What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

What is FTX exchange?

FTX is one of the most popular exchanges in the Crypto market, built and developed by the investment fund Alameda Research . The birth of the FTX exchange helps to solve the problems that the futures exchange is facing, such as: The transaction processing system is overloaded when there are many transactions at the same time, the liquidity poor accounts, less diversified asset portfolio.

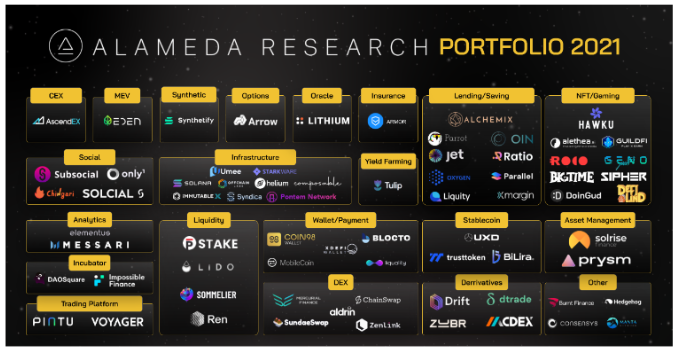

Alameda Research is a crypto hedge fund and an important market maker on the FTX exchange. Within 1 year of its launch, Alameda Research's FTX exchange has reached a trading volume of up to 1 billion USD per day.

This is an exchange that has made a name in the Crypto market thanks to the addition of new features such as fractionalized stocks, large leverage, prediction markets, futures derivatives contracts. …

FTX's goal is to become the leading derivatives exchange for both professional and novice traders. Therefore, from the very beginning, FTX's products often focused on derivative products, instead of the spot market like other exchanges.

Up to now, the futures market on FTX has more than 140 trading pairs, including periodic contracts (Margin) and perpetual contracts (Futures). The futures market is one of the most revenue generating segments for FTX.

Although, on the cryptocurrency market, there are many exchanges that develop derivatives markets, FTX sets itself apart from other exchanges in two ways:

In addition to the derivatives market, the FTX exchange also supports spot trading with more than 50 crypto asset pairs.

IEOs are a way for exchanges that support potential blockchain projects to launch tokens. Currently, most exchanges have this product, it brings benefits to the exchange such as:

In addition, for CEX exchanges that have developed their own ecosystem like Binance on BSC, FTX on Solana, the IEO is also a place to help them develop the ecosystem. Therefore, the majority of IEOs on FTX today are projects on Solana.

This is a form of leveraged token that combines spot trading and margin trading. It makes it possible for us to make high profits in a short time without any risk related to liquidity.

FTX is a pioneer exchange in the development of leveraged tokens. Currently, FTX is also the only one that provides leveraged tokens for many other projects.

Prediction games are organized by FTX as a small event for investors to participate in entertainment and receive attractive rewards. One of the most popular events of FTX is the bet of two US presidents, Donald Trump and Joe Biden.

FTX is the only centralized exchange that offers betting games and many users have made tens of millions of dollars from these simple games.

Not only providing basic products, FTX also has a number of other advanced products. While it does not generate too much revenue, these products represent the diversity of the FTX exchange:

Options Trading: FTX allows users to become options sellers and can set quote, strike price and time…

Stocks are tokenized: FTX listens and understands the needs of investors and understands they want to invest in stocks. Therefore, FTX has tokenized shares on the US stock exchange with the first stock code of Tesla to meet the needs of users. Currently, the FTX exchange supports trading of more than 47 tokenized stocks.

OTC Trading: Alameda Research is a market maker, providing liquidity for FTX. Therefore, OTC activity on FTX is also very active and generates a lot of revenue for FTX.

The financial market in the United States has always been a place that many financial institutions and companies aspire to touch. During its development journey, FTX has expanded into the financial market in the US, however, FTX US has a relatively low trading volume, only ~2% compared to FTX exchange.

On the other hand, not only FTX but many other centralized exchanges also want to touch this market. Because, expanding the market to the US will help financial companies have a clearer and more transparent legal basis. At the same time, help them reach a large customer and organization file in this country.

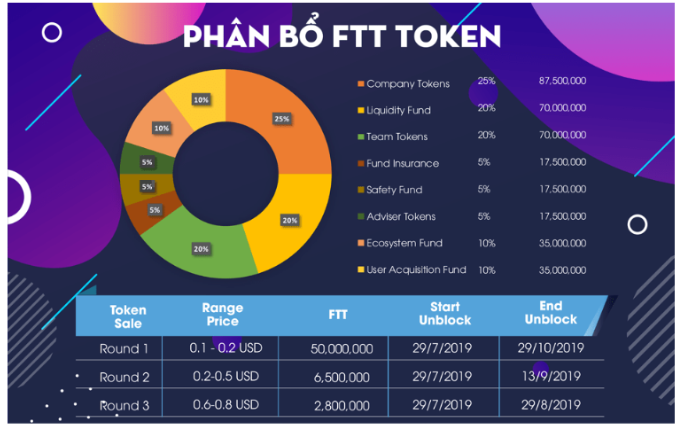

FTT (FTX Token) is a native token of the FTX exchange as a utility token. FTT is an ERC-20 standard token built on top of the Ethereum blockchain. It is used as a means of payment for services and transaction fees on the FTX exchange.

