What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

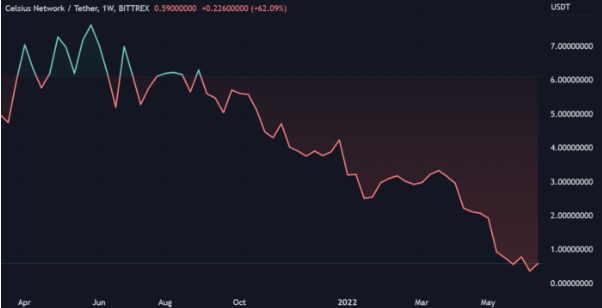

Recently, Celsius (CEL) price recorded the lowest level of 0.17 USD since reaching ATH. A 97% drop in CEL in a bear market could spell disaster for the project itself and all its stakeholders. This article will provide the basics of the Celsius project and why it fell apart.

Celsius is a lending platform that allows users to receive interest on deposited cryptocurrencies or receive crypto mortgage loans. Although, the project definition is like a bank, but according to their founder and representative - Alex Mashinsky, Celsius is on a mission to serve the "non-banking" society.

Celsius exists as an alternative to the international banking system with a fairer experience. The project offers services that rival banks, such as annual returns, no fees and fast transactions, but denies that it operates like a bank.

Legally, Celsius will have to pass extremely strict scrutiny before being allowed to trade as a “bank”. However, by describing itself as “a platform that provides services abandoned by the big banks”, Celsius was able to avoid the responsibility and appraisal of being a real banker.

However, it was the banking flaw that caused Celsius to collapse because it allowed Celsius to provide unsustainable financial services.

Celsius includes a collection of custodial and non-custodial accounts involving individuals and cryptocurrency exchanges. Celsius was created to minimize the transfer of crypto assets outside the blockchain network.

Celsius ecosystem includes 4 main objects:

By joining Celsius, you can act as a lender by depositing your crypto into Celsius account and become a liquidity provider . In return, you can earn interest on the cryptocurrency you have added to the liquidity pool .

As a borrower, you can access the liquidity pool to execute transactions or access other financial services.

The governance platform, in this case Celsius, determines the rules for the interest earned by a liquidity provider, based on the supply/demand pattern of that particular liquidity pool. Besides, Celsius also takes care of the user's risk management. This is similar to how AAVE and other DeFi platforms work.

And finally, the exchange will allow borrowers to use the loaned liquidity to trade, swap and use other financial services.

In a nutshell, Celsius's job is to ensure that the lender receives the full and sustained interest over time. Besides, it also ensures that the risks of borrowers (including themselves) must be strictly managed.

If a platform like Celsius wants to cut functionality in the name of scaling its business, it will typically take one or both of the following approaches:

In fact, Celsius did both of the above methods.

Launched in 2018, Celsius has reached $200 million in community assets after just 1 year of launch. At the time of the previous bull market, Celsius promised users a sizable profit, in return they only needed to deposit assets to provide liquidity on Celsius. According to Reuters, Celsius promises to offer returns of up to 18.6% annually.

In order for Celsius to maintain this level of profitability, the project will actively reinvest users' liquidity, as well as speculate in highly profitable projects.

Celsius has invested some of this liquidity in the Anchor protocol – a project on Terra that offers a 20% return. During the time that Celsius invested on Anchor, it raised more than 500 million USD (according to Etherscan).

Specifically, it invested more than 261,000 ETH in Terra's Anchor protocol in 3 batches from December 19, April 6, and May 3.

During the UST & LUNA crash , Celsius was one of the first projects to sell all of their holdings for $0.95 – $0.99 per UST.

However, the sale of Celsius caused UST to fall further and the collapse of the entire ecosystem spiraled out of control. DeFi Bank's other competitors, lenders were unable to exit and were forced to either sell at a large loss or hold their UST in the hope that it recovers to the $1 peg.

