What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Composable Finance is a full technical stack created for the purpose of promoting the development of digital assets and the DeFi protocol.

Therefore, this project creates an environment that allows users to more easily interact with projects in the DeFi space in a more seamless manner. At the same time, Composable Finance also provides interoperability that allows unification of functions across all blockchain ecosystems.

Not stopping there, this protocol also has the ability to connect between Layer 2 and the Polkadot, Kusama and Cosmos ecosystems through the IBC protocol. In the future, Composable Finance will expand its connection to other ecosystems such as Algorand, Solana, etc.

You may be interested : Composable Finance project review: An expert's perspective?

Composable Finance is building the infrastructure that allows developers to deploy decentralized applications. At the same time, the project provides users with the ability to access ecosystems such as Polkadot , Kusama, Cosmos ... and automatically interact between these layers with another layer or platform with another platform.

Composable Finance was created specifically for removing the complexity of using DeFi protocols. In addition, this project eliminates the problems of high costs and delays in transaction execution.

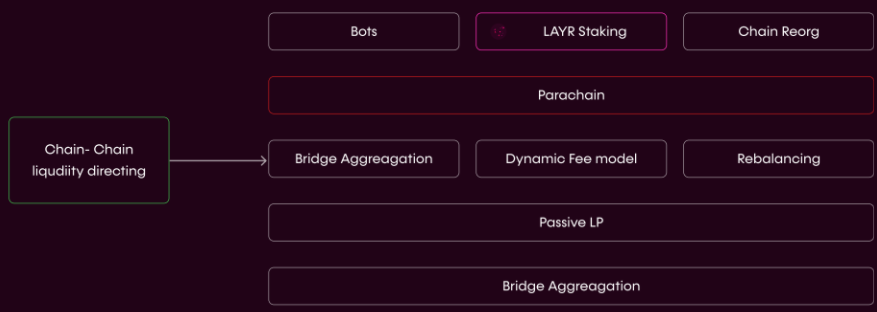

In addition, Composable Finance is creating an information transfer protocol in the ecosystem and virtual machine supported by IAL (Innovation Availability Layer). The IAL will serve as a fabric capable of orchestrating and computing smart contract functions across multiple Layer 1 and Layer 2 technologies seamlessly without compromising security. With this ability, all activities on Composable Finance can take place in the most optimal way.

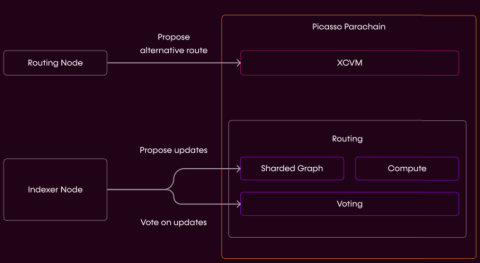

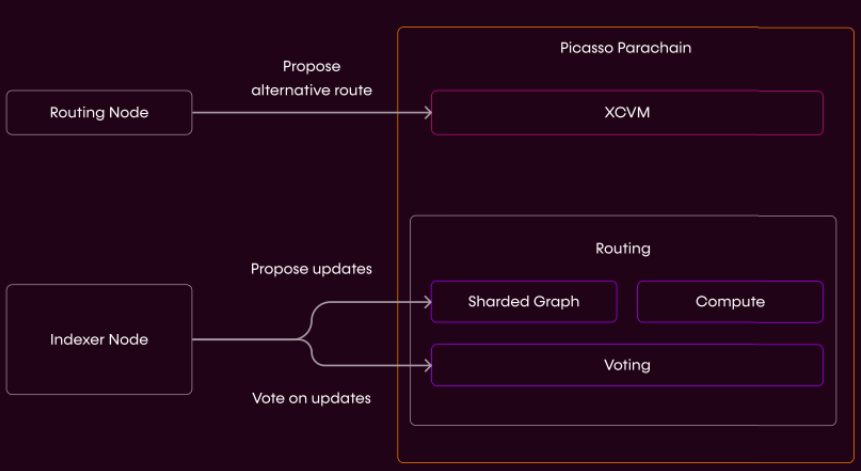

Cross-Chain Virtual Machine (XCVM)

The Cross-Chain Virtual Machine (XCVM) is a single and extremely developer-friendly interface to the project developer. This product allows them to interact and coordinate smart contract functions across multiple Layer 1 and Layer 2 existing in the cryptocurrency market.

