What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Kyber Network is a center of liquidity and cryptocurrency trading on various platforms such as Ethereum, Polygon, BNB Chain, Avalanche… The project's goal is towards building and developing new solutions, creating favorable conditions. value exchange on DeFi applications and NFT marketplaces , allowing users to trade at the best rates.

Key components of Kyber Network

To understand how the Kyber Network works, we need to look at the main components of the project to provide exchange services. Key components of Kyber Network include:

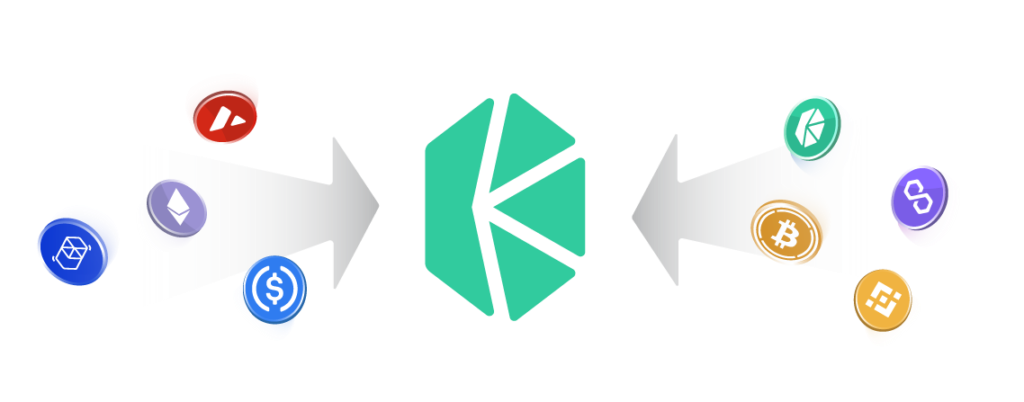

Kyber Network's Reserve Model

Liquidity on the Kyber network relies entirely on reserves. When a user initiates a transaction, the network conducts a search of the available reserves to select the best available rate offered by the taker currently.

There are three main types of reserves that provide takers with the ability to instantly convert tokens at unbeatable prices:

For example

You want to exchange ETH for KNC:

Although the above transaction is done through many steps, they are all completed in a single blockchain transaction. If something goes wrong, your transaction will be canceled and rolled back to the beginning. In addition, all exchange rates provided by the protocol are publicly verifiable and verifiable if you query smart contracts.

Simple integration

Unlike off-chain systems, Kyber allows blockchain applications to easily integrate with its various protocols, thereby saving time and operational resources.

Optimizing the exchange rate

Kyber guarantees the best rates for traders, Dapps… by sourcing liquidity from various liquidity protocols.

High transparency and safety

All activity in the Kyber Network takes place and is verifiable on the blockchain. Anyone can monitor this information and activities of Kyber Network.

High liquidity

Currently, Kyber has announced that it will reserve a large amount of tokens to provide high liquidity to users. As a result, you will likely receive the token immediately upon making your transaction.

DeFi's first multi-chain Dynamic Market Maker and the main protocol in the Kyber liquidity hub. KyberSwap is both an exchange (DEX) and an effective source of liquidity for liquidity providers, using technologies developed by Kyber Network.

KyberSwap owns a dynamic trade router (Dynamic Trade Routing) with the ability to aggregate liquidity and allows users to generate liquidity on various decentralized exchanges. This helps the platform always get the best exchange rate for any order, on any supported blockchain network. Additionally, users can still trade tokens that are not listed on KyberSwap but are available on other DEXs.

KyberSwap is audited by ChainSecurity and insured up to US$20 million by Unslashed Finance.

In July 2020, Kyber Network kicked off the Katalyst network upgrade and introduced KyberDAO, a decentralized autonomous organization (DAO) that allows KNC holders to participate in the management of the Kyber Network.

KNC holders can now stake their tokens for KyberDAO. This will allow them to participate in voting on various proposals related to the development and operation of the Kyber Network. Investors only receive the full staking reward if they vote on all proposals in each epoch (each proposal lasts about two weeks).

In August 2017, Kyber successfully launched its beta testnet. By Q1 of 2018, Kyber had released the mainnet. For the rest of 2018, the team added, focused support, developed KyberSwap, and created a set of developer-specific APIs. The next major milestone for Kyber Network is the implementation of Gormos, a scaling solution that uses Plasma and supports KNC staking.

At the moment, May 2022, the Kyber team has not yet given a specific roadmap for the future project. Here are some recent Kyber Network updates.

