What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Derivatives are products that are of great interest to traders because of their flexibility and potential profits. Derivatives contracts have not only become a key product of centralized exchanges, but they are increasingly popular on decentralized exchanges. Typical of these is the Perpetual Protocol project? So what is this derivative protocol? How they work. Let's explore Perpetual Protocol with TraderH4 in the article below!

First, let's get an overview of the project including key concepts, activities, and salient features of the Perpetual Protocol.

Perpetual Protocol is a decentralized perpetual contract protocol for a variety of assets, primarily cryptocurrencies. Perpetual is done by the Virtual Automatic Market Maker.

Like the mechanism of the Uniswap DEX, users can directly trade with the virtual automated market (vAMM) without going through any third parties. vAMM provides liquidity and guarantees the value of assets. The vAMM is designed to be completely market-neutral, so it can provide liquidity and guarantee the value of assets, as well as safety for traders.

Perpetual Protocol's goal is to create the most secure, accessible, and decentralized perpetual futures exchange. Perpetual Protocol allows any user, anywhere, anytime to access and use the platform to trade without going through a 3rd party. The remarkable point of Perpetual Protocol is that it does not hold rights. user management. Therefore, users have the right to actively control their personal assets, extremely safe and transparent.

Perpetual Protocol was founded in 2019 by Strike and launched the first version of Perpetual launched on the xDai network in December 2020. On November 31, 2021, version 2 titled Curie (after the famous scientist Marie Curie) of Perpetual Protocol, launched the Optimism program on November 31, 2021.

Perpetual Protocol allows trading of Perpetual Future Contracts (perpetual futures contracts) of many popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH)… Currently, Perpetual uses Stablecoin as USDC as collateral. mortgage. However, this could be extended to other types of collateral in the future.

vAMM works unlike AMM which is an automatic liquidity provider for token swaps like Uniswap and Balancer. DEXs use the AMM model to create live liquidity pools. Meanwhile, vAMM introduces virtual pools. In it, money instead of being kept in a pool or large pools like AMM, they will be kept in Smart Contracts. Disputes already handled by Smart Contract. Assets deposited into smart contracts are also fully collateralized. Therefore, it is possible to forecast price movements and ensure liquidity in the market. Thereby, leveraged trades and short sales are also done easily.

Perpetual contracts allow traders to predict the future price of an asset and then open a long position or open a short position. It is a fact of trading derivatives in the market that contracts will expire. If the time limit expires, orders placed against the price will be liquidated. In contrast, perpetual contracts are different, they will never expire and remain valid until the position is closed.

However, because of the difference, the price of the spot contract will be different from the price of the coin/token/asset on the spot market. This disparity mainly depends on the expectation of the crowd. If the majority of investors expect the price to rise sharply past the underlying value of the coin/token on the spot market, then the price of this coin/token in the perpetual contract could go much higher than its current value. at theirs.

The price of a perpetual contract will often differ from the price of the asset in the spot market. This is exactly the same in the case of too many investors expecting the price to fall.

So is there any mechanism to control this price difference if it is too big? The answer is yes. There are two mechanisms, Funding payments and Arbitrage, which are responsible for controlling this price difference. The goal is to bring the price of the cryptocurrency as close as possible to the spot market price. Specifically, these two mechanisms are as follows:

The Perpetual Protocol is designed to facilitate the buying and selling of perpetual contracts. It does this by creating a new instance of Automated Market Maker (AMM), a technique that uses a mathematical function to determine the price of an asset and to facilitate swaps of two or more. asset. Below is the general working mechanism of Perpetual Protocol.

In addition, in the Perpetual Protocol there is an insurance fund with the purpose of protecting investors in the event of unexpected losses such as liquidation of orders, inability to provide funds to maintain positions. This fund will support investors but also hold 50% of transaction fees. Once the insurance fund is depleted, a Smart Contract activates a new PERP token and is sold as collateral in the Vault. The ultimate goal is to maintain the liquidity of the whole system.

If you are not familiar with the highlights of this derivatives platform, here are the important things you should know about the Perpetual Protocol.

The Perpetual Protocol project development roadmap is described in detail as follows:

Next, let's take a look at the PERP token in detail. Is this a potential cryptocurrency and worth investing in?

PERP is a utility token , which is used primarily in the protocol and promotes decentralized management. Therefore, investors holding PERP tokens will have the right to vote on proposals in the protocol based on the number of tokens held. Here are the main uses of PERP.

