What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

In the late 1980s, America had a very serious environmental problem. When power plants continuously release sulfur dioxide into the environment for many years, causing acid rain to occur continuously in this country, destroying buildings, forest ecosystems and causing many deaths. terrestrial and aquatic flora and fauna.

So in 1990, the government of this country carried out a pilot law that required companies that were polluting the environment to pay for the gas they emitted into the environment, creating a new market. born: The carbon market, governed by a system called cap-and-trade.

About eight years later, acid rain in large areas of the eastern United States has received significant improvements, recording a 20% decrease in total acid rain. Since then, a measure to cut emissions was born.

In 1997, the International Climate Change Treaty (also known as the Kyoto Protocol) proposed the use of a cap-and-trade system for managing carbon dioxide emissions into the environment. Several years later, different countries and regions formed different emissions markets, most of them using the cap-and-trade system.

The government apparatus will set a cap (or maximum limit) on the amount of emissions that an industry is allowed to emit into the environment. The total maximum limit (in tons) will then be broken down into multiple permits, each showing an allowable amount of waste and has a cash value used by the producer. buy.

For example, if you are a manufacturing plant and your projected annual emissions are 1,000 tons. Each license in your area costs 200 USD and you are allowed to release 10 tons/permit into the environment. So that means you will have to spend $ 20,000 to "buy" back the amount of waste that you put into the environment, with 100 permits.

At the beginning, some countries and regions contracted a certain number of permits depending on the needs and commitments of the production unit. If that unit is not used up, they can resell it to units that are over the threshold. Conversely, if that unit is in short supply, they can buy back from the units that have a surplus. However, after each year, in order to gradually limit emissions into the environment, the governments of countries reduce the total maximum limit. As quantities become increasingly scarce, the market for emissions permits becomes active.

In theory, this cap-and-trade system is really a breakthrough idea and extremely smart because it applies a reward and punishment mechanism. If a manufacturer controls their emissions well, they will have more income from the amount of permits they are issued for their industry, otherwise it will have to cost them more to pay for permits or fines set by the state.

However, in reality, emissions did not decrease as expected, but increased for the simple reason that sanctions are only really effective when the accompanying benefits must be large enough. According to two economists Joseph Stiglitz and Nicholas Stern, to achieve the goal of the Paris Agreement on limiting global warming, the price of emissions in the world must average from 50 to 100 USD/ton before 2030, while currently emissions prices are much lower than the schedule. And yet, even if countries can somehow adjust the price level to the right level, the penalties are not effective because they are too low. For example, in the countries of the European Union, the fine for each ton of emissions exceeding the threshold is as low as 100 EUR, compared to the regulated price of 1 ton, it is not significant.

In addition, the control of emissions also has many unresolved issues such as how to measure, whether these emissions are directly into the environment or only indirectly released during the production process. . Not to mention the forms of fraud due to the indecisiveness of the government apparatus (loose application, bribery, forgery of documents...) and another equally common form is relocating production factories to areas with lower prices. That is called carbon leakage.

Currently, countries around the world, especially the EU, are gradually becoming stricter in applying this emissions market. They use measures such as limiting the number of permits to create scarcity, to drive up the price of permits, in addition to periodic price increases. In addition, countries in the European Union also apply a carbon dioxide tax policy, which means that even if the product is produced in another country at a lower fee, when entering the EU border, the goods are still subject to the same carbon dioxide tax as applied in these countries. In the near future, global emissions prices will soon be established if countries and regions are more serious about this environmental issue.

Before entering into the analysis of the Klima DAO project, TraderH4 would like to clarify that this article is only for analyzing the potential and some application aspects of the DAO (decentralized autonomous organization) and not investment advice. This article assumes that readers already understand what DAO is, so I will not delve into it. However, if you do not know what the DAO mechanism is, please refer to TraderH4's article on this topic.

Klima DAO is one of the DAO projects that has suffered a lot from the Crypto investment community in just a few months from the date of launch when the launch price of this token is more than $ 2,000 (October/October/ 2021), reached an ATH of nearly $3,700 in the same month and has now collapsed to less than $12/token.

So what is Klima DAO? The Klima DAO is a decentralized autonomous organization (DAO) created to intervene and increase the price of carbon dioxide in the global emissions market. By promoting the price growth of assets related to emissions (Bitcoin, Ether, etc.), Klima DAO is seeking to encourage companies to become more environmentally conscious. and reduce emissions.

