What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Magic Internet Money (MIM) is an algorithmic stablecoin valued at around US$1 and issued by decentralized lending platform Abracadabra.money. Abracadabra.money allows users to mortgage digital assets in exchange for loans that are MIM. When returning the MIM, the platform burns the MIM from circulation and returns the assets to the user.

Users can use Abracadabra to mint MIM on many different platforms including Ethereum , BNB Chain, Arbitrum, Fantom, Avalanche , Polygon ...

Abracadabra's mechanism of action is similar to other mortgage lending platforms such as MakerDAO, Aave, Synthetix, etc. DeFi lending protocols such as MakerDAO, Compound and Aave only accept cryptocurrencies such as BTC, ETH... instead of interest tokens as collateral. Interest tokens are generated by users when they stake their respective assets on yield farming platforms like Yearn.Finance, Curve or Sushi to receive interest. Some popular interest rate tokens can be mentioned as yvWETH, yvUSDC, yvYFI, xSUSHI… However, these tokens are not tradable on exchanges.

Recognizing user demand and the potential of interest tokens, the Abracadabra development team built and developed a platform that allows users to use interest tokens as collateral and to borrow stablecoins. MIM. With interest tokens from stablecoins, after mortgaging users can borrow up to 90% of the value of their staked assets.

By doing this, Abracadabra has opened up the opportunity to release capital trapped in yield farming platforms to help investors optimize returns as well as turn illiquid assets into liquid.

To maintain the value of MIM always stable around 1 USD, Abracadabra used the basic elements and properties of the law of supply and demand:

Abracadabra is currently supporting users on many different blockchain platforms to use its services. Users can buy, sell and trade MIM tokens on popular decentralized exchanges (DEXs) such as Uniswap, SushiSwap, SpiritSwap, Trader Joe, Pangolin...

MIM was originally issued under the ERC-20 standard but was later developed into a multi-chain token. Therefore, you can safely store MIM on many e-wallets such as MetaMask, SafePal, Math Wallet, Trust Wallet….

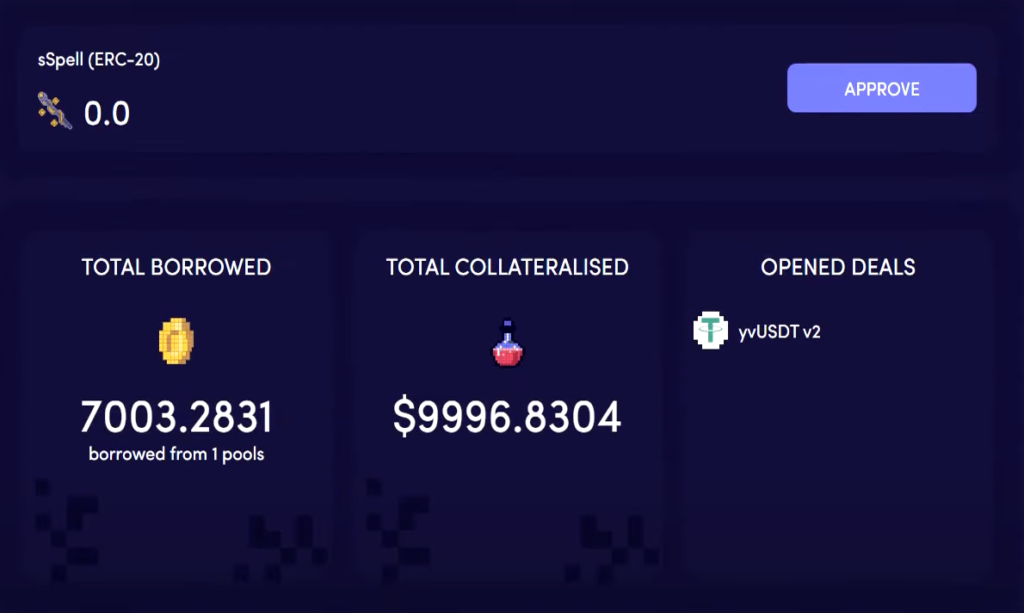

In this example, TraderH4 will guide you how to borrow MIM on Abracadabra with yvUSDT using Ethereum's network.

Step 1 : You access Abracadabra at https://abracadabra.money/ then connect to your MetaMask wallet.

Step 2 : You select the item “BORROW” on the menu bar to go to the MIM loan interface.

