What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

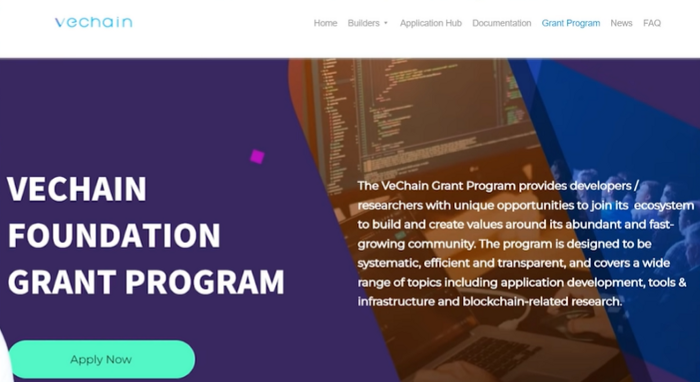

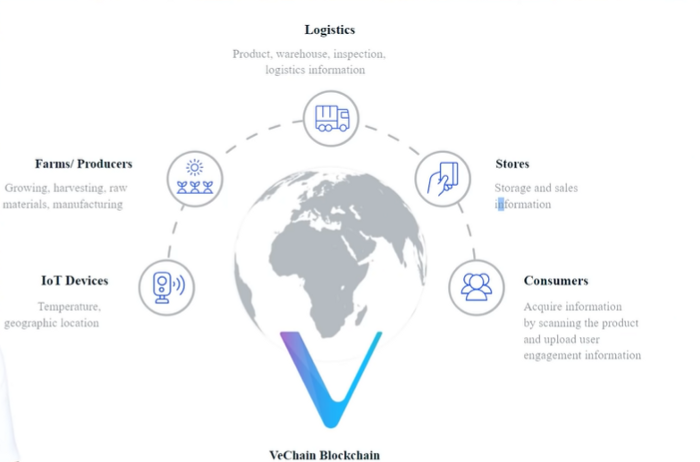

The supply chain industry has been struggling since the COVID-19 pandemic heated up. It is noteworthy that the recent conflict between Russia and Ukraine could bring this industry to the edge of the "abyss". Against this backdrop, supply chain solutions are more important than ever. And when it comes to Crypto, the dominant supply chain project in the field is VeChain.

In this article, TraderH4 team will briefly explain VeChain. At the same time help readers update some of the most important information of the project. From there, readers can assess the potential of this project, as well as answer the question "Should I invest in the VeChain project?".

VeChain is a blockchain designed to simplify the supply chain management process. The project was originally built as a solution to determine whether a product is genuine or fake, helping to prevent plagiarism.

VeChain was founded in 2015 by electrical engineer Sunny Lu of VeChain Tech – a software company based in China. The development of VeChain is coordinated by VeChain Fund – a non-profit organization based in Singapore.

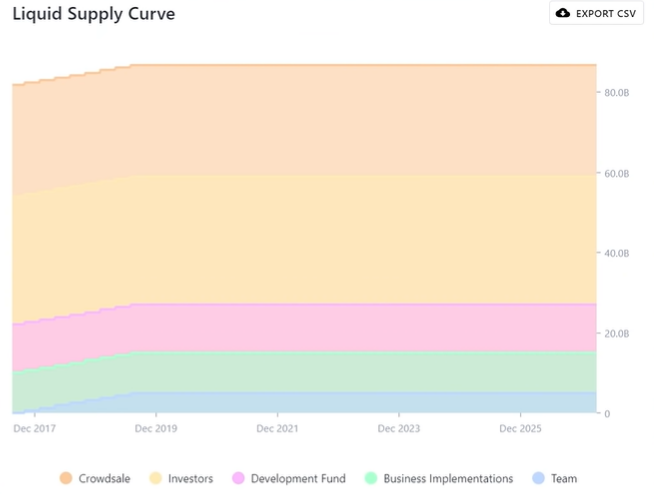

VeChain raised $20 million in an ICO in 2017 and its mainnet went live in summer 2018. VeChain's blockchain is called VeChainThor, and it's also a fork of the Ethereum blockchain . , but with the goal of optimizing for solutions in the supply chain industry.

