What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Parallel Finance project is a supporting DeFi protocol that provides users with lending, borrowing and staking services. The service operates on the AMM mechanism and supports assets on both the Polkadot and Kusama networks. In addition, Parallel allows investors who own tokens to profit from their assets.

On October 13, 2021, the Polkadot ecosystem officially announced the launch of parachain auction events . The first batch was held on 11/11/2021 and there are a total of 5 slots for projects. The project team staked the DOT token and called on the community to support voting the project by staking DOT. The five projects with the most DOTs will become the Polkadot parachain.

When the crowdloan event is successful, the amount of DOT tokens that the community contributes will be locked until the end of the project's slot rental period (up to 96 weeks). After that, the DOT token is returned to the owner, and during that time, the participants receive rewards that are the tokens of the projects they lend.

Parallel project held a crowdloan on Polkadot to participate in the first auction. On December 9, 2021, Parallel Finance won the fourth place by raising more than 10.75 million DOT equivalent to 306 million USD in this crowdloan.

The Polkadot ecosystem from launch to date has more than 40 billion USD in market capitalization. However, users of this ecosystem are used to the fact that staked DOT tokens will not be liquid, and to withdraw stakes, it takes up to 28 days. This limitation causes users to pay a huge opportunity cost when compared to their investment of assets in other Dapps.

However, staking on Polkadot is still a safe and easy decision because otherwise users also need to earn more than 14% on other platforms. In short, there is currently no active application on the Polkadot system that allows staking investors to have liquidity.

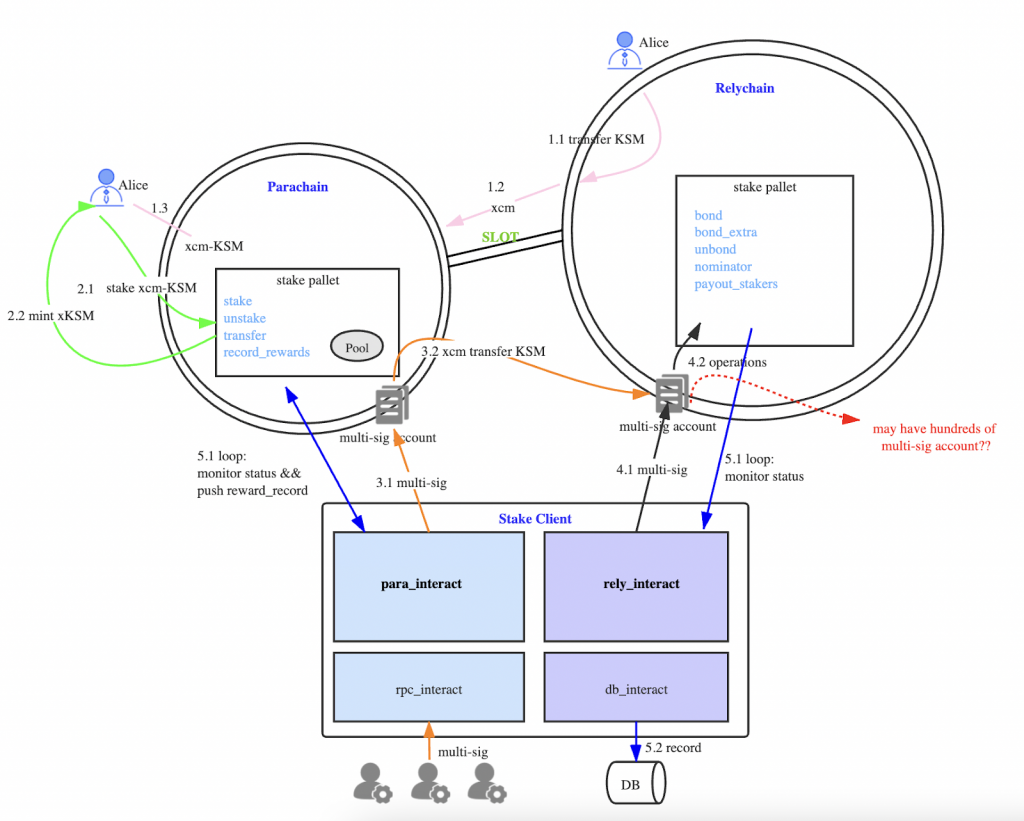

The Parallel Finance project provides a solution to the above problem. Parallel allows users to optimize investment by both making money from staking and having unblocked liquidity.

This solution is known as xDOT. Users who act as lenders will earn interest on their xDOT earnings. Meanwhile, borrowers can obtain additional loans from DOT assets valued as stablecoins and without having to sell their DOT tokens.

