What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Staking is the locking of cryptocurrencies to receive rewards. Or you can simply understand, Staking is a form of savings and you will receive interest on those coins.

In many cases, you can accumulate coins on the crypto wallet itself or on the exchange. The reward you receive will depend on the amount of cryptocurrency and the staking time.

Binance Staking is understood as a service that helps you Staking certain cryptocurrencies when storing assets on the Binance exchange. That is, you only need to deposit the cryptocurrencies that Binance supports Staking to be able to start participating in making profits from this form on the Binance exchange.

This is one of the channels that generate passive income for many long-term crypto investors. They want to increase their coin holdings but do not have time to learn about trading coins.

You can simply understand how Binance Staking works similar to how the PoS consensus protocol works. You will lock a certain amount of assets and receive rewards proportional to the number of locked assets as well as the lock time. This investment method does not require you to equip complex machinery such as the mining process. With Staking, you simply use your idle assets to earn more passive income.

When starting to confirm participation in Staking, the system will record and lock your cryptocurrency amount. Accompanied by agreements with each Staking package such as lock time, expected APY, method and time of reward payment ...

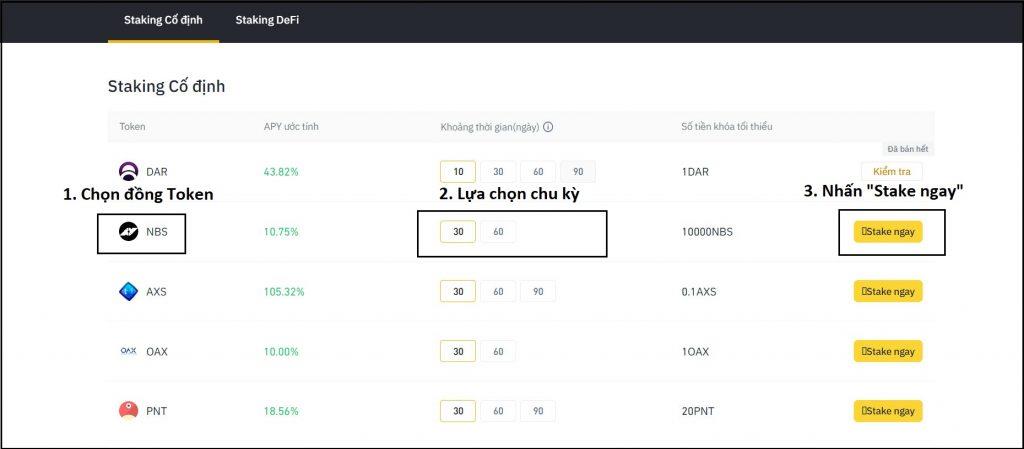

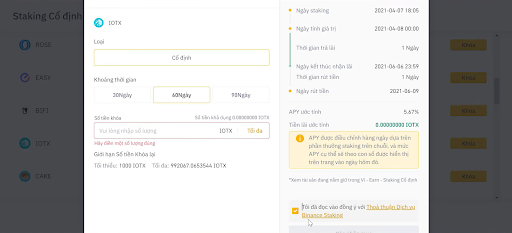

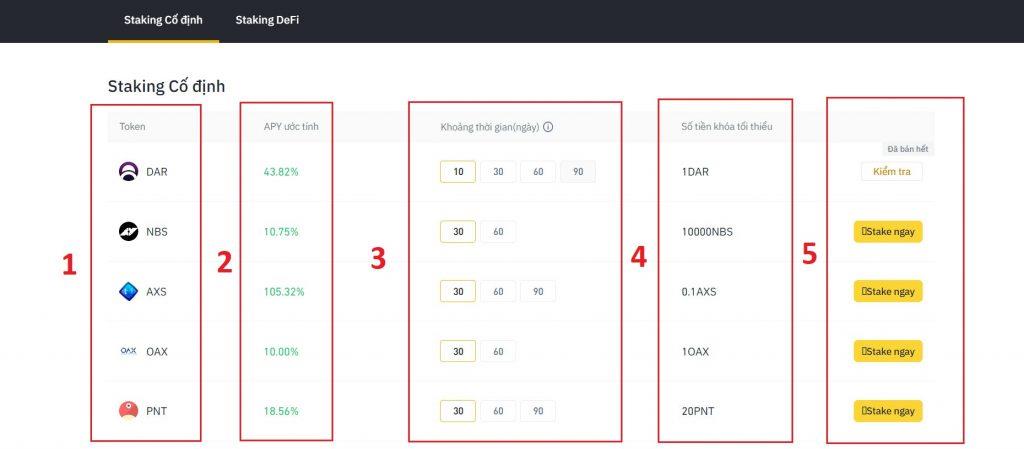

This form is also known as “Fixed Staking”. That is, you will lock a certain amount of cryptocurrency for Staking on Binance. The fixed cycle that you can choose from is 30, 60 or 90 days.

