What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

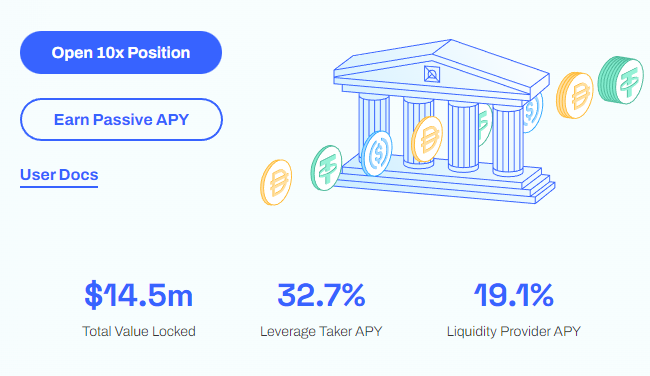

Archimedes is a Defi (Decentralized Finance) protocol on the Ethereum network, focusing on Lending and Borrowing with leverage. The special feature of Archimedes is that it allows users to provide liquidity to receive rewards from the project Pool, and at the same time can mortgage their assets to borrow Stablecoins from the Pool.

With Archimedes, users can borrow and lend at competitive interest rates, with no restrictions on loan duration or quantity. In addition, the project also features automatic refinancing and interest rate hikes to increase the attractiveness of liquidity providers.

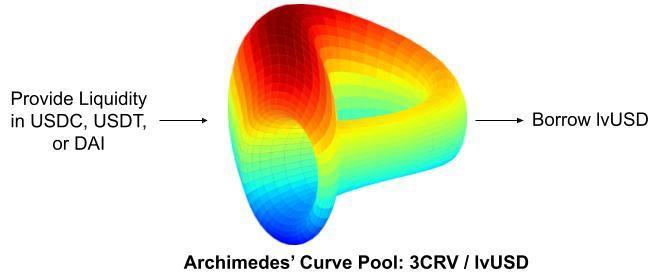

Archimedes is a DeFi (Decentralized Finance) project with a Lending product for liquidity providers. Users who provide liquidity into the 3CRV/lvUSD Pool (including USDT, USDC and DAI) will be rewarded with sustainable APY from the project's Real Yield revenue. The stablecoin of the lvUSD project is 1:1 against USD.

The project generates revenue from 3 fees: Leverage Fee, Origination Fee and Performance Fee. The Leverage Fee is a fee when the Borrower (the Borrower) mortgages an asset to open a leveraged position that allows for more assets to be borrowed. The Origination Fee is the fee when Borrower first opens a position, with a fee of 0.5% of the borrowed amount. The Performance Fee is a fee of 30% of the money earned from Borrower's position, and this money will be deposited into the project's Treasury.

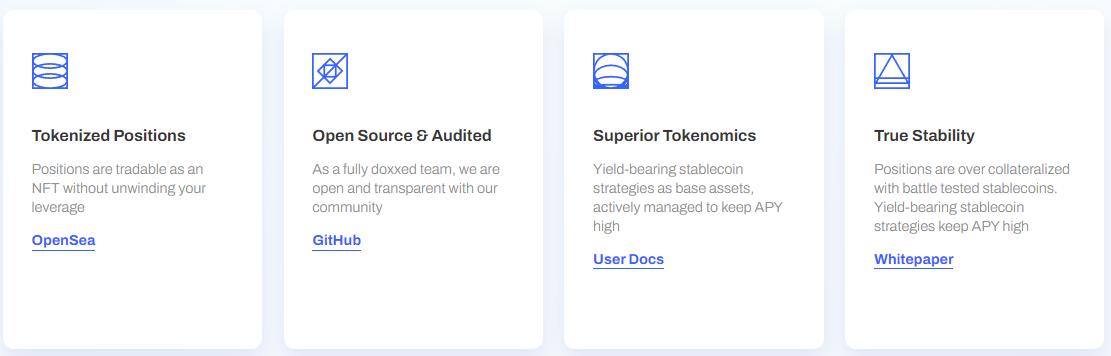

Taking Leverage is a product that allows borrowers to collateralize their assets so that they can borrow a higher value of Stablecoins than collateral thanks to the project's leverage mechanism. Leveraged positions will be encapsulated into an NFT (Non-Fungible Token) and users can make this NFT trade on the NFT Marketplace.

