What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Kien Bui – Research Analyst at TraderH4

The analysis below is written based on the opinion of author Kien Bui through the article How does HydraDX work and why is it valuable? Kien Bui is currently the Founder and CEO of SynerWork. Besides, he was the former Founder of Lamchame.com. He has experience in successfully investing in many decentralized projects. In addition, he is currently a Research Analyst at TraderH4.

HydraDX is a decentralized platform that supports cross-chain. The platform is powered by Substrate – a tool that helps leverage several popular platforms like Polkadot and Edgeware. However, HydraDX runs on Polkadot and acts as a parachain.

By using Substrate, HydraDX developers can perform system-wide upgrades without triggering a hard fork. On the other hand, implementing the project on Polkadot as a parachain allows HydraDX to optimize key characteristics such as speed, flexibility, and security.

Plus, Polkadot is a potential future platform with the number of projects on the platform skyrocketing. HydraDX primarily acts as a trusted and secure middleware to power decentralized token swaps both inside and outside the Polkadot platform.

Since the idea of the HydraDX project is very potential, the development team does not even need to promote or receive investment from funds, but only needs to rely on the community (even the original HydraDX community is quite small, most are technical people or know members of the development team). To understand why the idea of HydraDX is a good idea, let's learn with TraderH4 how the Olympus DAO works - where the idea of HydraDX originated.

Just like the Olympus DAO, HydraDX operates in a liquid ownership protocol way. With Olympus DAO, the platform guarantees that 1 of its tokens is worth at least the value of 1 DAI, which is 1 USD. But with the huge reward staking mechanism, users instead of selling stakes. Because stakes pay attractive rewards, there are few sellers, and at the same time, the need to buy to bring high stakes causes the price to rise. Suppose, when the price of OHM token (Olympus DAO token) goes down because many people sell, it is the protocol that buys it back, causing less supply to push the price up.

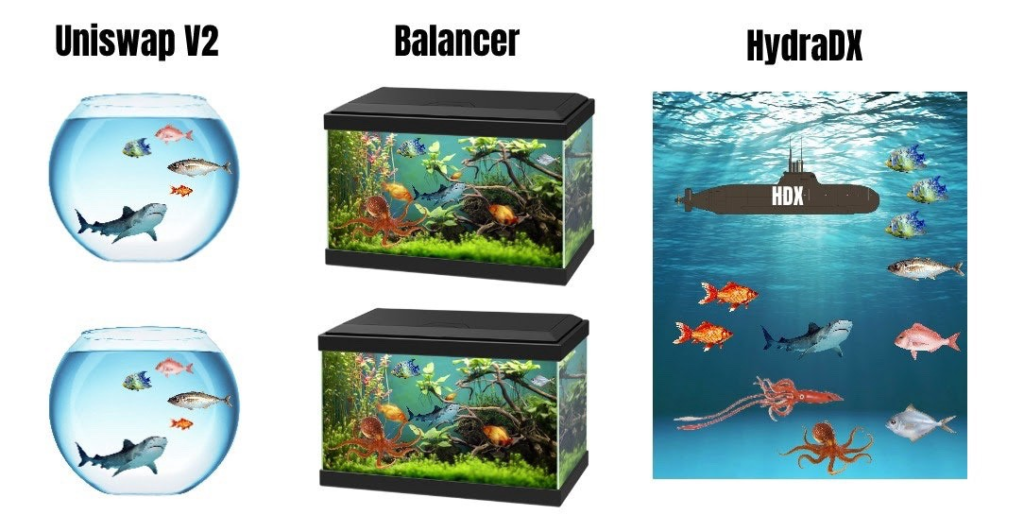

Meanwhile, HydraDX is essentially a decentralized exchange in the style of AMM (Automated Market Market). That means users will provide liquidity to the protocol. At the same time, when trading, the algorithm will automatically convert the user's coin amount according to the price corresponding to the liquidity of the exchange. However, instead of providing liquidity for each trading pair, for example, DOT with USDT, KSM with DAI, etc., HydraDX applies a mechanism where users only need to provide liquidity for a type of digital asset that they want. Have.

HydraDX's protocol will equate the value of user-supplied liquidity with the corresponding value of the protocol's coin. However, the protocol does not use its own coin like how Olympus DAO uses its token, but HydraDX generates a token called LHDX, which is converted to the HDX token (project coin).

