What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Helio is a Liquidity protocol built on the BNB Chain ecosystem, allowing users to profit from activities such as lending, borrowing, yield farming and staking. That is, you can collateralize BNB and borrow HAY – the stablecoin of Helio Protocol, to mine for profit.

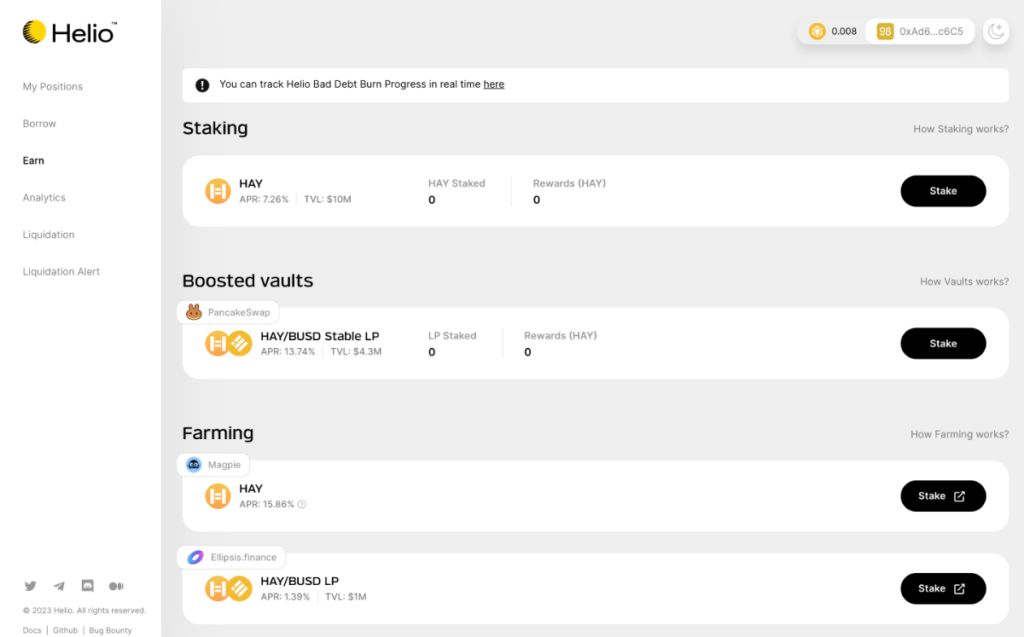

Staking: Users holding HAY can participate in staking on the Helio protocol to earn annual profits. The protocol also allows you to instantly claim rewards from staking activities. As of press time, there are a total of 7,874 users in the network, with TVL reaching over $67 million.

Boosted vaults: Users can use Helio's bounty vaults to get compound interest by compounding profits.

Farming: Helio offers multiple DEXs, including PancakeSwap, Ellipsis, Magpie and Thena, allowing users to farm assets like HAY.