In Parallel Finance, investors can make money in many ways: From staking to provide liquidity to lending to earn interest, or mortgaging assets to exchange for other currencies to use for other purposes.

In Parallel Finance, the main features include:

Currency market

Invest and borrow: Investors can deposit their assets into Parallel Finance. In return, for providing liquidity, they will receive some benefits of the borrower.

Investors can also choose to collateralize their properties to borrow against other currencies. This is essential when the price of one currency fluctuates and investors want to borrow another currency to hedge risk. At the same time, that also solves the liquidity for users' crypto.

Interest rate model: The interest rate model in Parallel Finance is very flexible, depending on the supply and demand situation in the market. Therefore, lending rates and borrowing rates will likely differ between blocks.

Staking

Since the Polkadot network uses Nominated Proof-of-Stake (NPoS – the process of selecting validators allowed to participate in the consensus protocol), DOT token holders can stake their assets to designate validators to earn money. on profits. However, those who have staked still have the need to optimize the return on their assets. Understanding that desire, Parallel Finance has launched a liquid staking solution to unlock the liquidity feature of staked DOT tokens without affecting the security of the system.

Liquidation

There are 3 ways to handle liquidation on Parallel: Automatic liquidation by off-chain employees, liquidation by customers and instant liquidation by anyone.

AMM . Mechanism

Parallel provides 2 different AMM mechanisms for users to choose: Stable is a low slippage AMM mechanism with stable 1:1 ratio assets, and Dynamic is an AMM mechanism used for asset class with a higher slippage rate.

Forecast

This is the real-life data collection feature of Parallel. This feature will provide market price information to the data leads, then aggregate it on-chain.

Administration

On the Parallel protocol, there are millions of users who are divided into 4 main groups: the development team and public contributors to the system, the group of investors who own the PARA token, the group of system users, and the group of people. system maintenance. Parallel's governance process will pay for the network activities of each group, and develop the protocol for the needs of a larger number of users.

