What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

We are living in a period of history where there is a constant contradiction between faith and unbelief. The tension is further magnified by a system of media agitators, specifically designed to trigger violent reactions in our psyche. However, there are very few people who will decide whether to act or not in the midst of such changes, the rest will remain in a state of believing or not believing. Of course, one's trust should not be shaken as much as a candle in the wind.

That's also what the writer personally reminds himself every time he feels the urge to do something right away. Hopefully, through this article, readers will have a more calm view of the volatile Crypto market today.

According to sources from DefiLlama, since the project's deposit rate reached 20%, the total value locked (TVL) on the protocol has increased from 4.3 to 11.6 billion USD.

After that, a lot of events happened: Volatility in the crypto market skyrocketed, listed share prices of mid-to-large tech companies were destroyed by data indexes. inflationary. The world is currently on the verge of nuclear disaster due to political tensions in the world.

All the positive arguments for maintaining liquidity within the 20% strategic level are masking volatility, they are trying to pretend that the volatility we can't see yet doesn't really exist. Meanwhile, Anchor's deposit yield, despite being affected by fluctuating world conditions, remained within its 19-20% range.

The coin on Anchor is UST too, it has withstood storms that swept across chains and remains firmly at 1:1 against USD, aiming to please all depositors.

So why should we worry? Shouldn't we just enjoy the reliance on the stable safe haven that Anchor Protocol provides in an uncertain world? Maybe we can!

To encapsulate the definition of Anchor Protocol, it is a borrowed protocol of the Terra blockchain ecosystem . This borrowing protocol differs from Maker in that it is not a platform that maxes out its own currency. Anchor is also different from the Aave-Compound duo in that it only lends to one asset, UST – Terra's native stablecoin.