December 2021:

In the year 2022:

Development team

Kyber Network was created and founded by Loi Luu, Victor Tran and Yaron Velner. All three are computer scientists with a remarkable breadth of knowledge and experience:

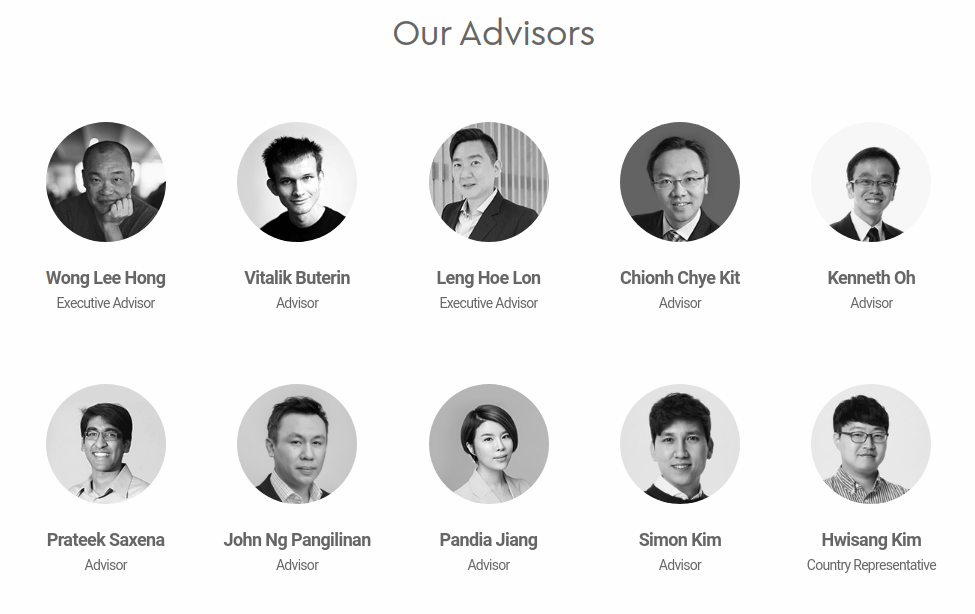

Adviser

Besides, Kyber Network also has an extremely powerful team of consultants with famous names in the blockchain field such as Vitalik Buterin (Ethereum Co-Founder), Leng Hoe Lon (Financial Market Manager). in Singapore, Brunei and Australia of Standard Chartered Bank), Simon Seojoon Kim (CEO and Partner Development at Hashed)….

Investors and partners

In September 2017, Kyber Network's ICO took place and raised US$60 million in funding (equivalent to 200,000 ETH). After that, the project continued to receive investment from many famous investment funds such as IOSG Ventures, 8 Decimal Capital, Fenbushi Capital, Chain Capital, Hashed, Fund Basic Labs, Amino Capital, Plasma Capital...

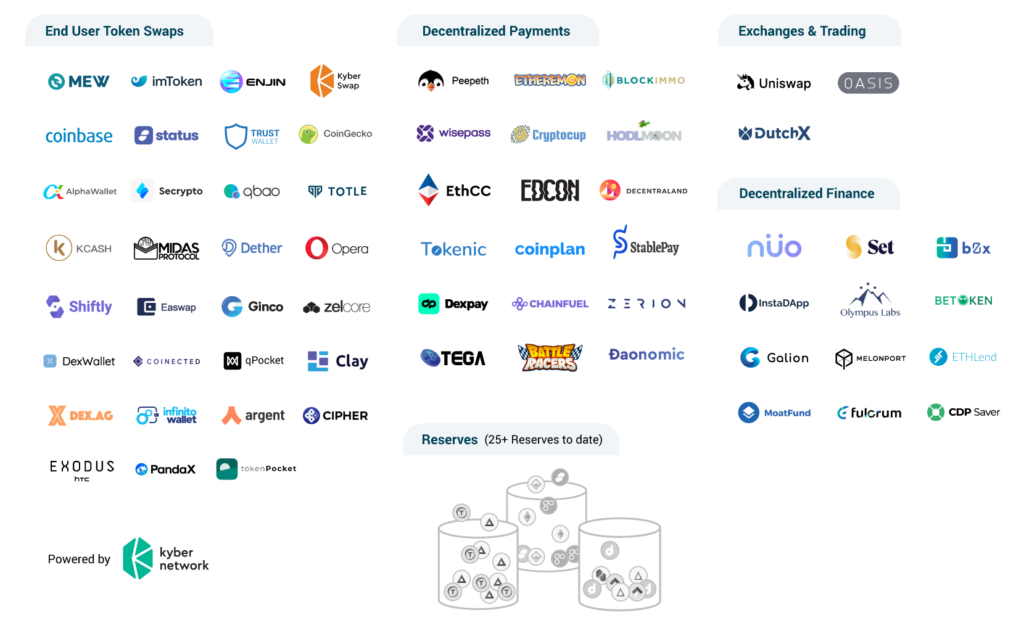

Currently, Kyber Network has cooperated with more than 100 different projects on many platforms such as Ethereum, BNB Chain, Avalanche… Some partners in specific fields such as:

Kyber Network Crystal v2 (KNC) is the utility and governance token of Kyber Network. KNC holders can participate in staking, vote at KyberDAO for upgrade proposals, receive transaction fees from Kyber Network.

