What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

NFTX is a community owned protocol that allows the creation of NFT-backed ERC-20 tokens. Notably, the NFTX protocol supports the creation and transaction, tracking of hunted NFT collections, such as CryptoPunks .

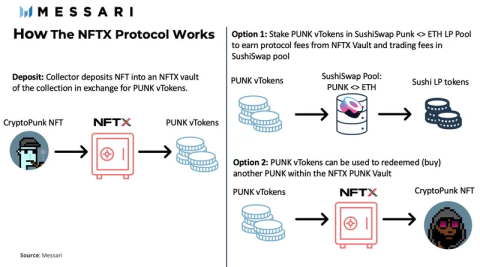

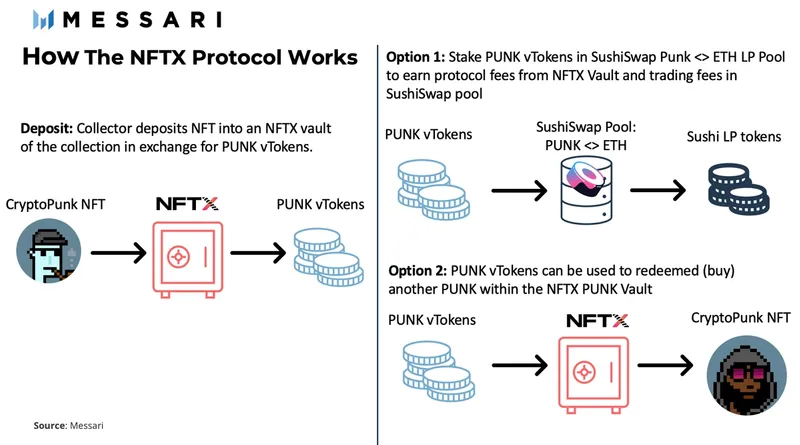

Investors can deposit NFTs into an NFTX vault and receive vTokens representing the value of that NFT. Investors can then use their vTokens to purchase any asset from the NFTX vault. Alternatively, they can redeem a specific token in the same vault by paying an additional fee.

The design of the NFTX protocol offers certain benefits to the stakeholders, such as profiting from idle assets and an abundant source of liquidity.

To earn fees from transactions contained in the vault, investors must stake their vToken in the respective liquidity pool. Every time an individual buys or swaps an NFT, vToken stakingers earn a fee from the respective vault. In addition, those who stake LP into the SushiSwap pool can also receive transaction fees for their assets.

NFTX's model is designed to provide liquidity to NFTs through vToken. Users can get instant liquidity when trading the NFTs contained in the respective vault.

For example, BAYC holders can instantly deposit their NFT Bored Ape Yacht Club into the NFTX vault for BAYC vTokens. However, instead of staking BAYC vToken, holders can sell that token on a decentralized exchange, such as SushiSwap.

As such, if liquidity is poor, NFT holders will likely have to sell their NFTs at a lower price on NFT exchanges (like OpenSea). However, that problem was solved with the advent of the NFTX protocol.

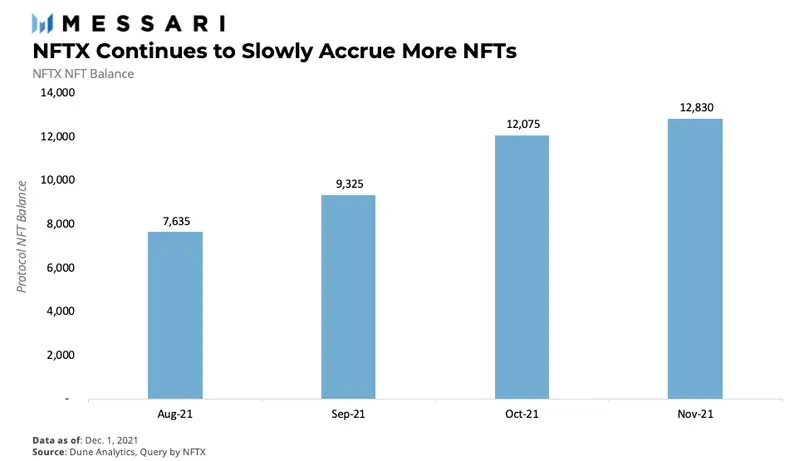

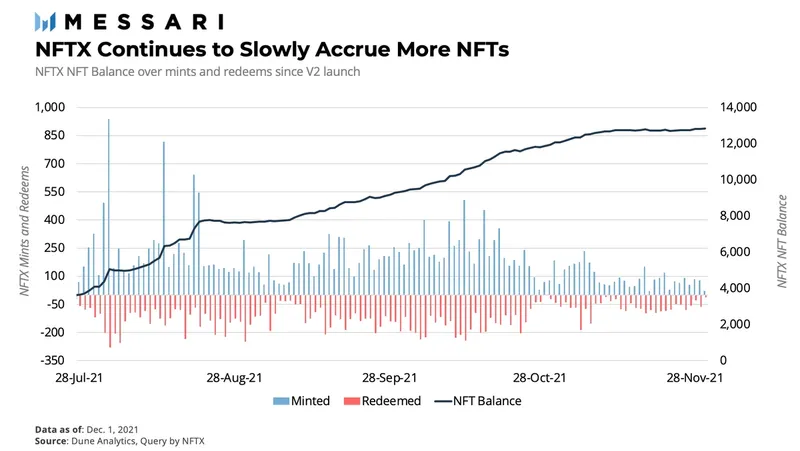

NFTX's V2 upgrade at the end of June has had some success and continues to increase liquidity from deposits into the protocol. In just a few months, NFTX has attracted a large number of high-value NFTs deposited into the best liquidity vaults, mainly including CryptoPunks, Hashmasks.