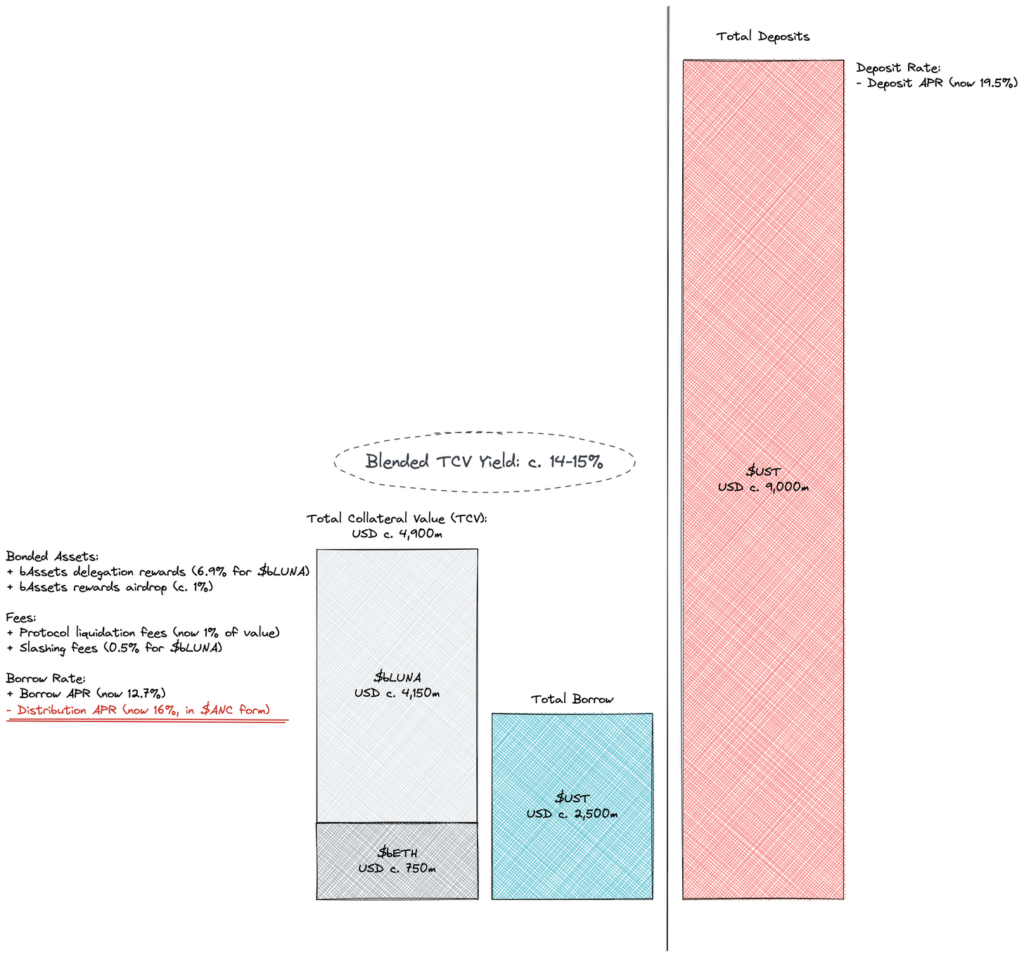

In contrast, like other projects, the platform allows the use of two tokens as collateral of a profit-making nature: LUNA and stETH. This can be explained very simply by the following logic:

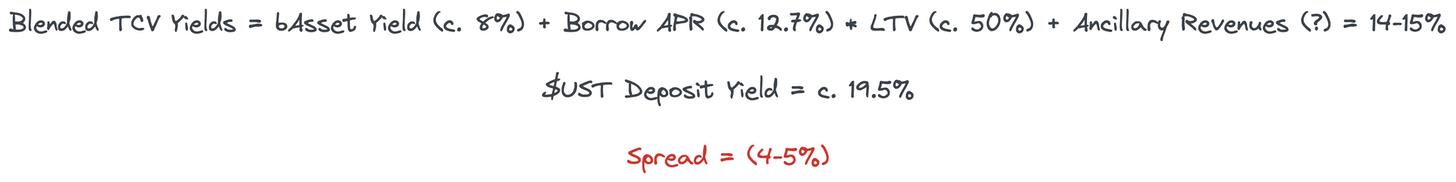

If we temporarily ignore the theory of reflexivity between Anchor and the broader ecosystem involving some crypto assets (such as UST and LUNA) and incentives paid in the form of ANC, then Anchor Not much different from a commercial bank. As a simplified bank, it will earn more from its assets than it spends on its liabilities. Typically, banks have a positive spread between the interest charged by the borrower and the rate paid to the depositor. So is this the case for Anchor? Not really.

Anchor is a negative arbitrage bank. Doesn't sound like much right? In fact, in terms of the cost of capital, Anchor is more like a private equity fund than a bank: While banks make their money from the independent management of both assets and liabilities, the concept has since been abandoned. abused in a world with negative interest rates, hedge funds still attract money from certain partners (which promise high rates of return) and when they do, they need to proactively manage their assets more efficiently to more than compensate for the promised profit.

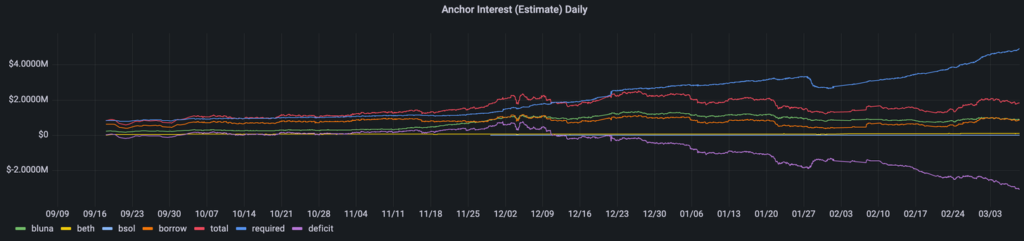

The equation above shows that if we look at it another way, for every 1 unit of collateral offered, Anchor can attract a maximum of 0.75 units of deposit to reach breakeven. Assuming a fixed LTV of 50%, this means a minimum deposit utilization ratio of 65-70%, Anchor has previously stated this figure is 60%. This number is quite reasonable considering that the assets of the equation are growing rapidly and there are many borrowers looking to enhance their positions. LUNA is one of the best performing assets in 2021 with an LTM return on investment (last 12 months) of 750%. It was not until early December that the market was active enough to ensure positive cash flow from interest rates for Anchor.

But with negative spreads you are racing against time and it is only a matter of time before the protocol suffers from its cyclical nature. With increasing volatility across all markets, the need to seek leverage stagnated and morphed into stability. It is that trend in the Terra ecosystem that has resulted in fewer borrowers now and fewer assets deposited with Anchor.

