What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Hop Protocol is a protocol for sending tokens that leverages rollups technology . The protocol is a new set of algorithms and tools that simplify cross-chain interaction by allowing crypto enthusiasts to move their assets between the blockchain and sidechain layers.

Hop Protocol complements external bridging infrastructures by introducing unique techniques that make the process easier, more secure, and less time consuming. These include the use of highly modified liquidity technologies, decentralized pools, and token minting strategies to create faster and more efficient communication between Ethereum Layer 2 networks, sidechains, and the Ethereum mainnet .

Hop Protocol's bridge currently supports the Ethereum blockchain, Optimism , Arbitrum , Polygon, and Gnosis . Assets that can be moved using the protocol include Ethereum, Polygon, USDT, DAI, and USDC, as well as the HOP token. Upcoming tokens to watch out for will be SNX and sUSD.

The main utility of the Hop protocol is its multi-network bridge facility – the Hop protocol bridge. It allows crypto assets to be moved between the Ethereum mainnet, the sidechain network, and the layer 2 network. Allows assets to be moved in two directions and between any choice of networks.

Hop applies a modified token issuance, redemption and swap algorithm to achieve a fast and cheap asset bridge between Layer 2 and independent networks. It provides this first by introducing unique smart contract tokens called Hop Bridge Token (hToken).

hToken are flexible tokens that can be transferred and redeemed across chains, Hop bridge users use hToken variants of the token when they make a swap. They reflect content that is actually locked on supported strings. hToken is issued at a 1:1 ratio with locked assets. That is, when a user locks a certain number of crypto assets (say 100 ETH), they will be able to mint the same amount of hToken for that asset (in this case, 100 hETH).

Issued hTokens can be transferred to other chains supported by the Hop protocol and redeemed on the fly. The transfer command for hToken activates write and mint to burn hToken on the source network and mint the same variant and quantity of hToken on the target chain and the account.

Write and mint transactions are performed relatively faster than conventional bridging functions used on other asset bridging platforms. The user then receives the hToken and proceeds to redeem them instead of waiting for the asset to move through the bridge.

There is one exception to the need for hTokens to transfer assets across chains: Token HOP. HOP does not require AMM to move across different Layer 2 chains, as HopDAO can decide which tokens are considered “standard” HOP and choosing hHOP as standard HOP token means no AMM is needed for final swaps at the destination chain, which saves the user fees.

The $HOP token bridge is now live.

— HopProtocol (@HopProtocol) October 11, 2022

Hop your $HOP tokens across L2s with 0 slippage and 0 AMM fees ⚡️

A true multichain token. pic.twitter.com/wcu6bodcbX

The rapid exchange of hToken on the destination chain is done through a separate party called a Bonder. Bonder creates upfront liquidity for hToken so that recipients can quickly exchange hToken for the underlying asset. On redemption, hTokens are burned while Bonders receive their assets once the proper bridge process is completed. For this important service, links are rewarded through affiliate fees paid by users.

To add more flexibility to hTokens, Hop Protocol has also developed a decentralized exchange powered by Automated Market Makers (AMMs) and decentralized liquidity pools. Hop protocol AMM works like the one used by regular decentralized exchanges. However, the transactions available are only crypto assets and their associated hTokens. AMM complements Bonder's services and makes hToken seamless.

The liquidity pool that powers AMM is based on contributions from independent users of the Hop protocol. As seen in other exchanges, Hop liquidity providers lock hToken and pair crypto assets in the pool and receive Liquidity Pool (LP) tokens representing their contribution to the pool.

Hop liquidity providers may suffer impermanent losses, but the severity of this is expected to be similar to that commonly found in stablecoin liquidity pairs. This is because the values of hToken and the assets they are paired with are designed to be the same.

In the event of a tangible change in the value of hToken and their underlying assets, this change is a good incentive for arbitrageurs who want to balance this change and earn profits in the process. If hToken trades at a discount to its underlying asset, an arbitrageur can purchase hToken through AMM and exchange them for the appropriate crypto asset across the bridge. Likewise, an opposite trade is profitable when the crypto asset trades at a discount to hToken.