XCVM tools allow developers to fully exploit communication functions and liquidity availability across a variety of platforms. Thanks to XCVM, users can make investments on more blockchain platforms.

Routing Layer

Suppose, an investor makes a loan of 1,000 USDC, the Routing Layer is responsible for evaluating all layers and blockchains that support borrowing to choose an optimal option for users.

Routing Layer will be absolutely secure and be provided with the ability to choose the best options to meet the needs of the user. This product will act as a function aggregator, providing optimal services to users. At that time, investors do not need to search for optimal profit opportunities in the entire DeFi space.

Another application of Routing Layer is cross-chain cost management. The infrastructure of Composable Finance intends to bring together multiple blockchains into a single network. At that time, a user's investment activity will have many implementation options. In this case, the user has to find the best option for himself based on many different factors. The Routing Layer will simplify this process and allow users to customize the parameters they want to optimize when completing a certain transaction.

Mosaic

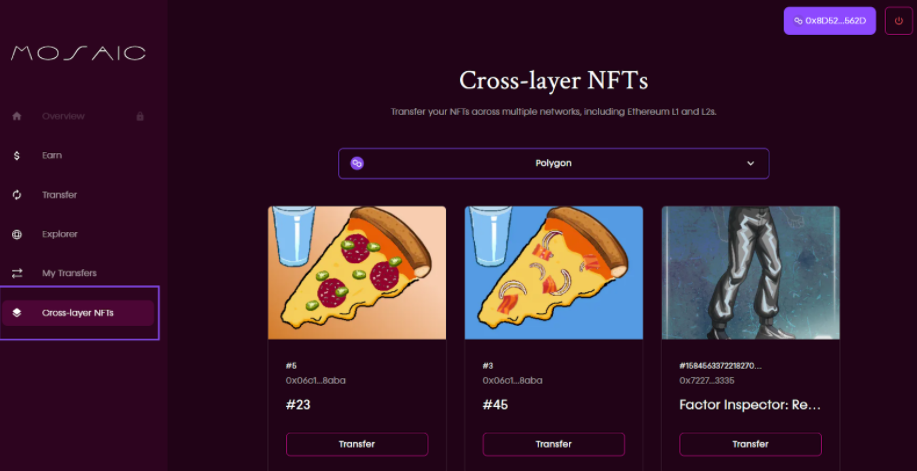

Mosaic is a cross-chain transfer system, created with the goal of ensuring that liquidity gets moved where it is really needed. Currently Composable Finance is testing this possibility on the EVM virtual machine system by launching Mosaic's Proof-of-Concept. From there, the project can generalize the liquidity problem as well as offer optimal solutions for other ecosystems.

Currently, Mosaic is integrated with Ethereum, Moonriver and several scaling solutions, Layer 2 such as: Arbitrum, Avalanche C-Chain, Polygon and Fantom. Going forward, Mosaic will connect all other DeFi ecosystems, including pioneering ones like Cosmos and DotSama, to create flexibility between different blockchains.

The immediate vision is for Mosaic to provide liquidity services for Layer 2 projects. The ultimate goal is to build a liquidity-driven system that can move liquidity as needed around the space of projects. Layer 2 project.

In addition, Composable Finance allows users to deposit their NFTs into the Summoner Vault from any source layer that is linked to Mosaic. This NFT will then be locked and cast back to any Layer associated with the Mosaic selected by the user. Through this simple Vault locking process, the freshness of the NFT will be maintained, while allowing users to easily migrate that NFT across different ecosystems in the DeFi space.

Picasso Parachain

Picasso is the twin brother of Composable Finance built on the Kusama network . Picasso Parachain provides enhanced interoperability, customization, and security on top of traditional blockchain structures.

Currently, Composable Finance is planning to build an entire ecosystem around the Composable and Picasso parachains. Composable Finance will provide app developers and users with a decentralized economy with unlimited access. This allows developers to have access to the best maintained parachains.

In addition, Picasso has a mechanism for users to vote on which Pallets they want to add at runtime. This will be done through Picasso native tokens (PICA), which provide PICA holders with governance votes.

Explanation of words : Pallets are solutions that help blockchain have additional features when upgrading.