According to the concept of Adam Smith (who is considered the father of the modern economy), market forces will reduce the incentive to deposit (by reducing the deposit rate) and potentially increase the incentive to borrow. by continuing to reduce lending rates. The Anchor project is certainly no stranger to the concept of algorithmic interest rates, looking at the documents they provide, the loan interest rate model is referenced on the utilization rate. Interestingly, the same pattern does not apply to deposits, with rates remaining around 20%.

Providing a stable and predictable rate is Anchor's highest ambition (a little hint, that's also the name of the project - anchor). It is this that gives rise to two more different questions that TraderH4 will attempt to analyze independently:

TraderH4 will analyze and explain them with you shortly.

First of all, things are going to be pretty murky from now on, but stay calm. In the above comments and analysis, TraderH4 deliberately ignored the borrowing motives that Anchor deployed in the form of ANC minting. Now let's analyze.

ANC is the protocol's own governance token, which is distributed to borrowers to incentivize them to provide (or rather, collateralize) profitable assets to the protocol and receive loans in cash. UST. At current levels, ANC's mining return to borrowers is higher (16%) than the average annual percentage loan (APY 12.7%). In other words, borrowing is now viewed as both a mining strategy and a wager based on the price of the ANC.

Mining encourages users to use the protocol and indirectly benefits ANC. However, the price to pay is strong dilution and selling pressure, which has caused a lot of harm to current ANC holders. Most, if not all, liquidity incentive schemes have one thing in common: they are not sustainable. You may already have an iPhone or a gift if you open an account with the current amount of money at a bank, there may be space but it is certainly not the bank's shares. there, but also periodically!

Aside from being unsustainable and having a negative impact on ANC holders, with deposits at $9 billion versus total loans at just $2.5 billion, that's clearly not OK. . The project documents indicate that Anchor's deposit rate is mainly adjusted by adjusting the ANC issuance rate to borrowers. Based on the current cash flow dynamics, it is clear that the feedback mechanism has not been effective or deposit interest rates have been maintained excessively high.

When ANC mining is not enough as a parameter for cash flow, the protocol relies on direct subsidies from its reserves. This isn't necessarily a bad idea when the reserve has a function of cyclical lubrication around the protocol's long-term growth trajectory, but not when the protocol's reliance on the reserve is structured.

By early February, it was clear how unsustainable the status quo was. Interestingly, in the forum post of the @nrmo account, the imbalance was proposed to be resolved in the long term by an improved borrowing model, while the deposit rate was proposed to be maintained. at 19-20%.

Meanwhile, through the newly created Luna Foundation Guard (LFG), a $450 million grant has been proposed. LFG was formed from a 1 billion USD capital raising event through a private token sale led by Jump and 3AC, with the participation of many other entities. The ambition of UST Forex Reserve was created through capital raising and is considered excellent in face value “digital gold” – BTC, which acts as a stabilizing factor and the ultimate reserve for the UST. In fact, not many of the chain's native stablecoins have a 1 billion backstop to hold their backstop. However, algorithms, no matter how good they may be, are not enough to achieve our unconditional trust.

