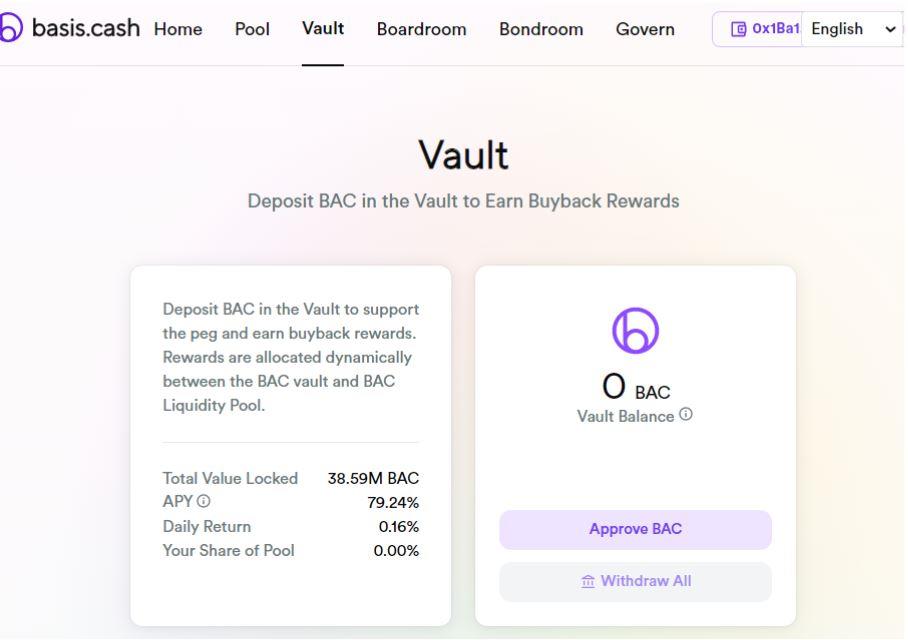

Vault Basis Cash: deposit BAC into the Vault to help BAC return to a stable level.

BAC holders can deposit BAC tokens into the Basis Cash Vault to help bring the BAC value back to a stable level. Basis Cash Vault works based on the following 2 cases:

When BAC is below stable: use BAC as collateral, then borrow DAI & BAS from Basis Lending. Part of BAS from borrowing will be transferred to Boardroom to receive BAS bonus and the rest together with DAI from previous borrowing is added to the pool to increase liquidity for BAS-DAI LP and get more BAS.

When BAC is above stable level: a part of BAC will be converted into DAI, then provide liquidity to BAC-DAI pool and use BAC-DAI LP as collateral to borrow DAI, creating leverage to increase liquidity reverse liquidity to the pool.

Vault Basis Cash

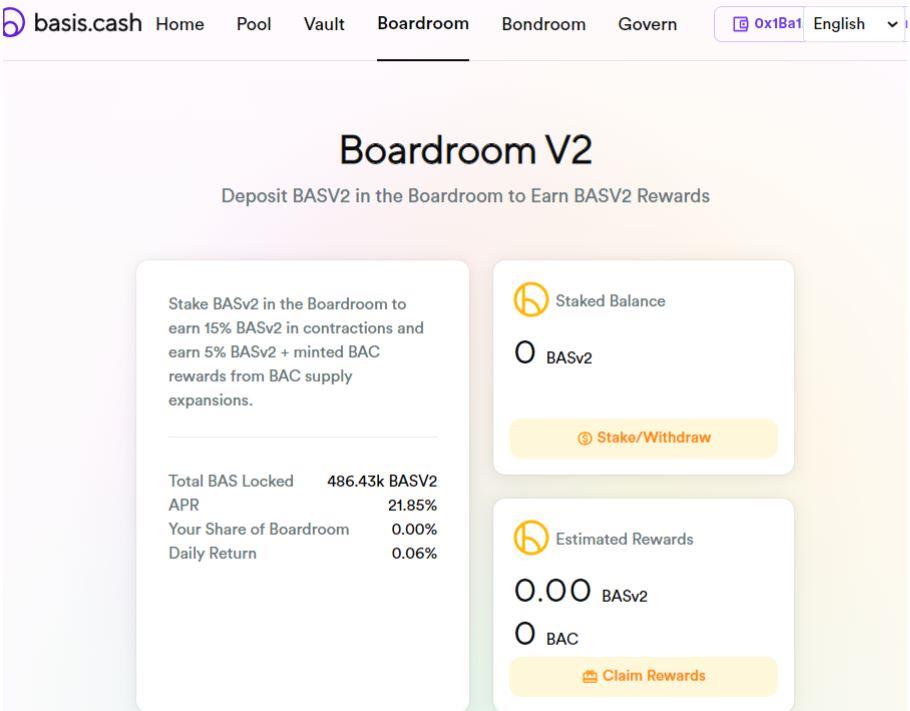

Boardroom Basis Cash: BASv2 token holders can deposit into Basis Cash Boardroom to participate in governance on the protocol and receive rewards .

