What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

DAI is an algorithmic stablecoin issued by MakerDAO on the Ethereum platform. DAI has a stable value with a 1:1 ratio to the US dollar. It is mainly used as a means of lending and borrowing crypto assets without the need for intermediaries.

MakerDAO was first introduced in 2015 by Danish entrepreneur Rune Christensen. By December 2017, MakerDAO created Maker Protocol, the underlying architecture for the stablecoin DAI, with the goal of building a credit system that would allow users to take out a mortgage with cryptocurrency.

DAI and its smart contracts officially launched on Maker Protocol on December 18, 2017 as a means to provide non-volatile lending assets to investors.

Users who want to own DAI will have to deposit their assets on the Ethereum platform into a smart contract. This amount of assets will be used as collateral for maintaining the stable value of DAI against the US dollar. The value of the user-submitted collateral needs to be worth more than the amount of DAI to be issued. If the value of the collateral falls below the value of the issued DAI, that collateral will be liquidated. When the user returns the DAI, their collateral will be unlocked again.

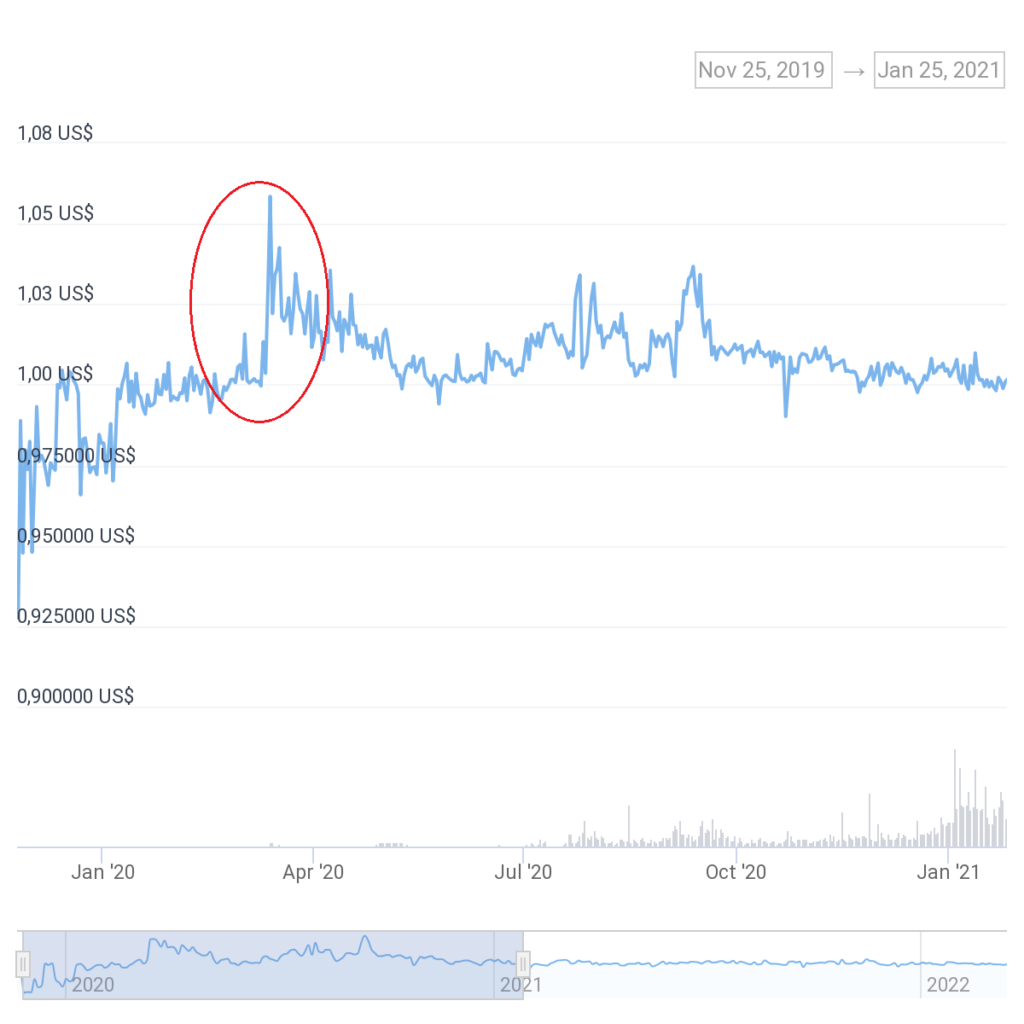

As mentioned above, DAI is fixed to the value of the US dollar. To maintain its value, DAI uses a Target Rate Feedback Mechanism. Dai's goal is to keep the value at US$1.

If the value of DAI is below US$1 then TRFM will raise the target rate for the price to rise again. When the target price increases, the loan interest rate will increase, causing users to buy more DAI to pay off debt or add more collateral. In addition to the increased lending interest rate, the system also adjusts for the savings interest rate when depositing DAI. This incentivizes users to hold and buy DAI. As demand increases, a decrease in the supply of DAI in the market will cause the price of DAI to return to its target price.

