What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

ClearDAO is an open source protocol specifically designed for derivatives products including OTC derivatives. With ClearDAO, anyone can create custom derivatives and manage risk in a streamlined, efficient way.

Specifically, merchants can design, price, trade, delete, and pay for derivatives on any crypto-asset. Buyers can purchase these derivatives through an OTC service.

By providing OTC derivatives and tools for risk management, ClearDAO is gradually perfecting the DeFi space. Not only that, ClearDAO's products also help create cash flow from the traditional financial market to the cryptocurrency market in general and DeFi in particular.

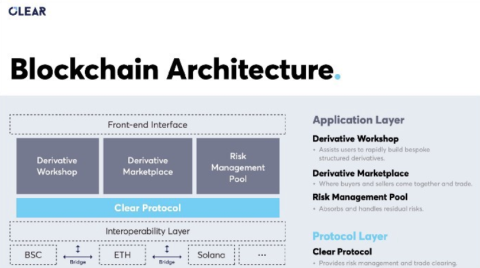

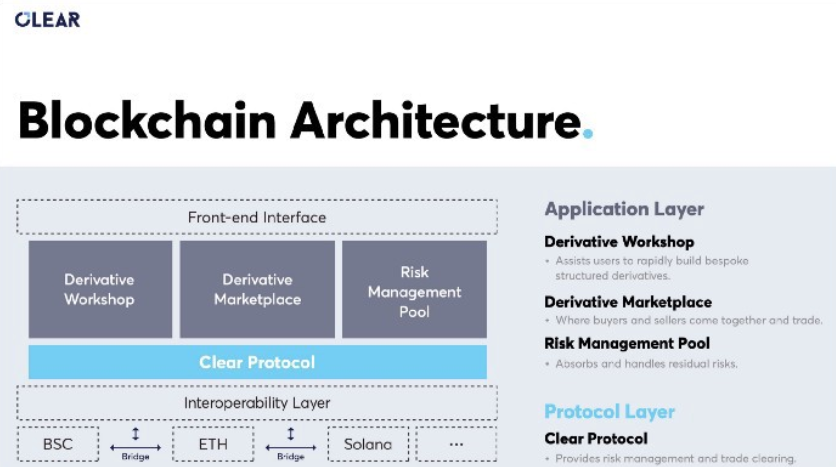

Currently, users can interact with ClearDAO through 3 application modules as follows:

Although DeFi's liquidity growth over the past 36 months has been very fast. But for DeFi to become a full-fledged financial system, it still takes a very long time. The lack of derivatives and risk management products limits DeFi's capital flow from traditional finance.

ClearDAO's goal is to introduce a complete suite of derivatives products to the DeFi market. By providing separate risk management and derivatives tools, ClearDAO helps users manage crypto portfolio risk more efficiently.

ClearDAO also provides an infrastructure that allows anyone to create and trade on-demand derivatives contracts on the open market that were previously limited to a certain group of investors. In addition, ClearDAO allocates a part of the platform fee to the Risk Management Pool to reduce the risk of trading with counterparties.

Besides the risk management tool Risk Management Pool, the outstanding feature of ClearDAO is also reflected in the tools to support the creation of derivative products:

Open Derivative SDK : The SDK Toolkit is the core product of ClearDAO, which is highly adaptable allowing developers to create new derivative products. The ClearDAO development team will continue to add support for basic content layers and derivative templates to the SDK to expand the aggregation capabilities of this toolkit.

Community Driven Market : This is the place that ClearDAO designed to invite community members to launch multiple trading platforms and build a derivatives ecosystem together.

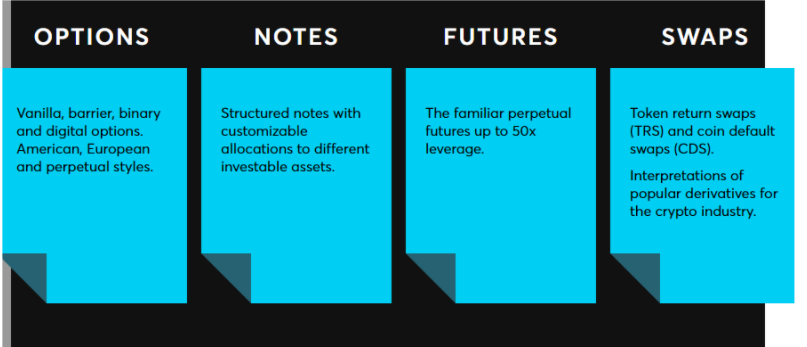

ClearDAO will focus on developing 4 products: Options, Notes, Futures and Swaps. Currently these products are not complete. The ClearDAO team is still continuing to test and perfect the above products and promises to launch the community in the future.

