What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Before learning about pSTAKE, we need to clarify the concept of liquid staking. Liquid staking, as the name implies, allows the use of Crypto assets that have been staked in a previous purchase or investment transaction for additional profit. Specifically, in addition to the profit from staked assets, investors can receive additional profits from new purchases or investments.

Liquid staking does this by encrypting stakes, so that stakeholders can use them as collateral on other financial applications. Encrypted stakes, or derivatives stakes, can be freely traded between users, between locations, or even between blockchains.

pSTAKE is a liquid staking protocol that optimizes profits from staked PoS (Proof of Stake) assets . PoS asset holders can stake their tokens on the pSTAKE platform to receive pTOKEN (ERC-20 token) at a 1:1 conversion rate.

Users can use these pTOKENs for trading and investing activities on Ethereum, thereby creating another source of profit.

Currently, cryptocurrency investors usually stake their PoS assets (such as ATOM, XPRT, ETH, SOL ...) on blockchain platforms for a certain period of time. After that, they will earn a corresponding profit. Locked assets usually cannot be staked or used for other purposes until unlocked and withdrawn from the platform.

pSTAKE is the solution for investors when allowing users to continue investing in previously staked assets. When staking on the pSTAKE platform, users continue to receive additional interest in the form of stkTOKEN coins at a 1:1 swap. They can then use these coins on the DeFi (decentralized finance) market to generate more profits.

Some note:

The project development team, belonging to Persistent company, are members with a lot of experience in blockchain, including:

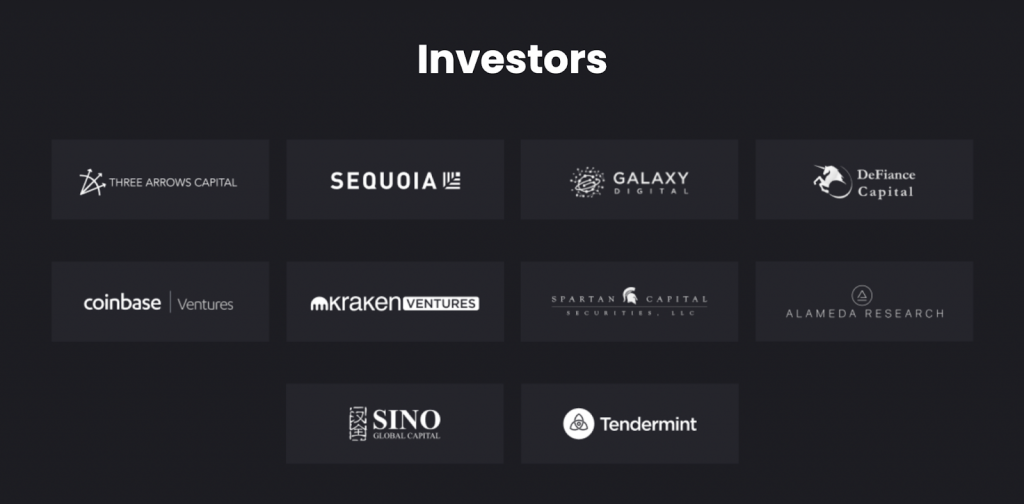

pSTAKE closed its first round of funding with $10 million for the company's operational strategy fund. Among them, there are famous investment funds such as Three Arrows Capital, Galaxy Digital, Sequoia Capital India and Defiance Capital. Besides, there are investors from Coinbase Ventures, Tendermint Ventures, Kraken Ventures, Alameda Research, Sino Global Capital, Spartan Group and some other angel investors.

The pSTAKE Finance project is advised and audited by PeckShield and Solidified. This is a duo that has worked significantly with some of the leading smart contract auditing companies in the DeFi market such as Aave, InstaDapp, Maker, Opensea, etc.

The pSTAKE Finance platform offers key products and features such as:

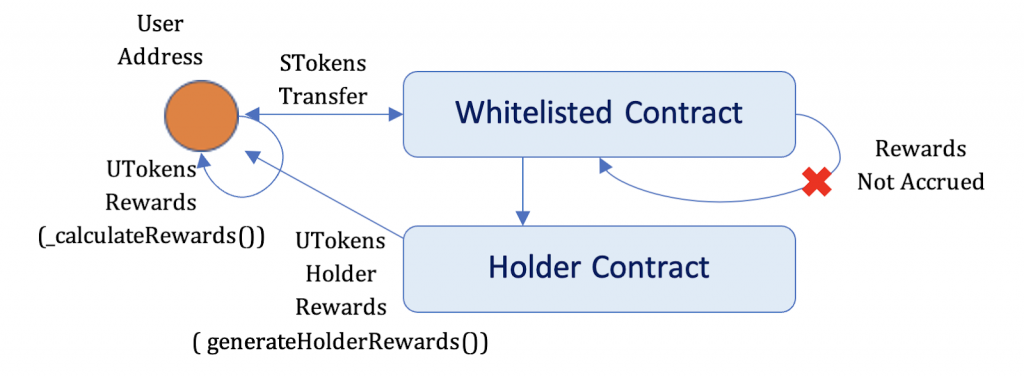

pSTAKE . smart contracts

pSTAKE smart contracts are responsible for minting as well as issuing:

pSTAKE . Platform

Stake

Users can bring their assets into the system to invest and then mint stkTOKEN coins. These coins can then continue to generate profits in the form of pTOKEN.

