What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

MonoX Finance is a DeFi project created with the goal of re-optimizing the capital generated by liquidity pairs using a single token model. That is, MonoX Finance will pool the deposited tokens into a virtual cryptocurrency pair with the stablecoin vCASH, instead of using the usual liquidity pairs. Thereby, MonoX Finance offers users a product called MonoSwap – a DEX with low transaction costs.

MonoSwap helps liquidity providers optimize the efficiency of using capital for escrow, and allows project owners to issue their tokens without capital. With MonoSwap, developers can leverage funds to focus on building their projects.

MonoX Finance also has the following highlights:

More efficient on capital

For other platforms, investors who want to provide liquidity must add at least 2 tokens to the Pool. With MonoX Finance, users only need to provide a certain token (let's say token A) to become a liquidity provider. This increases decentralization and increases capital efficiency.

For projects, developers can issue their tokens with zero capital.

Lower transaction fees

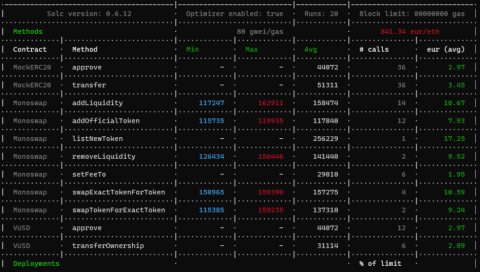

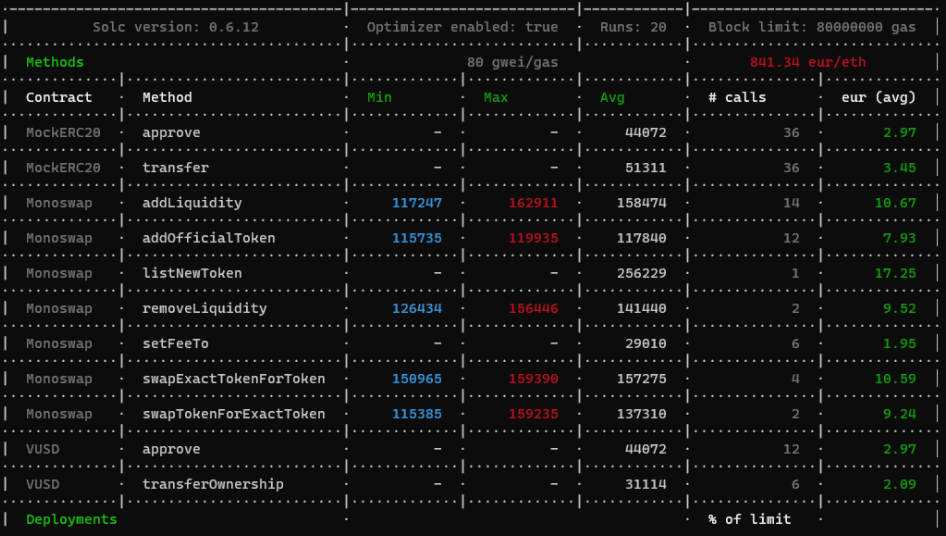

All liquidity pools or pairs are in the same smart contract with the ERC-1155 standard. Internal interaction within the same contract will be cheaper, helping users save transaction costs.

In addition, creating a virtual token pair with stablecoin vCASH also avoids long transaction paths, ie shortening paths in the process of swapping token A to token B. Therefore, each transaction costs only a fee of 0.3% of the total amount of the transaction.

Allow borrowing and lending from the same Pool : The borrowing and lending process is more optimized because investors do not have to withdraw/retain two tokens to keep the same contribution rate to the Liquidity Pool.

Virtual Pair : MonoX Finance's liquidity pool will include token A and virtual currency pair. The virtual currency pair is the liquidity pool of a regular ERC-20 token and a virtual stablecoin (vCASH). vCASH does not actually exist in the Pool but is only displayed as a balance. Each Liquidity Pool will have an initial balance of zero, but when token A is sold the result is token A's balance decreases, vCASH balance increases and vice versa.

vCASH : A new stablecoin introduced by MonoX Finance. vCASH is backed by all assets in MonoX Finance's liquidity pools. All assets in MonoX Finance's Pools are undervalued in vCASH.

MonoX Finance AMM : AMM uses a Liquidity Pool with a single token model.

In addition, MonoX Finance is in the process of finalizing the Lending & Borrowing and Derivatives protocols.

Value Backed Tokens (VBTs) : These are tokens that projects use as collateral backed by assets such as Synthetic, NFT shard, Gaming token, Insurance token...