Leveraged positions are packaged into NFT and tradable on the NFT Marketplace, solving the problem of leverage scarcity by allowing users to buy back someone else's leveraged positions. This makes it possible for users to borrow a larger amount than the collateral value. The project is transparent and clear because it is developed with open source code. In addition, the project provides attractive and sustainable APY levels to help liquidity providers earn stable profits.

Here are the detailed steps to make Borrower (borrower) mortgage 1000 OUSD and use leverage x10 to borrow 10,000 OUSD through leveraged platform:

Step 1: Lender (Lender) provides liquidity to Pool 3CRV/lvUSD on Curve.fi including USDT, USDC and DAI and receive ARCH with APY from 0.3% to 6.7%.

Step 2: Borrower collateralizes 1000 OUSD and uses leverage x10 to generate 9000 lvUSD.

Step 3: Borrower automatically swaps 9000 lvUSD at Pool 3CRV/lvUSD to get out 9000 USDT or USDC or DAI.

Step 4: Borrower continues to automatically swap 9000 USDT or USDC or DAI at Curve.fi to receive 9000 OUSD, with a total value of up to 10,000 OUSD.

Q1 2023:

Q2 2023:

Q3 2023:

OZ Rabinovitch is the founder and CEO of the company. He graduated with a Master of Business Administration from MIT in 2017 and previously had more than 3 years of experience as a Director at CBRE - a global real estate consulting firm with more than 10,000 employees.

Tomer Mayara is the founder and CTO of the company. He graduated with a master's degree in business administration from MIT University in 2015 and has extensive experience in the field of technology, having worked as a Freelancer in software development since 2007. Before joining Archimedes, he had more than 3 years. product management experience at Okta – a unicorn in the field of software development in the US.

Archimedes' total raised capital is $7.3 million after two rounds of funding.

In the Pre-seed Round, Archimedes raised US$2.4 million led by Shima Capital, with participation from Hack VC, NFR Ventures, BitScale, Kesha Ventures and several strategic investors such as Origin Protocol , Halborn and Simplex.

In the Seed Round, Archimedes raised US$4.9 million led by Hack VC, with participation from Uncorrelated Ventures, Psalion, Truffle Ventures, Cogitent Ventures, Haven VC, Palsar and several other investors.

Archimedes uses 2 tokens:

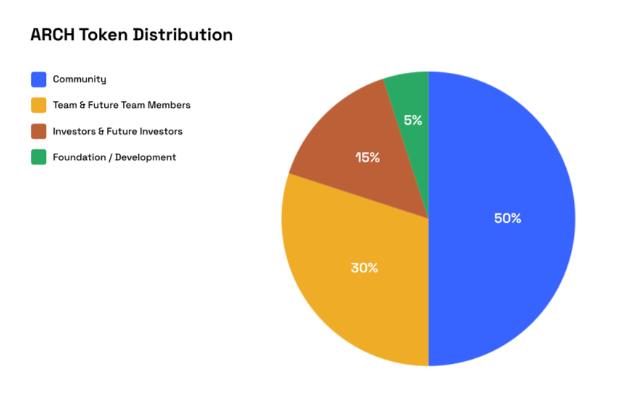

ARCH: The project's governance token.

lvUSD: The project stablecoin is worth 1 USD.

The project's token distribution is done as follows:

ARCH has three main uses as follows:

Archimedes is a new project with a unique idea and they have successfully raised capital up to 7.3 million USD. This shows that the project is worth paying attention to in the future, especially with a project on lending and borrowing.

However, the project currently has many limitations in Tokenomics design and the question is whether the project can retain liquidity providers. Moreover, whether the project can attract enough borrowers is also a challenge for Archimedes. You can see more information about this project on the following social platforms:

Website | Twitter | Discord | Medium

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.