What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Algorithmic stablecoins are a hot topic of discussion in the online community, especially after the fall of Terra's Stablecoin UST. So what's different about Frax Share's Frax Share Fractional Algorithm Stablecoin? Is FXS token really safe and potential? Let's learn with TraderH4 about the Frax Share project and the FXS token in the article below!

Before diving into the details of the FXS token, let's explore the Frax Share project overview.

Frax Share (FRAX) is the world's first launched fractional stablecoin protocol. Frax Share is an open source code built on the Ethereum blockchain platform. Many projects on the market have poor scalability, not really decentralized, and limited supply (e.g. Bitcoin). So, Frax Share was born to solve these problems and optimize the Stablecoin projects present in the market.

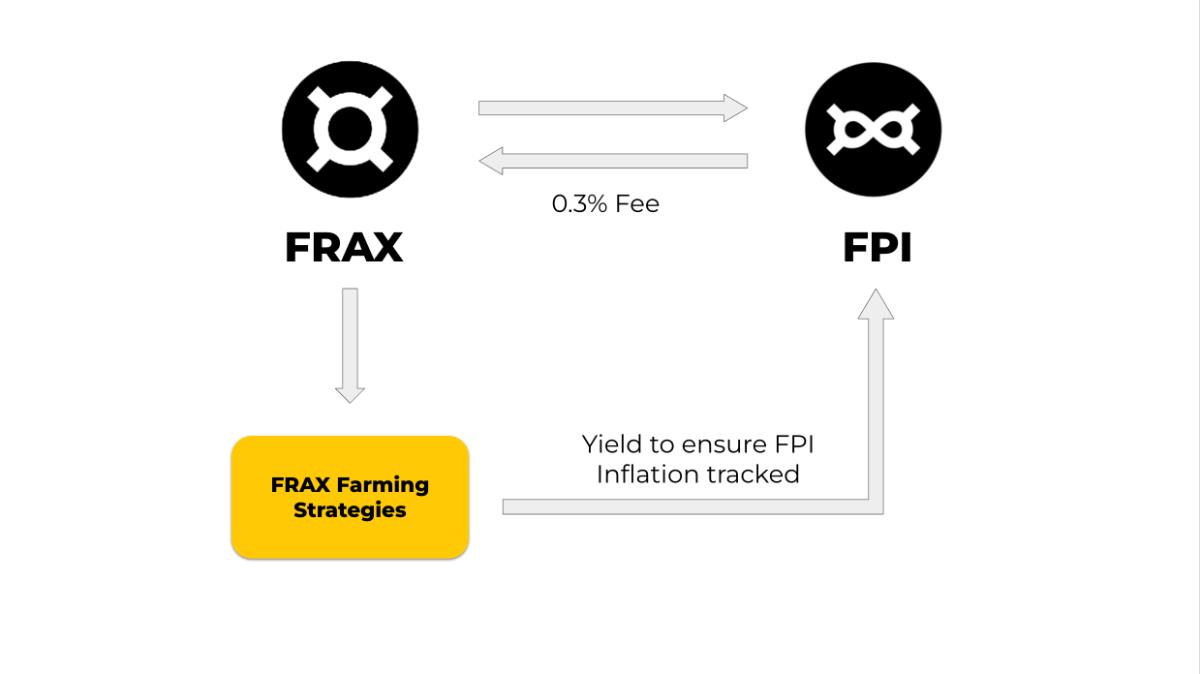

Frax Share has some important and outstanding features such as Fractional Algorithmic, Decentralized & Governance minimized, Buybacks & Recollateralization.

