What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Acala is a Polkadot DeFi platform that provides modular financial services and comes with a liquidity hub specifically designed to support Polkadot DeFi. It brings borrowing, lending and stablecoin functionality to the broader Polkadot ecosystem.

Acala is a comprehensive decentralized finance (DeFi) platform based on Web 3.0. Since the Acala network is the first DeFi protocol launched with Polkadot parachain auctions , it is considered the Polkadot DeFi hub. Compatible with the Ethereum virtual machine, developers can easily migrate their projects from Ethereum to the Acala network. This means it has the potential to become the DeFi hub for practically all cryptocurrencies.

The Acala network uses a dual token system, consisting of a governance token called ACA and a native decentralized stablecoin called aUSD. The ACA token is also used to pay for any transaction fees. Along with ACA, there is a range of additional tokens that are allowed to pay transaction fees on the Acala network.

Founded by the Acala Foundation, Acala is essentially an intensive collaboration between two teams developed with Polkadot DeFi, called Polkawallet and Laminar. The Foundation has been trying to develop the DeFi market on different blockchains connected by the Relay Chain. To this end, the Acala network was created as a community-owned and operated financial layer, using Polkadot's Substrate framework. While Acala includes financial application features, their main area of focus is on improving development capabilities and interoperability initiatives.

Development on the Acala network first started in 2019 when the Web3 Foundation provided Acala with a development grant. Since that time, the Acala network has received additional funding from crypto investment firms Pantera Capital and Polychain Capital. These private funds raised over US$8 million in August 2020, and the Acala network is officially launched on Polkadot by the end of 2021.

The Acala network offers a decentralized exchange (DEX), a liquid staking protocol, and a stablecoin, making it a full-fledged crypto project, part of the Polkadot DeFi initiative. Since the Acala network is fully EVM-compatible, it has a lot of benefits for Acala crypto investors.

