What is BendDAO?

BendDAO is a Lending & Borrowing protocol in the field of NFT that allows NFT holders to collateralize NFT to borrow money. Notably, BendDAO will be the liquidity provider for NFTs collateralized in the protocol.

Along with the explosion of NFT, many utilities designed specifically for NFT were also born. In general, the pieces of the NFT ecosystem have many similarities with DeFi. However, unlike fungible tokens, NFT is an asset class that fluctuates a lot in a short period of time and is quite illiquid. Therefore, developing a platform that can price and use NFT as collateral to borrow money at first will be very difficult and few successful projects.

BendDAO was born to solve the above problem, the project allows the implementation of NFT mortgage lending protocols. However, BendDAO launched again in mid-2022 – a time when NFT seems to have fallen at the end of the FOMO cycle, the price of popular NFT collectibles tends to level off.

Operation mechanism of BendDAO

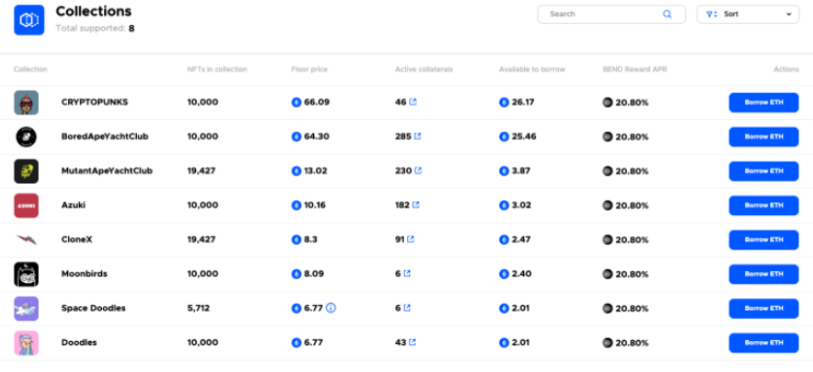

Instant NFT-backed Loan

NFT holders can borrow ETH through Lending Pools by depositing their NFT holdings into the BendDAO platform. This NFT will be used as collateral to borrow ETH. Besides, lenders can deposit ETH to profit from the interest that the borrower needs to pay. It is noteworthy that users can rely on this protocol to trade NFT leverage.

Collateral Listing

NFT owners or sellers can choose to instantly receive up to 40% of that NFT's floor price before it goes on sale. Instant liquidity is done instantly by BendDAO. The buyer will pay off the loan including interest after the agreement.

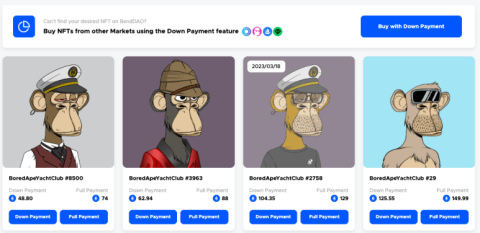

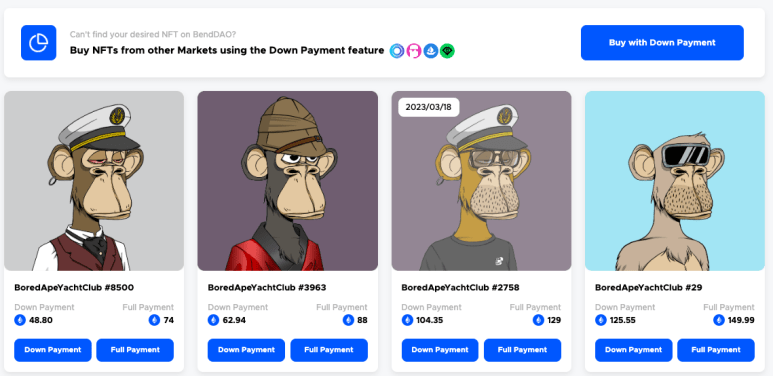

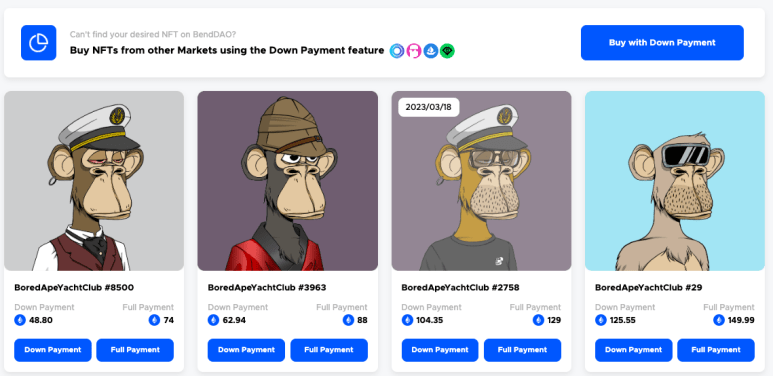

Buy with Down Payment

BendDAO also allows to buy NFT blue chips upfront 60% of the product value with the remaining 40% borrowed from the BendDAO platform. Users will pay this loan in installments over a period of time with an interest rate specified by BendDAO.

