What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

The crypto market has tens of thousands of projects divided into many fields. Therefore, it is inevitable that when "pouring money" into many different projects, the management of projects becomes a problem when the portfolio is too large. Especially investment funds or investors with large capitalization, spread investment. Enzyme Finance is known as one of the professional platforms, effectively handling this problem. So what is Enzyme Finance? Is the MLN token a potential investment choice? All these questions will be answered by TraderH4 in the article below. Let's find out together!

Enzyme Finance, formerly known as Melon Protocol before being upgraded in December 2022. It is a decentralized asset management platform built on Ethereum. Enzyme Finance eliminates middlemen, allowing users to create investments across different funds, while they are protected in a safe and transparent environment.

Enzyme Smart Vaults, the latest innovation in DeFi, makes it possible for investors to build, scale and monetize investment strategies. The purpose of that project is to decentralize the traditional way of asset management, without limiting each individual's portfolio.

As of now, Enzyme Finance supports more than 200 types of assets with high liquidity in different decentralized exchanges.

Mona El Isa is the creator of the Enzym Finance platform, which through its backing company Melonport, launched in 2016. Before that she was also the CEO and founder of Avantgarde Finance. In addition, Mona has many years of experience as a portfolio manager such as Capital Partner. At the same time, this strong woman was also the Vice President of Goldman Sachs at just 26 years old. Because of that, she quickly reached the top 30 young billionaires under 30 years old, voted by Trader Magazine in 2008 and Forbes in 2011.

In addition, Enzym Finance also has another talented female co-founder, which is Jena. She is a software engineer, but also has a background in financial markets and wealth management experience. With both financial and technical knowledge, Jenna is dedicated to building Melon as the new standard in wealth management.

In 2017, Melonport held an ICO and raised about $2.9 million from the sale of MLN tokens. This company only took over Enzyme Finance in the period 2017–2018, by 2019 control of the protocol had transferred to the Melon Council DAO. Like many other DAOs, the Melon Council has a mission to maintain the integrity of the network, drive innovation, and maximize adoption in the system.

The project aims to decentralize traditional asset management, allowing users unrestricted access to investments. The protocol uses the native token MLN to perform various operations on the platform in a fair and transparent manner.

For senior and experienced investors, it is completely possible to optimize by staking & yield farming activities. However, for less experienced novices it is much more difficult. They may not be able to leverage the power of DeFi to increase returns for their portfolio, or tracking and managing the portfolio will be complicated if the assets are on multiple platforms. From there, inevitably some unfortunate mistakes, such as missing assets, missed opportunities.

Using Enzyme Finance is an effective solution, allowing investors to maximize profits on the same platform with investment strategies connected to DeFi (lending, yield farming, derivative…) and more than 200 tokens , along with convenient portfolio management and risk management toolset, make managing and investing simpler and more efficient.

MLN is a utility token, considered as a currency providing energy and operating objects in the Enzyme Finance ecosystem.

So what functions does this token have? Here are the main processing cases of MLN tokens:

Melonport, the company behind the project Enzym Finance (formerly Melon Protocol) conducted a sale of 599,400 tokens (499,400 for participants, 100,000 for Melonport AG) raising a total of 2.5 million CHF, in less than 10 minutes.

The company reserves the right to issue 500,000 MLN upon completion of the first milestone and further issue another 183,212 discounted MLN during the mainnet test phase. After Melonport withdrew and transferred control to the Melon Council DAO, 317,388 MLN tokens were burned.

By March 2019, 150,000 MLN tokens had been paid to the project's Founder team, after more than 2 years of struggling with difficulties.