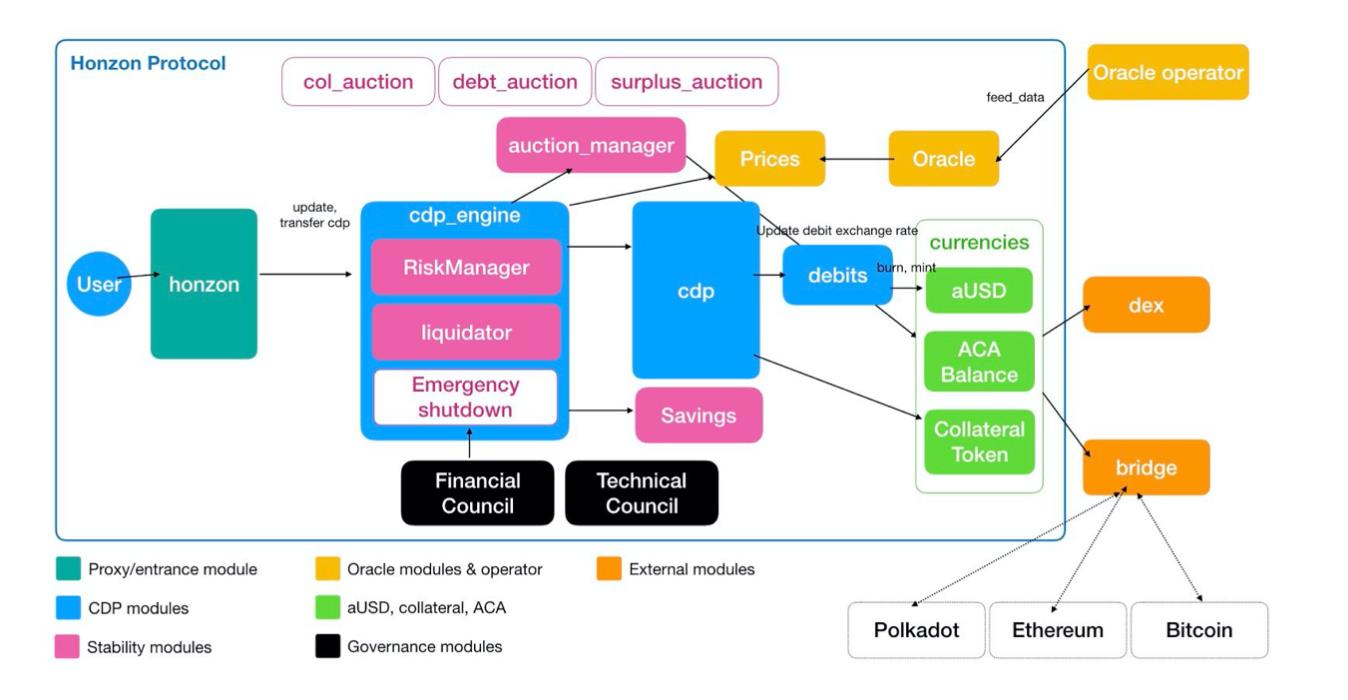

Using this platform, you will gain access to DApps, crypto assets, and DOT-based derivatives. Currently, the Acala network consists of three parts: AcalaSwap, Honzon, and Homa.

AcalaSwap is an automated market maker (AMM) based on a standard swap interface that gives you the ability to trade various crypto assets in liquidity pools. Any liquidity provider can earn fees for placing Acala crypto in pools. While the Acala DEX uses a very familiar structure, it is not necessary to completely change things when it comes to decentralized trading.

On the other hand, a new feature made possible through the Acala DEX network is the ability to trade natively between different cryptocurrencies, on any blockchain connected to Polkadot. Note that both Polkadot and Kusama have been widely adopted. In fact, popular projects announce that they want to join Polkadot via parachains on a regular basis. Therefore, it is believed that the amount of cross-chain liquidity available through Acala DEX will always hold.

One notable difference between the Acala network DEX and all other Ethereum-based DEX platforms is that the Acala DEX is much more affordable to use. Polkadot is known as a high-throughput blockchain that allows for small gas fees. These fees can be paid in Acala cryptocurrency and many additional cryptocurrencies.

Honzon is the stablecoin protocol used with the Acala cryptocurrency network. Acala has leveraged its reputation as a cross-chain interoperable network by developing its own stablecoin aUSD, a mathematical stablecoin pegged 1:1 to USD. However, it is also fully backed by other crypto collaterals.

The aUSD stablecoin platform, powered by the Honzon protocol, was created to mine stablecoins whenever these coins are deposited by crypto users as collateral. At the launch of this protocol, stablecoin platform aUSD was able to accept ETH, BTC, and DOT as collateral. It is believed that additional currencies will eventually be supported by parachains.

aUSD stablecoin is easy to understand. Once collateral from Acala (or many other currencies) is deposited, aUSD is officially minted, then you can open a collateralized position. Taking this position means that you owe money directly to the protocol, which must be repaid along with a certain amount of interest at a later date.

Once you have repaid your collateralized position, the previously mentioned protocol will burn the same amount of stablecoin aUSD, which reduces the number of stablecoin aUSD currently in circulation. This process allows stablecoin aUSD to maintain its USD rate. If you are considering investing in stablecoin aUSD, it is important to know that Honzon comes with enhanced stability and security.

