What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Exchange, buy, sell, swap or convert – these terms all represent a user exchanging one Crypto asset for another Crypto asset. Currently, there are countless DEXs on the market and billions of dollars are swapped on DEXs every week. In which DEX aggregator exchanges accounted for 22% of total cryptocurrency trading as of November 2021.

ParaSwap is a famous name recently among DEX aggregator exchanges. From November 18, 2021 to November 19, 2021, the price of the PSP token (ParaSwap's token) increased by 26%, from $0.77 to $1.03. Meanwhile, some investors are still unaware of the benefits from this platform. The following article will help readers learn more about ParaSwap as well as the PSP token.

ParaSwap is a DEX aggregator of the Ethereum platform , which aggregates the best prices on DEX exchanges for users.

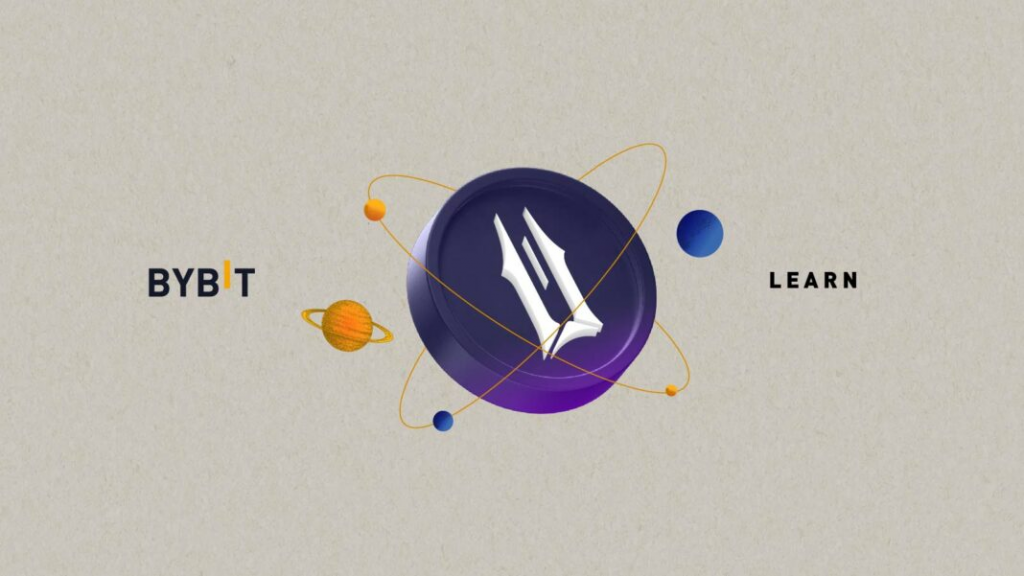

At ParaSwap's interface, users can view a summary of the transaction history they have made, including the estimated cost, price drivers, and the minimum number of tokens received. Details of transaction routes are also displayed to help users understand the direction of their token trade and to avoid confusion.

According to the operating principle, ParaSwap acts as an intermediary between DeFi users and DeFi services. It compares liquidity from over 20 DEXs and brings all functions into a single portal for maximum user convenience.

Many well-known investors have come forward to support the ParaSwap protocol. During the project's recent seed funding round, ParaSwap received investment from major companies such as CoinFund, Blockchain Capital, and Arrington XRP Capital. ParaSwap's goal is to become the preferred DEX aggregator on Ethereum, while processing the fastest transactions at the best rates.

In addition to Ethereum, ParaSwap also supports Polygon , Avalanche and Binance Smart Chain platforms .

ParaSwap provides users with an ideal route at a cost effective price by drawing a series of trade routes. It saves users time and effort by simplifying price comparisons and optimizing trading strategies.

When users visit the exchange, ParaSwap determines the best rate through a price aggregator that helps to retrieve prices off-chain. Then, ParaSwap conducts a swap using a smart contract to deposit fees into the wallet. This process can lead to splitting an order into different exchanges if that is the most cost effective.

Here's how the exchange trade takes place on the ParaSwap platform:

The following characteristics make the ParaSwap project remarkable.

