What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

AshSwap is a Stable-swap decentralized AMM built on the Elrond blockchain . AshSwap uses the same formulas invented by Curve Finance but introduces several new concepts to improve user experience, increase capital efficiency, and create a new, more powerful token model.

Prominent AMM DEXs like Uniswap V2 , Sushiswap , Bancor or Balancer all use a method known as Constant Function Market Makers (CFMM) or a modified version of it. This works well for normal assets but is not as efficient when swapping between stablecoins (or similarly priced assets like WETH/sWETH), as it leads to high slippage. It is not acceptable for people to exchange 1 USDC for only 0.9 USDT.

To maintain a sufficiently small slippage requires a large amount of liquidity in the pool, which is not optimal since most of the liquidity is not affected and the fees shared among the liquidity providers are not very large.

First introduced by Curve.fi, Stable-swap AMM offers a much better way to trade between stablecoins and stable-swap exchanges like Curve have become a must in every DeFi ecosystem .

Stable-swap AMM not only provides stablecoin traders with peace of mind, but it also opens up a whole new range of use cases, leverages and takes DeFi to the next level.

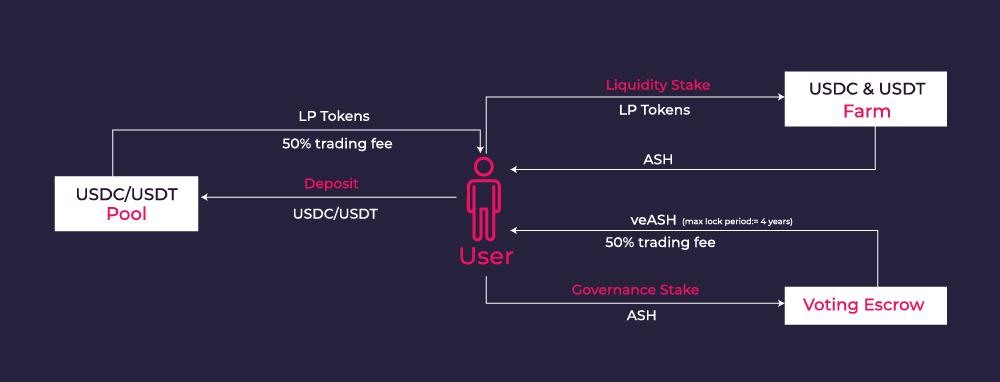

AshSwap divides the fee collected into 2 parts. 50% will go to LP token holders where transactions have been made and the other half will go to veASH holders. This incentivizes users to staking the governance token to earn a share of the protocol's revenue.

Liquidity Reserve (LLP) is a new concept that AshSwap introduces in which users do not have to give up their liquidity but instead exchange it. This also adds more use cases for the ASH token and increases revenue for both LPs and AshSwap.

Introducing a new stablecoin

Stable-swap exchange LP tokens have a very unique feature that at the end of the day, the underlying value of the collateral does not change much. Taking advantage of this, AshSwap allows users to mint a new stablecoin called “AOC”, using their LP token as collateral. This means that users can provide liquidity to the DEX, receive the same amount of stablecoins and put them to work for profit in other protocols.

As such, who will be entitled to the transaction fees rewarded for the LP tokens? The answer is users, they will receive rewards in different ways.

Speculation LP

If the user is a hardworking farmer and wants to earn income for a long time, he should pay all 1% ASH fee. The fees will then be used to reward those who make ASH or burn to make ASH scarce.

On the other hand, if he only needs AOC for a short time and the 1% fee makes it insignificant, he can give some (or all) of the transaction fee to AshSwap during that time to reduce the fee. Transaction fees will be used to redeem ASH on AMM (like Maiar) and distribute to ASH creators or burn.

In both cases, ASH holders, speculators and AshSwap win.

Listing partner projects

In the future, more projects will be listed on Maiar Exchange compared to stablecoins like USDC. If there are 100 projects and each project has a liquidity pool of $1 million, then $50 million worth of stablecoins are put into 100 pools.