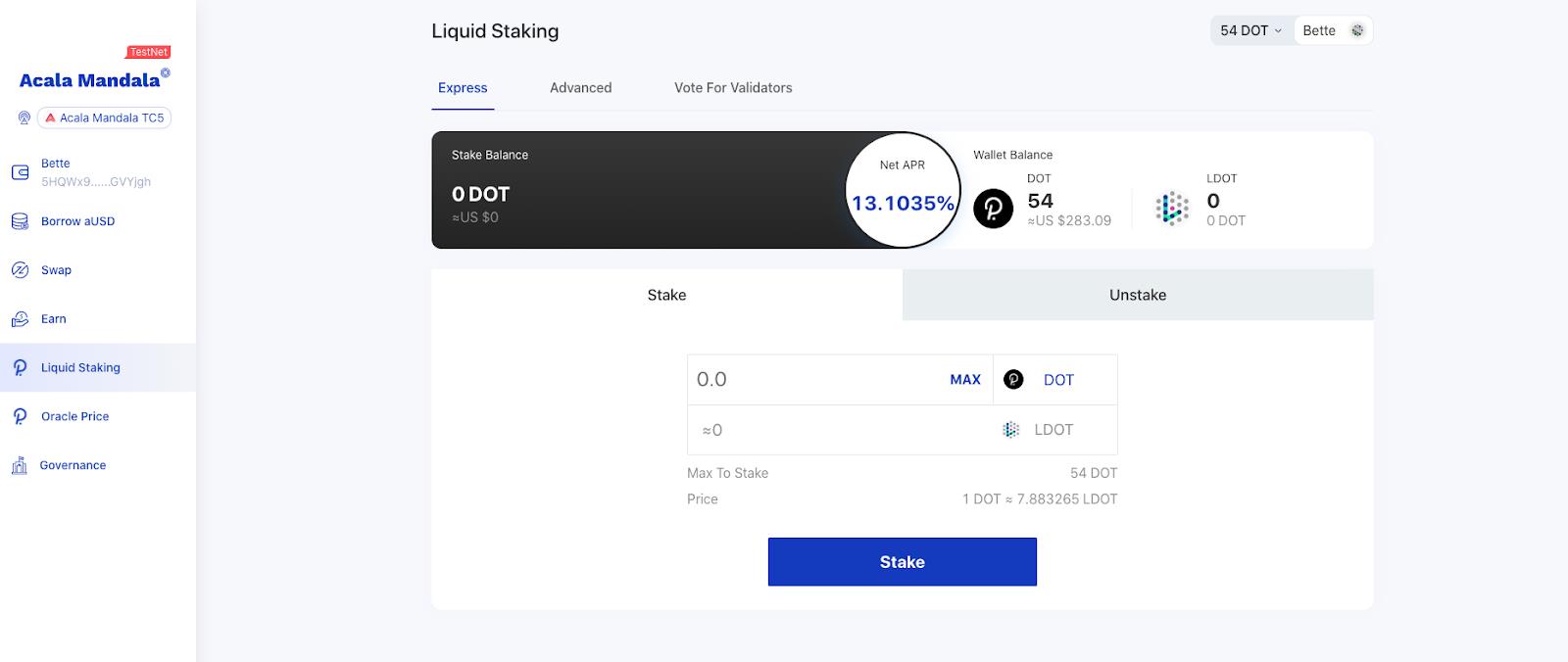

The Polkadot DeFi ecosystem is focused on bonding assets. “Bonding” involves a process similar to staking. During bonding, your tokens are locked with a smart contract for a certain amount of utility. In return you will receive interest.

Before the development of decentralized finance, it was difficult to find platforms that used staking assets. Once these assets exist, they cannot be used for liquidity. Now that staked derivatives have been created, crypto platforms can access staked liquidity.

The Acala Network takes it a step further by providing DOT LDOT holders through the Homa protocol. Also known as Liquid DOT, LDOT is a token used to represent your staked liquidity. Your LDOT may be removed from the Homa protocol before being used as collateral USD stablecoin through Honzon.

Acala provides developers, projects and investors with loans from the DOT community with the ability to pool their entire crypto capital without staking DOT directly in the market. The protocol is designed this way to solve the liquidity issues that come with staked DOT.

While Acala hasn't necessarily revolutionized DeFi, it has some unique aspects that distinguish it from other DeFi hubs. First of all, the Acala cryptocurrency network is focused on collaboration through its cross-chain DeFi infrastructure, which benefits the entire industry. Investors can borrow and mortgage entirely with cryptocurrencies from other blockchains. You can also use AMM to swap cryptocurrencies without having to wrap them first, which simplifies the whole process.

