What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

What is Heiko Finance?

Heiko Finance (HKO) is a decentralized finance protocol under the Lending & Borrowing array built on Kusama, similar to Compound or Aave on Ethereum . Specifically, Heiko Finance will provide leveraged borrowing, lending and staking services.

Outstanding features of Heiko Finance

Margin Staking : With this feature, investors can earn a higher return than normal staking when using more leverage. However, investors need to have a plan to manage the risk of liquidation of assets for themselves.

Auction Loans : Investors can borrow DOT and KSM with fixed or variable interest rates on Heiko Finance to join Crowdloan of any project on Kusama or Polkadot .

Lending & Borrowing : Investors can deposit crypto assets into Heiko Finance to provide liquidity to the platform and they will receive interest on the lending. In addition, investors can also mortgage their assets to borrow other cryptocurrencies.

Heiko Finance Developers, Investors and Partners

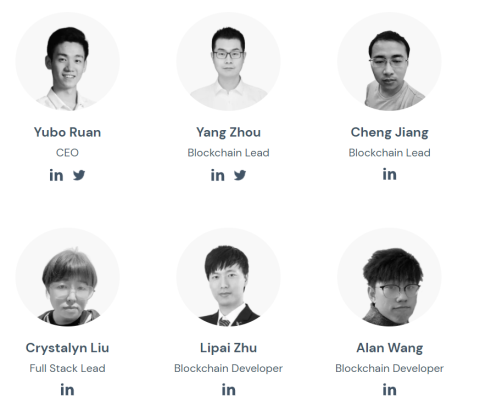

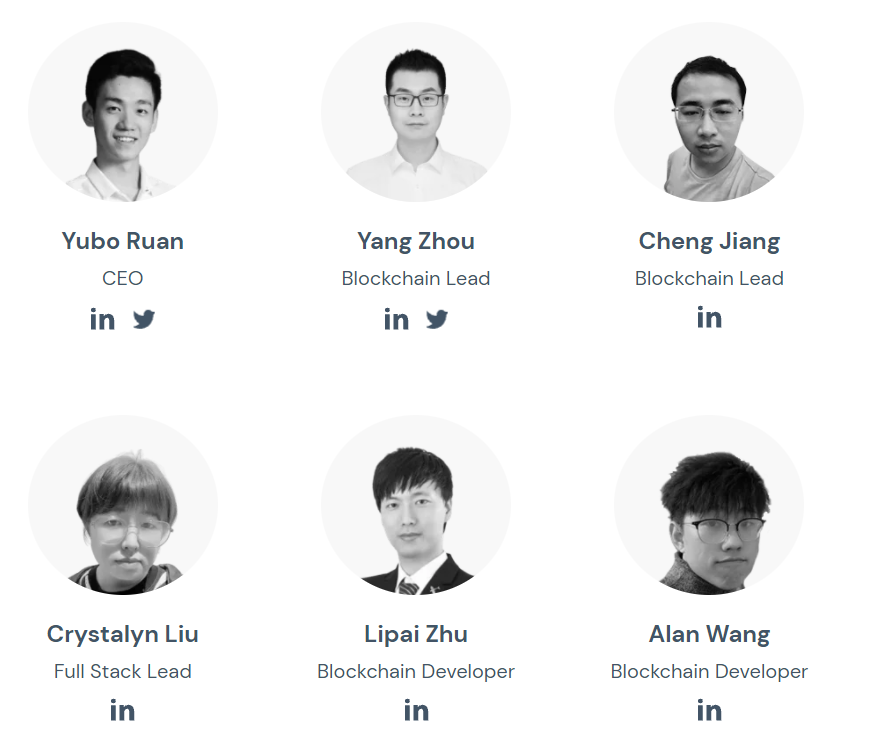

Heiko Finance's development team

Heiko Finance's development team includes: Yubo Ruan, Yang Zhou, Cheng Jiang, Crystalyn Liu, Lipai Zhu, Alan Wang and many others.