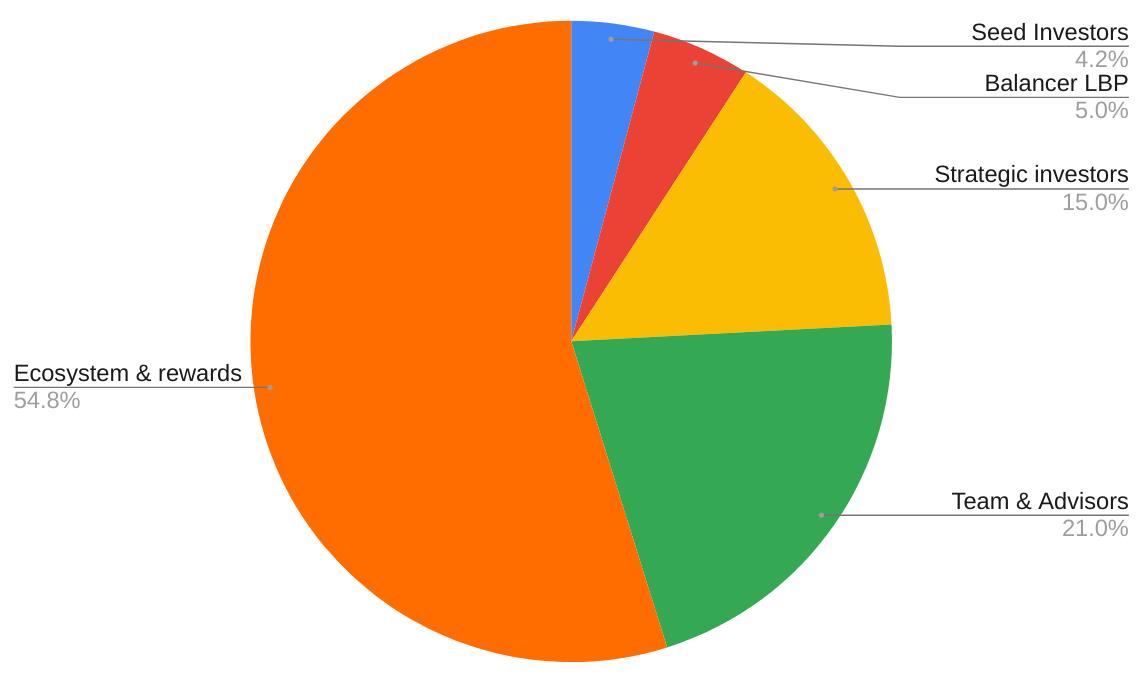

PERP Token Allocation

The allocation of 150,000,000 PERP is implemented according to the following plan:

Here is some information about the Perpetual Protocol project's Token Sale.

PERP tokens are being listed and supported for trading on most of the leading exchanges today including: Binance, Coinbase, Huobi Global, Bybit, FTX, KuCoin, Gate.io, Kraken… Translating with PERP tokens is quite diverse: PERP/ETH, PERP/USDT, PERP/BTC, PERP/WETH, PERP/BRL...

PERP token is developed on the Ethereum platform, according to ERC-20 standards, so it is easily compatible with many types of wallets today.

Let's take a look at TraderH4 with important information to evaluate the potential of the Perpetual Protocol project and whether or not to invest in PERP tokens.

In summary, we can consider Perpetual Protocol as one of the potential projects on the market today. Although still in the process of development and completion, Perpetual Protocol is still a project worth considering for investment. However, all trading activities in the market carry risks. Therefore, investors need to consider carefully before making investment decisions.

Below are the frequently asked questions of investors regarding PERP token and Perpetual Protocol project,

Some popular PERP token pairs today are PERP/USDT, PERP/BUSD, PERP/ETH, PERP/BTC…

Some official information channels of the current Perpetual Protocol project are:

Website / Twitter / Telegram / Discord

There are two main ways to own this PERP token, which is to buy directly on Perpetual Protocol and on the exchange that lists this token as TraderH4 shared above. In addition, staking PERP tokens also helps you to receive more PERP tokens.

The two main functions of the PERP token are staking and governance.

AMM is determined by the formula: x * y = k, where x and y are 2 types of crypto assets that you deposit into the liquidity pool. Based on the available quantity of these 2 currencies, the investor can set the swap price accordingly. If the supply of x increases, the supply of y decreases and vice versa. Whereas k is a constant and liquidity is always available.