Hop Protocol provides incentives to users and other community members who contribute to the performance of the bridging protocol and other services offered on the platform.

Through staking programs and rebates, Hop Protocol encourages the crypto community to use its services and make active contributions. The staking program rewards liquidity providers for locking their assets on the AMM that powers the bridge. Liquidity providers will receive staking rewards when they lock their liquidity pool tokens on the staking platform.

Staking rewards will vary depending on the user's network and the APR offered for locked assets. Fixed APR can be as high as 7% as seen in the Gnosis network. This bonus is not available for some assets and chains at the time of this writing.

Hop Protocol also offers rebate rewards. According to reports, users connecting to the Optimism network from the Ethereum blockchain to other supported Layer 2 and sidechain networks will receive a rebate of up to approximately 80% of the total bridging fee.

Happy to announce our 1m $OP rebate program is now live!

— HopProtocol (@HopProtocol) September 23, 2022

Going forward, every transfer into @optimismFDN will receive an 80% fee discount paid out in $OP tokens.

The best route into Optimism is on @hopprotocol 🥳 pic.twitter.com/vOX13Harkf

Given the safety risks that come with bridging facilities, the Hop protocol claims to take precautions to keep its smart contracts safe from technical exploits. Its smart contracts are audited against the evidence presented by the Hop protocol team.

Example: It has yet to develop support for arbitrary contracts and other features that would expose users to more risk.

On Hop Exchange, users can perform operations as diverse as bridging assets, providing liquidity to bridging protocols, and converting assets on supported chains.

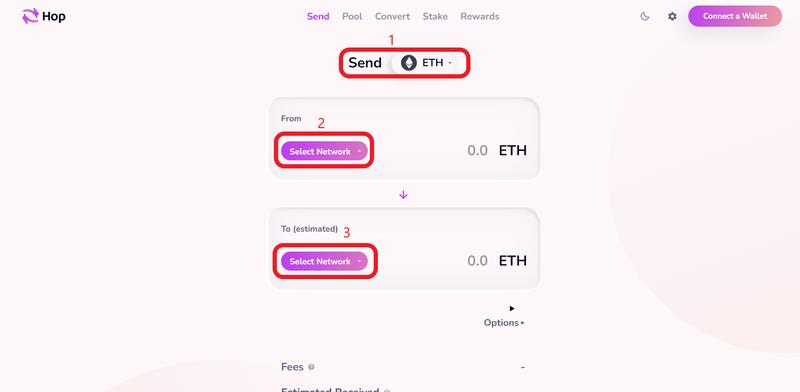

To connect your crypto assets using Hop Exchange, visit the bridge facility and connect your wallet.

Allows you to choose preferred assets and chains to bridge your tokens.

If you are using MetaMask, make sure you are using the correct network before proceeding to the next bridging steps.

If you want to receive the assets in another wallet, click “Options” and enter the receiving wallet address.

Specify the number of tokens you want to connect, proceed with the confirmation and complete the process.

Hop Protocol liquidity providers are required to lock their assets and some hToken (for that asset).

To get hToken, click “ Convert ” to use the asset conversion protocol.

Hop Exchange

On the switch interface, select the sidechain or layer 2 network for which you want to generate hToken.

Also, enter other required parameters including the number of tokens you want to convert. Once the process is complete, the hToken recording protocol is tied to the value of the asset you are converting and sends the hToken to your wallet.

To provide liquidity, select “Pool” and proceed to select the assets you want to lock on the protocol and chain on which you are providing liquidity.

Enter the amount of assets and hToken you want to add to the liquidity pool and click “Add liquidity” to confirm your liquidity position and get LP tokens.

Liquidity providers can also staking their LP tokens for passive rewards.

Click “Staking” to go to the staking page and lock your LP tokens for rewards according to the specified APR.