A few days after UST peg loss began, Terraform Labs & Do Kwon launched an initiative to restore the UST peg. Specifically, they announced that there will be a large purchase from DeFi companies such as Celsius, Jump Capital, Jane Street, Alameda Research , etc.

A lot of companies have agreed to do this buyback because they want to get their initial funds back. However, Celsius does not want to participate in this acquisition because they do not want to have anything to do with the Terra ecosystem anymore.

This is a reasonable decision from Celsius's point of view. However, the decision turned rival companies against them. These rival firms include Three Arrows Capital & Alameda Research.

These two companies purchased a $1 billion worth of LUNA from the Luna Foundation Guard, which will unlock linearly over the next 4 years. These companies wanted to get revenge on Celsius for making them lose so much, so they decided to join this acquisition.

Three Arrows Capital, Alameda & Celsius all hold large amounts of money with the stETH/ETH trading pair – the value of which is pegged to ETH.

When Three Arrows Capital & Alameda Research discovered that Celsius was also holding the asset. That's why both funds decided to sell all their tokens at once. Causes a stETH/ETH peg loss event, similar to the collapse of UST.

The only difference is that this time Celsius doesn't sell assets as they lose their pegs. As a result, Alameda Research & Three Arrows Capital has successfully retaliated and now Celsius is having huge liquidity problems due to this attack.

Another risky and unsustainable decision Celsius made was to reinvest available liquidity into Lido Finance – a DeFi platform that gives users the ability to stake ETH in exchange for stETH as it goes live on the mainnet. .

Since ETH isn't actually staked here yet, it's not a real deal. stETH is a synthetic token whose value is fixed to the price of ETH. Thus, giving investors a firm belief in its value.

Celsius, on the other hand, speculates on stETH, so it has promised customers to offer 6% to 8% interest on ETH deposits.

At the time, Celsius had at least $450 million in their main DeFi wallet. However, according to Andrew Thurman, an analyst at Nansen, Celsius may have more than that.

Below is a chart showing the stETH price for ETH.

From April 2022 until early May 2022, stETH fixed itself to the price of ETH. However, as of mid-May 2022, stETH has lost its peg to ETH and currently one stETH coin is only equal to 0.92 ETH.

Assuming that Celsius invested only $450 million in stETH, that investment is now worth $414 million. As we can see, $36 million is a relatively small loss for Celsius. However, Celsius' promise of high returns to Lenders could no longer be kept.

Celsius can only fulfill these promises as long as they can generate a return on their own investments. A series of strange transactions took place that destabilized the Celsius system and shaken investor confidence in the platform.

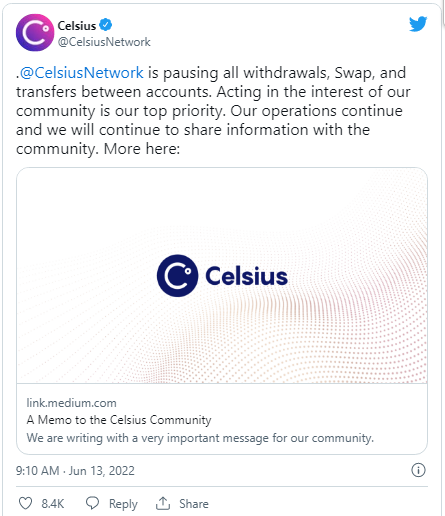

Once those investments turn sour, Celsius will no longer be able to deliver on its promise of high returns for the Lenders. If Celsius wanted to pay everyone back, it would have to pay out all of its investors' profits on its own. So Celsius decided to block users from withdrawing their funds.

Basically, Celsius took investment funds hostage and stated that stopping withdrawals was a reasonable option, otherwise all parties involved would be severely affected. Although the Celsius decision may be right, returning the money and liquidating the assets to the users is a must for them to do.

However, in fact this action of Celsius is not to protect investors' assets, but to protect himself.

It has been a week since Celsius announced that they are suspending all withdrawals and no resolution has been offered since that time. The only way out of this situation is for Celsius to ensure there is sufficient liquidity until the time they reopen.

