What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Allbridge is a trusted blockchain bridge that helps ensure the smooth flow of money between different networks. Allbridge is supported by the APYSwap Foundation with the initial goal of focusing on connecting Solana with other blockchains, hence the name Solbridge.

During its operation, this project has continuously improved and enhanced the user experience. At the same time, expanding the audience, Solbridge was renamed Allbridge with the goal of developing a platform that supports the entire blockchain space.

Allbridge provides interoperability, ensuring it is easier and faster to transfer assets between different blockchains. In the future, Allbridge will develop into a multi-chain hub under the DAO model .

In addition, Allbridge will establish connectivity features between both EVM-compatible blockchains (such as Ethereum , Polygon, BSC) and EVM-incompatible blockchains (such as Solana, Terra). This makes Allbridge a powerful supporter for layer 2 solutions (such as Arbitrum , Optimism) and the transfer of NFTs between different blockchains in the future.

As mentioned, Allbridge creates a bridge for EVM-compatible blockchains, layer 2 protocols, EVM-incompatible blockchains, and NFTs. The protocol uses a modular architecture to integrate additional chains more efficiently.

In just 7 months of launch, Allbridge has supported 47 assets on Ethereum, BSC, Solana, Polygon, Avalanche and 6 other networks. Aurora and Harmony are the latest blockchains supported on the platform.

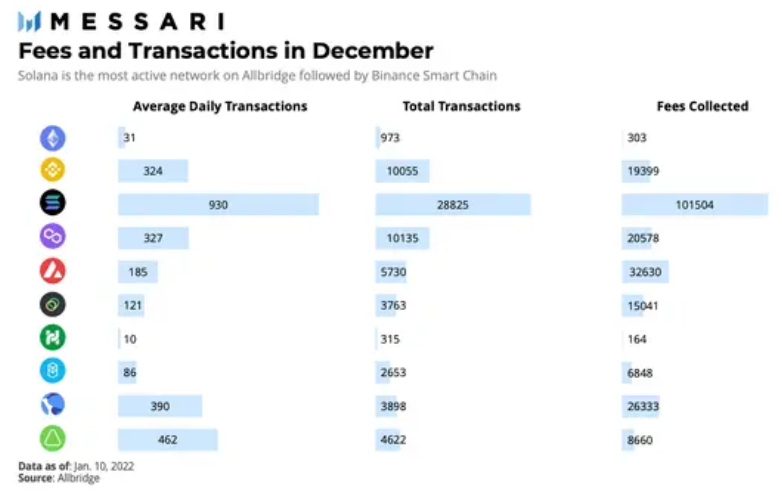

To date, Allbridge has had a total of more than US$5 billion worth of transactions taking place on the platform, an increase of 117% from US$2.3 billion in October 2021. In December 2021, Allbridge's transaction fees were $231,000, an average of 2,900 transactions per day on the platform.

In which, Solana is the most active network, accounting for 44% of revenue from transaction fees. At the time of writing, Allbridge's liquidity pool has reached over $380 million. These are impressive numbers for a 7 month old protocol like Allbridge.

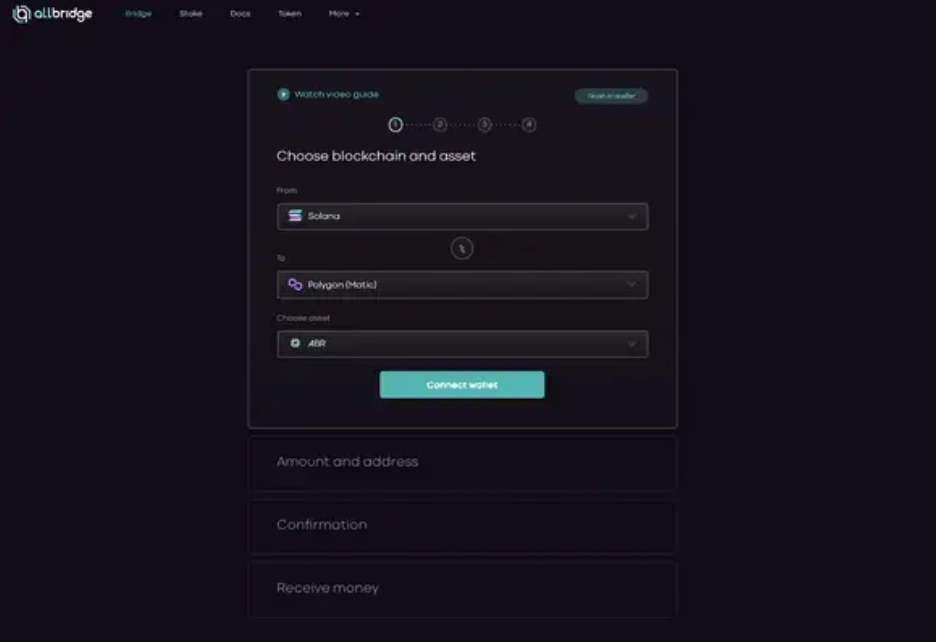

The Allbridge bridge provides users with an intuitive and easy-to-use interface. To use Allbridge, users only need to connect a wallet to be able to make send transactions on source blockchain A and receive transactions on destination blockchain B.