Heiko Finance's development team

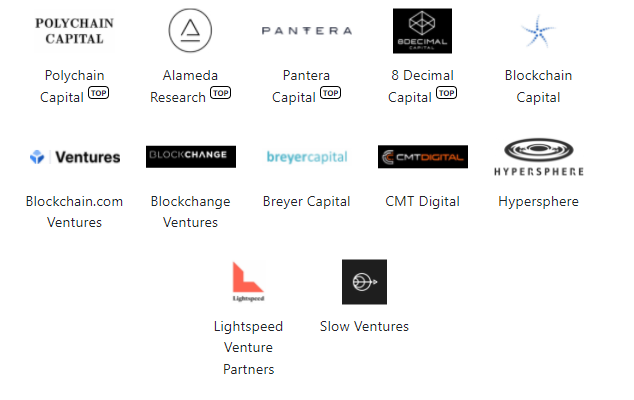

Investor of Heiko Finance

Heiko Finance has attracted many large investment funds such as Alameda Research, Polychain Capital, Pantera Capital, Hypersphere, Blockchain Capital, 8 Decimal Capital…

Investor of Heiko Finance

Partner of Heiko Finance

Heiko Finance has 2 main partners: DeFi Alliance, Halborn. If Heiko Finance wins this Parachain auction on Kusama, it may attract more partners in the future.

Partner of Heiko Finance

What is HKO used for?

HKO is the official token of the Heiko Finance platform, it is used to:

Participation in governance (Governance) : HKO owners have the right to propose and contribute ideas to help developers build Heiko Finance projects.

Payment of transaction fees : Investors can use HKO to pay for transaction costs and loan interest on Heiko Finance.

Network security : HKO holders can staking them on Heiko Finance to protect the network and get rewards.

Validator Reward : HKO is used as a reward for Heiko Finance's Validators.

Some information about token HKO

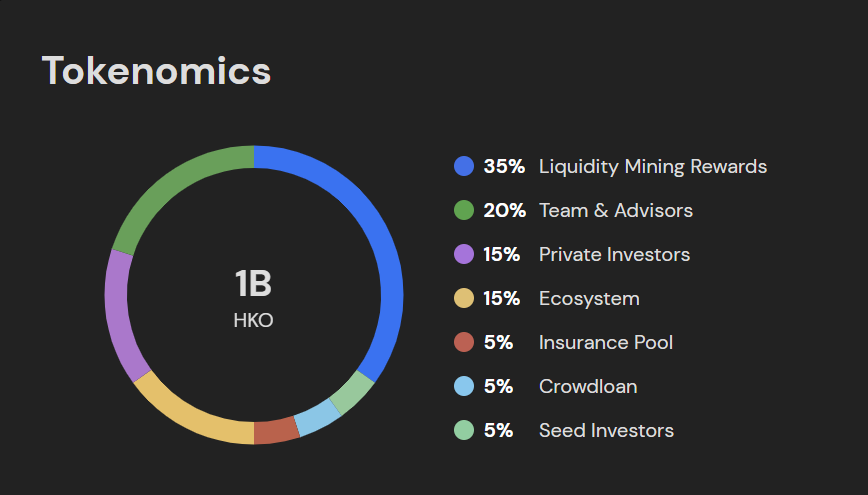

Allocate HKO . tokens

Allocate HKO . tokens

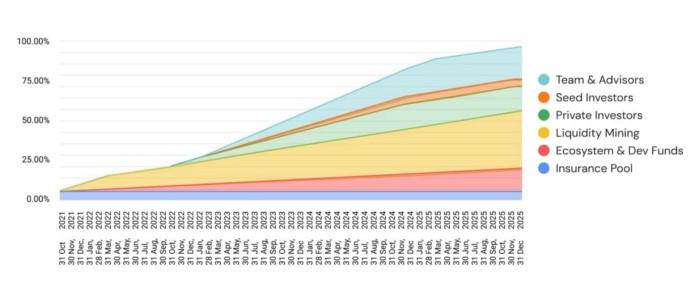

Token Allocation Schedule

Heiko Finance will lock HKO tokens for the first year from October 31, 2021 to October 31, 2022. After that, HKO will be gradually allocated to investors, team and advisors over 2 years. The detailed HKO token allocation schedule is shown in the figure below.

HKO Token Allocation Schedule

How to own HKO token

Currently, the HKO token is not listed on cryptocurrency exchanges. However, during this time, investors can join Heiko Finance's Crowdloan on Kusama to receive a reward of HKO tokens.

Thus, TraderH4 has just brought to readers all information about the Heiko Finance project and the HKO token. Heiko Finance is a Lending & Borrowing project that provides Auction Loans feature. With this feature, investors can borrow DOT and KSM to join Crowdloan with low interest. In addition, Heiko Finance also owns a development team with many years of experience in the field of blockchain technology and the project is in the process of implementing Parachain auction on Kusama. Can Heiko Finance win this Parachain auction?

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.