The number of NFTs in the NFTX protocol reached 12,830 in November 2021, representing an increase of about 6.25%. The development of NFT in the NFTX protocol will help increase the amount of liquidity in vaults.

On the other hand, the number of NFTs in NFTX has steadily increased in the last months of 2021. In particular, during November 2021 there were very few days where the net amount of NFTs deposited into the vault was negative.

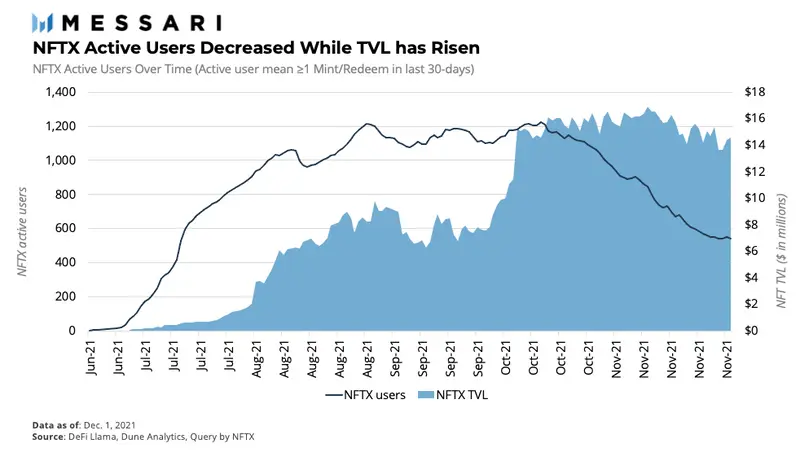

The total locked value (TVL) of NFTX peaked in early November 2021 and the days after that TVL was relatively stable at more than 14 million USD. Notably, the time TVL peaked was also the time when the number of active users decreased. This means that active users tend to contribute higher value NFTs.

NFTX improved its fee structure when it launched version V2. Under the new structure, fees can be customized per vault, with defaults as follows:

The cost difference between random NFT acquisitions and specific NFTs is because the protocol wants to incentivize users to buy NFTs in a more random way. This prevents other NFT collections from being undervalued in the absence of demand.

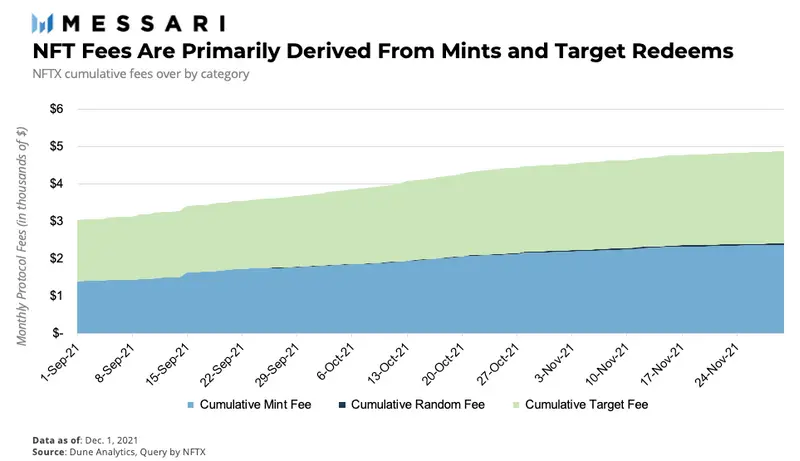

To date, NFTX vault miners have raised nearly US$5 million with most of the fees coming from NFT minting and NFT redemption in the vault. However, there is very little revenue generated from random NFT swaps. This shows that individuals primarily want to choose their favorite NFT from a given NFT vault.