Options

ClearDAO will develop the options market to include options such as: Standard (Vanilla), barrier (Barrier), binary (Binary), American and European style digital options. Currently this product is having test events on various blockchains . It is expected to be the first product that will be released to the ClearDAO community.

Notes

This product allows users to customize the allocation of investment capital into different types of crypto-assets.

Futures

Similar to Binance's Futures trading feature, ClearDAO offers perpetual futures with up to 50x leverage.

Swaps

This product plays an important role in ClearDAO's platform, allowing investors to swap tokens, similar to swaps on DEX exchanges.

In the ClearDAO system, the user interacts directly with the application layer. ClearDAO's core application modules run the core business and are designed around the following principles:

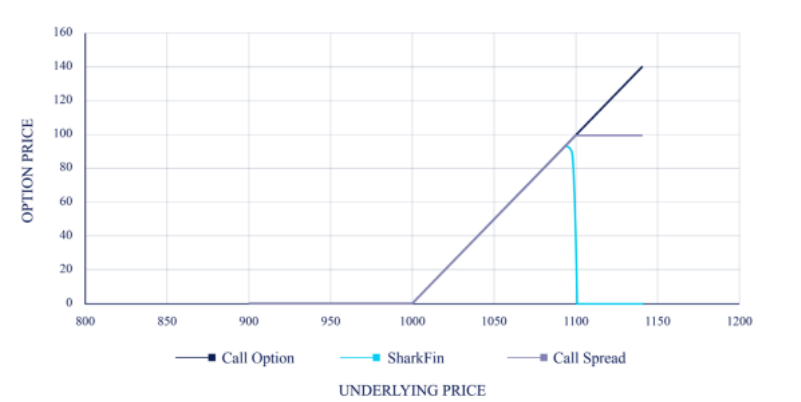

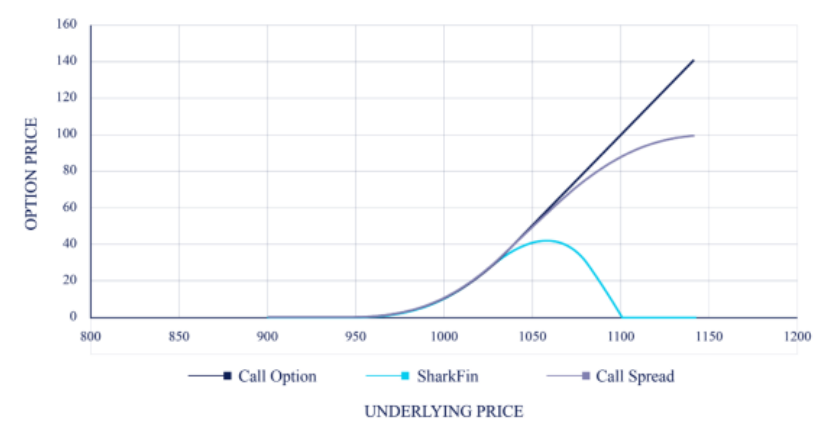

Option pricing principles and models

Standard option pricing (Vanilla Option) usually follows the BSM (Black-Scholes Merton) model. But, the blockchain system cannot guarantee that the option seller (Option Writer) will actively fulfill the payment obligation on time.

As a result, liquidity providers on ClearDAO offer hedged arbitrage options that make it easy for traders to open long or short positions, and even open both positions at the same time.

Essentially, the structure of the spread option ensures that liquidity providers have sufficient capital to fulfill their options contract agreements.

The team implemented QuantLib, a standard set of open source models for modeling options pricing. Liquidity providers on ClearDAO can choose from an available pool of reference assets or define their own based on their own assets.

They will then build their own options by setting hurdles, expiration dates and other parameters. When a user chooses to buy a particular option, the parameters are fixed and ClearDAO's pricing module automatically quotes a price based on the QuantLib model set.