The Perpetual Protocol vAMM has a similar mechanism, but the biggest difference is that it doesn't store any assets inside the AMM. We call vAMM a virtual liquid market because it does not store assets, does not trade, does not swap, it is only used for the sole purpose of price recognition. The assets will be sent to a Smart Contract called "Clearing House", then will store these assets in the "Vault". Clearing House accepts deposits and records position ownership with relevant information such as initial margin, leverage and whether it is a long or short position.

The article on TraderH4 shared details about the Perpetual Protocol project and the PERP token. Although it is considered a hidden gem of the market and has great potential for development. However, Crypto investment is still a risky field with quite a large risk. Therefore, investors need to analyze and consider carefully when making investment decisions. Let's accompany TraderH4 to find out other potential projects in the market!

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

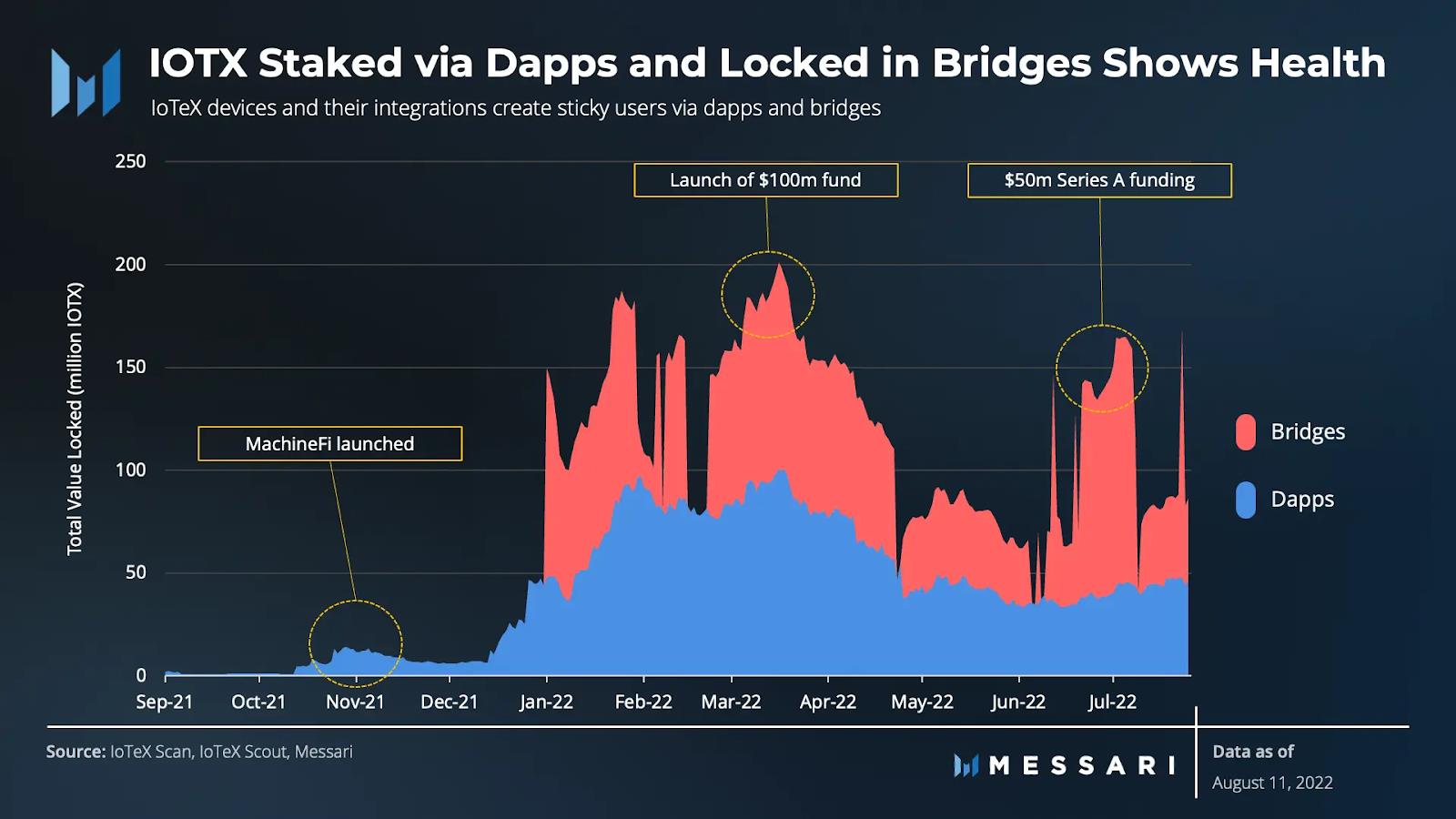

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.