What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Kwenta is a decentralized derivatives exchange, working on Optimism (Ethereum's Layer-2 scaling solution). It allows users to access on-chain derivatives and utilize the leverage power of the Synthetix protocol.

Synthetix is a DeFi protocol built on top of Ethereum . It provides a trading platform for synthetic assets (Synth) or specifically derivative products to help users get the benefits of holding an asset without actually owning it. that property.

Investors can buy and sell popular cryptocurrencies or even commodities, forex or stocks on Kwenta without the permission of a centralized third party.

Unlimited liquidity

Kwenta does not have an order book, all transactions are peer-to-peer, using the Synthetix protocol's aggregated liquidity model. This means that users will have access to an unlimited source of liquidity.

Slippage is 0

Thanks to its infinite liquidity, Kwenta can help users not to worry about order book and slippage when trading.

Gas fee reduced up to 50 times

Kwenta will process transactions on Optimism instead of happening directly on the Ethereum mainnet. As a result, it not only saves users up to 50 times gas fees, but also can process transactions quickly.

Futures contract

This is a new feature that the project is developing, providing Perpetual Future Contract (perpetual future contract, no expiration date). It allows traders to use leverage to enter a long/short position in the price of an asset without having to buy the asset.

Kwenta will launch a Perpetual Future Contract on the Optimism L2 Mainnet between March 14 and March 27, 2022, allowing anyone with a Web 3.0 wallet to access up to 10x leverage.

Enhance your trading experience

Kwenta has begun planning to develop limit-orders and stop-losses to improve the user experience on its platform.

Margin Product

In addition, the project also intends to build margin products and a generic leveraged product using available liquidity pools.

Cross-Market trading

Inheriting Synthetix's aggregation capabilities, the Kwenta team is working to combine financial products such as synthetic perpetual futures and options to create positions across multiple markets.

Simplify your trading experience

The Kwenta protocol is still in the process of being developed in order to be more complete in simplifying the trading experience and expanding other features for users such as: Mortgage using KWENTA tokens, veKWENTA, escrow cross and reference community based requests…

Quarter 1 of 2022:

Second quarter of 2022:

3rd quarter of 2022:

Quarter 4, 2022:

Currently, Kwenta has not yet announced information about the project's development team and investors. Investors interested in the project can follow the latest updates on TraderH4 or official communication channels such as:

Webs i te | Twitter | Discord | Telegram

Kwenta is hosting a Community Raise funding round. It is known that from February 14 to March 2, 2022, the project has raised 6.9 million USD in investment from the community.

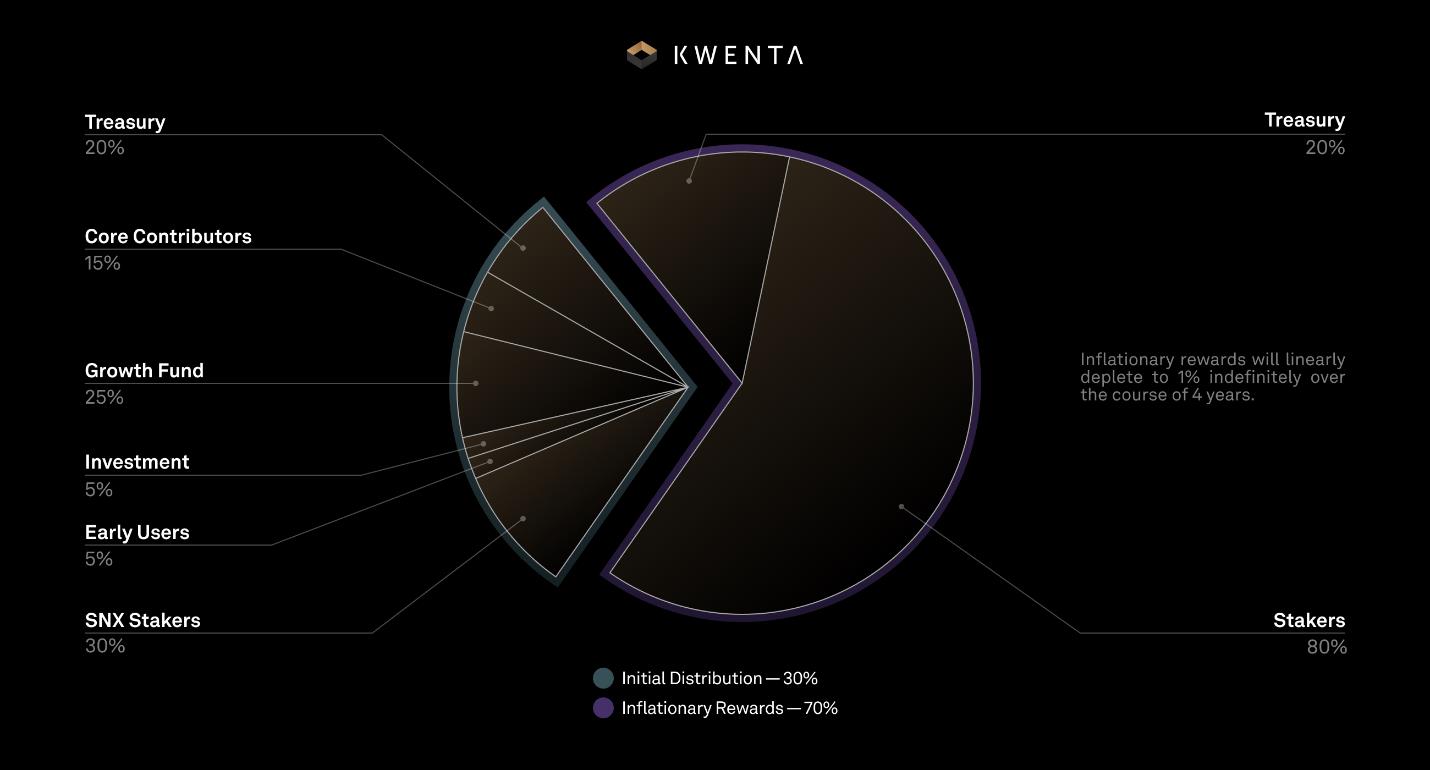

General information about KWENTA token:

KWENTA token initial supply distribution plan

A special feature of the project's token distribution is: The tokens distributed to the Kwenta Treasury will be staked indefinitely and the income from this staking is used as a fund to promote the community role, product development.

System management

KWENTA token holders can stake tokens to have the right to vote on issues related to the governance of the protocol. Each token will represent one vote. Example: One user stake 100 Kwenta tokens is equivalent to holding 100 votes. This is to help the system administration process to ensure decentralization.

Reward Mechanism

Users can stake KWENTA to get more KWENTA. This reward mechanism aims to motivate people to contribute more to the development of the DAO, providing the necessary infrastructure for the DAO to become sustainable.

Kwenta is one of the few decentralized derivatives exchanges today capable of allowing users to trade crypto-assets and non-crypto assets such as: Commodities, forex, stocks, etc. same platform, no permission required, censorship. In addition, it also allows investors to participate in finding profits on the DeFi ecosystem even without having to own real assets.

Based on these unique features, Kwenta's role is becoming more and more important for the cryptocurrency market. Investors can follow the news about the project which is constantly updated on TraderH4 so as not to miss the best investment opportunities.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.