Rewards can be tracked and confirmed from the “Rewards” page. Visit the rewards page to see claimable rewards and pending rewards.

HOP is the token of the Hop protocol. HOPs serve one primary purpose: governance. It was introduced as a means to develop a comprehensive governance strategy for the Hop protocol through a decentralized autonomous organization (DAO).

Through HopDAO and with the support of HOP, the affairs of the Hop protocol are managed by a community consisting of its users and investors.

HopDAO works through a decentralized voting and recommendation platform, where HOP token holders can submit improvement proposals and vote on proposals submitted by other members of the DAO. Members' votes are calculated according to the number of HOP tokens they hold.

HopDAO members vote on decisions like the next sidechain, Layer 2 network, or Layer 1 blockchain on which the Hop protocol will launch. The DAO votes will also decide which assets will be added to the Hop protocol bridge. A number of other financial issues such as allocation plans and treasury management will also need to be considered and approved by the DAO.

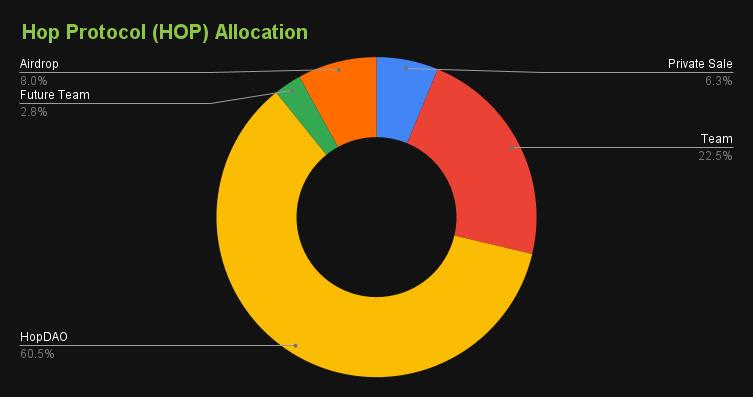

One billion HOP tokens have been issued on the Ethereum blockchain. This is the maximum supply of HOP. Most of the total supply has been delivered and will be gradually released in the future. 8% of the total supply was distributed to initial platform users as part of the airdrop program. More than 60% of the total supply has been earmarked for the project's treasury while 25% has been earmarked for the current and future team.

8% of the total supply of HOP has been distributed to platform users and socially active members of the Hop protocol community as a reward for pioneering community members and also to share HopDAO to those its first user.

To reward active community members, 500 active members on the project's official discord channel and 79 Twitter users who actively discussed the project were rewarded with a portion of the airdrop.

Users who have used the Hop protocol bridge at least twice and have bridged over $1,000 worth of assets via the cross-chain bridge also receive the Airdrop.

External contributors to the protocol and Authereum users are also eligible for the Airdrop. The snapshot for the Airdrop was taken on April 1, 2022, with the allocations scheduled as follows;

Eligible users are required to visit the claim website to redeem the allocated tokens, with a claim period of 6 months from the time of drop. During this time, the airdrop beneficiaries are expected to receive their rewards. At the end, HopDAO will claim any unclaimed allocations.

The efficiency of various Ethereum scaling solutions would be greatly improved if users could easily utilize each of these solutions to their best features. To be able to do this, users must have an efficient means of moving crypto assets across these platforms.

With a bunch of “cool” approaches, the Hop protocol is providing users with a way to move their assets across different Layer 2, sidechains, and the Ethereum mainnet. Current statistics show that its approach to token bridging is practical and flexible enough to maintain its effectiveness at higher levels.

Under the governance of a democratic community, future policies of the Hop protocol will be covered and discussed in detail to ensure that only the best financial and technological ideas from the community newly brought to life.

To a larger extent, Hop Protocol's approach to cross-chain bridging and platform governance can also serve as a base layer for new bridging solutions. Positive modifications to its algorithms will create even more alternatives, create competing solutions, and make cross-chain bridging a more reliable technology.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.