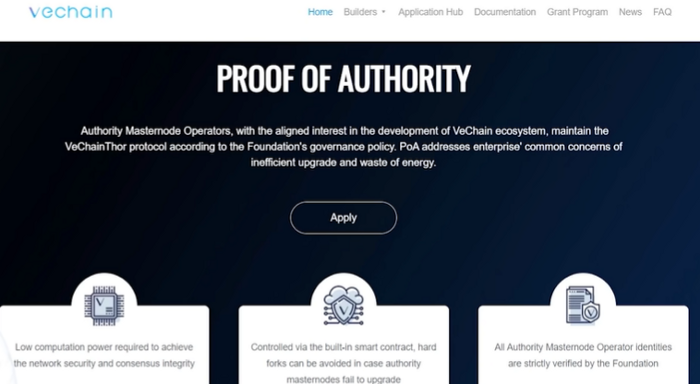

In contrast to Ethereum, VeChain does not use Proof of Work (PoW) or Proof of Stake (PoS). Instead, it uses a consensus algorithm called Proof of Authority created by Ethereum co-founder and Polkadot founder Gavin Wood.

Maybe you are interested : Difference of Proof of Work (PoW) and Proof of Stake (PoS) .

Proof of Authority selects network participants to create a block based on their own reputation.

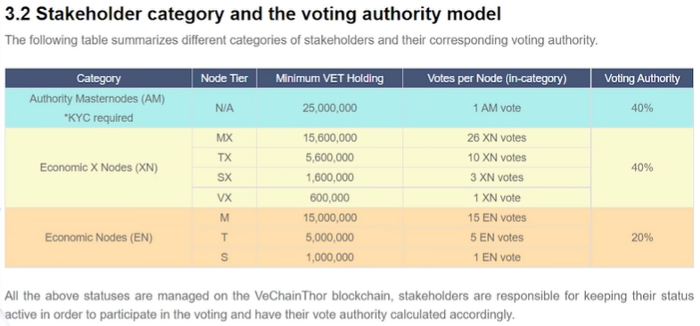

VeChain currently has 101 authority nodes, which process all transactions on its blockchain, and any potential authority nodes must register and be approved by the VeChain Foundation.

In addition, the authorized nodes must have a minimum of 25 million VET to staking and participate in the governance system. The maximum supply of VET is 86.7 billion VET.

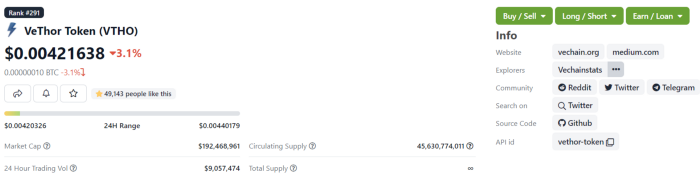

When staking VET and processing transactions, authoritative nodes will earn VTHO. This token is used to pay transaction fees on VeChain.

VTHO does not have a maximum supply and its inflation schedule is periodically adjusted by the VeChain Foundation with the consent of the stakeholders. In which, 70% of VTHO obtained from the payment of transaction fees were burned.

To ensure that VeChain is not too centralized, most of the voting rights for any changes to VeChain will be held by economic nodes (Economics nodes) and X nodes. These nodes do not process transactions but can also earn VTHO from staking VET.

This setup allows VeChain to process around 10,000 transactions per second. However, in reality, VeChain leverages the Ethereum virtual machine whose TPS is capped at around 300 transactions per second.

VeChain currently has around 70 decentralized applications, which can be accessed through the VeChain Sync wallet. To ensure that the VeChainThor blockchain is not too cumbersome, all decentralized applications and tokens are approved by VET holders and the VeChain Foundation.

VeChain has established many partnerships with subsidiaries of Chinese multinational corporations including Walmart, Buyer, PricewaterhouseCoopers (PwC).

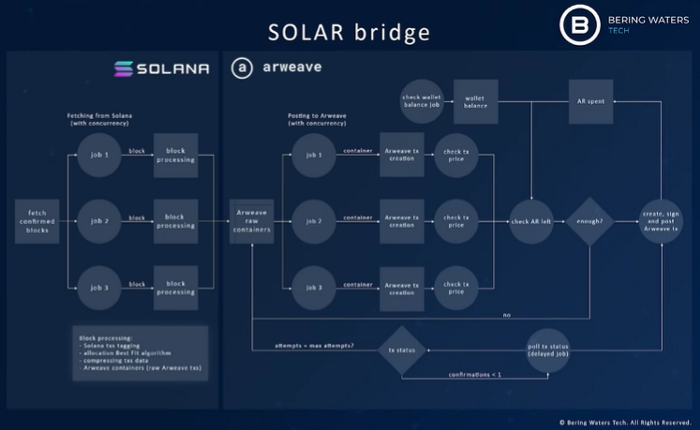

In April 2021, the VeChain Foundation launched a $1 million grant program to encourage the adoption of VeChain businesses in the field of NFT or eNFT for short.

In June 2021, VeChain partnered with a hospital in China to monitor the process of in vitro fertilization.

A month later (July 2021), VeChain partnered with the Greater San Marino Republic to develop a blockchain-based pandemic health passport using VeChain's eNFT.