If you have invested in the Polkadot platform before, then the Acala cryptocurrency network has essentially facilitated the Polkadot DeFi platform. The most modern and advanced DeFi features are supported with Acala. If you hold the Acala token, you have the ability to get a passive profit with it specifically. The profit you get is based on the amount of tokens staking. All your staking rewards are paid in ACA.

Despite the rich security features of Acala, as well as that of the entire Polkadot DeFi platform, an Acala DeFi hack occurred on August 14, 2022, which resulted in the mining of a large portion of the stablecoin aUSD. In turn, aUSD lost about 99% of its value, which is why the Acala DeFi hack is among the most serious crypto attacks that have occurred in years. The mining activity experienced by the Acala network was so intense that the price of one USD actually dropped to 0. Previously, it was pegged 1:1 to the US dollar.

The development team at Acala quickly determined that the Acala DeFi hack was caused by a misconfiguration of the aUSD/iBTC liquidity pool, which had been active just before that day. This incident resulted in a minting error with a sizable amount of aUSD. A hacker involved in the Acala DeFi hack was able to make about US$1.28 billion in one USD, which was exchanged for a much smaller amount of ACA.

Shortly after the Acala DeFi hack began, Acala put the parachain into maintenance mode, which halted all swaps. Oracle's price feed and cross-chain transactions were also halted, resulting in the hacker actually being stuck with $1.28 billion in worthless aUSD tokens.

Some additional users mimicked the original hack to earn between US$25,000 and US$80 million in one USD. The total amount stolen was less than US$10 million excluding the aUSD dependency. After the Acala DeFi hack, many crypto investors began to question the viability of the Acala network.

Since the Acala network breach in mid-August, the team has been trying to recover about 3 billion aUSD to help push the value closer to the 1:1 USD peg. In the second follow-up, after the Acala DeFi hack, they were able to recover about 1.68 billion aUSD. The first trace allows the recovery of 1.29 billion aUSD. Additional tracking reports are expected in the coming weeks, which may reduce the severity of the Acala DeFi hack.

While the Acala DeFi hack was severe, the Acala team was able to quickly freeze all services, which effectively mitigated the impact caused by the hack. Approximately 16 separate users who contributed to the aUSD liquidity pool received the aUSD coins minted during the Acala DeFi hack. While aUSD was initially valued at around US$0.01 following the Acala DeFi hack, it is now valued at around US$0.85 due to recent recovery efforts.

As Acala platform token, ACA has been allocated for rewards, strategic investors, Acala team, further development of the ecosystem and a certain amount of reserve. By the end of 2026, more than $800 million in ACA will be distributed. The amount distributed to crowd loan participants, strategic partners and the Acala team will increase over time.

ACA is currently priced at US$0.2 and has a circulating supply of over 508 million tokens. The market capitalization is right around 120 million US dollars. Acala aims to release a more detailed final tracking report on the recent DeFi hack soon, which can be verified by the community using on-chain data. Proposals will then be formed by collateralizing aUSD. The community will be able to make decisions and plan for service restoration.

The Acala DeFi hack immediately damaged the value of aUSD. While the Acala team has taken steps to fix this issue, the extent and severity of the hack means you should take some time to determine if Acala is a good investment for you. your investment portfolio.

Although the hack has been halted, Acala's development roadmap remains ambitious and could eventually help crypto investors gain confidence in the platform. For example, Acala ultimately wants to enable balance transfers and is working to invest more in growing the ecosystem over the next few years.

Before investing, consider focusing on what the Acala team has to say about the additional steps they will take to address the issues caused by the Acala DeFi hack. If they fix these problems, you will be able to invest without worrying too much about your crypto portfolio.

Despite the severity of the Acala DeFi hack, the team at Acala took many steps to recover the minted aUSD and prevent problems caused by this hack. However, some crypto investors still don't trust Acala, saying that the platform is not as decentralized as it was advertised. Whether you choose to invest in stablecoin aUSD or decide to take your crypto assets elsewhere, it is clear that the Acala DeFi hack has caused significant damage to the platform's reputation, as well as its value. aUSD.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.