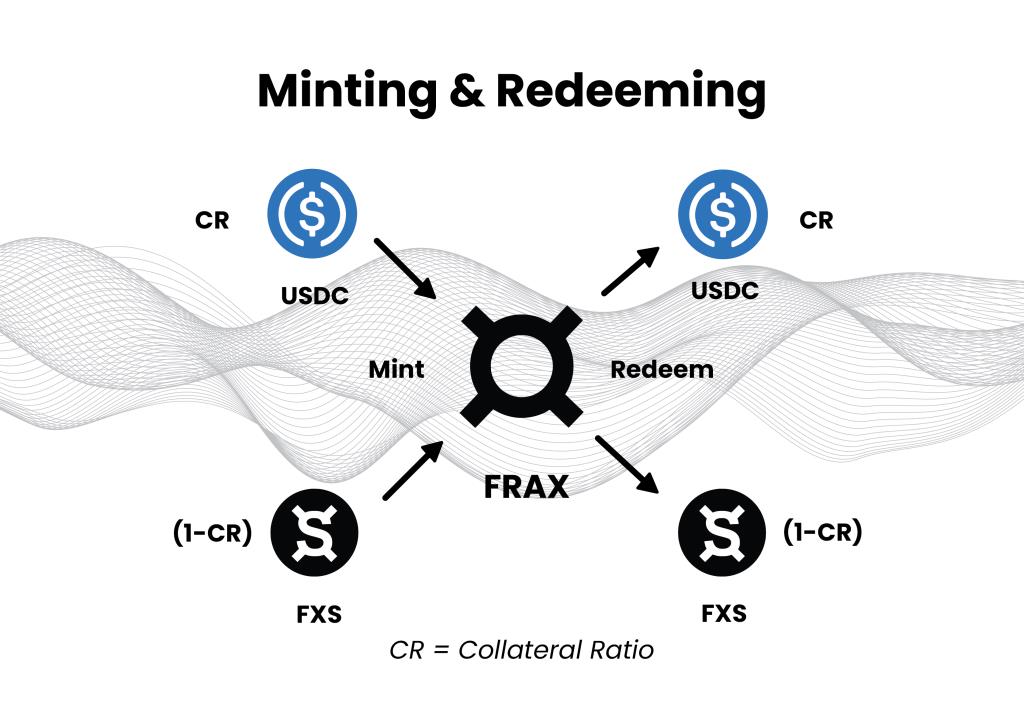

Fractional Algorithmic (FRAX)

Decentralized & Governance minimized

Frax Share is managed by an automated access algorithm without direct participation thanks to the following components:

Buybacks & Recollateralization

Frax Share uses two special swap features, Buybacks and Recollateralization, to guarantee the value of the collateral. The amount of collateral will often be redundant and will add value to FXS token holders.

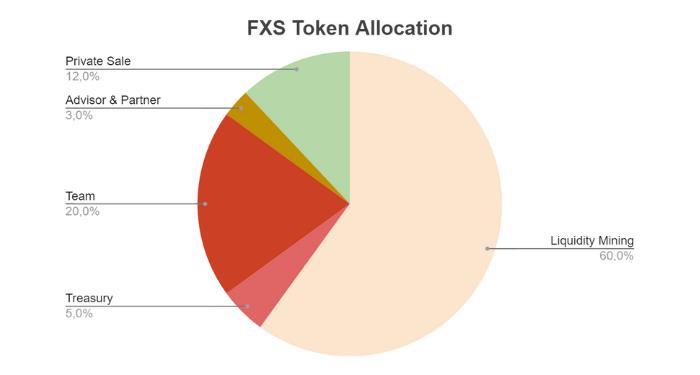

Among the outstanding features of Frax Share, this protocol has two differences. First, it is the Dual token mechanism that maintains the stability of the FRAX Stablecoin. In addition, the design of the platform is geared towards actively promoting members in the protocol community. It is known that Frax Share has more than 60% of the utility token supply (FXS) issued to bring profit to Farmers and Liquidity Providers.

Frax Protocol is the brainchild of Sam Kazemian, an American software developer. Sam is the one who came up with the first idea of a Fractional Stablecoin in 2019. In addition, there are 2 other founders, Travis Moore and Jason Huan and Stephen Moore.

Although Frax Share's FRAX is expected to become a bright star in the stablecoin village in the cryptocurrency market. However, the specific information about the development roadmap of the project is still not too much.

About FXS token

The section on TraderH4 shared a lot about the project and Stablecoin FRAX. Below, we will learn more about the protocol's FXS token.