Interestingly, Sunny Lu explained in a presentation that VeChain's pandemic health passport actually offers more privacy than passports provided by the European Government. He also alleges that the passports issued by the European Government are in violation of European data protection laws and that they are using the pandemic as an excuse to do so.

In August 2021, VeChain released a tool to help Chinese companies track their carbon footprint. From there, these companies can adjust to match China's 2060 carbon reduction target.

In September 2021, the China branch of PricewaterhouseCoopers unveiled a tool called Air Trace, which uses VeChainThor to monitor air quality in Chinese cities.

A report published in September 2021 also shows that VeChainThor is one of the most eco-friendly blockchains in the cryptocurrency market.

In November 2021, the VeChain Foundation pushed the project forward in a sustainable way by hiring a former CTO of accounting firm Deloitte to lead a new division focused on achieving the sustainability goals. sustainability of the United Nations.

VeChain has also completed the much-anticipated Proof of Authority 2.0 upgrade and it consists of two main components.

Vexchange is the first decentralized exchange (DEX) to be deployed on VeChain in November 2021. Its TVL currently has a total value of about 20 million USD. While not much, VeChain's focus is not on DeFi.

In December 2021, VeChain partnered with the Government of Inner Mongolia to track and trace agricultural products.

In January 2021, VeChain launched stablecoin VeUSD in conjunction with a US-based regulated Fintech startup, named Stently.

VeUSD is a centralized stablecoin like Circle's USDC or Paxos' USDP. This means that every VeUSD circulating in the market is backed by USD in a bank linked to Stably.

Grayscale also revealed that they are looking at creating trusts for 25 cryptocurrencies including VET. This shows that the US has a high demand for VET.

In February 2022, VeChain Fund established a new headquarters in the Great Peaceful Republic of San Marino. They will work with the Government there to achieve the mission of making San Marino the first country to be carbon-free in conjunction with the United Nations' sustainable development goals.

Shortly after, VeChain unveiled an upcoming platform called VeCarbon, which helps track the carbon emissions of both individuals and organizations. And eventually it will enable trading and carbon emissions. As far as TraderH4 finds out, VeCarbon has not been released yet.

In March 2022, the mining portal for VeChain's stablecoin VeUSD was opened to the public, allowing anyone to mint or exchange VeUSD into USD.

According to VeChain statistics, about 5 million VeUSD has been minted so far. This growth can be driven by the minting incentive policies provided by the VeChain Foundation.

Billionaire venture capitalist Tim Draper also partnered with VeChain to launch the VeChain Web 3.0 accelerator program in association with Draper University - an educational business of Tim.

The interesting fact is that Tim is actually one of the richest Crypto investors today. He had much of his early success investing heavily in the Chinese stock market, when it was just getting started.

With the downturn happening in the market at the moment, VET also has to suffer serious effects. However, before that, China cracked down on Crypto mining and the Chinese Government's decision to control the industry caused VET to plunge after setting ATH levels.

This is bad news for VeChain as China is where the project establishes most of its partnerships. It is also where the headquarters of the software company behind VeChain is located.

At the time of writing, the VET price is not very impressive as it has dropped 88.47% from the time it reached the ATH of $0.278 to $0.032.

However, VeChain like many blockchain projects in China has expanded its presence in other countries. The new headquarters of VeChain is located in Europe, the idea is supported by VeChain Fund and stablecoin partner VeUSD.

However, adoption of VeChain is unlikely to increase demand for VET, because it is only used for staking and governance. Of these two fundamental demand drivers, staking is perhaps the most dominant. However, the minimum staking amount to become an economic node or X node to earn a large amount of VTHO is quite large and not everyone can afford to pay.

On the other hand, VET staking can be done through selected third-party wallets and exchanges. However, the rewards received through third-party wallets and exchanges are very low, such as the Exodus wallet which only offers about 1% per year.

This opens up a lot of speculation about bullish momentum driven by another VET demand. These speculations stem from the low price of VET and the belief that the price of VET can reach 1 USD.

However, there are very few exchanges in the United States that support VET trading and this means that residents do not have as much access to VET as other crypto assets. As TraderH4 has mentioned many times before, the growth of a crypto asset is not because of its low price, but how far the market capitalization can grow. At the time of writing, VET has an average market capitalization of around $2.05 billion and holds the 32nd position in the Crypto market.

Another good news is that the VeChain Foundation team and investors didn't sell VET as much as people thought. We can easily explain that, VET has no selling pressure because the price of VET has not grown much compared to its ICO price.

However, there are still cases where small and medium investors have sold their VET as the coin's circulating supply has increased by nearly $2 billion compared to last year.