LHDX is used as an intermediary on the exchange, similar to how casinos use slots or chips. Therefore, LHDX can generate or burn, depending on the liquidity of the exchange. The project uses LHDX instead of the HDX token because the HDX token is also used for voting, so the protocol cannot arbitrarily print more or burn it like the Olympus DAO did.

Upon spawning LHDX, users can also provide liquidity with HDX tokens, and LHDX is generated in proportion to HDX token liquidity. However, the amount of LHDX is equivalent to the total liquidity of all other digital assets. However, with additional printing or burning of LHDX according to the user's HDX liquidity supply, this is very similar to the way Olympus DAO manages its assets.

Thanks to the above mechanism, the more liquidity on HydraDX, the higher the value of LHDX. In other words, the value of the HDX token itself is also high because the HDX token corresponds 1:1 to the LHDX. Since HydraDX's liquidity mechanism only needs to provide one type, it is very easy for Liquidity Providers (LP). Therefore, as long as the bonus mechanism is suitable, the liquidity for HydraDX will be very large in quantity and variety in types.

Since users do not need to have a corresponding amount of the two types of digital assets, it will be easier for them to invest. This makes the HydraDX exchange more attractive than others due to its diversity. In addition, a brother project with HydraDX, Basilik, which has the function of helping new digital assets to be valued, will connect to provide liquidity for Omnipool (HydraDX's multi-purpose liquidity pool).

In addition, because it is not in the form of a smart contract like other AMM exchanges, HydraDX is not limited in terms of having to perform transactions within a block period. At the same time, with flexibility, the HydraDX exchange allows the pooling and processing of transactions similar to the centralized exchange, so the slippage effect is reduced. As a result, the HydraDX exchange will help people make transactions much more economical than other exchanges.

But the beauty of HydraDX doesn't stop there. The HydraDX protocol owns its liquidity so that the liquidity of all assets on the exchange corresponds to the amount of HDX token liquidity provided by users. Therefore, when users withdraw liquidity, the amount of LHDX will be burned. And when users provide liquidity for more HDX tokens, it generates more LHDX.

Until the project launch date, the total amount of HDX tokens on the market will be about 4 billion coins. Of which, 1.5 billion is for the development team, 1.5 billion is for the initial community participation and 1 billion is for users to join the crowdloan. These 4 billion coins correspond to 40% of the total coins. However, the crowdloan will not have the coin immediately, but will release it slowly within 2 years. In addition, the amount of coins of the early community participating is not clear how long it will be locked or how it will be distributed.

However, if the initial supply to the market is small, plus an attractive reward mechanism for liquidity providers, the liquidity of digital assets will also be very large. The reason is because, investors only need to provide one type instead of a pair and are not limited in the number of equivalents like in other AMM exchanges.

However, if it comes with attractive payouts for LPs of other digital assets and high HDX staking rewards, the amount of coins is staked a lot. This makes the amount of HDX tokens provided in the form of less liquidity but more liquidity in other assets, so the price of HDX coins will be high.

Imagine if a day the amount of TVL of HydraDX is up to 10 billion USD but only about 2 billion HDX coins are provided with liquidity, the price of one HDX will be up to 5 USD, while the development team estimates the coin price when organizing. The crowdfunding organization starts at just $0.023.

HydraDX is really a potential project if the development team can realize its idea. The total market value of HydraDX will most likely exceed the market cap of Polkadot due to the attractiveness of the liquidity ownership protocol model, the advantage of being parachain, and the superior features of its unique technical characteristics. unique to the Polkadot ecosystem.

Exchanges like Uniswap cost a lot of money due to high gas fees and less flexible smart contracts than parachain, which causes high slippage. Meanwhile, HydraDX has no gas fees, no transaction costs (if you only need to deposit parachain with DOT tokens, the first 2 years have been crowdloaned by the community), it only needs to provide liquidity with an asset class. should have a lot of liquidity and diversified types. Therefore, just by doing the idea, HydraDX will definitely surpass Uniswap in terms of transaction volume and TVL.

Not only that, with a much lower cost, HydraDX is likely to cost half-and-double of Uniswap (the price here is the overall value of the project) in the long term. That is, if Uniswap is worth 10 billion USD, in the long run HydraDX has the ability to reach 20 billion USD, even this number can reach 50 or even 100 billion USD is not impossible.

With the proposed idea, HydraDX promises to be a potential project. However, investors need to take the time to observe the project's viability to consider and make wise speculation options.

Please follow the information about the HydraDX project at the media channels:

Website | GitHub | Twitter | Discord | Telegram | Project information

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.