ParaSwapPool

DEX aggregators generally do not hold or store any liquidity to themselves. In contrast, ParaSwapPool allows users to access ParaSwap's private pools as a source of DeFi liquidity, providing the opportunity for efficient and optimized transactions.

ParaSwap ensures that all transactions involved when going through ParaSwapPool achieve the best rate. ParaSwapPool is an aggregator from professional liquidity investors, accessible through RFQ system (quotation request system). However, ParaSwap is aiming to create an alternative that will make it more decentralized and accessible in the future.

MultiPath

MultiPath is a protocol designed by ParaSwap. Its function is to discover token trading routes during the exchange. MultiPath can also interoperate with AMM systems and DeFi lending platforms. With MultiPath, ParaSwap users' transactions can be traced to seamless transaction routes through major DeFi protocols such as Compound and Aave.

Protocol MultiPath can split transactions across different exchanges, while enabling intermediary tokens to negotiate better rates when required. Without a live trading pair when trading and swapping tokens, MultiPath can process transactions across multiple AMM systems, DEXs, and DeFi liquidity protocols.

In addition, gas fees on Ethereum and price fluctuations are also considered during the transaction. MultiPath can also support indirect transaction routes with two or more steps between protocols for a smoother user experience.

Cost on ParaSwap

A certain amount of computing power is required to process transaction requests on the Ethereum blockchain. This energy is called gas. Gas fees can fluctuate significantly, depending on the size of the transaction (but not the value) and the amount of activity taking place on the system.

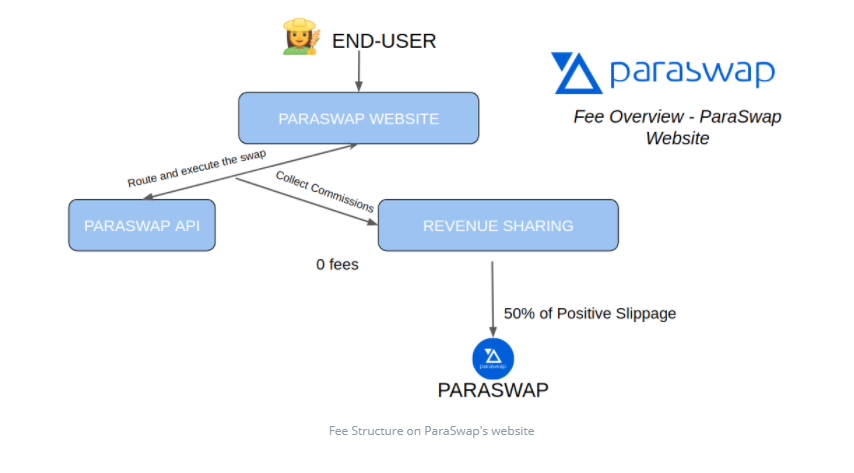

ParaSwap does not charge any fees for its services. Instead, services that integrate with ParaSwap will receive a commission for all supported swaps, while ParaSwap will receive 15% of this commission. In addition, ParaSwap receives a small commission through a revenue sharing contract for Dapps that use ParaSwap's API.

ParaSwap optimizes gas fees when users conduct transactions. Although users can use ParaSwap for free, they still have to pay fees for the Ethereum system because all ParaSwap.io transactions are through Ethereum.

When gas costs are low, ParaSwap also allows tokenization in the form of GST2 GasToken. These tokens are then used with ParaSwap transactions to reduce and optimize gas fees on Ethereum during peak operating hours.

Hedging against slippage

Cryptocurrencies operate in a free market where asset values fluctuate. While users wait for their transactions to be confirmed, other transactions on the system can push the token price up or down. This phenomenon is called "slipping" of prices. ParaSwap has implemented various features to insure against slippage. These features include a “minimum get” amount, as well as holding the token price for a certain period of time using the ParaSwap Pool.

For the smart contract ParaSwap v3, the fee model around slippage has been slightly adjusted. In the event of slippage, the user may receive more tokens than usual for the price paid. However, apps are not obligated to provide users with slippage amounts, some services even keep all profits earned.

As a community-driven project, ParaSwap contracts are set to put 50% of the slippage into the development of the platform, the other half going back to the users. For example, when selling ETH for DAI, this deal means that users can receive more DAI tokens than they initially claimed.