In addition, the protocols on pSTAKE are validated by the leading testing tools in the PoS ecosystem. As pSTAKE grows with more and more assets, the system will continue to add new testing tools to ensure the safety of the system and keep the decentralization of the platform.

Stake LP

The pSTAKE platform employs a unique mechanism called Stake LP, which allows users to continue to use their stkTOKEN tokens to trade on other DeFi products while still maintaining their stake on their assets. , while generating additional profits from DeFi protocols.

Unstake

Unstake is the process of withdrawing stakes, simply understood as reducing the amount of stkTOKEN that a user holds, and at the same time returning the same amount of pTOKEN (with a small difference due to the associated cost).

The problem here is that PoS networks usually take a long time to perform a staking transaction (from 07 to 30 days, depending on the network). After that, users will have to wait for an additional period of disconnection from the asset of about 21 to 28 days. To solve the above problem, pSTAKE allows users to instantly withdraw their investment (from stkTOKEN to pTOKEN) and deduct part of the cost to make a transaction.

The unstake process goes like this: When a user makes a withdrawal, that amount of stkTOKEN will be locked. After that, the original tokens are withdrawn from the system and the stkTOKEN coins will be destroyed. The corresponding number of pTOKEN coins are minted and locked during the disconnection timeout. Once the steps are completed, the user will receive pTOKEN in their wallet account.

Get profit

Users who own stkTOKEN can claim their stake at any time. They are free to use their profits for other transactions.

Interest on pSTAKE is accrued as pTOKEN and users can request a manual withdrawal at any time. Pending interest is also automatically confirmed when users make staking or unstake transactions. After the profit is confirmed, the profit amount will be synchronized on the user's Ethereum wallet.

Unwrap

Unwrap, aka pullback, is when users want to withdraw their original assets out of pSTAKE. Users can do this through the “Withdraw” command on the system.

The unwrap process is quick. Users will earn in proportion to the amount of pTOKEN they still hold in their account. For those who have used pTOKEN to stake and are only holding stkTOKEN, they will have to make an additional unstake transaction so that the system can refund as pTOKEN.

Upon executing the unwrap command, the pSTAKE system will return the asset's original wallet. This transaction is completely free.

Bridging networks – pBridge

pBridge has the function to issue (and destroy) representative pegged coins at a 1:1 ratio. An example is the issuance of a pegged coin for ATOM, or on the system called pATOM token. When the user deposits the original ATOM coin into the pSTAKE platform, the pBridge connection protocol will mint and issue the pATOM coin on the system to match the user's Ethereum address.

There are 3 ways to make money on pSTAKE Finance platform:

Method 1: When depositing native tokens (eg ATOM) into the pSTAKE account, the user will be granted the amount of pATOM anchor coins in the account. If the user holds that pATOM in the account, they will be rewarded with a small amount corresponding to a percentage of the amount they have deposited.

Method 2: After having the pATOM coin in the account, the user stakes that pATOM into the pools on pSTAKE Finance. The system will then return to the investors the corresponding amount in the form of stkATOM. During the staking process, the user's interest will be paid in the form of stkATOM so that they can continue to use it.

Option 3: After receiving stkATOMs from staking on pSTAKE Finance, investors can use it for any transaction on DeFi protocols to optimize profits.