FXS is the native token of the Frax Share protocol. This token is used in the following cases:

With a total supply of nearly 100 million FXS tokens, the project plans to allocate FXS tokens proportionally as follows:

The 5 groups of subjects allocated with FXS tokens will have a specific token payment schedule as follows:

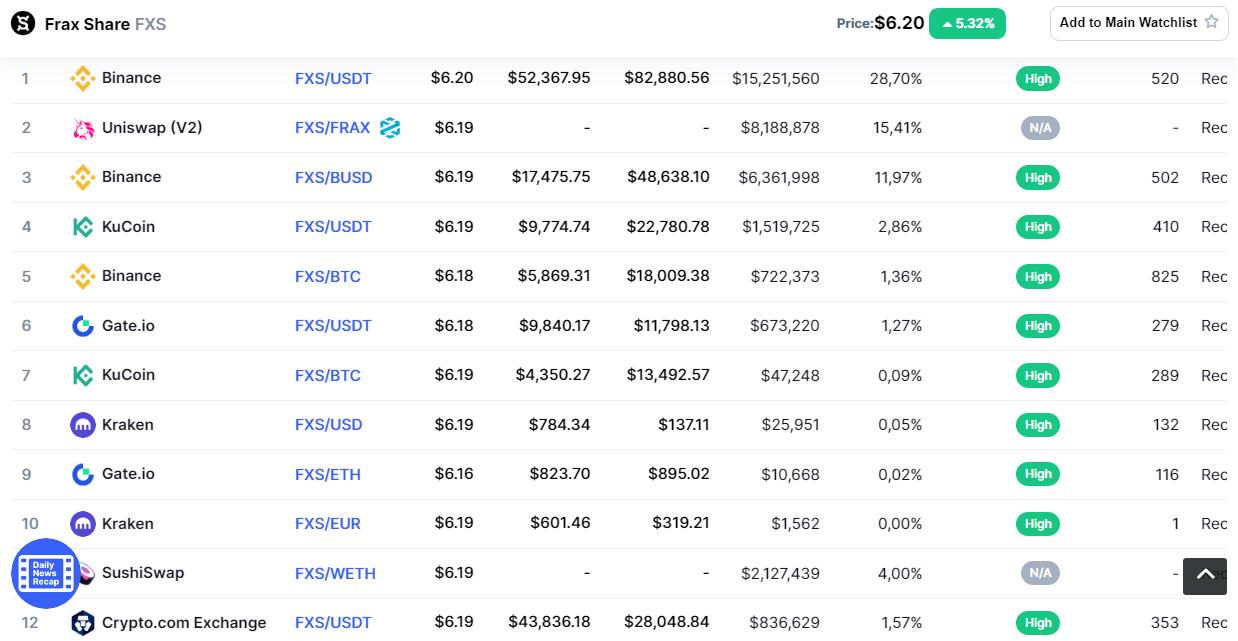

FXS tokens are listed and supported for trading on many famous exchanges such as Binance, Gate.io, KuCoin, Kraken, Uniswap V2… The currency pairs being traded with FXS are also quite diverse such as FXS/USD, FXS/EUR , FXS/USDT…

FXS is a token that runs on the Ethereum platform, ERC-20 standard. Therefore, you can store this token on wallets such as: Metamask, Trust Wallet, MyEtherWallet, Coin98 Wallet, imToken, hardware wallets (Ledger, Trezor)...

These are common questions related to the Frax Share project. If you have the same question, you can refer to the answers below.

First, you need to visit the address: https://app.frax.finance/ . After that, you must connect to your hosted wallet to be able to use the features on Frax Share.

While you can store FXS tokens on multiple wallets, Frax Share can only be linked to Metamask and WalletConnect wallets.

In addition to the main network, which is Ethereum, Frax Share also links with other networks such as BSC, Avalanche, Fantom, Polygon, Solana, etc.

This is a channel dedicated to monitoring and updating the latest information about the Frax Share project.

Website | Twitter | Telegram | Discord

Frax Protocol is a Frax Algorithm Stablecoin that is oriented and quite nicely designed. This is also the first and only stablecoin that combines fractional-algorithm hybrid design, which is highly appreciated by industry experts. However, Terra's crash with Stablecoin UST and token LUNA, is also a wake-up call for similar projects. Therefore, to be safe as well as improve investment efficiency, you need to analyze and research thoroughly before making a trading decision.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.