By splitting swap orders between different DEXs, ParaSwap is able to offer competitive rates for any swap. Simply select the 2 cryptocurrencies involved in the transaction and ParaSwap will handle the rest. In short, ParaSwap optimizes the swap process for users by plotting the best trading route. It also gives a warning if the user's intended trade is at risk of slippage or failure.

Gas fees recommended by ParaSwap are optimally calculated at the time of transaction. However, users still have full control and discretion over gas fees during the transaction. Leaving it up to users to decide may sound convenient for them, but low gas fees have significant harms. If the user-selected gas fee is too low, the miners will never choose to verify and confirm for this transaction.

Since ParaSwap is a decentralized exchange, users do not need to create an account on ParaSwap. They can use ParaSwap to do peer-to-peer swaps anywhere in the world, as long as they have an Ethereum wallet. ParaSwap's DEX platform ensures that users don't need anyone else to make transactions for them. Each keeps their cryptocurrency safe with their private key and has full control over their assets.

The user can give ownership of the security key. This also means that the entire responsibility rests with the user. When users enter their private key on a smartphone or computer, their account is at risk of being hacked, especially if not adequately secured.

Another downside of using an exchange like ParaSwap is that it doesn't allow users to buy cryptocurrencies directly. Furthermore, ParaSwap only offers the option of trading in cryptocurrencies, users cannot buy cryptocurrencies with fiat currency like EUR or USD.

ParaSwap's team consists of experts with many years of experience in many fields:

The governance token of the ParaSwap platform, the PSP token, is used to increase the decentralization and efficiency of the protocol. About 20,000 users participated in ParaSwap's Retroactive Airdrop token, worth over $240 million at the time.

In a free token allocation, ParaSwap allocated 150 million PSP tokens, or 7.5% of the total supply, to active users on the protocol.

Currently, PSP tokens are used for 2 purposes:

The total supply is 2 billion PSP tokens, of which 7.5% has been Airdropped, equivalent to 150 million PSP tokens in the initial circulating supply that has been distributed to the first users.

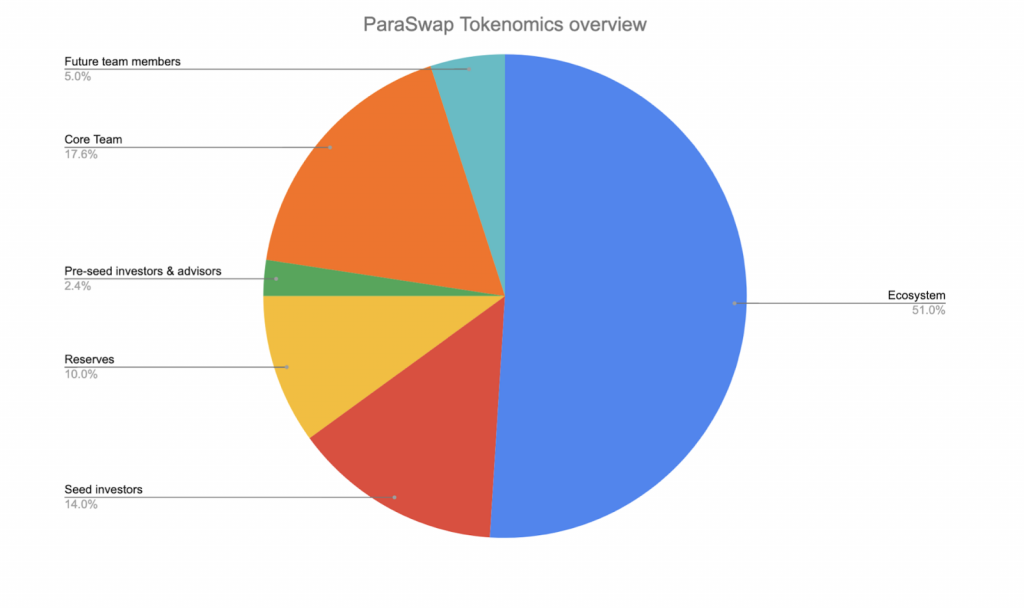

The remaining tokens are divided among ParaSwap team (17.6%), pre-seed round investors and advisors (2.4%), seed investors (14%), future team members (5%), reserves (10%) and ecosystems (51%).