Instead of adding stablecoins directly to the pool, 50 million can be added to the AshSwap stablecoin pool. LP tokens are given to AshSwap for minting 50 million AOC (with or without ASH fee), which is then used as liquidity on Maiar Exchange. This benefits all parties:

Social Mining

Individual investors have many untapped powers (or rewards), such as enthusiasm and network effects. To incentivize this, AshSwap wants to integrate many products into its ecosystem that do not require users to spend a large amount of capital, but still bring decent rewards.

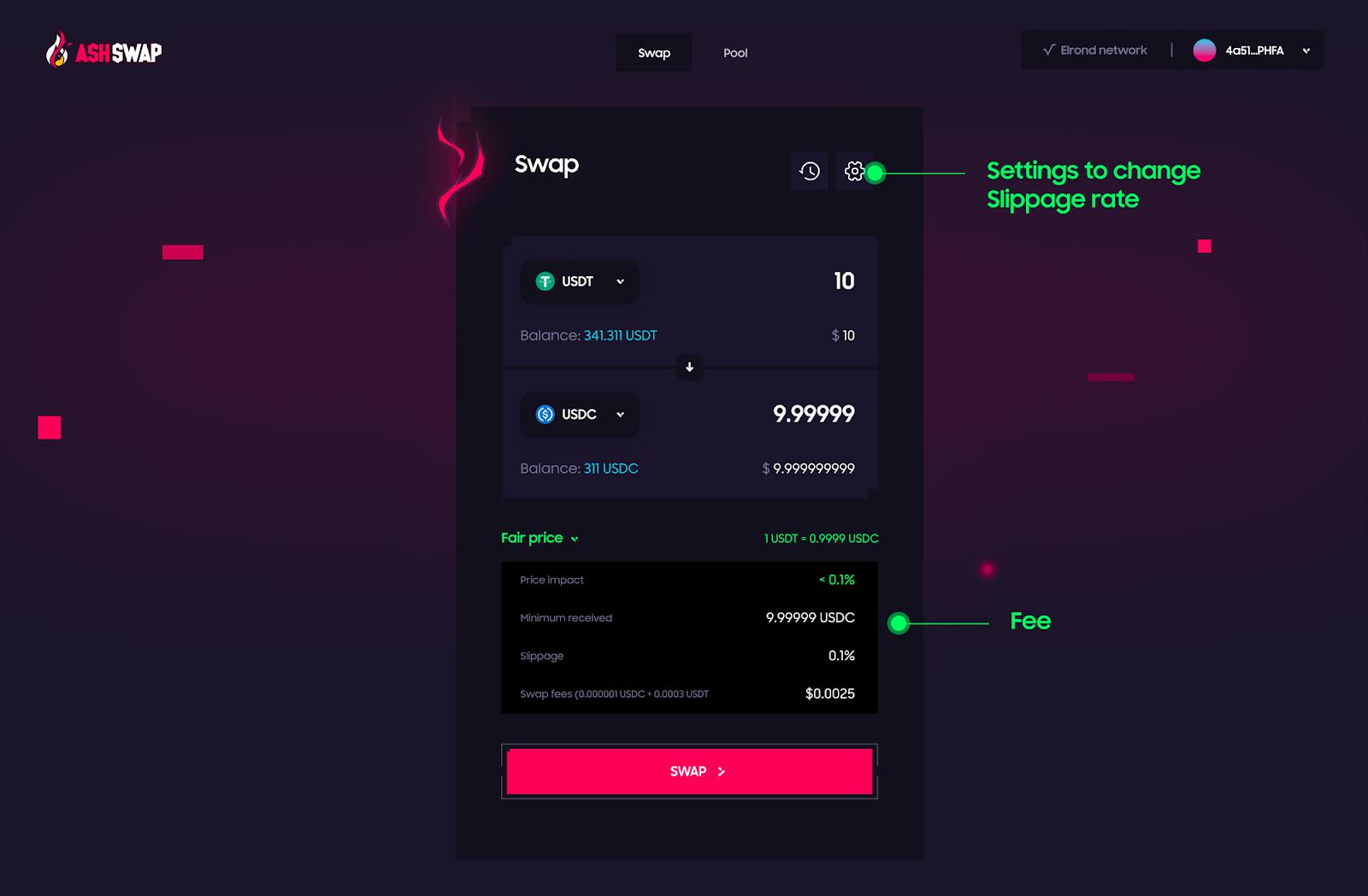

Here users can swap or trade stablecoins with relatively cheap fees and low slippage.