The advantage of Locked Staking is that the average annual return is higher than Flexible Staking. This form will be especially suitable for investors who want to increase the number of cryptocurrencies they hold.

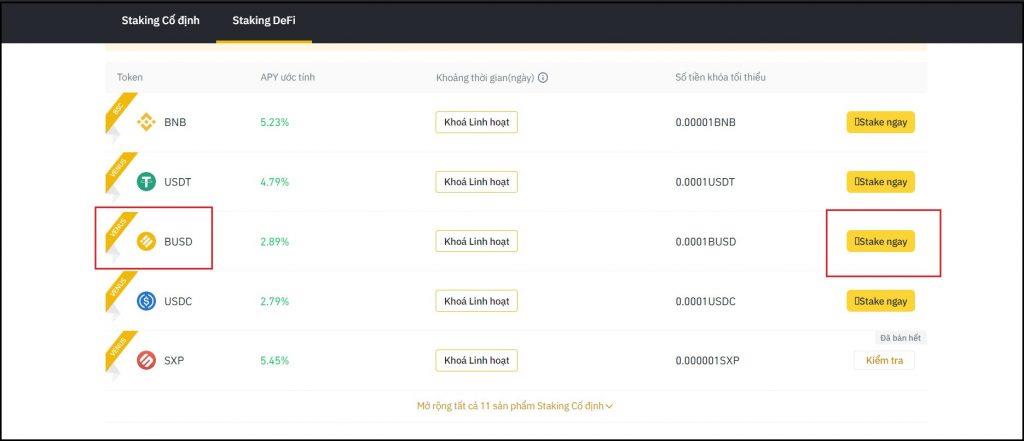

This is the simplest way to help you access DeFi products. Binance will represent you to invest in DeFi projects, receive income and redistribute it to you.

Profits from DeFi Staking are often higher than other forms. But this form also has many risks. Because you are not the person who directly Staking but authorize Binance. So, be careful and equip yourself with the most complete knowledge before participating in this form.

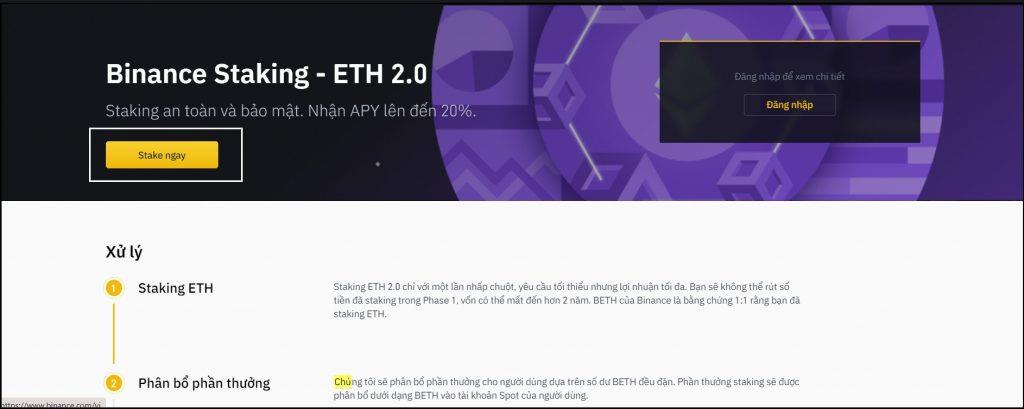

Staking ETH 2.0 is a very popular topic with crypto investors, even this has been a strong explosive trend in recent times. ETH 2.0 will be released in three phases and an essential part of it is Staking. Participating in Staking ETH 2.0 is not a simple and easy thing. Because you have to Staking at least 32 ETH.

Therefore, Binance has created an ETH 2.0 Staking form on its trading platform to make it easier for users to access. You can start Staking ETH 2.0 with only 0.1 ETH. All on-chain rewards will be distributed to users.

When participating in Staking on Binance, you will not have to pay any service fees. But all the rewards received by Binance are divided among all users.

Next, you absolutely have the right to unstake any time you want.