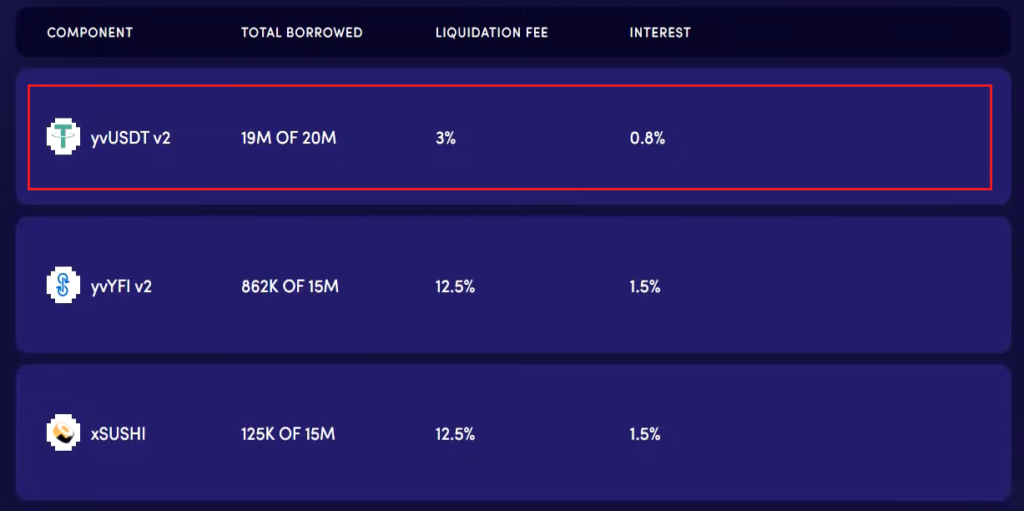

Step 3 : Click on “yvUSDT v2” to continue.

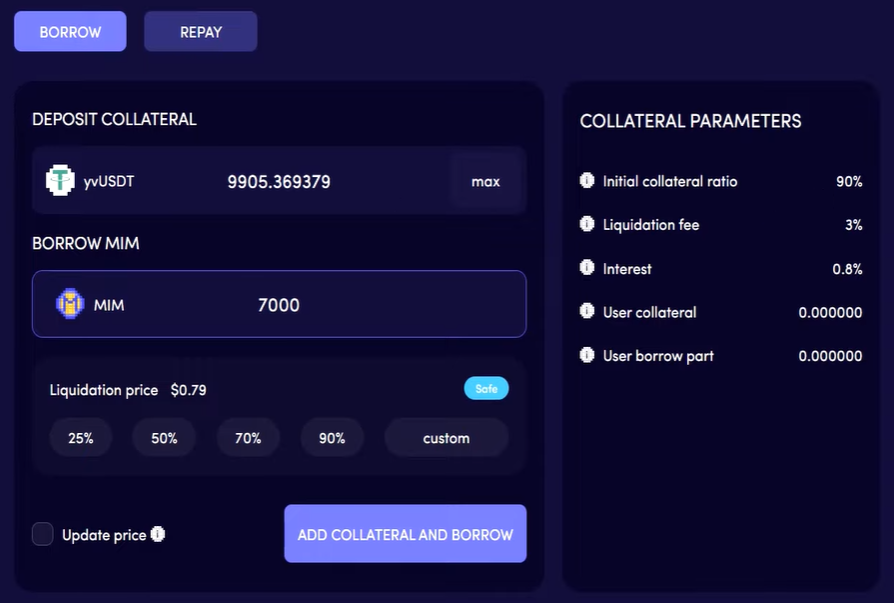

Step 4 : Enter the amount of AVAX you want to mortgage then enter the amount of MIM you want to borrow. Then press “ADD COLLATERAL AND BORROW” to continue.

Some information you need to keep in mind when applying for an MIM loan include:

Step 5 : You confirm on MetaMask wallet to complete the transaction.

As with all borrowing and lending platforms in decentralized finance (DeFi), asset liquidation can happen to anyone. When the value of the collateral falls below a specified point, usually when the collateral is insufficient to repay the loan, liquidation occurs. The liquidation limit is displayed as soon as the user opens debt positions on the Abracadabra.money platform. If a user uses interest tokens that represent volatile assets such as SUSHI, YFI or ETH, their loan position may drop below liquidation in the event of strong market movements.

In addition, the risks of using Abracadabra.money are the same as with other DeFi applications. The project works through the use of smart contracts. Although smart contracts are arguably one of the most important components for decentralized applications, hackers can still exploit security vulnerabilities from smart contracts to attack funds. product

Above is the basic information about Magic Internet Money (MIM) as well as instructions for borrowing MIM on Abracadabra. Abracadabra provides a completely new service to DeFi users by allowing illiquid interest rate assets such as xSUSHI, yvUSDT, etc. to be deposited as collateral and can create a liquid asset called MIM. With Abracadabra, users can now take their assets to the next level with minimal risk, creating new possibilities and models. However, with loan applications, users are always at risk of asset liquidation. Therefore, you should calculate and manage your capital properly to limit your risks and optimize your profits.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.