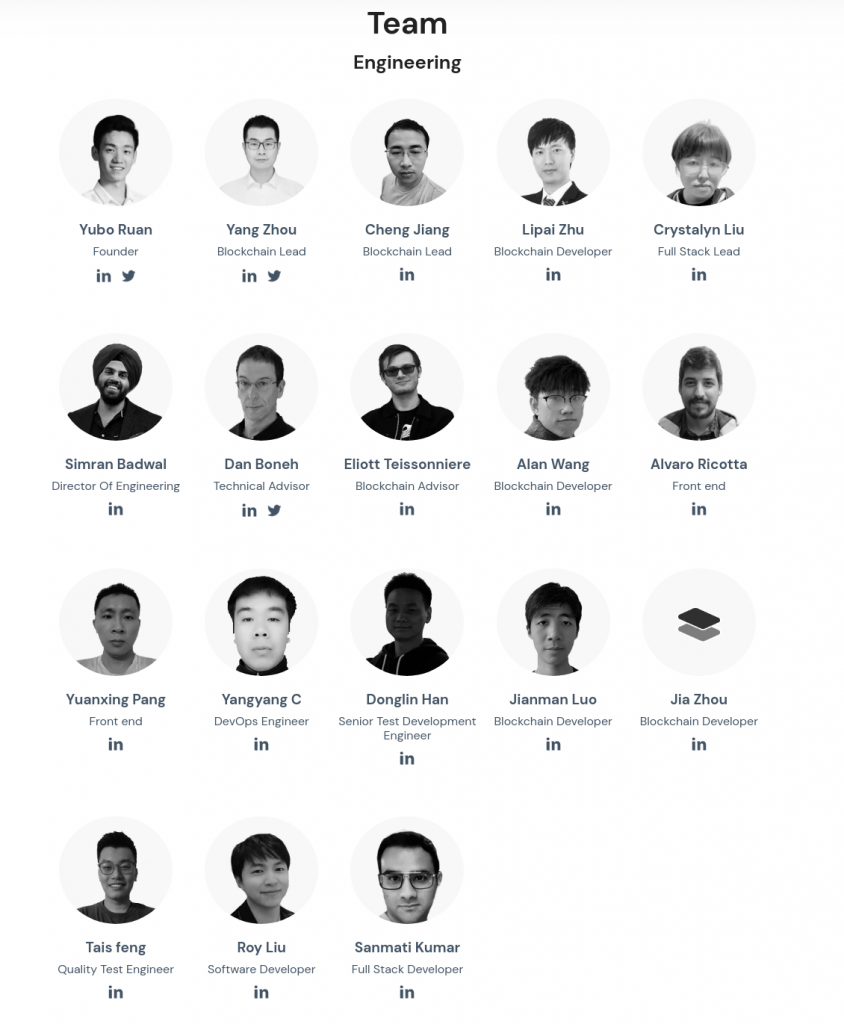

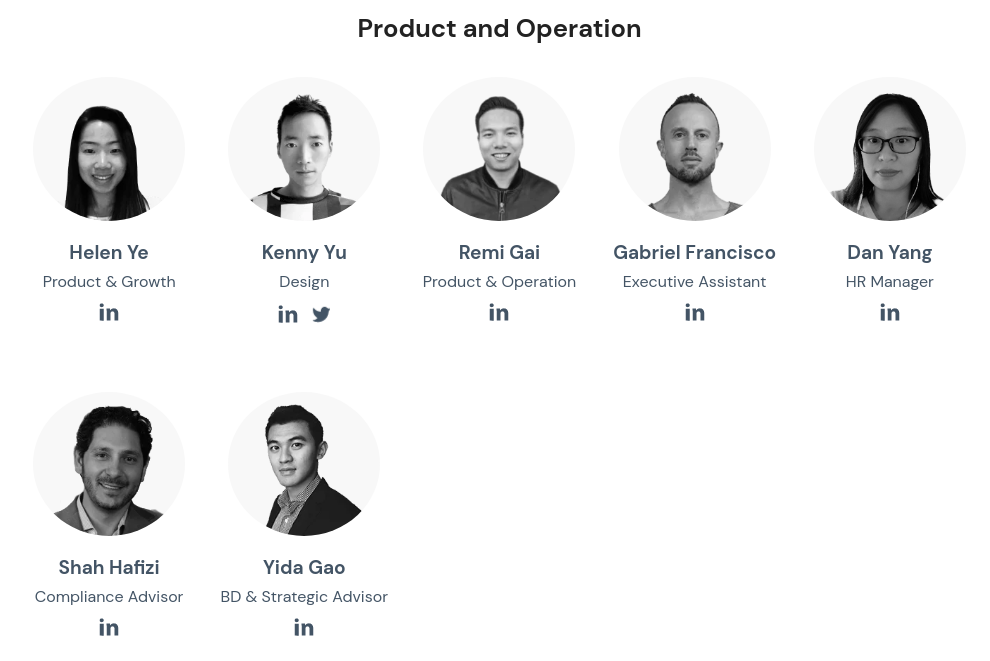

Parallel Finance project has a large development team, including 3 key players:

On August 30, 2021, the project successfully raised capital with the amount of USD 22 million for the Series A round with the participation of investors such as Alameda Research, Polychain, Slow Ventures, Lightspeed Venture Partners, gumi Cryptos Capital (gCC), CMT Digital Ventures, Blockchain Ventures and Blockchain Capital.

In addition, the Parallel Finance project also receives support from industry partners such as Moonbeam, Acala, gauntlet, Chainlink, DeFi Alliance, Halborn and others.

This information is being updated.

The PARA token is the native token of the Parallel Finance project on the Polkadot network, distributed to key users and partners in the ecosystem. In addition, the HKO token of the Heiko Finance protocol (a "brother" version of Parallel) also has the same function on the Kusama network.

Investors who own PARA tokens can use some key functions of the token such as:

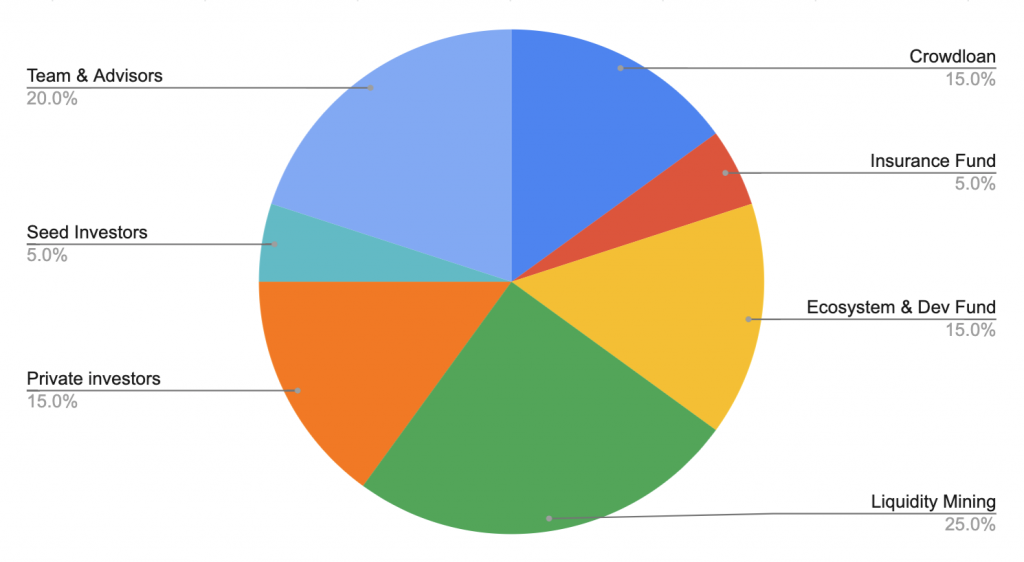

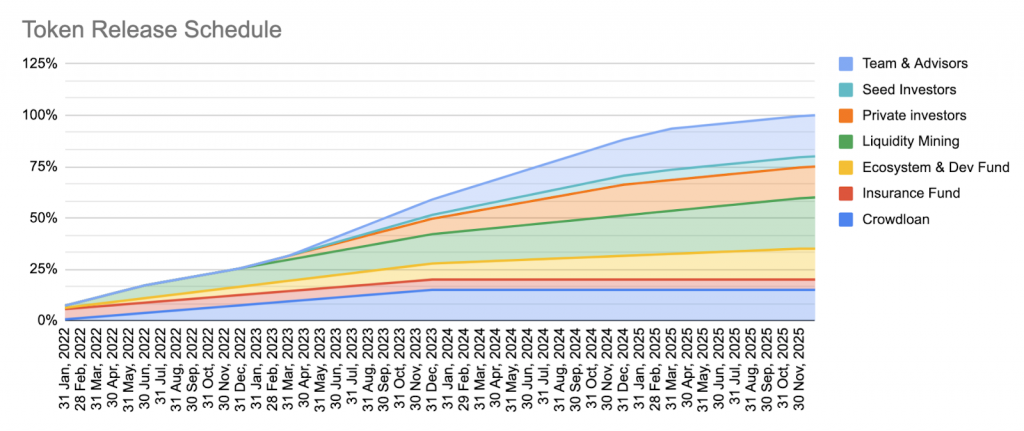

Below is the allocation rate and PARA token unlocking schedule.

The total supply of PARA is 10 billion tokens. The initial amount will be from the rewards for the project's crowdloan activity, which will be paid in installments according to the vesting schedule and from the liquidity mining programs.

Detailed information about PARA token allocation rate and vesting opening schedule:

| Category | Detail |

| Crowdloan | 1,500,000,000 (15%) Issued monthly within 24 months |

| Liquidity Mining | 2,500,000,000 (25%) 23% will be mined in the first 6 months, the remaining 77% will be mined in 47 months |

| Team and Advisor | 2,000,000,000 (20%) Locked for 15 months then released for more than 24 months |

| Seed round investors | 500,000,000 (5%) Locked for 15 months then released for more than 24 months |

| Private round investors | 1,500,000,000 (15%) Locked for 15 months then released for more than 24 months |

| Ecosystem Fund | 1,500,000,000 (15%) 25% issue at the time of TGE, the rest will release over 47 months |

| Insurance fund | 500,000,000 (5%) Transfer to insurance pool after TGE . event |

Currently, apart from the distribution for early activities on the platform, there is no information that PARA tokens will be sold on any other exchange other than Parallel Finance's own exchange. Investors will have to deposit other cryptocurrencies into their accounts and then buy PARA tokens through the website: https://parallel.fi .

Parallel Finance's long-term vision is to provide the future banking ecosystem with a place for everyone to participate and invest in economic development. In the short term, Parallel aims to be the first lending and staking protocol on the Polkadot ecosystem. It is also one of the first currency markets to target the staking economy in general.

On Polkadot, Parallel will become a parachain and optimized for financial applications, allowing anyone in the community to contribute and build Dapps within Parallel's ecosystem. Even launching their own parachain through Parallel's network. In addition to Polkadot, Parallel will provide a suite of intuitive financial tools on blockchains and a gateway to the DeFi marketplace.

The Polkadot network is a place of great potential, the Parallel Finance project helps to further develop that potential. Parallel does that by providing safe and secure Polkadot-compliant borrowing and lending solutions.

With the main services of staking promotion and auction lending, Parallel's new lending system has the potential to break the inherent stagnation of the DeFi market, along with higher returns and better opportunities. .

In addition to building lending facilities, Parallel also builds interactive user interfaces that increase interaction efficiency in the DeFi market.

For more information about the project, readers can access the following communication channels:

Website | Project Information | Twitter | Telegram | Email | LinkedIn | Medium | Discord | GitHub

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.