What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Exotic Markets is a DeFi protocol that specializes in structured financial products and is built on top of the Solana network . The token of the protocol is the EXO token, which is a governance token with a maximum supply capped at 10 million tokens. Exotic will operate as a decentralized autonomous organization (DAO), managed by EXO token holders who will be responsible for whitelisting new and regulated financial products. any parameters of the protocol.

Structured financial products (market-linked investments) are pre-packaged investment strategies based on various financial products, including stocks, options (derivatives), only digital assets, commodities, debt issuance and foreign currency.

Structured financial products help investors accept high risks and yield parameters for a wide range of investment arguments (e.g. Market will remain flat for the next 3 months). Exotic Markets looks for a simple way for investors to understand the upside or downside of a structured financial product. Besides, the team says Exotic is built on Solana because of fast transactions with low costs.

Exotic Markets is not the only financial platform on Solana. Solana is currently the 4th largest blockchain by market capitalization. In early 2021, Solana's token was below $2 and rose to a high of around $259 on November 5, 2021. At the time of writing (January 14, 2022), Solana is trading at $147.

The project will be audited by Halborn company in early 2022. Details will be updated later.

Exotic Markets project will include 2 types of markets:

Vaults will interact with pools of assets and run strategies that automatically copy certain payouts. Currently, the most common form of managed vaults in structured financial products are covered calls . Exotic Markets will improve this model by: Offering new underlying assets such as SRM, RAY and MNGO tokens, and new strategies such as spread calls, baskets, knock-in calls and management functionality permanent manager.

Single Products will allow buyers and sellers of structured financial products to interact freely on an open and transparent platform. The range of possibility of successful trading then is very large. In addition, Exotic Markets intends to provide solutions that never existed on DeFi.

Exotic will provide a number of structured notes containing different characteristics such as:

If investors already know their financial products, they can choose whatever they want. However, if the user feels overwhelmed because there are so many different products, the project assistant will provide guidance and find a suitable product for the investor. To get suggested results, users only need to answer a few simple questions about their vision for the market.

Each retail product on Exotic will have a subscription period. That is the time before the product starts to go on the floor, when investors can still place orders. The final yield will be the balance between the different effects. The process is different from a vault because investments are made at regular intervals. Products have a certain level of maturity in the vault and users will have clear information about their minimum participation time in the vault.

After the subscription period ends, the product will start working. At that point, the final yield is set and the investor will be allocated his position in the product. If the product has only a minimum interest rate, to protect users, only part of the product may be launched.

The protocol's dashboard will summarize all the investor's open positions. At that point, the user has 2 options:

Upon expiration, the product payments will be calculated through the oracle. The payout will determine how much each party can redeem from the product deposit account.

New products include new profits and new underlying assets. Structured financial products offer endless opportunities and after the DAO vote, Exotic Markets will add these products over time.

The grant market supports users who wish to terminate their participation in a single product before that product matures.

Exotic is a DAO (Decentralized Autonomous Organization) . The project team wants to bring the benefits of structured financial products to everyone. They are starting to implement the protocol and it will be managed by the community. Besides, EXO token holders will be responsible for the protocol.

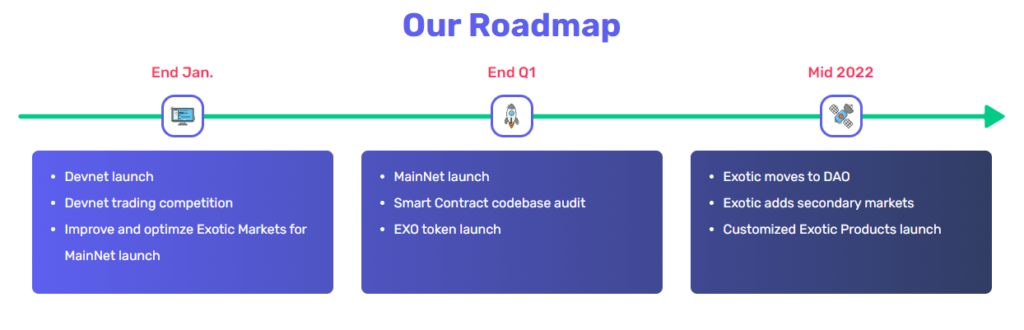

Exotic Markets project has a development plan with the following milestones:

Exotic Markets raised a total of $5 million in funding after one round. This is an ICO round that took place on January 5, 2022, led by Ascensive Assets. Exotic Markets is funded by 14 investors, of which mgnr.io and Morningstar Ventures are the most recent investors. Others include Alameda Research, Animoca Brands, Solana Capital, TPS Capital, Auros, LedgerPrime, 3Commas, Paradigm, Coban, Everview Capital, Multicoin Capital and Bitcoin.com.

The new capital will be used to strengthen the development team as well as the marketing strategies. Part of the funds will be allocated to market-making activities on the platform to promote the mainnet launch of the project (scheduled for the end of February this year). Market makers buy and sell assets for their own account, which also helps provide liquidity to the market.

EXO will be a governance token of the project, limited to a total supply of 10 million. Exotic Markets will be managed by EXO token holders. They will be fully responsible for whitelisting new structured financial products and regulating protocol parameters (fees, redemption and burn rates). Users can stake EXO tokens to receive reduced transaction fees and token incentives.

There is no official information yet.

The EXO token will provide the following features to holders:

There is no official information yet.

Exotic Markets offers a wide range of structured financial products (pre-packaged investments) on the Solana network, regulated by the EXO token. In a press release, Ascensive Assets managing partner Oliver Blakely said: “Structured financial products will open the door for investors to generate profits in stablecoins rather than governance tokens. . We see this as a very healthy evolution of the DeFi space.”

Besides, Exotic Markets co-founder Joffrey Dalet said that the new capital will go towards strengthening the team as well as boosting marketing. He said part of the fund will be allocated to market-making activities on the platform to promote the mainnet launch of the project, which is scheduled for the end of February (devnet is expected to be in the late February). later this month.) Market makers buy and sell assets for their own account, which also helps provide liquidity to the market.

The Exotic Markets project team decided to bring structured financial products and asset management to the decentralized financial market. In addition, Exotic's assistant is capable of helping users find the right investment product for them. Therefore, if investors want to find opportunities to speculate on cryptocurrencies, Exotic can help investors do that.

To learn more about this project, readers can view information at the media channels:

Website | Project Information | Twitter | Telegram | Medium | Discord

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.