What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

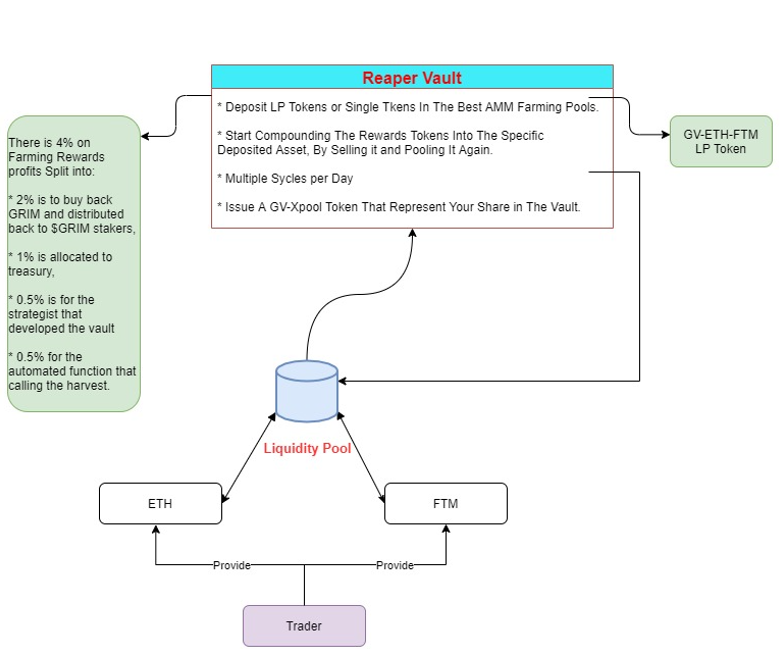

Grim Finance is a smart profit optimization platform that allows users to stake LP-Tokens issued from AMM (automatic market maker) in Grim Vaults, collect and stake rewards automatically their LP-Token to create a compounding effect, making it easier for users to get more rewards.

The project has also been audited by famous organizations such as Certik (V2), Solidity Finance and Solidity Finance (V2). However, at the end of 2021, Grim Finance was hacked and lost $ 30 million by a vulnerability on this platform. This incident caused Solidity Finance to officially apologize for omitting this issue during the audit 4 months ago.

Investing in cryptocurrencies and DeFi is always risky, moreover, Grim Finance is a project in beta. This article is for reference only about the content and characteristics of the project, not investment advice. TraderH4 urges readers to research carefully before making any investment decisions.

Grim Vaults (V2)

All Grim Vaults have an automatic aggregation (harvesting) feature that converts bonus tokens during mining into additional liquidity (LP) tokens, on behalf of the user. These LPs are automatically reinvested in the pool to create a compound interest effect.

Staking mining pool

Fee mechanism

Grim Finance vault fee mechanism

There is 4% fee in the total profit from mining rewards which will be split as follows:

Withdrawal fee mechanism

Recharge fee mechanism

Grim Sentinel (V2)

Sentinel contracts (aka killswitch) were introduced in GRIM V2 and were created to halt all vaults if any potential threats are detected. The Grim Sentinel is tasked with maintaining a list of all the platform's active strategies to enhance security.

TVL Locked Total Value Monitor (V2)

A TVL (or Total Value Locked) monitoring tool was introduced in GRIM V2 to alert the development team directly to any unusual movement of TVL in GRIM vaults (e.g. Changes. balance greater than 33%) directly via SMS and email.

Grim Finance is a fork of Beefy Finance and Convex Finance, which is a combination of different complex strategies and low transaction fees, which improves user experience and expands selection in mining pools on the entire Fantom ecosystem.

In addition, Grim users have access to Liquid Boost Vaults, designed to increase liquidity for a designated pool in the AMM.

In addition, Grim Finance allows liquidity providers in SpiritSwap AMM to earn transaction fees and receive rewards in the form of inSPIRIT tokens without the need for SPIRIT keys. Liquidity providers can get enhanced rewards in the form of SPIRIT tokens and the ability to mine liquidity with little effort.

Finally, if you want to stake SPIRIT to receive GinSPIRIT, Grim Finance allows users who have staked GinSPIRIT to receive swap fees on the SpiritSwap protocol and deposit fees from inSPIRIT.

No information.

No information.

No information.

There are 04 main types of tokens that hold different functions on Grim Finance, including:

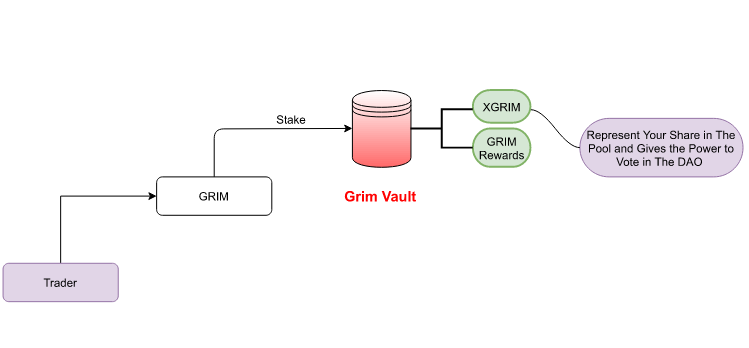

GRIM

GRIM allows holders to become shareholders in the Grim Finance platform and receive a distribution equal to 50% of Grim Finance's platform harvest fee.

GRIM was replaced by GRIM EVO in version V2.

GRIM EVO

GRIM EVO is a very special token that allows the holder to become a shareholder in the Grim Finance platform and receive a distribution equal to 50% of the Grim Finance platform harvest fee.

GRIM EVO is designed to reduce inflation, offering a (currently) 1% passive burn rate fee, which is used to generate the GRIM-FTM pair. This allows users to passively derive value from holding tokens.

GRIM EVO is V2 version of GRIM and users can mint GRIM EVO by using GRIM token (token of V1 protocol) at a ratio of 10:1 through using EVO minter on Grim Finance homepage.

xEVO is the protocol's voting token, which can be obtained from staking in GrimEVO's Grim Single Stake Pool.

REAPER

REAPER is Grim Finance's farming token and will be linked to GameFi projects, its index funds and mining pools. That means the project will use the REAPER token in the future, which includes attracting partnerships through token listings in partners' farms and airdrops.

ginSPIRIT

GinSPIRIT encoded from inSPIRIT

GinSPIRIT staking

GinSPIRIT's liquidity pools

Currently, Grim Finance tokens can be traded on two platforms, SpiritSwap and SpookySwap of the Fantom ecosystem.

Despite having a crash at the end of 2021, Grim Finance is still a project that receives a lot of community attention from its token financing mechanisms. TraderH4 hopes that through this article, readers will have more useful information about this automated productivity mining platform.

To get the fastest information about the Grim Finance project, readers can visit the project's official communication channels:

Website | Project Information | Twitter | Discord | GitHub

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.