What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Keep Network is a platform that connects, stores, and encrypts personal data on public blockchains. The network is made up of off-chain data storage blocks called “Keeps”. To operate these blocks, investors must stake KEEP on the system to become a Signer – the person chosen to perform work on the Keep Network.

Currently, data stored on public blockchains is completely public. Keep Network is designed to make it possible for users to store data on those blockchains while ensuring their privacy. Thereby, smart contracts can exploit the full application advantages of blockchain technology without compromising its transparency and trustworthiness.

In addition, Keep Network has partnered with Summa and Cross-Chain Group to provide a Bitcoin-to- Ethereum bridge called tBTC. This is the first application built on the Keep Network. This application will have a token of TBTC that carries the ERC-20 standard and is supported by Bitcoin and tied to the actual price of BTC. It enables Bitcoin holders to operate on the Ethereum blockchain, while accessing the DeFi ecosystem and making money with their own Bitcoin.

As mentioned, the Keep Network uses off-chain blocks of personal data storage called “Keeps”. Thereby, the platform helps smart contracts to interact intensively with personal data without affecting the transparency or auditability of the system.

Some cases where Keep Network can be used:

Firstly, the Keep Network can be used to confirm decentralized transactions on the main blockchain. Each participant who confirms the transaction will ensure the reliability of the transaction and other data.

Second, this network has the ability to set the "Dead Man Switch" key to automatic mode based on the initial settings. That allows users to open and close the project's blockchain data retrieval as needed.

Third, users can use Ethereum's Smart Contract to create a personal wallet to exchange crypto assets between various blockchains such as Bitcoin, Litecoin, Dash, etc.

Fourth, Keep Network can be used to create a digital product marketplace. With this marketplace, users can buy and sell products like e-books, videos, MP3s and more.

Finally, Keep Network facilitates smart contracts and decentralized autonomous organizations (DAOs) to store private information and data through the network's bridge. The platform uses MPC systems of complex cryptographic algorithms to ensure the privacy of users' data.

In addition, a first bridge application built on top of the Keep Network, tBTC, is censorship resistant because it uses “Keeps” to store data. The tBTC bridge application does not need to trust an individual or organization, allowing users to convert TBTC to BTC and vice versa, at any time that the user wants and without the consent of an intermediary. Tuesday.

Keep Network functions and tools include:

Designed as a security solution

The core advantage of Keep Network is its ability to store private information, such as Private keys. Those data and information are stored in blocks containing off-chain data called “Keep”. This helps to keep the data safe because no one has access except the owner.

Keep Network uses an elliptical curve digital signature algorithm (ECDSA), which allows smart contracts to manage and use private data without exposure to the public blockchain. Thereby, users no longer have to worry about personal data being leaked.

Keep Network uses random method to choose Signer on tBTC

Keep Network's Random Beacon feature is a mechanism that selects the Confirming Signer for deposits on tBTC. This mechanism requires that all parties will need to agree with each other to know the amount of tBTC being minted and the identity of the depositors. Signing groups must ensure that their identities remain private until the time they are selected by random beacons. This feature ensures that the Signers cannot collude to steal user funds or attack the network.

Benefits of the KEEP . token

The KEEP token provides Sybil resistance allowing tBTC to be censorship resistant and permissionless. KEEP holders can launch tBTC, similar to running a full node. KEEP stakers will have the right to operate the off-chain data storage block. When the Signers perform their functions properly, they will receive fees in the form of KEEP tokens.

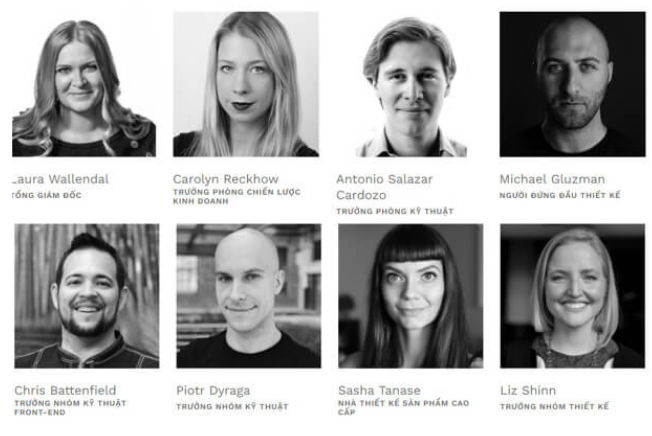

Development team

Keep Network was founded in 2017 by Matt Luongo and Corbin Pon. These are 2 veteran members who hold the leadership role of Keep Network. Previously, the two co-founded a Bitcoin rewards app called “Fold”.

