What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

One of the reasons blockchain projects grow so quickly is competition. And the level of competition in this market is extremely fierce.

Algorand is one of the few smart contract platforms that constantly improve and develop many utilities to meet the needs of users. Notably, Algorand's ALGO coin is becoming increasingly popular among individuals and institutions investing in the Crypto market.

So in the past half year, how has Algorand developed? Let's take a look at the events happening around the development journey of the Algorand project with the TraderH4 team in the article below.

Algorand is a blockchain platform that uses a new consensus mechanism called Pure Proof of Stake (PPoS). It allows anyone to participate in building decentralized financial protocols and applications.

The project was founded by MIT professor Silvio Micali in 2017 and built by Algorand Inc. – a software company based in the United States.

The development of Algorand is coordinated by the Algorand Foundation – a non-profit organization based in Singapore. Algorand raised over $126 million through ALGO coin sales in 2018 and 2019. A large portion of this money was returned to ICO investors as part of a buyback program.

The Algorand mainnet went live in June 2019, when the project was still under development, but essentially all core features and functionality were completed.

As mentioned, the Algorand blockchain uses a new consensus mechanism called Pure Proof of Stake (PPoS), which makes it possible to process around 11,000 transactions per second.

The Algorand platform is currently secured by around 120 validating nodes. These nodes choose one of the many nodes participating in the Algorand network to propose pseudo-random blocks based on the staking amount.

The number of nodes participating in the Algorand network has not been disclosed. This information is also not mentioned in the Algorand documents, but it is likely that the number is in the thousands of nodes because the joining process is very easy.

In contrast, becoming a relay node requires coordination with the Algorand Foundation, as well as advanced hardware. In fact, only about 20 of Algorand's relay nodes are operated by entities not directly affiliated with the Algorand Foundation.

However, the Algorand Foundation is actively introducing more linkless relay nodes. And it is expected that in the near future there will be about 20 new nodes randomly selected.

ALGO is the native coin of the Algorand blockchain. It is used for staking, administration and payment of transaction fees. Participating nodes must have at least one ALGO to participate in the consensus and there is no lock or unlock time nor any risk of loss.

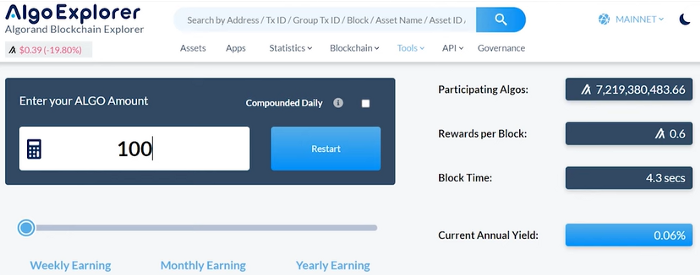

On the other hand, relay nodes do not need to stake any ALGO. According to AlgoExplorer, the current reward is only 0.06% per year, although Algorand's block reward has increased by about 7% compared to ALGO's reward-based governance participation.

Algorand's governance mechanism will not be analyzed in this article. But we should also know that Algorand's administration system has tens of thousands of active users.

Transaction fees on Algorand are 1%, but relaying nodes do not earn these transaction fees. Instead, Algorand will use a portion of all transaction fees to purchase Carbon Credits.

Algorand's ecosystem can be accessed using the Pera Algo Wallet, MyAlgo Wallet or the AlgoSigner browser extension wallet.

According to the website of the Algorand ecosystem there are about 300 projects built on Algorand. About 10 of these Dapps are DeFi protocols with a total locked value (TVL) of around $150 million (as noted by DefiLlama).

Algorand has announced the release of the Algorand virtual machine with the goal of supporting the next generation of DeFi protocols and applications.

In October 2021, the Algorand Foundation announced that the ALGO flash sale was complete. Thereby, this event makes it possible for initial investors to sell large quantities of ALGO whenever it is inflated. So the end of this program is obviously very good news for ALGO holders.

In November 2021, the Algorand Foundation announced the program to run the first relay node. Among them are 20 new transition node candidates that are not affiliated with the units behind Algorand.