Klima DAO follows the model of bonding with OHM of the Olympus DAO project and launches the supply of BCT (or Base Carbon Tonnes) – a tokenized version of carbon dioxide credits on the blockchain. Additionally, the project aims to reserve as much BCT as possible in its repository through the project's KLIMA token.

And yet, Klima DAO is an "official" clone of Olympus DAO because it has received approval from the development team of the Olympus DAO project. This is a successful project with DAO mechanism and is considered to be the opening of the DeFi 2.0 era for this cryptocurrency industry.

Market participants can buy BCTs on the exchange and link them to KLIMA to receive incentives. After 05 days, they will receive preferential KLIMA which they can sell for profit or stake in the platform to increase the amount of assets they have. As mentioned above, this mechanism is similar to the liquidity mechanism on the Olympus DAO. However, Klima's mechanism is different in that the price of the KLIMA token is backed by its BCT repository, or in other words the price of real-world emissions certificates or permits.

In short, the more BCT the Klima project accumulates, the higher the price of emissions in the world will be because it creates a scarcity situation, forcing market participants to adapt and join or pay later. higher emissions costs. In addition, by issuing more KLIMA – a token pegged to BCT, the platform can reduce the supply of carbon offsets (carbon offsets), which in turn directly govern the real-life market prices. .

Therefore, market participants all have the same purpose when participating in Klima DAO, which is to maximize their KLIMA shares through staking and bonding. Klima DAO allows for the same reinvestment withdrawal mechanism as Olympus, with APY at times reaching as high as 40,000%. Although KLIMA has its value anchored by the amount of BCT in its storage, staking participants are encouraged to ignore market price fluctuations as the massive returns they earn will exceed the conversion price between KLIMA and KLIMA. BCT.

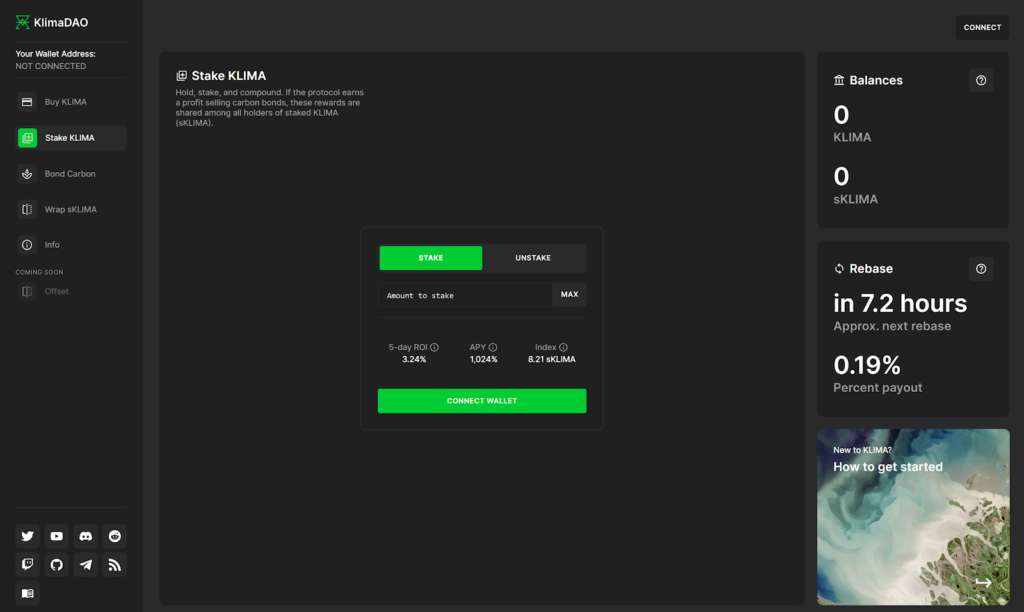

The interface of this platform is also very simple, with only basic functions such as buying KLIMA, staking KLIMA, bond carbon and wrap sKLIMA. Trading carbon offsets will be available soon in 2022.