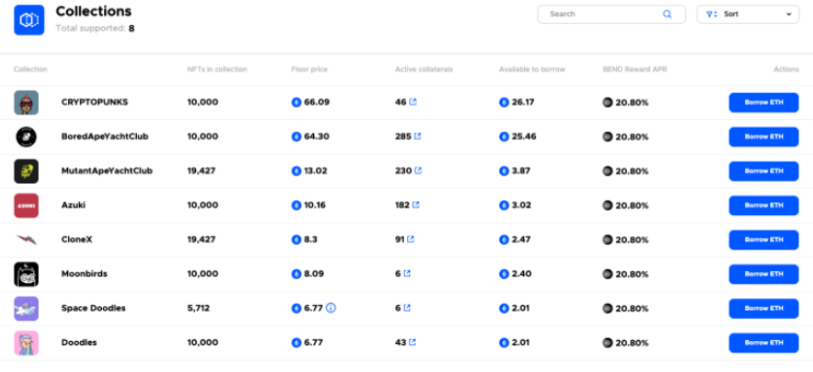

Note that BendDAO only allows users to use this service for highly liquid NFT collections, with the following NFT Bluechip criteria:

- Floor price above 10 ETH

- Market capitalization greater than “floor price * 10,000”

- The number of items is more than 5,000

- The number of owners is more than 1,000

- OpenSea all-time trading volume is over 50,000 ETH

- The collection has been minted for more than 30 days

Benefits for users

24 hour liquidation protection

To avoid losses due to market fluctuations, borrowers will have a 24-hour liquidation protection period to repay the loan.

Get Airdrop for Borrowers

NFT borrowers will also have the opportunity to receive all airdrops related to that NFT if their NFT is in the collateral pool on BendDAO. In particular, BendDAO offers borrowers the Flashloan feature, allowing users to claim NFT rewards on other protocols while still having NFT in the pool of collateral.

Never get stolen NFT

NFTs will be converted into ERC-721 boundNFTs representing NFT loans. boundNFT has the characteristics of Soulbound tokens (SBTs), boundNFT is non-transferable to avoid being stolen by hackers.

Development roadmap

BendDAO's 2023 development roadmap is as follows:

1st quarter of 2023

- ApeCoin Staking Improvement Proposal

- Supporting Moonbirds with Nesting Proposals

- Koda Wrapper for Otherdeed LAND Proposals

Second quarter of 2023

- P2P loan proposal NFT

- New NFT Auction Proposal

- Recommend private loan group

3rd quarter of 2023

- Proposal for on-chain governance

Project development team

Currently, the BendDAO team works anonymously, TraderH4 will update if there is more information from the project.

Investors and partners

The project currently has no investors, BEND tokens are issued on Fairlaunch. BendDAO's partner is Chainlink Keeper to help distribute fees to BEND stakers.

Tokenomics

- Token Name: BendDAO

- Ticker: BEND

- Blockchain: Ethereum

- Token Standard: ERC-20

- Token Type: Governance

- Total Supply: 10,000,000,000 BEND

- Circulating Supply: 382,458.902 BEND

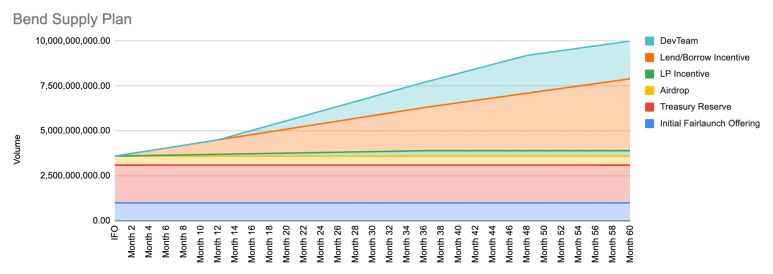

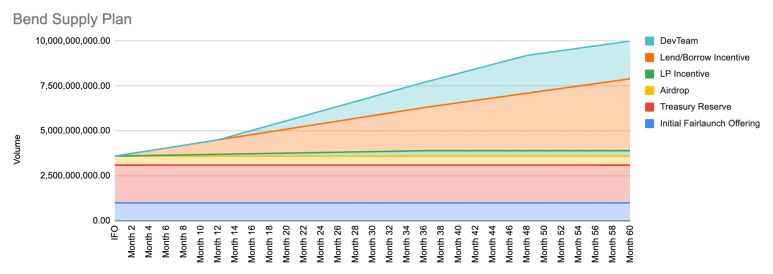

Token Allocation

- Developer Team: 21%

- Initial Fair-launch Offering: 10%

- Treasury Reserve: 21%

- Airdrop: 5%

- Uniswap LP Incentive: 3%

- Lend/Borrow Incentive: 40%

Token Release

Exchanges

Currently, you can buy BEND at exchanges such as Uniswap V2 and V3, MEXC, BKEX, Hotbit...

summary

Above is some information about the BendDAO project and the BEND token. Overall, BendDAO has opened up new use cases for NFT, setting the stage for the development of more NFT utilities in the future. The project has helped individual investors with small capital to easily access blue-chip NFTs. From there, the NFT field will be known to more people. If readers are interested in BendDAO, you can follow the following social networking sites:

Website | Discord | Twitter