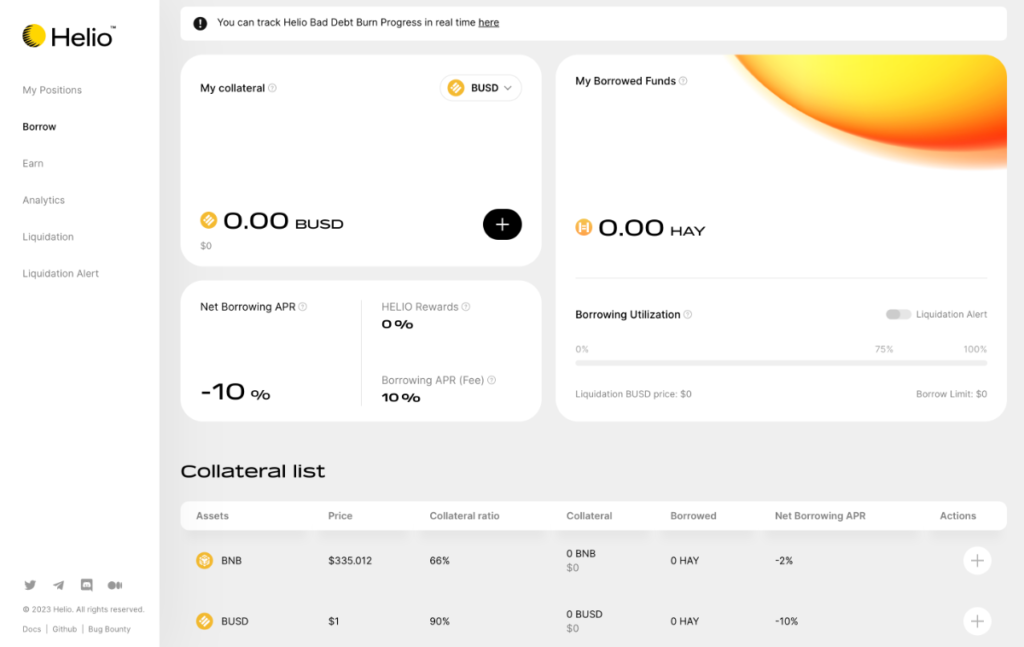

Borrow AWESOME

Helio allows users to use BNB or BUSD to borrow OR with low interest rates (2% and 10%/total loan value). Users can then use HAY in Earn products to mine profits from the platform. Collateral Ratio of the lending protocol is 66% (for BNB assets) and 90% (for BUSD).

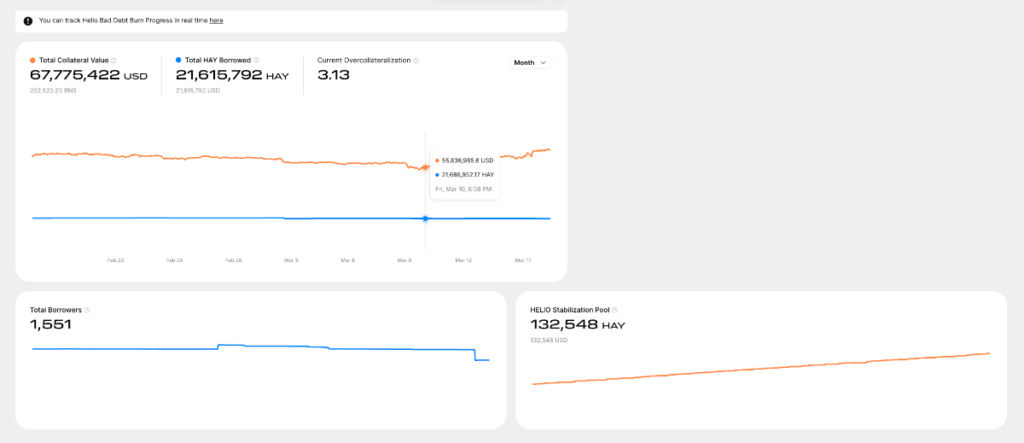

As of the time of writing, 1,551 users have borrowed, more than $67 million have been mortgaged to Helio and 21.5 million HAY tokens have been borrowed in the past month.

OR is a decentralized stablecoin in Helio's ecosystem pegged to 1 USD. With other stablecoins in the market, by default they should always peg with 1 USD, but with Helio peg right but it can't be held, because stablecoins are also affected by market demand.

Helio has a way to help ensure the value of HAY as follows:

HELIO is distributed proportionally as follows:

HAY will be generated through mint or purchased on decentralized exchanges (DEX): PancakeSwap (BNB Chain), Thena.

Phase 1: Helio will introduce destablecoin HAY and expand HAY's market share in the BNB Chain ecosystem, an upgrade in the traditional stablecoin market.

Helio Protocol does not publish information about the project team. TraderH4 team will monitor and update after official information from the project.

Above is some information about the Helio project and the HAY, HELIO token duo. Some similar projects are providing lending & borrowing services: MakerDAO, Aave, Kava, Compound, Alpaca Finance... If investors are interested in this project, they can follow more social networking sites like:

Discord | Twitter | Telegram

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.