Fees : Liquidity providers will earn fees from successful trades.

Price Impact : The execution of a transaction changes the share of tokens in the pool, causing a change in the price per token.

Minimum Amount Received : The minimum amount you will receive after deducting fees and the maximum slippage achieved.

Slippage : You can change this in the settings to make sure you get the amount you want or your trade won't be reverted.

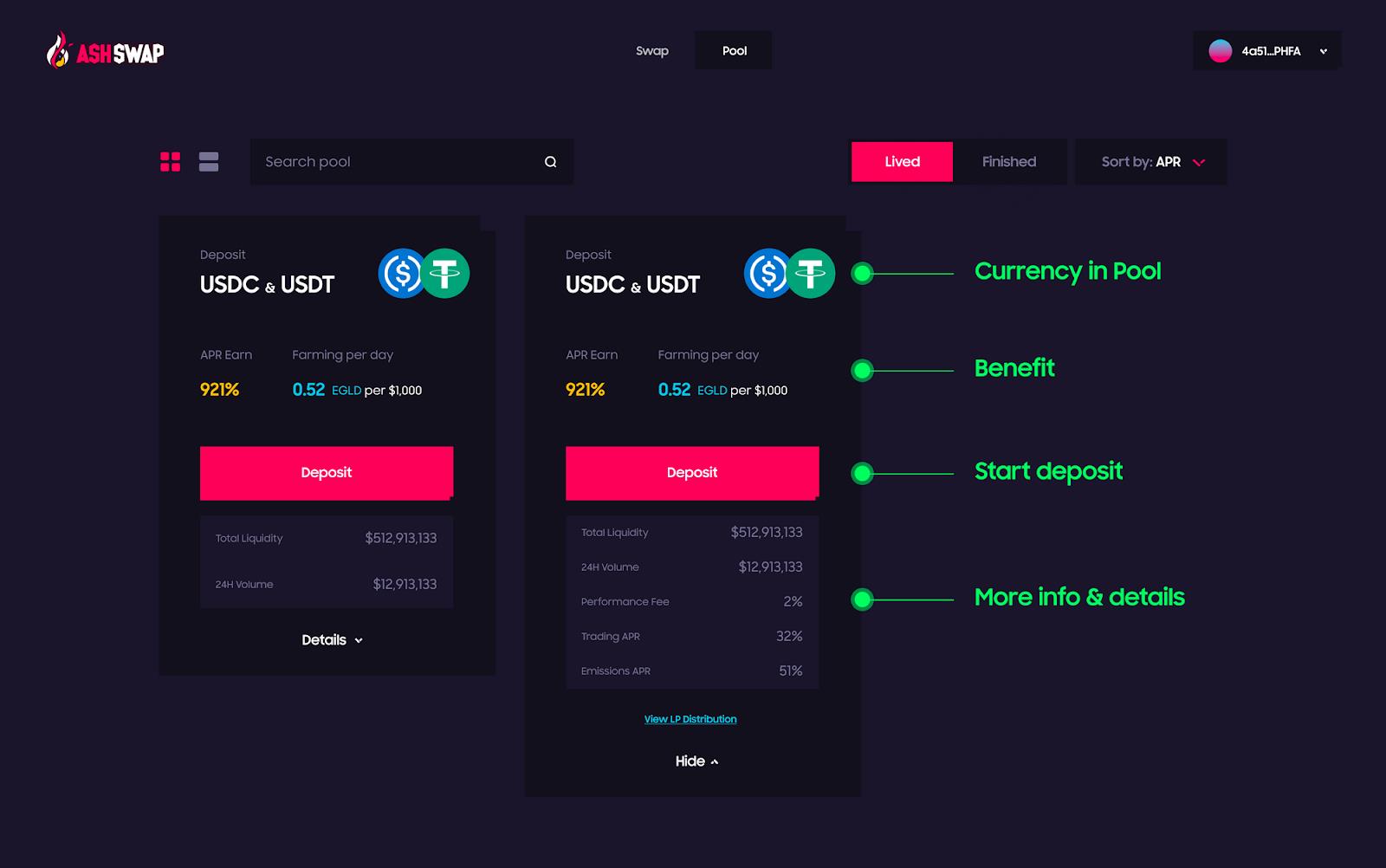

By depositing funds into the pool, you are providing liquidity for the two currencies in that pool and you will be honored as a liquidity provider (LP). LPs on AshSwap can earn both transaction fees and benefit from unique farming mechanics, which will be revealed later.