Development team

Composable Finance owns a team of individuals with a passion for decentralized finance and blockchain technology, including:

Cosmin Grigore, CEO of Composable : Cosmin has been involved in the cryptocurrency market since 2017 as a Solidity programmer. He used to work in the field of computer science. Cosmin made the full transition to cryptocurrencies in 2020. The first unit he worked with was Nakamo.to – a company invested by Advanced Blockchain AG, as the technical development team leader.

Karel Kubat, CTO of Composable : Karel is a longtime crypto developer and investor. Karel has worked on a wide range of blockchain protocols and platforms, such as Ethereum, NEO, Substrate, and more.

Zain, CMO of Composable : Zain is a marketing executive with years of branding experience. Prior to joining Composable, he was brand manager at Biconomy and chief marketing officer at Muzmatch.

Seun Lanlege, Parachain Lead of Composable : Seun was a core developer at Parity Technologies. While at Parity, Seun worked for Ethereum, Substrate, and Polkadot, while also learning how to launch and maintain other blockchain networks. He is leading the Polkadot development team, Seun will leverage his knowledge and experience to develop Composable Finance.

Investors

The project has raised 7 million USD from major investment funds in the cryptocurrency market such as: Alameda Research, Maven Capital Advanced Blockchain, CMS, DFG, Spartan, RareStone and many others.

Quarter 4 of 2021

1st quarter of 2022

Second quarter of 2022

LAYR is the native token of Composable Finance and has some main functions as follows:

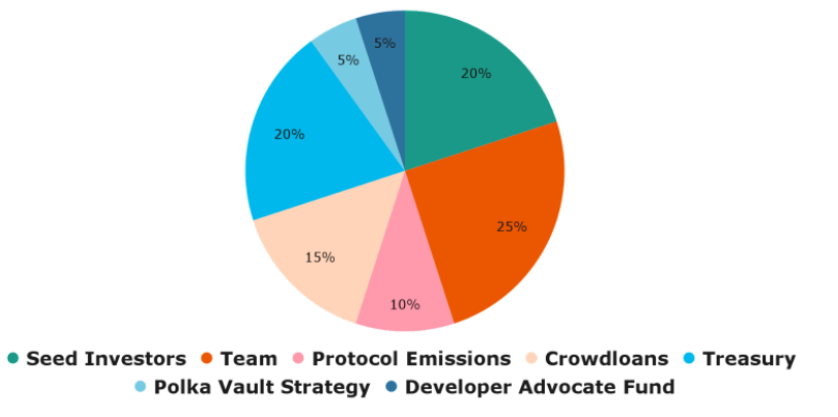

Seed Investor: 20%, of which 20% will be unlocked at TGE, the remaining tokens will be distributed linearly over 2 years.

Advisor: 5%, these tokens will be locked for 3 months and then distributed linearly over the next 3 years.

Team: 20%, these tokens will be locked for 6 months and then distributed linearly over the next 2.5 years.

Protocol Emission: 10%, this token will be distributed evenly every month for 36 months (277,777,778 LAYR per month for three years).

Crowdloan: 15%, of which 12% is being used in current Polkadot auctions with 25% to be allocated at TGE, the rest will be distributed over 2 years.

Treasury: 20%, tokens in the treasury will be allocated linearly over 2 years.

Polkadot Vault Strategy: 5%, of which 50% will be released at TGE, the rest will be distributed in 6 months.

Developer Advocate Fund: 5%, of which 50% will be issued at TGE, the rest will be distributed in three months.

Currently LAYR token is not listed on cryptocurrency exchanges. However, investors can join Composable's Crowdloan by contributing DOT or stablecoin to get LAYR back.

You may be interested : Composable Finance's guide to joining Crowdloan with stablecoins .

Moving assets back and forth between ecosystems has become easier and easier with the arrival of Composable Finance. The project creates a two-way bridge for many platforms such as Ethereum, Cosmos, Avalanche, Solana, NEAR Protocol, Moonbeam, Moonriver… With the continuous development of the cryptocurrency market, there are more and more applications. Start splitting operations across Layer 1 and Layer 2 platforms to minimize costs and maximize performance. Composable was born to serve all activities of interaction, transfer and transmission of information in today's popular ecosystems.

Some official information channels of the project that investors can follow are:

Website | Twitter | Telegram | Discord | Medium | Github

Thus, TraderH4 has just brought to readers all details about the Composable project and the LAYR token. With the advantage of saving the cost of transferring assets across the chain and transactions being processed quickly, Composable promises to attract more users in the near future.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.