And Binance is an exchange that offers the opportunity to make quite a profit. You have many choices, DeFi Staking or Locked Staking with fixed term. In addition, the exchange also offers Staking ETH 2.0 with APY up to 20%.

In cryptocurrency trading and Staking, there are risks that we cannot foresee. Even if you Staking on Binance, it is the same.

The first risk that you need to be aware of is cryptocurrency devaluation. Because when Staking, you will have to lock cryptocurrencies with a fixed cycle, possibly up to several months. During this time, property values can drop significantly. You will lose the opportunity to sell them at a good price.

Next, Binance will not be responsible for the risks coming from the project, such as the project not continuing to operate or being attacked by hackers. In the past there have been several DeFi projects hacked. Some names can be mentioned is the dForce project, on April 19, 2020, about 25 million USD was hacked. Or the Maker project was hacked on March 12, 2020 with an estimated total of about 9 million US dollars.

Finally, Binance's customer support service is quite slow. Many questions or user feedback went unanswered during the day.

Binance is a reputable and famous exchange in the cryptocurrency market today. You can trust that Binance will select potential DeFi projects for users to access. Limit basic risks such as inexperience or weak, under-assessed projects.

However, you should note that Binance is only an intermediary that connects projects with users and this exchange will not be responsible for unnecessary risks.

You should carefully read the damage disclaimer and disclaimer of the floor shown in the image below.

You need to buy/top up the cryptocurrencies supported in the Staking section of Binance to be able to do Staking on this exchange.

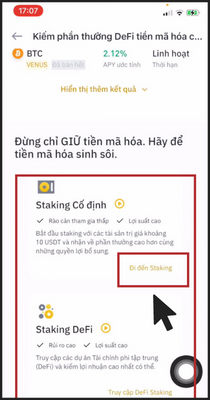

Step 1 : You access the Binance application on your phone. At the homepage, select “ Binance Earn ”.

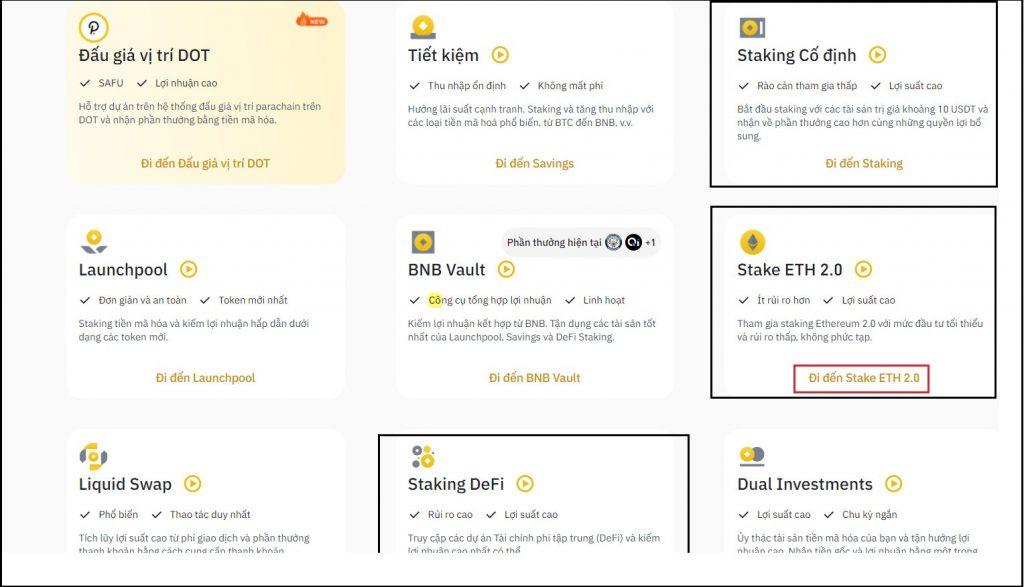

Step 2 : Next, scroll down to select the form of Staking you want to participate in.

Step 3 : You click:

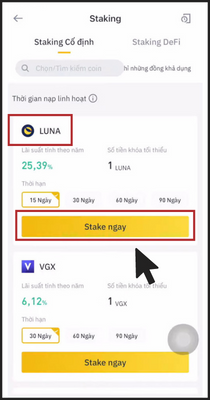

Step 4 : You click on the token to participate in Stake. Next, you choose “ Stake now ” or “ Stake now ”.