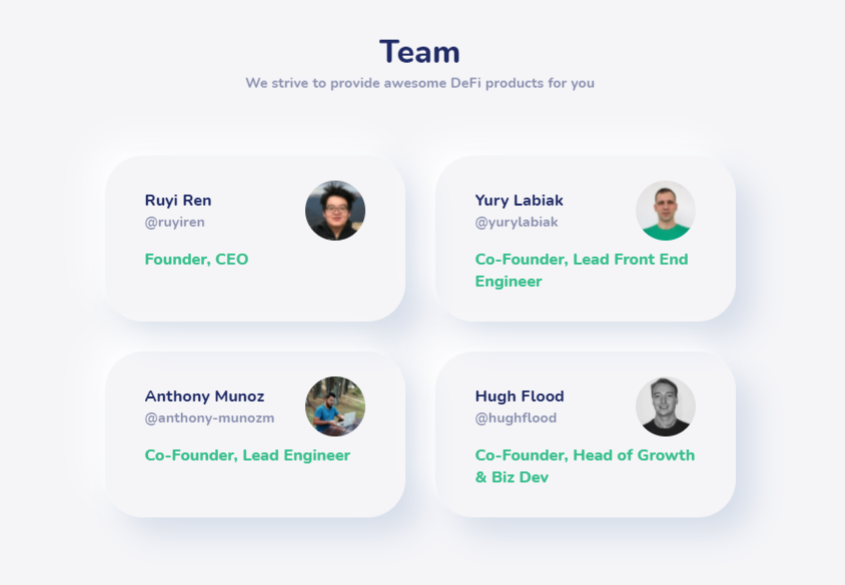

Development team

Ruyi Ren (Founder, CEO) : He has held various positions such as CTO of Kashir, Co-Founder and CIO of Jack AI.

Anthony Muñoz (Co-Founder, Lead Engineer) : He is a software engineer, specialized in AI and experienced in data analysis.

Yury Labiak (Co-Founder, Lead Front End Engineer) : Yury Labiak is an IT specialist specializing in CCTV. He used to work in Hikvision device based video surveillance and has experience in solving local area network issues and PC troubleshooting.

Hugh Flood (Co-Founder, Head of Growth & Biz Dev) : He used to work as a security manager at ConsenSys and as a consultant at Saxon.

Investors

On September 17, 2021, MonoX Finance raised US$5 million in a seed round with the participation of investment funds such as: Axia8 Ventures, Animoca Brands, Divergence Ventures, Block Dream Fund , 3Commas, LD Capital, Rarestone Capital, Youbi Capital, Krypital Group, OP Crypto.

Partner

Currently MonoX Finance is collaborating with Polygon , Halborn, SIL Finance, StaFi Collaboration…

Q4 2021 : The project will release Mainnet, MonoSwap and vCASH versions launching on Ethereum Mainnet and Polygon with full swap and liquidity features.

Q1 2022 : MonoX Finance launches derivatives market, supports more ecosystems and integrates Cross-chain swap.

Q2 2022 : Project to release Lending & Borrowing products and other derivative products.

Q3 2022 : MonoX Finance will release the IDO platform and Launchpad product.

Q4 2022 : The project will launch the transaction feature according to the Orderbook model.

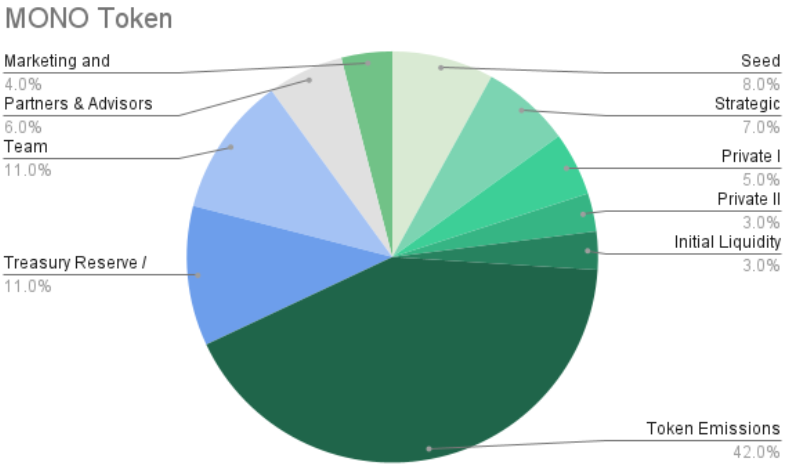

MONO is the governance token of MonoX Finance. MONO holders will be able to participate in DAO voting and own the treasury. Specifically, the MONO token will have the following functions:

MONO tokens will be sold on Huobi Primelist on November 25, 2021. In the future MONO will be listed on AMM of MonoX Finance. However, the MONO token is currently not listed on any other exchange.

MonoX Finance offers an optimal solution that is more efficient to use capital when users participate in providing liquidity on this platform. At the same time, thanks to MonoX Finance, developers can issue their tokens without additional capital. In addition, for traders, it is much more cost-effective to swap tokens on the MonoSwap product than on other platforms. Although, the project still has many features yet to be released. However, with the current support utilities, we can see that the project brings a lot of benefits to users.

In addition, the project also conducted many Audits with Halborn. This shows that users can safely use MonoX Finance's products when they have been censored for safety and security.

Overall, the MonoX Finance development team wants to build and shape a new economy that has a positive impact on the crypto investor community. Thereby, they will release new DeFi products and services that put the interests of users first. With the above information, hopefully readers have been able to make their own judgments about the project, thereby making investment decisions for themselves.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.