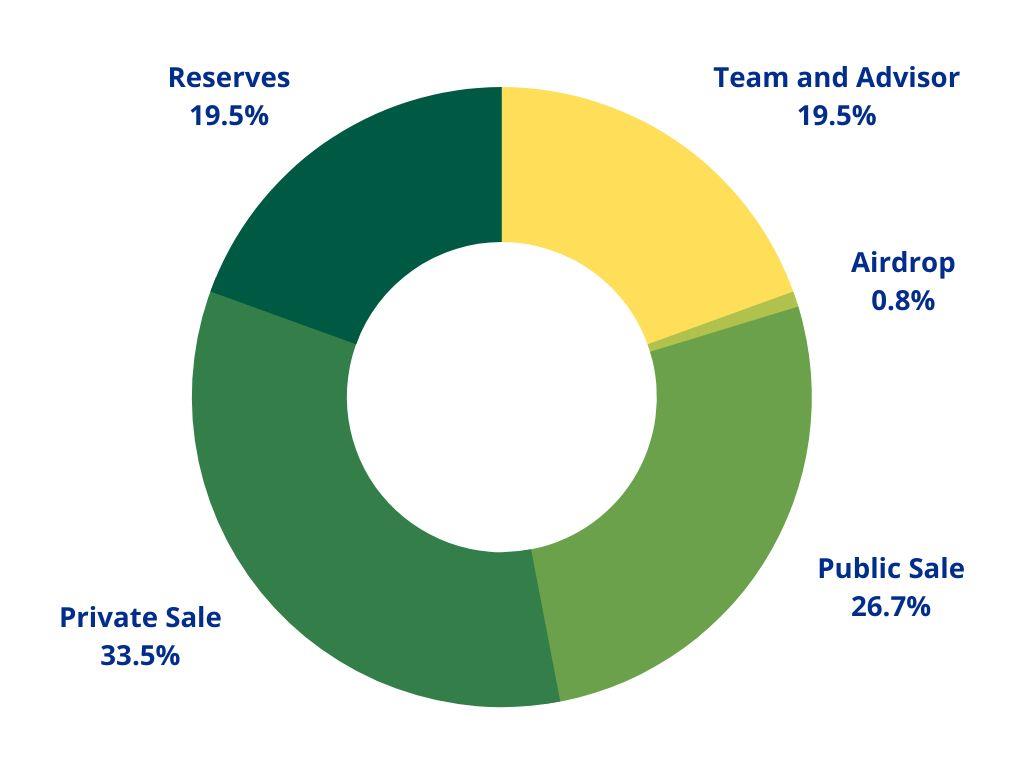

Released in 2017, almost all KNC tokens have been distributed and circulated on the market.

You can buy and sell KNC on many major cryptocurrency exchanges such as Binance, OKX, Huobi, Coinbase, KyberSwap…

KNC is a token issued according to ERC-20 standard and compatible with e-wallets that support Ethereum tokens such as MetaMask, Ledger, Trezor, etc.

On April 28, 2022, KNC peaked at $5.7, up nearly 400% from 2021 low before correcting. According to CoinMarketCap, with more than 200 million KNC circulating on the market, the market capitalization of this cryptocurrency has risen to the 80th position in terms of market capitalization. With this success, Kyber Network is the third Vietnamese blockchain project with a token reaching a billion dollar market cap after Axie Infinity and Coin98 from 2021.

According to many experts, the main driver behind this growth of KNC comes from KyberSwap expanding access to 11 different blockchain networks and integrating with Uniswap v3. Not long after that, KNC also suffered a strong correction according to the general trend of the market.

Kyber Network's goal in the future is to continue to refine the product and strengthen its position as an open solution that powers the liquidity and swapping power of the entire DeFi ecosystem. As DeFi becomes more and more popular and growing, Kyber Network and KNC can grow even more strongly.

Above is the basic information about the Kyber Network project and the Kyber Network Crystal v2 (KNC) coin. Kyber Network is an open source protocol that aggregates liquidity and enables decentralized token exchange. This technology of Kyber Network can be integrated into decentralized applications (Dapps), cryptocurrency wallets and decentralized exchanges to optimize exchange rates and transaction fees that users pay. In addition, the project also self-developed KyberSwap exchange which is the first Dynamic Market Maker with many attractive features and KyberDAO for users who own KNC.

For more details about the project, readers can view information at the media channels:

Website | Telegram | Twitter | Facebook | Discord | Medium | _ _ Youtube | Github

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.