Conversely, if the value of DAI is greater than 1 USD, TRFM will reduce the target rate. When the target price falls, users can borrow more DAI with their collateral increasing the supply of DAI. Other users holding DAI can also take profits when the price of DAI is already greater than 1 USD and wait to buy back at a lower level to increase profits. When the demand decreases and the supply of DAI in the market increases, it will cause the price of DAI to return to its target price.

Here are some outstanding features and advantages that DAI brings to investors:

You can buy DAI on most major exchanges in the crypto market such as Binance, Kraken, Coinbase, Uniswap…

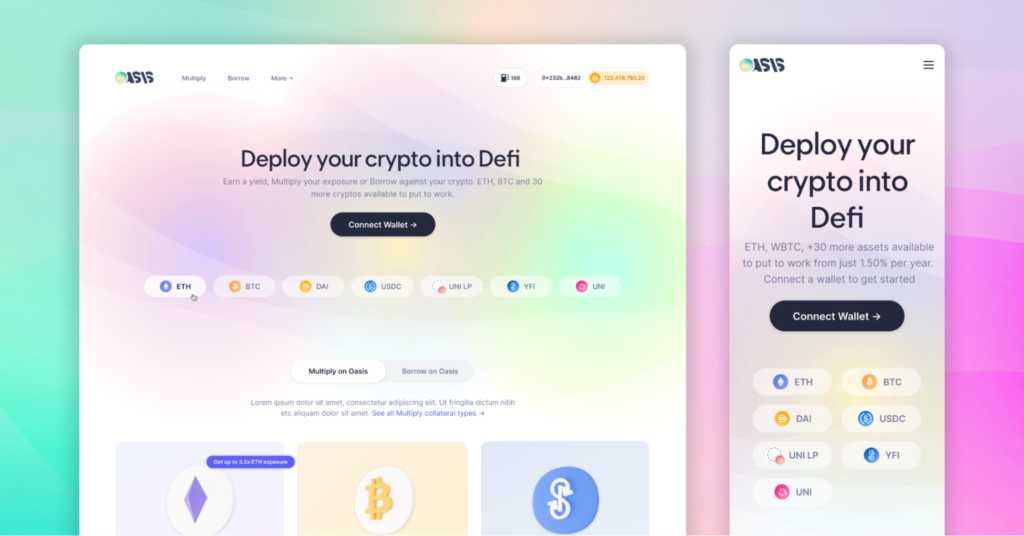

Alternatively, you can also create and borrow DAI by opening a Maker mortgage account through Oasis Borrow and depositing your assets there. The way Oasis works is similar to mortgage loans at traditional banks.

DAI is an ERC-20 standard token so it can be stored in any ERC-20 compatible wallet such as MyEtherWallet, Atomic, Exodus, Jaxx, MetaMask, Ledger, Trezor, etc.

The model and way of working of DAI is completely different from previous stablecoins. While stablecoins like USDT are backed by a fiat reserve managed by the issuer, no single entity can control the issuance of DAI, anyone can create DAI. without permission.

Also, unlike most other stablecoins that are collateralized with a single fiat currency or cryptocurrency, users can use various cryptocurrencies as collateral for DAI such as ETH, BAT, USDC, wBTC, COMP… The greater the number of currencies that can be used as collateral, the less risk of users and increase the stability of value for DAI.

All activities of DAI and smart contracts are publicly and transparently recorded on Ethereum's ledger, making it easy for users to check, track and limit the risk of fraud and corruption.

DAI is also managed by a decentralized autonomous organization (DAO) , where all changes and decisions need to go through community votes instead of focusing on just a few individuals and organizations. determined.

The decentralized finance (DeFi) boom in 2020 has seen DAI emerge as one of the most popular assets in the DeFi ecosystem. However, when the market corrected sharply on March 12, 2020 with BTC plummeting more than 50% from the price of $9,000 to $3,800, a series of altcoins dropped in price, in there is ETH. This has caused the price of DAI to increase sharply when the demand is high because investors need to buy them to avoid liquidation of their assets. To solve this problem, the developers introduced a controversial solution in the community using USDC as collateral for the stability of DAI.

Recently, regulators have turned their attention to stablecoins. In the US, a proposed stablecoin law requires stablecoin issuers to follow some of the same standards as banks. If this legislation is passed, it could have serious consequences for decentralized stablecoins like DAI.

Moreover, more and more stablecoins are born to compete with DAI, including TerraUSD (UST) with many attractive benefits for users. In addition, the exchanges also launched the deposit feature, mortgaged various assets with low interest rates, making DAI lose its position in the crypto market with ordinary investors.

If you are an investor who wants to store, use DAI to trade and make profits in the crypto market on centralized exchanges, this is not a great choice as DAI has quite a few trading pairs. translations on these exchanges. If you are an investor who likes to experience and profit DeFi projects on the Ethereum platform, DAI is definitely an option that you cannot ignore. DAI is currently the main source of liquidity for more than 400 different DeFi applications.

Hopefully, through this article, readers will have more useful information and knowledge about DAI. DAI is a decentralized algorithmic stablecoin issued by MakerDAO. Unlike other popular stablecoins whose value is directly backed by the US dollar, DAI is backed by crypto-collateralized assets that can be publicly tracked and audited on the Ethereum platform. . DAI and USDC are currently the main stablecoins that help DeFi grow and become more popular to everyone.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.