An Algorand project called Algomint has also created a bridge between the Bitcoin and Ethereum blockchains. The goal is to support the Algorand ecosystem that connects to the two most popular assets in the crypto market, BTC and ETH.

Soon after, a former Citibank CEO established a $1.5 billion crypto fund with Algorand as its first partner. This is a good sign for Algorand as it is very likely that a large amount of money is flowing into the Algorand ecosystem.

During Algorand's convention in Miami at the end of November 2021, Algorand announced that it would partner with the city of Miami to monitor air quality there.

In addition, Algorand's Head of Engineering also delivered a keynote on Algorand's upcoming quantum security through proofs of state.

At the beginning of December 2021, Borderless Capital announced that it would pour an additional $500 million into the Algorand ecosystem.

The Algorand Foundation also announced that they will be extending their relay node program to the Algorand community.

In mid-December 2021, the Algorand Foundation also announced a liquidity mining program for Algorand DeFi protocols. And the rewards of this program are extracted from the Viridis fund worth 300 million USD.

A few days later, a project built on the highly anticipated Algorand called Algofi was launched. Since then, this project has become Algorand's flagship DeFi protocol with a total locked value of more than $90 million.

In January 2022, the Algorand Foundation confirmed the issuance of the first batch of governance coins, ALGO, to Algorand investors.

A Drone Racing company also partnered with Algorand to create a Play to Earn title in development on the Algorand blockchain.

Grayscale Investments has revealed that it is considering establishing a trust fund for Algorand. This will make ALGO more accessible to institutional investors.

In early February 2022, the Algorand Foundation announced its proposal to create an exclusive group of key Algorand investors called xGov. Members of this group will discuss the recommendations of the investor community included in Algorand's governance system.

The Algorand Foundation also announced that it has selected former JPMorgan CEO Staci Warden as Algorand CEO.

At the ETH Denver conference, Staci Warden announced that the Algorand Foundation will allocate $10 million for Ethereum- compatible algorithms .

Besides, Algorand Wallet also announced that it has changed its name to Pera Algo Wallet and released a roadmap to develop new utilities such as: NFT support, Fiat, DeFi protocol integration and access to the interface governance of Algorand.

In early March 2022, Algorand completed an upgrade that extended its smart contract functionality to be able to create more complex Dapps. At the same time, this upgrade will also set the stage for Algorand's post-quantum features.

In mid-March 2022, a popular peer-to-peer music platform formerly known as LimeWire also announced that it would be relaunched as an NFT marketplace on Algorand.

The Algorand Foundation also announced that it will phase out the ALGO grant program and replace it with various ecosystem funding programs in the future.

At the same time, the Algorand Foundation announced that it had granted a grant to an Algorand project called “Algorand Name Service”.

Also in March 2022, the Algorand Foundation announced they had granted a grant to a more developed project called AlgoLaunch. This is a Launchpad platform for upcoming Algorand building projects.

At the end of March 2022, Grayscale announced the launch of the GSCPxE (Grayscale® Smart Contract Platform Ex-Ethereum Fund) fund featuring Algorand. However, ALGO only accounts for about 4.4% of the fund's current $2.6 million allocation.

In mid-April 2022, the Algorand Foundation purchased all the billboards in New York City's Times Square for Earth Day to send the message that cryptocurrencies can be eco-friendly.

As mentioned earlier, the Algorand Foundation also announced that a special smart contract will be created. Accordingly, part of the transaction costs on the Algorand blockchain is redirected to the purchase of Carbon Credit. This is seen as part of the zero-carbon pledge that the project signed in 2021.

At the end of April 2022, Algorand partnered with Flare Network to build additional bridges with other cryptocurrency blockchains. This is interesting because Flare Network is a cryptocurrency project that is part of the XRP ecosystem.

Another thing that Algorand announced at the end of April 2022, was a proposal regarding the modification of Algorand's governance process.

In early April 2022, Algorand announced that it would sponsor the upcoming FIFA World Cup in Qatar and the amount of sponsorship has yet to be disclosed.

More recently, Algorand announced that it has acquired another popular peer-to-peer music platform called Napster.