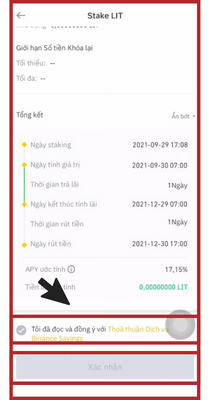

Step 5 : Enter the amount of tokens you want to Staking (Note the minimum and maximum number of tokens mentioned below. For Locked Staking you choose to add a lock period).

Step 6 : You tick the box “ I have read… ” or “ I have read and agree… ”. Finally, click " Confirm ".

You can absolutely do Staking on the Binance website interface.

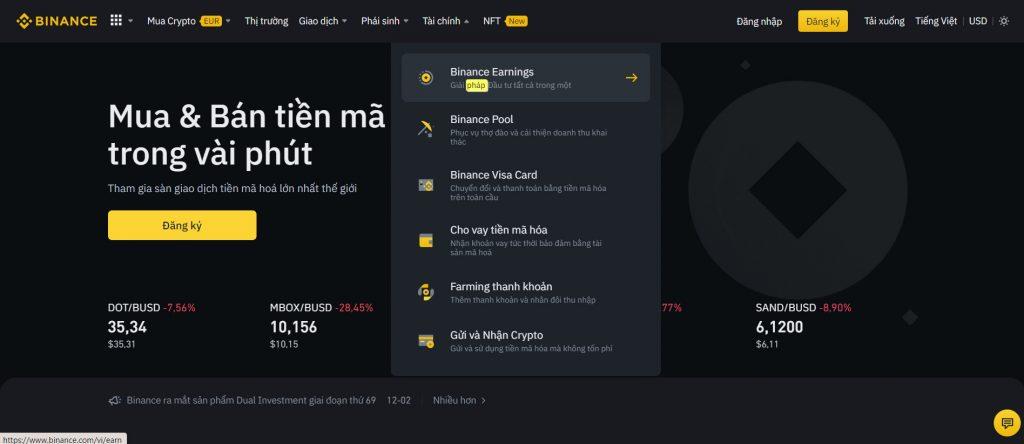

Step 1 : You access the Binance homepage . Click on “ Finance ” and then select “ Binance Earnings ”.

Step 2 : Next, scroll down to the bottom, select the appropriate form of Staking. Click “ Go to Staking” or “ Stake ETH 2.0 ” or “ DeFi Staking ”.

Step 3 : For each form of Staking on Binance, you will perform different operations.

Step 4 : Enter the number of tokens you want to Staking (Note that this number of tokens needs to satisfy the minimum and maximum number specified in each token). Next, check the box “ I have read and agree to the Binance Staking Service Agreement” and select “ Confirm Purchase ”.

Things to note when Staking on Binance

Before participating in Staking, you need to keep a few things in mind:

Taking the example of Axie Infinity (AXS), how to calculate Staking interest on Binance is as follows:

Amount of AXS received by each user = Total amount of AXS Staking Binance received * Percentage of AXS held by users.

User AXS Ratio = User AXS Hold / Total AXS Binance Holds Staking.

Cryptocurrency investors all understand that Staking is no longer an outstanding feature that can make a clear difference between exchanges and so is Staking on Binance.

What you need to care about most of all at this time, is the asset that is staking. Because maybe Binance does not accept Staking of this token, but other exchanges accept and give reasonable APY.

When Staking on Binance, you can completely buy or sell more tokens if you don't have enough. But in return, you will not receive other benefits, such as receiving NFT or a certain reward.

To answer the common questions of many investors, TraderH4 has compiled some of the most frequently asked questions when participating in Staking on Binance as follows:

Which Cryptocurrencies Does Binance Support Staking? Depending on the form of Staking you choose, Binance will support Staking of different cryptocurrencies. Currently, you can Staking the following coins: EOS, ATOM, XLM, TRX, ALGO…

Is it possible to withdraw before maturity Locked cryptocurrency? You absolutely can. To be able to withdraw early before the selected term, you must go to Savings Wallet and select Locked or DeFi Staking and select Early-redeem.

If early withdrawal of Staking tokens, how will the interest be calculated? Investors will receive the full principal amount and will not receive any interest if withdrawing early.

If early withdrawal of tokens, how long will it take you to receive? Early token withdrawals usually require one day to unlock. Because your tokens are locked to participate in on-chain contracts. And the system also needs time to complete the withdrawal and allocation process.

Through the above sharing, you can fully understand Staking, Binance Staking, as well as its operating mechanism.

From the point of view of many investors, Staking is one of the simplest methods for you to profit from the assets you are holding. Note that, before participating in any form of investment, you should carefully prepare the necessary knowledge to invest effectively.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.