Allbridge is built on Solana's blockchain, so it takes advantage of advantages such as fast transaction processing speed and low transaction fees. Therefore, the process of transferring assets on Allbridge is completed almost immediately.

In addition, the Allbridge bridge supports users to make transactions in 4 different styles, including:

Send native tokens and receive native tokens : Native tokens are locked on blockchain A and unlocked on blockchain B. This type of bridge works similar to a DEX supported by two liquidity pools to facilitate trading. token swap in blockchain A and blockchain B.

Send native tokens and receive wrapped tokens : Native tokens are locked in a liquidity pool on blockchain A and wrapped tokens are minted on blockchain B.

Send wrapped tokens and receive native tokens : Wrapped tokens are burned on blockchain A and native tokens are unlocked from the liquidity pool on blockchain B.

Send wrapped tokens and receive wrapped tokens : Wrapped tokens are burned on blockchain A and minted on blockchain B.

To understand how Allbridge works, let's take a look at the following example with the TraderH4 team:

Transfer the native token and get the wrapped token, the user sends the native token to a smart contract on blockchain A. This smart contract locks the native tokens and creates a log of the request when the transaction is complete.

Before a user can send a receive transaction to blockchain B, validators must check the request log. If the validator concludes that the original token is locked on blockchain A, they will send the signature to the user.

Next, the user sends the signature to the smart contract on blockchain B. This smart contract then mints the amount of wrapped tokens corresponding to the original token and sends them to the user.

Wrapped tokens track the price of the original asset using oracle, but they are compatible with other blockchains. This locking and minting process ensures a 1:1 ratio between locked tokens and minted tokens on the two chains.

Validator plays a defining role in the Allbridge bridge. Any bridging transaction must be confirmed by 2/3 of the validator. The validators will receive a portion of the fee each time the transaction is confirmed successfully.

To become a validator, a user must meet certain requirements. These requirements relate to the ability to set up servers and nodes. In addition, the validator must stake Allbridge's ABR token. In case, the validator has harmful behavior to the network will receive a penalty of cutting the staked amount.

Different from bridge solutions, Allbridge uses consensus of on-chain validators. That is, every transaction will be recorded, verified on-chain and monitored by a dedicated blockchain explorer. This improves transparency for the Allbridge protocol.

Development team

Allbridge is supported by the APYSwap Foundation with the initial goal of focusing on connecting Solana with other blockchains.

Investors

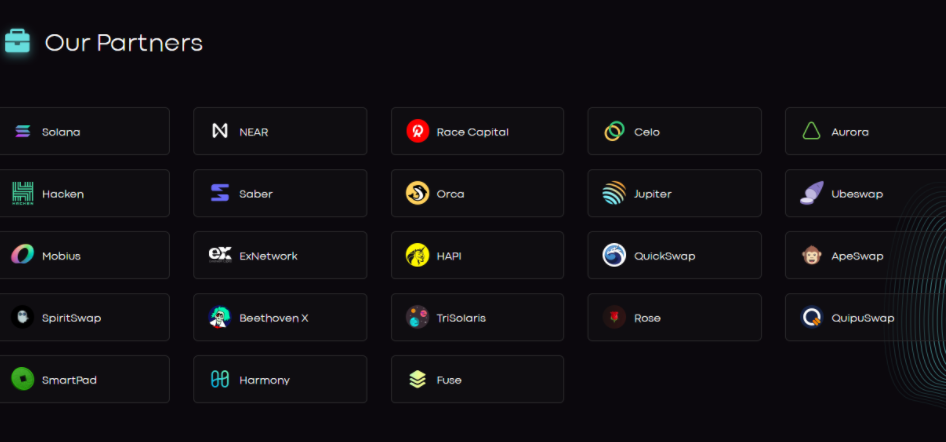

Up to now, Race Capital is the sole investor of the Allbridge project. They invested in this project US$2 million in a Private Equity round. TraderH4 team will monitor and update more information about investors in the near future.

Partner

Allbridge's partner list has more than 24 projects, some of the prominent names on this list are: Solana, NEAR Protocol, Celo, Harmony, Saber, Orca...