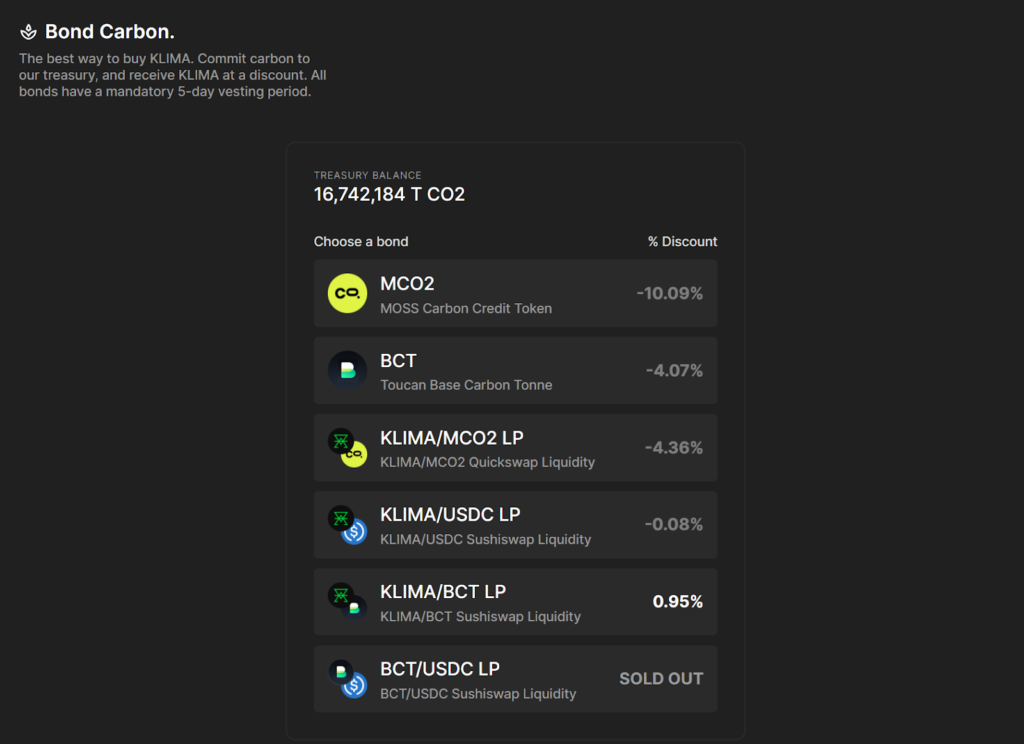

Currently, the APY level being announced is 1.024%, much lower than the project's 40,000% heyday. The remaining policies remain the same as when bonding carbonic credits, which is to receive KLIMA preferential treatment and be paid vesting in 5 days. In addition to BCT, the project is also supporting MCO2 and liquidity pairs on QuickSwap and SushiSwap. At the time of writing, only the liquidity pair KLIMA/BCT is giving a positive index at 0.95%.

Here are the official used contract addresses you can check on Polygonscan :

Klima DAO was founded by a group of anonymous developers and is governed by the community under the DAO mechanism. Although Klima DAO is not an official fork of Olympus DAO, the two projects are linked, and several Olympus DAO contributors also played a key role in the development of Klima DAO. In addition, Olympus also holds a small share of KLIMA in the archives of this project.

The development plan of the Klima DAO project is divided into 5 phases:

Discover – Discovery

Links – Integrations

Adaptation – Adoption

Sustainable development – Stabilization

Maturity – Maturity

Currently with an APY of more than 1,000%, it can be said that Klima is entering the adaptation phase. However, according to the project's report, the KLIMA token market volume is more than 1 billion 600 million tokens, which is already at the supply level of the maturity stage. There is still no update on the project's inflation adjustment policy. However, according to the information that has just been posted officially on the project homepage, a development toolkit, Klima Infinity, will help corporations and individuals put their carbon credits on the blockchain. transparently and effectively, helping to demonstrate their positive influence on improving environmental change.

Currently, according to published information, investors in Klima DAO include Petrock Capital, Zee Prime Capital and Mr. Mark Cuban.

KLIMA is the official utility and governance token of the project. With the following parameters:

Since Klima DAO follows an expansionary monetary policy initiated by Olympus, this project does not have a maximum supply for KLIMA. Currently, KLIMA is backed by around 11 million BCTs, valued at over $70 million.

Klima DAO launched an early sale on Discord (IDO) as part of their fair launch strategy, to kickstart the liquidity and distribution of KLIMA's initial supply. aKLIMA – a token that can later be redeemed for KLIMA, was distributed to a select number of community members at a price of 116 USD. The initial supply of aKLIMA is 120,000, which means that KLIMA collected over $1 million in liquidity in its initial launch.