To make it easier for you to imagine, I will briefly describe it in 2 steps:

Step 1: Once you get BASv2 from pool liquidity provision, you can stake BASv2 in Boardroom V2.

Step 2: You will receive BASv2 token and BAC token depending on the following 2 cases:

If Contraction happens: you get 15% BASv2 depending on your BASv2 Stake in Boardroom.

If Expansion happens: you get 5% BASv2 depending on your BASv2 ratio Stake in Boardroom and BAC token depending on the number of BAC tokens issued.

Boardroom Basic Cash

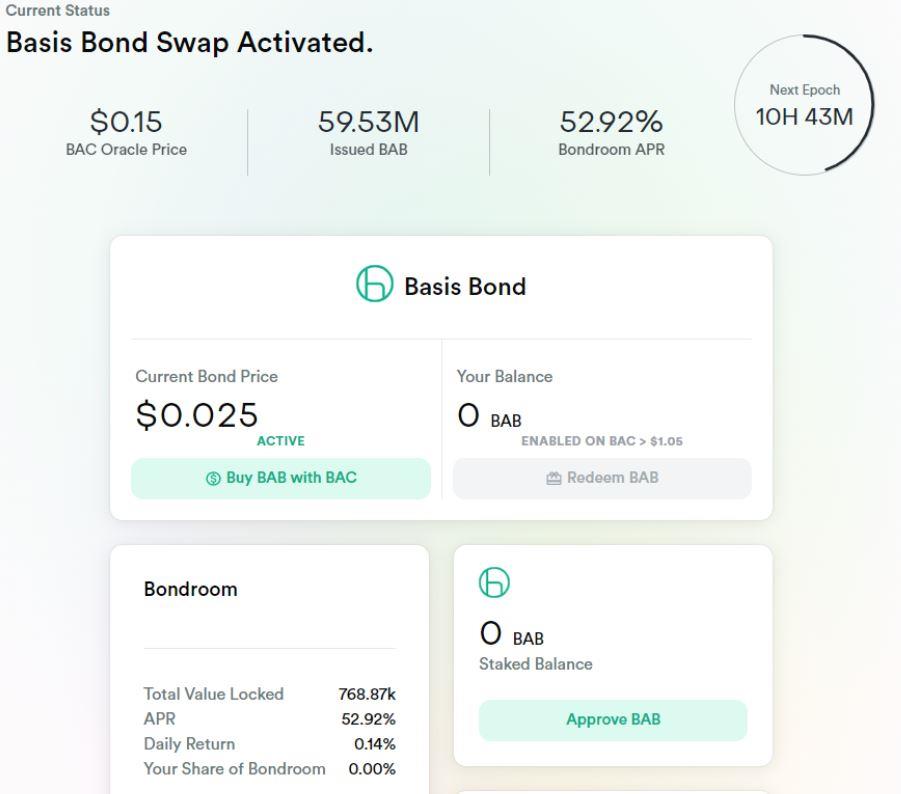

Bondroom Basis Cash: deposit BAB tokens to receive BAS rewards when BAC is below stable level and convert BAB to BAC when BAC value is above stable level.

I will give you an example to make it easy to understand:

I am holding 10 BAC and the current price of 1 BAC is 0.15 DAI, now I can buy 444 BAB (10/0.15^2) and bring BAB to stake to get more BAS. After the BAC price rises above the stable level ($1.05), I can change it to 444 BAC, and sell the BAC for a profit.

Bondroom Basis Cash

Investment opportunity to earn profit on Basis Cash?

If you read this far, you must have understood how to invest and profit from the operating model of Basis Cash. In addition to those activities, there is also investment activity from buying BAS tokens to store and wait for price increases, users will profit from arbitrage trading. In this way, to optimize profits, I will note a few points as follows:

The increase in the value of the BAS token is proportional to the total supply of the BAC token: the more the total supply of BAC, the more profitable BAS holders will be.

The promotion of the value of BAS tokens depends on the BAS token that an investor holds: the more BAS tokens hold, the more BAC the supply expands, the greater the reward.

The value boost of BAS token is inversely proportional to BAB token: that is, when BAC expands its supply, the project will give preference to BAB holders to use BAB in exchange for BAC first. Therefore, the smaller the number of BABs, the more BAC rewards for BAS investors.

Read more: Uniswap (UNI) on-chain analysis launches Uniswap V3 what data reveal?

Above is information about Basis Cash - the project that follows the vision of Basis Protocol from many sources that TraderH4 synthesizes and researches to bring to readers. Hope to help you better understand the project and find investment opportunities from the project's operating model.

Is the investment opportunity with Basis Cash in the crypto financial market really worth a try? Discuss with us at Telegram Group TraderH4. And don't forget to visit TraderH4's website to quickly update the upcoming events of the project. See you again in the next issue of "Active Model Analysis" of TraderH4.

Note: All information in this article is intended to provide readers with the latest information in the market and should not be considered investment advice. We hope you read the above information carefully before making an investment decision.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.