What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Goldfinch is a decentralized credit platform that allows people around the world to borrow cryptocurrency without collateral. At Goldfinch, anyone can borrow or lend the way banks do through DeFi.

Many lenders such as PayJoy in Mexico, QuickCheck in Nigeria have joined Golfinch and implemented it for their clients. Up to now, more than 1 million USD has been used by customers of the above units using Goldfinch's services with almost instant approval and disbursement time.

Goldfinch targets 4 main audiences: Borrowers, lenders, liquidity providers and auditors.

Liquidity Providers will provide capital to Goldfinch Pools. The protocol automatically allocates into Senior Pools for the group of people who need to borrow.

Liquidity Providers

Borrowers will propose to the Borrower Pools group on terms such as interest rates, periodic payment periods for the community to evaluate.

Borrowers

Backers will conduct funding for small branches of Borrower Pools.

Backers

The protocol works by extending credit lines to lending businesses. These businesses will use their line of credit to withdraw Stablecoins from Borrower Pools and then they exchange it for Fiat currency and deploy it locally. In this way, the protocol will allow businesses around the world to have access to the above form.

In addition, crypto asset holders can deposit them into pools to earn additional profits. And people needing loans will be disbursed immediately if the majority of the community approves.

How Goldfinch Works

Goldfinch is a decentralized protocol that allows borrowing of cryptocurrencies without collateral like Compound and Aave. In addition, with the Goldfinch protocol, the amount borrowed will be based on the credit rating assessed by the collective rather than on their crypto assets.

Global Expansion: Goldfinch has access to capital anywhere around the globe.

Increasing number of borrowers: This protocol has served thousands of borrowers around the world such as India, Mexico, Nigeria and Southeast Asia.

More than 10% Interest: Those who deposit in Pools will receive interest from 10% to 14% APY.

Stage 1: Build a “crypto credit fund” that generates real-world profit sources and is aggregated on DeFi.

Stage 2: Allows anyone to recommend or rate loans, not just the Goldfinch team.

Phase 3: Support all subjects, including small lenders.

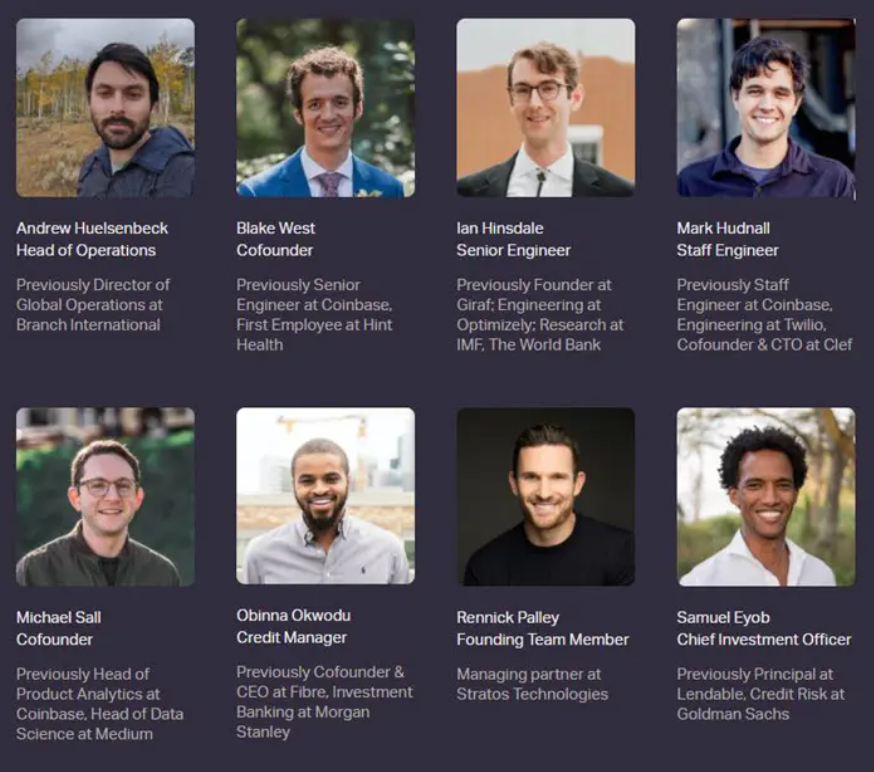

Project team

The project's development team includes the following members: Andrew Huelsenbeck, Blake West, Ian Hinsdale, Mark Hudnall, Michael Sall...

Goldfinch project team

Investors

Goldfinch has raised US$11 million from many major investment funds such as Andreessen Horowitz (a16z), Coinbase Ventures, Mercy Corps Ventures, A Capital, SV Angel, Access Ventures, Divergence Ventures, DeFi Alliance, Draft Ventures, Balaji Srinivasan , Wale Ayeni, Ryan Selkis, Jason Choi, Josh Hannah, Lisa Cuesta, Viktor Bunin…

Investors of Goldfinch

What is FIDU?

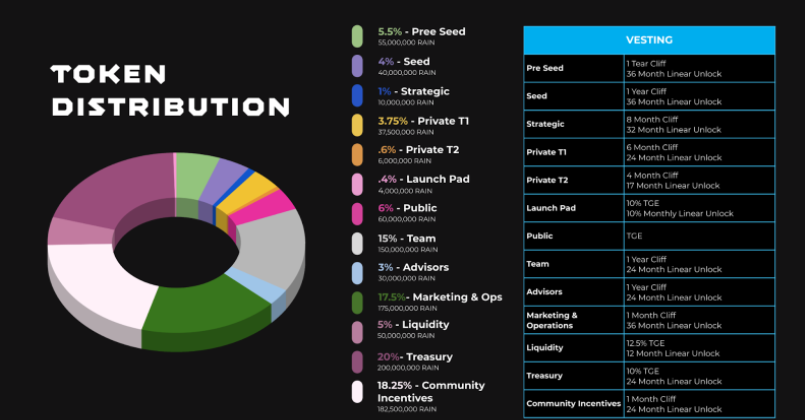

FIDU is the official token of the Goldfinch project. This token holder has the right to participate in the system administration process as well as they can contribute ideas to help the developer build the Goldfinch project.

Basic information about the Goldfinch token

Thus, TraderH4 has just provided readers with all information about the Goldfinch project and the FIDU token. Currently, the project is focusing on following the development roadmap. Through the above article, hopefully you have been able to judge the potential of the project in the future to make the right investment decision for yourself.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.