Celsius's 7-day withdrawal halt is sure to create a frenzy. Then people will rush to withdraw money to make sure their assets are safe. This left Celsius to choose another solution:

Even if Celsius could make all the withdrawals, this business model might not be viable in a bear market. That is, this could have marked the end of Celsius.

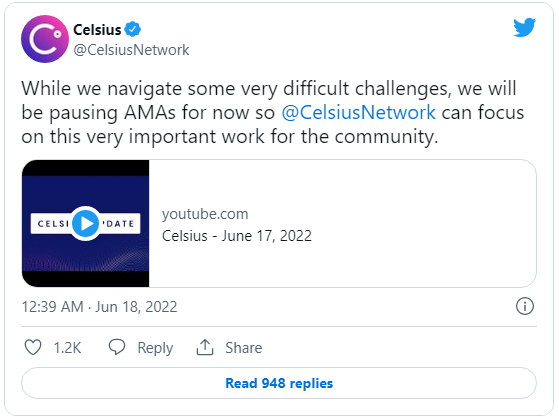

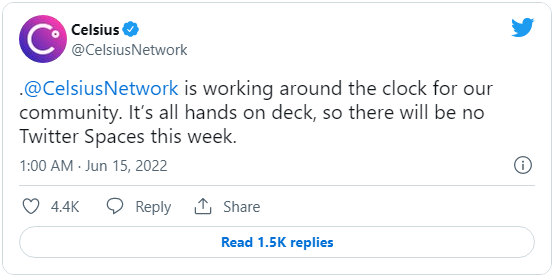

In response to investor concerns, Celsius has decided to keep quiet and cancel most public appearances, including online events for the time being.

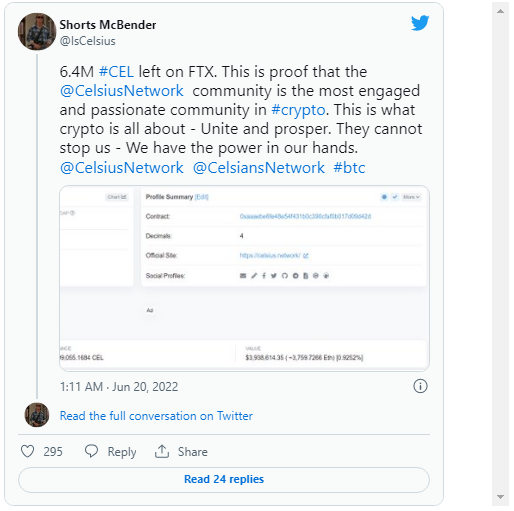

Since Celsius has halted all withdrawals, no CEL tokens can be traded in any way. In turn, most exchanges have also halted CEL trading. There is only one exchange that does not stop and that is FTX – the exchange related to Alameda Research.

After investors learned that Celsius had liquidity problems, many people sold CEL short. At that time, the market only had 6.4 million CEL left to meet the buying needs of users. If investors start buying a lot of CEL tokens at that time, its price will skyrocket.

As a result, CEL has increased 10 times since the bottom, leaving short sellers wanting to close their positions to limit their losses.

However, since there are only 6.4 million CELs left in the market, we could see a huge wave of short selling, if the last CEL tokens are bought up.

In a nutshell, previously Celsius quickly became a popular crypto project because of its high profitable and safe interest rate on crypto deposits. Celsius can only offer high interest rates because it is profitable to reinvest its liquidity to pay users. Along with the previous bull run, this has helped Celsius to great success.

However, reinvesting from user-provided liquidity made Celsius's source of interest payments unsustainable. If Celsius wants to survive, they need to create a more sustainable value and stop reinvesting from investors' liquidity.

In other words, Celsius should stay true to its original mission of serving a “non-banking” society to provide a truly fairer experience. It is not fair for Celsius to use user-supplied assets for venture capital purposes. Until something goes wrong, it does not allow users to cut their losses by suspending withdrawals for an extended period of time.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.