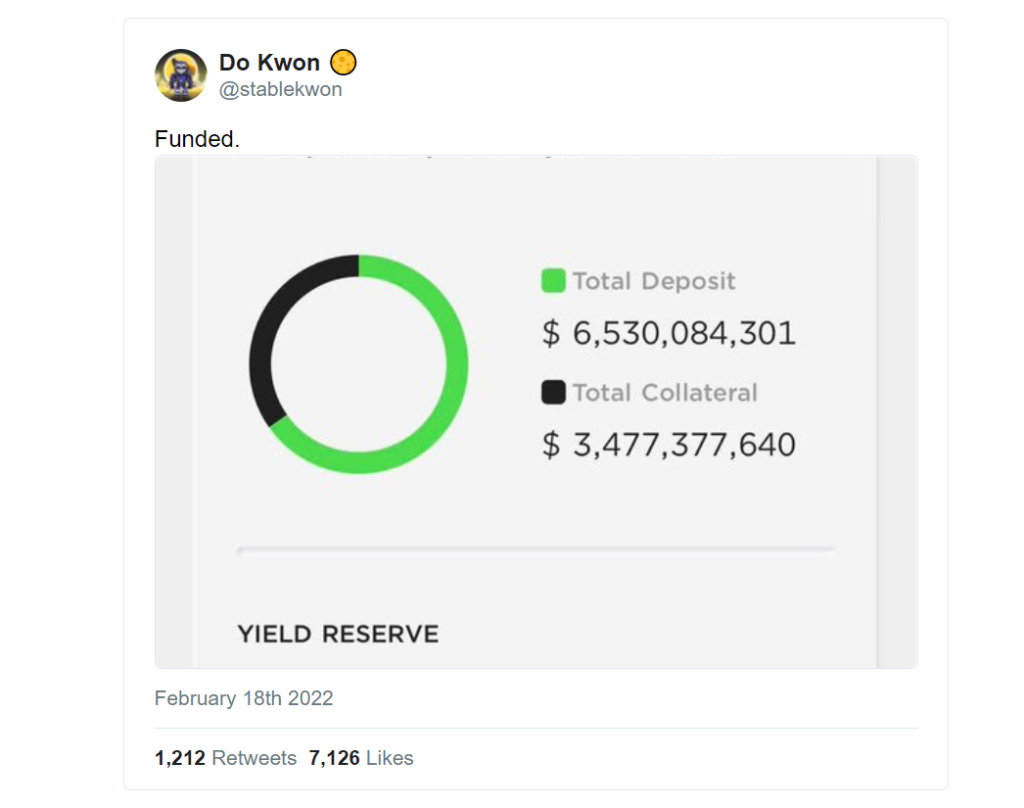

These are no small numbers, and it's impressive to see how mainstream a 20% anchor is worth over $0.5 billion. Perhaps the writer is not the only one who does not like this suggestion. @Pedro_explore is a frequent commenter on Anchor who strongly opposes the use of originally allocated funds to improve governance, security, and sustainability of the Terra ecosystem. If the Anchor is deemed too big to fail, making it bigger without solving its problems won't make things any better. In a word, Anchor may indeed remain Terra's most powerful marketing machine, but no one can "raise" such a flashy machine for too long. However, on February 18, Do Kwon announced a $450 million increase in the reserve fund.

But raising capital is just increasing the amount of money and it does not change the trajectory that Anchor has been on. Since the refinance date, the reserve fund has fallen from $510 million to $450 million in less than a month, the deposit yield once again remaining flat.

Anchor's importance to a vast Terra ecosystem cannot be denied. There are 14 billion USD of UST in circulation with 9 of them deposited in Anchor. To that, we should add 150 million (50% of the total 300 million) being offered to the ANC liquidity pool on the Astroport protocol and surely there are other places related to Anchor. There is no doubt that Anchor is the foundation of Terra today. It may not be so in the future with projects like Astroport, Prism, Mars, Mirror… but that future has not yet come.

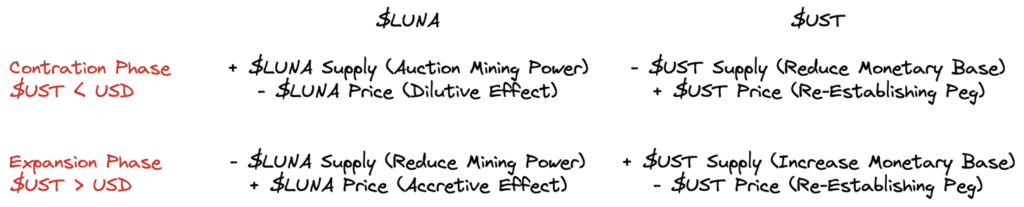

In Terra's integrated and transparent monetary system, LUNA and UST are two tokens that are directly connected to each other. Besides, Terra is also a financial center in the metaverse and it interacts with the rest of this universe by importing and exporting capital flows, this mechanism is divided into two phases:

In other words, Terra continuously changes the volatility between UST (system debt) and LUNA (system equity). One side will act as a supply reserve for the other, and both will survive. LUNA cannot withstand the strong outflows of UST if Anchor's deposit yields are reduced, as it will lose the ultimate stability to its price. Terra Ecosystem needs Anchor.

We need to agree that the interests of LUNA holders are not fully compatible with the interests of the ANC faction. Unless, of course, we assume that every six months some kind angel will pump half a billion dollars (and growing) into Anchor's reserves, thereby subsidizing the installments. release ANC to infinity.

Yet, we are back to the starting point: Conflict of interest between investors, token holders, traders, depositors, miners, enthusiasts, Anchor builders, and developers Terra. Perhaps nothing has changed markedly, but after this article it is possible that some perspectives have changed. Now we can clearly see many aspects of the Anchor project in particular and the Terra ecosystem in general or even a large and diverse Crypto market. The only thing we need to do now is to observe the movement of the platform closely.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.