Add Liquidity

Go to the Pool page to find the liquidity pool you want.

Enter the number of tokens. The project noticed user confusion when providing liquidity on other Stable-swap exchanges, that is, users have to manually enter both amounts, so at AshSwap you only need to fill in one amount. , the remaining amount will be automatically calculated. The rate will be equal to the current rate in the pool.

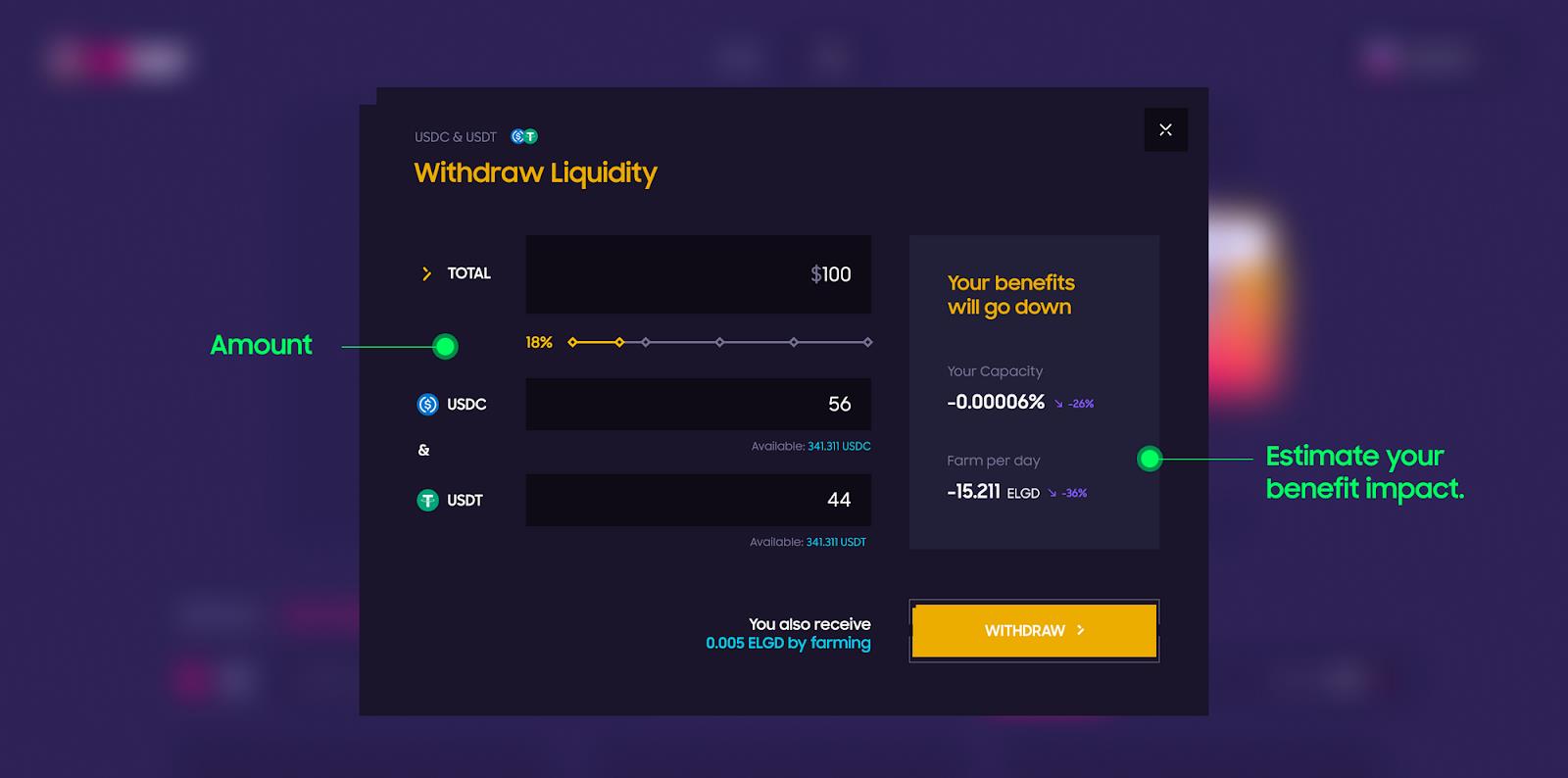

Withdraw Liquidity

Select the pool you want to withdraw the liquidity from and specify the withdrawal amount. Your reward will also be received.

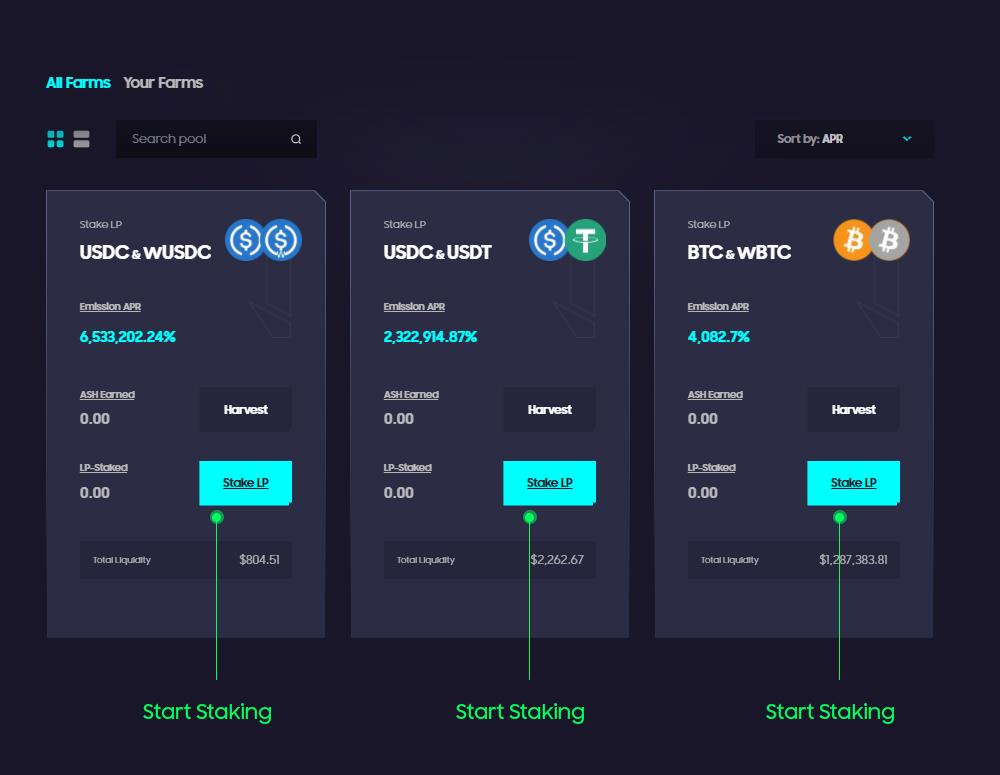

To start liquid staking, you first need LP tokens.

Select the group you want to staking your LP-Token

Check the APR ratio, total liquidity to find the most suitable pools.