Risk management principles and models

ClearDAO has built in multiple levels of risk control to handle a variety of contingencies. This is to help users and liquidity providers effectively control risk.

For liquidity providers, ClearDAO will set up a hedge fund. Liquidity providers can contribute to this provision and receive a certain level of risk protection.

Supposedly, in case the user account is locked and the deposits cannot be recovered to open the account, the risk reserve fund will allocate capital to solve this problem.

In the early stages of the project, the project operator will deposit a certain amount of money into the risk reserve fund to protect investors against bad situations.

Development team

ClearDAO is developed by the team of DerivStudio – a company specializing in the development of derivative products. DerivStudio members are also those who have innovative ideas on how to manage crypto-asset risk.

Investors

ClearDAO has completed a Private funding round with a total investment of $2.5 million. With the participation of many large investment funds such as Huobi Ventures, Kronos Research, SpringWind Ventures, Double Peak Group, Markarian Capital, Gate.io Labs, VRM, Hoo Cub Fund, AC Capital, DWeb3 Capital, Foresight Ventures, AlphaCoin Fund, Mintable Fund, NPC DAO.

ClearDAO's Seed Round was attended by LD Capital and StillWater Research.

Partner

Currently ClearDAO is working with Chainlink to integrate the price feed, while helping to secure the prices of DeFi derivatives products.

ClearDAO's development roadmap in 2022 includes the following activities:

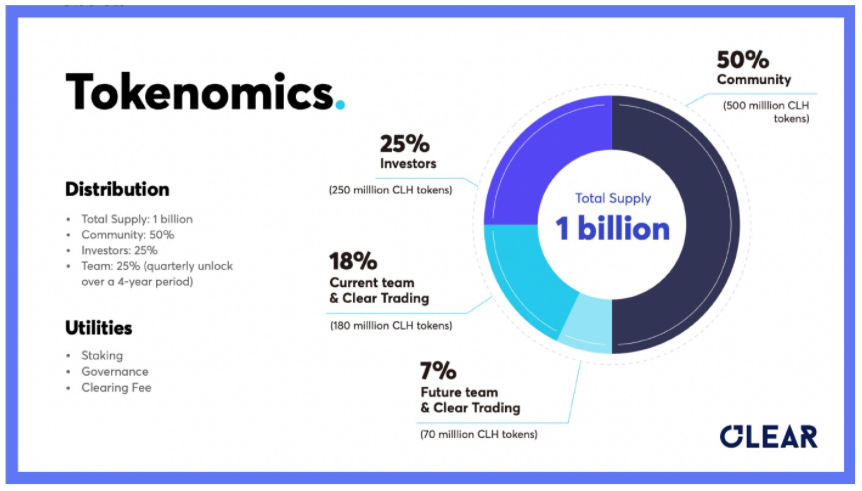

CLH is the native token of the ClearDAO ecosystem and has several functions as follows:

Investors: 25%, of which:

Core Contributors: 25%, this token will not be allocated immediately after TGE, 6.25% will be unlocked every quarter and distributed within 4 years.

Community: 50%, in which:

Investors can buy CLH tokens on KuCoin through the 18th Spotlight event from January 5, 2022 to January 7, 2022. Each CLH token is sold for 0.01 USDT, the total number of tokens sold in this round is 20,000,000 CLH.

We cannot deny that the DeFi ecosystem is growing very quickly. Initially, from simple transactions between two user addresses, DeFi now has many other pieces such as Farming, Lending... In addition, DeFi is also a place to create many opportunities to increase profits for home owners. invest.

However, there are still many people in the traditional financial market who are hesitant to join this rich DeFi land. So the question is “what prevents them from participating in DeFi?”.

Faced with that situation, the ClearDAO development team explained that there are currently two structural problems in DeFi: the lack of derivative products and risk management tools.

These could be barriers that keep DeFi from growing further, even though more and more people are investing in crypto assets. Therefore, ClearDAO was born to solve these two problems. The platform allows anyone to create and trade derivative contracts on demand on the open market.

Some official information channels of the project that investors can follow are:

Website | Twitter | Telegram | Medium

ClearDAO is contributing to the development of the DeFi market by building the infrastructure for derivatives products. In addition, the project is building a multi-chain ecosystem that allows users of many different blockchains to easily interact with ClearDAO products. With the above information, TraderH4 hopes that readers can make the right investment decisions for themselves.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.