In the first quarter of 2022, Allbridge will carry out the following activities:

In the future, Allbridge is expected to carry out the following activities:

ABR is the native token of the Allbridge bridge platform, some information that investors need to know about this token:

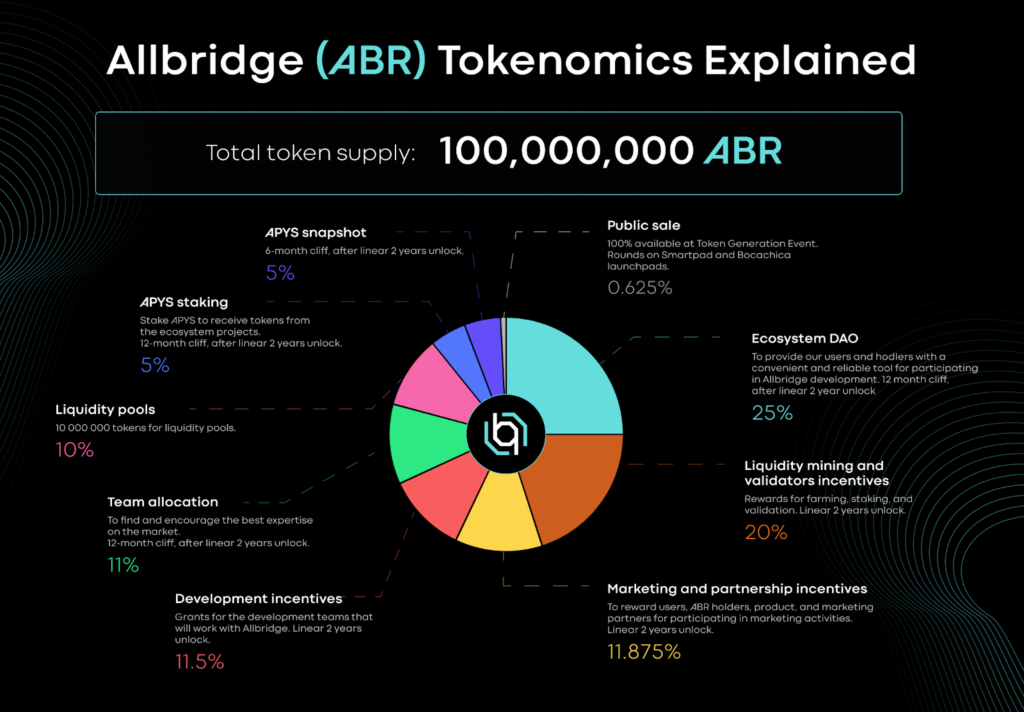

The total amount of 100,000,000 ABR will be allocated to the following 9 groups:

Payment of transaction fees on the bridge : Users pay a transaction fee on the bridge of a fixed rate of 0.3% for each asset transfer. These fees are paid by the token itself. About 80% of transaction fees will be converted to ABR and distributed to investors. The rest is divided among the development team.

Staking : ABR holders can stake them on all integrated blockchains on the Allbridge bridge. They will receive xABR – a token representing their stake in the staking pool. Staker will earn rewards from Allbridge fees and incentives. Once the reward is added to the staking pool, the number of ABRs in the pool will increase and xABR becomes more valuable than ABR. Therefore, when users burn xABR tokens, they will receive more ABR tokens than they originally staked. This is how distributors can make a profit on Allbridge.

Currently, ABR token has been listed on most decentralized exchanges such as: Uniswap, Raydium, TraderJoe, PancakeSwap, Orca...

Allbridge is aiming to create a multi-feature system integrated in the same platform. It wants to provide a common bridge, allowing users on any blockchain to have access to all crypto assets in the market. This is reflected in the roadmap of its development, where the Allbridge team is focusing on four main themes:

Blockchain : New networks are constantly being integrated on Allbridge, helping the bridge expand the reach of users on many other blockchains. At the same time, helping this platform get closer to the original goal set. In addition to the 12 largest networks already supported on the platform, in the future Allbridge looks forward to integrating Tezos, Arbitrum, Optimism and others.

Decentralized : More validators will be added to the bridge in Q1 2022. Besides, the project will launch the DAO interface, making it a truly decentralized bridge.

Marketing : Following recent user interface improvements and rebranding, Allbridge will launch a series of marketing campaigns and incentive programs to engage users. The development team will also establish partnerships with DEX exchanges to build its ecosystem.

B2B Products : Once the bridge is completed, Allbridge will build more B2B services. The development team plans to launch an open API in Q1 2022 and implement a subscription interface for projects. Going forward, Allbridge seeks to provide bridging API solutions as a service to AMM.

Some official information channels of the project that investors can follow are:

Website | Twitter | Telegram | Discord

The above article shared details about the Allbridge bridge and the ABR token. Allbridge has integrated 12 networks and the trading volume on the platform has also reached more than 5 billion US dollars. These are extremely impressive numbers for a bridge platform that has only been around for more than 7 months. However, investors need to carefully research and monitor security-related issues if they want to invest in this project.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.