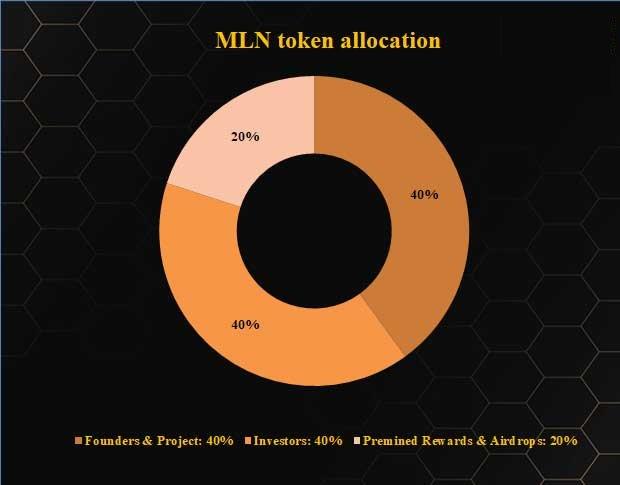

Enzyme Finance's MLN token acts as a mint and burn model. It is planned to have 300,600 MLN mined annually, this allocation will be decided in a vote. The main goal of this is to "compensate" the developers and maintainers to improve the platform and maximize the user experience. According to an update on CoinMarketCap on August 12, 2022, the total circulating supply is close to the maximum supply.

MLN is a token developed on the Ethereum platform, according to the ERC-20 standard. Therefore, there are many popular ETH wallets that can be stored today, specifically: Metamask , Trust Wallet , Coinbase Wallet , Coin98 Wallet, Trezor cold wallets, etc. In addition, you can also store online continue on exchanges that support the MLN token.

According to information on CoinMarketCap, MLN token has been listed on most major exchanges such as: Binance, Coinbase Exchange, Huobi Global, Kraken, KuCoin, Gate.io, Bitfinex, OKEx, Sushiswap, Bancor Network , Crypto.com Exchange, Kyber Network, Uniswap (V3) with full supported trading pairs: MLN/USD, MLN/USDT, MLN/BUSD, MLN/BTC, MLN/EUR, MLN/XBT, MLN/BNB , MLN/ETH, USDC/MLN, ALCX/MLN, WETH/MLN, CRV/MLN, AAVE/MLN…

Based on DeFilama's data source, the total TLV value of Enzyme Finance (MLN) is 53 million USD with a total capitalization of more than 59 million USD after the strong crash of the market in the recent downtrend, it can be said that this is the number Pretty impressive recovery.

Besides, the MIP7 plan also helps to increase the number of transactions, increase the total transaction fees, and reduce the supply of tokens. This creates conditions for MLN holders to break out strongly. In addition, investment fund Rari Capital has opened Vault on Enzym Finance with assets of nearly 20 million USD. These are all positive signals to increase the TVL value of Enzyme Finance in the near future, when the market recovers strongly.

Like Enzyme Finance, dHedge (DHT) is a crypto asset management protocol that integrates DeFi but is built on top of Synthetix. It can be said that these are two equally talented competitors in the same segment. These two projects have notable similarities as follows:

However, in terms of development, dHedge is slightly different from Enzyme Finance. While dHedge wants to bring back the best performing investment funds to the protocol, Enzyme Finance focuses on personalizing investment services rather than just making funds. Although competing, the development direction of the two projects is somewhat different. Therefore, the two projects can fully develop together, diversify and serve different audiences in the market.

In this market, any project that dares to change has a high chance of success. Because the market is always changing, and only projects that change to match the times can survive. Enzyme Finance's transformation from the inside out has shown the determination of the leadership team. Besides, we cannot forget to mention that the founding team of Enzyme Finance are all very talented and resilient women. This also shows the development potential of Enzyme Finance in the near future. However, before any investment decision and choice of time to "pour money", traders need to consider carefully because all investment plans always come with risks. Here are the outstanding improvements of the Enzyme.

Enzyme Finance has announced the Sulu update which outlines the newly integrated features to help improve the user experience, including:

Besides the Sulu update, Enzyme Finance's MIP7 plan also includes a change to the fee mechanism when using the protocol:

Thus, it can be seen that besides transferring my name from Melon Protocol to the new model as well as the Sulu update and the MIP7 plan, it is really a transformation for the Enzyme Finance team and brings potential to holders.

The article on TraderH4 shared details about the Enzym Finance project as well as the MLN token. It can be said that Enzyme Finance is one of the outstanding projects in the Crypto village that decided to change drastically to wait for the day the carp turns into a dragon. However, at a time when the market still has no clear signal, it is likely that investors will need a longer time to achieve expected profits. So you need to do thorough research before making an investment decision. Don't forget to continue to accompany TraderH4 to update other potential projects on the market!

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.