This leads many investors to ask: Will decentralized music streaming services lead the wave of crypto adoption in the near term?

ALGO giá Price Analysis

The cryptocurrency market has been in a recession since the time Bitcoin made its ATH in mid-November 2021. The reason is due to the FED's incessant increase in interest rates to combat ongoing inflation and the recent collapse of Terra & TerraUSD .

Besides, a number of other factors surrounding Algorand's ecosystem are reducing the value of ALGO. The vesting acceleration has stifled ALGO's price increase, because it allowed early investors to bulk sell ALGO whenever its price pumped.

This is why the price of ALGO only briefly surpassed the ICO price of 2.4 USD before plummeting. Although the snap auction ended in early October last year, the structured sale from the Algorand Foundation appears to be continuing. This shows us that Algorand Inc. also sold a large amount of ALGO they were holding.

Although, the amount of ALGO that Algorand Foundation has sold since September 2021 is not disclosed. However, what TraderH4 has found is that the circulating supply of the coin has grown by more than 1.1 billion ALGO since September 2021 according to historical data by CoinMarketCap and over 900 million according to data from CoinGecko .

So if we take an average amount of 1 billion USD and assume an average price of about 1 USD per ALGO during that time, it is possible that a large number of ALGOs worth about 1 billion USD have been sold since then. from September 2021.

According to fundamental economics, this sale of ALGO should not affect its value much if there is enough demand for ALGO. However, the demand for ALGO at the moment seems to be very low.

Example : The AlgoSigner browser extension has only 20,000 downloads, which is a 3-fold increase since last October. But this number is not impressive when compared to other ecosystem storage wallets.

Pera Algo Wallet has also only reached 100,000 downloads since October 2021, and this shows that the Algorand blockchain seems to have only 100,000 active users.

Algorand's top dapps had only about 50,000 users last month. This is really in line with the number of ALGO holders, the number of users who are participating in Algorand's governance.

Algorand's total TVL locked value is only about $117 million. This number makes it impossible for investors to believe that all this money comes from several thousand users on the Algorand protocol.

In interviews and presentations by Algorand team members, especially Algorand founder Silvio Micali introduced the upcoming roadmap of the project.

Previously, in October 2021, Algorand COO Sean Ford mentioned that they are in talks with Central Banks around the world to provide the infrastructure for their CBDC. However, he did not specify what type of assets or specific time to implement that plan.

Sean Ford also mentioned that Algorand will soon scale to 10,000 transactions per second thanks to next-generation scaling technologies.

In December 2021, Algorand's head of ecosystem Adi Wagenekt mentioned that the goal in 2022 is for the total value locked in Algorand's DeFi protocols to reach at least $200 million. In addition, the Algorand Foundation is planning to spend $500 million to expand the Algorand ecosystem.

The first challenge is Algorand's lack of user adoption. Almost every top cryptocurrency by market capitalization has seen exponential growth in its user base over the past few months. However, this exponential growth is not evident on Algorand.

This can be explained because the Algorand wallets used to interact with its dapps are not user-friendly in design.

The second challenge lies in Algorand's Tokenomics model. Its design isn't that great and it seems that ALGO's early investors are more dominant than the last ones, so it can't help ALGO's price action.

In fact, the circulating supply of ALGO continues to grow. Former Algorand Foundation CEO Sean Lee celebrated as the coin's circulating supply increased from 1.4 billion ALGO to over 6.3 billion ALGO in 2021.

All this sale will not have much impact on the price of the coin as long as there is enough demand for ALGO in the market. However, we have also seen that the current supply of ALGO is higher than the demand. The reason is that Algorand has focused on providing services to institutions, instead of users and retail investors.

The above is all information about the milestones that Algorand has experienced, as well as the challenges that Algorand needs to overcome in 2022. Algorand has a lot of work to do in the near future.

However, focusing on institutional investors may be limited in generating demand for ALGO. However, to appreciate the true potential of Algorand, we will closely monitor its development for an even longer period of time. Because, Algorand has advanced technology, but it has not promoted what this platform owns.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.