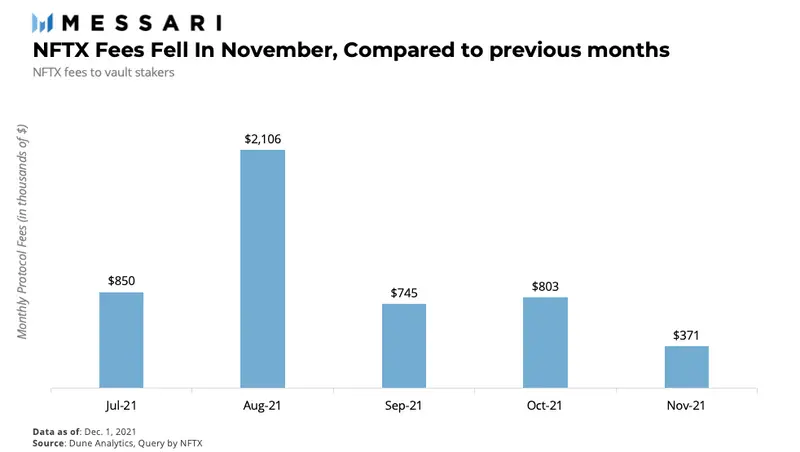

From June 2021 to October 2021, the vault operator's revenue was relatively stable, with over $700,000 in revenue. However, the sell-off in the NFT market failed to generate much revenue for vault operators throughout November 2021.

Notably, all fees from NFTX vaults are accrued to vault makers, rather than NFTX token holders. It is not necessary for the NFTX protocol to collect fees, instead NFT accumulation and liquidity are important short-term goals.

In other networks, it is common to use liquidity on NFT20 and NFTX to provide instant liquidity to the NFT and ensure smooth NFT transactions. This allows investors to easily buy multiple NFTs at once. And existing NFT liquidity protocols like NFTX could attract new protocols that want to take advantage of the platform's existing features.

Furthermore, NFTX has also partnered with Futureswap to provide a perpetual source of liquidity, allowing speculators to own short or long-term derivatives of NFT-representative assets in the NFTX vault.

Although, NFT products still have many limitations, there is no denying the potential to generate a lot of profit for NFT speculators. Thereby enriching the liquidity source and the ability to explore the potential of NFT products.

The floor price is the lowest or minimum value that an asset in the NFT collection sells on the exchange. Among collections like CryptoPunks or BAYC, floor prices are often set according to the assets with the least rarity in the collection.

Protocols such as NFTX and NFT20 automatically create pools that require inclusion of low to high rarity NFTs in the collection. Because a user can send a more valuable NFT and someone else can buy that NFT or replace it with a less valuable NFT.

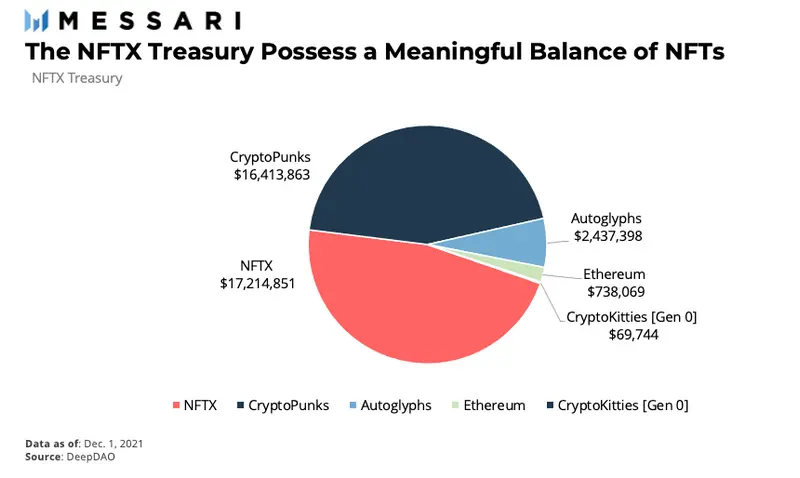

The NFTX protocol will be governed by the NFTX DAO. Interestingly, the NFTX DAO purchased high value NFTs including CryptoPunks and Autoglyphs, most of which the DAO allocated to NFTX vaults.

In addition, NFTX also owns a large amount of Sushi LP (SLP) tokens worth $25 million, including pools such as NFTX-ETH and NFT-SLP from NFTX vaults.

As such, the asset value of the NFTX DAO has reached US$60 million as of December 9, 2021, while the protocol maintains a fully diluted valuation of US$55 million.

The NFTX DAO has also begun issuing proposals to leverage the funds to launch new services and growth incentive programs.

On the other hand, NFTX passed a vote in November 2021 to operate a Graph Node to provide a consistent index. As the NFTX market is currently using The Graph to query data to provide a consistent user interface.

Furthermore, NFTX also plans to index and operate subgraphs for SushiSwap, EIP721, EIP1155 with the goal of generating revenue for the NFTX DAO. Proceeds from the sale of an existing portion of xSUSHI of the NFTX DAO to purchase services of The Graph.

NFT is still a puzzle piece that receives a lot of attention from investors because this market has a lot of potential waiting for them to explore. NFTX is not only a liquidity support solution for NFT products, but also creates a platform to help many people earn money by providing liquidity with the NFT assets they collect.

NFTX's success will depend on a number of factors, such as how it improves liquidity in the NFT market, expands integration with other protocols, and innovates other competing protocols, to release new market liquidity models.

Above are the basics of NFTX – a protocol that provides liquidity for NFT assets. Hopefully through the above article, readers can get a better overview of this important piece in the NFT market. From there, you can look for opportunities to generate profits for yourself.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.