All FTX products will serve the purpose of generating revenue for the exchange. After that, a portion of the revenue will be put into the FTT.

Similar to other CEX exchanges, FTT's Tokenomics model design will also have a token burning mechanism. FTX will use a portion of the revenue to buy back FTT and burn it periodically with the goal of creating value for the native token and reducing the circulating supply of FTT outside the market. Currently, the revenue used to buy back FTT will come from 3 sources:

In addition to buying back and burning tokens, FTT has many other use cases, creating the need to buy FTT, specifically as follows:

FTT is the native token of the FTX exchange and it is widely applied in the ecosystem of the FTX exchange, specifically:

FTT will be distributed into 8 parts with the following ratio:

The FTT release schedule is shown in detail in the illustration below.

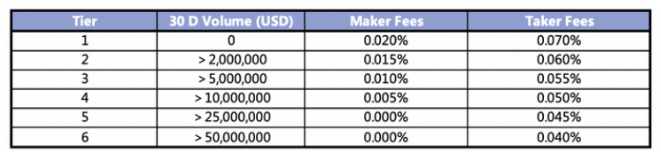

FTT is an ERC-20 standard token built on Ethereum. Therefore, when transferring FTT, you pay a fee to Ethereum miners.

In addition, when trading on FTX or any other exchange, you need to pay an additional transaction fee for that exchange, specifically as follows:

FTX exchange was founded by two main members, Sam Bankman-Fried and Gary Wang.

Sam Bankman-Fried is currently the CEO and Founder of the project. He used to work for Jane Street - a company specializing in transactions with a transaction volume of up to trillions of dollars on Wall Street. At the end of 2017, Sam founded the crypto exchange and investment fund Alameda Research.

Alameda Research is one of the largest cryptocurrency investment funds in the world. By 2019, FTX was born and behind this exchange is none other than Sam Bankman-Fried and Alameda Research.

Gary Wang used to be a software engineer at Google and was an intern at Facebook. He graduated from MIT - a prestigious American university, with a bachelor's degree in mathematics and computer science.

There are also some other developers such as Constance Wang, Nishad Singh, Can Sun, Dan Friedberg and Jen Chan. They are all experienced developers in programming and data coding.

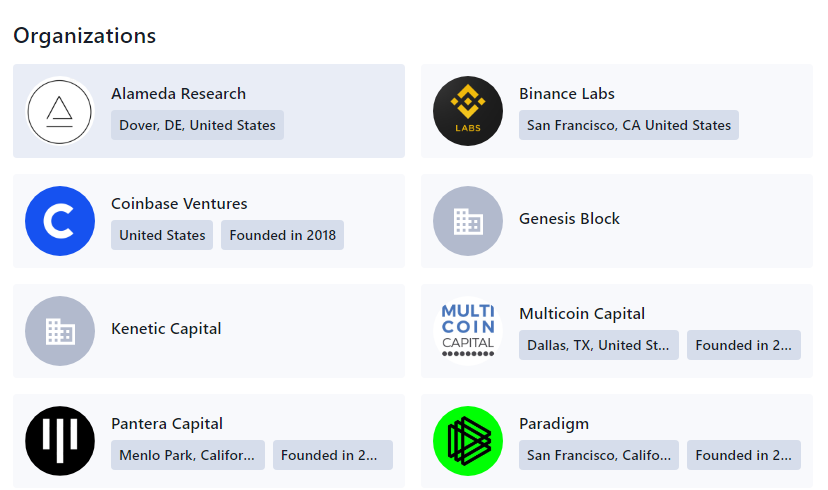

In addition to Alameda Research, FTX investors also include Binance Labs, Coinbase Ventures , Pantera Capital, Multicoin Capital, etc.

Above is the basic information about FTX exchange and FTT token. Up to now, FTX is the best derivatives exchange of all CEX exchanges. Although, FTX's age is still quite young, but the success that FTX has achieved can be compared to Binance - a leading exchange in the world.

In 2021, in the latest funding round, FTX raised $900 million, bringing the company's capitalization to $18 billion. Thereby, we can see that FTX has been proving its position in this potential market.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.