Development team members also receive a portion of pKLIMA, which is modeled after pOHM to align contributor incentives with the benefit of the protocol. The vesting amortization policy depends on sourcing an equivalent market share, with each stakeholder having a limited amount of pKLIMA which they can redeem for KLIMA such as:

Example: If advisors want to redeem their entire 50 million pKLIMA, they can only do so if their KLIMA market share does not exceed 1%. Therefore, this will only be possible when the supply of KLIMA exceeds 5 billion. The cumulative share of the total KLIMA supply of all stakeholders must not exceed 15.8%.

The KLIMA token will hold two main functions for the owner, having the right to govern and being able to increase the amount of KLIMA holding by staking.

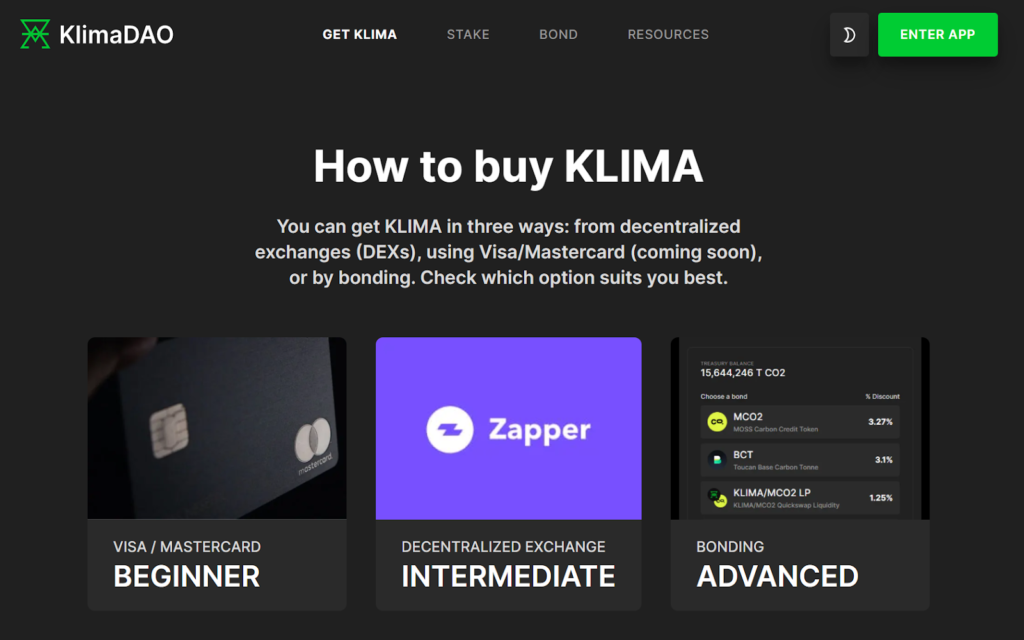

Currently, KLIMA can be purchased at HotBit exchange or the SushiSwap protocol (Polygon network). According to public information on the project's application page, in the near future, users can buy KLIMA with Visa/MasterCard credit cards easily.

Although the ideas and applications may sound quite new to the general community, Klima is not the first and only project in this field. In fact, Klima's carbon-linked assets were brought up by another project, Toucan , which developed the backend infrastructure of the protocol that brings carbonic credits to the blockchain. Klima is just a project using Toucan's infrastructure, applying the model of Olympus and bringing it all to Polygon to apply the carbonic credit aspect to the blockchain. In addition, there are a number of projects that are also aiming to accomplish the same purpose, for example Carb0n.Fi .