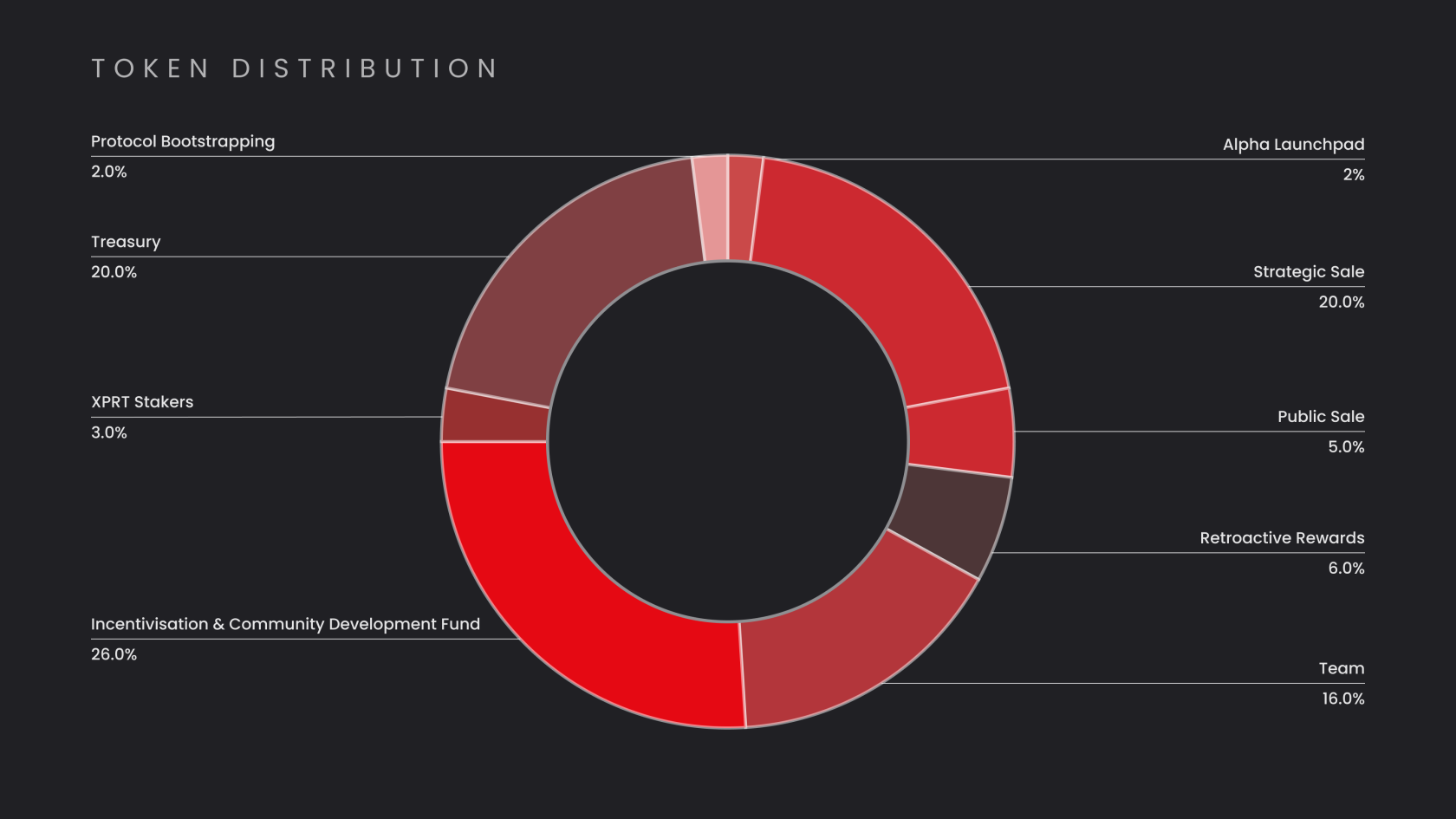

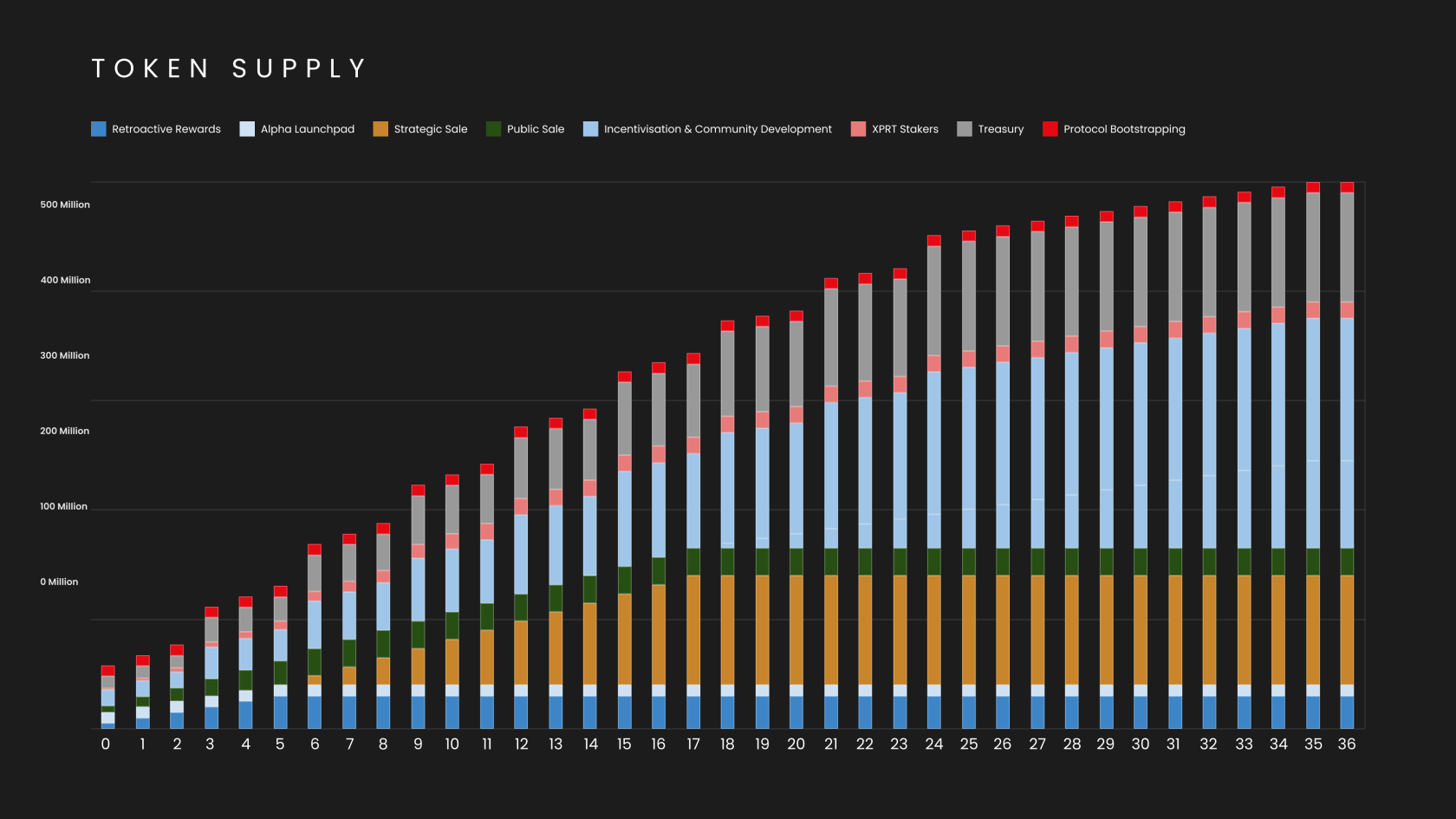

PSTAKE Token Allocation Schedule

PSTAKE will be distributed to the parties as follows:

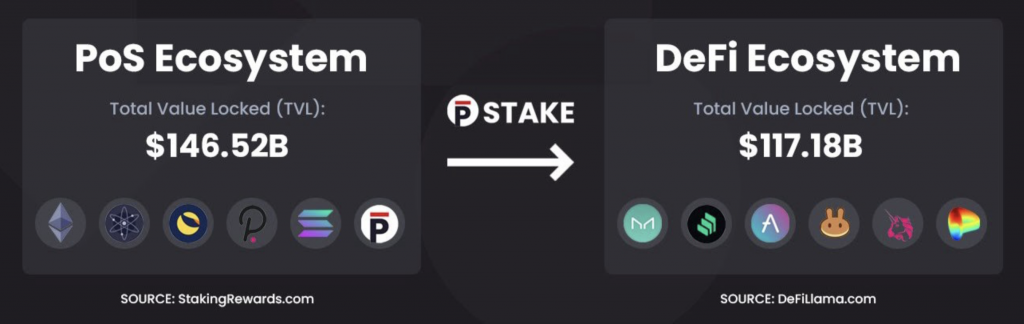

It can be seen that the ambition of the pSTAKE Finance project is to build a new model for the PoS ecosystem. Currently, pSTAKE is unlocking staked assets totaling over $100 billion. This helps create a more flexible, attractive environment with multiple opportunities and uses for PoS assets. This direction will definitely change the model of the PoS ecosystem that we have and change the DeFi market.

In addition to the Cosmos network that was launched in July, pSTAKE with the launch of Gravity DEX and Osmosis, will continue to expand the network using IBC protocols (inter-chain communication protocol) using stkTOKEN as a source abundant stake supply for DEXs (decentralized exchanges) in the Cosmos ecosystem. In the future, we will see pSTAKE covering the largest PoS platforms today, including Ethereum 2.0, Terra, Polkadot, and Solana .

With the bold idea of developing a protocol that allows users to further invest their staked assets, the pSTAKE Finance project promises a great potential in restructuring the PoS ecosystem that has been and been interested in the community for a long time.

Besides the huge and constantly increasing number of transactions over time of the pStake system, the presence of a large number of reputable investment funds has partly shown us the answer to the question of whether the pSTAKE platform. How far can this finance go?

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.