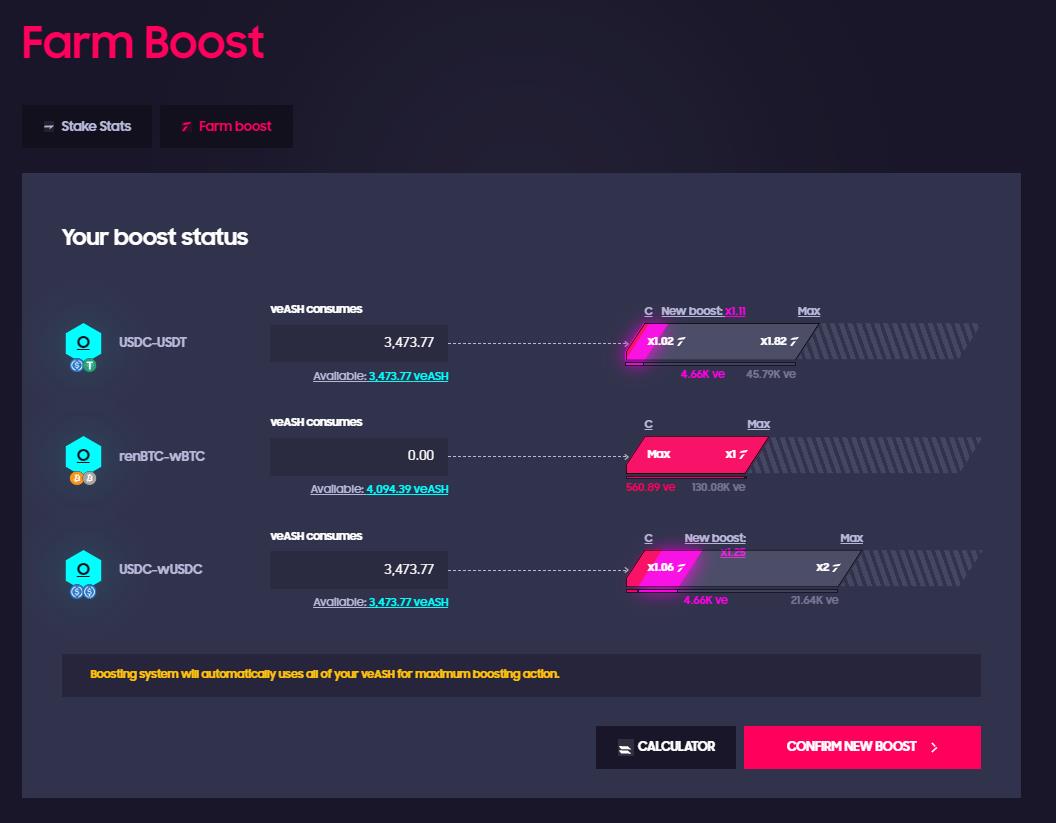

Yield Boosting is a new feature of AshSwap, this feature is still in beta. TraderH4 team will provide detailed and complete instructions on this feature when AshSwap completes Yield Boost testing.

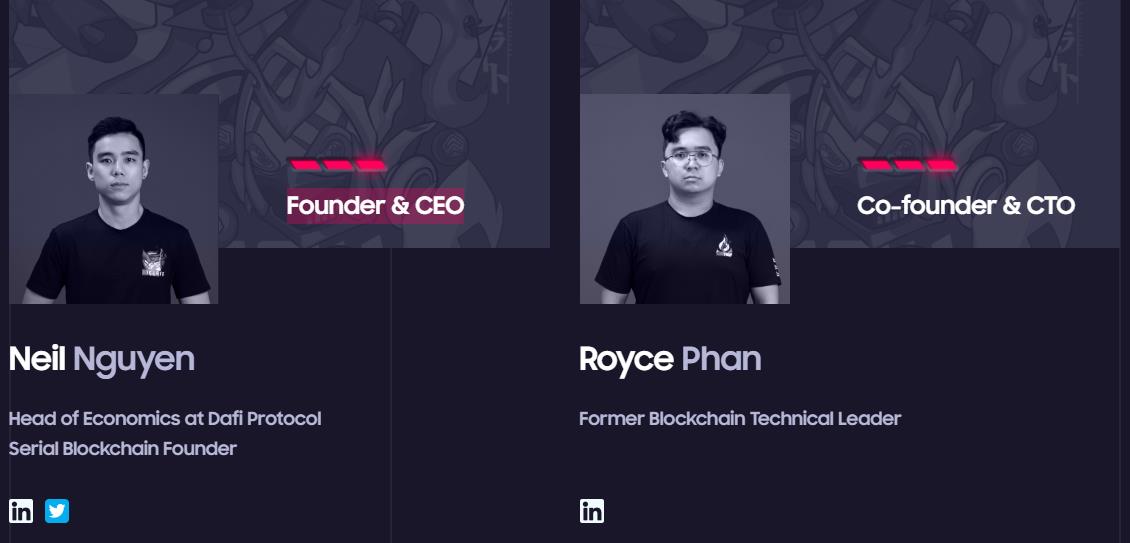

AshSwap is created by a team of talented developers and professionals. After a period of working and developing in this field, they decided to step out and build a meaningful product. We all aspire to the bright future of blockchain, DeFi and want to be a part of this wave of innovation.