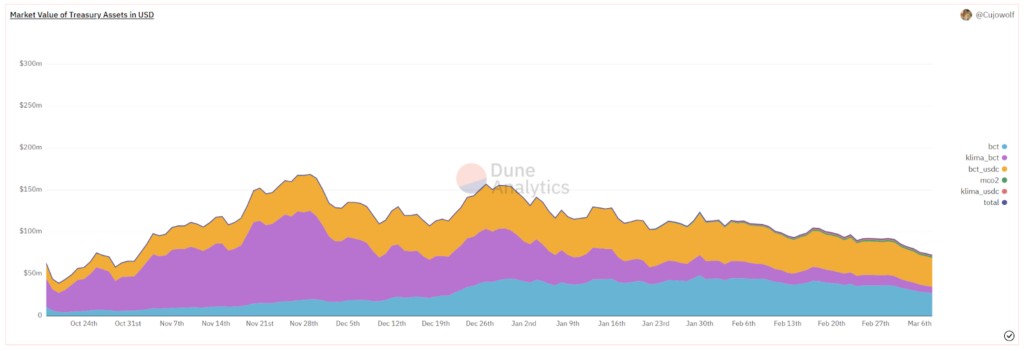

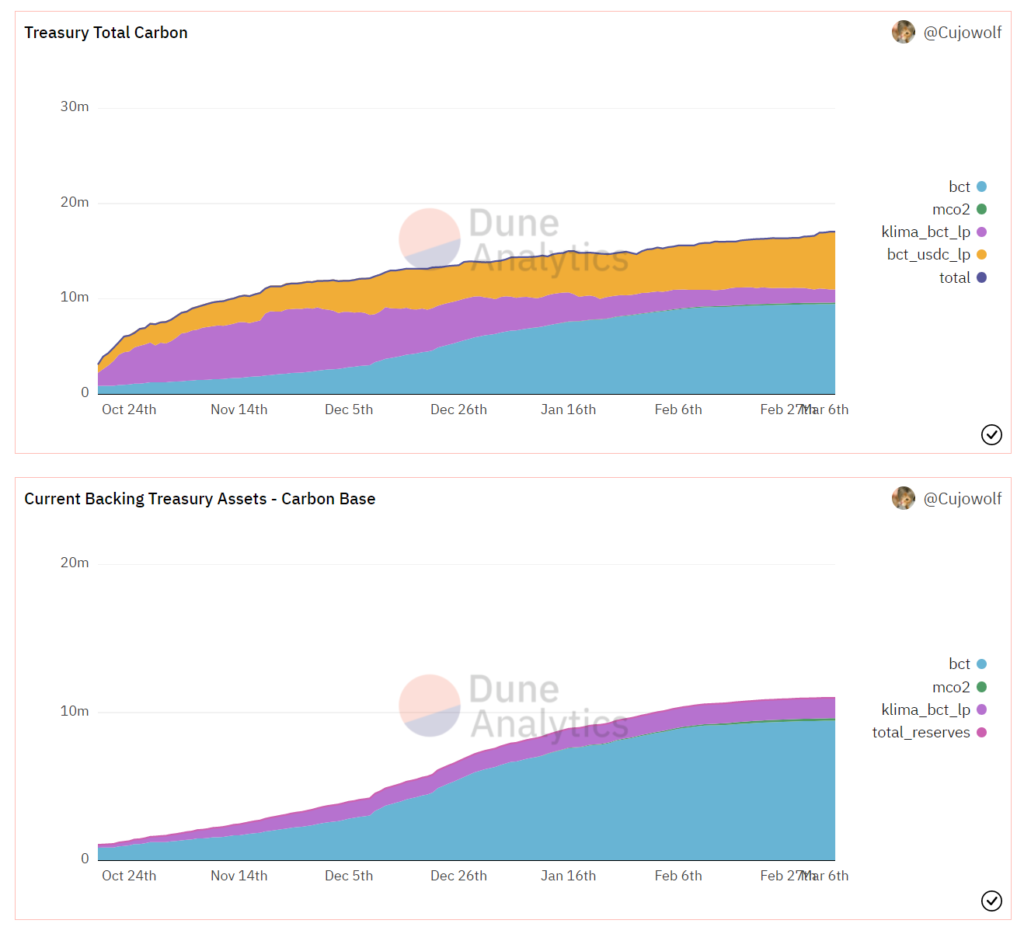

Despite the severe drop in the price of KLIMA as mentioned initially, the project's inventory continues to increase (according to statistics on Dune Analytics). If Klima's model is not a ponzi in the Crypto market in general and among the fledgling DAO projects in particular today, is it likely that we will see the growth of a Crypto project again? for the environment?

Klima DAO offers Web 3.0 developers and users the opportunity to participate in the carbon market through the KLIMA token. By developing Klima DAO on open source and transparent infrastructure, with the participation of Web 3.0 developers, carbon projects and climate experts, all of the above has helped to build building this new economy as well as rewarding the contributions of its participants.

If investors are interested in the Klima DAO project, please visit the project's information pages to get the earliest information:

Website | Project Information | Twitter | Discord | Reddit | Telegram | GitHub

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.