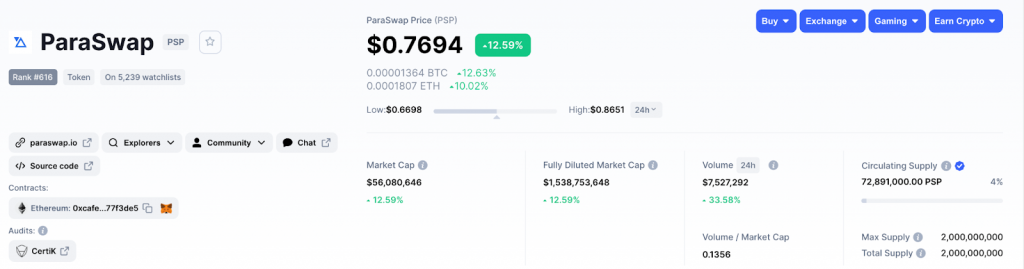

At the time of writing, the price of ParaSwap is $0.77, with a 24-hour trading volume of around $7 million. The PSP token's CoinMarketCap rating is 616, with a real market cap of approximately $56 million, a circulating supply of approximately 73 billion PSP tokens, and a max supply of 2 billion.

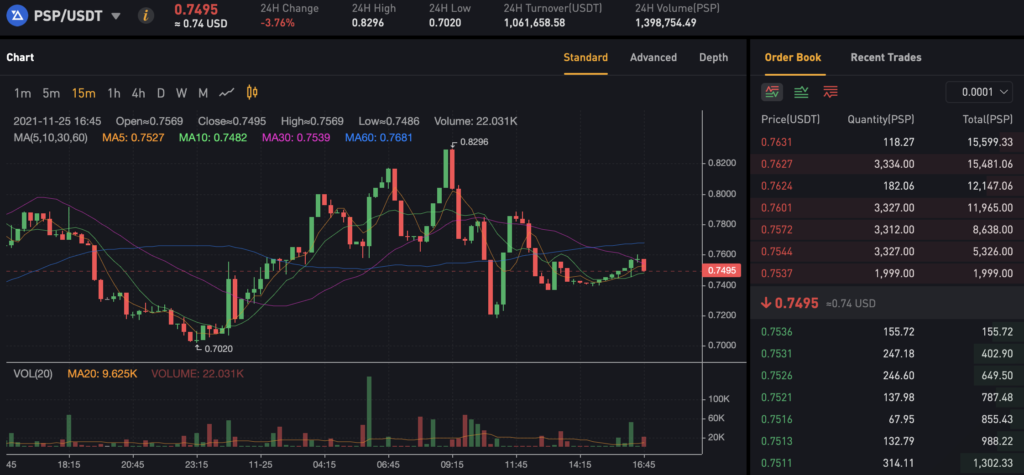

ParaSwap tokens – PSP tokens cannot be purchased directly with fiat currency. However, users can purchase USDT tokens with fiat currency and exchange them for PSP tokens. Here are four simple steps to get PSP tokens through the exchange.

Source: Bybit Exchange

Once users have PSP tokens, they can conduct various transactions on different exchanges.

The price of ParaSwap is predicted to reach $0.95 by the end of 2021 and possibly to more than $4.00 within the next five years. According to business experts and analysts, ParaSwap could reach $28.33 by 2030.

Since coin scarcity can lead to an upward price trend, the value of ParaSwap is expected to continue to increase. However, users are advised to check their personal investment goals and closely monitor the performance of the PSP token before investing in it.

DeFi users will certainly appreciate what ParaSwap has to offer. With ParaSwap, users can save on gas fees by consolidating their transactions into a single transaction. ParaSwap allows large transactions on Ethereum, with the most efficient swaps of 15 or more ETH tokens. Although Ethereum is the main token exchanged on ParaSwap, the exchange also supports other Crypto assets and allows exchange using several DeFi protocols.

The ParaSwap platform is designed for seamless integration into multi-developer Dapps. By implementing efficient protocols for both developers and traders, ParaSwap has secured a leading position in the DeFi market. Overall, the PSP token has a lot of potential for future growth.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.