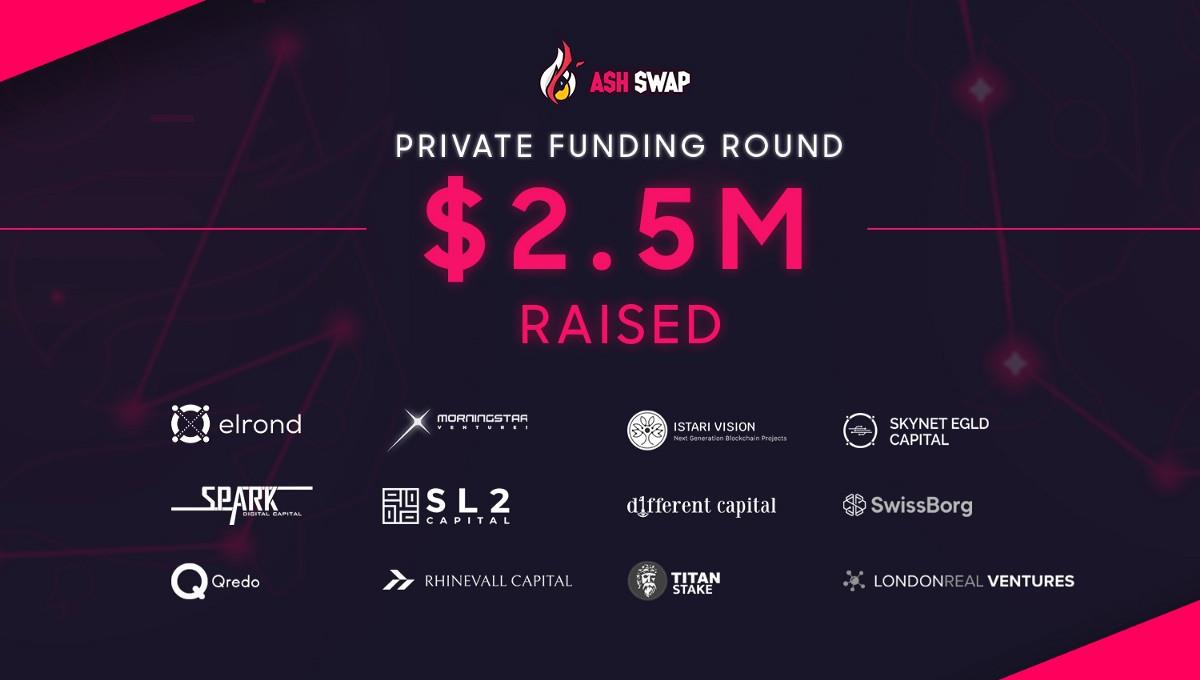

AshSwap has completed the funding round with a total raised of $2.5 million. With the participation of investment funds such as Elrond, Morningstar Ventures, Istari Vision, Skynet EGLD Capital, Spark Digital Capital...

Led by Elrond, they have brought to the project reputable investment funds in the blockchain technology industry with their rich experience and impressive portfolio. With the help of these funds, AshSwap will quickly transform from a young startup into a unicorn.

2022

2023

2024

Not much is known about the project's token yet.

LKASH will represent ASH and can be used to provide liquidity on Maiar Exchange or staking in certain programs on AshSwap.

LKASH can be exchanged to ASH at 1:1 ratio after 3 months calculated from TGE.

AshSwap is the first decentralized exchange built on the Elrond blockchain that allows users to trade between stable assets with large volume and small slippage. As Elrond grows to become the infrastructure of DeFi, more stablecoins will flow in and users will need a place to swap them.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.