According to data recorded on CoinGecko, the supply of VET has not increased significantly in the past year. However, with blockchain companies being banned from operating in China, it seems to have forced them to sell VET. This may also be the reason why the VET price has dropped so sharply.

Same for VET, VTHO doesn't seem to have a long-term uptrend and has also set a low last year.

As mentioned earlier, VTHO is used to pay transaction fees on VeChain and 70% of transaction fees on VeChain are used for burning.

VeChain statistics show that VeChain is seeing a sharp drop in the number of daily transactions, only half of what it was a year ago.

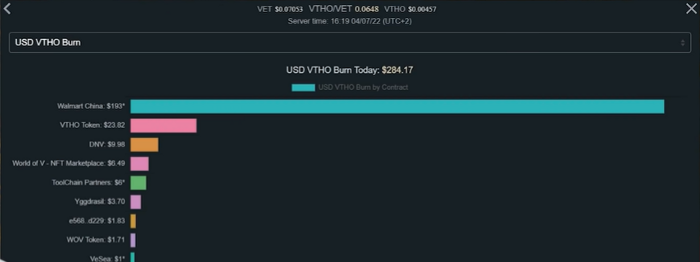

VTHO burning is falling deeply and this means that VeChainThor transactions are decreasing. As we all know, half of the demand for VeChainThor seems to come from Walmart in China, but this demand is not high, it's only a few hundred USD per day.

On the other hand, the circulating supply of VTHO has increased by almost 30% compared to last year. This helps the TraderH4 team confirm more firmly that the drop of VTHO is due to selling pressure from nodes on VeChain.

Whether VET and VTHO can reverse their downtrend will depend on upcoming VeChain milestones.

Although VeChain has no official roadmap, upcoming milestones can be found in interviews and exchanges with the VeChain team, mainly VeChain founder Sunny Lu.

In an AMM on Reddit in April 2021, Sunny Lu pointed out that VeChain is looking to establish partnerships in Western countries and so far this seems to be going according to plan.

In a video celebrating VeChain's third year in June 2021, VeChain's developers said that they are working to solve the problems of storing transaction history on VeChainThor. It is important to point out that this is a problem that almost every blockchain platform is facing, especially high TPS blockchains like VeChain.

This means that it is very likely that VeChain will soon adopt a decentralized storage solution. This is what Solana did when she decided to store data on Arweave.

Another VeChain developer says that they are working on cross-chain solutions. But he did not reveal which chains they are looking to connect to or when these bridges will be completed.

In various interviews in the second half of last year, Sunny Lu made it clear that VeChain has officially shifted its focus from supply chain management to sustainable development. Specifically, the sustainable development goals of the Chinese Government and the United Nations.

In a recent interview with another Crypto YouTuber called Thinking Crypto, Sunny Lu pointed out three things VeChain is looking to do in the short to medium term as part of its new niche.

The first business goal is to build a strong team in Europe so that VeChain's environmental ideas can be extended to other countries if they succeed in San Marino.

The second initiative is ongoing and that is VeChain's sponsorship program. Sunny Lu hopes to attract developers interested in making VeChain's new vision a reality.

The third goal is coming up with a series of VeChain accelerators organized by Draper University in the USA.

Most of VeChain's concerns relate to the pressure of China's Crypto crackdown. However, VeChain has solved the difficult task of balancing the wants and needs of international institutions, Western investors, and the Chinese Government.

VeChain clearly has close ties to Chinese companies and this means that the project will likely find it difficult to gain acceptance in Western countries. Especially when some of them are starting to accuse China of being complicit in Russia's invasion of Ukraine and are even threatening sanctions.

It seems that VeChain's goal of sustainable development is how the project overcomes these difficulties. Governments in the West are desperate to reduce carbon emissions in line with the United Nations' sustainable development goals. And the Chinese government has big plans of its own in that regard.

It is these issues that have helped VeChain receive more attention when it has solutions to control and reduce carbon emissions. The project is also creating a kind of carbon credit score for both individuals and institutions.

This system will not only reward individuals and organizations for acting in line with the UN's sustainable development goals, but will also punish them if they do anything inconsistent with the goals. This.

Sunny indicated that this would involve the quote “Digitalizing all acts” and the quote “Send a report to the authorities”. He also added that this plan will be up to governments in Western countries to decide what is encouraged and what is not.

Overall, VeChain has proven that they are willing and able to change everything to adapt to the difficulties it is facing. So far, VeChain has achieved many successes in changing focus.

VeChain grants and Draper University accelerator program will help VeChain overcome the current difficulties with this project. New use cases will be created to drive enough demand for VET and VTHO. From there, they will drive these two assets to new ATH levels.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.