In addition, the Keep Network project has the participation of more than 20 members, including engineers with extensive experience in mathematics, cryptographic algorithms, etc.

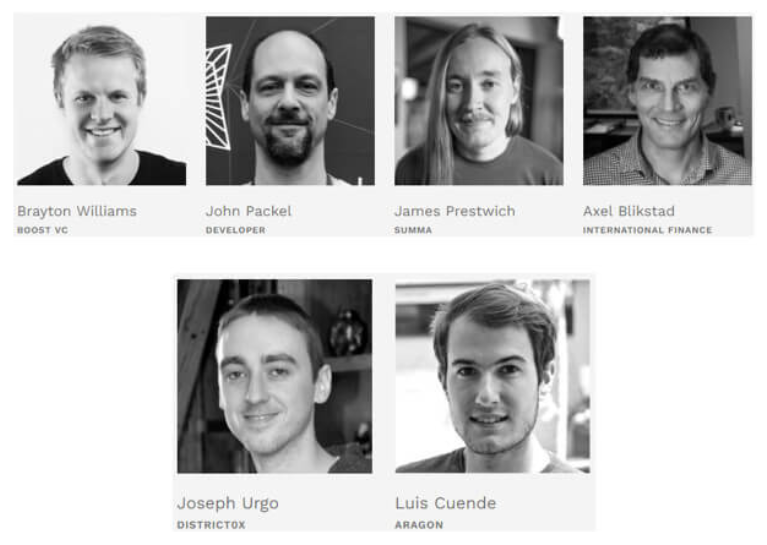

Advisory team

John Packel : He is the developer of ConsenSys – a system of blockchain business solutions.

Joseph Urgo : He is a developer of district0x – a blockchain platform that allows projects to interact with each other.

James Prestwich : Previously, he worked for Storj Labs – a research and product development company in Atlanta, Georgia.

Luis Cuende : He is the developer of Aragon – a platform that provides modules for creating and managing DApps, cryptographic engines, and decentralized autonomous organizations (DAOs).

Investors

Keep Network has gone through three rounds of funding and raised $7.7 million. With the participation of venture capital funds such as Polychain Capital, Andreessen Horowitz, Draper Associates, Paradigm, Fenbushi, A.Capital Ventures, Collaborative Fund, ParaFi...

Partner

Dfinity is Keep Network's first partner. On GitHub there will be a common repository and users can follow the interaction between the two development teams quite clearly. In the near future, it is likely that they will join together to put the Keep Network on the Dfinity network. Additionally, according to unconfirmed reports, the Keep Network team is developing two forks of Dfinity.

Keep Network's second partner is Lendroid. This project is a decentralized blockchain platform for margin trading, using the 0x protocol.

KEEP is an ERC-20 standard work token. Service providers in the ecosystem need to hold KEEP tokens and use them as collateral for algorithmic encryption and data storage services. They can also stake KEEP tokens to increase their chances of being selected by Keep Network to become a Signer. When the Signers perform their functions properly, they will receive fees in the form of KEEP tokens. In addition, KEEP also has some functions as follows:

Private sale for KEEP stakers

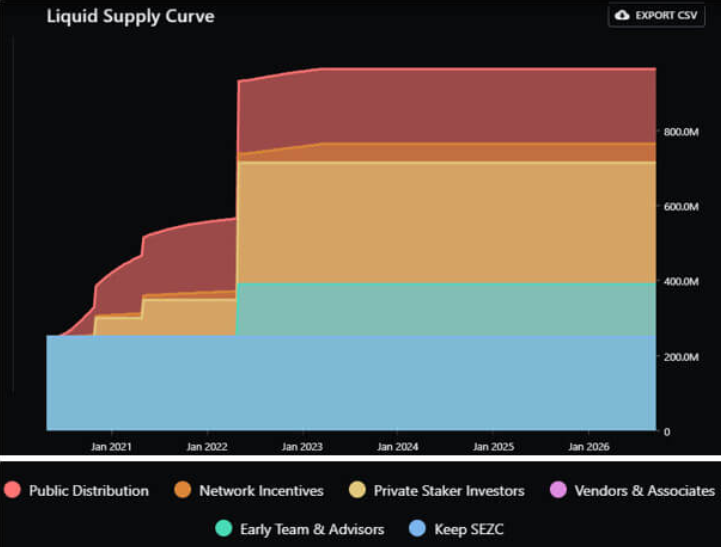

The Keep Network team sold a total of 322,882,336 KEEP in two rounds of Private Sale. During the first Private Sale, investors can receive additional bonus tokens ranging from 20% - 50% of KEEP tokens depending on the chosen lockout period (from six months to two years). The longer the lock time, the bigger the bonus. The second sale requires a KEEP lock-up period of one year, investors can receive 20% bonus. Of the totals distributed through these sales are:

Section for Keep Network's development team, partners and SEZC

Keep Network will allocate 390,598,594 KEEP to team members and advisors, associates, vendors and SEZCs who hold shares of Keep Network.

Public distribution

The Keep Network team plans to distribute up to 20% of the KEEP supply (200,000,000 KEEP) during the public Stakedrop event on June 8, 2020. Stakedrop allows users to stake their ETH in exchange for KEEP tokens as a reward. After 6 months, event participants were able to stake KEEP to continue earning rewards. The event can last up to 24 months with most of the rewards awarded in the first six months.

The project also deducts an additional 5% of the KEEP supply (50,000,000 KEEP) to reward on-chain tBTC liquidity providers to help incentivize the growth of the tBTC ecosystem.

The exact timing of KEEP distribution public events will not be fixed. Therefore, the liquidity supply curve here is just a reward simulation model created by Bison Trails.

All KEEP supply was minted when the Keep Network team deployed on Ethereum mainnet. Therefore, KEEP does not have an inflation model from the creation of new tokens. But the maximum supply of KEEP can decrease over time through the form of cuts. In order for a cut-off event to occur when a signer on the network acts against the rules, a portion of that person's KEEP tokens will be burned forever.

Investors can earn KEEP by staking tokens on the network today and gain access to the system's ETH Stakedrop reward program. In addition, you can also earn money by participating in the Playing for Keeps program, which allows people to learn how to stake and have a chance to receive rewards in KEEP tokens.

Currently, KEEP is being traded on exchanges such as: Uniswap , Matcha, Curve, Balancer, Kraken, Binance , Mandala Exchange, KuCoin, Coinbase Exchange, Gate.io.

On April 12, 2021, the Keep Network project published details of the second throttling of the tBTC bridge application. This time around, tBTC is expected to adjust the requirements that currently apply to shareholders. Specifically, investors only need to key KEEP instead of both Keep and Ethereum (ETH) tokens, along with changes to its wallet generation mechanism. tBTC will allow users to tokenize their Bitcoin (BTC) for use on the Ethereum network.

The dev team admits that they have learned a lot since tBTC's second mainnet launch in September 2020. Within days, the app was down for a short period of time, after a bug was discovered in its redemption codes. After that, Keep Network struggled to scale and regain users' trust.

Despite being backed by venture capital giant A16z and other big names, Keep Network's tBTC bridge has not achieved the expected number of DeFi users, with a circulating supply of just 1,293 TBTC, according to the report. CoinGecko.

According to the latest information, the development team for Keep Network and NuCypher is preparing plans for an on-chain merger in a preferred network for Ethereum. To determine the future and success of a security protocol, the community will need more time to evaluate. Thereby, it can be seen that this project always strives to create products with the desire to meet the needs of investors.

Some official information channels of the project that investors can follow are:

Website | Twitter | Telegram | Reddit | Discord

Keep Network is designed to ensure privacy and security by keeping private data private. By using randomness to facilitate security and without permission, Keep Network is built to help continue the vision of a secure, multinational, and decentralized economy. With the above information, hopefully you have been able to judge the potential of the project in the future to make the right investment decision for yourself.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.